2025 Side Hustle Survey: Nearly 2 in 5 Americans Have a Side Hustle, With 3 in 5 Saying the Income Is Essential

Almost 40% of Americans have a side hustle, according to a new LendingTree survey, and 61% of those who have one say their life would be unaffordable without it.

Our 2025 survey explores how many people have side hustles, why they have them, how much time they devote to them and how essential they are to financial health, among other things.

Here’s what we found.

Key findings

- Many Americans have a side hustle — and they’re earning big money. 38% of people have a side hustle, down from 44% in 2022. The most popular are delivering food or groceries (15%), online freelancing (15%) and part-time or seasonal work (14%). Side hustlers say they earn an average of $1,215 monthly, though the median is just $400.

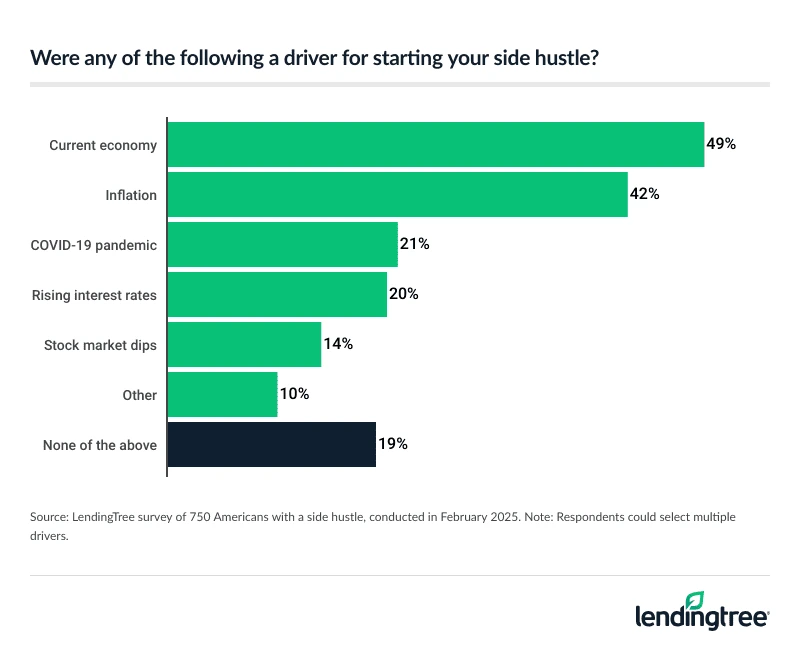

- As the cost of living increases, so does the need for a second income. A third of side hustlers say they have one due to cost-of-living expenses, 29% say they need the money for bills and 28% say it’s used for discretionary income. When asked what was a driver for starting their side hustle, 49% said the current economy, 42% said inflation and 21% said the COVID-19 pandemic.

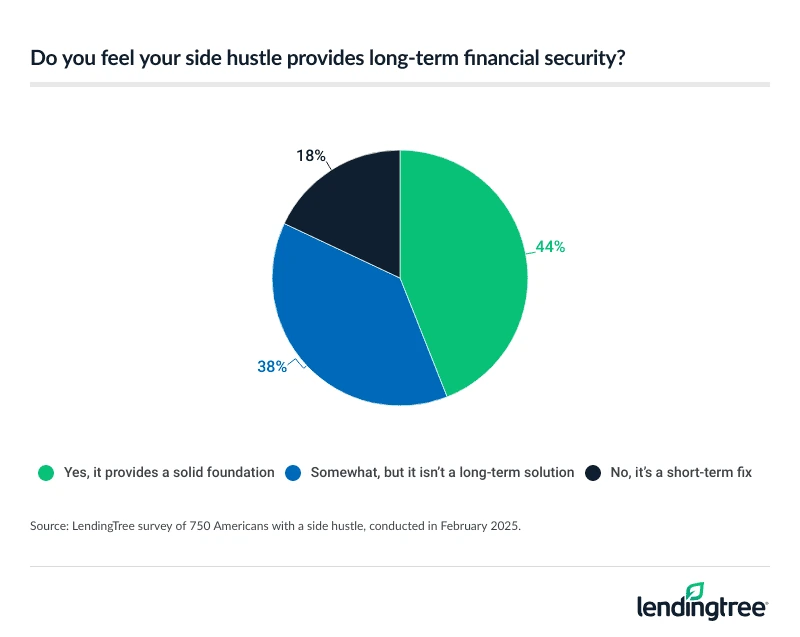

- Side hustles provide financial security. 61% of people say their life would be unaffordable without their side hustle income, and 77% say their side hustle improves their quality of life. Additionally, 44% say their side hustle provides long-term financial security.

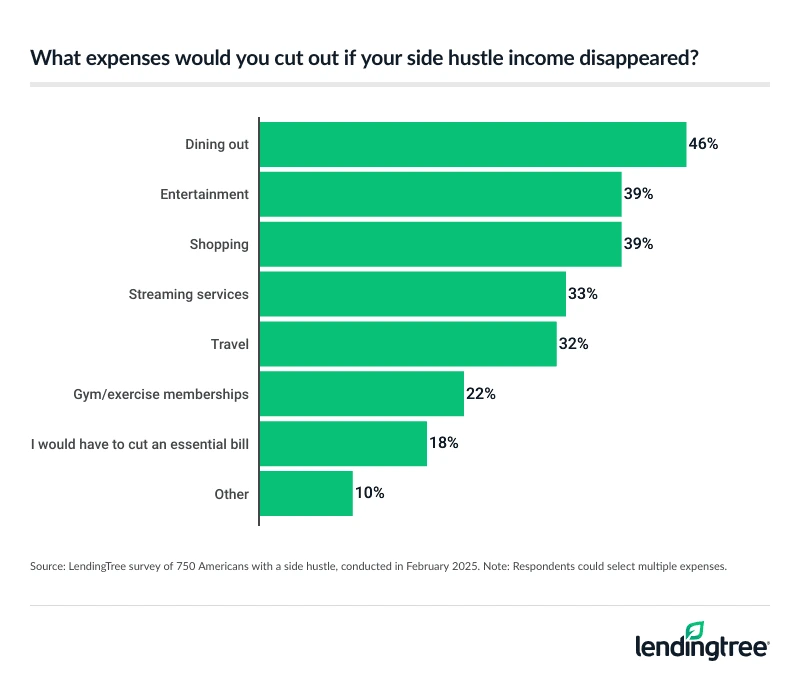

- However, multiple jobs aren’t ideal for everyone. If given the opportunity, 65% of side hustlers say they’d prefer to have one main source of income rather than multiple. When asked what they would cut if their side hustle disappeared tomorrow, 46% said dining out, 39% said entertainment and 39% said shopping.

Many Americans have a side hustle — and are earning big

Nearly 2 in 5 Americans (38%) have a side hustle. While that’s down from 44% in 2022, it’s still a big number.

- 2024: More than half of Gen Zers and millennials have a side hustle, 80% of whom say they’re more reliant on the extra money due to the current economy

- 2022: Side hustlers on the rise, and nearly 70% say they’re more reliant on the extra income due to inflation

- 2020: Half of millennials have a side hustle amid the coronavirus pandemic

- 12 ways to make extra cash

A deeper dive into the data shows that men, younger Americans, parents with young children and the highest earners are the most likely to say they have a side hustle. But it’s clear that people of all ages, income levels and more are pursuing side hustles, at least to some degree.

Side hustles can take many forms. Our survey showed that the most popular were food or grocery delivery (15%), online freelancing (15%) and part-time or seasonal work (14%). However, housecleaning (13%), making and selling items (13%), e-commerce resale (12%) and social media influencing (11%) weren’t far behind.

Further down the list were a variety of gigs, including babysitting, pet sitting or caretaking (9%), rideshare driving (8%), day trading (7%), tutoring or teaching (6%) and even OnlyFans (5%).

The median amount our side hustlers earned monthly was $400, but the average was $1,215. Considering how tight many households’ budgets are, $1,215 is nothing short of a game-changing monthly amount. Men report earning more than double what women say they earn — an average of $1,580 versus $749.

High cost of living in 2025 pushes people toward side hustles

There can be as many reasons for having a side hustle as there are stars in the sky. When asked why they have a side hustle, one-third said they needed it because of cost-of-living expenses, 29% said they needed it to pay bills, 28% said they wanted the money for discretionary spending and 24% needed to pay off debt.

Not everyone has a side hustle because they’re struggling, though. More than 1 in 5 (22%) do it to fill their spare time, 15% do it to help others and 14% do it to pursue their passions.

We also asked side hustlers what drove them to start their side gigs. By far, they most commonly cited the economy (49% said so) and inflation (42%). Those two were cited at least twice as often as the pandemic (21%), rising interest rates (20%) and stock market dips (14%).

Side hustles provide financial security

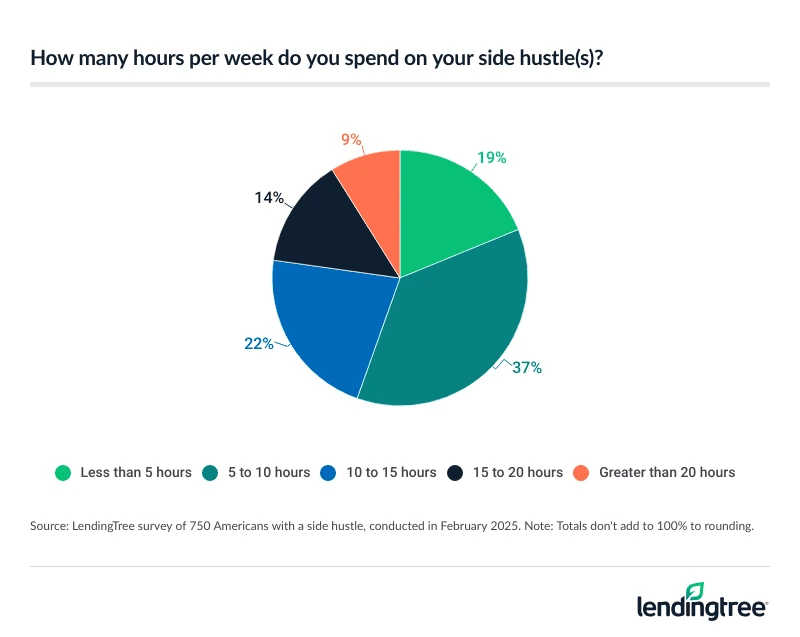

In most cases, side hustles aren’t passive income. They involve a major time commitment, which can be a real challenge given how long most people’s to-do lists already are. While 19% of side hustlers say they spend less than five hours a week on their hustles, 45% say they spend at least 10 hours a week. That includes 9% who spend more than 20 hours.

Even with that extreme time commitment, 77% say their side hustle improves their quality of life. Parents of young kids are among the most likely to say so, with 82% agreeing, including 47% who agree strongly.

Ultimately, it’s all about the income. Our survey found that 61% of side hustlers say their lives would be unaffordable without their side hustle income. Those earning less than $30,000 a year (75%), millennials ages 29 to 44 (66%), parents of young kids (65%) and women (64%) are among the most likely to agree.

Less than half of side hustlers (44%) say the income provides long-term financial security. Parents of young kids (59%), millennials (52%) and men (50%) are some of the most likely groups to say so.

Most wish they didn’t need their side hustle

Sure, many people have side hustling in their blood. They’re working these side gigs because they’re passionate about them, not just because of the money. That’s not most people, though.

Nearly two-thirds of side hustlers (65%) say, if given the opportunity, they’d rather have one main source of income rather than multiple. About 7 in 10 parents of young kids (71%), 70% of millennials and 68% of men agree.

When asked what they would cut if their side hustle disappeared tomorrow, most respondents talked about discretionary items — 46% said dining out and 39% said entertainment. However, 18% said they’d have to cut an essential bill. Men were slightly more likely than women to say so (20% versus 17%), and millennials were more likely to say so than Gen Xers ages 45 to 60 and Gen Zers ages 18 to 28 (22%, 17% and 16%, respectively).

Use side hustle income to break the cycle of debt

Our survey revealed, not surprisingly, that many Americans take on side hustles to help them manage debt. They’ve cut their spending to the bone to try to free up money to put toward the debt before realizing they need to bring in more income to make a real dent in their problem.

If you’re serious about bringing in more income over the long term, choosing the right side hustle matters. It isn’t about jumping on the first opportunity. It’s about finding something that matches your talents, meets a need in the marketplace and can be sustained over time. Finding it requires homework, a plan and probably even some failure and course correction. Once you find it, though, it can change your life.

Still, there are other options for those struggling with debt:

- A 0% balance transfer credit card can be a game-changer. A year or more without accruing interest on a transferred balance? It’s true. These cards aren’t perfect, as they typically come with fees, transfer limits and other fine print, plus you’ll need good credit to get one. But if you can get one, it can save you hundreds or even thousands of dollars in interest assuming you use it wisely.

- A low-interest personal loan may be your next best option. Sure, you’re not going to find 0% offers with these loans. However, if you can’t qualify for a 0% balance transfer card, shopping around for a personal loan can lead you to one that has a lower interest rate than you pay on your credit card. That’s a good place to start.

- Ask your lender for help. No, really. If you’re struggling to pay, let your lender know. Most lenders have hardship programs to help people battling a short-term rough patch. They can include temporarily lowered APRs, deferred payments, waived fees and other such breaks, but the bank can’t give them to you if it doesn’t know you’re struggling. And even if you’re not struggling that badly, it can be worth calling your credit card issuer and asking for a lower interest rate. A 2024 LendingTree survey showed that 76% of people who asked for a lower rate in the past year got one, but too few people ever ask.

- Save while paying down debt. Don’t choose between saving and paying down debt. Do both. Yes, the amount you save at first may be tiny. And, yes, it means it’ll take you a little longer and cost you a little more to pay off the debt, but that’s OK. That’s because that savings means that when your debt is down to $0 and some big unexpected expense arises, it won’t necessarily have to go right back on your credit card. That’s how you break the cycle of debt. (Returns of 4% on online high-yield savings accounts help a lot, too.)

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,999 U.S. consumers ages 18 to 79 from Feb. 4 to 5, 2025. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2025:

- Generation Z: 18 to 28

- Millennial: 29 to 44

- Generation X: 45 to 60

- Baby boomer: 61 to 79

Get debt consolidation loan offers from up to 5 lenders in minutes