62% of Bridal Party Members Have Taken on Debt to Cover Wedding Costs

Wedding bells are ringing, but they can come with a hefty price tag — for the happy couple and their guests. According to the newest LendingTree survey of nearly 2,000 U.S. consumers, 40% of those who’ve attended a wedding in the past five years have gone into debt to be there. For those who’ve been part of a bridal party, that percentage jumps to a staggering 62%.

With the majority of Americans saying weddings are getting too expensive, many guests are feeling the pressure to shell out for someone else’s big day (or days). Keep reading to learn more about the financial toll that weddings can take on attendees and the impact it can have on their relationships with the newly wedded couple.

Key findings

- Celebrating someone else’s love does cost a thing. Of the 69% of Americans who’ve attended a wedding in the past five years, 40% have taken on debt to witness someone tie the knot. Across generations, millennials are hearing the most wedding bells — and paying the price. Over the past five years, they’re the most likely to have attended a wedding and taken on debt.

- For those lucky enough to stand by the bride and groom in the wedding party, debt is more likely. 62% of Americans who’ve been a member of a wedding party in the past five years have spent more than they could afford to celebrate the nuptials, with 32% racking up at least $500 in debt. Additionally, groomsmen are more likely to fall into debt than bridesmaids (66% versus 56%) and tend to spend more.

- Under pressure: Almost half (49%) of those who took on debt to attend a wedding did so because they felt obligated to do so. Not only is there pressure to attend, but 85% of those who traveled for a wedding outside their area still felt pressured to give the happy couple a gift.

- As 80% of Americans agree that weddings and wedding-related events are getting too expensive, some are setting financial boundaries and declining invitations to save money. 31% of Americans have declined an invitation to a wedding due to cost, and 27% said “no” to being in a bridal party. However, brides and grooms aren’t always the most understanding, as 10% say skipping the wedding ruined their relationship with the couple.

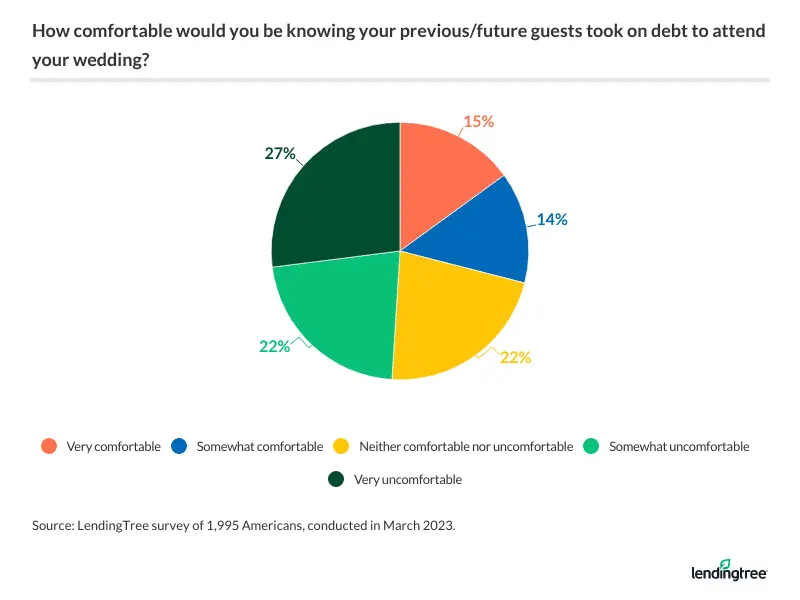

- Is ignorance bliss? Wedding couples may not be aware of the financial burden their wedding places on guests. 49% of Americans would be uncomfortable knowing their guests took on debt to attend their wedding. Some brides and grooms are open to feedback, as 36% of Americans have been asked for their opinion on the cost of someone’s wedding.

40% of wedding guest attendees have taken on debt

Love may be priceless, but weddings certainly come at a cost. Of the 69% of Americans who’ve attended a wedding in the past five years, 40% have taken on debt to do so. And among the generations, millennials ages 27 to 42 seem to be hearing the most wedding bells — and they’re also the most likely to take on debt for it. Among this age group, 77% have attended at least one wedding in the past five years, with half (50%) racking up debt to attend one or more of them. In comparison:

- 72% of Gen Zers ages 18 to 26 have attended at least one wedding, with 47% taking on debt.

- 58% of Gen Xers ages 43 to 58 have attended at least one wedding, with 24% taking on debt.

- 56% of baby boomers ages 59 to 77 have attended at least one wedding, with 12% taking on debt.

Meanwhile, men are more likely to take on debt as an attendee than women. Of the 72% of men who attended a wedding recently, 46% have taken on debt. Meanwhile, 66% of women have attended a wedding in the last five years, with 34% taking on debt.

Notably, consumers earning between $50,000 and $74,999 are the most likely income group to take on debt for a wedding. Of the 77% who’ve attended a wedding recently, less than half (46%) say they took on debt to attend. As far as the income group least likely to take on debt, 49% of those earning less than $35,000 have attended at least one wedding recently, with 31% of this group taking on debt for it.

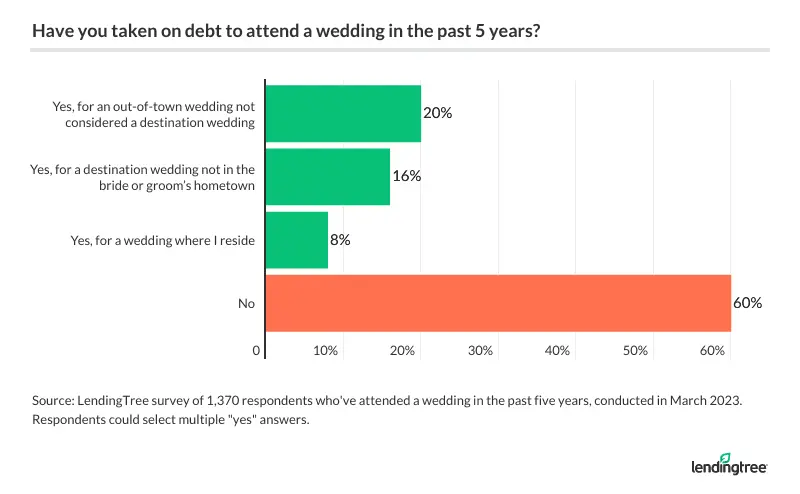

What sort of wedding are consumers racking up debt to attend? Unsurprisingly, 1 in 5 (20%) say they took on debt for out-of-town weddings — the most common type to put consumers in debt. Meanwhile, 16% took on debt for destination weddings and 8% for local weddings.

According to chief consumer finance analyst Matt Schulz, it’s understandable that consumers are taking on debt for other people’s weddings.

“It seems like weddings have gotten crazy-expensive and progressively more elaborate over the years,” he says. “They can also be incredibly stressful and emotionally volatile times. That can mean that the bride or groom don’t give enough thought to whether their guests can afford to come, and it can also make it scary to approach the bride or groom to talk to them about those costs. The last thing you want to do is look like a cheapskate and complain about someone’s big day, but sometimes it’s incredibly important to speak up.”

Groomsmen and bridesmaids are more likely to rack up debt

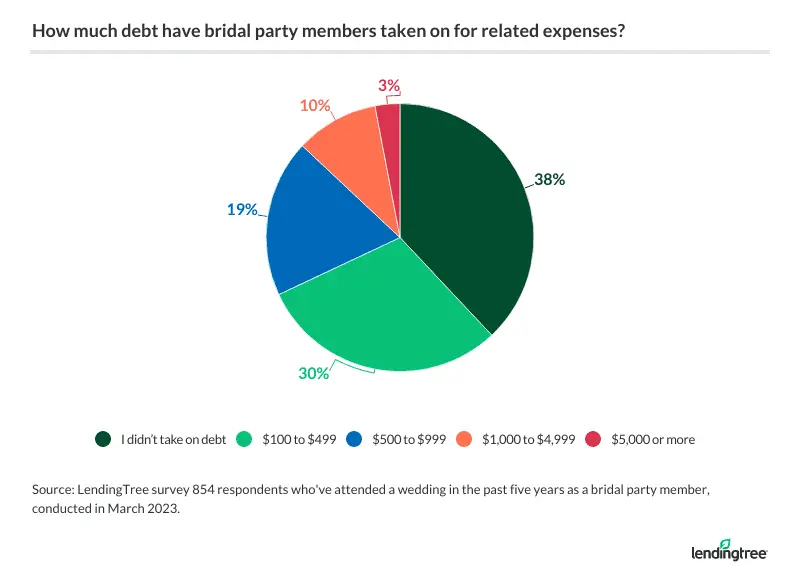

Attending a wedding can be expensive, but being a member of the wedding party can take the financial burden to a whole new level. Among those who’ve attended a wedding recently, 43% have been a member of the wedding party — and they’re more likely to shell out more than they can afford to do so. In fact, 62% had spent more than they could afford to celebrate the happy couple’s special day, with 32% racking up at least $500 in debt.

Worth noting, though, a similar 30% of wedding party members took on between $100 and $499 in debt — so many party members’ debt may be on the low end of the spectrum.

Men (48%) are more likely to be in a wedding party than women (38%) — and they’re also more likely to take on debt to do so. Among groomsmen, 66% took on debt, with 38% spending $500 or more. Comparatively, 56% of bridesmaids have taken on debt, with just 26% spending a similarly high amount.

According to Schulz, that’s indicative of a much larger trend.

“Many reports we’ve done over the years have shown that women tend to be more cautious and careful with their money than men,” he says, “Knowing that, it would be in character for men to go a little more spending-crazy with their weddings and be willing to risk taking on a little more debt to be part of the party.”

Attendees say they feel pressured to spend more than they have

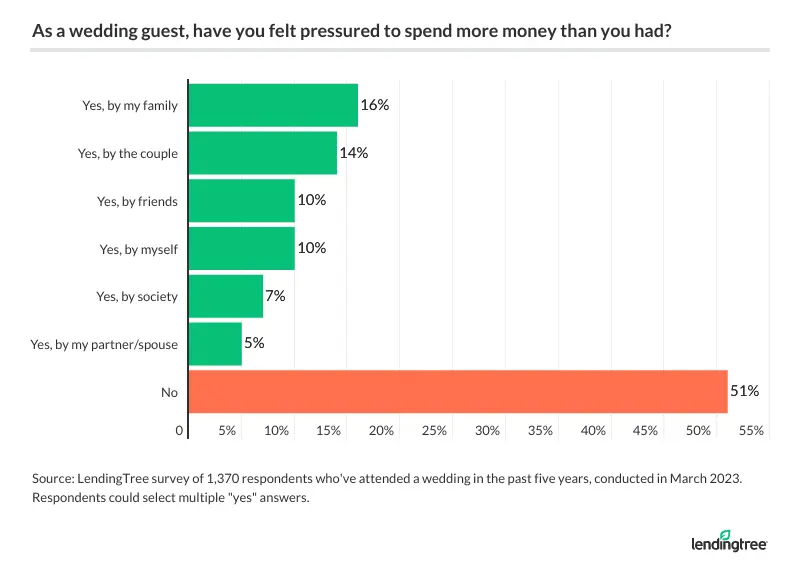

Attending a wedding often comes with an unwritten code of conduct, which can put guests in a tricky spot. In fact, almost half (49%) of those who took on debt to attend a wedding did so because they felt obligated to do so.

Who’s piling on the pressure? The majority don’t blame the soon-to-be-married couple, with 16% saying they felt pressured to take on debt by their family, while 14% say it’s the couples themselves. For some, the call’s coming from inside the house. Among those who felt pressured to take on debt, 10% say it was self-inflicted.

The pressure doesn’t stop there. Of those who traveled for a wedding outside their area, 85% still felt obliged to give a wedding gift. Despite that pressure, though, just 69% did give a gift — and 15% didn’t.

Americans believe weddings are getting too expensive

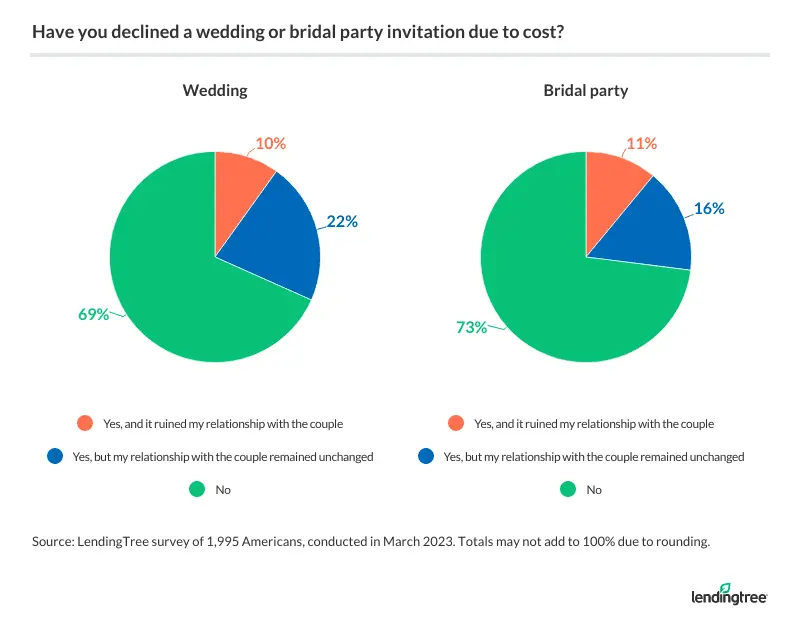

As more consumers feel the financial strain of attending weddings, some are declining invitations to save money. With 80% agreeing that weddings and wedding-related events are getting too expensive, it may be unsurprising that 31% of Americans have declined an invitation to a wedding due to cost — and 27% said “no” to being in a bridal party.

Unfortunately, not all couples are understanding when guests opt out. In fact, 10% said declining their wedding invitation ruined their relationship with the couple. Similarly, 11% of those who declined being in a bridal party say it hurt their relationship with the bride and groom.

Schulz believes turning down a wedding invitation due to costs may become a growing trend.

“I do think more people might say no to more extravagant weddings because of inflation,” he says. “I also think we’ve seen it become more socially acceptable for wedding guests to push back on the bride and groom about costs, though there’s still great risk in doing so. That’s certainly the kind of thing that can lead to hurt feelings and damaged relationships if it doesn’t go well, so tread lightly.”

Notably, millennials are the most likely age group to opt out of a wedding as guests (39%) and party members (35%). Meanwhile, those with children older than 18 are significantly less likely to opt out of weddings as guests (17%) than those without children (27%) and those with children younger than 18 (41%). Couples are generally more understanding toward parents with older kids, as just 2% of these parents say it harmed their relationship with the couple. Meanwhile, 15% of those with kids younger than 18 say similarly — the most of any demographic.

Despite making the most money, six-figure earners and those earning between $75,000 and $99,999 are the most likely income groups to turn down a wedding invitation due to costs at 39% for both. At the other end of the spectrum, just 25% of those making less than $35,000 say similarly — the least of any income group. Meanwhile, those earning between $75,000 and $99,999 are the most likely to opt out of a wedding party (35%), while those earning less than $35,000 are again the least likely (21%).

These findings come as a quarter (25%) of consumers say they would never take on debt for a wedding. Meanwhile:

- 55% would take on debt for an immediate family member’s wedding

- 32% would for a close friend

- 17% would for an extended family member’s wedding

- 6% would take on debt for any wedding

Almost half of Americans say they’d be uncomfortable if a guest took on debt for their wedding

Weddings are supposed to be a time of celebration, and that joyfulness may blind couples to the financial burden their nuptials may have on guests. Despite the high percentage of guests taking on debt for another person’s wedding, 49% of Americans would be uncomfortable knowing their guests took on debt to attend their wedding.

Perhaps more financially empathetic, women (57%) are more likely to report feelings of discomfort than men (41%). By age group, baby boomers are the most likely to say they’d be uncomfortable with guests taking on debt at 64%. That’s followed by:

- 58% of Gen Xers

- 44% of millennials

- 40% of Gen Zers

However, 29% of Americans would be fine knowing that their guests took on debt to attend their wedding. That’s particularly true of those with children younger than 18 (38%), millennials (37%) and men (37%).

Still, some couples are open to feedback — 36% of Americans have been asked for their opinion on the cost of someone’s wedding, a figure Schulz says is a step in the right direction.

“It’s amazing that so many people have been asked their opinion of a wedding’s cost,” he says. “That definitely has not always been something that many people have been willing to do. As awkward as those conversations may be, they’re still really important.”t many people have been willing to do. As awkward as those conversations may be, they’re still really important.”

Financial nuance and nuptials: Navigating debt and weddings

While weddings are often a fond time for couples and guests alike, there’s no question that attending one can be expensive. If you’re looking to avoid debt to attend a wedding, Schulz offers the following advice:

- Save, save, save. “If you have a feeling that you may end up being invited to a few weddings in the next few years, start putting some money aside in a high-yield savings account to prepare for those costs,” he says. “When the big day comes, you’ll be glad you did. And if those weddings never materialize, you’ll just be left with some extra savings, which is never a bad thing.”

- Work together. “If you’re concerned about the costs of attending a wedding, chances are that you’re not the only one,” Schulz says. “Consider asking around to see if anyone would be interested in splitting some of the costs by sharing a hotel room with you, carpooling to the destination or going halfsies on a rental car.”

- Leverage credit card rewards. “The right credit card can make a difference in the costs of attending a wedding,” he says. “Whether you’re getting a free hotel night or airfare with your points and miles, checking a bag for free or just getting 2% cash back on everything you spend, savings are out there to be had.”

If you’re the happy couple in question and you’re uncomfortable with consumers taking on debt for your big day, Schulz encourages you to open up a conversation with your invitees. To do so, he says:

- Be sincere. “I think it’s important that couples be sincere when they’re seeking input about wedding costs,” he says. “If you ask people’s thoughts about your plans and it eventually becomes clear that you didn’t listen or didn’t take any actions as a result of what you were told, it can reflect poorly on you. It may look like you were asking for show, not because you cared what people thought. Of course, that doesn’t mean that you have to change all your plans to match the wishes of your guests, but refusing to budge on anything isn’t good either.”

- Consider offering multiple options for the wedding party. “For example, if you’re planning a bachelorette party, you might offer up a lower-cost option, a midrange option and a deluxe option,” he says. “Maybe one involves renting an Airbnb in your hometown, the middle one a trip to Austin or Nashville and the deluxe being a trip to New York or Hawaii. You can do the same with dresses and many other different aspects of the wedding. Creating a Google form and sending it out to friends and family can make that easier and allow people to comment anonymously if they’d prefer.”

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,995 U.S. consumers ages 18 to 77 from March 17 to 21, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Get debt consolidation loan offers from up to 5 lenders in minutes

Recommended Articles