76% of Americans Say Inflation/Economy Has Made It More Difficult to Afford Bills, and 45% Have Paid One Late in Past Year

More than 3 in 4 Americans say inflation and the economy are making it harder for them to afford their bills, according to a new LendingTree survey. And 40% of Americans say they’re less able to afford their monthly bills than a year ago.

It isn’t breaking news that inflation has caused hardships for many Americans. However, LendingTree dug into the impact of inflation on people’s monthly bills, how people are managing it and what they’ve chosen to prioritize in its wake.

Here’s what we found.

Key findings

- Inflation is making it harder for Americans to pay their bills. About 3 in 4 (76%) say inflation and the current economy make it more difficult to afford their bills. 40% say they’re less able to afford their monthly bills than a year ago, while just 23% say they’re more able.

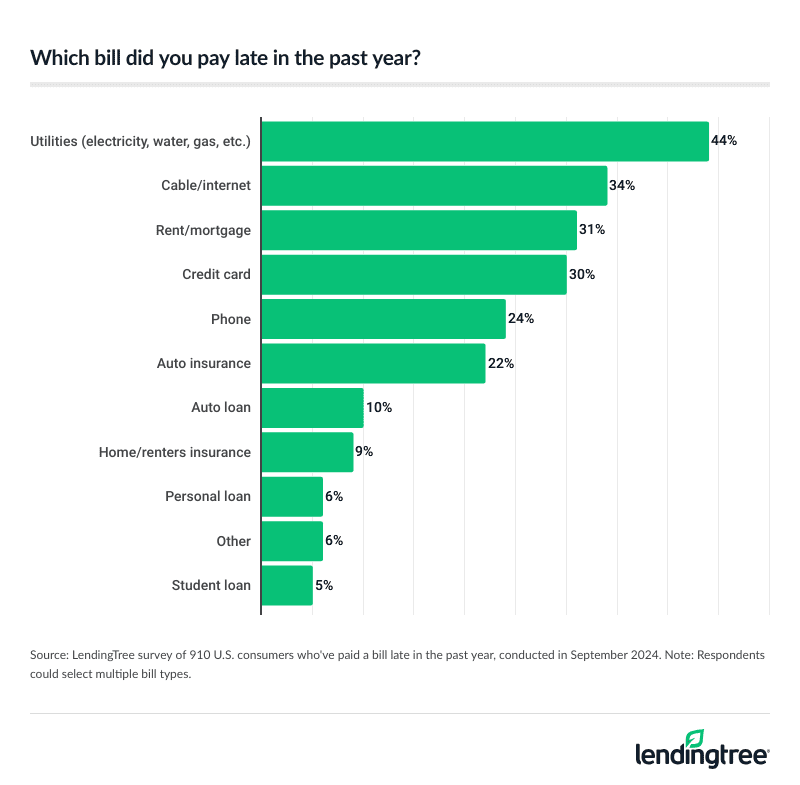

- Almost half of Americans have paid a bill late in the past year. 45% have paid a bill late in the past 12 months, with 29% doing so in the past six months. When asked which bills have been late, 44% said utilities, 34% said cable or internet and 31% said rent or mortgage.

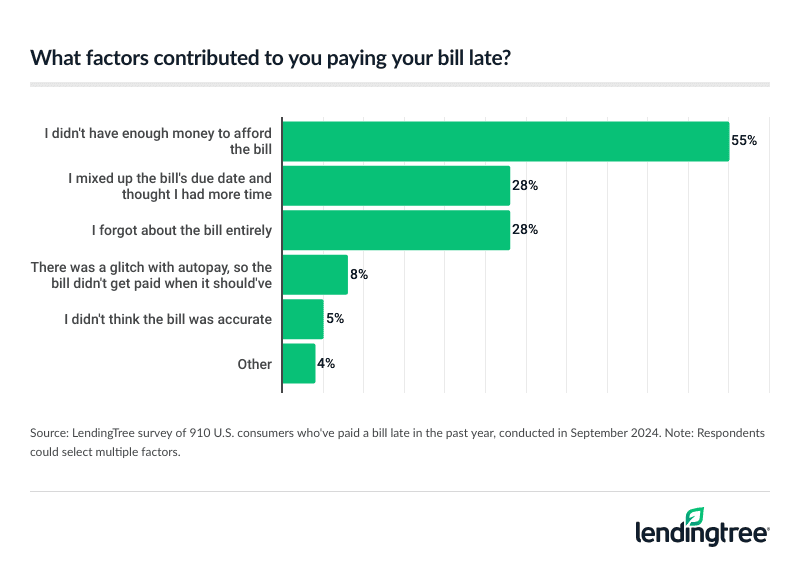

- Most late payers can’t afford their bills. The most common reason for making a late payment is not having the money to afford it (55%), while 28% mixed up the due date and 28% forgot about it. Additionally, 48% of late payers admit they’ve paid three or more bills late in the past year, and 50% of Americans say they’ve overdrafted an account paying a bill.

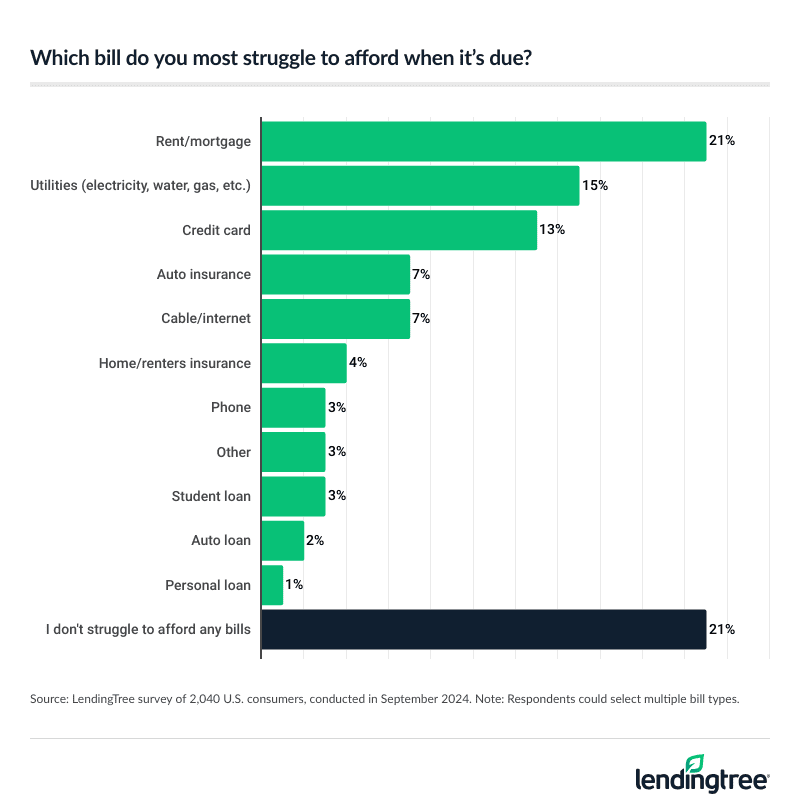

- Some bills are prioritized more than others. More than half of respondents say rent or mortgage (53%) is the most important bill to pay on time, followed by utilities (18%) and credit cards (9%). Similarly, 21% say their rent or mortgage is the hardest bill to afford, followed by utilities (15%). Just about a fifth (21%) of Americans say none of their bills are difficult to afford.

Inflation is making it harder for Americans to pay their bills

As seemingly everything has gotten more expensive in recent years, it has taken a toll on many Americans’ budgets. More than 3 in every 4 Americans (76%) say inflation and the current economy have made it more difficult to afford their bills.

That’s a huge percentage, and a deeper dive shows how widespread the struggle is. For example, there’s little variation among age groups, with Gen Xers ages 44 to 59 the most likely to say they’re struggling (79%), baby boomers ages 60 to 78 the least likely (73%), and Gen Zers ages 18 to 27 (77%) and millennials ages 28 to 43 (76%) in between.

Women are more likely than men to say inflation has made it harder on them (79% versus 73%), but the difference isn’t huge. Even at the highest household income levels, more than 7 in 10 (71%) Americans making $100,000 or more say so.

While inflation has moderated in recent months, a large percentage of Americans (40%) say they’re less able to afford their monthly bills than a year ago. Only about 1 in 4 (23%) say they’re more able to do so.

Women are significantly more likely than men to say they’re less able to pay their bills than a year ago (46% versus 34%). Gen Xers are the most likely age group to say so (49%, versus 40% of boomers, 38% of millennials and 30% of Gen Zers). And perhaps unsurprisingly, the more money you make, the less likely you are to say you’re less able to pay your bills than a year ago. Just 27% of those making $100,000 or more a year say so, versus 47% of those making less than $30,000 a year.

Almost half of Americans have paid a bill late in the past year

For millions of Americans, that struggle has led them to pay bills late. Just under half (45%) of respondents say they’ve paid at least one bill late in the past 12 months, with 29% saying they did so in the past six months.

Millennials and Gen Xers (37% and 31%, respectively) are the most likely age groups to say they’ve paid late in the past six months. Women are slightly more likely than men to say so (31% versus 28%).

As for which bills have been late in the past year, the most common answer is utilities (44%). Cable or internet is the second most common response (34%), followed by rent or mortgage (31%).

Utilities are the most commonly late bill payment for both men and women, as well as for all age groups except Gen Zers. The most common late payment for them is their rent or mortgage (36% say so, versus 31% who say cable/internet and 30% each who say credit cards or utilities).

The least common answer overall is student loans. Just 5% of respondents say they paid that loan late. That’s noteworthy because while federal student loan payments restarted in October 2023, the government instituted a grace period where late payments on student loans wouldn’t be reported to credit bureaus until October 2024. That means people could pay late without worrying about damaging their credit, but our survey indicates that most people with student loan debt chose to keep paying on time anyway.

Most late payers can’t afford their bills

There can be as many reasons for paying late as there are grains of sand on a beach. However, our survey finds that perhaps the simplest reason is the most commonly offered: not having the money to afford to pay the bill.

More than half of late payers (55%) cite this, including nearly two-thirds of women (64%, versus 46% of men). The next most common reasons are they mixed up the due date and they forgot about it (both at 28%).

Not having enough money to pay the bill is by far the top reason given for late payments by every age group, except Gen Zers. It’s still the most common reason, but only by a single percentage point. Among Gen Z late payers, 43% say they didn’t have enough money, 42% mixed up the bill’s due date and 30% forgot about the bill entirely.

Unfortunately, paying late isn’t a one-time thing for many Americans. Almost half of late payers (48%) admit they’ve paid three or more bills late in the past year — including 62% of Gen Z late payers and 50% of male late payers — while 50% of Americans say they’ve overdrafted an account paying a bill.

Some bills are prioritized more than others

When money gets tight, tough decisions have to be made. For many in our survey, that can even mean choosing which bill to be sure to pay on time and which may be a lower priority.

When asked which bill was hardest to afford, the most commonly given answer — perhaps unsurprisingly — was rent or mortgage. More than 1 in 5 people (21%) cite this. It’s the most popular answer for both men and women, as well as for every age group. The utility bill is the next most common answer overall (15%), followed by credit cards (13%). Meanwhile, more than 1 in 5 people (21%) say they don’t struggle to afford any bills.

When it comes to which bill is prioritized most heavily, the top three answers are the same as above. By far the most common response is rent or mortgage (53%), with utilities a distant second (18%) and credit cards third (9%). Though the percentages vary a bit, both men and women prioritize these bills in the same order, as does every age group.

Auto-drafting can make things easier on you

Everyone’s busy. We’ve all got to-do lists a mile long, and we all have things slip our minds from time to time — even really important things like bill due dates. Luckily for us, however, there are plenty of tools to help us stay out of our own way.

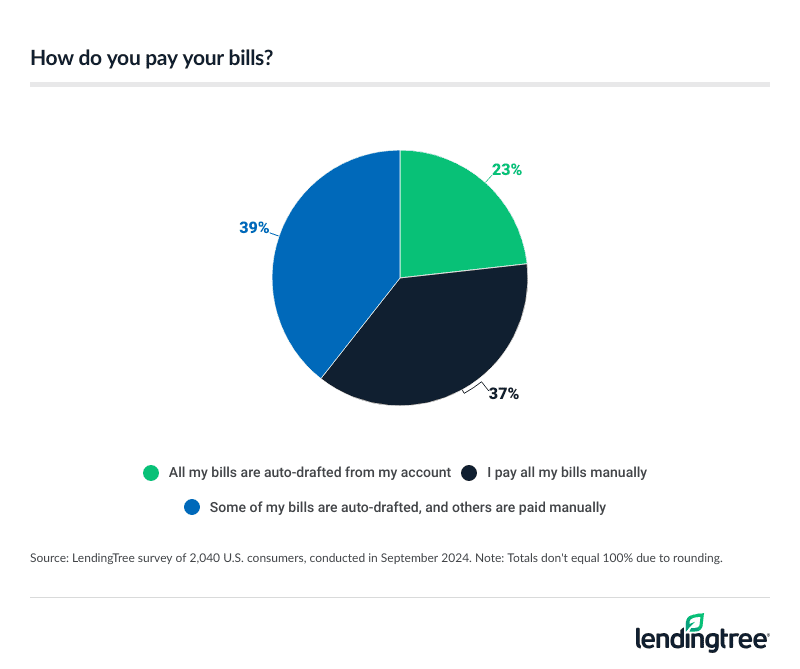

Text alerts and email alerts of due dates can be a huge help. Putting due-date reminders in our favorite online calendar tool can also help. But perhaps nothing is as effective as arranging automatic payments. The good news is that more than 6 in 10 (63%) Americans say they have at least some of their bills auto-draft from an account.

Surprisingly, the younger you are, the more likely you are to say you pay all your bills manually. Just 25% of boomers say so, compared with 41% of both millennials and Gen Xers and 43% of Gen Zers. Men and women are nearly equally as likely (38% and 37%, respectively).

Still, as our survey shows, paying late isn’t always about being forgetful and neglectful. It’s simply about not having the money to afford to pay the bills. In some cases, a budget can help, especially if you feel like your spending is out of control in areas that just aren’t necessary. A credit counselor can be a great help as well, guiding you through the basics of creating a budget and helping you come up with a plan to attack your debts and improve your credit.

Also, if you’re in a short-term pinch and don’t know how you’ll pay your bills, call your lender. It takes courage to be vulnerable and admit you have the need, but most lenders have so-called hardship programs designed to help people navigate a brief rough patch. They may be able to lower your interest rate temporarily, waive a payment or two, reduce a minimum payment or take other steps that could help. You won’t know if you don’t ask.

The need is far more acute for some, however. The good news is that there are resources designed to help you. Googling “resources near me for people struggling to pay bills” will likely lead you to information about local, state and federal government resources near you, as well as nonprofits that work to help those in a financial pinch.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,040 U.S. consumers ages 18 to 78 from Sept. 3 to 5, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

Get debt consolidation loan offers from up to 5 lenders in minutes

Recommended Articles