43% of Americans Expect to Add Debt in Next 6 Months, Especially Parents With Young Children

Amid a 40-year inflation high, borrowing is getting more expensive. Last month, the Federal Reserve raised the federal funds rate by three-quarters of a percentage point, its biggest hike in nearly 30 years. Consequently, lenders of various types are raising their rates — but despite this, many Americans expect to add debt in the next six months, according to the latest LendingTree survey of more than 1,000 U.S. consumers.

What does that indicate? According to LendingTree chief consumer finance analyst Matt Schulz, it’s not necessarily a bad sign.

“The truth is that debt can be either a sign of confidence or struggle, and I suspect we’re seeing the effect of both of those in our data,” he says. “Many people take on debt because they feel good about their financial situation and aren’t too worried about paying a little interest if it gets them what they want or need. Plenty of others take on debt because they have to. There’s no question that both situations are happening right now.”

Key findings

- 43% of Americans expect to add debt in the next six months, fueled by credit cards (22%) and auto loans (10%). Parents with children younger than 18 are most likely to expect to take on debt during the second half of the year, at 58%.

- More than 3 in 5 (61%) Americans are dealing with debt, with credit cards being the primary driver at 70%. Gen Xers are the most indebted generation (70%), while parents are more likely to have debt than those without kids. Those with the lowest credit scores are also more likely to have debt than those with the highest (80% versus 46%).

- Necessities (30%), emergencies (26%) and health or medical issues (25%) are the most common reasons consumers are in debt. Additionally, a quarter of indebted Gen Zers and millennials say they’re in debt to build credit, though it’s a popular misconception that carrying a credit card balance improves your score.

- More than 1 in 5 (21%) Americans are debt-free after paying off their balances — here’s how they did it. The majority of those who were formerly in debt say they stuck to a strict budget (45%) and put all extra money toward paying off the debt (35%). However, when those who currently have debt were asked what they believe is the best way to get out of debt, just 16% thought budgeting or cutting spending was the way to go.

- Which repayment strategy is more popular: debt avalanche or debt snowball? It’s a 50/50 tie, but those who’ve paid off all their debt prefer saving on interest through the debt avalanche method (57%). Women (52%) and Gen Zers (52%) are more likely to prefer the debt snowball method, celebrating small wins by paying off the lowest balance first, while men (53%) and Gen Xers (53%) opt for the debt avalanche method, saving money on interest by paying off the debts with the highest rates first.

43% of Americans expect to take on debt in next 6 months

Of those who expect to take on debt during the second half of the year, parents with children younger than 18 are most likely to do so (58%). Creditworthiness also plays a role in a consumer’s likelihood of taking on debt. Those with credit scores from 670 to 739 — rated good by FICO — are more likely to take on debt, at 56%.

FICO credit scores differ from VantageScores. While both rate credit scores on a scale of 300 to 850, the categories within are different. For example, 781 is considered an excellent score by VantageScore, but it’s very good (one tier lower) by FICO. Ranges within this survey are based on FICO scores — more to come on the specifics.

By age group, younger consumers expect to take on debt more than older consumers. Take a look at the breakdown:

- 56% of millennials ages 26 to 41

- 55% of Gen Zers ages 18 to 25

- 41% of Gen Xers ages 42 to 56

- 21% of baby boomers ages 57 to 76

Credit cards are the most common source of future debt for consumers — just over 2 in 10 (22%) consumers expect to take on credit card debt. This is particularly true for those with good FICO scores between 670 to 739 (33%) and parents with underage children (30%). Following credit cards, 1 in 10 (10%) expect to take out an auto loan, though men (13%) are more likely to be planning for future auto loans than women (7%).

Unsurprisingly, Gen Zers plan to take on school-related debt more than any other age group — 21% expect to take out a student loan, ranking it second-highest for this generation outside of credit cards (25%). Additionally, 11% of parents with underage children plan to take out a personal loan, making them almost twice as likely to do so than the average American (6%).

Views on debt differ by generation

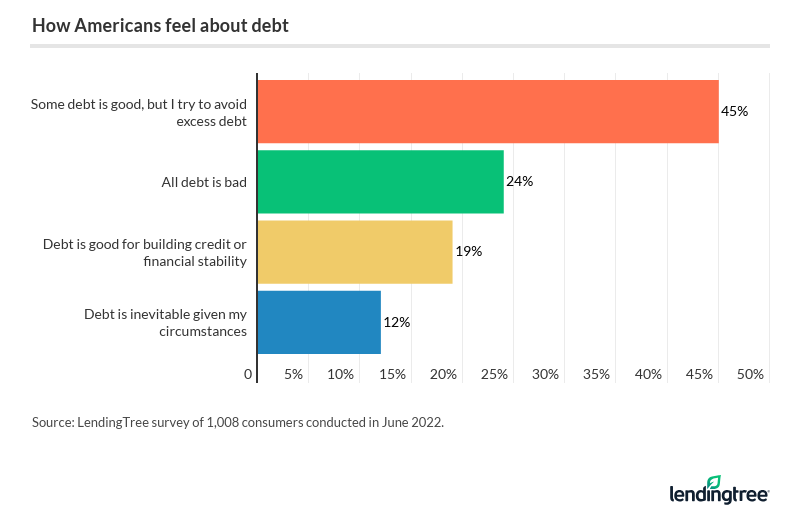

Generally, consumers are most likely to think that some debt is good (45%), but opinions vary by generation. Baby boomers and Gen Zers are the most likely to believe debt is good for building credit or financial stability, at 22% each. While Gen Zers (31%) are also the most likely to believe all debt is bad, Gen Xers are the most likely not to have an opinion either way. Rather, 15% believe that debt is inevitable given their circumstances.

With that said, most consumers are uneasy about taking on debt. Overall, 60% of Americans would rather use cash or savings to cover a purchase, particularly consumers with poor FICO scores between 300 and 579 (69%) and millennials (67%). While Schulz says paying with cash is often a great idea, he cautions against leaving money on the table while inflation is rampant.

“The better move is to pay for purchases with a credit card and then use that cash to pay the card off in full every month,” Schulz says. “If you can manage to do that, it really is a best-of-both-worlds situation. You get card rewards to help you extend your budget, and you can get them without going into any debt along the way.”

The risks are high for the 39% of Americans who are debt-free, Schulz says. But for the 18% of Americans who’ve never taken on debt, Schulz warns that the risks are even higher.

“Debt can be absolutely devastating, of course,” he says. “It can ruin lives, in no uncertain terms. However, those who swear off all forms of debt forever may end up limiting their potential in the future. It may sound good in the short run and be done with the best intentions, but sometimes you have to take on a bit of risk to reach greater success.”

3 in 5 consumers dealing with debt

While many plan to take on debt in the future, the majority of Americans (61%) are already dealing with it. Gen Xers (70%) are the most indebted age group, but baby boomers (65%) and millennials (65%) aren’t far behind. Meanwhile, only a quarter (25%) of Gen Zers have debt, though this may be because they haven’t had enough time to build debt compared to older generations.

Parents are more likely to have debt than those without kids: 68% of parents with adult children and 66% of parents with underage children have debt, compared with 52% of child-free consumers. Additionally, those with lower credit scores are typically more likely to have debt. Take a look at the percentages of consumers in debt by FICO credit score ranges:

- 80% of consumers with poor FICO credit scores (300 to 579)

- 77% of consumers with fair FICO credit scores (580 to 669)

- 61% of consumers with good FICO credit scores (670 to 739)

- 60% of consumers with very good FICO credit scores (740 to 799)

- 46% of consumers with exceptional FICO credit scores (800 to 850)

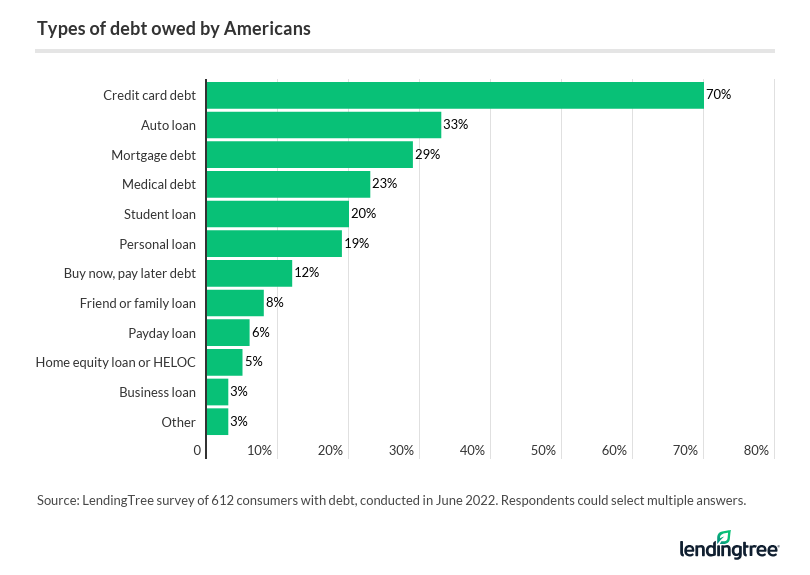

Credit cards are the top source of debt here, too, as 70% of indebted consumers have a credit card balance. That’s followed by auto loans (33%) and mortgages (29%). Medical debt ranks fourth overall, but consumers with poor credit scores are particularly likely to owe medical debt — 35% of this group owes for this reason, compared with 10% of those with exceptional credit scores.

Though just 12% owe buy now, pay later (BNPL) loans, millennials (20%) have more of this type of debt than any other generation.

The amount owed varies by group, too. While 53% of indebted consumers owe $10,000 or more excluding mortgage debt, Gen Zers (68%), consumers with good credit scores from 670 to 739 (65%) and parents with children younger than 18 (64%) are the most likely to owe more than that.

On the other hand, those who don’t know their credit score are notably the most likely to owe less than $10,000 (63%). That’s followed by baby boomers (55%) and parents with children 18 and older (53%).

Including mortgage debt, however, has a notable impact — particularly by income. Six-figure earners are most likely to be impacted by mortgage debt. Excluding mortgage debt, 15% of these high earners owe $100,000 or more, but 64% owe $100,000 or more when mortgage debt is included. Comparatively, just 25% of all consumers with debt owe that much when mortgage debt is included.

Most common reasons consumers go into debt

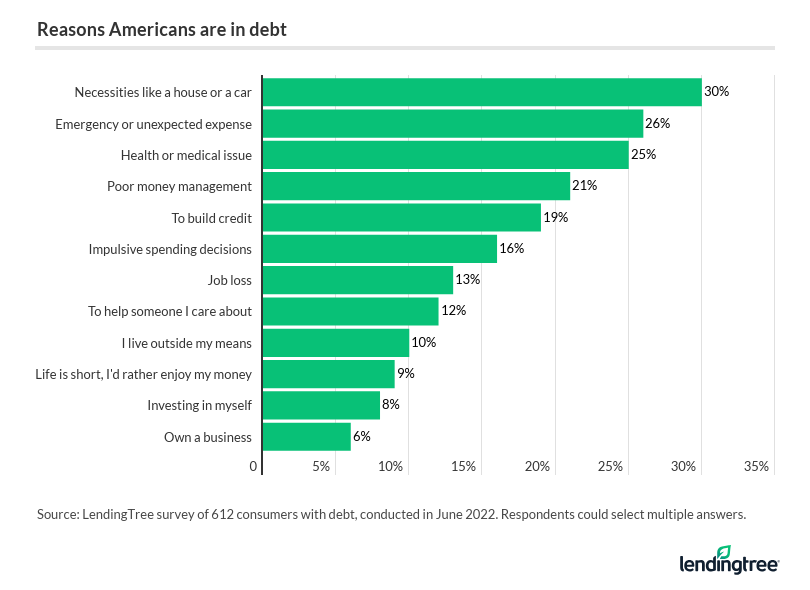

Generally, most consumers are going into debt to cover vital expenses. In fact, necessities (30%), emergencies (26%) and health or medical issues (25%) are the most common reasons consumers are in debt.

Consumers with poor credit scores from 300 to 579 are the most likely group to cite health or medical issues (34%), and they’re also more likely to cite poor bad money management skills (35%). Meanwhile, among those with annual household incomes of $75,000 to $99,999, 16% say life’s too short to not enjoy money — and for six-figure earners, 28% say their debt is a result of impulsive spending decisions.

Additionally, a quarter (25%) of indebted Gen Zers and millennials say they’re doing it to build credit. However, carrying a credit card balance won’t help your credit score — though a recent LendingTree survey on credit card mistakes found that 65% of consumers believe it does. It’s more important to pay off your credit cards in full every month.

Best way to pay off debt: What consumers think vs. what’s worked

More than 1 in 5 (21%) Americans are now debt-free after paying off their balances. Among these consumers, 45% say they got out of debt by sticking to a strict budget — and 35% say they put all their extra money toward paying off their debts.

But that’s not what the majority of indebted consumers think works. While 45% agree that increasing monthly payments (either in frequency or amount paid) is the best way to get out of debt, just 16% think budgeting works.

Meanwhile, the majority of all consumers surveyed agree with those who are debt-free: If a loved one were struggling with debt, 46% would advise them to stick to a budget to pay off debt. Meanwhile, 33% would advise them to cut up or cancel their cards to stop spending.

Debt snowball vs. debt avalanche: Consumers split down the middle

The two most popular methods to make debt payments are:

- Debt avalanche: Making minimum payments on all outstanding accounts, then using any remaining money designated for debts to pay off the bill with the highest interest rate.

- Debt snowball: Paying off the smallest debts before moving on to bigger ones. This helps encourage consumers to keep paying off debt by celebrating multiple wins first.

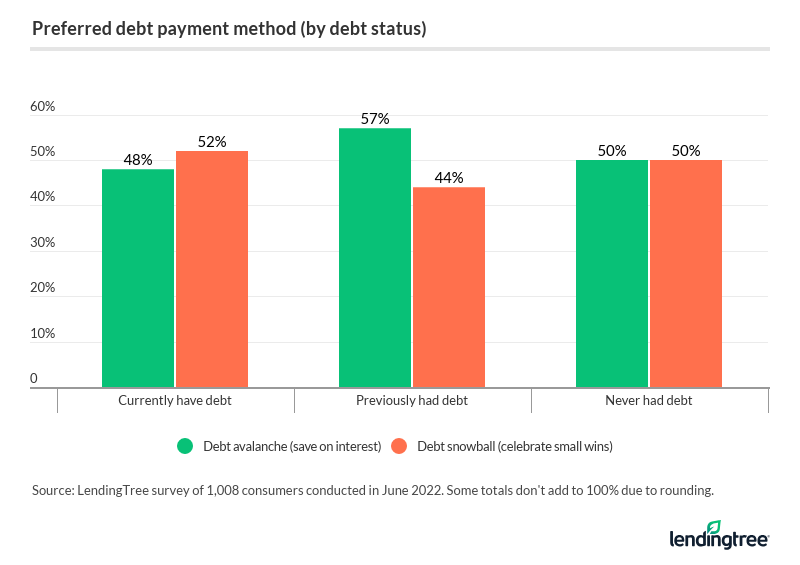

Consumers generally don’t prefer one over the other — across all those surveyed, both methods tied at 50%. However, women (52%) and Gen Zers (52%) are more likely to prefer the debt snowball method, while men (53%) and Gen Xers (53%) opt for the debt avalanche method.

When it comes to what worked, though, the avalanche method takes a slight lead. Of those who’ve paid off their debts, 57% say they prefer the avalanche method. Meanwhile, 52% of those in debt say they prefer the snowball method.

Schulz says one method isn’t better than the other. Rather, it’s just a matter of math versus psychology.

“The best debt payoff method is the one that you’re the most likely to stick with,” Schulz says. “If you’re motivated by paying your debt off as quickly as possible and paying as little interest as possible, the avalanche method is for you. If you’d be more motivated by getting wins, the snowball method is the way to go. Paying off debt is a marathon rather than a sprint, and sometimes mixing in a few small victories can be the fuel you need to keep going.”

Expert tips for dealing with debt

Breaking a debt cycle can be difficult. Depending on how much you owe, it may often feel impossible. For those struggling with debt, Schulz offers the following advice:

- It all starts with a budget. “You can’t make a meaningful plan to knock down debt unless you know exactly how much money is coming in and going out of your household regularly,” Schulz says. “Once you have a handle on that, you can make some important decisions on how to spend your money based on your current priorities. For someone struggling with debt, that would obviously include paying it down.”

- Don’t stop building up your savings. Schulz says you can (and should) pay off your debts while simultaneously building up your savings. “That way, when you finally get that card balance to $0, you won’t be left with an empty checking or savings account and forced to break out the credit card again for the next unexpected expense,” Schulz says. “That’s how you break the cycle of debt that so many people find themselves in. It isn’t easy, but it is worth it.”

- Don’t discount the importance of emotional support. “Paying down debt sucks,” Schulz says. “I’ve been there. It’s really tough. However, if you have a group of friends or relatives rooting for you and helping you stay on the straight and narrow, it can be so much easier.”

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,008 U.S. consumers, fielded June 17-20, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

While the survey also included consumers from the silent generation (those 77 and older), the sample size was too small to include findings related to that group in the generational breakdowns.

Get debt consolidation loan offers from up to 5 lenders in minutes

Recommended Articles