2024 Pet Debt Report

As high costs continue to affect virtually every aspect of consumers’ daily lives, pet owners are barking up the debt tree.

According to the latest LendingTree survey of nearly 2,000 U.S. consumers, 85% of pet owners say inflation is making ownership more expensive — and 37% have gone into debt for their pet.

Here’s what we found.

Key findings

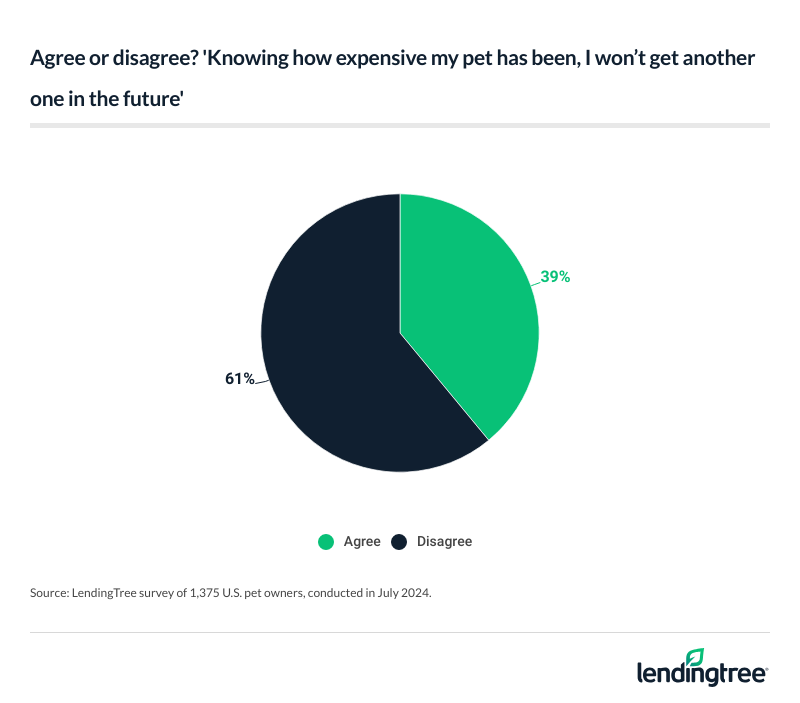

- Many Americans are getting priced out of owning a pet. Almost a quarter of pet owners (23%) say they’ve considered going petless due to costs, and 39% say they won’t own a pet again in the future. Additionally, 12% of Americans (and 25% of Gen Zers) have surrendered a pet because they could no longer afford to care for it.

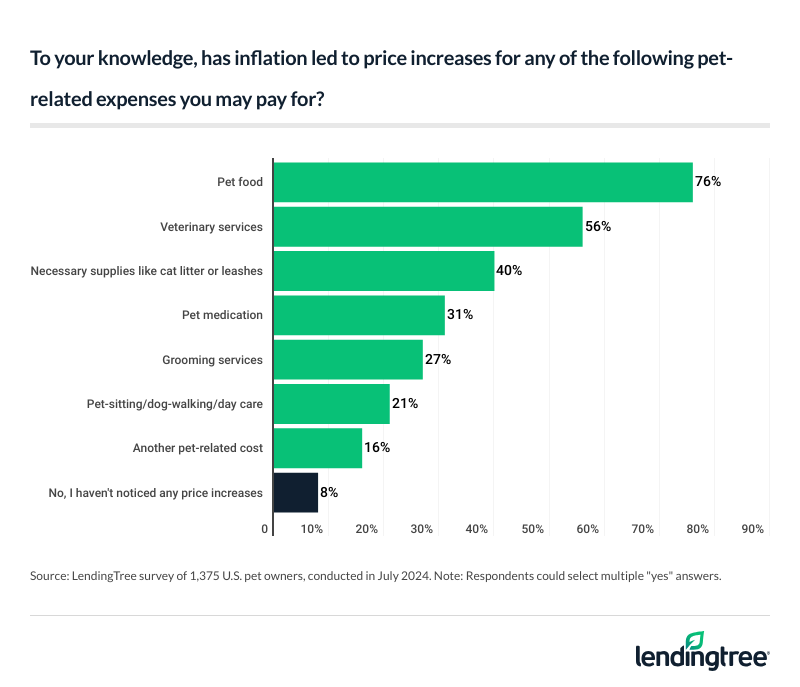

- Owners blame inflation for pet care costs. 85% of pet owners say inflation is making ownership more expensive, with 41% struggling to afford costs. When asked what’s getting more expensive, 76% said pet food, 56% said vet services and 40% said necessary supplies.

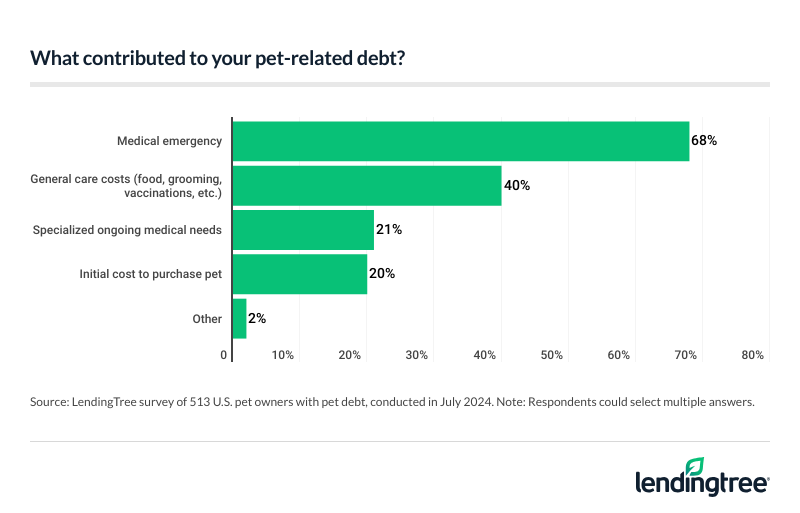

- Some pet owners have already been led into debt. 37% of pet owners have gone into debt for their pets, with 68% saying a medical emergency caused it. These emergencies are common, as 64% of owners say they’ve had an unexpected medical expense for their pet, and only 27% have pet insurance.

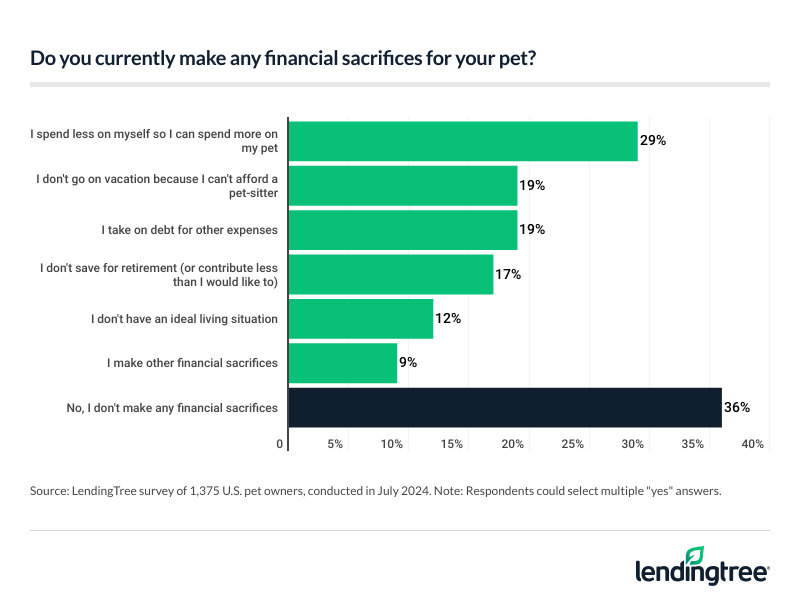

- Non-pet owners want to avoid expenses. Among the 31% of Americans who don’t have a pet, 25% can’t afford one. It’s a real concern, as 64% of those with pets say they make financial sacrifices for them, including cutting back on personal spending (29%), not going on vacation (19%) and taking on debt for other expenses (19%).

Pet owners say their furry friends are pawsitively expensive

Pets are pricey, and it’s giving owners pause. In fact, of the 69% of Americans who are pet owners, 23% say they’ve considered going petless due to costs. Men pet owners (33%) are far more likely to share this sentiment than women (14%).

By age group, Gen Z pet owners ages 18 to 27 (46%) are the most likely to consider going petless. That’s followed by:

- 29% of millennials ages 28 to 43

- 14% of Gen Xers ages 44 to 59

- 7% of baby boomers ages 60 to 78

Meanwhile, 39% of pet owners won’t own again in the future. That’s especially true for men (44%), those with children younger than 18 (44%) and Gen Zers (43%).

Those regrets run deep for some. Nearly a quarter (24%) say they wouldn’t have gotten their pet if they knew how expensive it would be. This is most common among Gen Zers, at 37%.

Some have done more than just consider going petless. Across all Americans, 12% have surrendered a pet because they could no longer afford to care for it. That rises to 25% among Gen Zers and 21% among parents with young children.

Inflation gets the blame for pet expenses

What makes pets so expensive? The majority (85%) of pet owners blame inflation, with 41% saying they struggle to afford rising costs. This is highest (50%) among people earning less than $30,000 annually.

Across pet owners, 76% have noticed increases in pet food prices — the most common response. Following that, 56% cited vet services and 40% cited necessary supplies.

According to LendingTree chief consumer finance analyst Matt Schulz, inflation may drive pet costs in various ways. “So much goes into owning a pet,” he says. “It isn’t just food, leashes and toys. Inflation has left many people with less disposable income. When that happens, you have to make difficult decisions and prioritize your money. For many, that doesn’t leave room for pets.”

Pet debt has affected 37% of owners

Given rising costs, it may not be surprising that nearly 2 in 5 (37%) pet owners have gone into debt for their pets. The percentage rises most among those with children younger than 18 (46%), Gen Zers (43%), those who earn $50,000 to $99,999 or $100,000 or more (both 41%), and men (40%).

Vet costs are causing owners to open their purr-se strings, with 68% of owners with debt saying a medical emergency caused it.

Among those with pet-related debt, 68% have $500 or more of it. Here’s the full breakdown of how much pet debt people who have it owe:

- Less than $250: 13%

- $250 to $499: 19%

- $500 to $749: 28%

- $750 to $999: 19%

- $1,000 to $1,999: 10%

- $2,000 or more: 13%

Regardless of debt, emergencies are common. In fact, 64% of owners say they’ve had an unexpected medical expense for their pet. Despite that, just 27% have pet insurance. Gen Zers (57%) are the only group with at least half of pet owners having insurance.

Schulz — author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says pet insurance is worth considering. “What people shouldn’t do is sign up with the first pet insurance provider,” he says. “It’s important to understand the coverages, costs and other details involved with the insurance, while also thinking about what you can afford and your pet’s special needs. For a young, healthy pet, it may not be as necessary. For an older animal with health concerns, it may be a must.”

With these low insured rates, what would owners do if a $1,000 emergency came up? Just over half (51%) of pet owners say they would use a credit card to pay for the emergency. Meanwhile, 31% would use cash and 29% would dip into their savings.

A quarter of non-pet owners can’t afford one

Non-pet owners aren’t particularly keen to join the debt party. Of the 31% of Americans who don’t have a pet, a quarter (25%) say they can’t afford one.

That could be because they notice how much owners do for their pets. In fact, 64% of those with animals make financial sacrifices for theirs, including 76% of Gen Zers. Among pet owners, 29% cut back on personal spending — the most common response. Meanwhile, 19% don’t go on vacation because of their pet and 19% take on debt for other expenses.

According to Schulz, it takes a village to raise a pet — and you don’t necessarily need to make some of these sacrifices if you rely on one.

“If you have trusted friends or family willing to help in certain circumstances, let them,” he says. “That vacation becomes much more financially feasible if you don’t have to pay for a boarding place while you’re gone. Also, hand-me-downs can make a difference. Leashes, bowls, beds and toys are a few of the things you might be able to get from loved ones or find used at secondhand stores or online.”

Furry finances: How to handle pet costs without going barkrupt

Meow money, meow problems. If you’re a pet owner struggling with rising costs, Schulz recommends the following:

- A budget is a must. “It can allow you to make sure you’re spending on those things that matter most, including your pet,” he says. “It can allow you to more easily shift money around when unexpected or emergency expenses arise.”

- A pet emergency fund can be very useful. “Set money aside each month in a high-yield savings account devoted to your pet,” he says. “Surprises will happen. When they do, having extra cash earmarked for those costs will make them easier to manage.”

- Consider a low-interest personal loan. “In times of need, these loans can come in handy, especially if you have good credit, as could a credit card with a 0% offer on new purchases,” he says. “Just make sure you shop around before applying because offers vary widely by lender. The last thing you need is to pay extra on a loan.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,991 U.S. consumers ages 18 to 78 from July 1 to 8, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

Get debt consolidation loan offers from up to 5 lenders in minutes