77% of Parents With Young Kids Say Raising Them Is Far More Expensive Than Expected

We’ve all heard that it takes a village to raise a child, but in 2025, it might take a village worth of savings to afford one.

The majority (77%) of parents of kids under 18 find raising kids much more expensive than they’d anticipated, according to a LendingTree survey of more than 600 parents. These costs have real-world consequences. About two-thirds (64%) have gone into debt to make ends meet for their kids, and 46% have fewer kids because they can’t afford more.

- More money, fewer problems, say parents. Nine out of 10 parents with kids younger than 18 say parenthood would be easier with more money, with 77% saying that raising kids has been far more expensive than expected. Lighter wallets lead to smaller families, with almost half (46%) of respondents choosing to have fewer children due to financial constraints.

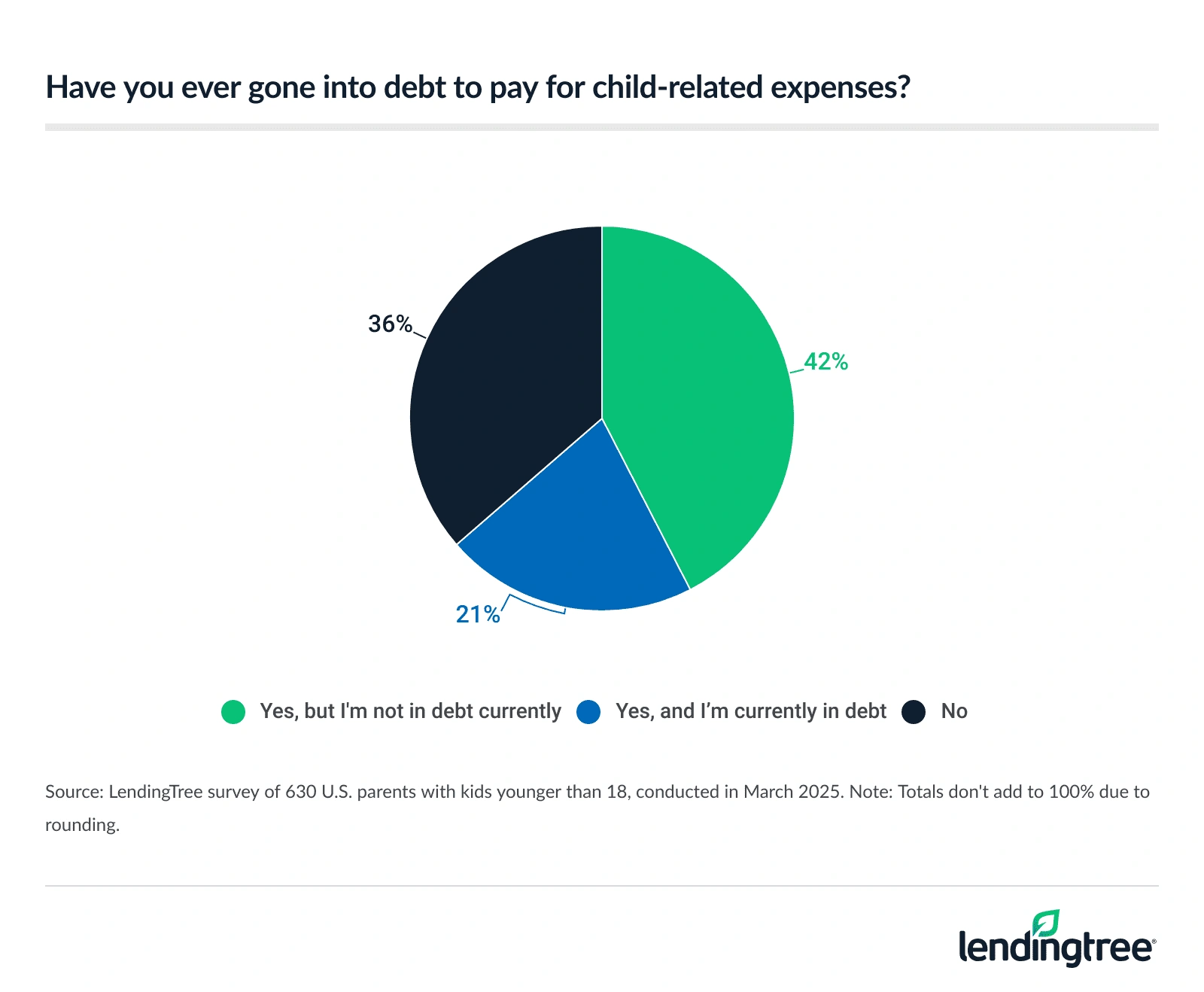

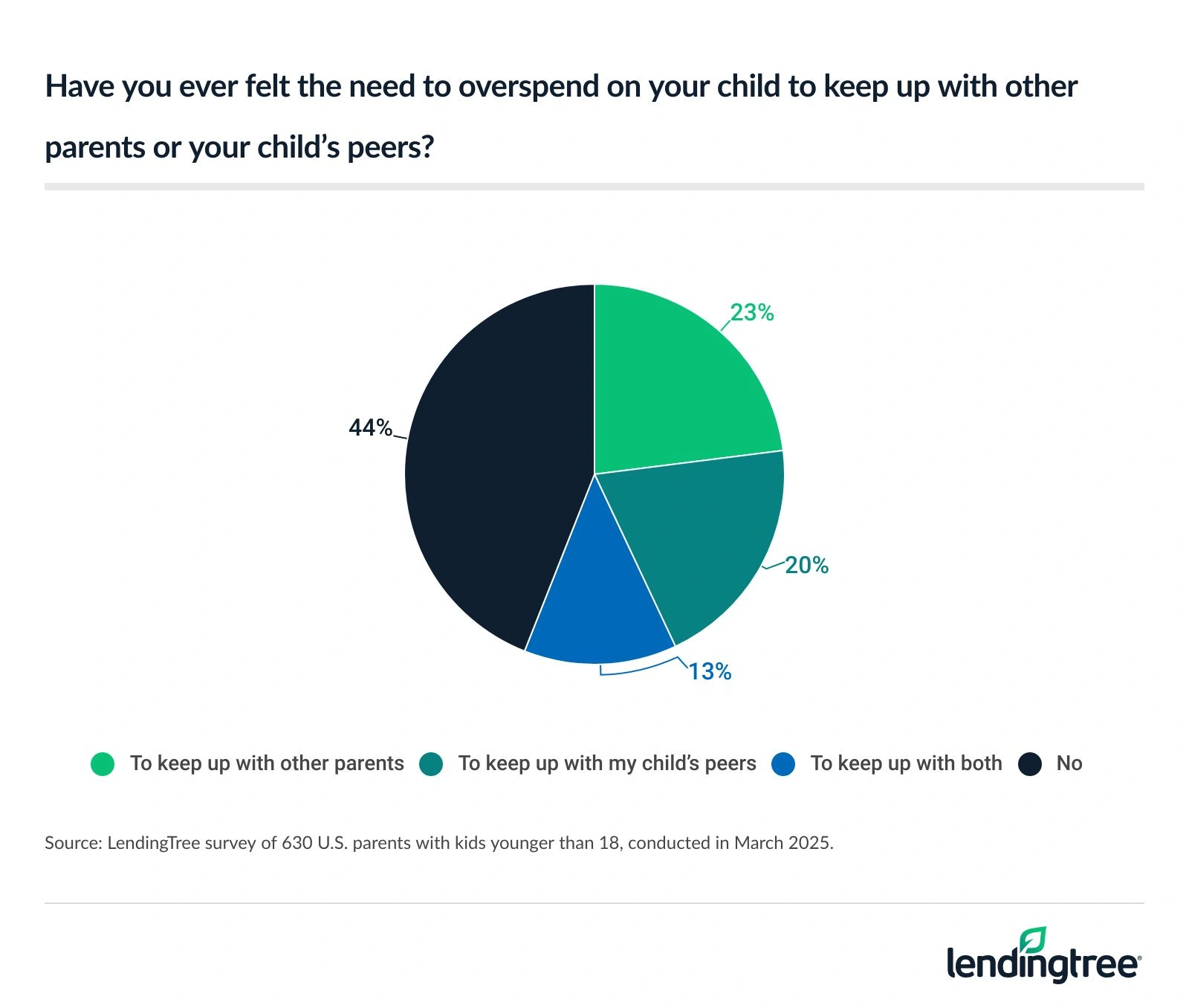

- Nearly 2 in 3 parents have taken on debt for their kids. 64% of parents with kids younger than 18 have gone into debt to pay for child-related expenses, and 21% are still in debt. Over half (56%) of parents with young kids admit to overspending to keep up with others, whether it’s other parents or their child’s peers.

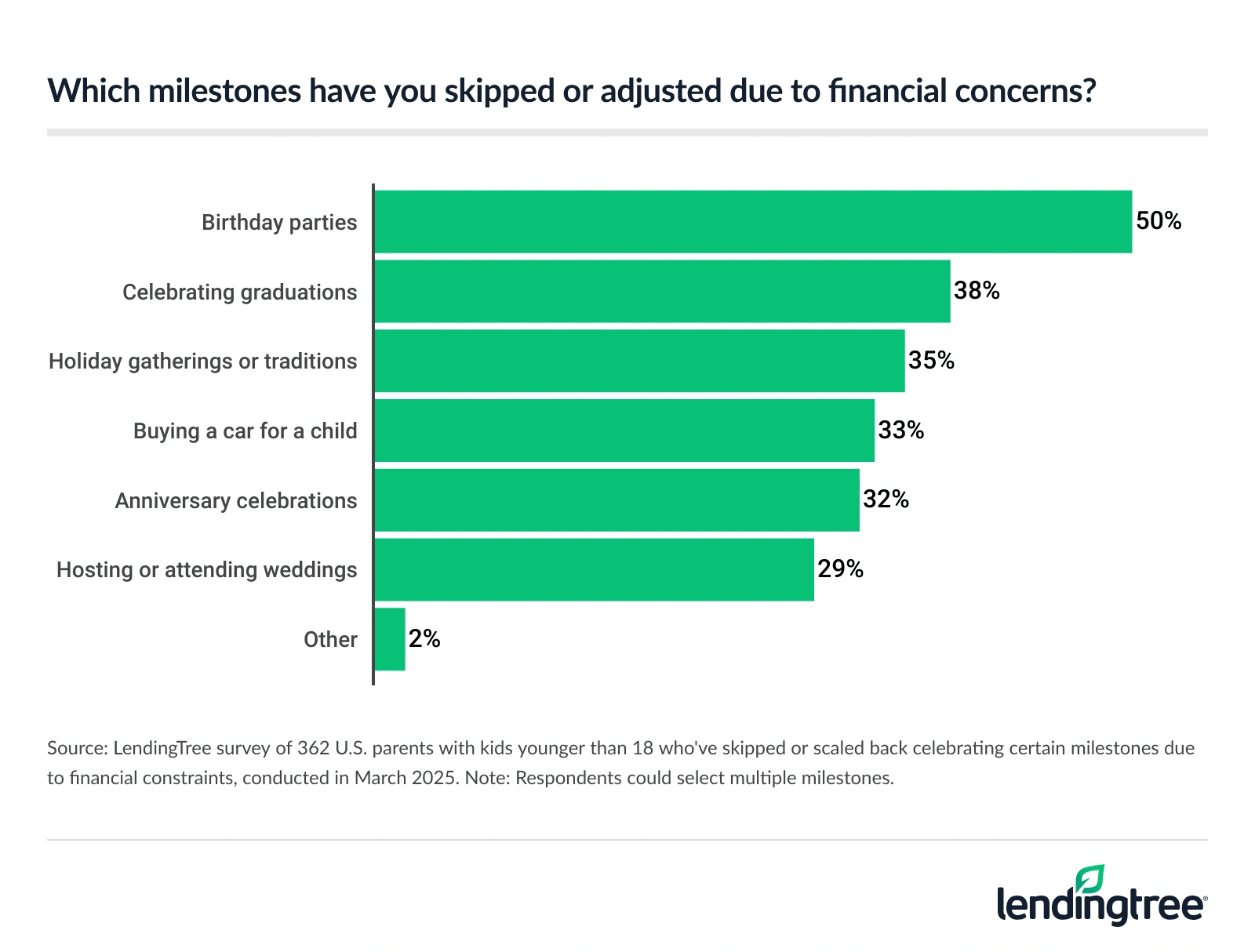

- Parents have scaled back on celebrations due to tight budgets. More than half (58%) of parents with young kids have cut back on milestone celebrations due to costs, including birthday parties (50%), graduations (38%) and holiday gatherings or traditions (35%).

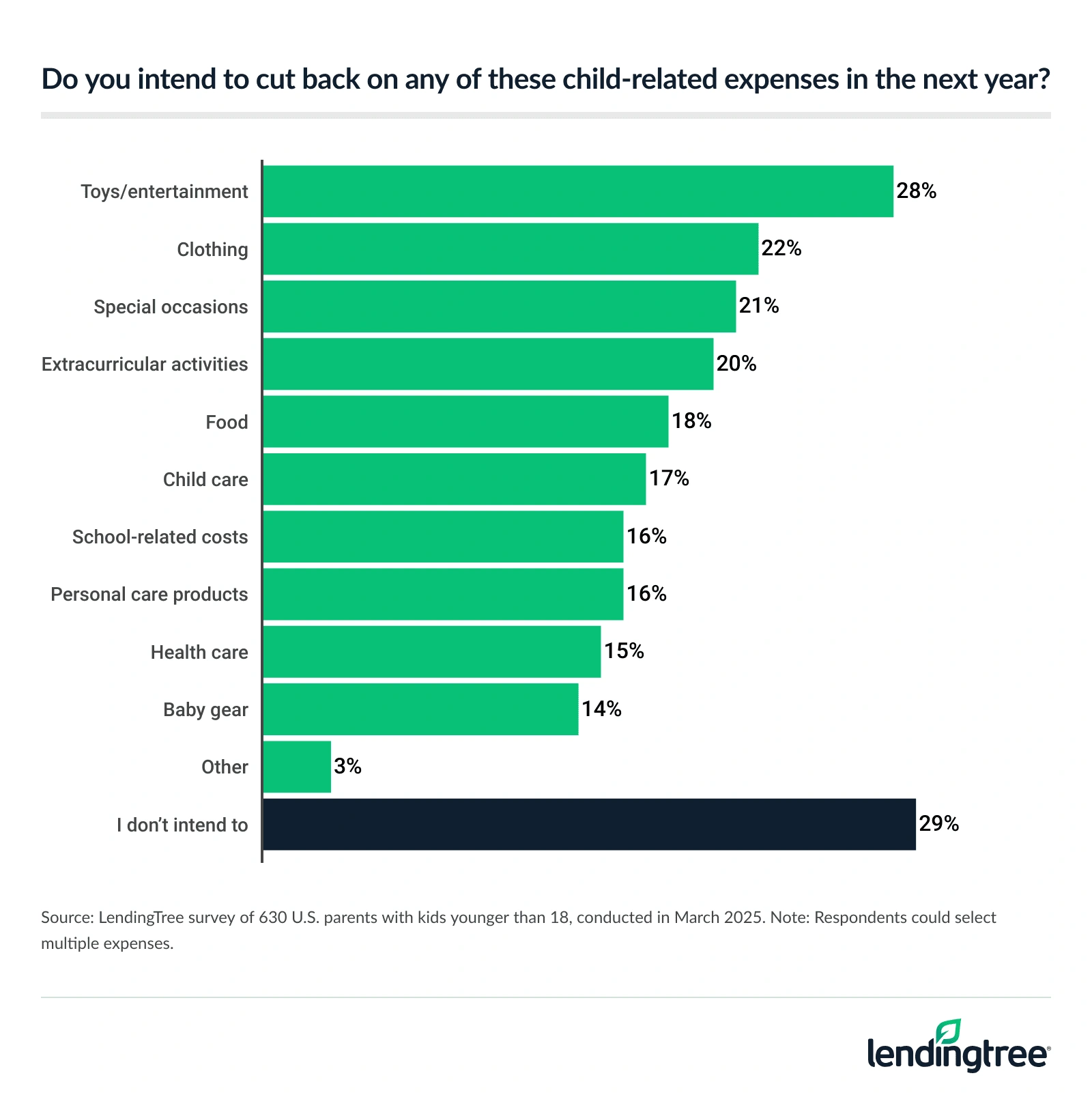

- A majority plan to cut back on child-related spending. 71% of parents with young kids say they plan to curb spending on their children in the next year, mostly on toys/entertainment (28%), clothing (22%) and special occasions (21%). Parents cited food (22%) as the top financial burden of raising kids, followed by clothes (15%) and child care (13%).

More money, fewer problems, say parents

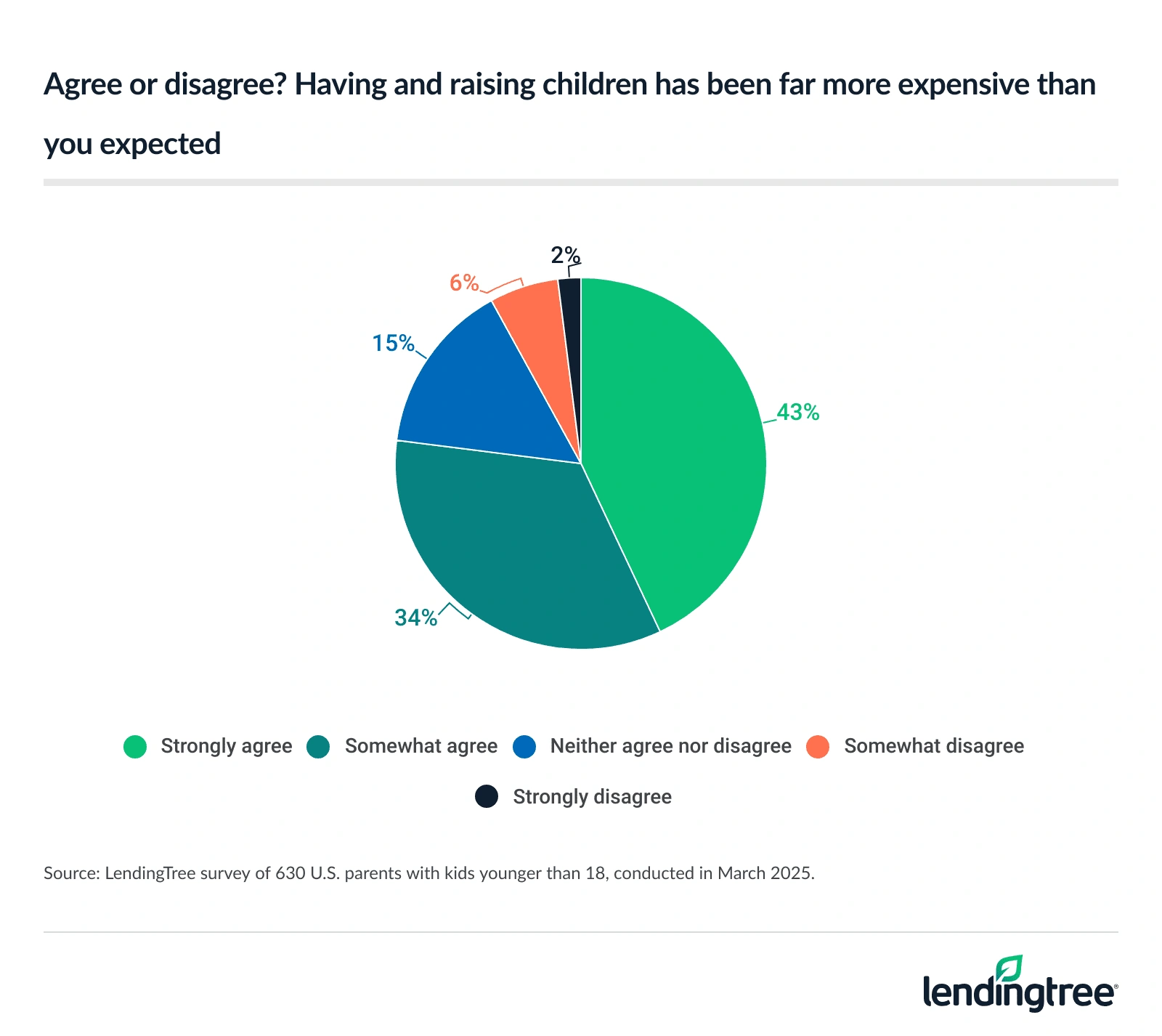

More than three-quarters (77%) of parents of young kids agree that raising kids is more expensive than they’d expected, with 43% strongly agreeing with the sentiment.

These parents have a point — it is more expensive to raise kids today. It costs almost $300,000 to raise a kid to age 18, with annual expenses for raising a small child rising 35.7% over the last two years.

It’s not surprising, then, that 90% say that parenthood would be easier with more money. When asked for the top factors that would make raising kids easier, parents’ top three answers related to their finances. A majority (52%) want more financial resources like higher income, 39% want workplace flexibility like paid leave and remote work, and 28% want affordable child care.

Almost half of parents with young kids say that the cost of raising children has directly impacted the size of their families, with 46% saying they have fewer kids because of financial constraints. Gone are the days of the Brady Bunch — only 14% of respondents have three or more kids under 18, while 48% have one and 38% have two.

Nearly 2 in 3 parents have taken on debt for their kids

When it comes to racking up debt, a common refrain rings true: Parents will do anything for their kids. Almost two-thirds of parents with kids under 18 have borrowed money to pay for child-related expenses, and 21% are still paying it off.

These numbers are high, but they fit in the context of the larger economy. Like all Americans, today’s parents face rising household financial insecurity and inflation. But parents also have to pony up for the increasing costs of raising kids. Child care alone costs almost a fifth of parents’ income on average, according to a recent LendingTree study.

Our study found another potential culprit when it comes to parental debt: keeping up with the Joneses. More than half (56%) of parents say they’ve overspent to keep up with other parents or their kids’ peers.

Nearly 4 in 10 parents with young kids don’t have an emergency savings fund to pay for unexpected family expenses.

What do emergency funds have to do with debt? Everything. If you don’t have an emergency fund, you’ll need to borrow money to cover the unexpected, and you’ll pay it back — with interest.

Parents have scaled back on celebrations due to tight budgets

More than half (58%) of parents with young kids have responded to economic pressure by tightening their purse strings when it comes to celebrations and milestones.

Parents who have scaled back or skipped celebrations made cuts across the board, with half spending less on birthdays, 38% spending less on graduations and 35% spending less on holiday gatherings or traditions.

But there’s still hope for kids who want lavish birthday parties the likes of which we haven’t seen since MTV’s “My Super Sweet 16.” A sizable chunk (43%) of parents with young kids haven’t cut back on celebrations at all.

Despite parents making cuts to their holiday budgets, the 2024 holidays were the season for debt. Nearly half of parents with young kids took on debt last holiday season, making them the most likely demographic to take on holiday debt.

A majority plan to cut back on child-related spending

Seven in 10 parents of young children are planning to tighten their belts when it comes to spending on their kids.

Nonessentials like toys and entertainment are first up on the chopping block, with 28% of parents planning to scale them back in the coming year. But parents are also planning to make cuts to essentials like clothing (22%), food (18%), child care (17%) and health care (15%), suggesting that budgets are particularly tight this year.

Parents aren’t the only ones eyeing their food budgets this year. Almost 9 in 10 Americans have changed their grocery shopping habits in response to inflation, with 61% concerned about affording groceries.

Affording kids in 2025

The total cost of raising a child to age 18 has increased by 25.3% compared with two years ago, making parenting more expensive than ever.

But you’re not powerless in your fight against inflated costs. Here’s what you can do to keep afloat.

- Cut nonessential expenses. Pull up your bank account online and look at your transactions for the last three months. Consider what you can easily cut to save money, including streaming services, subscriptions and meal delivery services like DoorDash and Uber Eats.

- Take a hard look at your budget. Now that you’re more familiar with your spending, look at your big monthly expenses. If most of your paycheck is going to child care, look into nanny sharing or subsidized child care. If you’re blowing most of your money on food, check out the subreddit r/EatCheapandHealthy for recipe ideas.

- Get creative. Rotate streaming services on a monthly basis so you’re only paying for one at a time. Keep a stash of shelf-stable foods like pasta for when you’re tempted to pull up your favorite delivery app. Gather other neighborhood parents and take turns hosting the kids after school to save on child care.

- Ask for a raise. Work up the courage to ask your boss for a pay increase — 82% of workers got a raise when they asked. If that’s not in the cards, ask for a flexible work schedule or additional paid time off to cut back on child care expenses.

- Take on a side hustle. Almost 40% of Americans have a side hustle, and they earn $1,215 per month on average. You can make extra cash with typical side hustles like Uber or Lyft, or with at-home ventures like freelancing or testing websites. “Just be aware that a side hustle isn’t a quick fix,” says Matt Schulz, LendingTree chief consumer finance analyst. “As with any business, it takes time and effort to get off the ground, and it may take a while before you see any profits.”

Here’s what Schulz, author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” advises:

“Lowering the interest rate on your debts can dramatically reduce the interest you pay and the payoff time for the debt, freeing up money for other goals.

“If you have good credit, a 0% balance transfer credit card is perhaps your best weapon in the battle against credit card debt. If your credit is lacking, consolidating your debt with a low-interest personal loan can be a good option, too.

“You can even ask your credit card issuer to lower your interest rate on your credit card. It works far more often than you’d think.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 630 parents ages 18 to 79 with kids younger than 18 from March 4 to 6, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.