How Non-Mortgage Debt Has Changed Amid Coronavirus Crisis

Non-mortgage debt levels increased by 2.1% during the first half of 2020 amid the coronavirus pandemic, compared with a 1.8% increase in the first half of 2019. While these increases are relatively similar, there were major shifts within debt categories — particularly credit cards and student loans — according to a LendingTree analysis of more than 1.4 million anonymized credit reports.

Key findings

-

Average overall non-mortgage debt balances in the 100 largest U.S. metros increased by 2.1% during the first half of 2020.

- Winston-Salem, N.C., saw the greatest growth in non-mortgage debt (6.6%), with average balances increasing by $2,053 from January 2020 to June 2020.

- Miami and Stockton, Calif., had the next highest growth of non-mortgage debt at 6.3% and 5.4%, respectively. Despite Miami’s lower percentage change than Winston-Salem, the Florida city had the largest average balance increase — $2,150 — among those 100 U.S. metros.

-

Sixteen of the 100 metros reduced their overall non-mortgage debt balances.

- Madison, Wis., reduced non-mortgage debt by 2.9% — with balances decreasing by $970 — during the first half of 2020, the most of any metro we reviewed.

- Two Ohio cities — Toledo and Cleveland — followed, lessening their average non-mortgage debt by 2.2% and 1.9%, respectively.

-

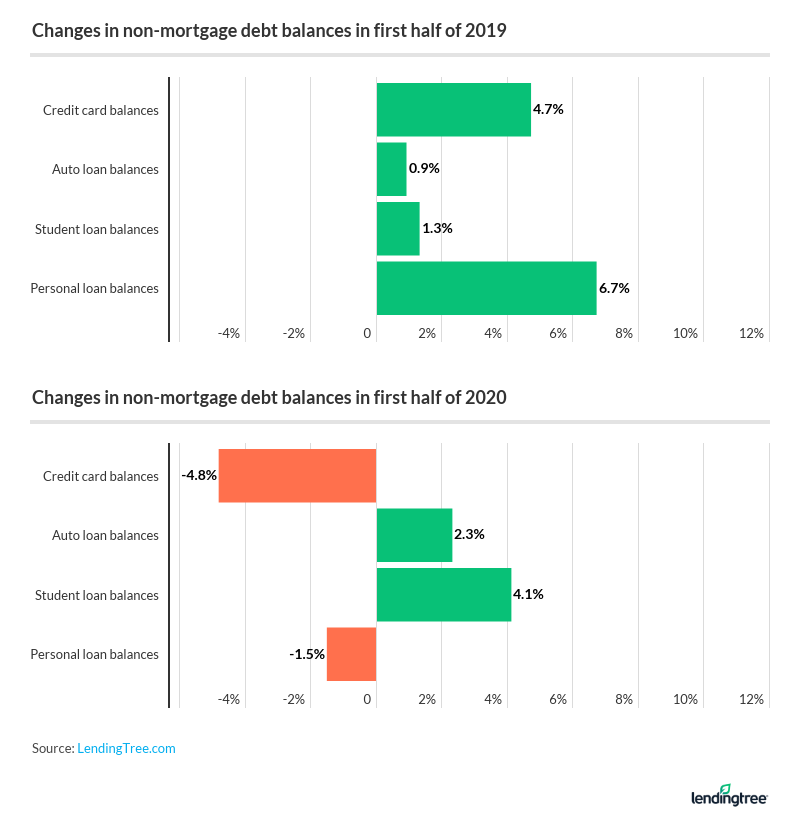

During the first half of 2020, credit card and personal loan balances dropped, while student loan and auto loan balances increased. Breaking it down:

- Credit cards balances are down 4.8%

- Personal loan balances are down 1.5%

- Student loan balances are up 4.1%

- Auto loan balances are up 2.3%

Overview of non-mortgage debt in first half of 2020

In the second quarter of 2020 alone, non-mortgage debt balances saw a record $86 billion decline.

Credit card balances fell by $76 billion, reflecting decreased levels of consumer spending during the coronavirus crisis, which struck in conjunction with the U.S. officially entering a recession in February. Auto loan balances remained roughly the same, while student loan balances increased by $2 billion after many federal student loan payments were paused through September and more forbearances were granted.

Here’s a look at non-mortgage debt in the first halves of 2019 and 2020:

Metros where non-mortgage debt increased the most in first half of 2020

Eighty-four of the top 100 metros saw a rise in non-mortgage debt balances from January 2020 to June 2020, with eight of the 10 with the largest increases being in the South.

While Winston-Salem, N.C., saw the greatest percentage change in overall balance from January 2020 to June 2020, the other metros in the top 10 — except for Stockton, Calif. — started and ended with higher balances than Winston-Salem.

Breaking it down by debt type in those 10 metros:

- Credit card balances increased in half of the top 10 metros. Winston-Salem had the largest increase — $7,100 to $7,769, or 9.4% — while Memphis, Tenn. — $7,623 to $7,745, or 1.6% — had the smallest increase.

- Auto loan balances increased in each of the 10 top-ranking metros, except for Greensboro, N.C. New Haven, Conn., saw the biggest rise — $16,474 to $17,525, or 6.4%.

- Student loan balances increased in each of the 10 metros, with the highest growth — $34,922 to $38,820, or 11.2% — in Austin, Texas.

- Personal loan balances increased in nine of the 10 metros. Greensboro, N.C., saw the biggest rise — $11,522 to $12,612, or 9.5%. It’s noteworthy to point out that the only metro among the top 10 that saw a decrease was Stockton, Calif., where the average balance for personal loan holders fell by 13.8% from $14,019 to $12,087.

Metros where non-mortgage debt decreased in first half of 2020

Of the 16 metros where non-mortgage debt decreased, all are in the West or Midwest, except for Jackson, Miss., and Baltimore.

Jackson had the highest starting and ending non-mortgage debt balance from January 2020 to June 2020, while Grand Rapids, Mich., had the lowest.

Breaking it down by debt type in those 16 metros:

- Credit card balances dropped in 11 of the 16 metros. Madison, Wis., saw the biggest percentage decrease — $6,862 to $5,979, or 12.9%. Wichita, Kan., and Cleveland tied for the smallest percentage decrease, 5.9%.

- Auto loan balances fell in nine of the 16 metros. The biggest decrease was in Boise, Idaho — $24,699 to $23,318, or 5.6%.

- Student loan balances also fell in nine of the 16 metros. Madison had the biggest decrease — $37,782 to $36,360, or 3.8%.

- Personal loan balances dropped in eight of the 16 metros. Dayton, Ohio, saw the biggest drop — $15,041 to $12,597, or 16.2%. Of note, Jackson saw an increase of 33.7%.

Changes in debt balances: Highlights

Unsecured debt balances have dropped

Credit card balances went down by an average of 4.8% over the first half of 2020. Contributing factors included:

- Issuers allowing cardholders to defer payments

- Credit limits being cut

- Fewer cards being opened

This is a big turnaround from an average credit balance increase of 4.7% during the first half of 2019.

Changes in non-mortgage debt balances in first halves of 2019, 2020

| Debt category | Change in non-mortgage debt balances in the first half of 2019 | |||

|---|---|---|---|---|

| Jan. 2019 average balance | June 2019 average balance | $ change | % change | |

| Credit card balances | $7,470 | $7,821 | $352 | 4.7% |

| Auto loan balances | $21,422 | $21,624 | $201 | 0.9% |

| Student loan balances | $39,043 | $39,542 | $500 | 1.3% |

| Personal loan balances | $12,760 | $13,618 | $858 | 6.7% |

| Debt category | Change in non-mortgage debt balances in the first half of 2020 | |||

|---|---|---|---|---|

| Jan. 2020 average balance | June 2020 average balance | $ change | % change | |

| Credit card balances | $7,897 | $7,520 | -$377 | -4.8% |

| Auto loan balances | $22,024 | $22,535 | $511 | 2.3% |

| Student loan balances | $40,350 | $41,993 | $1,643 | 4.1% |

| Personal loan balances | $14,107 | $13,898 | -$208 | -1.5% |

Personal loan balances also fell — by 1.5% — during the first half of 2020 after increasing 6.7% during the first half of 2019.

Inquiries for personal loans saw some steep week-to-week drops during the first half of 2020, according to our Personal Loan Index. Inquiries hit a low in late April and early May before seeing some slight upticks heading into the second half of the year. Consumers have increasingly been seeking personal loans for home improvements, major purchases and business purposes in the latter portion of the first half of the year.

Other debts have increased

Student loan balances increased by 4.1% during the first half of 2020, compared with 1.3% during the first half of 2019. In a recent Student Loan Hero survey, we found that 42% of federal student loan borrowers would continue monthly payments while they’re suspended through September, while 40% were postponing payments. These borrowers could save the money not used on student loans or pay other debts with it, including rent or mortgage, household bills and groceries.

Elsewhere, an increase in auto loan balances by 2.3% partly reflects a heightened interest in car financing since early April, with the number of auto financing inquiries on the LendingTree marketplace being 92% higher in the final week of May compared to the first week of 2020.

How COVID-19 changed debt landscape — and what borrowers can do

The coronavirus rescue package has prevented many consumers from going into further debt in the first half of 2020 — especially student loan borrowers.

Federal student loan borrowers could strategically choose to continue student loan payments that would go directly toward the principal in an interest-free environment. Refinancing could be an option for private student loan borrowers, as these loans aren’t covered by the federal government’s interest waiver.

As for auto loan borrowers, lenders may be more lenient amid the coronavirus pandemic, so you can inquire about whether you may be able to:

- Defer payments

- Extend leases

- Waive fees

Those unable to pay personal loan balances should consult their lender or bank to discuss options, including forbearance and payment plans.

Since 2013, household debt has increased in most quarters, reaching its highest amount at the end of 2019 at more than $14 trillion. While COVID-19 has led to major reductions in unsecured debt levels and a large decline in overall household debt as of the second quarter of 2020, whether these debt trends will remain in the long term remains to be seen.

Methodology

LendingTree analyzed over 1.4 million anonymized credit reports from January 2019, June 2019, January 2020 and June 2020 to determine average non-mortgage debts, as well as the average balances for those who held credit card, auto loan, student loan and personal loan debt within the 100 largest U.S. metropolitan areas. Additional data is from the Federal Reserve Bank of New York.

Get debt consolidation loan offers from up to 5 lenders in minutes

Recommended Articles