2 in 3 Cardholders Support Credit Card Rate Cap, Even if It Means Reduced Rewards

More and more Americans support a cap on credit card interest rates, even if it means significantly reduced credit card rewards, according to a LendingTree survey.

In the wake of Donald Trump’s victory in the 2024 presidential election, LendingTree surveyed cardholders about their support for a credit card rate cap. While on the campaign trail, the president-elect proposed a 10% maximum interest rate on all credit cards in the U.S. While he is hardly the first politician to propose a rate cap — U.S. Sens. Bernie Sanders (I-Vt.) and Josh Hawley (R-Mo.) and U.S. Rep. Alexandria Ocasio-Cortez (D-N.Y.) are among those who’ve done so in the past five years — Trump’s victory makes his proposal worthy of further study.

Following similar surveys in 2019 and 2022, LendingTree asked consumers whether there should be a cap on the rates that financial institutions can charge on a credit card. However, we then asked those who said yes if they would still support a rate cap even if its implementation brought consequences such as reduced credit card rewards or restricted access to lending for those with imperfect credit. (The credit card industry and others against a rate cap say both of those things would likely happen if a rate cap were implemented.)

Here’s what we found.

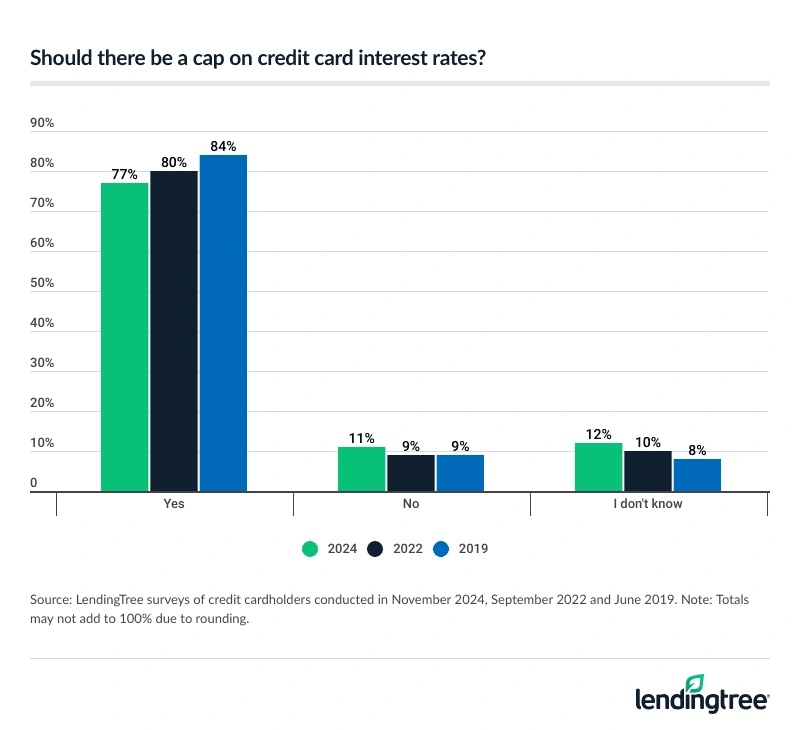

- More than 3 in 4 cardholders back a credit card rate cap, but that support is slipping. When asked whether there should be a cap on the interest rates financial institutions can charge on a credit card, 77% said yes. That’s a sky-high rate, but it’s down from 2022 (80%) and 2019 (84%).

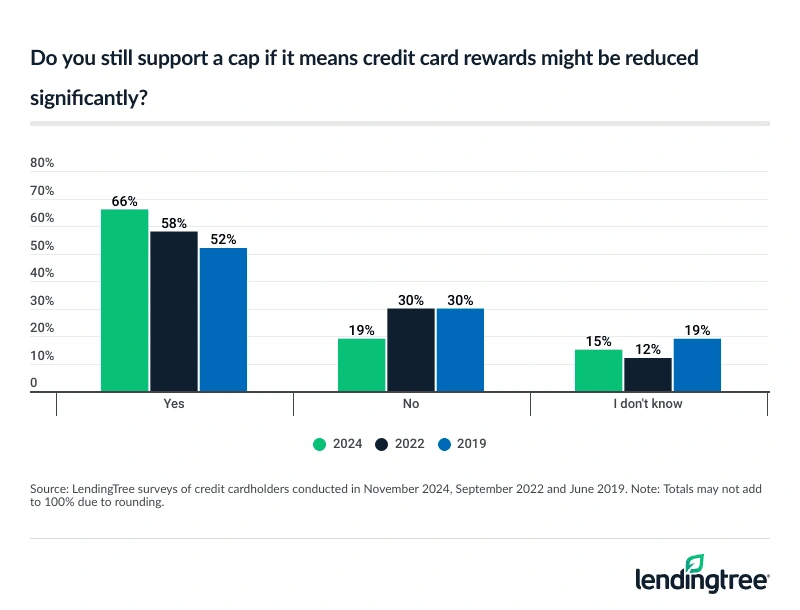

- Of those who support a cap, 66% say they’d do so even if it means reduced rewards — up significantly in the past five years. The last time we did the survey in 2022, 58% supported a cap even if it meant lesser rewards. In 2019, the first time we did this survey, just 52% did. That means that support has risen by 14 points in five years.

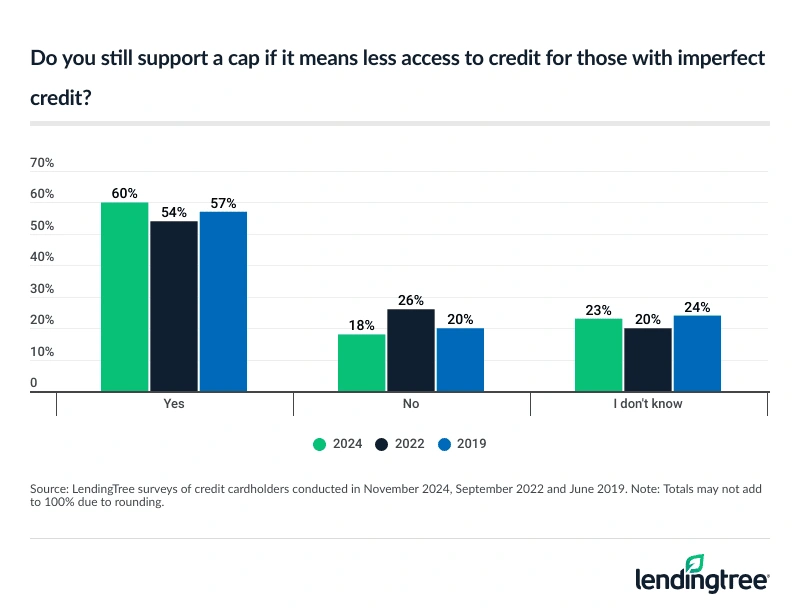

- 6 in 10 cap supporters say they’d support it even if it means less access to lending for those with imperfect credit. This is also at the highest level since we began tracking. In 2022, 54% said they’d support it, while 57% did in 2019.

Overall support for a cap is slipping

Americans are sick of high interest rates. Though credit card rates have dipped a bit in recent months due to moves from the Federal Reserve, card APRs are still near record highs. Rates are almost certain to keep falling in early 2025, but anyone expecting a dramatic dip in their credit card’s APR anytime soon is going to be disappointed.

That’s the landscape in which we asked cardholders if they thought there should be a cap on the interest rates that financial institutions can charge on a credit card.

To our surprise, a lower rate of people said yes today than in 2019 or 2022.

A cap is still very popular — 77% support it — but that popularity has been slowly waning. In 2022, 80% supported it, while 84% did in 2019. That’s a significant decrease in a relatively short time and is particularly noteworthy given how credit card rates have skyrocketed in recent years.

Men and women are equally likely to support a cap (both at 77%). However, support for a cap increases with age. By generation, 84% of baby boomer (ages 60 to 78) and Gen X (ages 44 to 59) cardholders support it, versus 73% of millennial (ages 28 to 43) and 61% of Gen Z (ages 18 to 27) cardholders.

As for how high the cap should be set, 86% of cardholders say rates should be capped at 15% or lower, including 51% who say it should be 10% or lower.

More cardholders willing to support cap when they know it could mean reduced rewards

It shouldn’t be surprising that most Americans like the idea of a cap on credit card rates. Who wouldn’t love to see banks reined in a bit, right? Well, it’s not quite that simple.

Every time the idea of a credit card rate cap arises, banks quickly remind people that implementing a cap would likely mean a dramatic reduction in credit card rewards. That’s because it costs money for card issuers to provide these rewards, and the high interest rates that issuers charge (along with swipe fees and other fees) help make it all possible.

That’s likely not an idle threat either. For example, federal credit unions have an 18% cap on credit card rates. While they still offer rewards, they’re generally no match for those the megabanks offer. We also saw debit card rewards largely vanish more than a decade ago when regulations capped debit card swipe fees.

Given all that, any polling about a rate cap has to include asking about its possible consequences. So that’s what we’ve done over the years — and we’ve seen views change significantly since we started polling in 2019.

Today, two-thirds of cardholders (66%) say they support a credit card rate cap even if it means reduced rewards. That’s 14 points higher than the 52% who said so the first time we asked in 2019 and eight points higher than two years ago when 58% said so. That’s a big change.

Men are more likely than women to agree (72% versus 61%), as are parents of young kids (71%). Millennials (70%) are more likely than any other age group, and Republicans (71%) are more likely than Democrats (67%) or independents (59%) to say so. In previous years, those numbers by political party would have been surprising given Republicans’ traditional bent toward deregulation of business. However, President-elect Trump’s rate cap proposal seems to indicate that things have changed, at least as it relates to credit cards.

They’re also OK with cap if it leads to less lending to those with imperfect credit

Credit card rewards aren’t the only thing that will supposedly be affected if a rate cap becomes a reality. Issuers have long believed that a rate cap would make them less likely to lend to those with imperfect credit. That’s because card issuers use interest rates to manage the risk that someone won’t pay them back — the riskier the borrower, the (generally) higher the interest rate. Take away the ability of banks to raise rates on those risky borrowers, and banks say they may just stop lending to them altogether.

When asked about that possibility, 6 in 10 cardholders (60%) said they’d still support a rate cap even if it means less access to lending for those with imperfect credit. That’s less support than we saw when asking about diminished credit card rewards, but it’s still the highest level since we began asking this question. In 2022, 54% said they’d support it, while 57% did in 2019.

The data showed a massive gender gap here: 70% of men express support, versus just 49% of women. (Women are also far more likely to say “I don’t know” when asked about this issue — 30%, versus 16% of men.)

As with the other question, we saw that Republicans (68%), millennials (64%) and parents of young kids (64%) are some of the other groups most likely to express their support.

Don’t hold your breath for a rate cap

It’s a long, long, long shot that a credit card rate cap will pass. Perhaps that shot isn’t quite as long today, given the president-elect’s support, but it’s still quite unlikely. A 10% cap, which is what Trump proposed, is the longest of long shots. However, if that proposal isn’t the final plan but the start of a negotiation with Congress, the financial institution lobby and all the other powerful people who’ve opposed a cap over the years, perhaps the odds are a little better.

The good news is you don’t have to wait for Congress, the president or the Federal Reserve to lower your interest rates. You can do it yourself. Here’s how:

- Apply for a 0% balance transfer credit card: You won’t find a better weapon in the battle against high interest rates than these cards. You’ll need good credit to get one, but if you can, it can save you huge amounts of interest by giving you up to 21 months without accruing any interest on the transferred balance. Make sure you know any fees with the card as well as the rate that kicks in after the 0% period ends.

- Take out a low-interest personal loan: You’re not going to get a 0% deal like with a balance transfer card, but you can still save with the right personal loan. Shop around and you may be able to find a loan with a lower rate than your current credit card. Then, you use the personal loan to pay off that card and even consolidate other high-interest debts. That way, you’ll streamline your to-do list, too, because you’ll just have one bill to worry about instead of many.

- Call your lender and ask for a lower rate: No, seriously, this works. Whether you’re looking for temporary help during a short-term financial pinch or to permanently slash your rates, a call to your card issuer can help. A LendingTree report showed that 76% of people who asked for a lower interest rate on one of their credit cards in the past year got one, with an average reduction of 6.5 percentage points. That’s like going from 27% to 20.5% — a big deal.

- Seek credit counseling: A nonprofit credit counseling agency such as the National Foundation for Credit Counseling can be incredible for those struggling with sky-high rates and debt. It can help you improve some basic money skills, such as budgeting, but it can also work with you to craft a debt management plan that can include negotiating rates and other details with your creditors.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,031 U.S. consumers — including 1,380 credit cardholders — ages 18 to 78 from Nov. 19 to 21, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78