60% of Americans Are Planning to Host or Considering Hosting Thanksgiving, and a Third of Them Say It’s a Financial Strain

When the turkey and the bills are roasting, it’s a true Thanksgiving challenge — and many Americans may balance both this year.

According to the latest LendingTree survey of over 2,000 U.S. consumers, 60% of Thanksgiving celebrators say inflation is impacting their plans or budget in some way.

Here’s what else we found.

Key findings

- Hosting Thanksgiving comes with financial challenges, and some are already feeling stuffed with regret. 60% of Americans are planning on hosting or considering hosting Thanksgiving this year, and they expect 11 guests, on average. Potential hosts expect to spend an average of $361 on food, drink and decor. For parents of children younger than 18, that catapults to $469. However, nearly a quarter (24%) say the high costs could deter them from hosting again next year.

- High grocery bills are on the menu thanks to inflation. 60% of celebrators say inflation is impacting their Thanksgiving plans or budget in some way. Many potential hosts are cutting costs where they can, with 77% planning to shop around and/or use coupons to lower their spending. Setting and sticking to a budget can also help rein in costs, and 22% of potential hosts have a strict budget in place. Meanwhile, 56% say they have a rough budget that’ll allow wiggle room and 22% say they aren’t limiting turkey day spending.

- Guests should come bearing gifts or risk getting squashed from next year’s guest list. 34% of those potentially opening their homes for Thanksgiving say this year’s celebration will cause a financial strain. However, some guests are ready to help offset the costs. Among those celebrating but not hosting, 61% will contribute to the table spread, with the top items being homemade side dishes (46%), dessert (30%) and alcoholic beverages (19%). Among potential hosts, 1 in 5 (20%) say they might not invite their guests again next year if they show up empty-handed.

- The financial weight of Thanksgiving may be carried into the new year. Among the 41% of potential hosts who say they’ll use a credit card to cover some or all expenses, just half (50%) expect to pay it off within a billing cycle. Nearly 1 in 5 (19%) say it’ll take them over three months to pay it off. Meanwhile, 8% of potential hosts are turning to buy now, pay later (BNPL) options, with parents of children younger than 18 (13%) among the most likely to do so.

Thanks-spending: Potential hosts plan to spend an average of $361

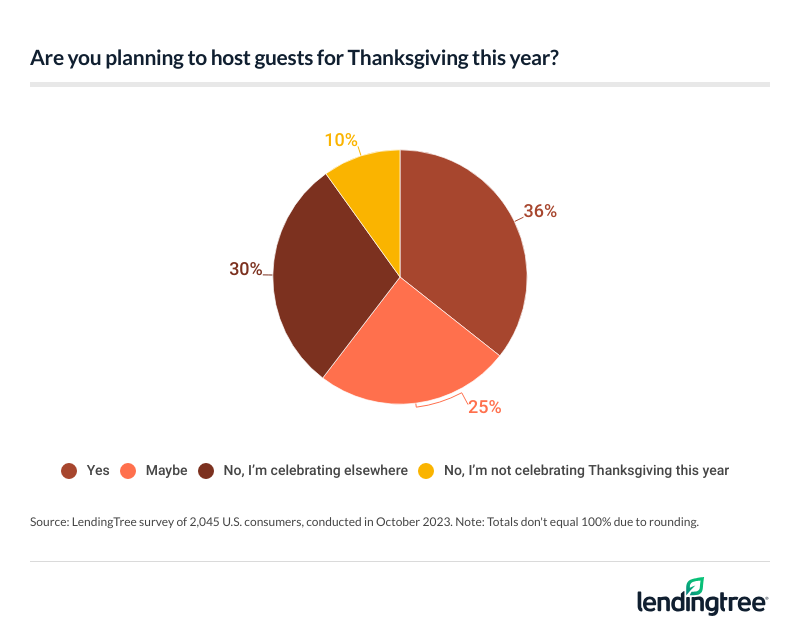

Thanksgiving hosts have a slew of concerns, and many Americans may take on this duty this year. In fact, 60% of Americans are either planning to host or considering hosting Thanksgiving in 2023.

Those with children younger than 18 are the most likely to potentially host Thanksgiving this year, at 72%. That compares with 59% of those with children older than 18 and 52% of those with no children. By age group, Gen Zers ages 18 to 26 are the most likely to be potential hosts, at 64%. On the other hand, baby boomers ages 59 to 77 (55%) are the least likely.

Meanwhile, 70% of those earning $75,000 to $99,999 may host — the most likely by income group. Just less than half (48%) of those earning less than $35,000 say similarly, making them the least likely income group to do so.

How many people do hosts expect to serve this year? Those planning to host or considering hosting expect 11 guests, on average. Gen Zers expect the fullest tables, with an average of 14 guests. Following that, those with children younger than 18 expect 13 guests and six-figure earners expect 12, on average.

When it comes to those guests, most expect family members at the table. To break it down:

- 87% expect to host close family members

- 55% expect to host friends

- 15% expect to host neighbors

- 12% expect to host distant relatives

- 9% expect to host colleagues

Hosting comes with several responsibilities — including a hefty financial duty. As potential hosts prepare their homes and tables, they expect to spend an average of $361 on food, drink and decor. That’s a drop from the $396 hosts expected to spend when we conducted this survey last year.

Unsurprisingly, six-figure earners expect to spend the most this year, shelling out an average of $515. That’s followed by parents with children younger than 18 ($469), millennials ($458) and those earning $75,000 to $99,999 ($423). Notably, men ($402) plan to spend more than women ($322).

LendingTree chief credit analyst Matt Schulz says these are certainly big numbers, but inflation means it isn’t exactly surprising.

This comes as nearly a quarter (24%) say the high costs could deter them from hosting again next year. That’s particularly true among those without children (30%) and Gen Zers (30%).

Outside the home, where do Americans plan to celebrate the holiday?

For those celebrating Thanksgiving elsewhere this year, 46% say they’re celebrating at the house of a family member other than a parent — the most common response. Meanwhile, a quarter (25%) plan to celebrate at their parents’ house and 14% plan to celebrate at a friend’s house.

While 9% plan to celebrate at a restaurant, those with young kids may be particularly inclined to avoid cooking and socializing this year. Among those with children younger than 18 who plan to celebrate outside the home, 14% are celebrating Thanksgiving at a restaurant.

High grocery bills contribute to Thanksgiving costs

Of course, the Thanksgiving meal itself gobbles up many Americans’ budgets. Overall, 60% of celebrators say inflation is impacting their Thanksgiving plans or budget in some way. Of this group, 26% say they’re changing their food choices, 25% are couponing more, 17% are cutting back on the number of guests and 8% are skipping hosting altogether.

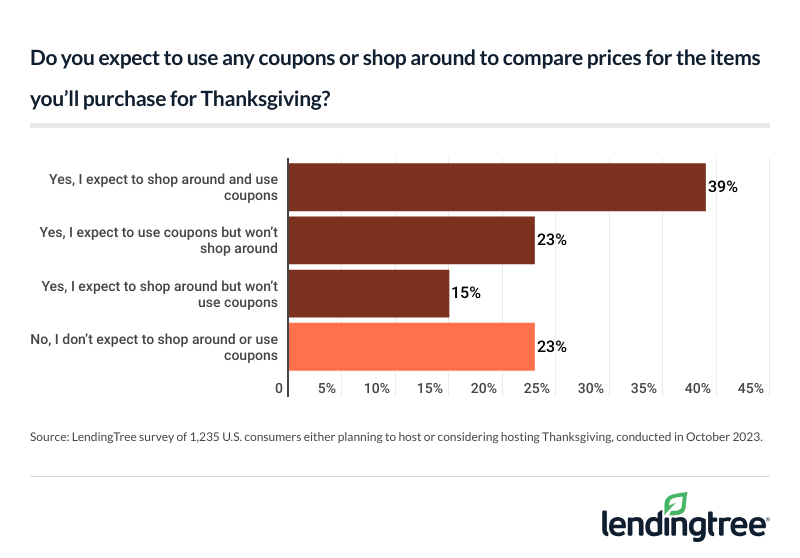

Many potential hosts are also cutting costs. Of those planning on hosting or potentially hosting this year, 77% plan to shop around and/or use coupons to lower their spending.

Setting and sticking to a budget is also a crucial way to control costs. Among potential hosts, 22% have a strict budget, while 56% say they have a rough budget that’ll allow wiggle room. On the other hand, 22% aren’t putting a limit on Thanksgiving spending.

By age group, potential baby boomer hosts (33%) are the most likely to be budget-free this Thanksgiving, while millennials ages 27 to 42 (28%) are the most likely to have a strict budget. Perhaps unsurprisingly, six-figure earners are the most likely income group to not put a budget on Thanksgiving, at 29%. Meanwhile, those earning less than $35,000 (31%) are the most likely to have a strict budget.

As potential hosts face financial stressors, guests are expected to help out

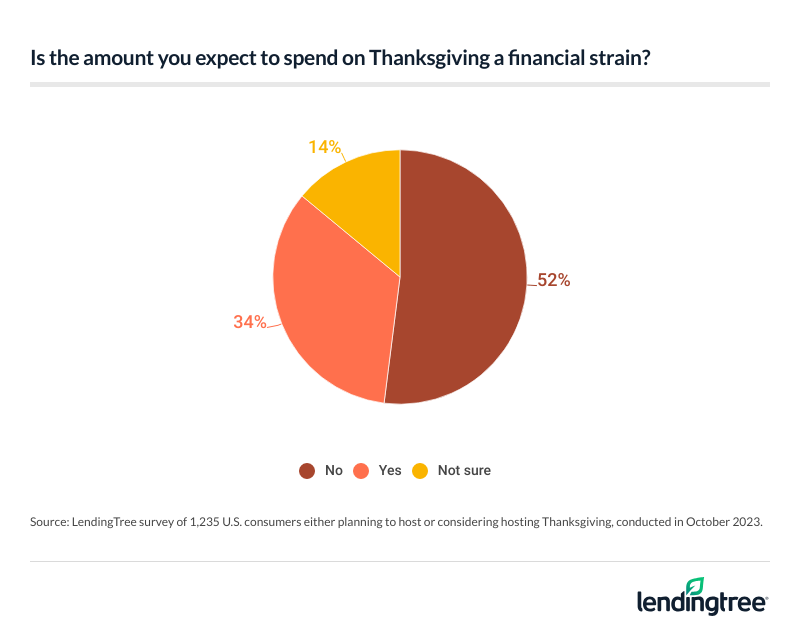

With costs as high as they are, it may not be surprising that 34% of potential hosts say this year’s celebration is a financial strain.

That’s especially true among those earning less than $35,000 (42%), millennials (40%) and those with children younger than 18 (40%). Additionally, women who may host (38%) are more likely to feel that financial strain than men (30%).

Still, it’s worth noting that most guests are willing to pitch in. Among those celebrating but not hosting, 61% will bring something to the host’s home. Of this group, 46% plan to bring homemade side dishes — the most popular option. That’s followed by:

- Dessert (30%)

- Alcoholic beverages (19%)

- Store-bought food (18%)

- Something else (12%)

- Nonalcoholic beverages (11%)

- Turkey (9%)

- A gift for the host (7%)

- Flowers (6%)

- Games (5%)

- Dinnerware/utensils (4%)

If you’re a guest this Thanksgiving, Schulz says it’s only polite to pitch in somehow. “Even if you’re only coming with napkins or a bag of chips and some store-bought dip, you need to contribute,” he says. “That’s true even if the host tells you not to bring anything. Otherwise, don’t be surprised if you’re not invited back next year.”

Most hosts (62%) think their guests will offer money or bring food/beverages to help offset the Thanksgiving expenses. That percentage is highest among Gen Zers (72%), millennials (69%) and six-figure earners (67%).

Coming giftless may mean guests will miss the gravy train next year. Among hosts, 1 in 5 (20%) say they might not invite their guests again next year if they show up empty-handed. Gen Zers are the most unforgiving hosts, with 36% saying they might not invite giftless guests next year. In a distant second, 26% of those without children say similarly.

Potential hosts are relying on credit cards

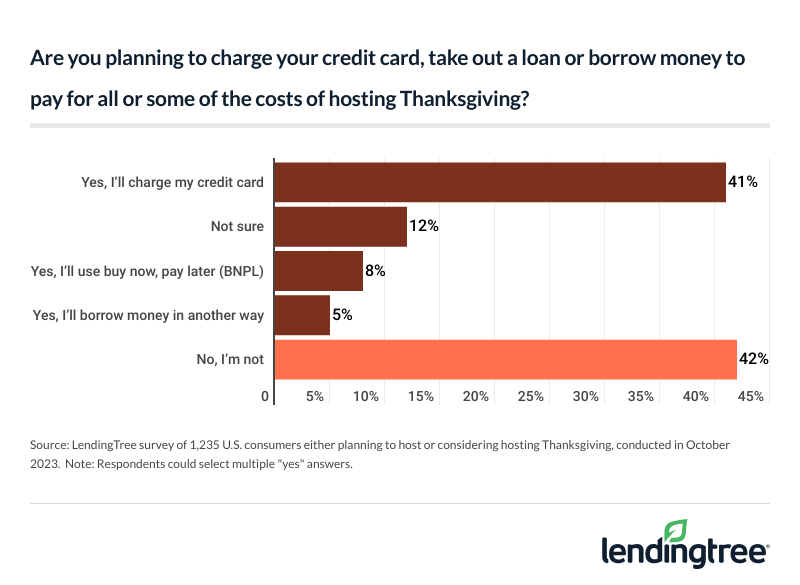

This year, 41% of potential hosts plan to use a credit card to pay for Thanksgiving — the most common response. That’s particularly true among six-figure earners (58%) and parents with young children (49%). It’s also worth noting that men (47%) are more likely to use a credit card than women (35%).

Meanwhile, 8% of potential hosts are turning to buy now, pay later (BNPL) options, with Gen Zers (14%), millennials (13%) and parents of children younger than 18 (13%) the most likely to do so.

Schulz says BNPL can be a great tool when used wisely. “However, unlike with credit cards, you have a set, finite amount of time in which you have to pay off that loan,” he says. “If you don’t think you’ll be able to do it, you could pay late fees or potentially damage your credit.”

Among those who say they’ll use a credit card to at least partially cover their Thanksgiving expenses, 50% expect to pay it off within a billing cycle. On the other hand, 19% say it’ll take them over three months to pay it off.

“If your Thanksgiving celebration is going to take three months to pay off, it may be time to consider dialing back what you’re doing or at least asking your guests to pitch in,” Schulz says. “It’s certainly not as bad as taking six months or longer to pay it off, but even over three months, you’ll potentially pay a significant amount of interest.”

While 16% of all hosts say it’ll take them three to six months to pay off their credit card bills, that rises to 24% among those earning $35,000 to $49,999. That’s followed by Gen Xers ages 43 to 58 (21%).

Carving out a Thanksgiving budget: Top expert tips

Don’t let the cost of Thanksgiving gobble up your expenses — budget (and feast) wisely. This year, Schulz offers the following tips:

- Get creative. For example, if you and your family have more time than money, prepare for your big Thanksgiving party by making decorations rather than buying them.

- Buy next year’s stuff this year (but not the turkey). “This won’t help you for 2023, but you can make 2024’s celebration cheaper by purchasing supplies and decorations and such right after this year’s holiday,” Schulz says. “There’s no less expensive time to buy holiday merchandise than right after that holiday has passed. It requires a little bit of forethought, but it can bring real savings.”

- Enlist help. “The best Thanksgiving gatherings are group efforts,” he says. “Get people involved. Chances are that they want to help. And you can make it easier on them by talking with them in advance about what could help you the most. If Mom knows in advance to bring the sweet potatoes, Big Sister knows to bring the drinks, Little Brother knows to bring the pie and your friends know to bring the games, it can help everything move much more smoothly and inexpensively.”

- Take advantage of credit card rewards. That extra 1% or 2% cash back can help extend your budget, and every little bit matters when money is tight.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,045 U.S. consumers ages 18 to 77 from Oct. 12 to 15, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

The content above is not provided by any issuer. Any opinions expressed are those of LendingTree alone and have not been reviewed, approved, or otherwise endorsed by any issuer. The offers and/or promotions mentioned above may have changed, expired, or are no longer available. Check the issuer's website for more details.