Americans Rely on Credit Cards to Make Ends Meet As 64% Admit to Living Paycheck to Paycheck

It’s not breaking news to say having an emergency fund is important. Keeping three-to-six months’ worth of expenses banked can shield you from financial disaster when life’s unexpected (but guaranteed) twists and turns show up.

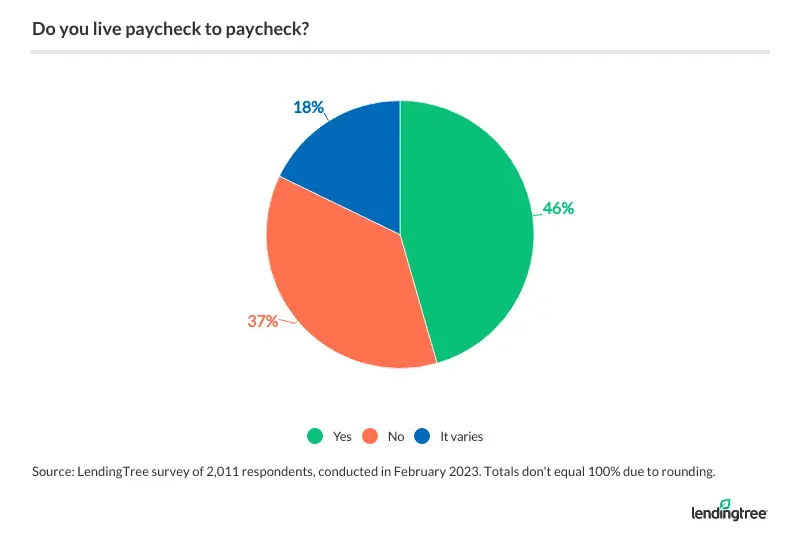

But that feat isn’t easy for many Americans — 64% of whom, according to the latest LendingTree survey of more than 2,000 U.S. consumers, are living paycheck to paycheck at least periodically. (Almost half, at 46%, live this way all the time.)

“Life is incredibly expensive in 2023,” says LendingTree chief consumer finance analyst Matt Schulz, and accruing an emergency fund, as difficult as it is, can “be life-changing.”

Still, there’s some hope. These figures have slightly improved in recent years — despite the challenges Americans have faced.

Key findings

- Financial instability plagues many Americans, as nearly two-thirds (64%) at least periodically live paycheck to paycheck. 46% say they live this way consistently, while 18% report it varies. Even if they aren’t living paycheck to paycheck, many Americans have very little discretionary income, as 35% have less than $100 left after covering all their monthly financial obligations.

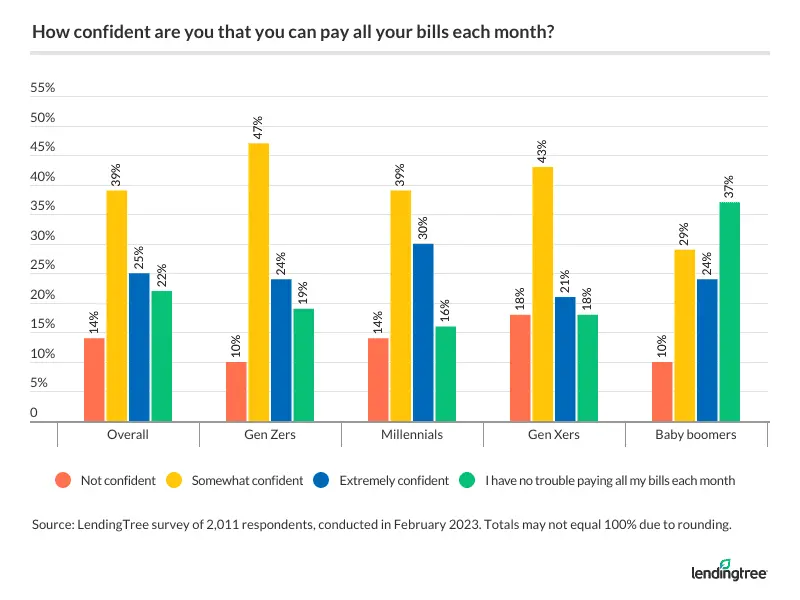

- An inability to cover necessary expenses could contribute to the rise in credit card debt, with 58% of those unable to make ends meet amid high inflation having used a credit card to bridge the gap at least once. Only 22% of total respondents say they have no trouble paying their bills each month, with baby boomers (37%) nearly twice as likely to say so as Gen Zers (19%), the next highest generation. Only 16% of millennials say they pay their monthly bills without difficulty.

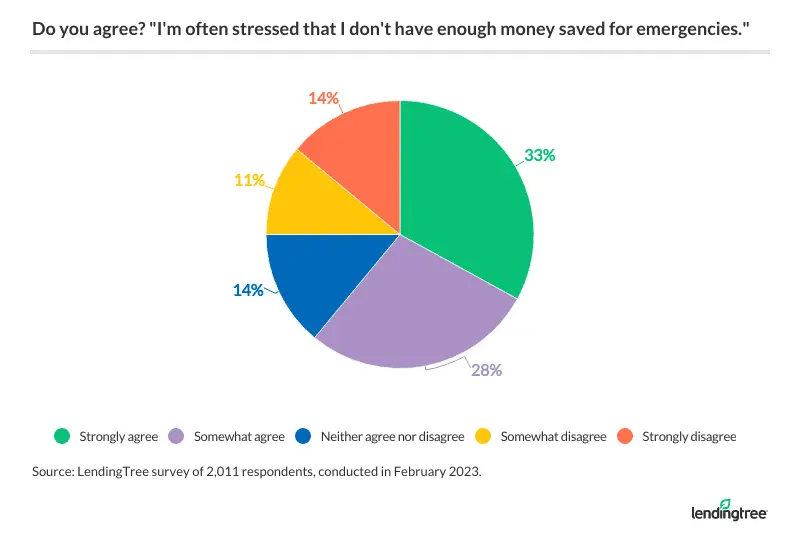

- Rising costs and uncertain economic times have strengthened the importance of an emergency fund, but most are unprepared. Experts recommend households save three to six months’ worth of living expenses, but only 42% of Americans have at least three months saved. Americans recognize this risk, as 61% say they often feel stressed they don’t have enough saved for emergencies and 44% admit they couldn’t afford a $1,000 unforeseen expense.

- Newest to the workforce, Gen Zers seem to be the most optimistic about their financial habits, though they periodically live paycheck to paycheck more than any other generation. 90% of the youngest surveyed generation feel at least somewhat confident in their ability to pay their bills each month, a higher percentage than millennials and Gen Xers. Gen Zers are also more likely than those generations to have three months of living expenses saved. But 74% of Gen Zers report variable paycheck-to-paycheck living, a potential indicator of how different generations view finances.

- As inflation lingers, one of the best ways Americans can improve their finances is to start making more dough. This could be easier said than done, as 65% say their household income is the same or lower than a year ago. 70% of Gen Xers report this, followed by 65% of millennials and 63% of baby boomers.

64% of Americans live paycheck to paycheck

This year, a staggering 64% of Americans admit to living paycheck to paycheck at least intermittently — 46% of whom say they do all the time.

While this figure is worrying, it’s an improvement over recent years. In early 2022, 65% of Americans reported periodically living paycheck to paycheck, 50% of whom said it was consistent. In 2020, those figures were 70% and 53%, respectively.

This improving trend is “kind of amazing,” Schulz says. “But Americans have continued to be amazingly resilient in the face of all the economic weirdness and uncertainty they’ve faced in the past few years.” Many Americans, he says, were able to save money and pay down debt in 2020 and 2021 — even in the face of the darkest days of the pandemic.

Still, most of us are feeling the pinch. A high percentage of Americans have very little discretionary income — the money left over each month to invest, save or spend after covering necessities. About 1 in 5 (22%) say they have less than $50 to their name after buying groceries and keeping the lights on, while 66% have less than $500.

Perhaps unsurprisingly, this dynamic varies with age. Nearly 1 in 4 (23%) baby boomers ages 59 to 77 report having more than $1,000 in monthly discretionary income. Only 14% or 15% of Gen Zers ages 18 to 26, millennials ages 27 to 42 and Gen Xers ages 43 to 58 can say the same. Most respondents across age brackets have between $100 and $499 in discretionary income, which understandably makes the prospect of saving a five-digit emergency fund daunting.

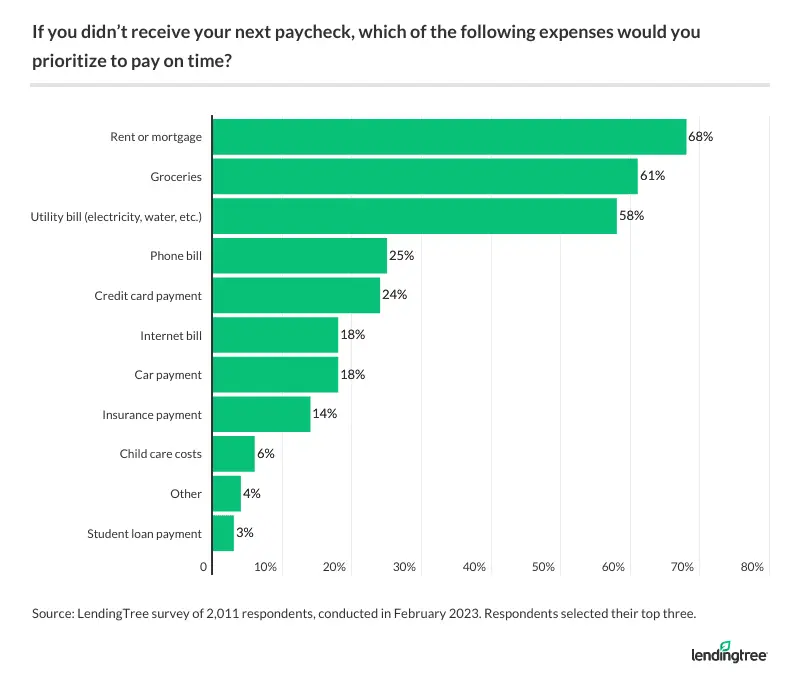

Prioritizing necessary expenses

With so little wiggle room, Americans are forced to think critically about their most pressing expenses — and for many, it’s the basic cost of living. We asked respondents which common costs they’d prioritize if they didn’t receive their next paycheck, and the top three answers were:

- Housing (68%)

- Groceries (61%)

- Utilities (58%)

Other heavy hitters included phone bills (25%) and credit card payments (24%). Unsurprisingly, respondents with kids younger than 18 are more focused than other groups on the cost of child care.

Despite these trends, respondents say they could last 17 weeks, on average, before taking on debt if they got their last paycheck today. That indicates that most Americans could sustain themselves for at least three months — or even four — if they lost their job.

However, it’s worth noting that men are in a substantially better position than women on this front. Men say they could go 20 weeks, on average, without taking on debt after a final paycheck, while women say they could only last an average of 15 weeks.

Consumers rely on credit cards to make ends meet

In today’s financial environment, liquidity is hard to come by. Almost half of respondents, 49%, say they’ve been unable to cover a primary bill with the money in their bank accounts at least once since inflation began rising in 2021 — 27% of whom say this has happened multiple times.

Of those who experienced this conundrum, 58% say they used credit cards to make ends meet at least once — 32% of which did so multiple times. Others turned to friends and family for help (15%) or waited until they had enough money in their account to cover the bill (26%), likely incurring a late fee.

While using a credit card to cover essentials isn’t uncommon — and for some, may even be unavoidable — it can be a dangerous game. “You’re essentially kicking the can down the road,” Schulz says. “You’re solving today’s problems by pushing them off until tomorrow.” When coupled with rampant inflation and rapidly rising interest rates, he says, that pushed-off problem “is only going to keep getting bigger, pricier and scarier until you deal with it.”

Unsurprisingly, financial realities can impact consumers’ confidence in their ability to keep themselves afloat: 52% say they’re only somewhat confident — or not confident at all — they’ll be able to pay their bills in full each month.

Only 22% of survey respondents say they have no trouble paying their bills each month, with another 25% saying they’re extremely confident. This confidence varies significantly across demographics.

- Having a partner helps: 56% of married people are comfortable paying their monthly bills, as opposed to 40% of those who’ve never been married and 36% of divorced folks.

- Younger respondents have more faith in their ability to pay the bills even during tight times: 90% of Gen Zers say they feel at least somewhat confident they’ll meet all their monthly expenses, a higher percentage than millennials and Gen Xers. (That’s despite 45% of Gen Zers living paycheck to paycheck consistently.)

- Men are significantly more self-assured in this regard than women: Only 47% of men say they’re only somewhat confident, or not confident at all, that they’ll pay all their bills each month, while 57% of women align with those statements.

An emergency fund can be vital, but many Americans are unprepared

Having an emergency fund — savings that exist solely to meet unexpected financial needs — is a primary objective for anyone looking to fix their finances. But when even the bills are a stretch, major savings goals can be hard to meet: 60% of Americans don’t have three months’ worth of living expenses saved, 19% of which say they don’t have enough money coming in to even try.

It makes sense then that 61% of respondents say they’re at least somewhat stressed that they don’t have enough money saved for emergencies. (Once again, baby boomers are the least-stressed generation; 30% of them indicate they almost never worry about having enough money to pay for an emergency, more than any other age bracket surveyed.)

Despite these anxieties, only 28% of those who don’t yet have an emergency cushion are actively working to save one, though most respondents indicate they’d like to. Only 5% say having emergency savings is not a priority; the rest have already had to dip into theirs or don’t have enough disposable income.

Another disconcerting statistic: 44% of Americans say they wouldn’t be able to cover a $1,000 emergency with funds in their checking or savings accounts. Again, men (64%) are in a better position than women (48%) on this front.

As discussed above, bills that can’t be paid in cash are all too often paid with plastic — which is why having an emergency fund is “so, so, so important,” Schulz says. “It means that an unexpected expense, such as a flat tire or an emergency trip to the vet for your dog, won’t automatically have to go on your credit card.”

5 ways to fight rising inflation

Americans may not have much control over inflation, but they have some control over their income. Still, only 35% of respondents say their household income is higher today than a year ago — and 23% say it’s dropped.

It isn’t always possible to make more money. But, fortunately, there are other ways to fight rising inflation that may help consumers feel less financial stress:

- Ditch your debt. While paying off debt on low income can be a challenge, it’s possible — and it can pay dividends in freeing up your money for other purposes. Once you have an emergency fund saved up, you’ll be less vulnerable to falling deeply into credit card debt, which can help keep this constant financial drain plugged for good. (Although it may sound counterintuitive, a debt consolidation loan could help!)

- Lower your regular expenses. If you can’t make more money, the next best thing is to figure out how to spend less — which means coupon-clipping, bargain-hunting and shopping around. Taking the time to figure out where to get better grocery prices or lower car insurance premiums “can really help,” Schulz says. “It’s old advice and may sound completely obvious, but it works.”

- If you’re facing an unexpected expense, consider a paycheck advance instead of using your credit card. Many of them allow you to access money before your official payday without interest or fees, although most are capped at lower amounts ($250 or $500).

- Use credit card rewards to your benefit. If you’re able to pay off your cards in full every month, using one with cash back rewards could move the needle, even if only a little bit. “Getting 2% cash back may not sound like a big deal,” says Schulz, “but when you’re on a tight budget living paycheck to paycheck, every little bit helps.” Again, just make sure you aren’t carrying a balance, or the interest you’ll owe will far outstrip whatever rewards you earn.

- Consolidate your debt. Going into more debt to get out of debt in the long run may sound counterintuitive, but it’s a tried and true financial tactic. “If you have good credit and a lot of credit card debt, it’s tough to beat a 0% balance transfer credit card,” Schulz says. “These cards can allow you to avoid accruing interest for up to 21 months on transferred balances — which can save you a ton of money in interest and dramatically reduce the amount of time it takes to pay off your debt.”

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,011 U.S. consumers ages 18 to 77 from Feb. 21 to 24, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77

Get debt consolidation loan offers from up to 5 lenders in minutes