2025 Super Bowl Spending Report

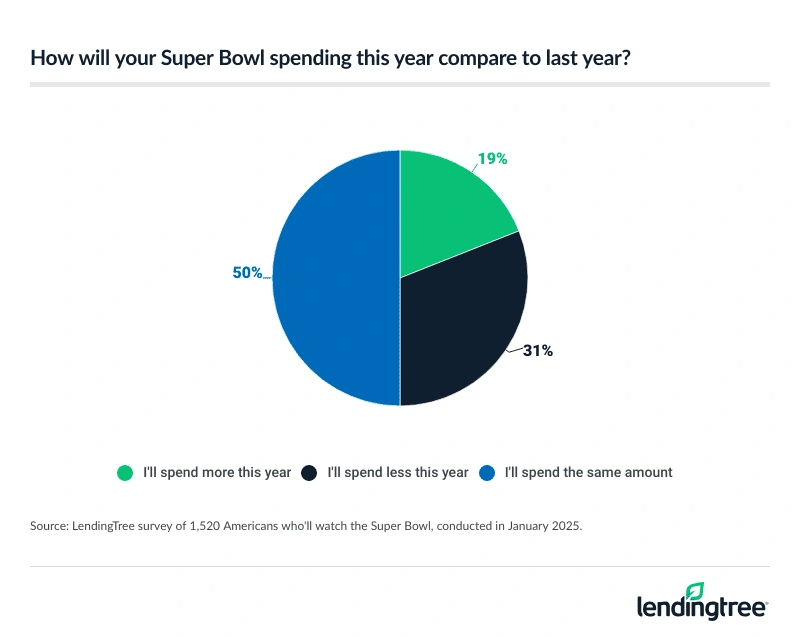

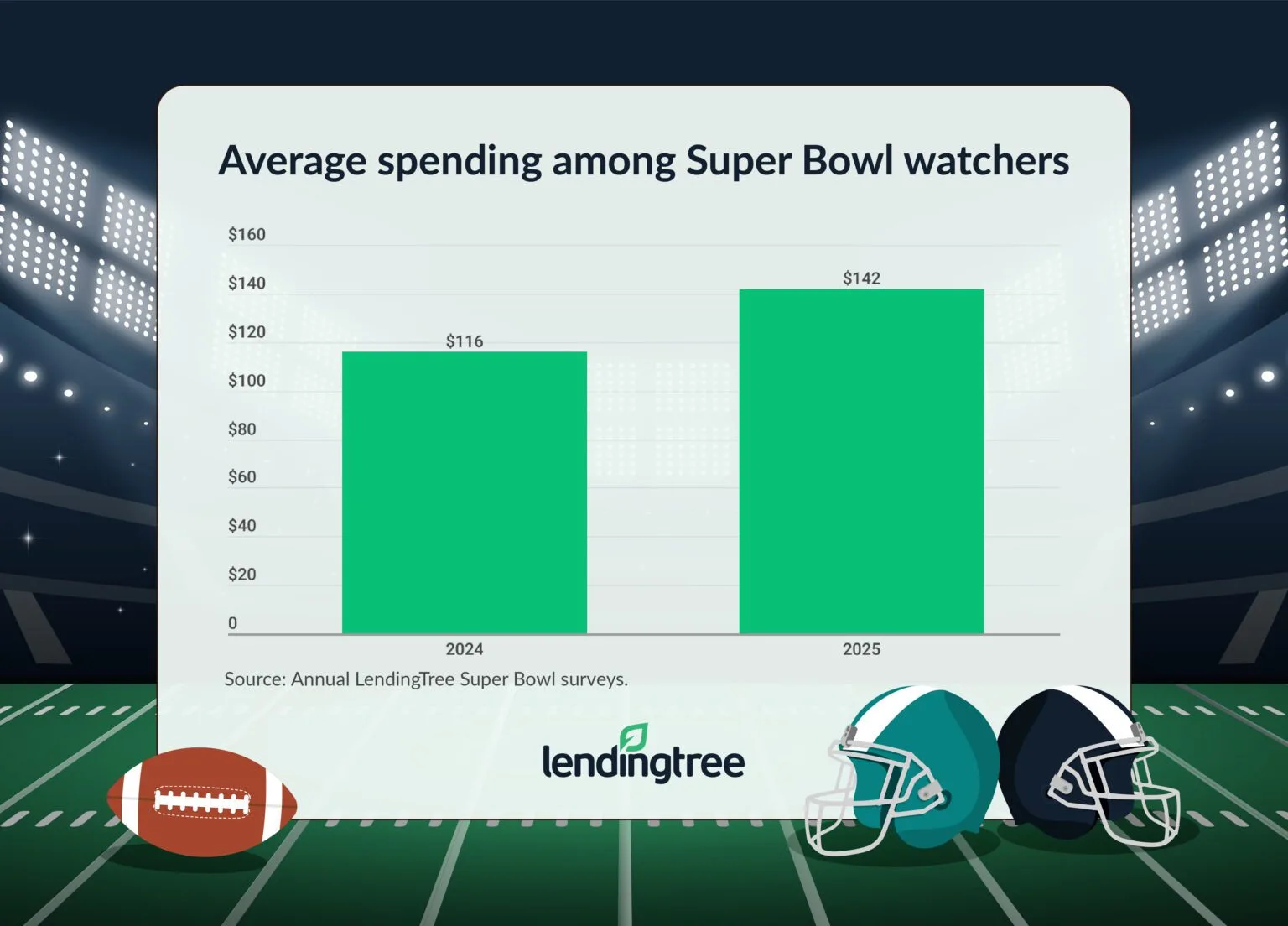

Almost a third of Americans who plan to watch the Kansas City Chiefs and Philadelphia Eagles in the Super Bowl say they’ll spend less on the big game this year — far higher than those who say they’ll spend more. However, those who’ll spend expect to shell out $142 on average, which is higher than last year’s figure.

That’s according to the LendingTree 2025 Super Bowl Spending Report. This year’s survey covers everything from food and fan merch to sports betting and Taylor Swift, whose boyfriend’s team has reached the Super Bowl for a third year in a row.

Here’s what we found.

- More Americans dial back Super Bowl spending. 75% of Americans say they’ll tune in to the Super Bowl, but 31% of those who’ll watch say they’ll spend less on the big game this year. That’s far more than the 19% who say they’ll spend more. Half (50%) say they’ll spend the same amount as last year.

- But those who’ll spend expect to shell out significantly more. Those planning to watch the game expect to spend $142 on average — up 22% from $116 in 2024 — with the top items being food and beverages and fan gear. Nearly half (48%) of viewers say the game isn’t the primary reason for watching.

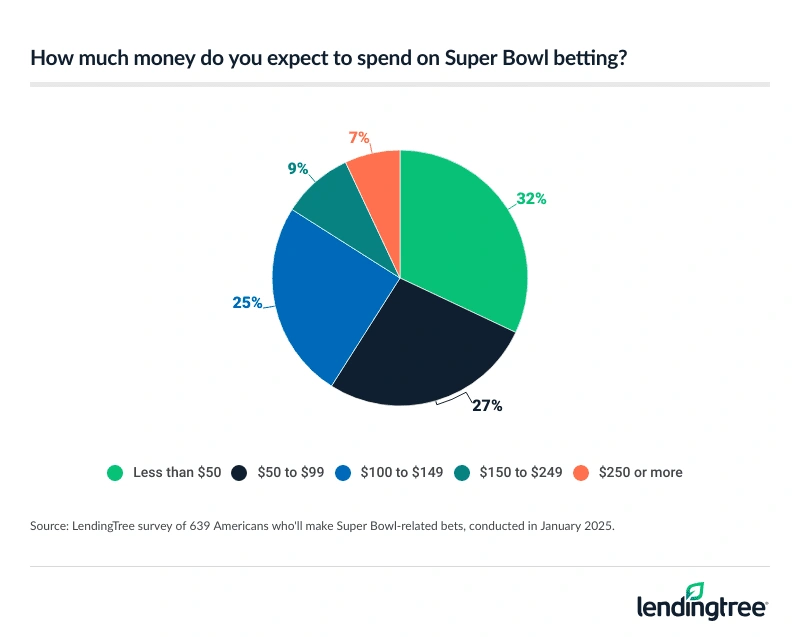

- Some hope for touchdowns of their own by scoring extra dough. 41% of Super Bowl watchers say they’ll place bets related to the game, led by 66% of Gen Zers, 59% of parents of young kids, 56% of millennials and 51% of men. Among bettors, 41% plan to spend $100 or more, and 40% will use a credit card to place wagers.

- Further legalization of sports betting is contributing to its popularity. When asked how they’ll place bets, 63% said sites such as DraftKings or FanDuel, up from 52% last year. Additionally, 41% will bet informally between family and friends, and 25% will utilize in-person options.

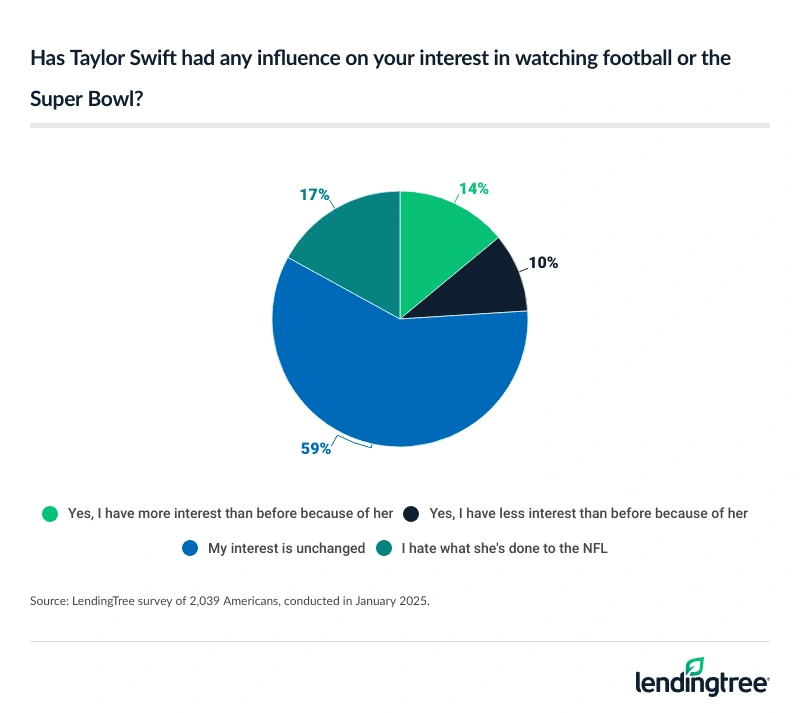

- Taylor Swift’s love story with the NFL has Americans divided. Almost a quarter of Americans say she has impacted them, with 14% gaining NFL interest and 10% losing it. Additionally, 17% say they hate what she has done to the league. However, 39% of Gen Zers and 31% of millennials say she has impacted how much they spend on football.

More people cut back on Super Bowl spending

Few things unite Americans like our collective love of football, and there’s no greater proof than the Super Bowl. Our survey finds that 3 in 4 Americans (75%) say they’ll watch the Feb. 9 game between the Kansas City Chiefs and Philadelphia Eagles — unchanged from last year when it was the Chiefs and San Francisco 49ers.

Of course, we don’t just watch. A fortunate few will buy crazy-expensive tickets and travel to the game in New Orleans. For the rest of us, we throw parties at home that revolve around the game. We place bets. We buy mountains of food and drink. We get cool merchandise to make us look like fans of the best team and not people who jumped on the bandwagon.

However, this year will look a little different for many Americans. Nearly 1 in 3 Americans who’ll watch the Super Bowl say they’ll spend less on the big game in 2025 than in 2024.

Women are far more likely to say they’ll spend less this year, with 37% saying so and 13% saying they’ll spend more. Meanwhile, 26% of men say they’ll spend less and 25% say they’ll spend more.

Younger Americans are far more likely than their older counterparts to say they’ll spend more (34% of Gen Zers ages 18 to 28 versus 5% of baby boomers ages 61 to 79), while the age gap is far less pronounced among those who expect to pay less. Gen Zers, at 35%, are again the most likely, while millennials ages 29 to 44 are the least likely at 29%.

- 2024: 75% of Americans will tune into the Super Bowl (Taylor’s Version), spending $116 on average

- 2023: Inflation wins again as Americans plan to spend an average of $115 on the Super Bowl this year

- 2022: Super Bowl spending expected to drop 19% as fewer Americans say they’ll watch

- 2021: Half of Americans will bet on Super Bowl, led by millennials and Gen Zers

But those who’ll spend will shell out significantly more

This year’s Super Bowl watchers expect to spend an average of $142. That’s a 22% increase from $116 in 2024.

The biggest Super Bowl spenders? Millennials ($226), those making $100,000 or more a year ($223) and parents of young kids ($217). Meanwhile, men expect to spend more than twice as much as women ($187 versus $89).

The most common expenses are food and beverages, bought by 67% of Super Bowl watchers, followed by fan gear (17%). The younger you are, the more likely you are to buy fan gear, with 27% of Gen Zers and 25% of millennials planning to do so, versus 11% of Gen Xers ages 45 to 60 and 3% of boomers.

Still, as we know, Super Bowl Sunday isn’t only about the game. Our survey shows that almost half (48%) of those who expect to watch say the game isn’t the primary reason. Nearly 1 in 5 viewers (19%) say the halftime show is their main reason for tuning in, while another 17% say they watch mostly for the commercials. The younger you are, the more likely you are to say you’re watching for the halftime show — 27% of Gen Z viewers and 23% of millennial viewers, versus 18% of Gen X viewers and 10% of boomer viewers.

Meanwhile, 4% of viewers say they do so out of social obligation. Everyone else is watching, so I guess I should, too.

Many hope to score extra dough via sports betting

The survey is further proof — as if we needed more — that betting enormously impacts Super Bowl watching.

More than 4 in 10 Super Bowl watchers (41%) say they’ll place bets related to the game. Among those who’ll watch the game, a staggering 66% of Gen Zers say they will, as will 56% of millennials and 51% of men.

Among bettors, about 4 in 10 (41%) plan to bet $100 or more. That includes 7% who expect to wager $250 or more. Men are more than twice as likely as women to do so (9% of men versus 4% of women).

Our survey finds that 40% of bettors will use a credit card to place at least one bet. The younger you are, the more likely you are to do so.

For decades, the only place to legally gamble on sports in the U.S. was Nevada. Then, people were largely limited to betting informally among friends and family, or seeking illegal bookies to facilitate the betting. Boy, have things changed. Sports betting is now legal in more states than it isn’t, and it’s having a huge impact.

Among bettors, when asked how they’ll place bets, nearly two-thirds (63%) said they’d use sites such as DraftKings or FanDuel. That’s up 11 points from 52% last year.

The rise of online betting sites doesn’t mean people have stopped betting in old-school ways. Our survey finds that 41% of bettors will still bet informally between family and friends, and 25% will utilize in-person options, such as a sports book.

Betting sites are far and away the most popular option for men, with 70% of male bettors saying they’d place Super Bowl bets using those types of sites (versus 51% of women). On the other hand, women (46%) are more likely to say they’ll bet informally among friends and family than men (39%).

Taylor Swift’s love story with the NFL has Americans divided

Sports betting isn’t the only phenomenon that has driven interest in football in recent years. Taylor Swift has unquestionably done so as well. That doesn’t mean everyone is happy about it, though, even though boyfriend Travis Kelce’s team is once again in the Super Bowl.

Nearly a quarter of Americans say she has impacted their interest in watching football — 14% say they’ve gained interest because of her and 10% say they’ve lost it.

The more money you make and the younger you are, the more likely you are to say Swift’s involvement has increased your interest in the game. Interestingly, younger Americans are also more likely to say she has decreased their interest in football. That can happen because a far higher rate of young people than old people say Swift has impacted their interest in football — good or bad. Just 28% of boomers and 37% of Gen Xers say she’s had an effect, versus 47% of millennials and 53% of Gen Zers.

Swift isn’t just leading people to watch games, though. She’s driving spending, too. One in 5 (20%) Americans say Swift has influenced their spending on football. Among Gen Zers and millennials, that rate rises to 39% and 31%, respectively. Interestingly, 26% of men say she influenced their spending on football, versus 14% of women.

Still, an awful lot of people aren’t happy about Swift’s increased presence around NFL games. Nearly 1 in 5 Americans (17%) say they hate what she’s done to the NFL. Among the most likely groups to say so: Gen Xers (21%), those making less than $30,000 a year (19%) and, perhaps surprisingly, women (18%).

Swift has been at both of the Chiefs’ playoff games this year. Barring any issues, you can expect to see her at the Caesars Superdome on Feb. 9.

How to keep your fandom from sacking your finances

While the buzz from watching your favorite team lift the Lombardi Trophy can last a long, long time, the debt you run up in watching them do it shouldn’t.

Here are some ways you can make sure your Super Bowl debt doesn’t last into next season:

- Budget for it. If you love it and spend money on it, you should budget for it. That’s true no matter your passion, and football is no exception. If you know you’re going to spend a significant amount of money on or around Super Bowl Sunday, your best move is to start planning now. A big step in that process is creating a budget or updating the one you have to make sure it includes your spending on your football fandom. That way, you can enjoy the game without worrying about it wrecking your finances.

- Remember: New isn’t always better. That old Patrick Mahomes or Jalen Hurts jersey probably fits fine; there’s no need to shell out for a new one. Those leftover football-themed decorations from your last watch party should be perfectly usable, too. The same goes for your old football. Avoiding unnecessary spending can help keep your costs down and may even be the key to keeping you from landing in debt.

- Leverage credit card rewards. The right credit card, used wisely, can help extend your budget. Cash back rewards can put an extra 1% or 2% back in your pocket. Travel rewards can get you a little closer to that training camp trip you’ve wanted to take. And if you’ve got cash saved to pay for the big game, get a new credit card. Then, put your Super Bowl spending on that card and use the saved cash to pay it off at the end of the month. That way, you may be able to take advantage of that $100-plus sign-up bonus on that card without paying extra interest in the process.

- Consolidate your debt. Using a 0% balance transfer credit card or a low-interest personal loan to consolidate your debt can be a game-changer. Not only can it lower your interest rate — which can shorten your payoff time and reduce the cost of paying off the balance — it can shrink your to-do list. That’s because you can use a single consolidation loan to pay off multiple loans, leaving you fewer bills to manage.

- Get an accountability buddy. Having someone who knows you’re trying to work on your financial situation and will cheer you on while you do it can be an enormous help. That’s true in many aspects of life, and money is no exception.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,039 U.S. consumers ages 18 to 79 from Jan. 2 to 6, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79