2024 Cost of Thanksgiving Report

Thanksgiving will gobble up many Americans’ budgets this year.

According to the latest LendingTree survey of nearly 2,050 U.S. consumers, potential Thanksgiving hosts plan to spend an average of $431 on Thanksgiving food, drinks and decor — up 19% from last year. And 36% of them admit doing so is a financial strain, which may put some in debt.

Here’s what else we found.

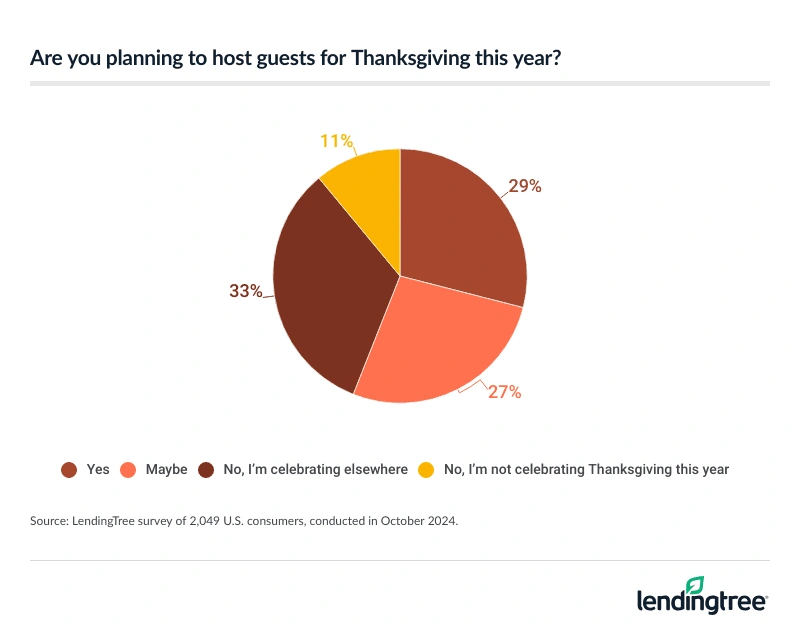

- Hosting a Thanksgiving meal can cost you. Over half (56%) of Americans may host guests for Thanksgiving this year, spending an average of $431 on food, drinks and decor, up 19% from last year. Six-figure earners ($579), men ($496) and parents with young children ($493) expect to spend the most on average.

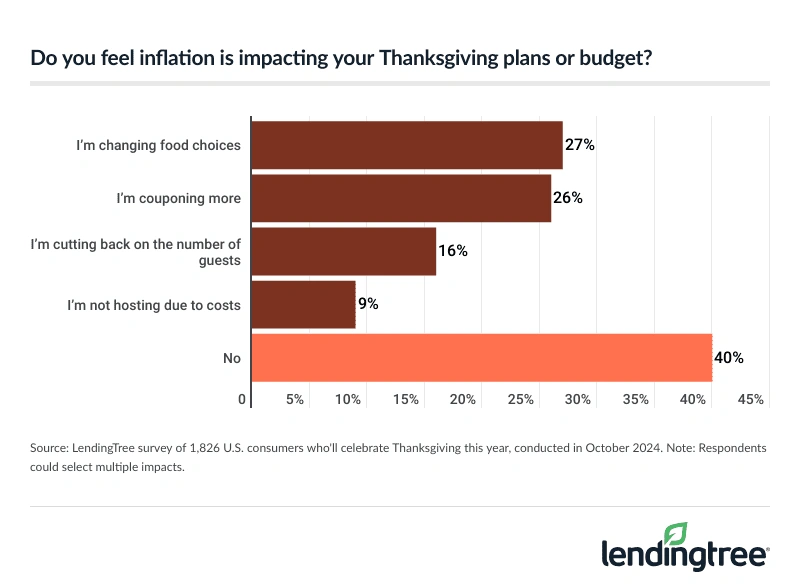

- Inflation is leading some to change their Turkey Day plans. 60% of celebrators say inflation is impacting their Thanksgiving. Most commonly, 27% will change food choices, 26% will coupon more and 9% won’t host due to costs. Given the cost, 35% of potential hosts may reconsider opening up their homes next year.

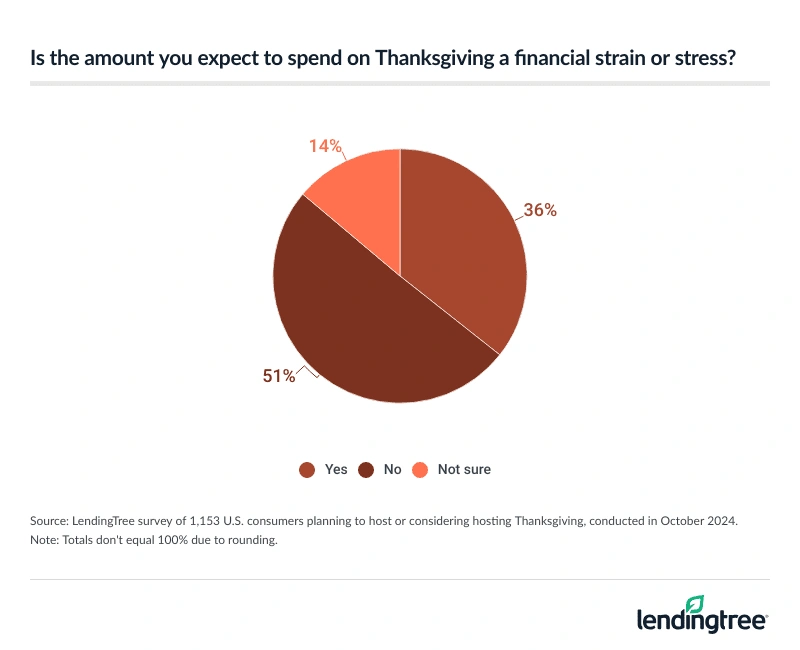

- Bellies are full of turkey and stuffing, but some are full of regret. Over a third (36%) of potential hosts admit the amount they plan to spend on Thanksgiving will be a financial strain, and 14% already regret their decision to host. 34% of potential hosts will use their credit cards to pay Thanksgiving costs.

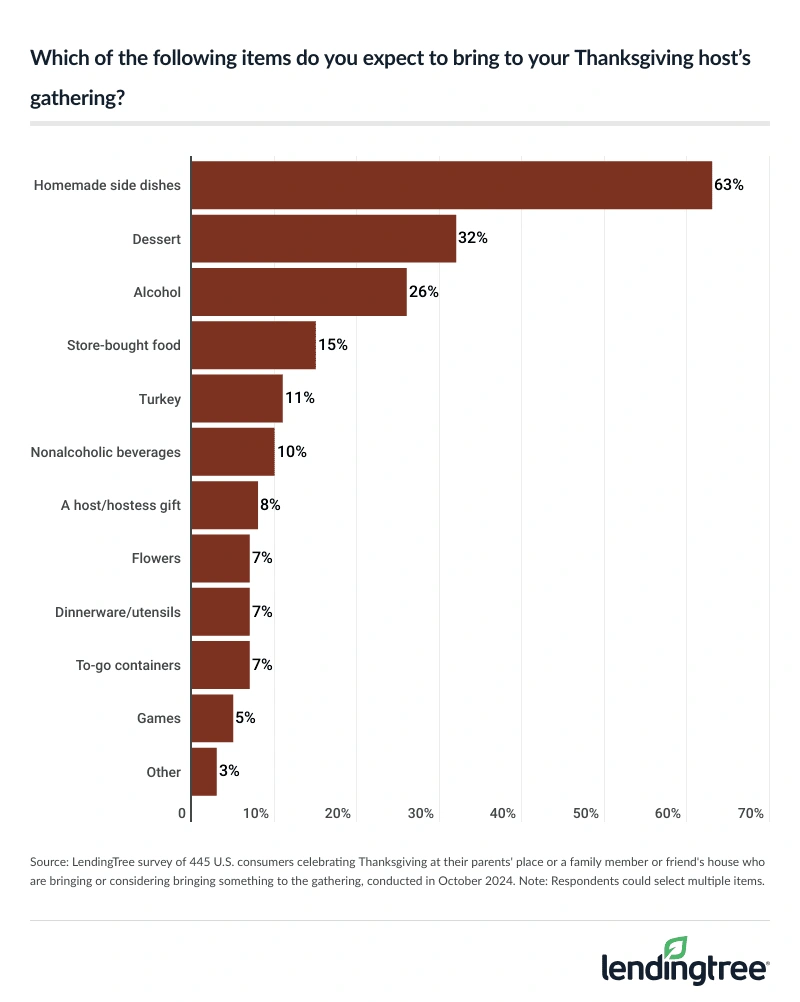

- Guests should plan to come with gifts, or they may not receive an invite next year. 6 in 10 potential hosts expect their guests to offer money or an item to offset expenses, and 25% say they may reconsider an invitation next year if a guest arrives empty-handed. However, the majority of those attending a celebration elsewhere plan to contribute to the spread, most notably with side dishes (63%) and desserts (32%).

Hosting Thanksgiving gobbles up cash

Consumers are gearing up for Thanksgiving — particularly the 56% of Americans who may host guests this year. Those with children younger than 18 (68%), six-figure earners (66%) and Gen Zers ages 18 to 27 (63%) are the most likely to consider hosting this year.

These potential hosts will spend an average of $265 on food and drinks and $166 on decor. That puts their total average spending at $431 — up 19% from last year.

Going further, six-figure earners plan to shell out $579 on average — the highest by demographic. That’s followed by men ($496) and parents with young children ($493).

Over half (53%) of potential hosts say their budget is flexible. Meanwhile, 27% have a strict budget and 20% say they’re OK with it costing however much it does. Still, Matt Schulz — LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says careless spending is risky.

“Whenever you start spending more, there’s always going to be more risk,” he says. “That’s especially true when you’re spending almost 20% more than last year. Most people’s budgets are tight, leaving little financial wiggle room from month to month, so a 20% increase can be a big deal. That’s money that won’t be able to go to other financial goals, such as building an emergency fund or paying off high-interest debt.”

To help give context to their budgets, potential Thanksgiving hosts expect an average of 11 guests at their table for the holiday this year — the same number as last year.

As far as who’s on the guest list, 86% of potential hosts expect to welcome close family for Thanksgiving this year, while just over half (51%) expect to have friends over. That’s followed by neighbors (15%), distant relatives (13%) and colleagues (11%).

Inflation will impact some celebrators’ plans

While many Americans are giving thanks this holiday season, it’s not thanks to inflation. Across all celebrators, 3 in 5 (60%) say inflation is impacting their Thanksgiving. That’s particularly true among Gen Zers (68%), those with children younger than 18 (64%) and those earning less than $30,000 (64%).

Among celebrators, 27% will change their food choices — the most common impact from inflation. Also, 26% will coupon more, 16% will cut back on the guest list and 9% won’t host due to costs.

Schulz says inflation is forcing people to make tough choices across the entire holiday, too.

“For some, it might be that they have to spend more of their time bargain hunting and coupon seeking,” he says. “For others, it might mean they can’t afford to do things they love, like hosting a big family Thanksgiving. These are things that people across the country have had no choice but to wrestle with over the years.”

Keeping the guest list small isn’t the only thing on Americans’ minds. Among potential hosts, 35% may reconsider doing so next year. Still, 65% of potential Thanksgiving hosts are willing to host again next year despite the costs.

Cornucopia of costs leaves potential hosts feeling regretful

Hosts may plan for a feast, but it may put their wallets on a fast — much to their regret. In fact, 36% of potential hosts admit their planned Thanksgiving spending will be a financial strain.

Additionally, 14% already regret their decision to host. That jumps to 26% among six-figure earners and 22% among those with children younger than 18.

When it comes to paying for their parties, 34% plan to shop with a credit card, while 13% will use buy now, pay later (BNPL) loans.

“As long as it only takes a few billing cycles to pay off your credit card, the impact on credit scores shouldn’t be significant,” Schulz says.” A little bit of a balance carried every once in a while for a short period is fine. The danger comes when the debt is big and is frequently carried for a long time. There certainly may be some who go down that road because of Thanksgiving, but that debt won’t be debilitating or long for most people.”

To help offset costs, 30% of potential hosts will shop around, while 22% will use coupons and 33% will do both.

Potential hosts expect guests to bear some of the expenses

It’s not Christmas, but guests shouldn’t show up empty-handed — unless they don’t want an invite next year. Among potential hosts, 60% expect their guests to offer money or an item to offset expenses. A quarter (25%) say they may reconsider sending an invitation next year if a guest arrives empty-handed.

On the bright side, 67% of those attending a celebration elsewhere plan to contribute to the spread, especially baby boomers ages 60 to 78 (78%), those with children 18 or older (78%) and women (71%).

The most common thing to bring is side dishes, at 63%. That’s followed by desserts (32%) and alcohol (26%).

Where are guests headed? Of those planning to attend a Thanksgiving celebration, 49% plan to celebrate at a family member’s house, 21% plan to attend at their parents’ house and 12% plan to celebrate at a friend’s.

Breaking bread without breaking the bank: Top expert tips

Whether you’re a host or guest, you can help cut back on costs in a few ways. Schulz offers the following advice.

- Offering to help the host doesn’t have to cost you. “If you’re struggling financially, consider coming a little early to the party to help with the cooking or the decorations or picking up people from the airport,” he says. “All these things, and plenty others, can be extremely helpful without really costing you, except for a little bit of gas in the tank.”

- The right credit card, used wisely, can make a difference. Whether you’re getting free airfare and hotel nights, reduced prices at the pump or points back on everything you buy, credit card rewards can extend your holiday budget.

- Shop around. “It’s such old and cliched advice, but it’s true,” Schulz says. “Taking the time to comparison shop can save you significant money at the holidays or any other time of year.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,049 U.S. consumers ages 18 to 78 from Oct. 1 to 3, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78