It Costs an Additional $297,674 to Raise a Child Over 18 Years, Up 25.3%

Having a child is daunting for several reasons, and costs are top of mind for many Americans.

The latest LendingTree study shows that the annual costs associated with raising a small child (from food and apparel to transportation and child care) are $29,419 — up 35.7% since we last conducted our study.

Here’s what we found.

Key findings

- The annual costs associated with raising a small child have jumped 35.7% since we last conducted this study in 2023. Annual expenses minus tax exemptions or credits total $29,419, up from $21,681 in our 2023 study. Over 18 years, costs add to $297,674, up 25.3% from $237,482 in our last report.

- Annual expenses to raise a small child total $36,472 in Hawaii — more than any other state. Massachusetts and Washington follow at $33,004 and $32,418, respectively. Conversely, annual costs are lowest in Mississippi ($16,490), South Carolina ($17,699) and Alabama ($17,870). Only six states have infant day care costs of less than $10,000 annually, guiding them to the lowest overall annual expenses.

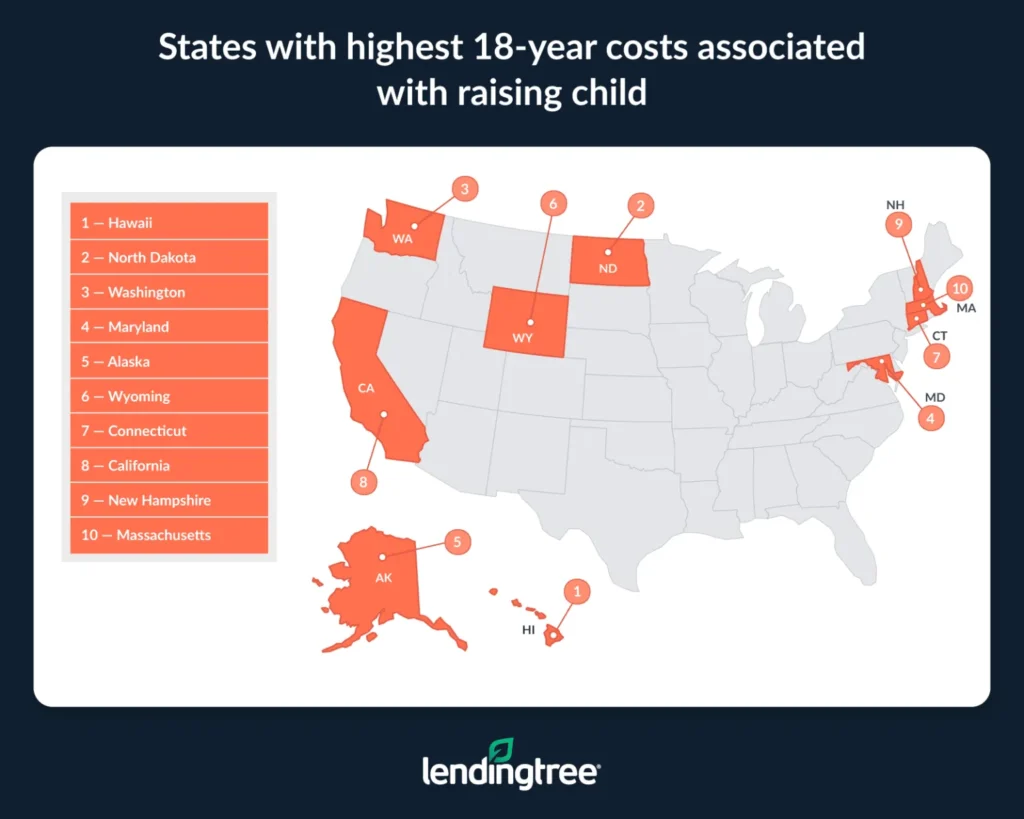

- In four states, families are projected to spend more than $300,000 over 18 years on costs associated with raising a child. This is the case in Hawaii ($362,891), North Dakota ($325,158), Washington ($318,714) and Maryland ($310,040). It’s projected to cost less than $200,000 in this period in Mississippi ($190,402) and the District of Columbia ($194,108).

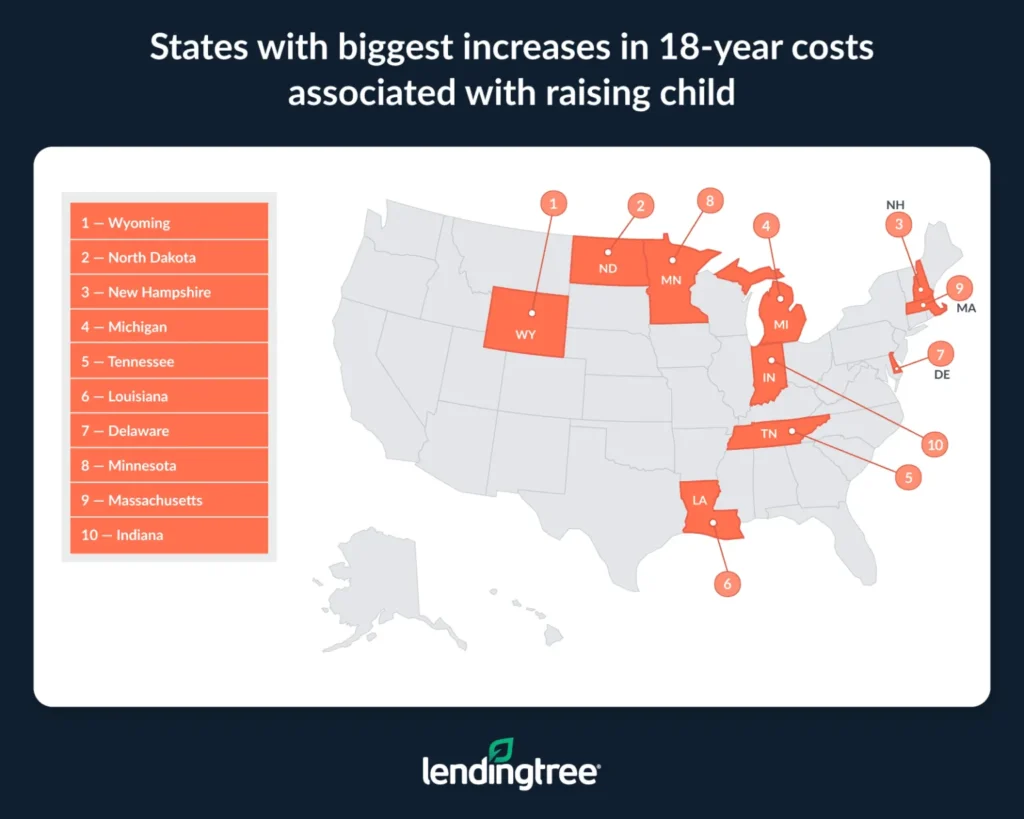

- Wyoming saw the biggest increase in the 18-year cost to raise a child, up 47.9%. North Dakota follows at 44.0% — the only other state above 40.0%. New Hampshire (34.9%) rounds out the top three. Just three states saw a decrease in 18-year costs: the District of Columbia (7.5%), Oregon (4.9%) and North Carolina (0.8%).

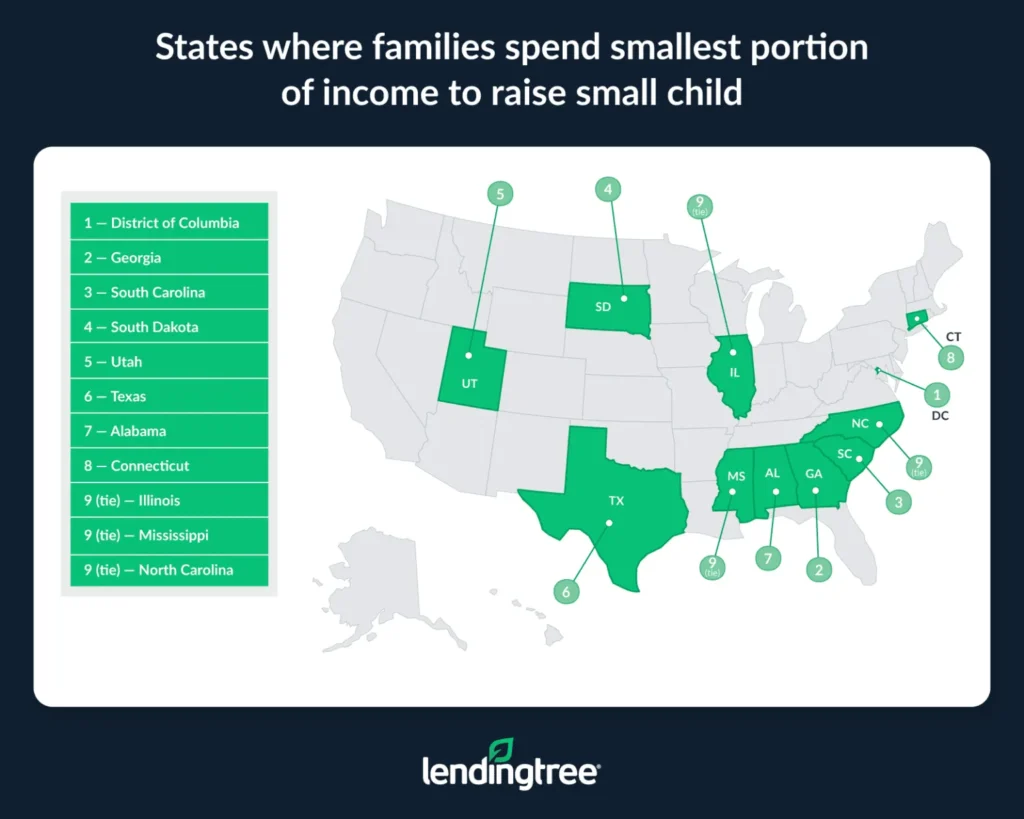

- Families spend an average of 22.6% of their income on the basic annual expenses to raise a child, up from 19.0% in our 2023 study. The percentage is lowest in the District of Columbia (14.0%) and highest in Hawaii (25.4%).

Our research highlights the costs of raising a child — specifically, the additional costs that impact parents. That includes a mix of child-specific expenses (like day care) and regular household expenses that raising a child can impact (like rent).

As an example, we incorporate full child care costs since that’s an additional cost of raising a small child. However, for expenses like rent, we only tally the cost difference between households with and without children to show the true impact.

The majority of our data is from 2023 based on availability, but our national day care data and our info on tax exemptions or credits are newer. Here’s a look at the categories and how they were calculated:

- Rent: The difference in average rent paid between households without children and households with a child younger than 18 present. This is calculated by state. (U.S. Census Bureau 2023 American Community Survey — ACS — with five-year estimates)

- Transportation: The difference in typical transportation spending between a two-person household and a two-person household with a child. This is calculated by region. We used different sources by state and nationally because of data availability. (State: MIT Living Wage Calculator, 2023; national: U.S. BLS Consumer Expenditure Surveys, 2023)

- Food: The difference in typical food spending between a two-person household and a two-person household with a child. This is calculated by region. We used different sources by state and nationally because of data availability. (State: Massachusetts Institute of Technology — MIT — Living Wage Calculator, June 2023; national: U.S. Bureau of Labor Statistics — BLS — Consumer Expenditure Surveys, 2023)

- Health insurance premiums: The difference in the average annual cost of premiums for a single person on workplace insurance (times two for two adults) compared to a single workplace-based family plan. (KFF, 2023)

- Day care: By state, data is based on the annual price of center-based child care. Nationally, it’s the average child care cost for one infant at a day care center. We used different sources by state and nationally because of data availability. (State: Price of Care: 2023 report from Child Care Aware of America; national: Care.com 2024 Cost of Care Report)

- State tax exemptions or credits: This assumes that two parents filing jointly (married) earn the national median income for families. For exemptions, the subtracted amount is the exemption amount multiplied by the marginal tax rate for that national median income. For credits, the dollar amount of the credit was applied. (Tax Foundation and IRS)

- Apparel: The average amount married couples with children spend each year on apparel for girls ages 2 to 16. Researchers chose girls clothing due to typically higher spending compared to boys clothes. (U.S. BLS Consumer Expenditure Surveys, 2023; U.S. Bureau of Economic Analysis — BEA — regional price parities were used to calculate state estimates)

Costs associated with raising child jump 35.7%

Our 2025 report finds that annual expenses associated with raising a small child (minus tax exemptions or credits) total $29,419 — up 35.7% from $21,681 when we last conducted this research in 2023.

Among the tracked categories, day care costs jumped the most, rising 51.8% from $11,752 to $17,836. Food (29.6%) and health insurance premiums (25.0%) followed.

Meanwhile, the value of federal tax credits shrunk by a significant 44.4%. In our 2023 report, tax credits removed $3,600 from the total costs due to the temporary 2021 expansion of the Child Tax Credit, but that figure has returned to $2,000 as of our latest report.

Bare-bones cost of raising small child in U.S.

| Category | Cost, 23 report | Cost, 25 report | Difference ($) | Difference (%) |

|---|---|---|---|---|

| Rent | $1,104 | $1,128 | $24 | 2.2% |

| Food | $3,254 | $4,216 | $962 | 29.6% |

| Day care | $11,752 | $17,836 | $6,084 | 51.8% |

| Girls apparel | $273 | $247 | -$26 | -9.5% |

| Transportation | $6,010 | 4,383 | -$1,627 | -27.1% |

| Health insurance premiums | $2,888 | $3,609 | $721 | 25.0% |

| Value of federal tax credit | -$3,600 | -$2,000 | $1,600 | -44.4% |

| Total annual cost | $21,681 | $29,419 | $7,738 | 35.7% |

Over 18 years, the costs add to $297,674. That includes 18 years of rent, food, apparel, transportation and insurance premiums and five years of child care. That’s a 25.3% increase from $237,482 in our last report.

Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” says this is a staggering increase — and terrible news for parents.

“No one should be surprised that costs have risen in recent years, but the type of growth we’ve seen in child care costs is on a whole other level,” he says. “There are plenty of reasons for the growth, including inflation, growing labor costs and rising demand. However, whatever the reason, this growth is making an already challenging aspect of parenthood that much worse.”

Costs highest in Hawaii

By state, Hawaii has the highest annual costs associated with raising a small child, at $36,472.

Most notably, the difference in typical food spending between a two-person household and a two-person household with a child is highest here, costing couples an additional $2,481. Additionally, the difference in rent when factoring in a child is the second-highest by state, adding $4,944 in costs. Hawaii also has the third-highest day care costs ($22,585) and transportation costs ($3,305).

Overall, Massachusetts ($33,004) and Washington ($32,418) rank second and third, respectively.

States with highest annual costs associated with raising small child

| Rank | State | Rent | Food | Infant day care | Girls apparel | Transport | Health insurance premiums | Value of exemption or credit | Total annual cost |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Hawaii | $4,944 | $2,481 | $22,585 | $268 | $3,305 | $2,983 | -$94 | $36,472 |

| 2 | Massachusetts | $84 | $2,193 | $24,005 | $267 | $2,944 | $3,561 | -$50 | $33,004 |

| 3 | Washington | $1,380 | $2,109 | $20,370 | $268 | $2,987 | $5,304 | $0 | $32,418 |

Schulz says these costs can create real hardship.

“While families in these states have some of the highest incomes in the country, they’re also three of the most expensive states to live in,” he says. “Higher overall income doesn’t always equate to more expendable income, so it’s important to make sure high-income people are planful and thoughtful with their budgets, too.”

Conversely, annual costs are lowest in Mississippi at $16,490 — nearly $20,000 less than in Hawaii. Day care costs here are the second-lowest by state, at $8,186.

Overall, South Carolina ($17,699) and Alabama ($17,870) follow.

Child care costs certainly play a large role in overall annual expenditures: Only six states have infant day care costs of less than $10,000 annually, and they’re all the states with the lowest annual overall expenses.

Full rankings: States with highest/lowest annual costs associated with raising small child

| Rank | State | Rent | Food | Infant day care | Girls apparel | Transport | Health insurance premiums | Value of exemption or credit | Total annual cost |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Hawaii | $4,944 | $2,481 | $22,585 | $268 | $3,305 | $2,983 | -$94 | $36,472 |

| 2 | Massachusetts | $84 | $2,193 | $24,005 | $267 | $2,944 | $3,561 | -$50 | $33,004 |

| 3 | Washington | $1,380 | $2,109 | $20,370 | $268 | $2,987 | $5,304 | $0 | $32,418 |

| 4 | Maryland | $2,532 | $2,078 | $19,906 | $257 | $2,986 | $3,994 | -$152 | $31,601 |

| 5 | California | $396 | $2,023 | $19,547 | $278 | $3,205 | $5,056 | -$446 | $30,059 |

| 6 | Minnesota | $1,836 | $2,075 | $20,129 | $243 | $3,041 | $2,910 | -$343 | $29,891 |

| 7 | New Jersey | $1,944 | $2,068 | $19,634 | $269 | $2,935 | $2,961 | -$83 | $29,728 |

| 8 | New York | $1,344 | $2,141 | $19,584 | $266 | $2,430 | $3,617 | -$55 | $29,327 |

| 9 | District of Columbia | -$4,284 | $2,378 | $25,480 | $274 | $1,919 | $3,419 | $0 | $29,186 |

| 10 | Colorado | $1,392 | $2,035 | $19,573 | $250 | $2,905 | $2,767 | $0 | $28,922 |

| 11 | Connecticut | $2,028 | $2,111 | $17,888 | $256 | $3,069 | $3,547 | $0 | $28,899 |

| 12 | New Hampshire | $3,264 | $2,031 | $17,250 | $260 | $3,287 | $2,246 | $0 | $28,338 |

| 13 | Vermont | $1,068 | $2,183 | $17,973 | $239 | $3,202 | $3,345 | -$320 | $27,690 |

| 14 | Virginia | $972 | $2,013 | $16,397 | $249 | $3,000 | $4,088 | -$53 | $26,666 |

| 15 | Rhode Island | $1,536 | $2,127 | $16,899 | $250 | $2,896 | $2,668 | -$235 | $26,141 |

| 16 | Oregon | $1,476 | $2,048 | $17,680 | $259 | $2,915 | $1,978 | -$249 | $26,107 |

| 17 | North Dakota | $5,496 | $1,875 | $10,758 | $219 | $3,237 | $4,249 | $0 | $25,834 |

| 18 | Alaska | $4,620 | $2,342 | $11,760 | $251 | $3,462 | $2,486 | $0 | $24,921 |

| 19 | Kansas | $1,680 | $1,900 | $15,071 | $222 | $3,134 | $2,649 | -$128 | $24,528 |

| 20 | Arizona | $456 | $1,807 | $14,040 | $250 | $2,972 | $4,929 | -$100 | $24,354 |

| 21 | Illinois | $276 | $1,965 | $16,373 | $244 | $2,826 | $2,796 | -$137 | $24,343 |

| 22 | Wyoming | $3,660 | $1,917 | $11,075 | $224 | $3,502 | $3,884 | $0 | $24,262 |

| 23 | Delaware | -$24 | $1,951 | $14,995 | $245 | $3,089 | $3,658 | -$110 | $23,804 |

| 24 | Indiana | $1,764 | $1,731 | $13,736 | $228 | $3,190 | $3,168 | -$31 | $23,786 |

| 25 | Pennsylvania | $840 | $1,991 | $14,483 | $241 | $2,918 | $2,797 | $0 | $23,270 |

| 26 | Florida | $1,320 | $2,054 | $12,639 | $256 | $2,754 | $4,218 | $0 | $23,241 |

| 27 | Missouri | $1,764 | $1,883 | $12,907 | $227 | $3,066 | $3,354 | $0 | $23,201 |

| 28 | Nebraska | $2,340 | $1,883 | $13,000 | $223 | $3,174 | $2,691 | -$157 | $23,154 |

| 29 | Nevada | $1,968 | $1,894 | $13,024 | $240 | $3,164 | $2,773 | $0 | $23,063 |

| 30 | New Mexico | $1,464 | $1,834 | $13,521 | $223 | $2,910 | $3,036 | -$196 | $22,792 |

| 31 | Tennessee | $972 | $1,920 | $11,985 | $228 | $3,110 | $4,478 | $0 | $22,693 |

| 32 | Maine | $1,728 | $2,043 | $11,960 | $240 | $3,118 | $3,272 | -$300 | $22,061 |

| 33 | Wisconsin | $912 | $1,904 | $13,572 | $230 | $3,118 | $2,231 | -$37 | $21,930 |

| 34 | Michigan | $1,584 | $1,833 | $12,667 | $233 | $3,066 | $2,736 | -$238 | $21,881 |

| 35 | Montana | $2,016 | $1,918 | $11,700 | $223 | $3,177 | $2,830 | $0 | $21,864 |

| 36 | Iowa | $1,800 | $1,873 | $12,168 | $219 | $3,223 | $2,568 | -$40 | $21,811 |

| 37 | Idaho | $2,364 | $2,040 | $10,108 | $226 | $3,260 | $3,799 | $0 | $21,797 |

| 38 | Utah | $1,896 | $1,849 | $11,232 | $235 | $3,289 | $3,373 | -$90 | $21,784 |

| 39 | Louisiana | $1,236 | $1,855 | $10,101 | $218 | $3,076 | $4,755 | -$35 | $21,206 |

| 40 | Ohio | $1,332 | $1,867 | $12,351 | $227 | $2,978 | $2,519 | -$88 | $21,186 |

| 41 | Texas | $744 | $1,711 | $11,024 | $240 | $3,069 | $4,101 | $0 | $20,889 |

| 42 | North Carolina | -$72 | $1,908 | $12,251 | $232 | $2,996 | $3,503 | $0 | $20,818 |

| 43 | Oklahoma | $1,704 | $1,836 | $10,065 | $218 | $3,228 | $3,670 | -$48 | $20,673 |

| 44 | West Virginia | $2,364 | $1,717 | $10,140 | $222 | $3,099 | $2,517 | -$102 | $19,957 |

| 45 | Georgia | $612 | $1,921 | $11,066 | $239 | $3,116 | $2,373 | -$165 | $19,162 |

| 46 | Kentucky | $1,560 | $1,704 | $9,685 | $224 | $3,138 | $2,838 | $0 | $19,149 |

| 47 | South Dakota | $1,680 | $1,941 | $7,862 | $218 | $3,281 | $3,936 | $0 | $18,918 |

| 48 | Arkansas | $1,836 | $1,735 | $8,869 | $214 | $3,142 | $2,875 | -$29 | $18,642 |

| 49 | Alabama | $984 | $1,897 | $8,771 | $222 | $3,161 | $3,335 | -$500 | $17,870 |

| 50 | South Carolina | $432 | $1,842 | $9,048 | $230 | $3,112 | $3,330 | -$295 | $17,699 |

| 51 | Mississippi | $720 | $1,783 | $8,186 | $216 | $3,259 | $2,397 | -$71 | $16,490 |

18-year costs over $300,000 in 4 states

Over 18 years of raising a child, families are projected to spend more than $300,000 in four states. Hawaii ($362,891) ranks first again, followed by North Dakota ($325,158), Washington ($318,714) and Maryland ($310,040).

Why doesn’t Massachusetts appear here, despite ranking second for the highest annual costs? Its annual ranking largely boils down to day care costs. At $24,005, it has the second-highest day care costs by state. But we included just five years of day care in our 18-year calculations based on schooling, making those costs less important than in our one-year look.

Differences in rent costs played a bigger role here: For example, parents in North Dakota pay an additional $5,496 in rent costs per year while raising a child, while Massachusetts parents pay just $84 in additional rent costs.

States with highest 18-year costs associated with raising child

| Rank | State | Added 18-year costs |

|---|---|---|

| 1 | Hawaii | $362,891 |

| 2 | North Dakota | $325,158 |

| 3 | Washington | $318,714 |

| 4 | Maryland | $310,040 |

Meanwhile, two states saw 18-year costs of less than $200,000: Mississippi ($190,402) and the District of Columbia ($194,108). Despite the District of Columbia having the highest day care costs at $25,480, households with children pay $4,284 less annually for rent here.

Full rankings: States with highest/lowest 18-year costs associated with raising child

| Rank | State | Added 18-year costs |

|---|---|---|

| 1 | Hawaii | $362,891 |

| 2 | North Dakota | $325,158 |

| 3 | Washington | $318,714 |

| 4 | Maryland | $310,040 |

| 5 | Alaska | $295,698 |

| 6 | Wyoming | $292,741 |

| 7 | Connecticut | $287,638 |

| 8 | California | $286,951 |

| 9 | New Hampshire | $285,834 |

| 10 | Massachusetts | $282,007 |

| 11 | New Jersey | $279,862 |

| 12 | Minnesota | $276,361 |

| 13 | New York | $273,294 |

| 14 | Virginia | $266,827 |

| 15 | Colorado | $266,147 |

| 16 | Vermont | $264,771 |

| 17 | Idaho | $260,942 |

| 18 | Arizona | $255,852 |

| 19 | Florida | $254,031 |

| 20 | Tennessee | $252,669 |

| 21 | Rhode Island | $250,851 |

| 22 | Louisiana | $250,395 |

| 23 | Missouri | $249,827 |

| 24 | Indiana | $249,580 |

| 25 | Nebraska | $247,772 |

| 26 | Utah | $246,096 |

| 27 | Nevada | $245,822 |

| 28 | Kansas | $245,581 |

| 29 | Maine | $241,618 |

| 30 | Montana | $241,452 |

| 31 | Oklahoma | $241,269 |

| 32 | Oregon | $240,086 |

| 33 | South Dakota | $238,318 |

| 34 | New Mexico | $234,483 |

| 35 | Iowa | $234,414 |

| 36 | Delaware | $233,537 |

| 37 | Texas | $232,690 |

| 38 | Pennsylvania | $230,581 |

| 39 | Michigan | $229,187 |

| 40 | West Virginia | $227,406 |

| 41 | Illinois | $225,325 |

| 42 | Ohio | $220,785 |

| 43 | Arkansas | $220,259 |

| 44 | Kentucky | $218,777 |

| 45 | Wisconsin | $218,304 |

| 46 | North Carolina | $215,461 |

| 47 | Alabama | $207,637 |

| 48 | Georgia | $201,058 |

| 49 | South Carolina | $200,958 |

| 50 | District of Columbia | $194,108 |

| 51 | Mississippi | $190,402 |

18-year expenses jump most in Wyoming

Compared to our 2023 report, Wyoming saw the biggest increase in 18-year costs to raise a child. Expenses jumped 47.9% from $197,918 to $292,741.

North Dakota followed, with costs rising 44.0% from $225,755 to $325,158. New Hampshire (34.9%) was third.

States with biggest increases in 18-year costs associated with raising child

| Rank | State | Cost, 23 report | Cost, 25 report | % change |

|---|---|---|---|---|

| 1 | Wyoming | $197,918 | $292,741 | 47.9% |

| 2 | North Dakota | $225,755 | $325,158 | 44.0% |

| 3 | New Hampshire | $211,895 | $285,834 | 34.9% |

According to Schulz, those increases can be absolutely devastating for a family’s budget.

“Most Americans are on a budget and don’t have a ton of wiggle room from month to month,” he says. “When a big cost like child care shoots up by 40%-plus, it can be a real crisis. That extra money has to come from somewhere, so it forces families to make some difficult decisions.”

The District of Columbia saw the biggest decrease, at 7.5%. That’s followed by Oregon (4.9%) and North Carolina (0.8%) — the only other states that saw a decrease.

Full rankings: States with biggest increases/decreases in 18-year costs associated with raising child

| Rank | State | Cost, 23 report | Cost, 25 report | % change |

|---|---|---|---|---|

| 1 | Wyoming | $197,918 | $292,741 | 47.9% |

| 2 | North Dakota | $225,755 | $325,158 | 44.0% |

| 3 | New Hampshire | $211,895 | $285,834 | 34.9% |

| 4 | Michigan | $174,440 | $229,187 | 31.4% |

| 5 | Tennessee | $192,392 | $252,669 | 31.3% |

| 6 | Louisiana | $192,102 | $250,395 | 30.3% |

| 7 | Delaware | $180,688 | $233,537 | 29.2% |

| 8 | Minnesota | $214,632 | $276,361 | 28.8% |

| 9 | Massachusetts | $219,133 | $282,007 | 28.7% |

| 10 | Indiana | $194,623 | $249,580 | 28.2% |

| 11 | California | $225,627 | $286,951 | 27.2% |

| 12 | Florida | $200,390 | $254,031 | 26.8% |

| 13 | Rhode Island | $200,428 | $250,851 | 25.2% |

| 14 | Iowa | $189,055 | $234,414 | 24.0% |

| 15 | Washington | $257,388 | $318,714 | 23.8% |

| 16 | New Jersey | $230,042 | $279,862 | 21.7% |

| 17 | Vermont | $218,336 | $264,771 | 21.3% |

| 18 | New York | $226,849 | $273,294 | 20.5% |

| 19 | South Dakota | $198,572 | $238,318 | 20.0% |

| 20 | Connecticut | $240,194 | $287,638 | 19.8% |

| 21 | Maryland | $259,149 | $310,040 | 19.6% |

| 22 | South Carolina | $169,327 | $200,958 | 18.7% |

| 23 | Ohio | $186,287 | $220,785 | 18.5% |

| 24 | Missouri | $213,749 | $249,827 | 16.9% |

| 25 | Arizona | $219,957 | $255,852 | 16.3% |

| 26 | Utah | $213,012 | $246,096 | 15.5% |

| 27 | Hawaii | $314,529 | $362,891 | 15.4% |

| 28 | Kentucky | $191,021 | $218,777 | 14.5% |

| 29 | New Mexico | $205,092 | $234,483 | 14.3% |

| 30 | Georgia | $176,626 | $201,058 | 13.8% |

| 31 | Maine | $213,052 | $241,618 | 13.4% |

| 31 | Illinois | $198,778 | $225,325 | 13.4% |

| 33 | Arkansas | $196,509 | $220,259 | 12.1% |

| 34 | Texas | $207,830 | $232,690 | 12.0% |

| 35 | Virginia | $238,953 | $266,827 | 11.7% |

| 35 | Wisconsin | $195,371 | $218,304 | 11.7% |

| 37 | Idaho | $234,172 | $260,942 | 11.4% |

| 38 | Pennsylvania | $209,314 | $230,581 | 10.2% |

| 39 | Kansas | $223,725 | $245,581 | 9.8% |

| 40 | Montana | $220,986 | $241,452 | 9.3% |

| 40 | Alabama | $190,056 | $207,637 | 9.3% |

| 42 | Alaska | $270,930 | $295,698 | 9.1% |

| 43 | Colorado | $246,589 | $266,147 | 7.9% |

| 44 | Nevada | $229,388 | $245,822 | 7.2% |

| 45 | Nebraska | $238,720 | $247,772 | 3.8% |

| 46 | West Virginia | $219,342 | $227,406 | 3.7% |

| 47 | Oklahoma | $233,421 | $241,269 | 3.4% |

| 48 | Mississippi | $185,350 | $190,402 | 2.7% |

| 49 | North Carolina | $217,182 | $215,461 | -0.8% |

| 50 | Oregon | $252,558 | $240,086 | -4.9% |

| 51 | District of Columbia | $209,947 | $194,108 | -7.5% |

Average of 22.6% of income spent on added care costs

Given these costs, it’s no stretch to assume they take up a significant chunk of a family’s income. In fact, families spend an average of 22.6% of their income on the basic annual expenses associated with raising a small child. That’s up from 19.0% in our 2023 study.

Schulz says that’s sadly in line with many parents’ expectations. “For many families, the costs of child care are so high that it eats up the majority of their salary and makes it nonsensical financially for people to stay in that job,” he says. “It’s awful that people find themselves in that situation, but many do.”

Parents in the District of Columbia spend the lowest portion of their income on raising a child, at 14.0%. The state’s high average family income of $208,264 plays a role here. Georgia (15.9%) and South Carolina (16.1%) follow.

States where families spend smallest portion of income to raise small child

| Rank | State | Avg. family income | Total annual cost to raise small child | % of income to raise child |

|---|---|---|---|---|

| 1 | District of Columbia | $208,264 | $29,186 | 14.0% |

| 2 | Georgia | $120,846 | $19,162 | 15.9% |

| 3 | South Carolina | $110,261 | $17,699 | 16.1% |

Meanwhile, families dedicate the highest percentage of their salaries toward caring for a child in Hawaii, at 25.4%. That’s followed by New Mexico (22.8%) and Vermont (21.8%).

Full rankings: States where families spend smallest/largest portion of income to raise small child

| Rank | State | Avg. family income | Total annual cost to raise small child | % of income to raise child |

|---|---|---|---|---|

| 1 | District of Columbia | $208,264 | $29,186 | 14.0% |

| 2 | Georgia | $120,846 | $19,162 | 15.9% |

| 3 | South Carolina | $110,261 | $17,699 | 16.1% |

| 4 | South Dakota | $116,410 | $18,918 | 16.3% |

| 5 | Utah | $131,648 | $21,784 | 16.5% |

| 6 | Texas | $123,171 | $20,889 | 17.0% |

| 7 | Alabama | $104,486 | $17,870 | 17.1% |

| 8 | Connecticut | $164,258 | $28,899 | 17.6% |

| 9 | Illinois | $136,221 | $24,343 | 17.9% |

| 9 | Mississippi | $92,303 | $16,490 | 17.9% |

| 9 | North Carolina | $116,074 | $20,818 | 17.9% |

| 12 | New Jersey | $164,717 | $29,728 | 18.0% |

| 12 | Virginia | $147,886 | $26,666 | 18.0% |

| 14 | Wisconsin | $120,679 | $21,930 | 18.2% |

| 15 | Ohio | $115,826 | $21,186 | 18.3% |

| 15 | Pennsylvania | $126,984 | $23,270 | 18.3% |

| 17 | Delaware | $128,596 | $23,804 | 18.5% |

| 18 | Iowa | $117,142 | $21,811 | 18.6% |

| 18 | Kentucky | $103,036 | $19,149 | 18.6% |

| 20 | Alaska | $133,487 | $24,921 | 18.7% |

| 20 | Maine | $117,937 | $22,061 | 18.7% |

| 22 | Arkansas | $99,268 | $18,642 | 18.8% |

| 22 | Michigan | $116,562 | $21,881 | 18.8% |

| 24 | Nebraska | $122,519 | $23,154 | 18.9% |

| 25 | Rhode Island | $136,801 | $26,141 | 19.1% |

| 25 | Idaho | $114,047 | $21,797 | 19.1% |

| 25 | Montana | $114,636 | $21,864 | 19.1% |

| 28 | New Hampshire | $147,266 | $28,338 | 19.2% |

| 29 | Massachusetts | $170,075 | $33,004 | 19.4% |

| 30 | Florida | $118,620 | $23,241 | 19.6% |

| 30 | Colorado | $147,459 | $28,922 | 19.6% |

| 30 | Nevada | $117,611 | $23,063 | 19.6% |

| 33 | California | $152,870 | $30,059 | 19.7% |

| 33 | New York | $148,673 | $29,327 | 19.7% |

| 35 | Oklahoma | $104,357 | $20,673 | 19.8% |

| 36 | Maryland | $158,170 | $31,601 | 20.0% |

| 37 | North Dakota | $127,444 | $25,834 | 20.3% |

| 37 | Missouri | $114,143 | $23,201 | 20.3% |

| 37 | Arizona | $120,039 | $24,354 | 20.3% |

| 40 | Tennessee | $111,007 | $22,693 | 20.4% |

| 40 | Oregon | $127,896 | $26,107 | 20.4% |

| 42 | Louisiana | $102,891 | $21,206 | 20.6% |

| 43 | Kansas | $117,994 | $24,528 | 20.8% |

| 44 | Wyoming | $115,624 | $24,262 | 21.0% |

| 44 | West Virginia | $94,941 | $19,957 | 21.0% |

| 46 | Minnesota | $140,512 | $29,891 | 21.3% |

| 47 | Indiana | $111,386 | $23,786 | 21.4% |

| 48 | Washington | $150,744 | $32,418 | 21.5% |

| 49 | Vermont | $126,901 | $27,690 | 21.8% |

| 50 | New Mexico | $99,975 | $22,792 | 22.8% |

| 51 | Hawaii | $143,714 | $36,472 | 25.4% |

Thriving financially while raising children: Top expert tips

While it can be difficult to feel financially comfortable if you’re shelling out thousands of dollars toward raising a child, there are a few ways to cut costs and thrive. Schulz recommends the following:

- Prioritize saving. “It can be hard to save when you’re a young parent and child care is crazy expensive,” he says. “It’s so important, though. Even if you’re only putting a few dollars per paycheck in a high-yield savings account, it will add up over time and give you a much-needed cushion when the next unexpected expense happens. And as every parent knows, they will happen.”

- Don’t be afraid to seek help. “If you’re lucky enough to have a relative or trusted friend interested in helping with child care, you should seriously consider it,” he says. “It’s a huge advantage. If you don’t, know that there are plenty of organizations whose goal is to help struggling families. Googling ‘financial help for parents in my area’ can be a good place to start.”

- Remember, cheaper isn’t always better. “As much as you want to keep costs down, that isn’t the most important consideration when finding child care,” he says. “Putting your child in a place where they’ll be safe and nurtured is paramount. Finding that place may cost a little bit more, but the peace of mind that comes with that will be invaluable.”

Methodology

LendingTree researchers used various data sources to calculate the average annual costs associated with raising a small child in a two-earner household in each state and the District of Columbia.

Our calculations incorporated expenses for rent, food, day care, apparel, transportation and health insurance premiums. Dependent tax benefits — whether exemptions or credits — were subtracted from expenses to create the average annual cost to raise a child by state.

Some notes on our expense and tax benefits categories:

- The rent, child care, apparel and health insurance premiums data is state-based, while the food and transportation data is regionally based.

- To determine the value of tax exemptions, researchers assumed parents’ tax returns were filed jointly with a combined income of $96,922 (the national median income among families in 2023, the latest year for which data was available).

Researchers analyzed data from the following sources:

- U.S. Census Bureau 2023 American Community Survey with five-year estimates (tabulated and micro data)

- U.S. Bureau of Labor Statistics (BLS) Consumer Expenditure Surveys, 2023

- Massachusetts Institute of Technology (MIT) Living Wage Calculator, 2023

- Price of Care: 2023 report from Child Care Aware of America

- Care.com 2024 Cost of Care Report

- U.S. Bureau of Economic Analysis (BEA) regional price parities

- KFF, 2023

- Tax Foundation, 2024

- IRS

Get debt consolidation loan offers from up to 5 lenders in minutes