What Happens If You Have a Bad Credit Score?

- Bad credit can limit your access to money, housing, cars and even jobs.

- It’s possible to get loans, credit cards and mortgages with bad credit, but you’ll pay a lot more than people with fair or good credit.

- You can use free online resources to monitor your credit or work with a professional credit counselor to improve your credit over time.

How bad credit affects you

It’s harder to get money

Having a bad credit score makes it harder to qualify for every type of loan and credit, from personal loans to credit cards. Think of your credit score as a grade for how you handle your money. Lenders use it to determine how likely you are to make on-time payments (or pay them back at all).

If you have a FICO score below 580 or a VantageScore below 600, lenders will likely see you as a risky bet and may deny you a credit card or loan.

Nearly three-quarters (74%) of Americans with bad credit were denied a financial product like a loan or credit card because of their score, according to a recent LendingTree study.

It’s harder to buy or rent housing

You’ll need a credit score of at least 620 to get a conventional home loan, and even FHA loans designed for first-time homeowners require a credit score of at least 500. The credit requirements for buying a house can make it much harder for people with bad credit to get mortgages.

Your credit score can also affect whether you’re approved to rent an apartment or a house. Landlords can request to see your credit report as part of their screening process. They won’t see your actual credit score, but they’ll see whether you’ve missed payments, had accounts sent to collections or filed for bankruptcy.

Only 3.6% of mortgage money is issued to borrowers with scores under 620, while 77.4% of mortgage debt goes to borrowers with scores of 720 and above.

It’s harder to buy a car

There’s no universal minimum credit score you need to buy a car, but most auto loans go to borrowers with credit scores of at least 660.

You can get a bad-credit car loan, but you’ll pay much higher rates. The average rates for borrowers with scores below 600 are between 13.18% and 15.77%, compared to the 6.84% average across all borrowers. That means you could be paying twice as much money in interest on your car loan than the average person.

Less than 15% of car loans go to borrowers with scores below 600, according to the most recent data from Experian.

More expensive loans, credit cards and insurance

It will cost you more to borrow money with a credit card or loan if you have bad credit. Lenders charge higher rates to people with lower credit scores to make up for the risk that these borrowers won’t pay them back.

You may pay more for insurance, too. Insurance companies charge drivers with bad credit an average of 77% more for car insurance. Some states currently limit or prohibit the use of credit scores in calculating car insurance quotes, including California, Hawaii, Massachusetts, Michigan, Maryland, Oregon and Utah.

- The average annual percentage rate (APR) for credit cards for good credit is 21.48% versus 28.36% for bad credit. This could add up to hundreds of additional dollars in interest payments over time if you carry a balance on your card.

- Average personal loan rates for borrowers with bad credit range from 165.39% to 184.89%. These rates fall into the category of predatory lending, meaning they are so high that they often trap borrowers in a cycle of debt.

It may prevent you from getting a job

In many states, employers can legally check your credit for employment as part of their hiring process. They won’t see your three-digit credit score, but they will see how much debt you have, any accounts you have in collections and whether you’ve filed for bankruptcy.

While it’s legal in many states for employers to check your credit during a background check, they have to follow a set of rules in the Fair Credit Reporting Act. They have to tell you before they check your credit, get your written consent to do so and let you know if your credit is the reason they didn’t give you the job.

Unfortunately, bad credit can hold you back when it comes to financing large purchases and even renting a home. While it’s not impossible to get a loan with bad credit, it’s difficult and you could pay high interest rates. Some simple ways to improve credit include finding a co-borrower, becoming an authorized user on a loved one’s credit card or applying for a credit builder loan.

How to improve your credit score

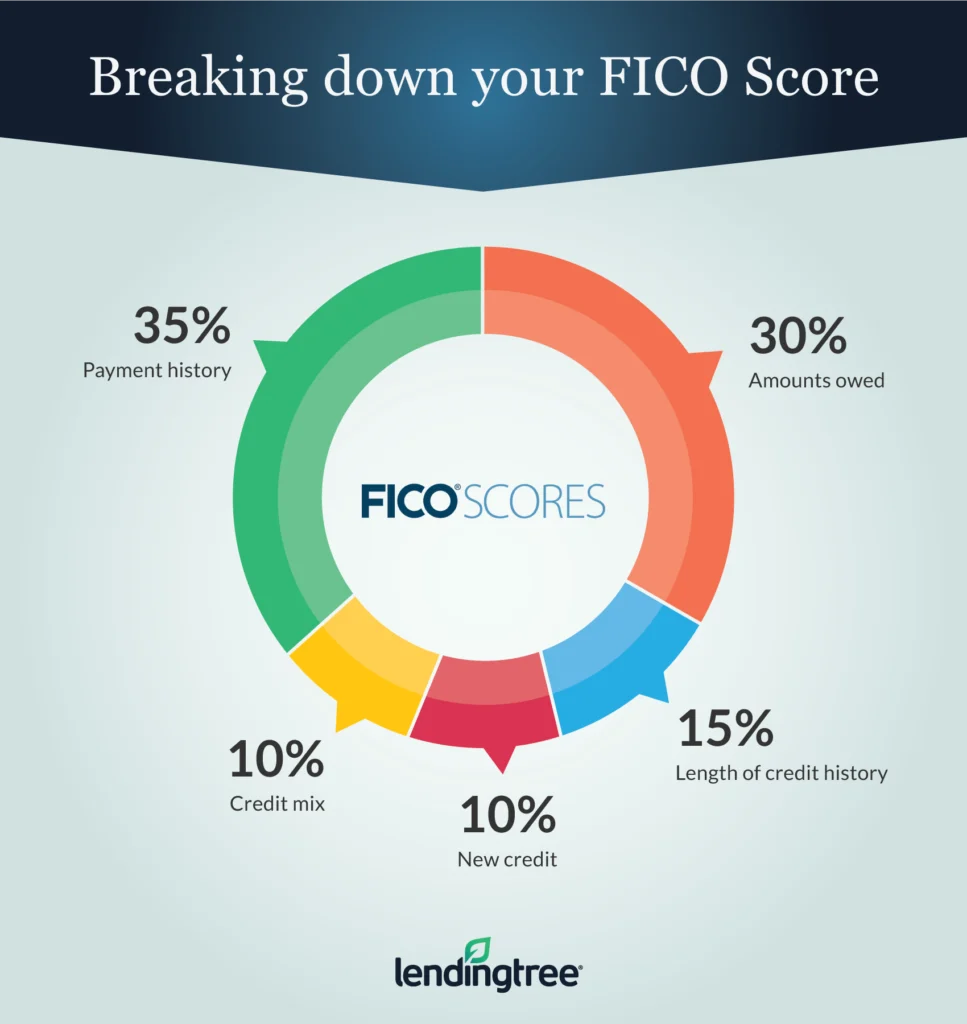

Your payment history and amounts owed make up 65% of your FICO score, so two of the fastest ways to improve your credit are to make on-time payments and to pay down as much debt as possible.

Getting out of debt takes time and patience. You can monitor your credit for free with a credit-monitoring service or work with a credit counselor to create a debt management plan if you need extra help.

Monitor your credit score and get personalized recommendations to improve your credit — for free — with LendingTree Spring.

Credit myths

It’s possible that your credit is suffering because you believe one of the common myths about personal finance. If that’s the case, you’re not alone — 96% of Americans believe at least one money myth.

Here are a few beliefs that could be affecting your credit score or your wallet.

You should carry a balance on your credit card

Nearly two-thirds (65%) of Americans believe that carrying a balance on your credit card will boost your credit score — and they’re wrong. A balance won’t affect your score as long as you’re making minimum payments, but it will cost you money in interest. If you can afford it, pay off your cards on time and in full every month.

All debt is bad debt

All debt is not created equal. Some forms of debt, like investments and student loans, can help you achieve your financial goals. This is called good debt. Unnecessary expenses, like luxury items or taking out vacation loans, are examples of bad debt. Bad debt does not help you achieve your financial goals.

It’s bad to use a credit card

When comparing credit versus debit, a credit card comes with benefits like the ability to build your credit history, earn rewards points and take advantage of benefits and travel protections. But you’ll have to use your card the right way to get these perks (and not end up spending hundreds or thousands on interest payments).

Compare your debt relief options

Get personalized debt relief solutions that may reduce what you owe and help you regain financial stability.

Frequently asked questions

A bad credit score is a FICO score under 580 and a VantageScore under 600.

The lowest credit score for both FICO and VantageScore credit scoring models is 300, but it’s possible to have no credit score at all. If you’ve never taken out loans or gotten a credit card, you’re credit invisible. This means the credit bureaus haven’t generated a credit score for you yet.

No matter how low your credit score is, you can start to improve your score right away by adopting good credit habits like paying off debt and making on-time payments.

That said, it can take years for bankruptcies, missed payments or accounts in collections to completely fall off your credit report and stop affecting your credit.

Learn more about your credit score

Want to know your credit score? Click here.

Learn more about credit repair companies!

How is my credit score calculated?

Get debt consolidation loan offers from up to 5 lenders in minutes