Thanksgiving Hosts to Spend $300+ This Year, While Most Guests Won’t Pitch In

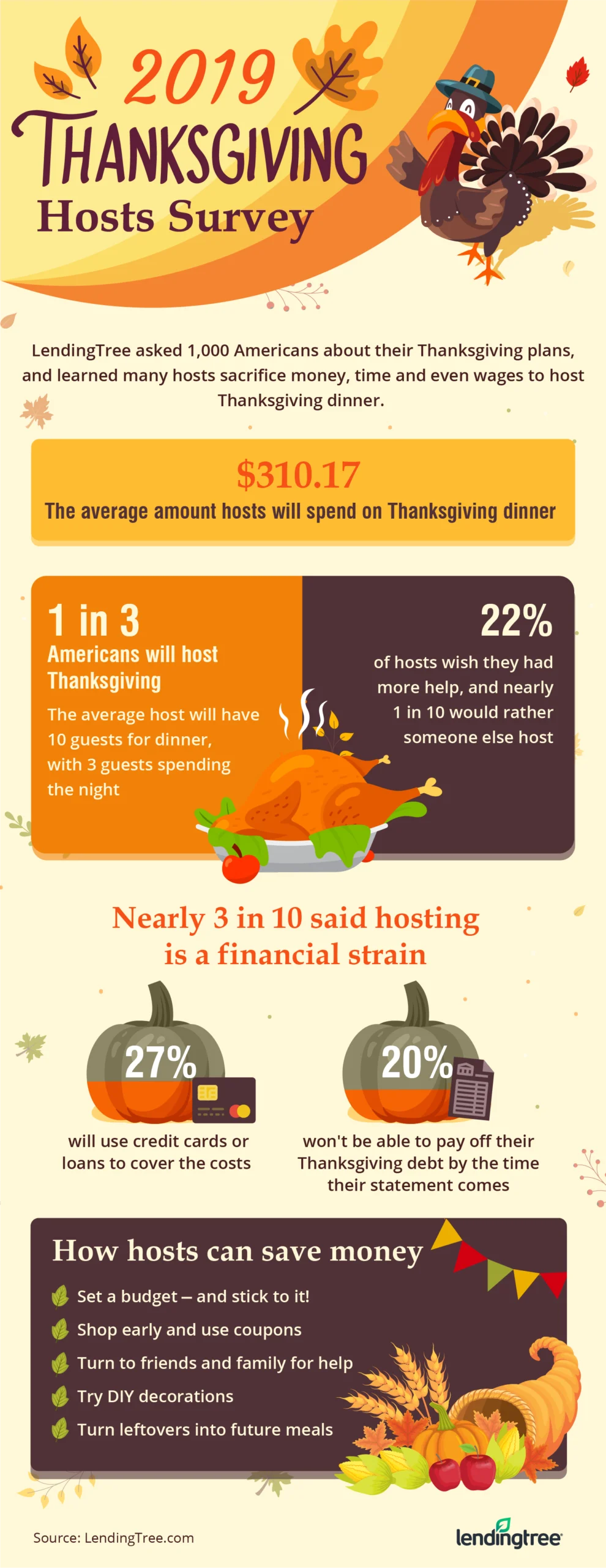

If you love to fill your home with laughter and joy during the holidays, you’re not alone. One in three Americans will host Thanksgiving this year, and they’ll spend more than $300 on average between food and décor.

But most hosts won’t receive financial help from their guests, and 27% of hosts say they’ll have to borrow money in some way to cover the costs. That’s what LendingTree found in its latest survey of 1,000 Americans about their Thanksgiving plans. Here’s what they said.

Key takeaways

- 1 in 3 respondents will host or co-host Thanksgiving this year, with an average of 10 people feasting.

- Hosts will spend an average of $310.17, or $31 per guest. Most hosts (64%) won’t receive any offers from guests to help cover costs.

- Nearly 3 in 10 said hosting Thanksgiving this year will be a financial strain, and roughly the same amount will borrow money to cover the costs. Twenty percent of those who will use credit or loans to finance Thanksgiving will incur debt by doing so, meaning they don’t expect to pay off the balance by the time the bill is due.

- Only 30% of hosts have a firm budget. Conversely, 45% have a “very flexible” amount in mind, and a quarter of hosts are willing to spend whatever it costs.

- 56% of hosts say they plan every year, and 54% said it’s stressful. Still, nearly three-quarters said they love hosting Thanksgiving.

Hosting Thanksgiving dinner is a costly undertaking

As it turns out, you can put a price on love: $31 per guest, to be exact. On average, hosts will spend:

- $227.42 on food and drink

- $82.75 on housewares, like dishes, furniture, linens and décor

That’s $310.17 on a meal for 10 people that will last a few hours at most.

Preparing for Thanksgiving is labor-intensive, too. Most hosts spend about 10 hours prepping for the occasion. Out of the 10 guests that come to dinner, about three will spend the night, which could further add to hosting costs.

Despite the fact that Americans put so much time, effort and money into hosting Thanksgiving, 64% do not expect their guests to offer money or other contributions to help cover the costs.

1 in 5 hosts will incur debt this Thanksgiving

Perhaps because they’re left with a majority of the costs, 27% of hosts will charge a credit card, take out a loan or otherwise borrow money to pay for all or some of the costs of hosting Thanksgiving.

While nearly half of those who borrow plan to pay off the debt within a month, about 20% said they wouldn’t pay it off by the time the bill is due, carrying debt and potentially accruing interest on their purchases.

Despite costs, 7 in 10 Thanksgiving hosts love doing it

More than half of all hosts experience some level of stress about Thanksgiving. But the joys of playing host must outweigh the financial strain, because 71% of Thanksgiving hosts said they love doing it. That could be why 56% of hosts do so annually, and only 4% are first-timers. Plus, just 7% of this year’s hosts said that they wished someone else would host Thanksgiving.

How you can save money this Thanksgiving

Set a budget ー and stick to it!

Budgeting can keep holiday spending under control by helping you map out costs ahead of time. Despite its uses, you may be surprised to learn that:

- 1 in 4 hosts don’t create a budget for Thanksgiving

- Nearly half of hosts have a “flexible” budget

- Just 30% actually set a firm budget for Thanksgiving

Your allotted Thanksgiving budget depends on the number of people you’re hosting, but it also comes down to your family’s preferences. You might spend more if you go for many intricate courses, but you could lower your costs by opting for a low-key potluck.

Shop early and use coupons

Don’t let your impulses get the best of you and buy the first turkey you see. Shop around and compare prices.

Plus, when it comes to buying turkey, sometimes “fresh” isn’t always the best. You might opt for a flash-frozen turkey for Thanksgiving, which is guaranteed fresh even if you buy it weeks in advance while it’s on sale.

Your local Sunday paper comes with a coupon insert, and it may roll out Thanksgiving specials closer to the holiday. Browse your local newspaper’s pennysaver well before Thanksgiving, so you know when to expect it. If you’d prefer browsing deals on your phone, check your grocery store’s app or website, where coupons and promotions may be advertised.

Turn to friends and family for help

Hosting Thanksgiving is a labor of love, but you shouldn’t shoulder the burden alone. Make Thanksgiving a potluck this year by asking your loved ones to bring a dish to the table. Not only will this take some of the cost and responsibility off your plate, but you’ll also bring a whole different flavor to the holiday.

Try DIY decorations

With a few Mason jars, glitter and construction paper, anything is possible. You might even want to get the kids involved with a fun Thanksgiving craft to help decorate. It’s a win-win situation, because it keeps young children out of the kitchen, and you’ll get fun holiday decorations in the end.

Or, you could go light on the decorations this year. A few lit candles can warm up any dining room.

Turn leftovers into future meals

Stuffing is delicious on the day you make it, but ask any foodie: it’s even better on the second day. That’s because the flavors of rosemary, thyme and sage really get to know each other alongside broth and bread.

Thanksgiving casserole is another way to utilize all your leftovers to create something even better than it was before. You’ll get to enjoy all your leftover vegetables, turkey and stuffing in one easy bake.

After the holidays: Look into these debt relief options

Don’t bring your holiday debt into the new year. If you’re struggling to repay debt, you could:

- Account for more aggressive debt repayment in your budget. If you’re making the minimum payment on your credit cards, you’ll end up paying significant interest on your purchases. Budgeting for more debt repayment each month will help you pay down your debt faster and ultimately pay less interest in the long run.

- Open a balance transfer credit card. Transfer your credit card debt to a new credit card that has a promotional 0% APR period. If you pay down your debt within the period, you could end up paying no interest at all. Keep in mind that some banks charge a balance transfer fee of 3%-5%, and you could be stuck paying deferred interest if you don’t pay off the balance within the promotional period.

- Combine your debt into one monthly payment with a debt consolidation loan. An unsecured personal loan helps you consolidate all your debts into one manageable monthly payment without having to put up collateral. Borrowers with credit scores over 720 saw an average interest rate of 7.27% in Q1 2019. However, borrowers with subprime credit profiles saw an average rate of 85.92%.

This holiday season, you can host the party of your dreams and pay off debt with the right tools at your disposal.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,000 Americans, with the sample base proportioned to represent the overall population. The survey was fielded Oct. 25-29, 2019.

Get debt consolidation loan offers from up to 5 lenders in minutes