Love and Debt Is in the Air for Americans Celebrating Valentine’s Day This Year

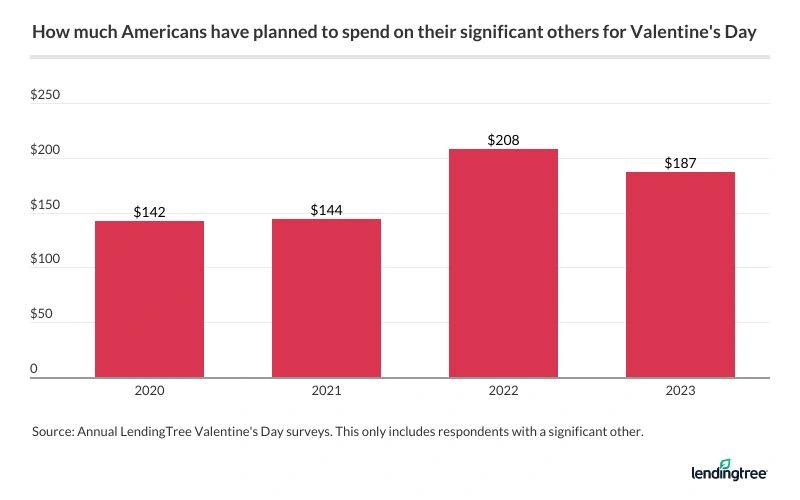

Love is in the air this Valentine’s Day, but inflation is in the bills. This year, consumers in relationships plan to spend an average of $187 on Valentine’s Day gifts, according to the latest LendingTree survey of more than 2,000 Americans. That’s a decrease from last year but still significantly above 2021 and 2020 spending.

Keep reading to learn what consumers want this V-Day (hint: the cheesier, the better), and stick around for tips on keeping costs low when celebrating with your special someone.

- Love does cost a thing for the 82% of Americans in a relationship who plan to give their significant others a present this Valentine’s Day, but inflation could force lovebirds to cut back. Those in a relationship plan to spend an average of $187 on their significant others this Valentine’s Day, a 10% decrease from 2022 but significantly above 2021 and 2020 spending.

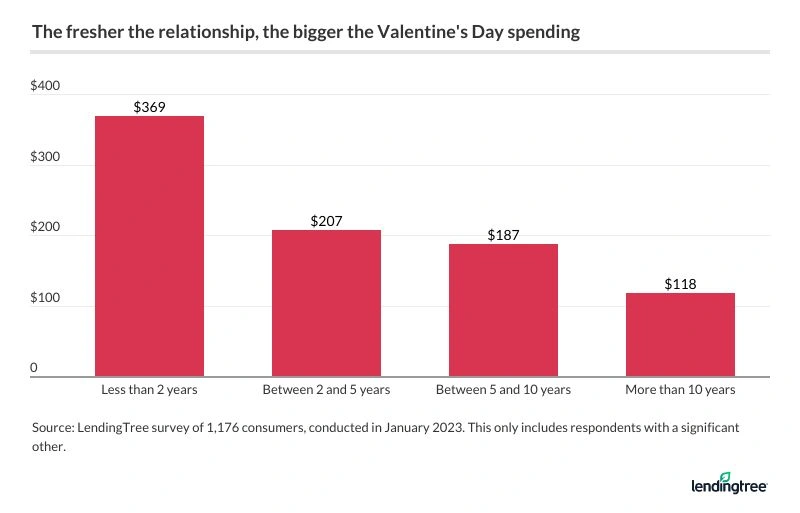

- Chivalry may not be dead, as men expect to spend nearly three times more on their valentines than women ($286 versus $103). Additionally, spending steadily declines the longer couples have been together. Partners of up to two years plan to spend an average of $369, while those in a relationship for more than a decade plan to spend an average of $118.

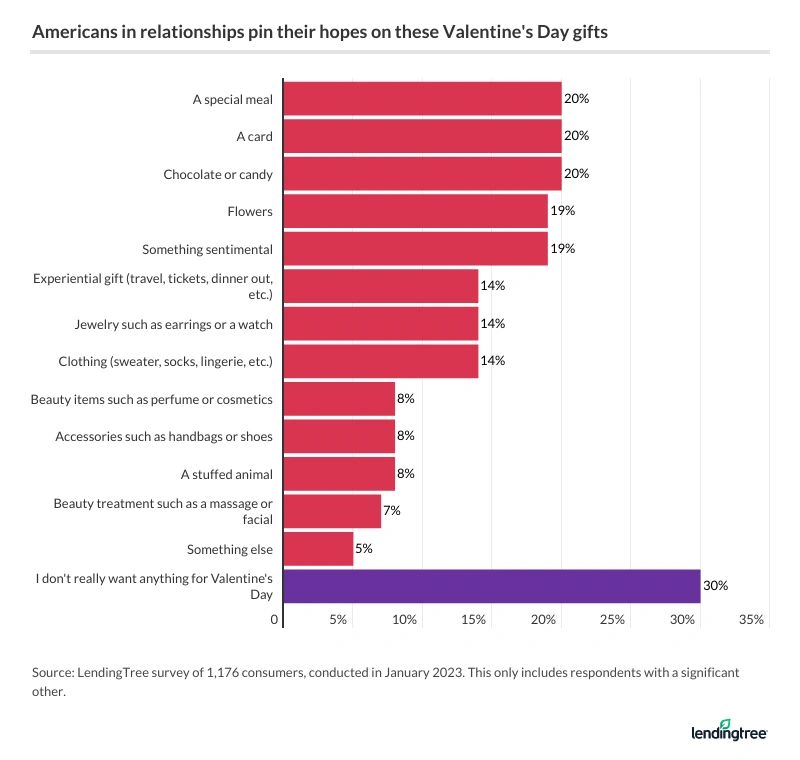

- Thoughtful gestures outweigh material gifts for Valentine’s Day this year. The most desired gifts are a special meal, a card and chocolate or candy. Fortunately for those celebrating, these are the top three gifts people plan to give their partners. Among women, flowers top the wish list — and men are prepared.

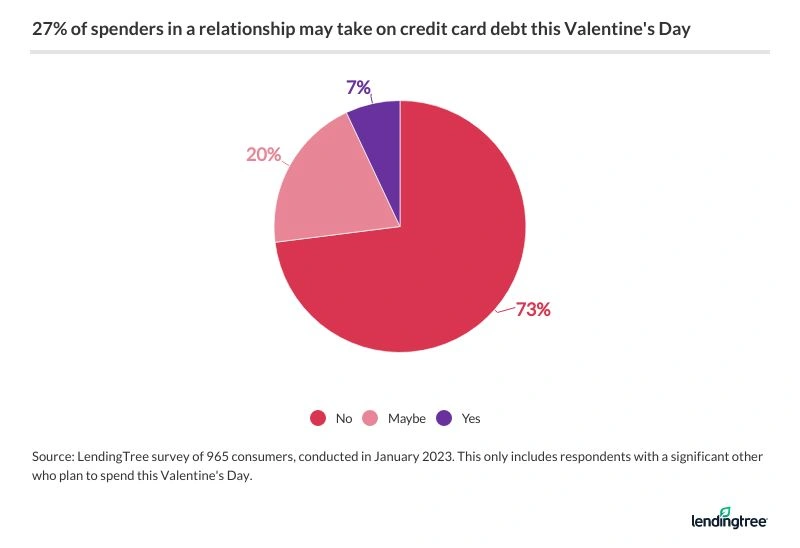

- After the roses have died and the chocolates are gone, Valentine’s Day debt lingers. More than a quarter (27%) of consumers planning to spend think they may take on Valentine’s credit card debt this year. 51% of them expect it to take at least two months to pay it off. If they rack up card debt, 41% say they won’t disclose that to their partner. Men are more likely to hide this debt than women (48% versus 35%).

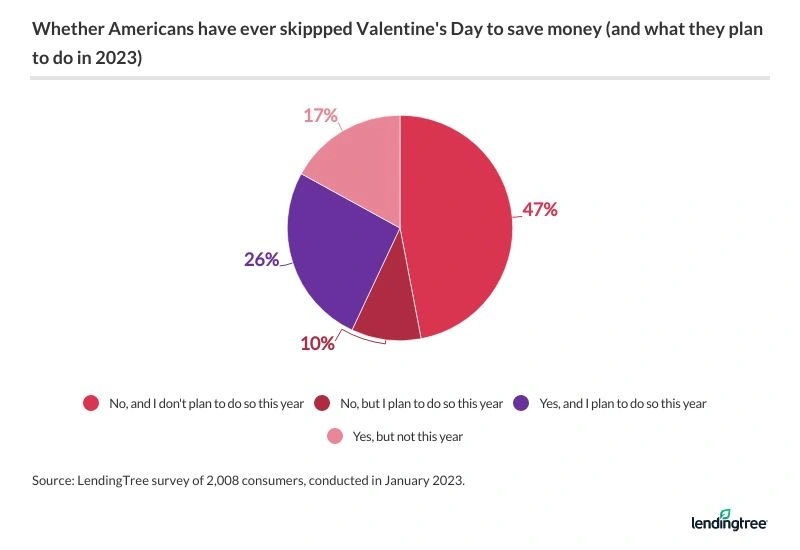

- Some respondents say breaking the bank is an investment in their future. 31% of people in a relationship believe that spending more than they can afford is worth it to show their significant other how much they care. This may explain why 47% of consumers have never skipped Valentine’s Day due to money (and don’t plan to) and 55% have never set a V-Day spending limit with their partner.

Significant others are cutting back on Valentine’s Day spending

Valentine’s Day is approaching, but it’ll come at a cost this year. About 82% of Americans in a relationship (whether dating, engaged or married) plan to spend an average of $187 on their significant others this Valentine’s Day. That’s a 10% decrease from 2022 but still significantly above 2021 and 2020 spending.

According to LendingTree chief consumer finance analyst Matt Schulz, there are a few reasons why lovebirds may be shelling out less than they did last year.

“Inflation might be forcing people to dial back the Valentine’s Day festivities a bit — or at least it’s spurring them to find creative ways to have a great day without breaking the bank,” he says. “Also, many people might have celebrated Valentine’s Day in a big way in 2022 because they couldn’t do so when COVID-19 was a larger concern. Now that it’s not, however, they may be more comfortable dialing it back a bit.”

Although those in a relationship may be shelling out close to $190 on average, most don’t expect their significant other to spend that much. Those in relationships expect their partner to spend an average of $122 this year — significantly lower than the $152, on average, they expected from their S.O. last year.

By age group, millennials 27 to 42 expect their significant others to spend the most on them this Valentine’s Day — $182, on average. Following that, Gen Zers ages 18 to 26 expect their partner to spend an average of $168. Baby boomers ages 59 to 77 ($44) and Gen Xers ages 43 to 58 ($80) expect their partners to spend the least, on average.

By relationship status, those dating expect their partner to spend an average of $148 this year. That compares with an average of $111 among married respondents.

Couples have different expectations depending on how long they’ve been together, too. Those who’ve been with their significant other for less than two years expect their S.O. to spend the most on V-Day, at $215. After the two-year threshold, the longer a couple has been together, the less they expect their S.O. to spend:

- Those who’ve been together between two and five years expect their partner to spend an average of $177

- Those who’ve been together between five and 10 years expect their partner to spend an average of $97

- Those who’ve been together more than 10 years expect their partner to spend an average of $80

Overall, 17% of those in relationships say they plan to spend more this Valentine’s Day than last year, while nearly a quarter (23%) plan to spend less.

Men plan to spend more than women

Regardless of what they expect their partner to spend, the data indicates that chivalry may not yet be dead. In fact, men expect to spend an average of $286 on Valentine’s Day — nearly three times more than the $103 women expect to spend, on average, on their partners.

Those who’ve been with their partner for a while may not be planning anything extravagant this year, though: Spending steadily declines the longer couples have been together. Partners of less than two years plan to spend an average of $369, while those in a relationship for more than a decade plan to spend an average of $118.

According to Schulz, those who’ve been with their partner for a while may not feel the need to impress.

“In those early days, people often feel more pressure to spend more and do things that impress their loved one,” he says. “That’s certainly true around Valentine’s Day. Once you’re further into the relationship, both sides often feel a little more comfortable and a little less need to go over the top with every gift-giving occasion. They may even be willing to openly set spending limits around various holidays. That can be a good thing, but it shouldn’t mean killing all the romance around a relationship. It’s still important to treat your partner and make them feel special from time to time, whether you’ve known them for a few months or a few decades.”

Similarly, younger generations seem to have bigger plans for the holiday. Millennials plan to spend the most this year, shelling out an average of $284. That’s followed by:

- Gen Zers ($182)

- Gen Xers ($153)

- Baby boomers ($63)

Unsurprisingly, high earners plan to spend the most on Valentine’s Day. Six-figure earners say they expect to spend an average of $392 on their partner this year — far higher than the $118 those making between $50,000 and $74,999 expect to spend on average (the smallest spenders by income group).

Partners prefer thoughtful gestures

You don’t have to break the bank to make your partner happy. In fact, most would prefer thoughtful gestures over material gifts this year, with the most commonly desired gifts including a special meal, a card and chocolate or candy.

Fortunately for those celebrating, their partners plan to give them what they want. Nearly 3 in 10 (28%) plan to get their partner a card or a special meal, making them the most common gifts this year. Chocolate or candy isn’t far behind, with nearly a quarter (24%) planning to buy their partner a sweet treat.

For women, flowers (30%) top the wish list — and men are prepared, with 39% planning to buy their partner flowers. As far as what men want, though, most (39%) say they’re not looking for any gifts this year.

Beyond gifts, what do couples have planned for this V-Day? Sharing a meal is the most common way to celebrate, with 38% planning to go out to a special dinner and 31% planning to eat at home. Still, 10% of Gen Zers say they’re going to the movies — the most likely group to do so.

27% of spenders may take on Valentine’s Day debt

Valentine’s Day is a fantastic opportunity to show your loved one some appreciation, but Cupid’s arrow stings both the heart and the pockets. In fact, more than a quarter (27%) of consumers planning to spend for Valentine’s Day think they may take on debt by paying with their credit cards.

By generation, 35% of millennial spenders expect they may take on Valentine’s Day debt, making them the most likely to do so. That’s followed by:

- 34% of Gen Zers

- 22% of Gen Xers

- 16% of baby boomers

Most don’t expect to pay off their debts very quickly, either. Of those who think they’ll take on debt, more than half (51%) expect it to take at least two months to pay it off. If they rack up card debt, 41% say they won’t disclose that to their partner, with men (48%) more likely to hide potential debt than women (35%).

In light of this, Schulz cautions against overspending this V-Day. “The desire to get nice things for those you love is understandable, and most people love getting an extravagant gift every once in a while,” he says. “However, we tend to overvalue how important our partner thinks those things are. As much as we love getting gifts, hardly anyone wants their partner to go into debt in the process. That doesn’t help anyone.”

Some significant others say spending more than they can afford is worth it

Given all that potential debt, is it worth splurging on Valentine’s Day? Some say yes. In fact, 31% of people in a relationship believe that spending more than they can afford is worth it to show their significant other how much they care.

That may be why 47% of consumers have never skipped Valentine’s Day due to money (and don’t plan to do so this year). That’s particularly true for those who’ve been together for more than a decade (57%), six-figure earners (54%), baby boomers (54%) and those who are married (54%) — though there may be some significant overlap between these demographics.

It’s also worth noting that 55% have never set a V-Day spending limit with their partner. Of this group, 37% would never consider doing so.

According to Schulz, that’s not necessarily a bad thing.

“They say that good debt is debt that gives you a great return on investment,” he says. “Some people may look at spending on their loved one in that way. It’s fine to spend more than you can afford every once in a while to do something special for the one you love. If you go too big or too often, it can be a recipe for trouble, but splurging every now and then for your partner can help you show them how much you care. Just do it responsibly.”

On the other hand, 43% of respondents have skipped Valentine’s Day due to money, and just over a quarter (26%) are planning to do so this year.

Expert tips to save some cash this Valentine’s Day

Love doesn’t have to come with a hefty price tag. If you’re looking to celebrate Valentine’s Day on a budget, here are a few tips to avoid taking on too much Valentine’s debt:

- Get creative. “Yes, expensive dinners and fancy jewelry are always a hit, but you can make amazing memories with a home-cooked dinner, a handmade gift and some creativity,” Schulz says. “Romance doesn’t have to be expensive.”

- Put it in your budget. “If you’re planning on doing Valentine’s Day in a big way this year, be planful and thoughtful about it,” he says. “That can start by thinking through what you want to do and making a budget for how much you want to spend. That way, you can shift around some expenses for a month or two and potentially minimize the amount of debt you need to take on.”

- Be open with your partner about money. “It may not be comfortable to do in the early stages of a relationship, but once you both know that you’re in it for the long haul, it’s an absolute must,” he says. “As much as you may not want to tell your partner about any debt you might have, keeping it from them will only make it worse. If you talk with them openly and honestly about it, chances are they’ll only want to help you get out of it — even if that means taking it easy this Valentine’s Day.”

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,008 U.S. consumers ages 18 to 77 from Jan. 19 to 23, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77