Side Hustlers on the Rise, and Nearly 70% Say They’re More Reliant on the Extra Income Due to Inflation

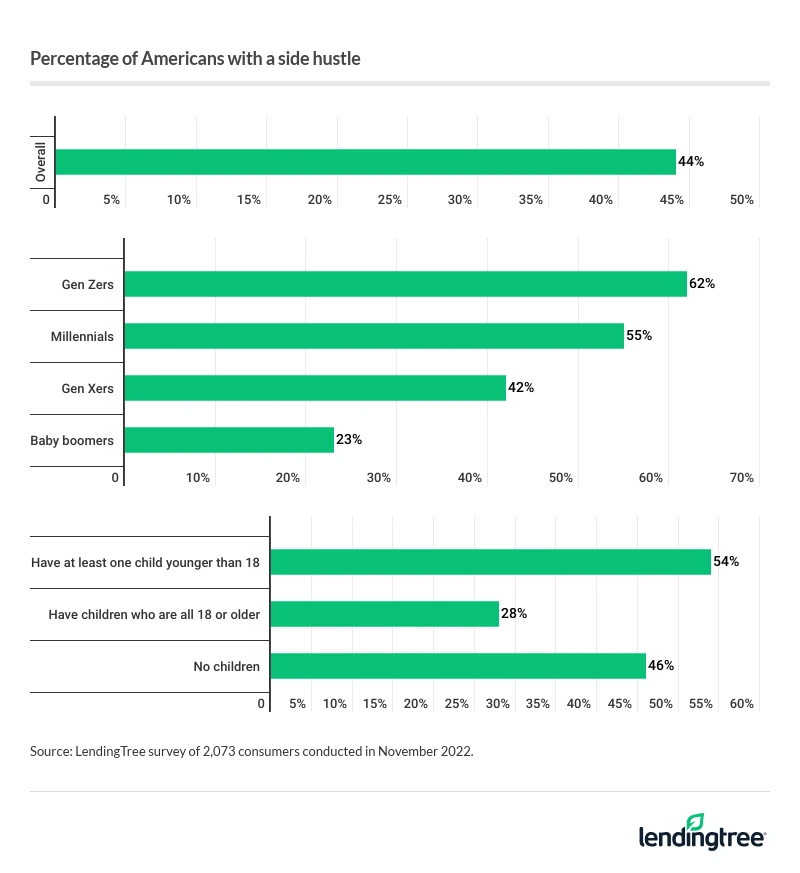

Between cutting back on Thanksgiving costs and struggling with late bill payments, consumers have felt the effects of inflation. Now, after a year of steep price hikes, a higher rate of Americans are turning to side hustles to pick up the financial slack. According to the latest LendingTree survey, 44% of Americans say they have a side hustle — up 13% from 2020.

We asked nearly 2,100 U.S. consumers about their side hustle habits. Here’s what we found.

Key findings

- As inflation has soared, so has side hustling, with 44% of Americans reporting having a side hustle, up 13% from 2020. This is especially true among Gen Zers (62%), millennials (55%) and parents with children younger than 18 (54%).

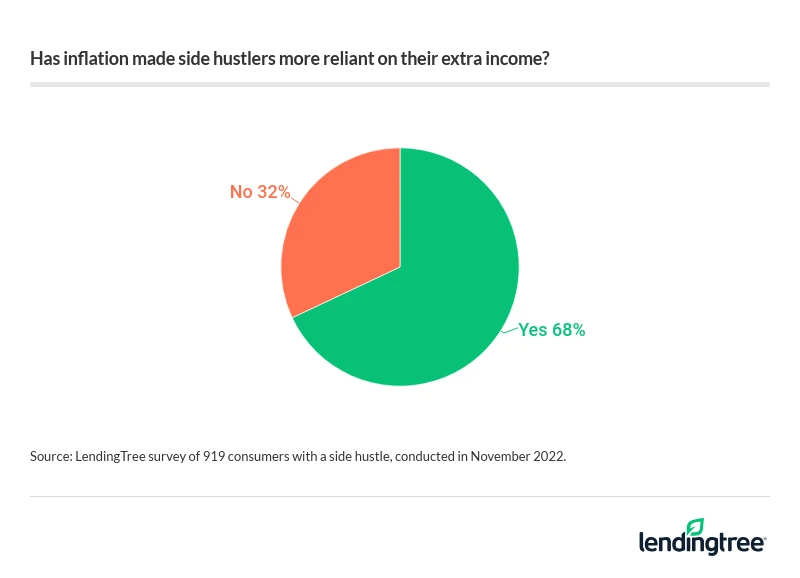

- Side hustlers are working hard to fill financial gaps, as 43% say they need the money to pay their primary expenses or bills. Even though inflation eased in the latest consumer price index, 68% of hustlers say they rely more on the extra income because of these price increases.

- Side jobs are bringing home the bacon, with Americans earning $473 a month, on average, from their side hustle — or almost $5,700 a year. Men ($568) and parents with children younger than 18 ($533) are among the side hustlers who bring in the most dough monthly. However, hustlers making less than $35,000 a year use side gigs to make up 12% or more, on average, of their incomes.

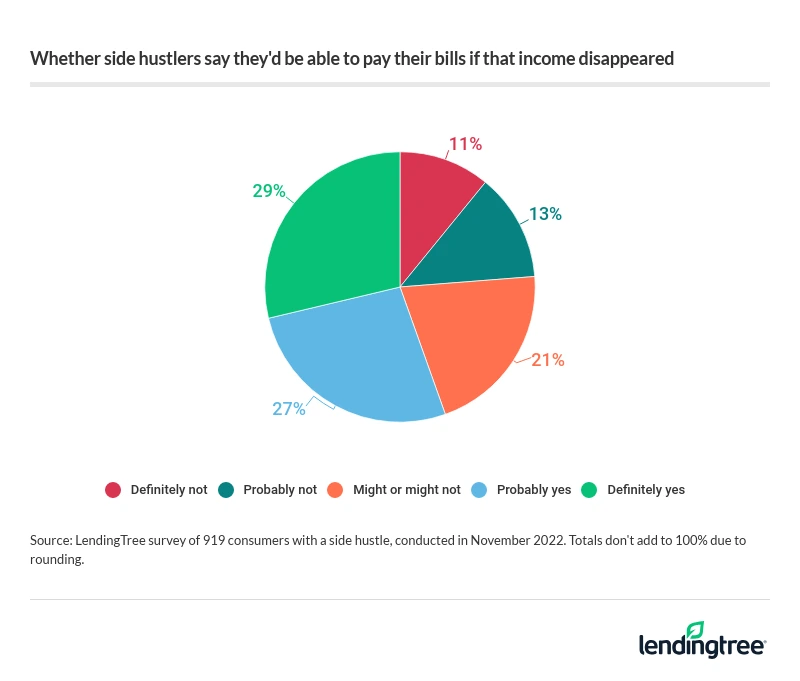

- If this money were to disappear, 71% with a side gig say they aren’t certain they’d still be able to pay all their bills. Not surprisingly, Americans making six figures (48%) are the most likely to feel completely confident in their ability to still pay their bills if their additional jobs were to disappear. Those married or in a domestic partnership (35%) are also near the top.

- While many are using side jobs to supplement, it seems as though Americans are bouncing back from the pandemic’s impact on the job market. In 2020, 14% of hustlers said they started their side gig because they lost their job or were furloughed due to the pandemic. This year, only 7% of respondents reported they had their side hustle because they lost their job or were furloughed.

44% of Americans have a side hustle

Inflation isn’t the only thing on the rise. As consumers combat soaring costs, 44% of Americans report having a side hustle. That compares to the 39% who said they had a side hustle in 2020 — an increase of 13%.

LendingTree chief consumer finance analyst Matt Schulz says he’s not shocked that more people have side hustles now, but he finds that growth eye-opening.

“I think the onset of the pandemic emboldened a lot of people to try a side hustle, and that has just continued to grow,” he says. “And now that inflation has gone wild, more and more people have embraced side hustles out of necessity. Life is really expensive today and many people need that extra side hustle income to make ends meet or to provide themselves with a little bit of financial wiggle room.”

The top side hustlers? Gen Zers ages 18 to 25 (62%), millennials ages 26 to 41 (55%) and parents with children younger than 18 (54%) are the most likely to have a side gig. Meanwhile, baby boomers ages 57 to 76 (23%) and parents with adult children (28%) are the least likely.

When it comes to what consumers are doing on the side, making and selling items on sites like Etsy (8%) is the most popular choice. Following that, 7% make extra cash by babysitting, pet sitting and caretaking, while 6% deliver food or groceries with services like Instacart, DoorDash and Uber Eats. Other common gigs include:

- Reselling items on e-commerce sites like eBay, Poshmark and Amazon (6%)

- Picking up part-time or seasonal work (5%)

- Being a handyman (5%)

- Online freelancing (4%)

- Day trading (3%)

Meanwhile, 2% or less of side hustlers make their extra income by:

- Blogging, podcasting or producing content (2%)

- Being a social media influencer (2%)

- Tutoring or teaching (2%)

- Directly selling and/or working with a multilevel marketing company (2%)

- Engaging in adult-related or illicit activities such as selling illegal substances (2%)

- House sitting (1%)

- Bartending or serving (1%)

- Ride-sharing (such as Uber or Lyft) (1%)

- Renting out properties, including long-term and short-term leases through Airbnb and Vrbo (1%)

- Industry consulting (1%)

- Fitness instructing (1%)

- Posting on OnlyFans (1%)

Notably, men are twice as likely as women to make extra money through illicit activities (though 2% or less of both groups said so). Men are most likely to get extra work as a handyman (8%), driving for a delivery service (8%) and reselling items online (7%).

Consumers without a side hustle say they don’t have the time

While side hustles are arguably appealing to many Americans, the 56% of consumers who don’t have one aren’t just uninterested in earning extra cash. In fact, 30% of those who skip the side gig say they don’t have the time — the most common response. That’s particularly true for parents with underage children (42%) and millennials (40%).

Still, picking up a side hustle isn’t entirely out of the question for many of these consumers. In fact, about a quarter (25%) say they’re considering one. Gen Zers (30%), millennials (29%) and parents with underage children (29%) are among the most likely to say they’re thinking about it.

Meanwhile, those who don’t have a side gig are most likely to cite the following reasons:

- They don’t want one (20%)

- They don’t have an idea or a hobby to monetize (15%)

- They’re too stressed to consider a side hustle (10%)

- It never occurred to them (10%)

- They don’t need the money (9%)

Generally, baby boomers and Gen Zers feel the least inspired. Among baby boomers without a side gig, 37% say they don’t want to start one — 17 percentage points higher than average. Meanwhile, Gen Zers are the most likely to say they don’t have an idea to monetize, at 20%.

The main reason for side hustling? Most say it’s to pay for primary expenses, bills

One thing is clear: Consumers are working to close their financial gaps. Of those with a side hustle, 43% say they do it to pay for their primary expenses or bills. That figure is highest among the lowest-earning cohorts, with 54% of those earning between $35,000 and $49,999 and 53% of those earning less than $35,000 citing this reason.

This comes as 68% of hustlers say they’re more reliant on the extra income because of these price increases — even though inflation eased in the latest consumer price index. That figure is particularly high among parents with children younger than 18 (75%), those with an annual household income between $75,000 and $99,999 (73%) and millennials (73%).

Schulz says it’s understandable so many consumers still need a side job to survive price increases.

“Inflation has eased recently, but it certainly hasn’t stopped,” he says. “Most everything has gotten more expensive, and that’s eaten away at most people’s financial margin for error. It’s particularly troubling when the cost of the most basic of expenses rises because it’s not like you can choose to cancel your utility bill or stop buying groceries the way you can a Netflix subscription.”

Those aren’t the only financially motivated reasons for picking up a side gig. Beyond filling the inflation-driven gaps, 36% of those with a side hustle say they use the additional income for discretionary spending and saving. Another 22% of side hustlers say they do it to get out of debt.

With the gift-giving season around the corner, 16% of people with a side hustle say they’re doing it to pay for holiday expenses. They’re not the only ones with cash concerns this year: In a separate LendingTree survey on gift-giving concerns, more than half (56%) of those planning to give a holiday gift said they’re worried about giving — and affordability was the No. 1 reason for stress.

Side hustlers earn an average of $473 a month

Regardless of why they’re doing it, those with side jobs are certainly making some extra cash. In fact, Americans are earning $473 a month, on average, from their side hustle — totaling almost $5,700 a year.

Men are among the groups that bring in the most from their side gigs, earning $568 a month, on average. Parents with children younger than 18 are similarly successful hustlers, earning an average of $533 a month from their side gigs.

Though they earn less on average from their side roles, consumers with low income may be more likely to say their side hustles have a greater impact on their finances. Hustlers making less than $35,000 a year say they earn just $366 a month, on average, from their side roles — but that makes up 12% or more of their incomes. Here’s how that stacks up against other income groups:

- Hustlers earning between $35,000 and $49,999 make $410 a month, on average, earning 10% or more of their incomes.

- Hustlers earning between $50,000 and $74,999 make $487 a month, on average, earning 8% or more of their incomes.

- Hustlers earning between $75,000 and $99,999 make $555 a month, on average, earning 7% or more of their incomes.

Despite its impact on consumers’ finances, Schulz cautions against spending it all immediately.

“Just because the income doesn’t come with a W-2 doesn’t mean that you don’t have to pay taxes on it,” he says. “Make sure that you set some of that side hustle income aside for taxes, and consider enlisting an accountant and a tax professional for help. It’s serious business, so give it the attention it requires.”

Given how much hustlers make, it’s not surprising that 66% would at least consider making their side gigs their full-time job. This increases to 71% among men and parents with children younger than 18.

Those who’d consider going full time may have a long way to go, though, as 43% say their side hustle income would have to be roughly equal to their current full-time income before making the transition. Another 35% wouldn’t risk it unless their side gigs brought in more money than their full-time jobs.

Many wouldn’t be able to pay the bills without their side hustles

Those with side gigs are pretty reliant on their extra income. If they were to lose their side gig, 71% say they aren’t certain they’d still be able to pay all their bills. Just under a quarter (24%) are at least somewhat certain they could survive without it.

While that percentage is concerning, Schulz isn’t exactly surprised so many feel reliant on their side gigs.

“That high percentage is definitely troubling,” he says. “However, for many Americans, the truth is that they have no other choice but to have that side hustle. There’s just no way they can budget, sell unused items or slash expenses enough to get themselves out of their financial bind, so they have to come up with ways to boost their income however they can.”

It’s not surprising that low-earning consumers are the least certain they’d be able to pay their bills. Among these side hustlers, 82% of those earning less than $35,000 and those earning between $35,000 and $49,999 say they aren’t sure they’d be able to make do without their side gigs.

Meanwhile, those making six figures are the most likely to feel completely confident in their ability to still pay their bills if their additional jobs were to disappear, at 48%. That’s followed by side hustlers with adult children (38%), baby boomers (38%) and those married or in a domestic partnership (35%).

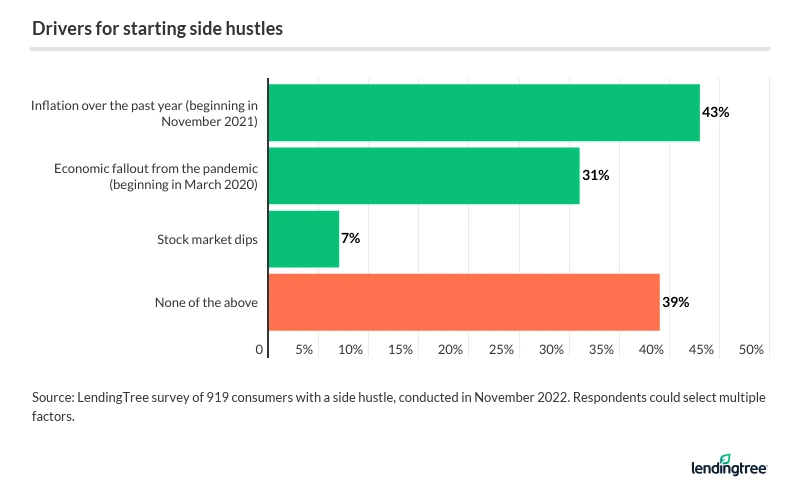

Reasons for starting a side hustle indicate the job market is recovering

Despite the high reliance on side hustles, consumers are less likely to say they started a side hustle because they were laid off or furloughed — indicating that the job market is recovering from the pandemic. This year, only 7% of respondents reported they had their side hustle because they lost their job or were furloughed. That compares to the 14% of hustlers who said similarly in 2020 due to the coronavirus pandemic.

Seeing how unemployment has changed between the two surveys, that’s understandable. In October 2020, the national unemployment rate was 6.9%. In October 2022 — the latest available — it was 3.7%.

Unemployment isn’t the only economic factor inspiring consumers, though. When it comes to what played a role in their decision, 43% of Americans with side hustles say inflation over the past year was a motivator to starting their side gig — the most common response. To break that down even further, 52% of people making between $50,000 to $74,999 say inflation was a driving factor. Others who cite this highly include 46% of people with adult children, 46% of baby boomers and 45% of women.

Meanwhile, 31% were motivated to start a side hustle due to the economic fallout from the pandemic, with parents of children (38%) and millennials (36%) being the most likely groups to say so.

Top tips for starting a side hustle

A little extra cash can go a long way, but it can be hard to know what’s worth your time or money. For those looking to start a side gig, Schulz offers the following advice:

- Play to your strengths. “Leveraging your current skill set is one of the best ways to start a side hustle,” Schulz says. “If you’re a great editor or writer, look for that type of work. If you’re really organized and like working with people, consider being a virtual assistant. There are a million possibilities. We all have skills and talents — using yours to help bring in some extra income can be a great way to help yourself and your family’s financial situation.”

- Temper your expectations. “Don’t expect a side hustle to dramatically improve your financial life immediately or without much effort,” he says. “The truth is that side hustles often take a lot of time and effort to start generating revenue. That’s especially true if you’re starting a small business. That doesn’t mean you shouldn’t try one. They can be absolutely amazing and can make a huge difference to your finances. Just be sure you don’t go into it with rose-colored glasses. Otherwise, you might end up disappointed.”

- If you can, try not to rely too much on your side gig. Side gigs aren’t always the most secure source of income, so utilizing any extra cash to establish financial independence can offer support if your gig fails or falls through. “A budget can be a great place to start,” he says. “Once you know exactly how much money is coming in and going out of your household each month, you can make some choices and do some prioritizing to free up some funds to put toward debt or savings or other financial goals.”

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,073 U.S. consumers ages 18 to 76 from Nov. 1 to 3, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

Get debt consolidation loan offers from up to 5 lenders in minutes

Recommended Articles