More Than Half of Gen Zers and Millennials Have a Side Hustle, 80% of Whom Say They’re More Reliant on the Extra Money Due to the Current Economy

Young Americans are hustling — literally.

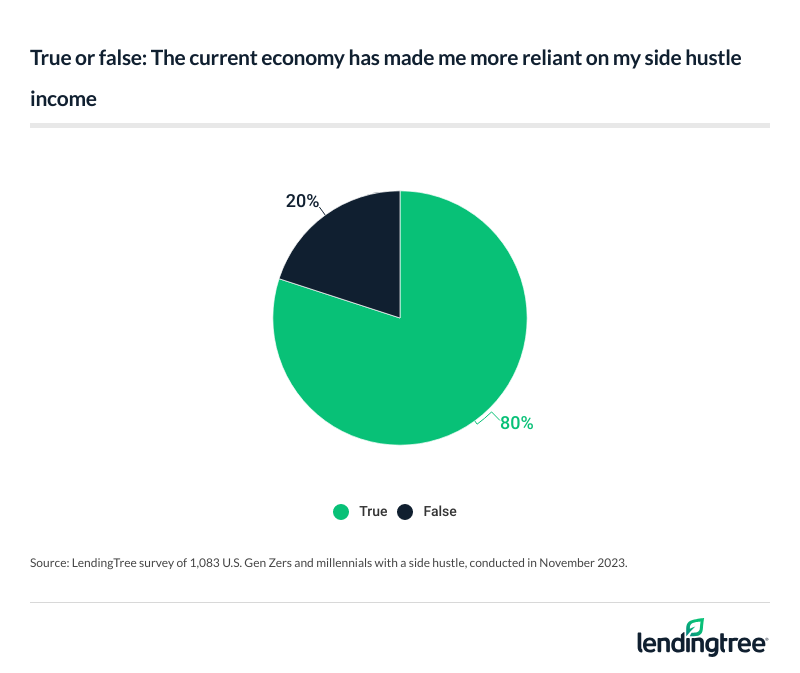

According to the latest LendingTree survey of nearly 2,000 U.S. Gen Zers and millennials, more than half of young Americans have a side hustle. And it isn’t just an option, as 80% of these side hustlers say they’re more reliant on the extra income because of today’s economy.

Here’s what else we found.

Key findings

- More than half of young Americans have a side hustle, with many driven by inflation. 55% of Gen Zers and millennials have a side hustle, averaging $1,253 a month in supplemental income. When asked what drove them to start one, 40% of these young Americans said inflation, while 38% cited economic fallout from the COVID-19 pandemic.

- As life gets more expensive, side hustlers need the money to make ends meet. 4 in 5 (80%) Gen Zers and millennials with a side hustle say the current economy has made them more reliant on the income from it, with 52% needing the money to pay their primary expenses or bills. Just 21% of young side hustlers believe they definitely would be able to pay off all their bills if their side hustle disappeared tomorrow.

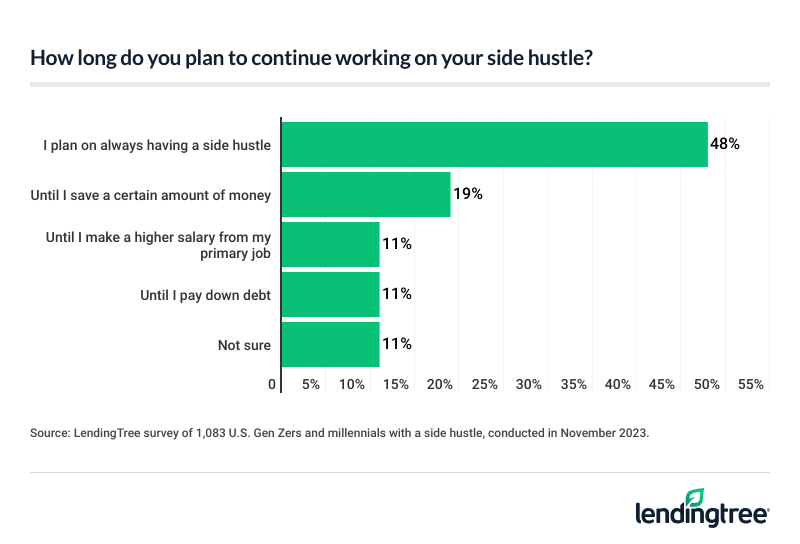

- While side hustles vary, having one is becoming the norm. Nearly half (48%) of Gen Zers and millennials with a side hustle plan to always have one. When these hustlers were asked about their second source of income, the top answers were making and selling items on sites like Etsy (19%); babysitting, pet sitting or caretaking (19%); and delivering food or groceries (16%). Additionally, 8% engage in illicit activities such as illegal substance sales.

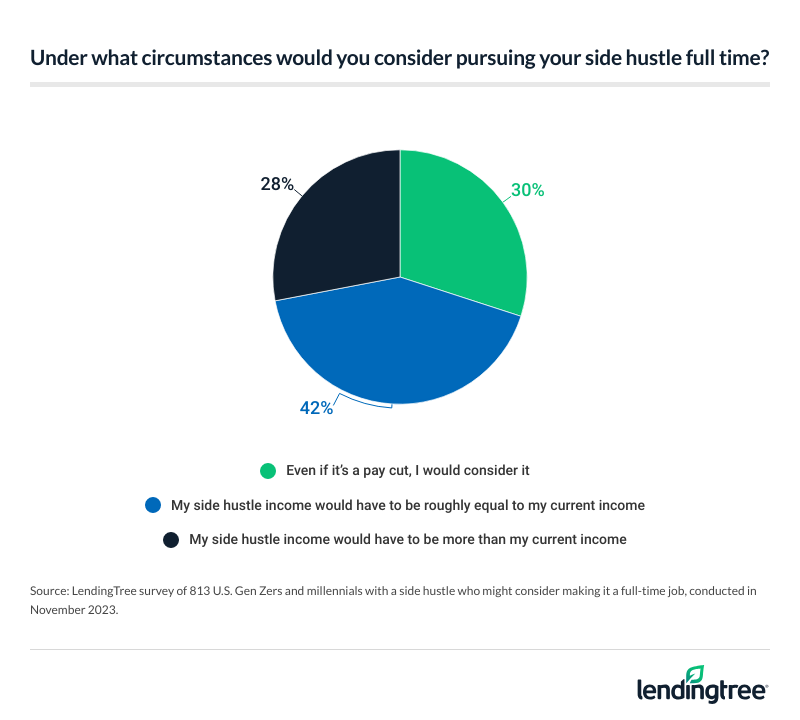

- Side hustles may turn into full-time hustles for some. 45% of young hustlers would consider making their side hustle their full-time job. When asked what it would take to make the transition, 42% of those considering it would do it if their side hustle made as much money as their full-time job. Meanwhile, 30% would consider doing it even with a pay cut. Currently, 55% of side hustlers spend less than 10 hours a week on their gig.

55% of young Americans have a side hustle

Side hustles are common among young Americans. In fact, 55% of Gen Zers ages 18 to 26 and millennials ages 27 to 42 have a side hustle. Breaking that down further, young men (58%) are more likely to have a job on the side than young women (51%).

By income group, six-figure earners (62%) are the most likely to have a side hustle, while those making less than $35,000 (50%) are least likely. Meanwhile, 57% of Gen Zers and millennials with children younger than 18 have a side hustle. That compares with 53% of those without children.

How much are young Americans making on the side? On average, they’re bringing in $1,253 a month in supplemental income. Notably, men with a side gig ($1,589) make significantly more than women ($898). Gen Zers earn $1,505 a month on average, while millennials earn $1,119.

When asked what drove them to start their side gig, 40% of these young Americans said inflation — the most common response. Following that, 38% cited economic fallout from the pandemic, 28% said rising interest rates and/or the current economy and 13% cited stock market dips.

LendingTree chief consumer finance analyst Matt Schulz says it’s understandable so many young Americans have picked up a side gig to make ends meet. “It’s been a tough few years for many younger Americans, many of whom have a smaller financial margin for error than their older counterparts,” he says. “Because of that, lots of younger Americans have chosen to take matters into their own hands. For many, that means a side hustle.”

With that in mind, it’s worth noting that most side hustlers are relatively new to the game: Among these young Americans, 37% have had their side hustle between one and two years, while 29% have had it for less than a year. That leaves 34% who’ve had a side gig for two years or more.

Side hustlers are reliant on their supplemental incomes

Having a side hustle doesn’t necessarily mean chasing dreams. For today’s hustlers, it means chasing dollars. Among young Americans with side gigs, 80% say the current economy has made them more reliant on the income from it. That’s especially true for those with children younger than 18 (83%), those earning less than $35,000 (83%) and those earning between $50,000 and $74,999 (83%).

According to Schulz, relying on extra income isn’t necessarily bad, though it may mean you’re in a tough spot.

“Having multiple sources of income can be good because it gives you a bit of a safety net,” he says. “However, if you’re relying on multiple revenue streams to get by, it probably means you’re not able to get ahead. You probably don’t have much money to put aside for emergencies, retirement, college, mortgage down payments or other goals. That may not seem big when you’re young, but it’s significant. That’s because time is your most powerful asset when building wealth. The longer you wait to save and invest, the greater the opportunity cost.”

Beyond being reliant on their side hustles, 52% say they have a side hustle because they need the money to pay their primary expenses or bills. While that may not be a driving factor for some, just 21% of young side hustlers believe they definitely would be able to pay off all their bills if their side hustle disappeared tomorrow. Beyond paying bills, the top reasons Gen Zers and millennials have side hustles are to:

- Have money for discretionary spending or saving (34%)

- Fill their spare time (26%)

- Pursue their passions (21%)

- Diversify their income (20%)

If their side hustle disappeared, Gen Zers and millennials are most likely to say they’d have to stop dining out (51%) — the most common response. Following that, young side hustlers say they’d have to forgo shopping (47%), travel (39%), entertainment (33%) and streaming services (31%).

This comes as just less than 3 in 5 (58%) Gen Zers and millennials are employed full time.

Young Americans are in their side hustles for the long run

Having a side hustle isn’t temporary for some. In fact, 48% of Gen Zers and millennials with a side hustle plan to always have one. That’s especially true for six-figure earners (59%), those with children younger than 18 (52%) and millennials (51%). Following that, 19% of young Americans with a side hustle plan to have it until they save a certain amount of money.

While it’s understandable why so many people assume they’ll always have a side hustle, Schulz says many won’t always need one.

“Planning for the worst makes a lot of sense, especially in the wake of the economic issues so many Americans have faced in recent years,” he says. “The reality, however, is that they may not always need them. Tough times require tough choices, but not all times are tough. A side hustle may not be as necessary in a booming economy, for example.”

As far as what young Americans are doing on the side, making and selling items on sites like Etsy (19%) and babysitting, pet sitting or caretaking (19%) are the most common responses. Those are followed by:

- Delivering food or groceries (16%)

- Blogging/podcasting/content production (13%)

- Online freelancing (12%)

- Day trading (10%)

- E-commerce resale (10%)

- Bartending or serving (9%)

- Part-time or seasonal work (9%)

- Engaging in illicit activities such as illegal substance sales (8%)

- Doing handyman work (6%)

- Social media influencing (5%)

- Tutoring or teaching (3%)

- Working in direct sales and/or a multilevel marketing company (3%)

- House-sitting (3%)

- Fitness instructing (3%)

- Ride-sharing such as Uber or Lyft (2%)

- Running rental properties or vacation rentals like Airbnb (2%)

- Managing an OnlyFans (2%)

- Industry consulting (2%)

While Gen Zers are most likely to babysit or pet sit (28%), millennials are most likely to make and sell items on sites like Etsy (20%).

45% would turn their side gigs into full-time jobs

For young Americans, BYOB may mean being your own boss. In fact, 45% of young Americans with a side hustle would consider making it their full-time job, while another 30% are on the fence about it.

What would it take to make the transition? Among those considering it, 42% would go full time if their side hustle made as much money as their full-time job. Beyond that, 30% would consider doing it even with a pay cut, while 28% would only do it if their side hustle made them more money than their current job.

Schulz says there’s a ton of risk in changing a side hustle to a full-time job — and failing to consider some things can lead to some serious struggles for those who dive into their side hustle full time.

Side hustlers on the rise, and nearly 70% say they’re more reliant on the extra income due to inflation

“Even if the revenue from your side hustle matches your salary in your day job, that shouldn’t be the whole story,” he says. “For example, revenue from your side hustle may be inconsistent throughout the year while your day job’s paycheck is steady and predictable. Your day job may also provide bonuses, insurance coverage, 401(k) matches, tuition reimbursement and many other things that go beyond your base salary. That certainly doesn’t mean you shouldn’t make that move. It just means you need to do some serious homework before you take the plunge.”

Most side hustlers aren’t putting in anything near full-time hours. Across all young side hustlers, 55% spend less than 10 hours a week on their gig. Meanwhile, 36% spend between 10 and 20 hours a week on their side hustle and 9% spend more than 20 hours a week on it.

Clocking in for cash: Expert tips to maximize side gig profits

When it comes to having a side hustle, what you’re doing and how you’re using the cash can make a huge difference to your life. To help maximize your profits, Schulz offers the following advice:

- Make a plan. “It sounds basic, but it’s incredibly important and sometimes gets overlooked in the rush to get a business off the ground,” he says. “You can literally start a business in an afternoon for very little money in many cases, but taking the time to make a plan that includes goals, cost estimates, target audiences, key competitors and other details is crucial. Whether starting a brick-and-mortar business or a simple side hustle, success is far from guaranteed. A business plan can help push the odds a bit more in your favor.”

- Build savings and pay down debt simultaneously. “If you’re bringing in extra revenue with that side hustle, put it to good use,” Schulz says. “Focus on paying down high-interest debt, such as credit cards, while also building your emergency fund. Yes, it may take you longer and cost you a bit more to pay down that debt. However, if you have savings to lean on once your debt gets down to $0, you’ll be better prepared to handle the next unexpected expense. That means the next time the dog has to be rushed to the vet or you have a flat tire, you can pay it off with cash rather than dumping it on your credit card. That’s how you break the cycle of debt that so many people find themselves trapped in.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 1,984 Gen Zers and millennials ages 18 to 42 from Nov. 16 to 20, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

Get debt consolidation loan offers from up to 5 lenders in minutes