55% of Americans Have Been Burdened With Medical Debt, With 50% of Them Sent to Collections

More than half of Americans have incurred medical debt in the past — including 27% who still have it, according to a new LendingTree survey.

Even worse, half of those who’ve taken on medical debt have had a debt go into collections.

There’s no question that millions of Americans struggle under the weight of significant medical debt. A single unexpected medical event and the associated costs can upend someone’s financial life in ways that can take years to recover from. To better understand the scope, the enormity of its impact and people’s perspective, LendingTree surveyed more than 2,000 consumers about their experiences with medical debt. The results were sobering.

Here’s what we found.

Key findings

- The U.S. health care system is leaving many Americans financially broken for getting sick. Over half (55%) of Americans have incurred medical debt, with 27% still paying it off — up from 25% in 2023. The burden weighs heavily on parents of young children and millennials, with 38% and 32%, respectively, currently managing medical debt.

- The high cost of healing lingers far beyond recovery. Nearly three-quarters of those with current medical debt expect it’ll take six months or more to pay it off — 17% believe it’ll take over five years. To keep up with payments, Americans with medical debt are dipping into savings (27%), charging credit cards (25%) and draining retirement accounts (12%). Worse, 50% of those with medical debt — either now or in the past — have had an account sent to collections.

- The financial strain of medical costs is taking a toll on Americans’ physical and economic well-being. More than half (54%) of those who’ve had medical debt have skipped medical care due to cost, with 30% of them experiencing worsened conditions as a result. Additionally, 64% of individuals with medical debt now say it’s preventing them from achieving other financial goals — a reality particularly stark among millennials (71%).

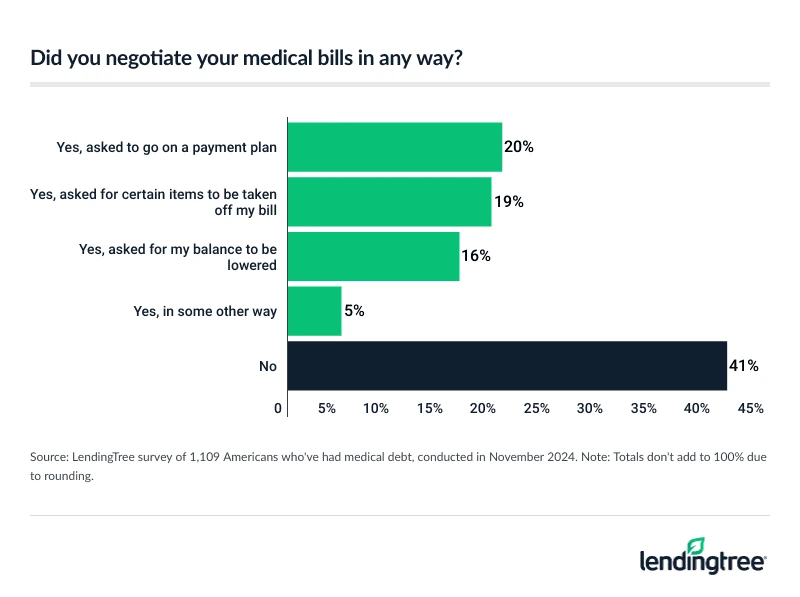

- Negotiation may offer some relief. 59% of Americans who’ve had medical debt have negotiated a related bill, with 93% of them reporting at least partial success — 66% received what they requested. Negotiation tactics included requesting payment plans (20%), disputing specific charges (19%) and asking for balance reductions (16%).

The U.S. health care system is leaving many Americans financially broken for getting sick

Medical debt is an epidemic in this country. Our survey found that 55% of Americans have had medical debt, including 27% still paying it off now — up from 25% in 2023.

Parents of young children (38%) and millennials ages 28 to 43 (32%) are among the most likely groups to be currently battling medical debt. Perhaps surprisingly, we also found that the higher your household income, the more likely you are to currently have medical debt. Nearly 1 in 3 (32%) people making $100,000 or more a year have medical debt, versus 24% of those earning less than $30,000 a year.

The survey also showed that medical debt doesn’t discriminate by gender. While men are slightly more likely than women to currently have medical debt (28% versus 26%) and women are a bit more likely than men to say they’ve never had medical debt (46% versus 44%), the margins are small compared to the differences among income groups.

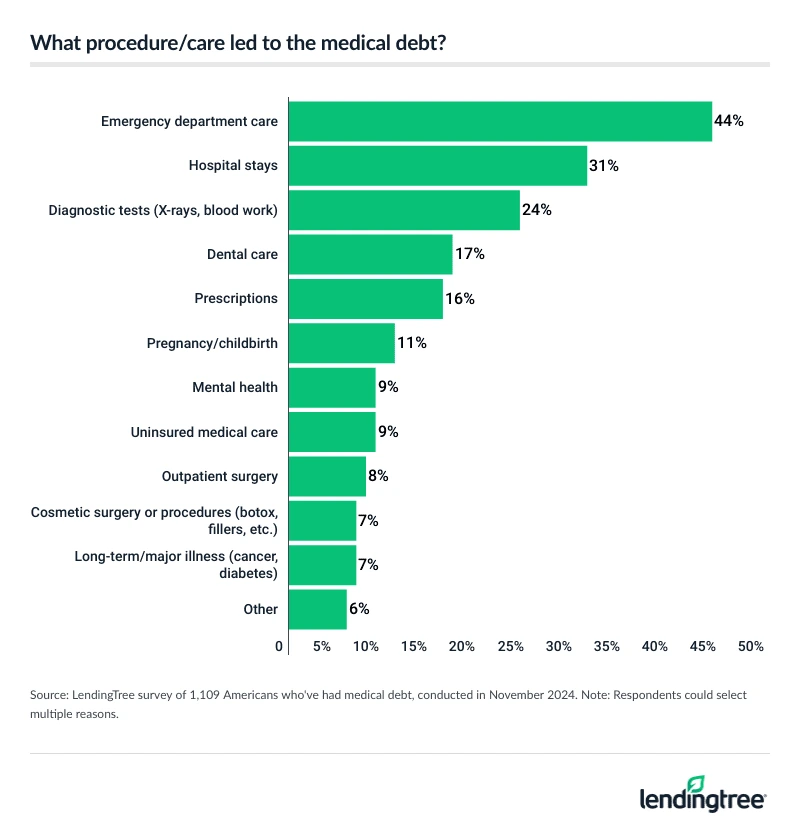

Emergency room care was the most common culprit sending people into debt, with 44% of current or former debtors pinpointing that as a cause. However, the types of procedures and services that send people into debt range widely, including diagnostic tests (24%), dental care (17%), pregnancy/childbirth (11%), cosmetic surgery (7%) and long-term or major illnesses such as cancer or diabetes (7%).

More than 1 in 5 people (22%) who’ve had medical debt say they have acquired it due to weight-loss drugs, surgery or treatment — including drugs like Ozempic or Mounjaro. This is especially true among Gen Zers ages 18 to 27 (47%) and millennials (31%).

The high cost of healing lingers far beyond recovery

The problem doesn’t go away quickly for most people with medical debt. Our survey found that 74% of those with medical debt think it’ll take six months or more to pay it off, including nearly 1 in 5 (17%) who say it’ll take more than five years.

Women are far more likely to say their medical debt will last longer than a year, with 56% saying so, versus just 29% of men. That 56% includes 24% who say their debt will last more than five years, while just 10% of men say the same.

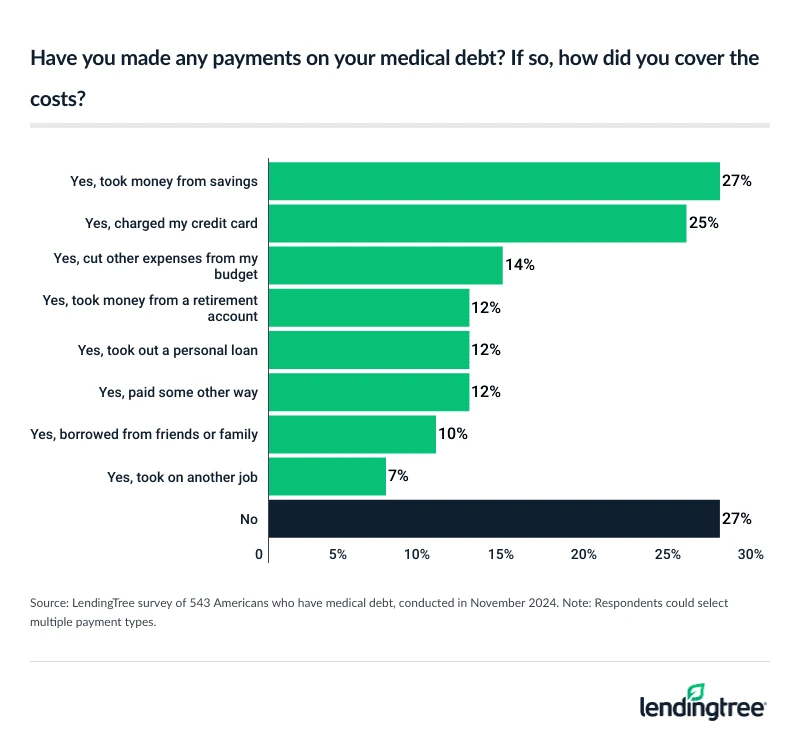

Those struggles force people to make difficult decisions, including immediate sacrifices to ensure their medical debt bills get paid. Our survey found that those with medical debt choose to dip into savings (27%), charge credit cards (25%) and withdraw from retirement accounts (12%) to cover their medical bills.

For many Americans, the situation is even worse. The survey found that 50% of those who have medical debt now or have had it in the past have had an account go into collections. Women are slightly more likely than men to say it’s happened (51% versus 49%), while millennials are the most likely age group (58%, versus 52% of Gen Xers ages 44 to 59, 47% of Gen Zers and 35% of baby boomers ages 60 to 78).

Nearly 6 in 10 (58%) of those who’ve had medical debt and make $100,000 or more a year say they’ve had debt go into collections, higher than any other income bracket. Conversely, 46% of those making $30,000 to $49,999 a year say the same.

In January 2025, the Consumer Financial Protection Bureau (CFPB) delivered some much-needed good news for those struggling with this type of debt. The consumer watchdog agency is set to ban the inclusion of medical debt on credit reports. The CFPB rule — expected to take effect in March, though challenges are possible — would remove an estimated $49 billion in medical debts from the credit reports of roughly 15 million Americans and could boost the credit scores of those impacted by an average of 20 points.

The financial strain of medical costs is taking a toll on Americans’ physical and economic well-being

Long-term debt can be devastating. Every dollar that goes to paying down debt can’t go toward other financial goals such as building an emergency fund, starting a small business or saving for retirement, college or a mortgage down payment. That’s the situation facing millions of Americans today.

Nearly two-thirds of individuals with current medical debt (64%) say the debt prevents them from achieving other financial goals. Among those with debt, more than 7 in 10 parents of young children (74%) and millennials (71%) say so, as do 69% of men.

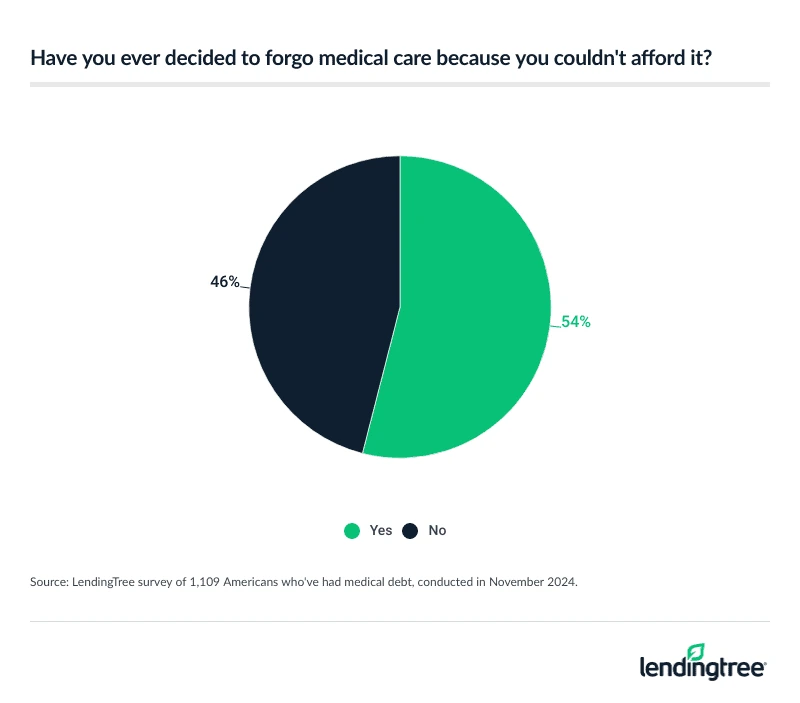

Still, medical debt doesn’t just affect people financially. It can be detrimental to their physical and mental health. More than half (54%) of those who’ve had medical debt have chosen to forgo medical care because of its cost — and nearly a third of those (30%) experienced worsened conditions as a result.

The younger you are, the more likely you are to have forgone medical care because you couldn’t afford it: 61% of Gen Zers did so, versus 58% of millennials, 54% of Gen Xers and 43% of boomers. Nearly 6 in 10 (59%) parents of young kids say the same.

Negotiation may offer some relief

Now for some good news: Our survey shows that you likely have more power over your medical bills than you think.

Nearly 6 in 10 Americans (59%) who’ve had medical debt have negotiated at least one of their medical bills, with 93% of them reporting they had at least some success. That 93% includes 66% who say they received what they requested. That’s big. Respondents say their negotiations included requesting a payment plan (20%), disputing specific charges (19%) and asking for a reduced balance (16%).

Men are much more likely than women to say they’ve negotiated (68% of men have done so, versus 49% of women). They’re also more likely to get what they asked for (70% of men did, versus 60% of women), but only slightly more likely to be at least somewhat successful in their negotiations. Overall, 95% of men had at least some success, as did 91% of women.

The success rates for negotiations were similarly high across age groups and income brackets. In every age group, at least 90% of respondents reported at least some success. Among the various income brackets, your chance of some success grew with your income, but even those making less than $30,000 per year usually found some success, at 88%.

In short, you have a good chance of successfully negotiating no matter who you are or how rich you are. It’s unquestionably worth your time.

Tips for a successful negotiation

Knowing you can negotiate medical bills doesn’t mean you know how to do it. I offer word-for-word scripts for how to do this and other medical-related negotiations in my book, “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life.”

Here are a few things you should know before you begin.

- Start by making sure you have an accurate bill: By some estimates, up to a stunning 80% of medical bills have errors in them. Those mistakes can have a massive impact on the total bill, so making sure you’re getting billed for the procedures and services provided is the best way to start. Call your medical provider and ask for an itemized bill that includes current procedural terminology (CPT) codes. These codes are standardized language in the medical industry, and they’re used to identify specific procedures and services. Once you receive those codes, you can Google the ones on your bill to see if they represent what you had done. If they do, great. If they don’t, have the provider fix them. (Also, simply having the wrong doctor name on a bill can turn an in-network bill into a far pricier out-of-network bill, so make sure that’s accurate.)

- Ask about an interest-free payment plan: Don’t just accept that you have to pay that medical bill on your credit card — or, worse, with a medical credit card. If you need help with financing, always ask the provider if they offer an interest-free payment plan. Many medical providers will make that available to patients, though you may have to ask.

- Don’t be afraid to share your story: If you’re unsure how to pay your bill, speak up. The medical provider may have special programs to offer financial assistance to those who qualify, or they may be able to point you in the direction of helpful resources.

- If possible, paying more up front can lead to discounts: It’s true, and not just with medical providers. If you’re willing to make a bigger payment today, a business will often dramatically reduce your overall bill. Sometimes they’ll even consider the bill closed. Of course, you shouldn’t expect to pay $500 up front and have a $10,000 bill wiped away. However, if you can pay two-thirds of a bill today, it may be worth asking if they’d be willing to forgo the rest of the payments.

- Be proactive: The negotiations can begin before the procedure or service occurs. Asking a doctor, “What happens if we wait?” can let you know if the service needs to be done today or could be put off until you’re more financially prepared. You may also consider pursuing a second or third opinion if you think the cost you’re quoted for a service or procedure is too high. And don’t worry about offending your doctor by taking these steps. Any doctor worth their salt won’t mind. If they do mind, it’s a red flag — and a hint that it may be time to find a new doctor.

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,016 U.S. consumers ages 18 to 78 from Nov. 6 to 8, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

Get debt consolidation loan offers from up to 5 lenders in minutes