Buy, Use, Return: Shoppers Admit to ‘Borrowing’ Retail Goods

While buying nice things feels good, it isn’t always practical — especially if you only get one or two uses out of something. Instead, many Americans choose a morally gray form of borrowing: Buying an item and returning it after use.

In fact, 39% of shoppers who’ve returned an item after using it did so intentionally, according to this LendingTree survey of 1,715 U.S. shoppers.

Here’s a closer look.

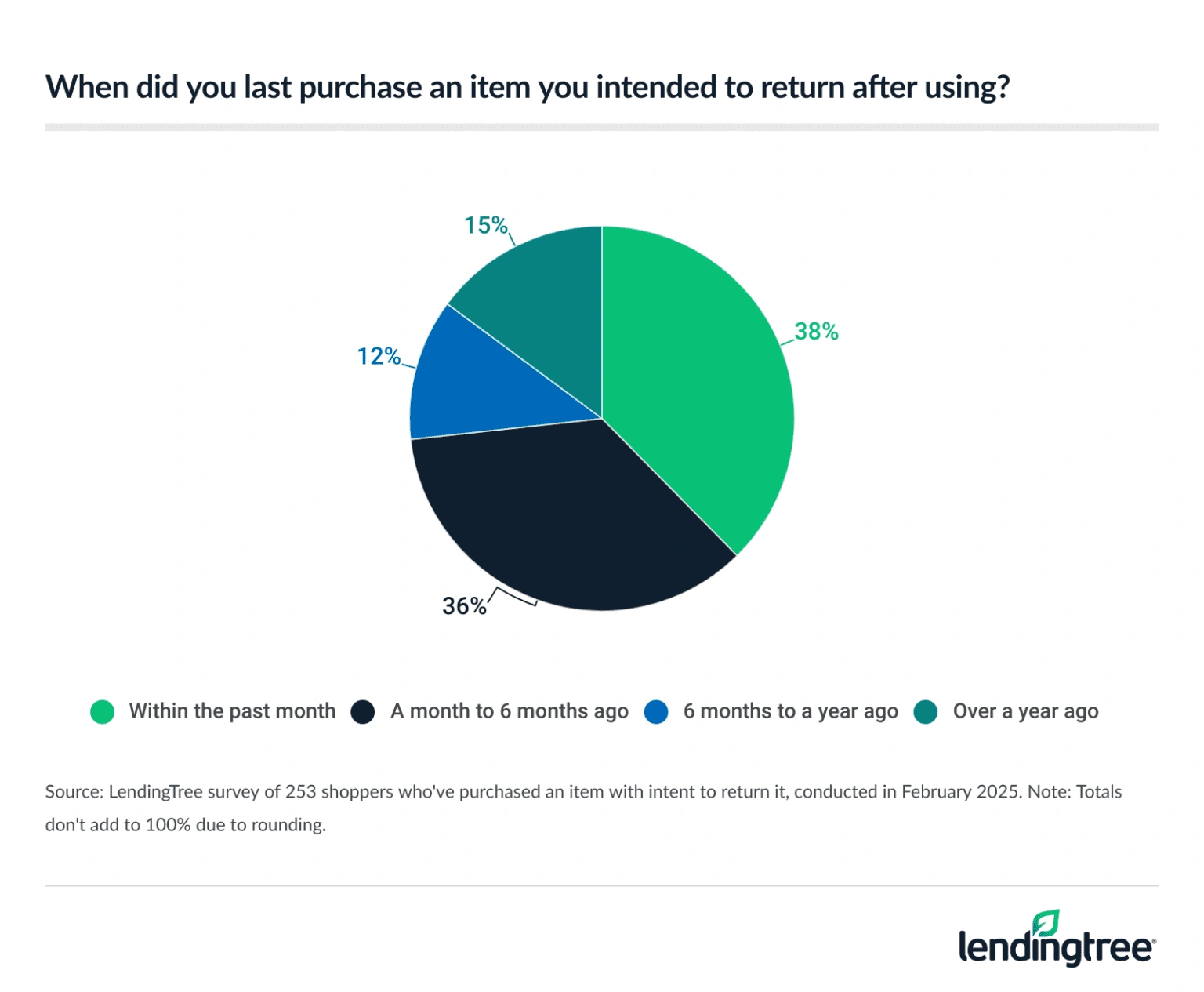

- Some shoppers intentionally “borrow” instead of buy. 39% of shoppers who’ve returned an item after using it admit they intended to do so. Of this group, 37% say they do it frequently and 73% have done it in the past six months. Among all shoppers, 38% have returned an item after using it.

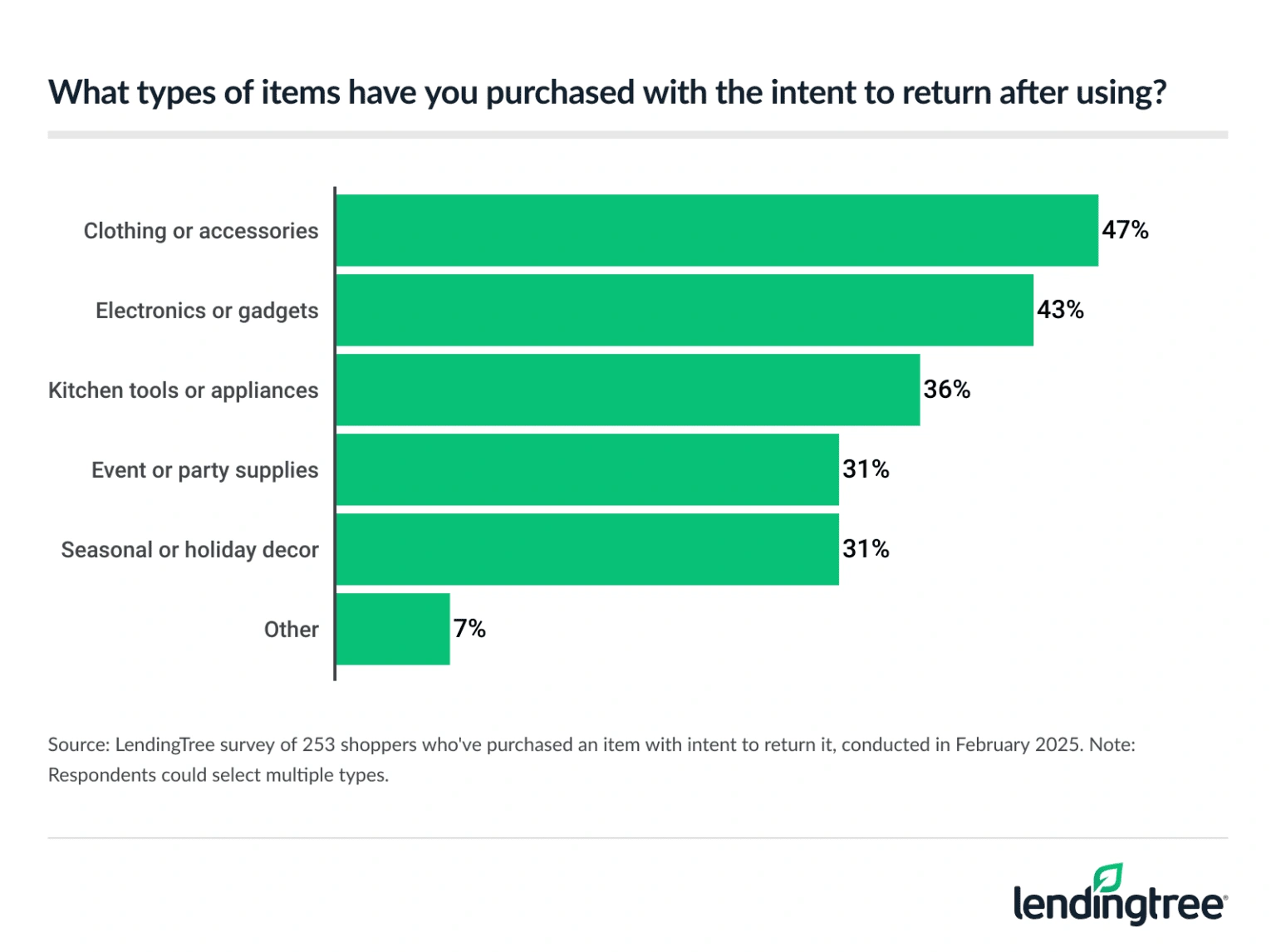

- From fashion to party supplies, consumers are strategically “borrowing.” The most common items brought back among those with return intent include clothing or accessories (47%), electronics or gadgets (43%) and kitchen tools or appliances (36%). Returns — regardless of intent — can come at a cost, with 30% of shoppers spending at least $50 annually on related expenses.

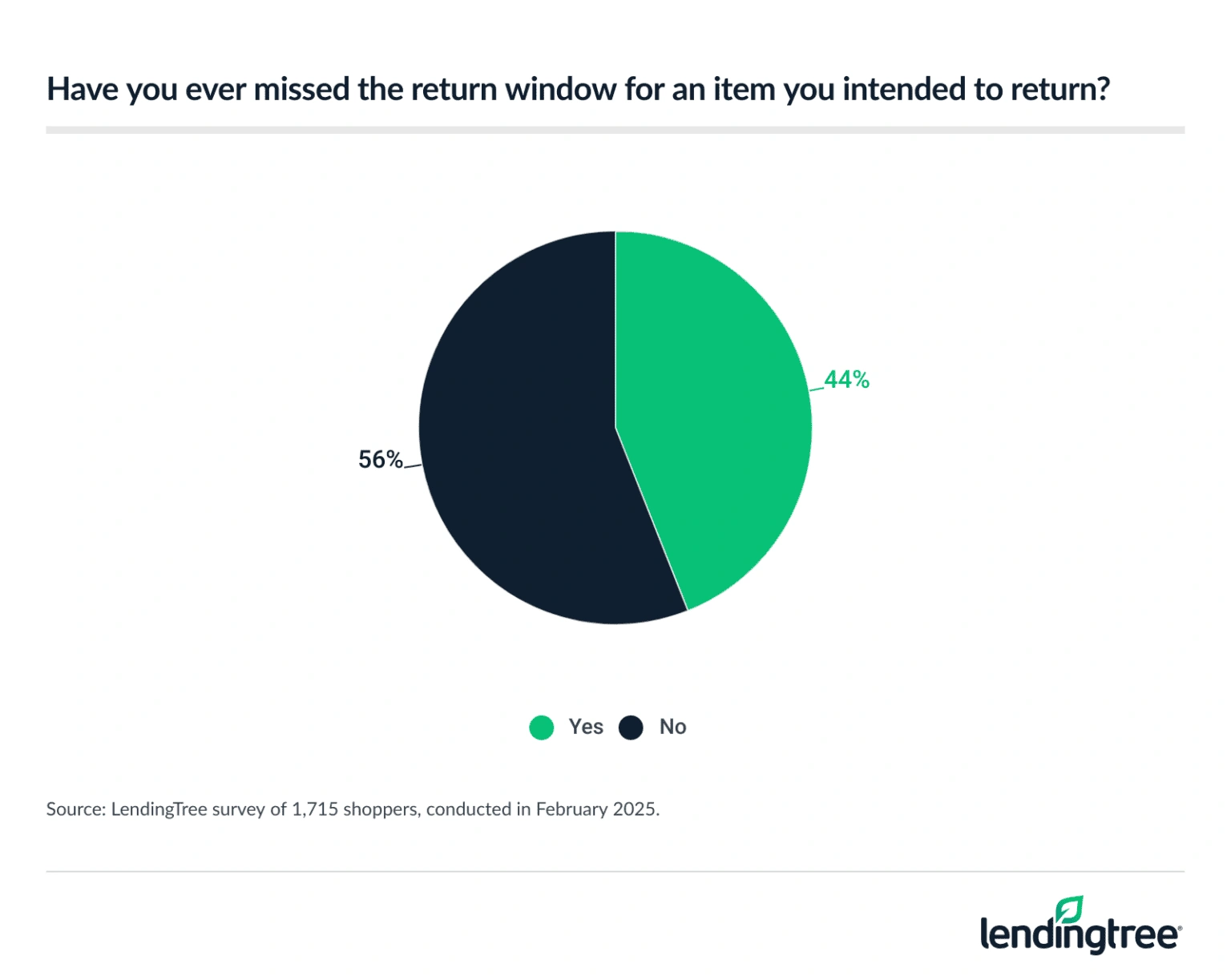

- The hassle of returning items can be a deterrent. 44% of shoppers have missed the window for an item they planned to return, highly common among millennials and Gen Zers at 53% each. Additionally, 58% have kept an unwanted or unneeded item because the return process was too inconvenient, again common among younger shoppers.

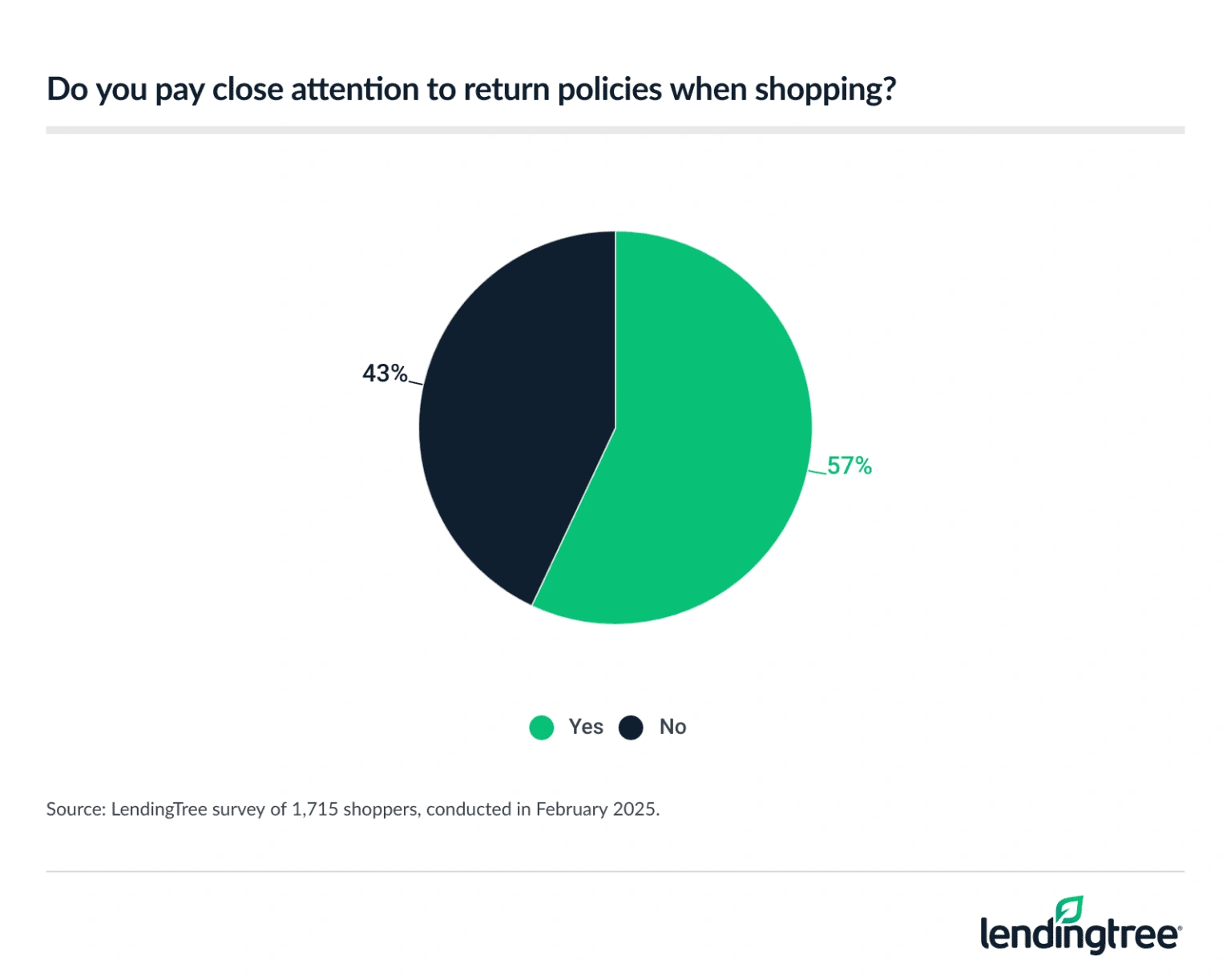

- Not all return policies are created equally. More than half (57%) of shoppers say they pay close attention to return policies. Consumers identify department stores (39%), grocery stores (25%) and apparel retailers (14%) as having the most lenient return policies, while luxury or high-end retailers (41%) are the most strict.

39% of shoppers who returned an item after use did so to ‘borrow’ it

Shoppers who’ve returned an item don’t always have the best intentions.

In fact, 39% of shoppers who’ve used an item before returning it admit they intended to do so. That figure is highest among those with children younger than 18 (56%), millennials ages 29 to 44 (49%) and six-figure earners (48%).

Of this group, 37% do so frequently and 73% have done it in the past six months.

Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” says there are risks to buying with the intention of returning the item.

One risk among the many: A shopper overspends on something that gets damaged and can’t be returned.

“A dress you hope to return could get red wine spilled on it at the party you bought it for,” he says. “If that happens, you could be stuck with the unwanted merchandise and potentially some debt. Neither of those is a great situation.”

Those who intentionally return an item after using it are most likely to return online purchases by mail (47%). Meanwhile, 32% return their online purchase in store and 21% return their in-store purchase at a retailer.

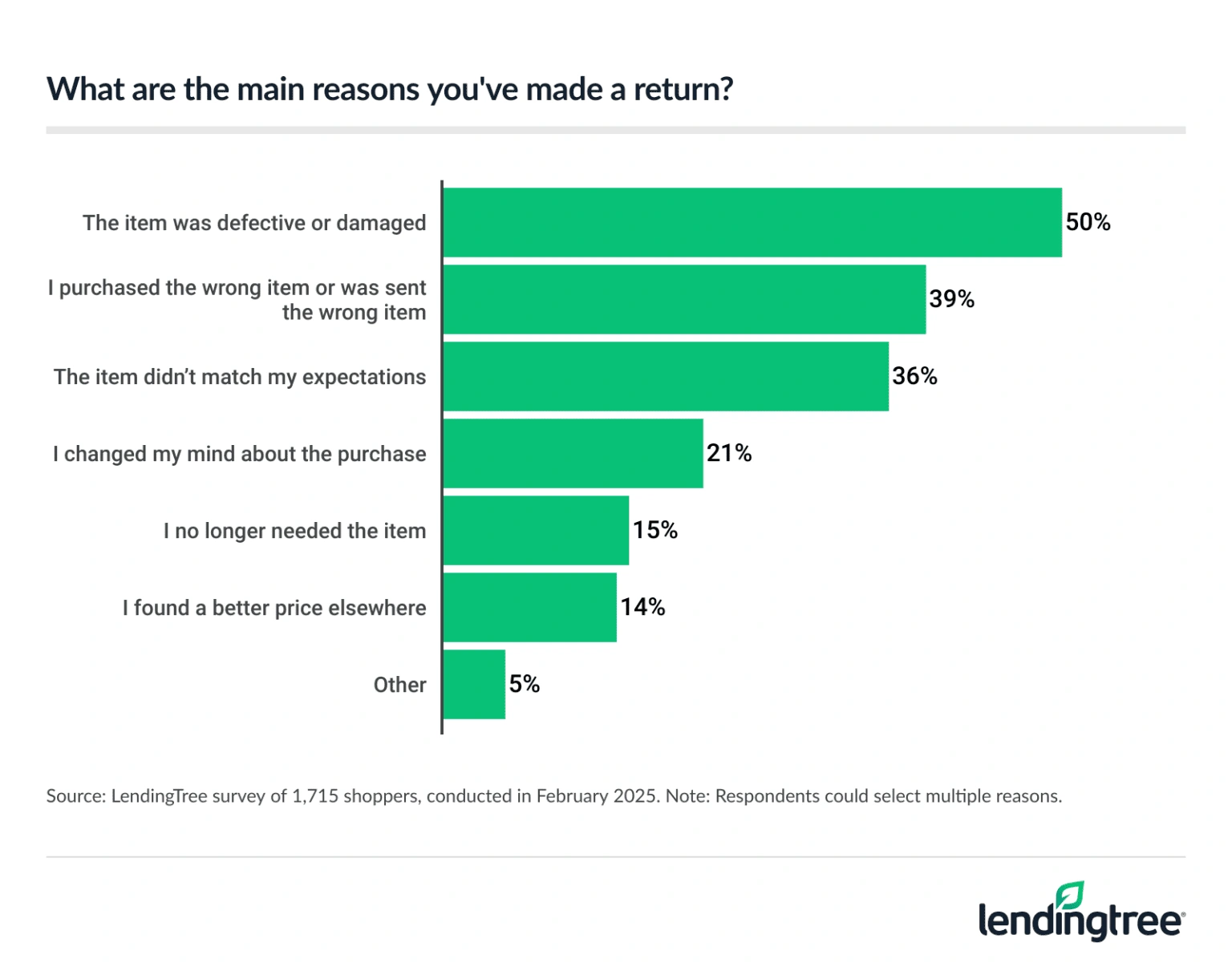

Across all shoppers, 38% have returned an item after they used it. Regardless of intent to return, shoppers mainly make returns because the item was defective or damaged (50%), they purchased or were sent the wrong item (39%) or the item didn’t match their expectations (36%).

Clothing is most commonly ‘borrowed’

Shoppers who “borrow” are most likely to buy and return clothing or accessories, at 47%. Electronics or gadgets (43%) and kitchen tools or appliances (36%) follow.

Those categories are about in line with what Schulz expects.

“It can be very tempting to get clothing for a special occasion, wear it once and try to return it,” he says. “Electronics, gadgets, kitchen tools and appliances can also be one-time use items. For example, if you’ve just bought a new home or moved into a new apartment and know you’re going to have a ton of projects in the next week or two, buying power tools and other such items and returning them may seem like a wise move. But here’s the truth: It’s not. It’s a form of fraud.”

Returning, in general, can be a hassle, respondents say. Across all shoppers, 30% spend at least $50 annually on expenses related to returning items. Also worth noting, 13% of shoppers have had difficulty returning an item they purchased with a buy now, pay later (BNPL) loan.

Many consumers believe no amount is too little for returns, as 28% say the least expensive item they’ve returned was $11 to $20 and another 27% say it was $21 to $50. About a quarter (24%) have returned an item that cost $5 to $10, while 12% have returned an item that cost less than $5. Just 9% have never returned something that cost $50 or less.

Returning items is too much of a hassle for some

Returning an item is certainly a hassle, and the returned cash isn’t enough of a reminder for some. In fact, 44% of shoppers have missed the window for an item they planned to return. That’s especially true among Gen Zers ages 18 to 28 and millennials, at 53% each.

While 59% who’ve missed the window rarely do so, 27% do so occasionally and 14% do so frequently.

Meanwhile, 58% of shoppers (regardless of intent) have kept an unwanted or unneeded item because the return process was too inconvenient. That’s again common among younger shoppers, at 62% of millennials and 61% of Gen Zers.

Schulz says return policies can vary widely by retailer, but many, for the most part, make it easier than ever to make a return.

“Still, deadlines are often associated with these returns,” he says. “Since so many of us have to-do lists that are a mile long, sometimes things just get forgotten or overlooked. There may be a very real price to pay for missing the return deadline. That may not be a big deal for smaller purchases, but if you get stuck with a big-ticket item you didn’t expect to have to pay for, it can wreak havoc on your budget.”

Return policies depend on the store

Consumers may have a harder time returning an item at certain stores, and not everyone’s prepared for it. Across all shoppers, 57% say they pay close attention to return policies.

Regardless of your intent to return, Schulz believes it’s important to know a store’s policy.

“Life happens,” he says. “Sometimes you get an item home and realize it wasn’t what you thought it was or the color you liked in the store doesn’t look as good at your apartment. Maybe an item didn’t work or the person you bought it for turned up their nose at it. There are a million possible reasons for wanting to return. Whatever yours is, it’s easier to do the return if you know the rules.”

When it comes to the type of retailer with the most lenient return policies, 39% of shoppers say department stores. Grocery stores (25%) and apparel retailers (14%) follow.

As far as the strictest store policies, 41% cite luxury or high-end retailers.

Top expert tips for cutting costs without ‘borrowing’

You don’t have to “borrow” items to cut costs or save your budget. Schulz says there are a few budget-friendly alternatives, including:

- Consider renting items instead. “Whether you’re looking at a new dress for that big party or some power tools to help your kid move into her new apartment, you can find places that’ll let you get them via a short-term rental,” he says. “You won’t get the stuff for free, and you’ll still have to be careful to not ruin or damage them, but it may help you feel better that you’re not dipping your toe in some morally gray waters with that return.”

- Shop used. “Retailers that sell used merchandise are everywhere these days,” he says. “With a little legwork, you can often find items that look and work as good as new for just a fraction of the price.”

- Use credit cards for the purchases instead of buy now, pay later loans. “BNPL loans have become notorious for how difficult they can be when it comes to returns,” he says. “If you suspect you may make a return, a credit card is a far better option.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,715 U.S. shoppers ages 18 to 79 from Feb. 4 to 5, 2025. These shoppers have all returned items they purchased. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79