More Than 1 in 5 Americans Have Shoplifted, With Grocery and Department Stores the Easiest Targets

When the cost of living outpaces paychecks, shoplifting can become a crime of necessity rather than one of opportunity. In fact, 23% of Americans have shoplifted, according to the latest LendingTree survey of 2,000 U.S. consumers — and 90% of recent shoplifters say they were motivated to do so because of inflation and the current economy.

With more than a third of American households facing financial insecurity, that five-finger discount may seem understandable.

Here’s what else we found.

Key findings

- More than 1 in 5 Americans admit to shoplifting. 23% of Americans have shoplifted. Of those with a shoplifting history, 23% have done so within the past year, and 52% were older than 16 at the time. Shoplifters are most likely to hide the items on their bodies (55%) or in purses or bags (36%), while 25% are bold enough to walk out with their loot in plain sight.

- The current economic climate makes theft more enticing. An overwhelming 90% of recent shoplifters say they steal secretly due to inflation and the current economy. Over a third (34%) of shoplifters rely on five-finger discounts because prices have become otherwise unaffordable, while 30% say it helps make ends meet and 27% say it helps save a few bucks.

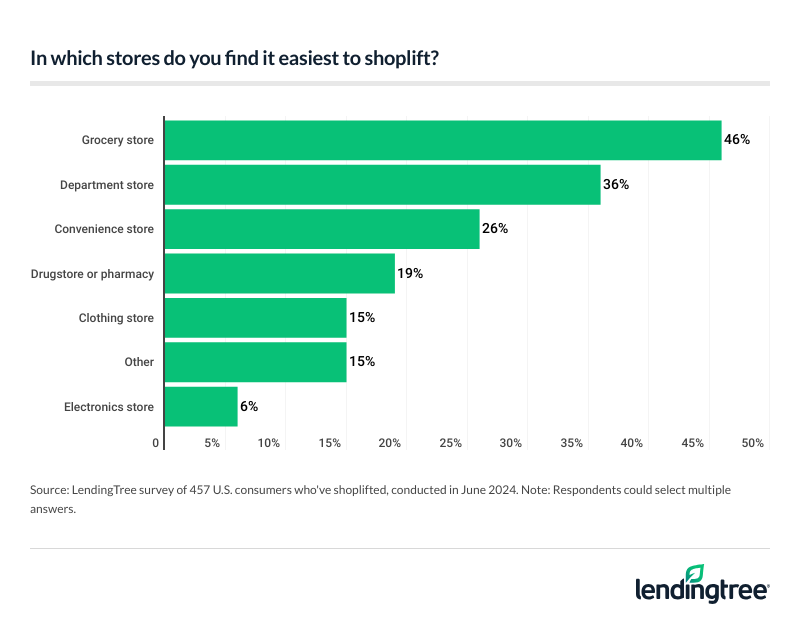

- Shoplifters are more likely to take from chain stores (52%) than local stores (28%). They admit that their thievery is easiest in grocery (46%), department (36%) and convenience stores (26%). The most common items shoplifters target are food and nonalcoholic drinks (45%), clothing, accessories or jewelry (39%), and makeup or cosmetics (21%).

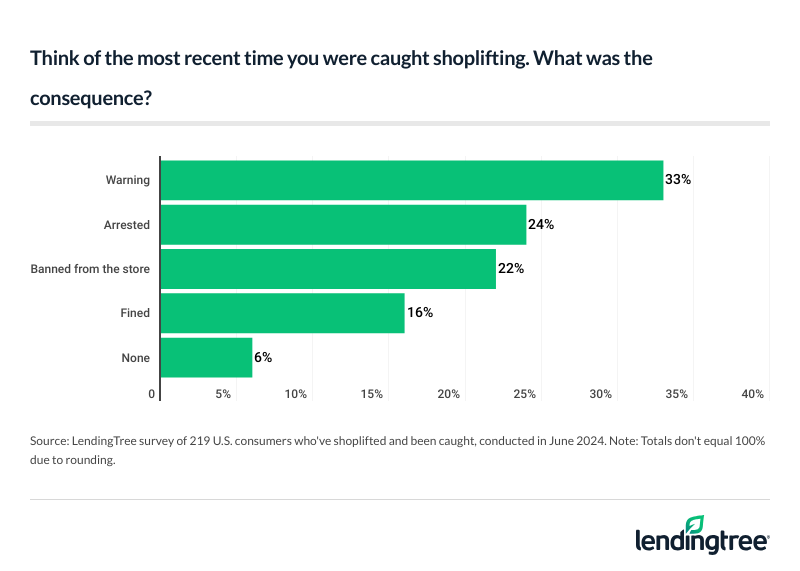

- Most shoplifters get away with the crime, but many are caught in the act. Barely over half (52%) of shoplifters say they got away with it, with 48% saying they were caught red-handed. Of those caught, 33% were warned, 24% were arrested and 22% were banned from the store. Overall, 18% of Americans say today’s anti-theft technology doesn’t deter them from shoplifting.

23% of Americans have made their own discounts

Whether out of necessity or convenience, Americans feel emboldened at the store. In fact, almost a quarter (23%) have shoplifted. Those with children younger than 18 (27%) and millennials ages 28 to 43 (26%) are among the most likely groups to snatch something.

Men (26%) are also more likely to have shoplifted than women (20%).

Many shoplifters have done so recently. Of Americans who’ve shoplifted, 23% have done so within the past year. Notably, 6% of Americans who’ve shoplifted say they do so regularly. Generally, though, most shoplifters have put the past behind them, with 68% of Americans who’ve shoplifted saying the last time they did so was over five years ago.

“I’m sure some of the instances were young people being reckless and seeing what they could get away with for the thrill of it,” says LendingTree chief consumer finance analyst Matt Schulz, “but that’s not the whole story, and it’s likely causing problems for businesses across the country.”

It’s not all just youthful irresponsibility, as 52% of shoplifters were older than 16 at the time of the crime.

As for how they got away with shoplifting, 55% say they hid the items on their bodies. That’s especially true among shoplifters with children 18 or older (63%), Gen Xers ages 44 to 59 (62%) and men (61%).

Meanwhile, 36% hid the items in purses or bags and 25% carried them out in plain sight. Millennials (30%) and those without children (30%) are the most likely groups to utilize the latter bold strategy.

69% of self-checkout users think it makes stealing easier — and 15% of shoppers admit to purposely doing so

Not all shoplifting is intentional

Regardless of whether they’ve had a history of shoplifting, Americans unintentionally steal — or let something slide. In fact, 41% of Americans have accidentally taken something without paying for it. Of this group, 45% felt guilty about it and 32% were embarrassed the last time it happened. Still, 51% didn’t bring it back to the store to return it or pay for it.

Meanwhile, 34% have stayed silent when a cashier forgot to ring up something during checkout, most common among parents with young kids (41%), millennials (38%), Gen Zers ages 18 to 27 (37%) and men (37%).

Shoplifters are motivated by the current economy

With the current economy in mind, Americans go to great lengths to stay afloat. In fact, that’s what drives many shoplifters, with 90% of recent shoplifters admitting they steal due to inflation and the current economy.

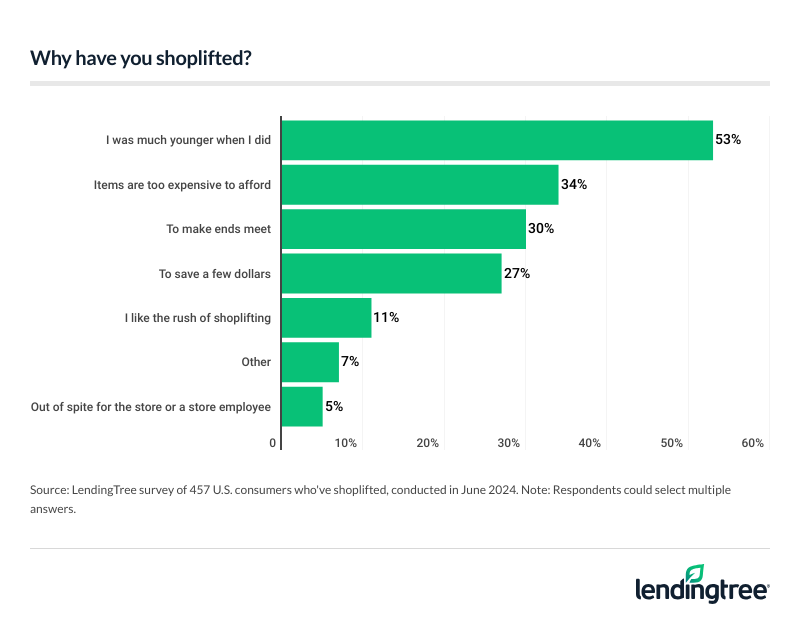

Breaking down reasons (among all shoplifters), 53% admit they stole because they were young, though we didn’t explore whether it was an impulse, peer pressure or something similar. Following that, the main reasons for shoplifting include:

- Prices becoming otherwise unaffordable (34%)

- Helping make ends meet (30%)

- Helping save a few bucks (27%)

- Liking the rush of shoplifting (11%)

- Doing it out of spite for a store or employee (5%)

Schulz — author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says unaffordability is a major factor for Americans, so he isn’t surprised to see consumers shoplifting because of it. “Lots of people are struggling in the face of still-rising prices, and they’re going to somewhat desperate measures to help them get by,” he says. “With inflation stubbornly sticking around, that’s not likely to change soon.”

In fact, financial insecurity is up 6.7% from 2022, with 36.4% of households reporting difficulties paying for typical expenses like food, housing and medicine in 2024, according to a recent LendingTree study. For those ages 18 to 24, that jump from 2022 to 2024 rose to 25.0%.

Shoplifters target chain stores over local shops

Shoplifters are more likely to stick it to the man than harm a local mom-and-pop shop. In fact, 52% of shoplifters say they’ve stolen from chain stores, while just 28% have stolen from local shops. Overall, 46% of shoplifters say stealing is easiest from grocery stores. That’s followed by department (36%) and convenience stores (26%).

What are shoplifters stealing? Food and nonalcoholic drinks (45%) top the list. That comes as 10.8% of Americans report not having enough to eat in a given week, according to a LendingTree food insecurity study.

Following that, shoplifters are most likely to target clothing, accessories or jewelry (39%) and makeup or cosmetics (21%). Other commonly stolen items include:

- Toys (15%)

- Alcohol (14%)

- Tobacco products (12%)

- Technology or electronics (11%)

- Home improvement items (10%)

- Home decor (7%)

- Pharmaceutical products (6%)

“What they’re shoplifting tells you a lot about why they’re shoplifting,” Schulz says. “These generally aren’t thrill-seekers looking for an adrenaline rush or a big score. These folks are taking things that they really, really need, things like food and clothing and even makeup.”

48% of shoplifters have been caught

The risk may not be worth the reward — particularly because getting caught is practically a coin toss. Just over half (52%) of shoplifters say they got away with it, leaving 48% admitting they were caught red-handed.

The punishments themselves may be light, however. Of those caught, 33% were given a warning — the most common response. Meanwhile, just under a quarter (24%) were arrested and 22% were banned from the store. Just 6% faced no consequences.

While shoplifting may seem like a short-term fix for your financial struggles, Schulz says the consequences of getting caught can make things far worse.

“Depending on your age and the circumstances of your theft, getting caught could lead to hefty fines and even jail time,” he says. “In some cases, the damage can last for years, as a criminal record can make it harder for you to get a job, rent an apartment or get into a college. All these things can greatly affect your long-term financial health.”

Although stores may try to combat theft, deterrents do little to discourage consumers. Nearly 1 in 5 (18%) Americans say today’s anti-theft technology doesn’t deter them from shoplifting, though 65% say they wouldn’t be inclined to shoplift either way.

Generally, Americans don’t speak up when they witness shoplifting, either. Just over half (51%) of Americans have witnessed someone shoplifting, with 67% of them doing nothing to stop them. Despite this inaction, 61% of Americans think there should be stricter punishment or enforcement for shoplifting.

Making ends meet without relying on crime: Top expert tips

While the Robin Hood route may seem necessary for some with dire financial circumstances, Schulz says there are options without potentially severe consequences. Particularly, he recommends:

- Remember help is available. “Countless businesses, nonprofits, government agencies, religious groups and other organizations do incredible work in service of people struggling to put food on the table or make ends meet,” he says. “It can be difficult emotionally to admit that you need help from someplace like a food bank, but it’s so important that you do so if you need to.” It’s not just about these groups, either. Opening up to family and close friends about what you’re going through can help. Even if their support is only emotional, it can be significant because struggling with debt is hard, but going through it all alone is far worse.

- Consider consolidating your debts. “If runaway debt is one of the things keeping you from making ends meet, debt consolidation can be an incredible first step toward digging out of that hole,” Schulz says. “Not only can it lower your interest rates and shorten the time it takes to pay off your balances, but it can also streamline your finances. That’s because instead of worrying about paying multiple bills off on time every month, you can use a low-interest personal loan or a 0% balance transfer credit card to consolidate them, leaving you with just one bill to pay instead of several.”

- Again, remember the possible consequences. “When you’re trying to get out of debt, it can sometimes seem like you’d be willing to do anything to make things better,” he says. “However, in doing something rash such as shoplifting, you risk making things far worse in many ways.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,000 U.S. consumers ages 18 to 78 from June 13 to 14, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78

Get debt consolidation loan offers from up to 5 lenders in minutes

Recommended Articles