LendingTree Survey Shows 46% of Taxpayers Plan To Save Their Refunds

April’s Tax Day is approaching, and many U.S. taxpayers have filed their 2021 returns. In fact, the IRS had already received 45.4 million individual returns as of Feb. 25, a 0.3% jump from the prior season. And the newest LendingTree survey of more than 1,000 taxpayers shows signs of positivity, with 46% planning to put refund money in their savings.

Two years into the pandemic, LendingTree chief consumer finance analyst Matt Schulz feels this signals that people are still heeding one of the major lessons of the pandemic: You can never have too much money put away in savings.

“The next rainy day that comes may not be quite as stormy as this one, but it will definitely come, and extra savings makes you better prepared when it does,” Schulz says. “It also shows that a lot of people are still doing a good job of managing their debts. The lower your debts, the easier it is to save. And the more you save, the less susceptible you are to falling into a debt cycle. That’s a good thing, and I hope people keep doing a good job.”

Key findings

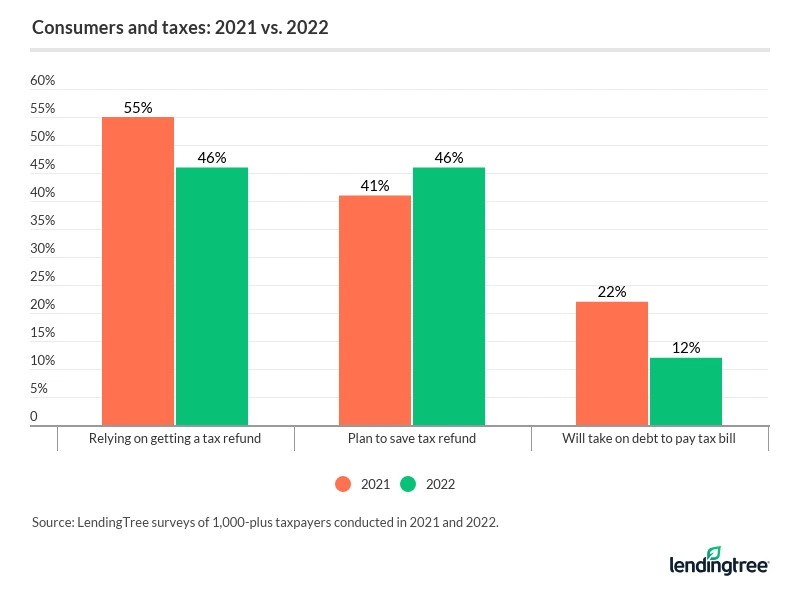

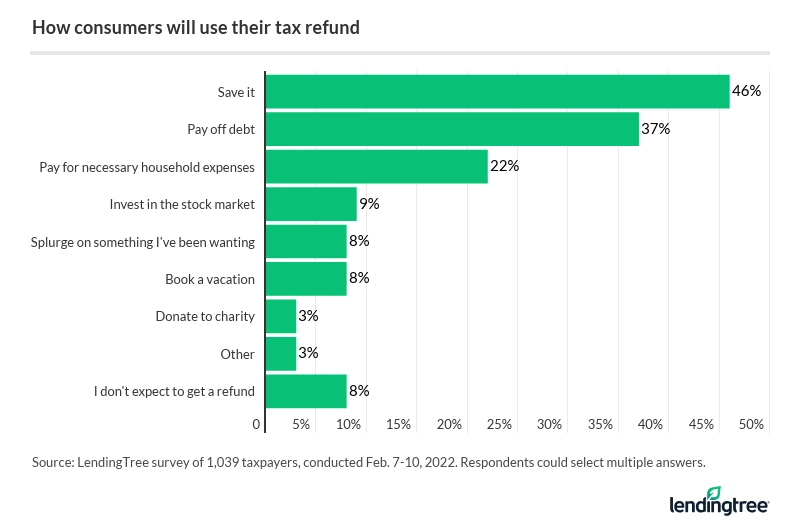

- More consumers plan to save their tax refunds if they get one this year. 46% plan to put refund money in their savings accounts, compared with 41% in 2021 and 40% in 2020. Meanwhile, 37% will pay off debt — led by 48% of parents with kids younger than 18.

- While many taxpayers rely on refunds, the percentage decreased year over year. 46% of taxpayers are relying on a refund this year, down from 55% in 2021 but up from 40% in 2020.

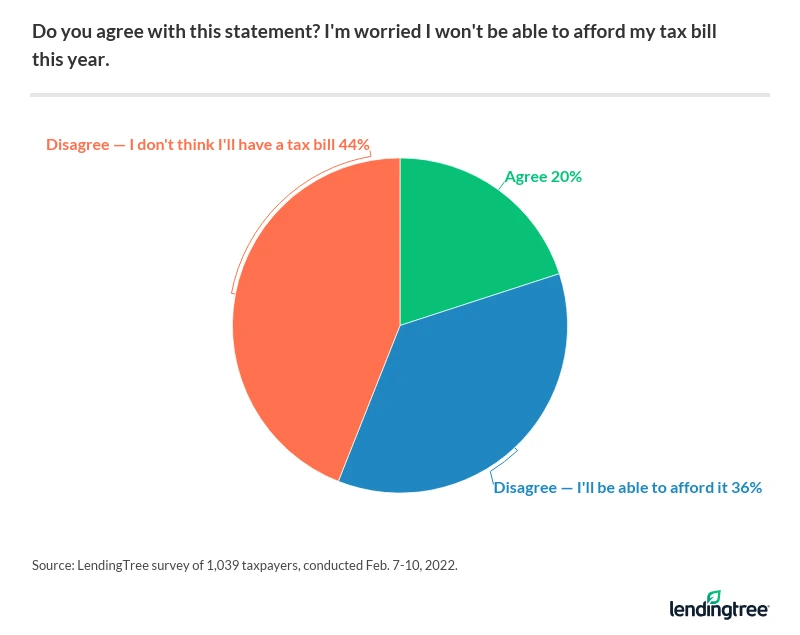

- Americans are less likely to take on debt to pay a tax bill this year — another positive sign. Just 12% would take out a personal loan or use their credit card to pay their taxes, down from 22% last year. Still, 1 in 5 Americans worry that they wouldn’t be able to afford their tax bill this year.

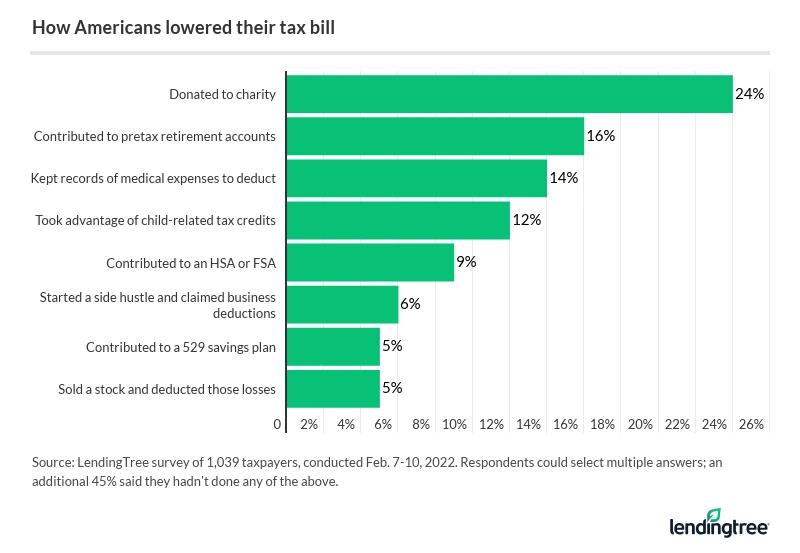

- 55% of consumers do at least one thing to reduce their tax bill, such as donating to charity, contributing to pretax retirement accounts or deducting medical expenses. However, women are less likely to do so, as are Gen Zers.

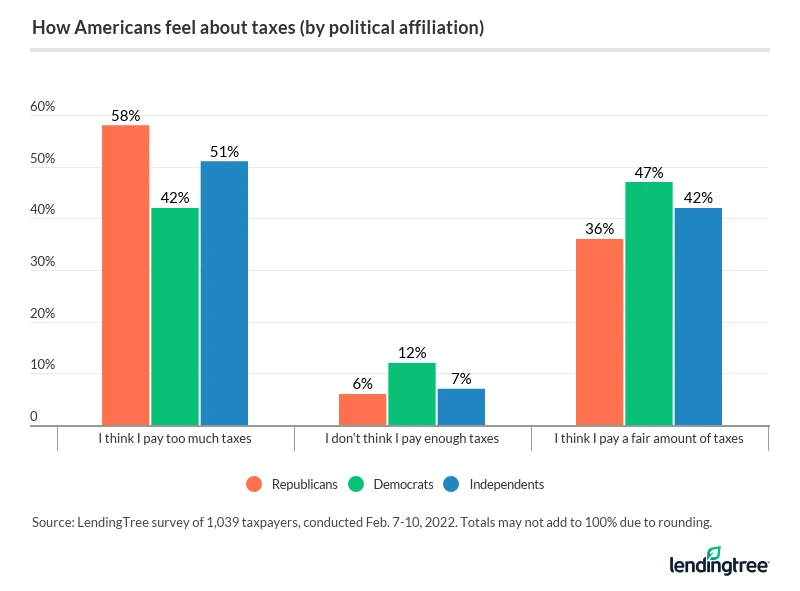

- 50% of taxpayers think they pay too much in taxes. Republicans (58%) are more likely to believe this than independents (51%) and Democrats (42%).

Nearly half of taxpayers plan to put refund money in savings

When asked how they would spend a tax refund if they get one this year, almost half of consumers (46%) intend to put money into savings. The percentage of savers is on the rise, too: In 2020, only 40% had intentions to put their refund into savings, followed by 41% in 2021.

More than 6 in 10 Gen Zers ages 18 to 25 (62%) plan to put refund money into savings, compared with:

- 47% of millennials ages 26 to 41

- 42% of baby boomers ages 57 to 76

- 41% of Gen Xers ages 42 to 56

Following savings, 37% plan to pay off debt — with parents with kids younger than 18 (48%) being especially eager to do so. Women (41%) are also motivated to use their tax refund to pay off debt, compared with just 34% of men.

Meanwhile, some consumers plan to use their tax refund to pay for living expenses. About a third of consumers (30%) making less than $35,000 a year need their tax refund to pay for necessary expenses like rent or groceries. And when it comes to using a tax refund to invest, Gen Zers are more likely to invest their tax refund than older generations.

Schulz isn’t surprised to see Americans are ready to save and pay off debt.

“It is likely that many Americans have burned through much of the savings that they built up in the early days of the pandemic, even if they haven’t gone back into debt just yet,” Schulz says. “These tax refunds can help folks build that cushion up again, protecting them from needing to rely on credit cards and other loans for a while longer. As student loan payments possibly resume and interest rates rise, it’s likely to get harder and harder on the average consumer to avoid taking on some debt, though. That makes building that emergency fund even more important.”

Tax refunds can be quite helpful, so it’s understandable that 46% of taxpayers are relying on a refund this year — down from 55% last year but up from 40% in 2020.

At least half of Americans making less than $50,000 a year are relying on a refund this year, versus 34% of consumers making $100,000 or more.

But as helpful as tax refunds can be, Schulz warns against relying on them.

“As much as some people love tax refunds, they’re not ideal,” Schulz says. “A tax refund means that you overpaid taxes to the government, and a big refund means you overpaid in a big way. That means that you basically let the government hold on to money that you could’ve used to invest with, save with or even just pay the bills with.”

Ideally, Schulz says, your tax refund would be $0. While you don’t want to get a big refund, you also don’t want to have to write them a big check in April either.

He advises that working with a tax professional can help you get to that magic $0 number. But you can also use tools — like the IRS’ withholding estimator — that can help you better understand how much more or less you need to have taken out of every paycheck to get where you want to go.

So you owe money to the IRS — what’s next?

While not owing any money or receiving a large refund is ideal, a refund is preferable to a big tax bill.

When asked how they would manage to pay for taxes they owe, the most common response was to use money they have in their checking account (39%), led by those who earn $100,000 or more a year (57%) and baby boomers (56%); this was followed by using money they have in savings (27%). Only 12% would need to take out a personal loan or use their credit card to pay their taxes, down from the 22% reported last year.

Unfortunately, though, 1 in 5 Americans express concern that they won’t be able to afford their tax bill this year — including 27% of Americans with kids younger than 18.

If someone owes taxes, Schulz advises carefully considering what you can do to move forward.

“The first thing to do if you owe taxes is to understand that you have options,” Schulz says. “They may not all be great, but they are there. However, it is incredibly important to not panic and rush into a decision. People make bad decisions when they are in a hurry and don’t understand what they’re getting into. That’s certainly the case with taxes. Take your time, do your homework and enlist the help of a tax professional if you need to.”

How Americans are cutting their tax bills this year

Understandably, more than half (55%) of consumers plan to do at least one thing to reduce their tax bill. These reduction methods include donating to charity (24%), contributing to pretax retirement accounts (16%) and deducting medical expenses (14%). However, women are less likely to do at least one of these things to reduce their tax bills, as are Gen Zers.

While 55% are taking at least one action to reduce their tax bill in 2022, that’s notably down from 70% in 2021.

When it comes to parents, 29% intend to take advantage of tax credits related to their children, including the child tax credit, earned income tax credit and/or higher education-related credits.

50% of Americans think they pay too much in taxes

It’s safe to say that most people don’t enjoy paying taxes, but — to make matters worse — 50% of taxpayers believe they pay too much in taxes.

And there’s an interesting political influence here, with Republicans (58%) being more likely than independents (51%) and Democrats (42%) to believe they are paying too much in taxes,

Get help with your taxes

Most taxpayers get outside help with filing (86%), such as from an online tax filing service (41%), paid accountant or advisor (32%) or loved one (17%). Notably, baby boomers are less likely to use outside assistance than younger generations.

If you’re looking for help with your taxes, Schulz shares these tips for finding the help you need to navigate tax season:

- Find the right tax professions. “Tax professionals can be very helpful, but it isn’t a relationship to enter into lightly,” Schulz says. “If you can, get recommendations from friends and family. That certainly doesn’t guarantee success, but it can bring peace of mind as you enter this process.”

- Be wary of credit card fees. If you’re looking for a bit of financial help in the form of earning extra credit card points, Schulz advises caution. “It may seem like a great idea to pay your taxes with a credit card and collect all those rewards,” Schulz says. “Unfortunately, the math typically doesn’t work in your favor because you’ll likely have to pay excess fees to pay with plastic. Those fees are typically near 2%, which is generally the highest return you’ll find on most cash back cards. That means that the best-case scenario is that you’ll break even.”

- Use IRS Free File if you qualify. If you need help working your way through the tax process but don’t want to pay for assistance, you may be able to use the IRS Free File tool. This allows you to prepare and file your federal income tax online by using their guided tax preparation system to file a federal return for free.

- Consult the Interactive Tax Assistant. Another free and helpful IRS tool is the Interactive Tax Assistant, which answers different tax law questions and provides answers that are specific to your financial situation. This tool bases its answers on your personalized input and can determine things like whether you need to file a tax return, what your filing status is and if you’re eligible to claim a credit.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 1,039 U.S. taxpayers from Feb. 7-10, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

While the survey also included consumers from the silent generation (those 77 and older), the sample size was too small to include findings related to that group in the generational breakdowns.

Get debt consolidation loan offers from up to 5 lenders in minutes