Where Residents Rely Most on Debt to Make Ends Meet

As a general budgeting rule, it’s not wise to go into debt to meet day-to-day spending needs. But with the COVID-19 pandemic impacting every aspect of American life, the rules are changing.

In fact, U.S. Census Bureau survey data from mid-July shows that large segments of the American population are relying on credit cards, loans and help from friends or family to survive.

In this study, LendingTree researchers used this data to estimate the places where residents were using debt the most to meet everyday spending needs. Here’s what we found.

Key findings

- The District of Columbia ranks first with up to 44.9% of residents using debt to meet weekly spending needs, followed by Colorado (up to 42.1%) and Nevada (up to 42%).

- North Dakota has the lowest percentage of residents relying on debt, with just 7.3% responding that they borrowed money from friends or family, and 16.5% saying they used credit cards or loans.

- States within New England generally use less debt to make ends meet. Vermont, New Hampshire and Maine all rank in the bottom five, while Rhode Island ranks in the bottom 10.

- At the national level, just over 24% of adults say they use credit cards or loans to meet spending needs, while 12% say they borrow from friends or family.

- 36% of people who borrowed money from friends or family report feeling nervous, anxious or on edge nearly every day.

3 states where residents rely most on debt to make ends meet

1. District of Columbia

The District of Columbia had the highest percentage (30.7%) of residents who used credit cards or loans to meet everyday spending needs during the period in mid-July covered by the Census Bureau survey. Other methods that D.C. residents used to make ends meet included:

- Dipping into savings or selling assets: 20.6%

- Using economic impact payments: 18.2%

More than 8 in 10 reported to the Census Bureau in mid-June that they had already received or were expecting to receive their economic impact payment, likely leaving those needing an infusion of cash to meet weekly spending needs to seek other methods.

2. Colorado

In the Centennial State, using credit cards or loans (26.7%) was almost as likely to be a tactic for financing immediate spending needs as using savings or selling assets (28.5%). The state enacted limitations in late June that protect up to $4,000 in bank accounts from wage garnishments, so that could help make savings a more plausible option for those already dealing with debt.

Unemployment benefits in Colorado, on the other hand, were the second-least likely option (11.3%), which is backed up by the state’s relatively low July unemployment rate of 7.4%.

3. Nevada

Nevada residents were slightly more likely to use money from savings or selling assets (28.3%) than they were to use credit cards or loans (25.3%) to finance necessary expenses.

The state had the third-highest July unemployment rate (14%) in the nation. By contrast, bordering Utah had the lowest rate at 4.5%. So Nevada’s rate is in line with the sizable percentage of people (20%) who used those benefits to make ends meet.

3 states where residents rely least on debt to make ends meet

51. North Dakota

North Dakota had the lowest percentage of people who used debt to pay for necessary expenses. North Dakotans were more than twice as likely to use credit cards or loans (16.5%) than they were to either borrow from friends or family (7.3%) or use unemployment benefits (7.2%). That aligns with the state having the seventh-lowest unemployment rate (6.6%, tied with Iowa).

The most-used tactics for residents were:

- Using economic impact payments (20.5%)

- Using money from savings or selling assets (19.4%)

50. Vermont

Like North Dakota residents, Vermonters were most likely to use either money from savings or selling assets (24.6%) or economic impact payments (20.2%) to pay for their necessary expenses. That just beats out credit cards and loans, which came in at 19.2%.

Vermont residents were least likely to use either money saved from deferred or forgiven payments (5.6%) or money borrowed from friends or family (6%) to meet their spending needs.

49. New Hampshire

While 80.9% of New Hampshire residents were able to rely on regular sources of income, more than a quarter (26.6%) said they had to dip into their savings or sell assets to make ends meet. And about one-fifth said they used credit cards or loans.

New Hampshire residents on average have higher median household incomes than the U.S. average, which could have contributed to a decreased need to rely on debt during these unprecedented times.

More debt means more stress for borrowers

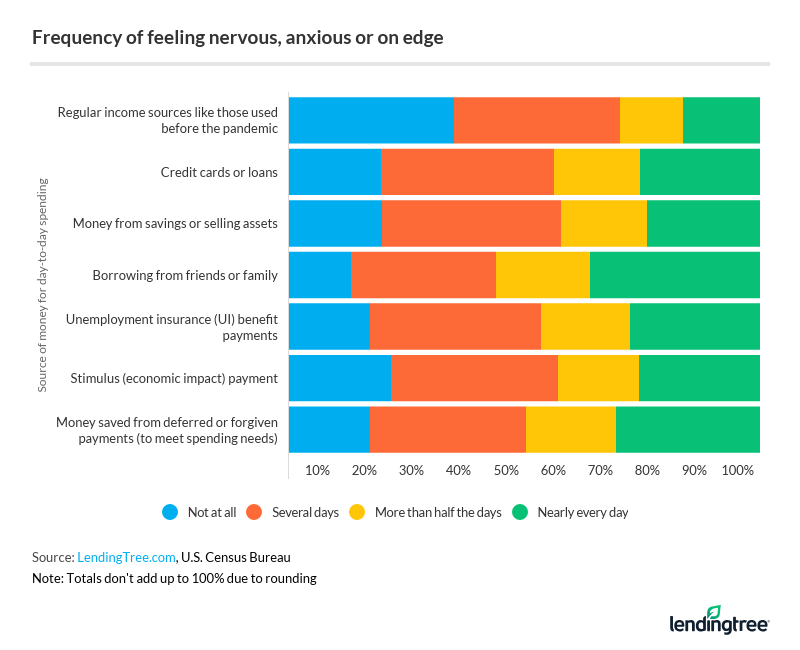

Living through a pandemic is stressful, and adding debt to the mix is going to heighten that sense. Among those who used credit cards or loans to finance their everyday spending, nearly 3 in 4 (73.5%) respondents reported feeling anxious, nervous or on edge at least several days during the survey period. Comparatively, about 65% who used their regular income reported the same feelings.

Meanwhile, 36% of people who borrowed money from friends or family reported feeling nervous, anxious or on edge nearly every day.

The idea of borrowing is wrapped up in quite a bit of taboo for some and — if things go wrong — it can have a real impact on relationships. Comparatively, for those who used credit cards or loans, many (36.7%) reported this kind of anxiety several days a week, while only a quarter (25.4%) said it was something that impacted them nearly every day.

Age also showed an interesting trend. Younger individuals tended to report experiencing these feelings most days of the week or more frequently than other groups.

How debt-financed spending weighs on borrowers

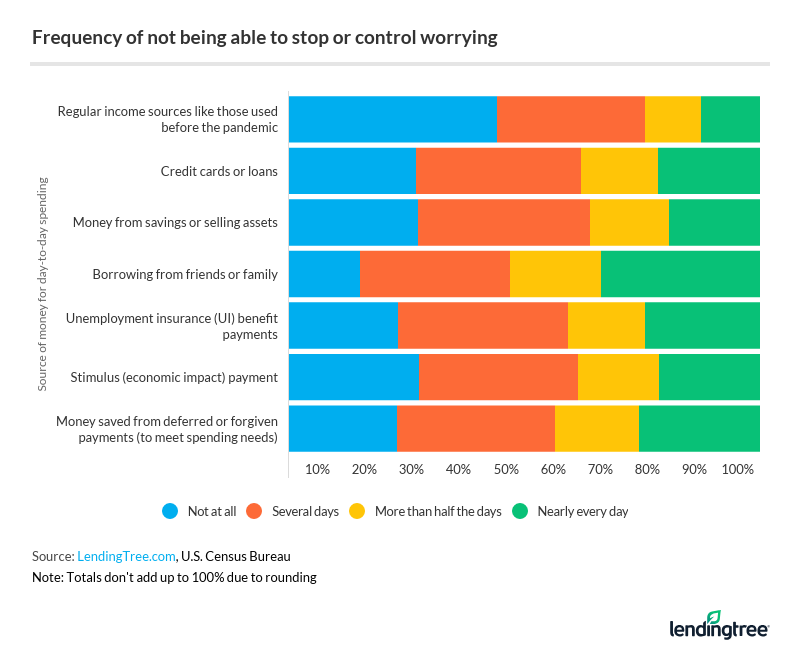

About a third reported not being able to stop or control their worrying several days of the week, regardless of the type of non-income source they used to pay for their expenses:

What to do when you’re relying on debt to make ends meet

Debt not only impacts your finances, but it can affect your mental health, too. And the first step to getting out of debt (and improving your mental state) is acknowledging that it exists.

“Far too many people just bury their heads in the sand and wind up overwhelmed by debt, and it doesn’t have to be that way,” said Matt Schulz, LendingTree’s chief consumer finance analyst. Part of that could be checking your credit report to view all your loans in one place. Credit reports can be accessed for free weekly through April 2021 at AnnualCreditReport.com.

For those who can afford to step away from debt, here’s what else to consider:

- Make a budget: “A budget is a crucial first step,” Schulz said. “It’s virtually impossible to make a meaningful plan to attack credit card debt if you don’t know exactly how much money comes in and goes out of your household each month.” A budget can help you better understand your debts in relation to your income, and how to go about becoming debt-free.

- Call your lender: For those whose money struggles are pandemic-related, letting the lender — whether it be personal loans or credit cards — know about those issues is vital. The lender may be able to work with you to find a solution, like pausing payments for a few months, while you get your income and finances back on track.

- Watch your credit card usage: Consumers should still use a credit card over a debit card to pay for online shopping — this has become almost a necessity due to the pandemic — because it’s safer for their finances. However, “there’s no question that credit cards can make it easier to spend money you don’t have,” Schulz said. “That makes it crucial that you use that card wisely, including paying the card balance in full each month. That’s not always realistic for folks, but it should always be the goal.”

- Find a side hustle or part-time job: Increasing your income is always going to be the fastest way to get out of debt. In a pandemic, when so many have lost their jobs, this can be a tall order. But side hustles or part-time jobs are still worth pursuing, particularly if they play off your existing skills.

For those who can’t afford to start paying down their debt and need to continue using options like credit cards or personal loans to make ends meet, it can feel that much more difficult. But it won’t always be that way.

“Don’t be so hard on yourself,” Schulz said. “A lot of the normal rules of personal finance go out the window during times like these. Yes, good credit is important, as is avoiding debt. However, keeping food on the table and keeping the lights on for your family is more important.”

Methodology

LendingTree analyzed the U.S. Census Bureau Housing Pulse Survey data compiled July 16-21, 2020, the last week of the first phase of the survey, to estimate the places where residents were using debt the most to meet everyday spending needs. We compared the total population of people aged 18 and older to the number who responded they used credit cards or loans to meet spending needs, and the number who reported borrowing money from friends or family.

Get debt consolidation loan offers from up to 5 lenders in minutes