What It Takes to Earn an 800 Credit Score

From buying a home or renting an apartment to taking out a loan, having a good credit score can make a huge difference in your everyday life. Having an exceptional or excellent credit score of 800 to 850 can offer even more opportunities, but boosting your score to that top range isn’t as easy as it seems.

To offer insight into what it takes to get an exceptional score, our researchers analyzed the anonymized credit reports of 100,000 LendingTree users with credit scores of at least 800. Here’s what habits they had in common.

Key findings

- On average, 100% of our sample of LendingTree users with a credit score of 800 or higher pay their bills on time every month. Payment history accounts for 35% of a credit score, making it the most important factor.

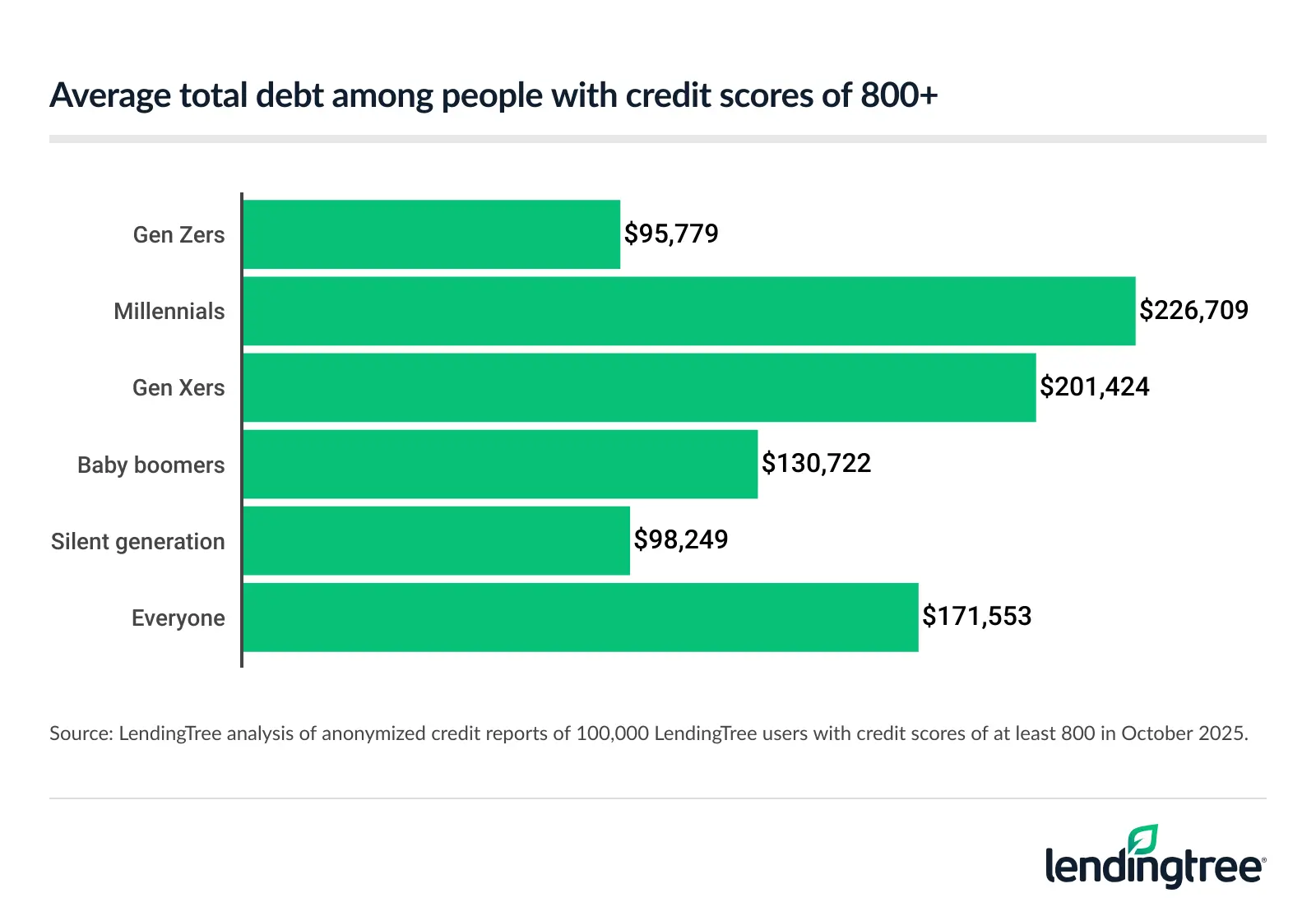

- Americans with 800-plus credit scores have an average of $171,553 in debt, including mortgages. That’s up 14.2% from October 2022. The average debt among those with 800-plus credit scores is highest among millennials ($226,709) and lowest among Gen Zers ($95,779). Overall, Americans with the highest credit scores are making average monthly debt payments of $1,945. Amounts owed account for 30% of consumers’ credit scores.

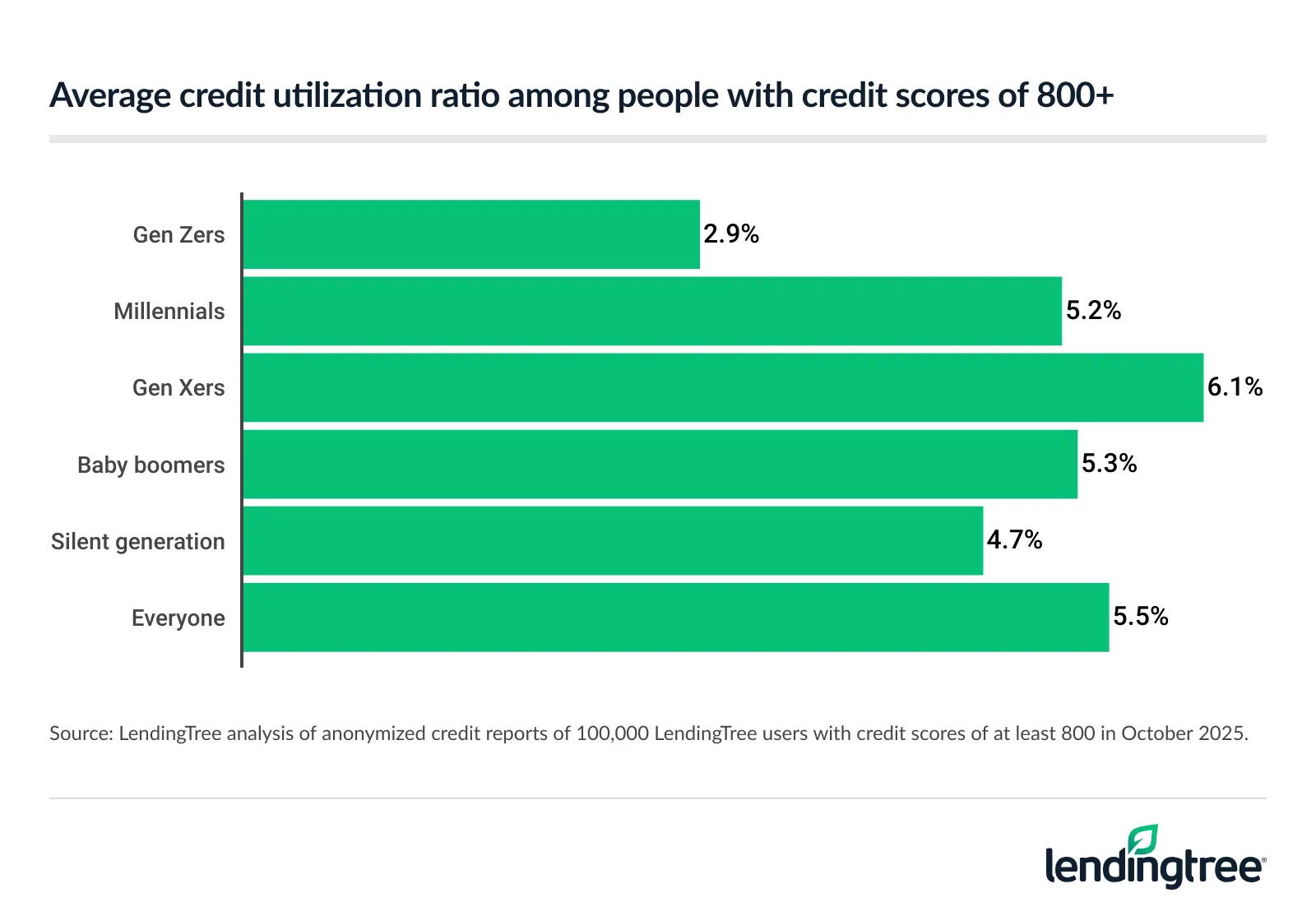

- People with credit scores of 800 or higher keep their credit utilization ratios exceptionally low, using an average of just 5.5% of their available credit. Gen Zers (2.9%) and members of the silent generation (4.7%) maintain the lowest utilization rates. Gen Xers use the most credit at 6.1%, still far below the commonly recommended 30% threshold.

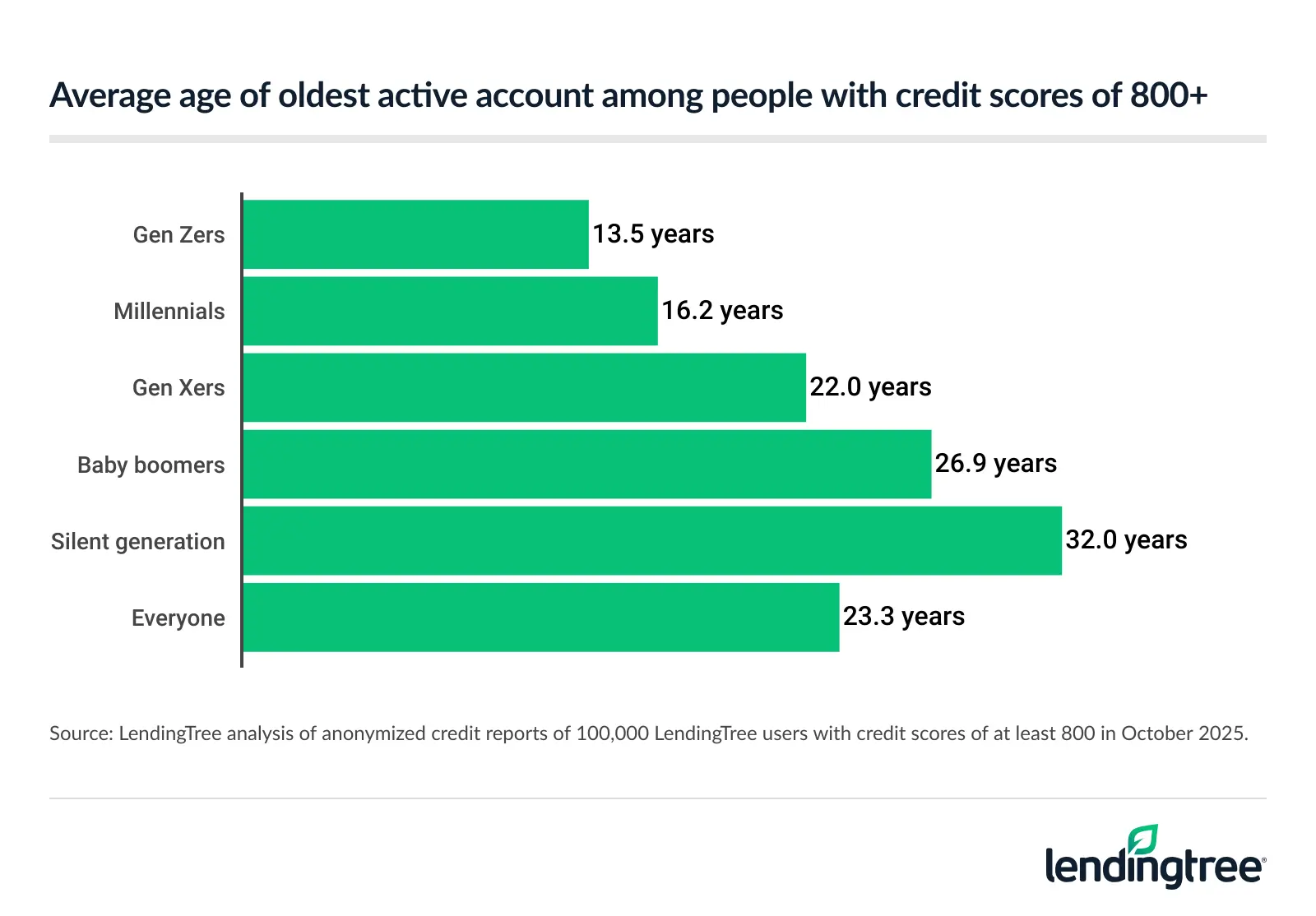

- The oldest active account for those with 800-plus scores averages 23.3 years — a slight uptick from 21.7 in 2022. Gen Zers have the lowest average at 13.5 years. Length of credit history (15%) is the third most important factor in a credit score.

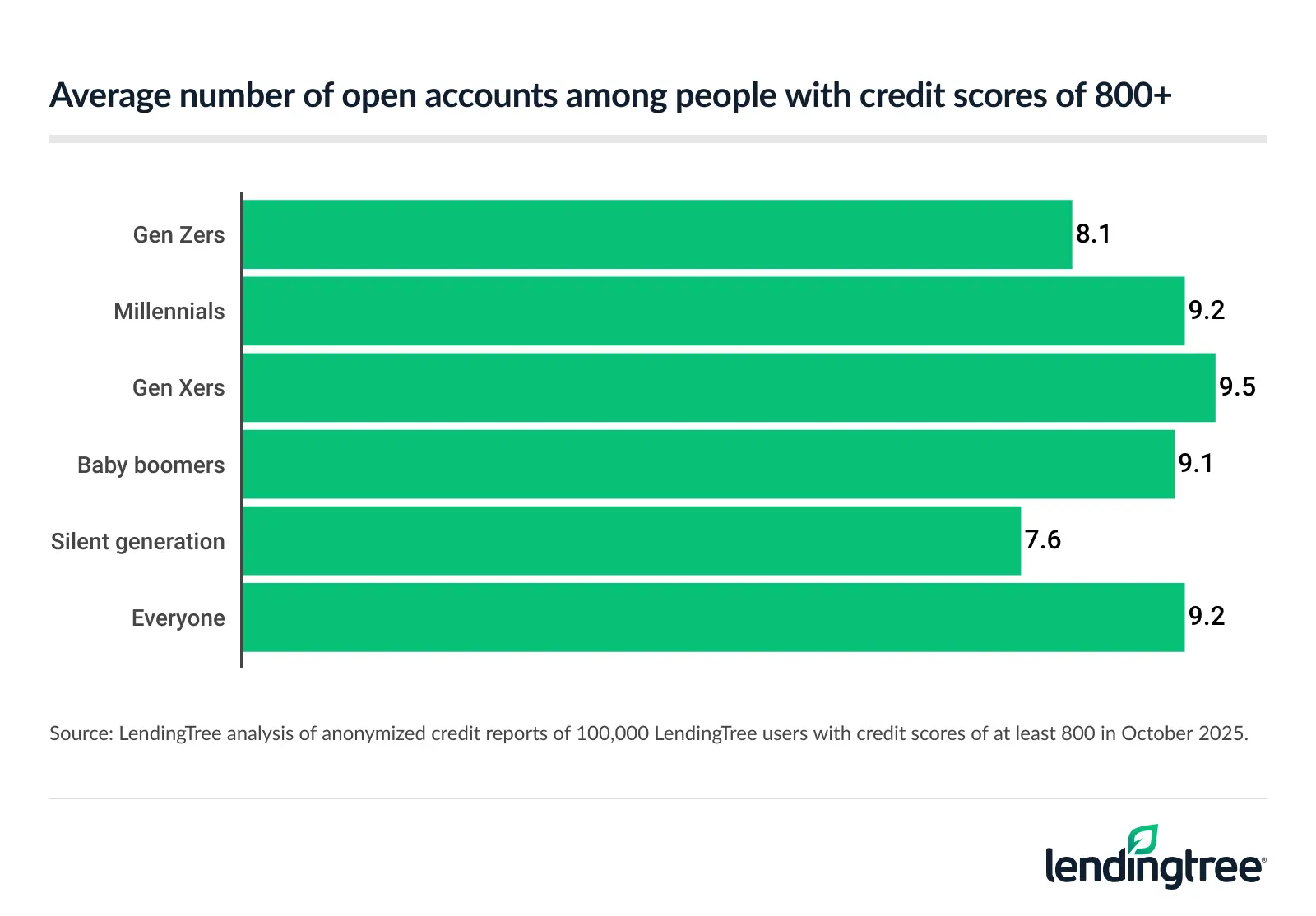

- Consumers with 800-plus credit scores have an average of 9.2 open accounts — an increase from 8.3 in 2022. Gen Xers have 9.5 open accounts, on average, which is the highest among any of the generations. While not as important as payment history or amounts owed, credit mix still accounts for 10% of consumers’ credit scores.

- Americans with high scores are limiting credit card inquiries. Americans with a credit score of at least 800 have an average of just 1.7 credit inquiries in the past two years. This virtually remained the same from 1.8 inquiries in 2022. New credit accounts for 10% of your credit score, and new inquiries remain on your credit report for two years.

100% with high credit scores pay their bills on time

One thing consumers with exceptional credit scores have in common? They pay their bills on time. An average of 100% of our sample of LendingTree users with a credit score of 800 or higher consistently pay their bills on time every month.

Payment history makes up 35% of a credit score. Since payment history is the most important factor in a credit score, it’s not surprising that all high-score consumers pay their bills on time. In fact, 100% of consumers with exceptional credit scores paid their bills on time the three other times we’ve conducted this study, in 2023, 2021 and 2019.

Matt Schulz, LendingTree chief consumer finance analyst and author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life,” says it’s incredibly telling that everyone with an 800 credit score or higher has a perfect payment history.

“It’s, by a mile, the most important part of your credit score,” he says. “That makes sense, given that the whole point of a credit score is to help lenders understand how likely you are to pay your bills on time. Of course, as the saying goes, past performance doesn’t guarantee future success when it comes to paying bills, but it’s hugely important to your score.”

Just 1 missed payment can affect your credit

To show how quickly one late payment can hurt a credit profile, consumers with one missed payment have an average credit score of 553 — about 80 points lower than those with perfect payment histories.

Credit report profile of those with no missed payments vs. those with 1 missed payment

| Factor | No missed payments | 1 missed payment | % change |

|---|---|---|---|

| Credit score | 635 | 553 | -12.9% |

| On-time payment rate | 98.7% | 94.7% | -4.1% |

| Total debt | $91,843 | $85,238 | -7.2% |

| Monthly debt payment | $1,247 | $1,187 | -4.8% |

| Credit card limit | $20,387 | $6,822 | -66.5% |

| Credit utilization ratio | 34.9% | 51.7% | 48.1% |

| Age of oldest active account | 10.4 years | 8.5 years | -18.3% |

| Number of open accounts | 8.9 | 9.2 | 3.4% |

| Credit inquiries in past 2 years | 5.4 | 6.8 | 25.9% |

Those who have missed payments also have significantly lower credit limits, at just $6,822 on average, compared with $20,387 among those without missed payments. Perhaps because they lack wiggle room in their credit availability, this group also has higher utilization rates (51.7% versus 34.9%).

How much debt do Americans with 800+ scores have?

Americans with 800-plus credit scores have an average of $171,553 in debt, including mortgages, up 14.2% from October 2022. Amounts owed account for 30% of consumers’ credit scores.

Of this high-credit group, millennials ages 29 to 44 have the highest debt, at an average of $226,709. Meanwhile, Gen Zers ages 18 to 28 ($95,779) have the least debt.

Of course, millennials make up a significant chunk of first-time homebuyers, which likely accounts for their high debt. In fact, LendingTree research on millennial homebuyers found that 49.7% of mortgage inquiries in the largest 50 metros are from millennial borrowers.

While debt may be high, payments are, too. Among Americans with excellent credit scores, monthly payments are $1,945 on average. They’re highest among Gen Xers ages 45 to 60 ($2,331) and millennials ($2,315). Meanwhile, they’re lowest among members of the silent generation ages 80 and older ($1,090) and Gen Zers ($1,127).

Users with 800+ scores have low utilization ratios

The amount you owe compared to your available credit makes up your credit utilization ratio. The less you owe and the more credit you have, the lower your credit utilization ratio. It’s generally recommended to keep your utilization ratio below 30%.

Notably, those with excellent scores keep their credit utilization ratios significantly below that threshold, using an average of just 5.5% of their available $73,280 in credit. Gen Zers and members of the silent generation maintain the lowest utilization rates, at 2.9% and 4.7%, respectively. They also have the lowest credit limits, at $54,850 among Gen Zers and $64,643 among the silent generation.

Meanwhile, Gen Xers use the most credit at 6.1%, followed by baby boomers ages 61 to 79 at 5.3%. They also have the highest credit limits, at $76,975 among Gen Xers and $73,073 among baby boomers.

Oldest active account is over 23 years on average

The oldest active account for those with 800-plus scores averages 23.3 years. That’s slightly higher than the average age of 21.7 in 2022. Among the silent generation, the average account age is the highest, at 32.0 years.

Meanwhile, Gen Zers have the lowest average at 13.5 years. While you can’t open a credit card account until 18 and most people don’t qualify until 21, many parents add their children to their credit cards as authorized users to help build credit early. Many banks don’t have minimum age requirements for authorized users.

Length of credit history is the third most important factor, making up 15% of a credit score. Because of this, Schulz says it’s definitely easier for older people to have a higher credit score simply because they’ve had more time to prove themselves.

“I always compare it to kids asking their parents to borrow the car,” he says. “The first time you ask, Mom and Dad are going to pull all sorts of restrictions on you. However, if you consistently show that you can handle the responsibility, they’ll eventually loosen the reins. It’s the same with lenders. If you don’t have a history of borrowing, a lender is going to want you to prove yourself first.”

That said, Schulz believes it’s possible for young people to have an excellent credit score, particularly if their parents added them as authorized users on their own accounts.

Consumers with 800+ scores have 9.2 open accounts

Consumers with 800-plus credit scores have an average of 9.2 open accounts. That’s up from 8.3 in 2022.

By age group, Gen Xers have the most, at 9.5 open accounts. Meanwhile, the silent generation has the fewest, at 7.6 open accounts.

The types of accounts that appear on a credit report can include credit cards, auto loans, personal loans, student loans and mortgages. Having different account types is known as credit mix, which accounts for 10% of consumers’ credit scores.

“Credit mix matters because creditors want to see if you can manage multiple different types of credit,” Schulz says. “You may be able to manage a credit card, but can you also pay your auto loan, personal loan and mortgage on time? If you can do all these things, lenders will be happy to let you borrow.”

While credit mix is important, Schulz also cautions that it comes with risk. “More loans mean more bills to pay, and more bills to pay mean more opportunities for mistakes,” he says. “That’s a big deal because a single payment paid 30 or more days late can wreak havoc on your credit.”

High-credit-score consumers are limiting hard inquiries

It’s not only about paying their bills on time or how they’re utilizing their accounts — consumers with high credit scores are also limiting their credit card inquiries. Americans with a credit score of at least 800 have seen an average of just 1.7 credit inquiries in the past two years, similar to the 1.8 inquiries in 2022. That means they’re not applying for new loans or lines of credit on a frequent basis.

New credit accounts for 10% of your credit score, and new inquiries remain on your credit report for two years.

Full details: Credit report profile of people with credit scores of 800 or higher

| Factor | Everyone | Gen Zers | Millennials | Gen Xers | Baby boomers | Silent generation |

|---|---|---|---|---|---|---|

| On-time payment rate | 100% | 100% | 100% | 100% | 100% | 99% |

| Total debt | $171,553 | $95,779 | $226,709 | $201,424 | $130,722 | $98,249 |

| Monthly debt payment | $1,945 | $1,127 | $2,315 | $2,331 | $1,575 | $1,090 |

| Credit card limit | $73,280 | $54,850 | $70,811 | $76,975 | $73,073 | $64,643 |

| Credit utilization ratio | 5.5% | 2.9% | 5.2% | 6.1% | 5.3% | 4.7% |

| Age of oldest active account | 23.3 years | 13.5 years | 16.2 years | 22.0 years | 26.9 years | 32.0 years |

| Number of open accounts | 9.2 | 8.1 | 9.2 | 9.5 | 9.1 | 7.6 |

| Credit inquiries in past 2 years | 1.7 | 1.5 | 1.8 | 1.8 | 1.6 | 1.4 |

Achieving an excellent credit score: What experts recommend

Earning an 800-plus credit score isn’t easy. It can take a long time to build up your credit history, and a few mistakes can set back your score for a while. However, earning that excellent score isn’t impossible. To build your score quickly, Schulz recommends the following:

- Let technology help you. “Automate payments to make sure you’re never late,” he says. “Sign up for app, text or email notifications to remind you when your payment is due. Put reminders in your online calendar to prompt you to pay. Technology is imperfect, so it won’t completely absolve you of all responsibility for making these payments, but it can be helpful when used wisely.”

- Review your credit reports for mistakes. “People don’t realize how inaccurate credit reports can be, and often the only way to know is to review the report yourself,” he says. “If you check your report and see errors, report them to the credit bureau immediately. It’s hard enough to have good credit. The last thing you want is for someone else’s negligence or fraudulent behavior to hold your score down unnecessarily.”

- Don’t overthink it. “Yes, credit scoring formulas are complex, but they’re not impossible,” he says. “Ultimately, good credit comes down to three things: Paying your bills on time every time, keeping your balances low and not applying for too much credit too often. Do these things consistently over time and your credit will be fine.”

Methodology

LendingTree researchers in October 2025 analyzed the anonymized credit reports of 100,000 LendingTree users with credit scores of at least 800.

Researchers reviewed factors such as total debt, monthly debt payments, credit card limits, utilization ratios, account age, number of open accounts and recent credit inquiries to understand how top-credit consumers manage their finances. We also compared this to the anonymized credit reports of 100,000 LendingTree users with credit scores of at least 800 in October 2022.

A separate October 2025 analysis compared the reports of 100,000 LendingTree users of all credit scores with no missed payments and those with one missed payment to illustrate how a single late payment can correlate with lower credit scores and changes in overall credit health.

We defined generations as follows:

- Generation Z (born after 1996; ages 18 to 28 in 2025)

- Millennial (born between 1981 and 1996; ages 29 to 44 in 2025)

- Generation X (born between 1965 and 1980; ages 45 to 60 in 2025)

- Baby boomer (born between 1946 and 1964; ages 61 to 79 in 2025)

- Silent generation (born in 1945 or earlier; ages 80 and older in 2025)

Get debt consolidation loan offers from up to 5 lenders in minutes