Chase Credit Journey: How It Works and What To Know

- You can use Chase Credit Journey to check your credit score and learn how to improve your credit.

- You don’t need to be a Chase customer to use Chase Credit Journey.

- Chase Credit Journey offers a free, safe way to monitor your credit without knocking points off your credit score.

What is Chase Credit Journey?

Chase Credit Journey is a free credit monitoring service that helps you keep track of your money and financial health. Here are a few ways you can use Credit Journey:

- Overview of current finances and credit history. Chase Credit Journey is like a report card for your financial health. You’ll see your credit score, credit usage, account balances and any missed payments or recent credit inquiries.

- Alerts of any changes in your credit. Get free alerts for major events happening with your credit, like when a company checks your credit, a new account has been opened in your name or your personal information is found on the dark web.

- Plan your next financial move. You can use the credit score simulator to see how taking out a loan, getting a credit card or missing an upcoming payment will affect your score.

- Learn about credit. Joining Chase Credit Journey gives you access to Credit Insider, a private database of expert videos and articles that will help you understand your own personal finances.

Some competitor credit monitoring services give you access to additional perks like three-bureau reporting, but these services tend to cost money. If you already have a Chase credit card or bank account, using Chase Credit Journey is a no-brainer — you just have to sign in to your Chase account to access free resources.

How to use Chase Credit Journey

Sign in to your Chase account on your phone or computer. If you don’t have a Chase account, you can create an account with Chase Credit Journey for free.

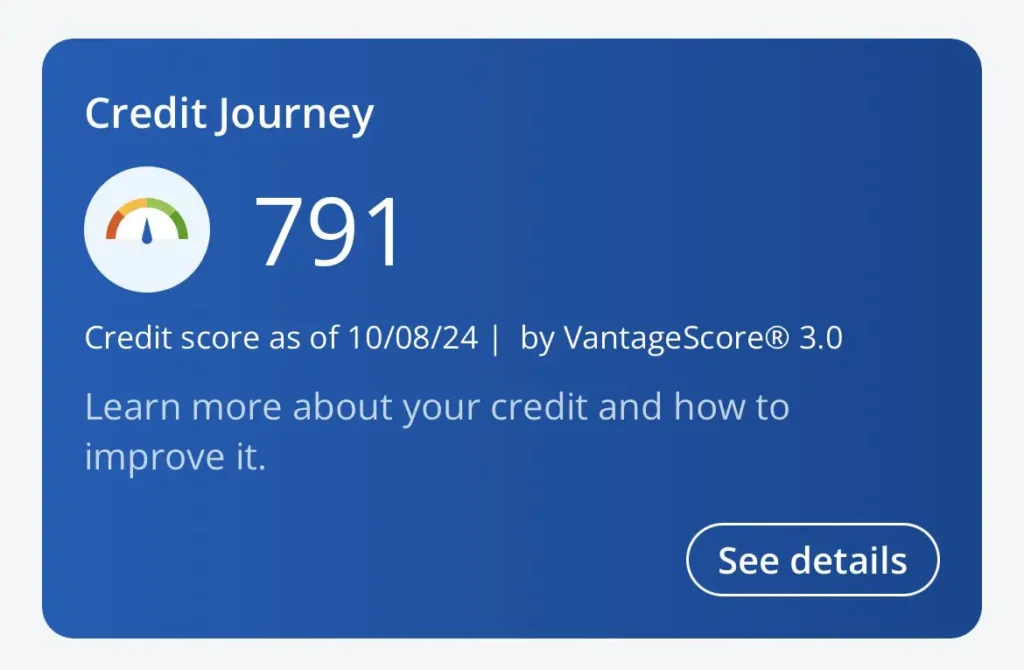

Scroll down until you see a blue tile.

When you click on “See details,” you’ll see the Credit Journey homepage, where you’ll find your updated credit score and links to other tools that help you keep track of your credit.

Here’s what you can do on the Chase Credit Journey homepage:

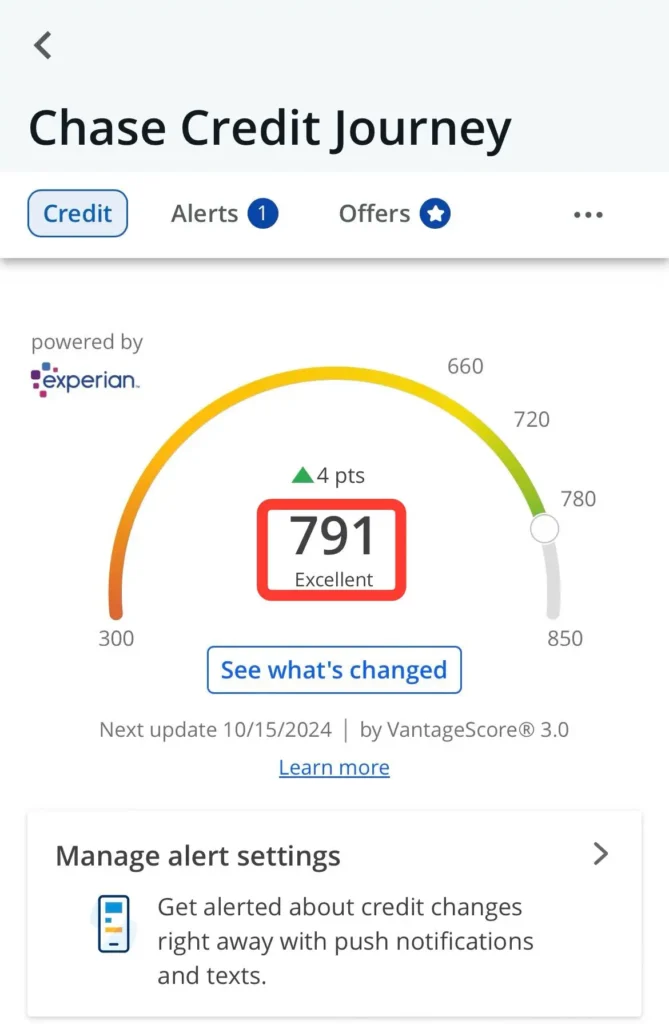

1. Review your credit score and credit band

You’ll see your VantageScore 3.0 credit score and credit band at the top of the Chase Credit Journey homepage.

Having good or excellent credit will likely give you access to financial products like credit cards and loans at low rates, meaning you’ll pay less than those with bad credit.

Compare your credit score and band to the ranges below.

| VantageScore | Credit band |

|---|---|

| 300-499 | Very poor |

| 500-600 | Poor |

| 601-660 | Fair |

| 661-780 | Good |

| 781-850 | Excellent |

2. Check out your credit history

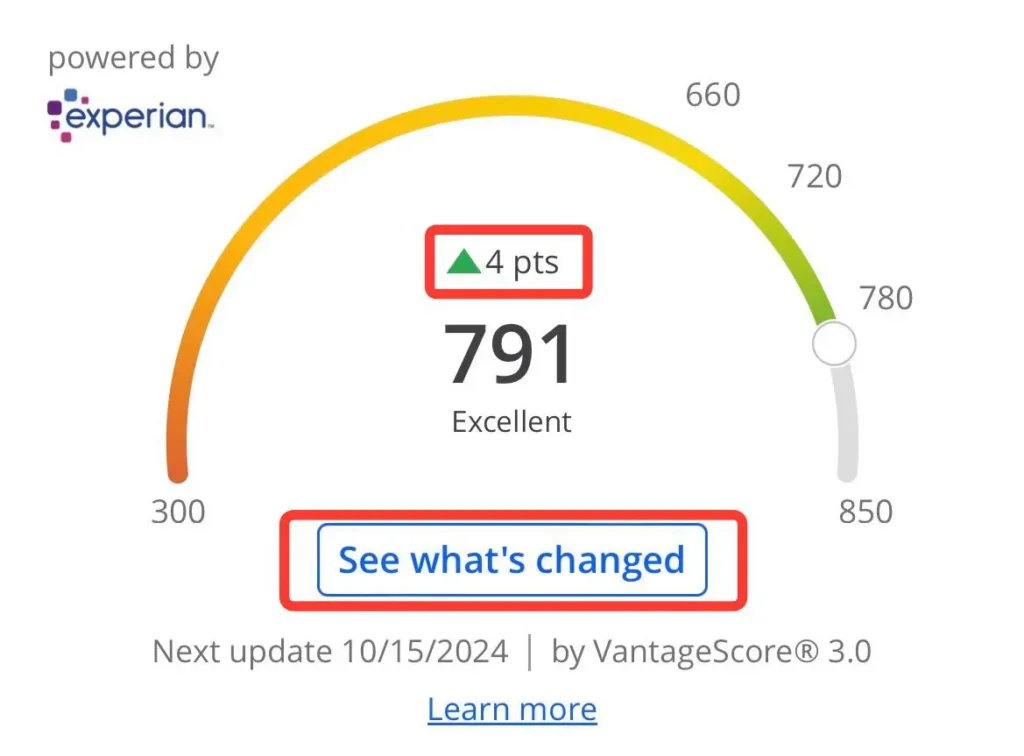

Above your credit score and band, you’ll see how many points your score has recently increased (or decreased).

Click on “See what’s changed” to view a detailed breakdown of how the factors that affect your credit score have changed over the past month. You can also review how your score has changed over time.

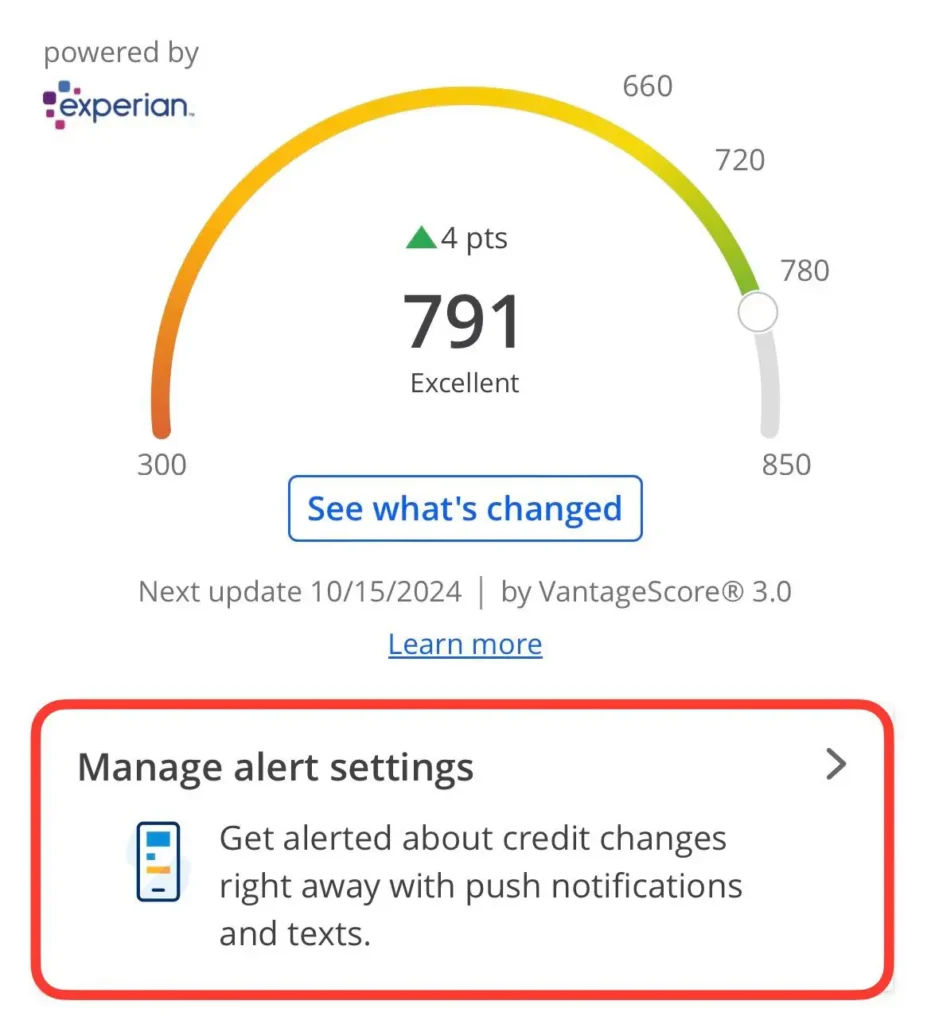

3. Sign up for instant credit monitoring alerts

When you click on “Manage alert settings,” you can sign up to get push notifications, emails and/or texts when:

- Someone requests your Experian report

- There’s any activity on your Experian credit report

- Your identity has been compromised, like in a data breach

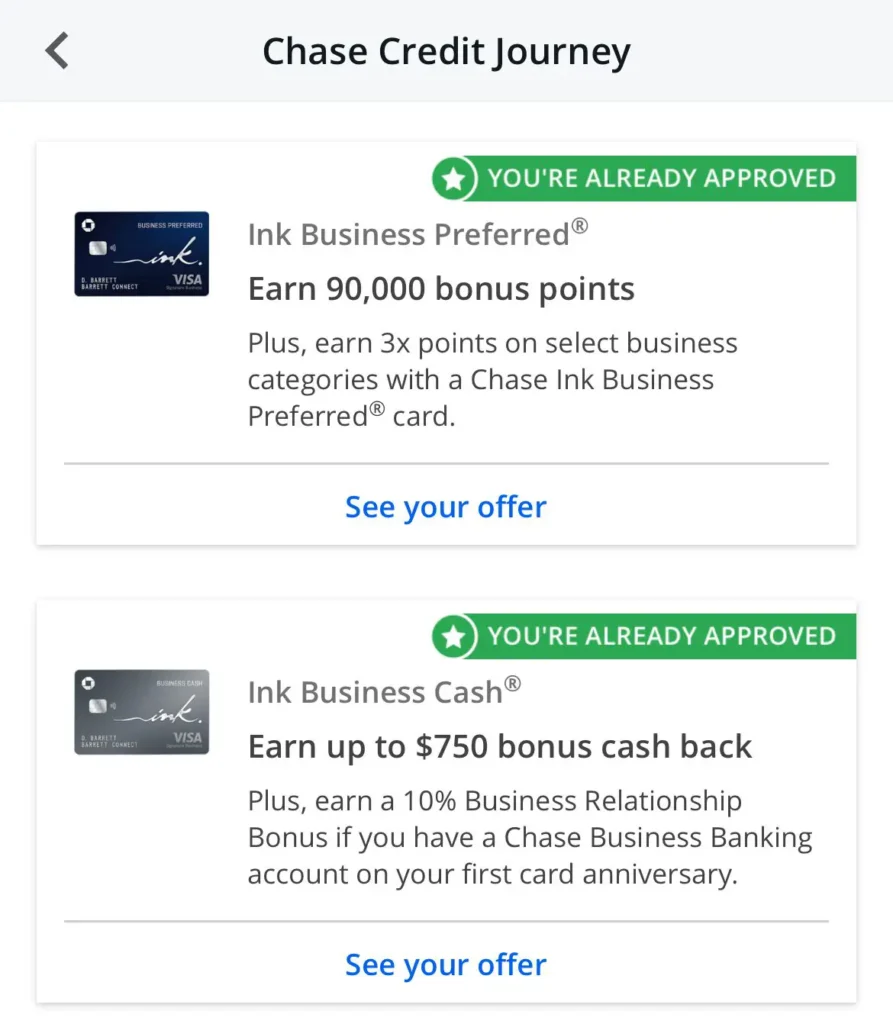

4. Check out special offers

Chase Credit Journey may show you preapproved credit cards and checking account offers based on your credit score and range.

Being preapproved for a credit card doesn’t guarantee that you’ll qualify, but it does mean you have better chances of getting the card.

Chase Credit Journey features

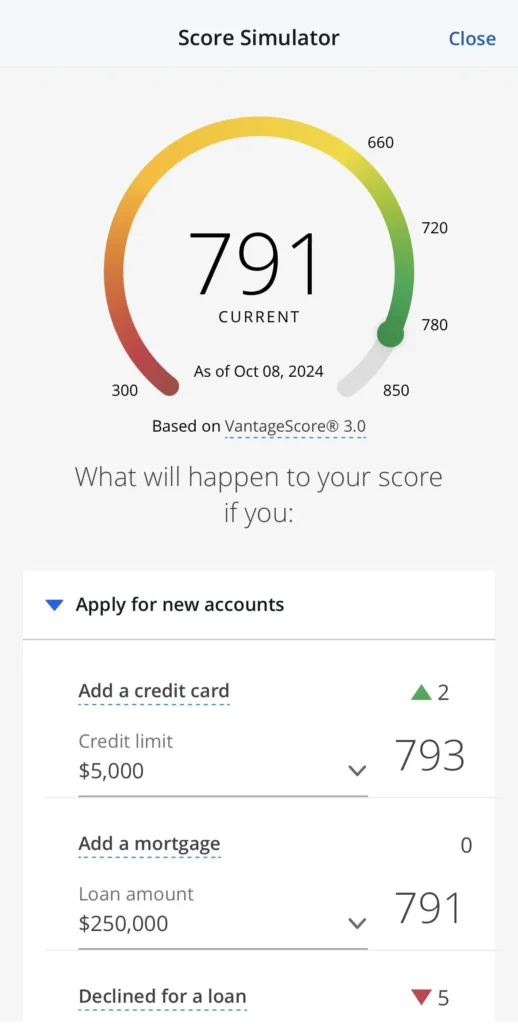

Score simulator

With Chase Credit Journey’s score simulator, you can test out what will happen to your credit score if you apply for more credit, pay off some or all of your debt and make or miss payments on any of your accounts.

Credit Journey makes it easy to test out specific situations. For instance, you can see how your credit score will change if you get a mortgage or personal loan for a particular amount of money. You can also play with how consolidating debt or being declined for a loan will affect your credit.

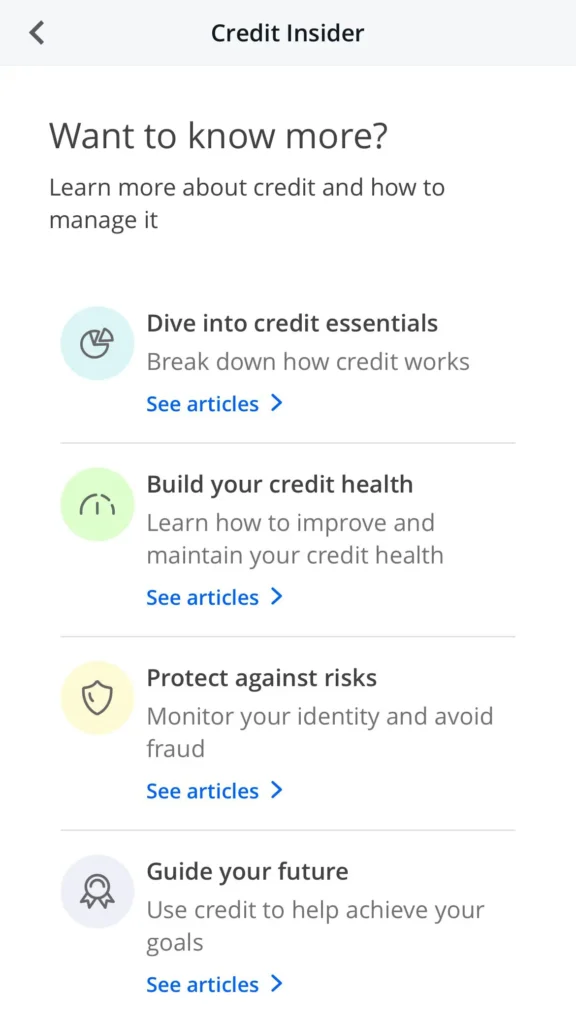

Credit Insider

Chase’s Credit Insider platform gives you access to short videos and articles that explain key components of financial health.

These resources are broken up into four broad categories that cover topics ranging from building your credit to protecting yourself against fraud.

You can use these videos and articles to improve your financial literacy and plan your next money move.

Identity restoration

If you’re a victim of identity theft, you can use Chase Credit Journey’s 24/7 concierge service to help you through the process of restoring your identity and keeping your information safe.

You can also call the concierge service to ask for help with replacing your identification and credit cards if your wallet is stolen.

See your Experian credit report

Chase Credit Journey shows you your credit report from Experian, one of the three major credit bureaus. Review your report for any inaccurate information, and dispute any errors to ensure your credit score is as high as possible.

You can see your free weekly credit report from the other credit bureaus — Equifax and TransUnion — at AnnualCreditReport.com.

Frequently asked questions

Yes, the credit score you see on Credit Journey is accurate. Chase Credit Journey pulls your VantageScore 3.0 directly from Experian at least once a month.

You can check your credit score directly with any of the three credit bureaus or with a free credit monitoring service like Chase Credit Journey or LendingTree Spring.

No, checking your credit score does not lower it. It’s important to review your score regularly to maintain your financial health.

Learn more about your credit score

Want to know your credit score? Click here.

Learn more about credit repair companies!

How is my credit score calculated?

Get debt consolidation loan offers from up to 5 lenders in minutes