Best Homeowners Insurance in Alabama

Allstate offers the cheapest home insurance in Alabama, with rates that average $2,228 a year, or $186 a month. Farmers and USAA are also great options for their affordable rates, coverage options and customer service.

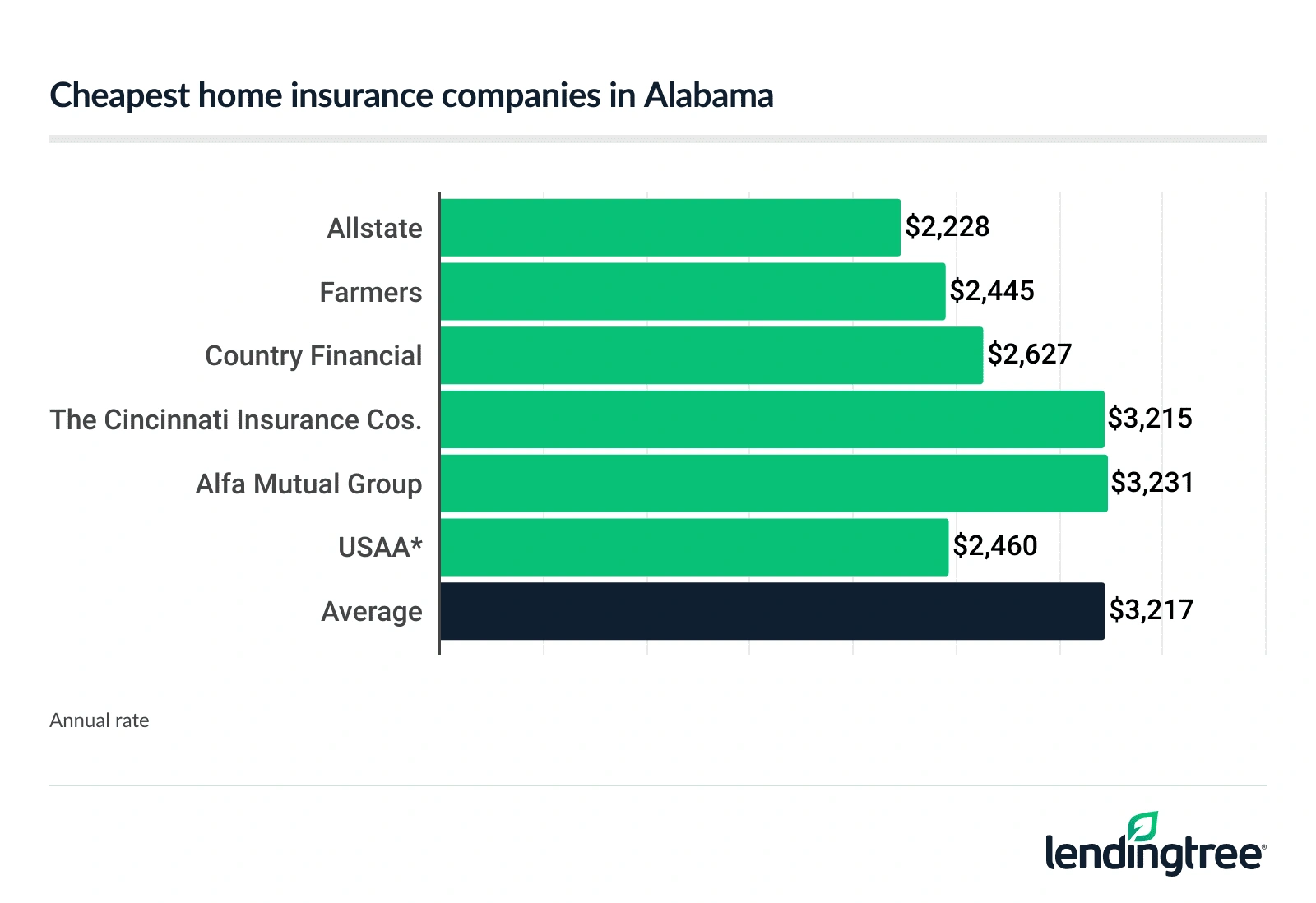

Cheapest home insurance companies in Alabama

Allstate is the cheapest homeowners insurance company in Alabama, with an average rate of $2,228 a year for $400,000 in dwelling coverage. This is 23% cheaper than the national average of $2,801 a year.

Farmers is the next-cheapest option at $2,445 a year, on average.

| Company | Average annual rate | |

|---|---|---|

| Allstate | $2,228 |

| Farmers | $2,445 |

| Country Financial | $2,627 |

| The Cincinnati Insurance Cos. | $3,215 |

| Alfa Mutual Group | $3,231 |

| State Farm | $3,287 |

| Nationwide | $3,825 |

| Travelers | $5,639 |

| USAA* | $2,460 |

Best home insurance companies in Alabama

Allstate, Farmers and USAA are the best home insurance companies in Alabama based on their average rates, customer satisfaction ratings, coverages and complaint scores.

- Allstate is our overall pick for homeowners in Alabama

- Farmers is our pick for best coverages in Alabama

- USAA is the best option for military personnel and veterans

| Company | Average annual rate | Customer satisfaction rating | LendingTree score |

|---|---|---|---|

| Allstate | $2,228 | 809 |  |

| Farmers | $2,445 | 800 |  |

| Country Financial | $2,627 | 819 | Not rated |

| The Cincinnati Insurance Cos. | $3,215 | Not rated | Not rated |

| Alfa Mutual Group | $3,231 | Not rated | Not rated |

| State Farm | $3,287 | 829 |  |

| Nationwide | $3,825 | 812 |  |

| Travelers | $5,639 | 790 |  |

| USAA* | $2,460 | 881 |  |

- Cheap rates

- Offers a multi-policy discount of up to 25% off

- Offers discounts that are easy to qualify for

- Has a subpar customer satisfaction score from J.D. Power

- Low average rate

- Offers Building Ordinance coverage for upgrades required by law

- Offers a variety of discounts

- Below average customer satisfaction score from J.D. Power

- Excellent customer satisfaction score from J.D. Power

- Offers replacement cost coverage for your items

- Only available to military members and veterans, as well as their families

How much is home insurance in Alabama?

The average annual cost of home insurance in Alabama is $3,217, which is 14% higher than the national average rate. Your home insurance rates depend on many factors, which can include:

- Your location

- The amount of coverage you need

- The deductible amount you choose

- Your claims history

- The age and condition of your home

Home insurance rates can vary greatly based on the amount of dwelling coverage you need. Your dwelling coverage amount should equal the cost of rebuilding your home. For example, raising your dwelling coverage from $350,000 to $400,000 can increase your rate by 12%, on average.

| Dwelling coverage | Average annual rate |

|---|---|

| $350,000 | $2,881 |

| $400,000 | $3,217 |

| $450,000 | $3,549 |

Insurance companies may be able to estimate your home’s replacement value based on the square footage, location, age of your home and more.

Alabama home insurance rates by city

Your location can also have a big impact on your home insurance rate. Among the most populated cities in Alabama, average home insurance rates range from $2,455 a year in Auburn to $5,101 a year in Mobile.

Mobile is close to both the Gulf of Mexico and Mobile Bay, which is why home insurance rates tend to be high there.

| City | Average annual rate

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

|

|---|---|

| Abbeville | $2,911 |

| Abernant | $4,294 |

| Adamsville | $2,854 |

| Adger | $2,940 |

| Akron | $3,184 |

| Alabaster | $2,339 |

| Albertville | $3,173 |

| Alexander City | $2,518 |

| Alexandria | $2,950 |

| Allgood | $4,735 |

| Alpine | $3,069 |

| Alton | $4,239 |

| Andalusia | $2,997 |

| Anderson | $3,104 |

| Annemanie | $3,004 |

| Anniston | $2,944 |

| Arab | $3,197 |

| Ardmore | $3,036 |

| Argo | $2,888 |

| Ariton | $3,035 |

| Arley | $3,481 |

| Arlington | $3,221 |

| Ashford | $2,871 |

| Ashland | $3,106 |

| Ashville | $3,264 |

| Athens | $2,762 |

| Atmore | $3,113 |

| Attalla | $3,040 |

| Auburn | $2,455 |

| Auburn University | $3,931 |

| Axis | $7,205 |

| Babbie | $3,038 |

| Baileyton | $3,291 |

| Ballplay | $3,193 |

| Banks | $2,854 |

| Bankston | $3,407 |

| Bay Minette | $4,285 |

| Bayou La Batre | $8,162 |

| Beaverton | $3,400 |

| Belk | $3,172 |

| Bellamy | $3,959 |

| Belle Fontaine | $8,133 |

| Belle Mina | $4,427 |

| Bellwood | $3,394 |

| Berry | $3,415 |

| Bessemer | $2,888 |

| Billingsley | $2,964 |

| Birmingham | $2,906 |

| Black | $3,249 |

| Blue Ridge | $2,598 |

| Boaz | $3,277 |

| Boligee | $3,868 |

| Bon Air | $4,430 |

| Bon Secour | $5,396 |

| Booth | $4,272 |

| Boykin | $3,004 |

| Brent | $3,044 |

| Brewton | $2,810 |

| Bridgeport | $3,213 |

| Brierfield | $2,826 |

| Brighton | $2,957 |

| Brilliant | $3,555 |

| Brook Highland | $2,339 |

| Brooklyn | $4,491 |

| Brookside | $2,945 |

| Brookwood | $2,776 |

| Brownsboro | $2,687 |

| Brundidge | $2,865 |

| Bryant | $3,314 |

| Bucks | $4,793 |

| Buhl | $2,800 |

| Burnwell | $4,556 |

| Bynum | $4,610 |

| Calera | $2,438 |

| Calvert | $3,819 |

| Camden | $3,063 |

| Camp Hill | $2,491 |

| Campbell | $3,120 |

| Capshaw | $2,825 |

| Carbon Hill | $3,611 |

| Cardiff | $4,227 |

| Carlisle-Rockledge | $3,150 |

| Carlton | $2,998 |

| Carrollton | $3,215 |

| Catherine | $3,073 |

| Cecil | $2,851 |

| Cedar Bluff | $3,280 |

| Center Point | $2,885 |

| Centre | $3,347 |

| Centreville | $3,045 |

| Chancellor | $2,899 |

| Chapman | $4,328 |

| Chatom | $3,603 |

| Chelsea | $2,431 |

| Cherokee | $3,392 |

| Chickasaw | $4,589 |

| Childersburg | $3,025 |

| Choccolocco | $2,943 |

| Chunchula | $4,049 |

| Citronelle | $3,501 |

| Clanton | $2,931 |

| Clay | $4,216 |

| Clinton | $4,341 |

| Clopton | $3,028 |

| Cloverdale | $4,545 |

| Coaling | $2,677 |

| Coats Bend | $3,048 |

| Coden | $7,784 |

| Coffee Springs | $3,007 |

| Columbia | $2,945 |

| Columbiana | $2,559 |

| Cook Springs | $2,940 |

| Coosada | $2,663 |

| Cordova | $3,479 |

| Cottondale | $2,643 |

| Cottonton | $4,241 |

| Courtland | $3,270 |

| Cowarts | $2,822 |

| Coy | $3,198 |

| Cragford | $2,863 |

| Creola | $4,914 |

| Cropwell | $3,144 |

| Crossville | $3,237 |

| Cuba | $3,950 |

| Cullman | $2,984 |

| Cusseta | $2,743 |

| Dadeville | $2,507 |

| Daleville | $2,915 |

| Daphne | $5,932 |

| Dauphin Island | $13,146 |

| Daviston | $2,594 |

| Dawson | $3,299 |

| De Armanville | $4,503 |

| Deatsville | $2,567 |

| Decatur | $2,867 |

| Deer Park | $3,491 |

| Delmar | $4,844 |

| Delta | $2,978 |

| Demopolis | $2,870 |

| Detroit | $3,604 |

| Dickinson | $3,087 |

| Dixons Mills | $3,178 |

| Docena | $2,974 |

| Dolomite | $3,024 |

| Dora | $3,088 |

| Dothan | $2,676 |

| Dozier | $3,000 |

| Duncanville | $2,708 |

| Dunnavant | $2,560 |

| Dutton | $3,122 |

| East Brewton | $2,774 |

| East Tallassee | $4,049 |

| Eastaboga | $3,015 |

| Echola | $2,789 |

| Edgewater | $3,104 |

| Edwardsville | $3,111 |

| Eight Mile | $4,721 |

| Elba | $3,122 |

| Eldridge | $3,579 |

| Elkmont | $2,929 |

| Elmore | $2,667 |

| Elrod | $2,793 |

| Emelle | $3,837 |

| Emerald Mountain | $2,643 |

| Enterprise | $2,737 |

| Epes | $3,734 |

| Equality | $2,828 |

| Estillfork | $3,212 |

| Eufaula | $3,144 |

| Eutaw | $3,903 |

| Evergreen | $3,034 |

| Excel | $4,351 |

| Fackler | $3,292 |

| Fairfield | $2,949 |

| Fairhope | $6,575 |

| Fairview | $3,143 |

| Falkville | $3,119 |

| Fayette | $3,352 |

| Five Points | $3,097 |

| Flat Rock | $3,349 |

| Florala | $3,103 |

| Florence | $3,050 |

| Foley | $5,270 |

| Forest Home | $2,773 |

| Forestdale | $2,974 |

| Forkland | $3,907 |

| Fort Deposit | $3,995 |

| Fort Mitchell | $2,724 |

| Fort Payne | $3,148 |

| Fort Rucker | $2,928 |

| Franklin | $3,134 |

| Frankville | $3,471 |

| Fulton | $3,006 |

| Fultondale | $2,615 |

| Furman | $4,476 |

| Gadsden | $2,942 |

| Gainestown | $3,094 |

| Gallant | $3,268 |

| Gallion | $3,089 |

| Gantt | $4,388 |

| Garden City | $3,193 |

| Gardendale | $2,605 |

| Gaylesville | $3,122 |

| Geneva | $2,974 |

| Georgiana | $2,874 |

| Geraldine | $3,425 |

| Gilbertown | $3,136 |

| Glen Allen | $3,313 |

| Glencoe | $2,987 |

| Glenwood | $2,934 |

| Good Hope | $3,079 |

| Goodsprings | $4,664 |

| Goodwater | $2,981 |

| Goodway | $4,281 |

| Gordonville | $3,999 |

| Goshen | $2,706 |

| Grady | $2,709 |

| Graham | $2,984 |

| Grand Bay | $6,278 |

| Grayson Valley | $2,721 |

| Graysville | $2,975 |

| Green Pond | $2,933 |

| Greensboro | $3,151 |

| Greenville | $2,747 |

| Grimes | $2,795 |

| Groveoak | $3,375 |

| Guin | $3,484 |

| Gulf Shores | $4,820 |

| Guntersville | $3,113 |

| Gurley | $2,907 |

| Hackleburg | $3,383 |

| Hackneyville | $2,597 |

| Haleyville | $3,370 |

| Hamilton | $3,408 |

| Hammondville | $3,328 |

| Hanceville | $3,221 |

| Hardaway | $3,372 |

| Harpersville | $2,706 |

| Hartford | $3,044 |

| Hartselle | $2,830 |

| Harvest | $2,775 |

| Hatchechubbee | $2,718 |

| Hayneville | $3,965 |

| Hazel Green | $2,961 |

| Headland | $2,773 |

| Heflin | $2,933 |

| Helena | $2,442 |

| Henagar | $3,413 |

| Higdon | $3,165 |

| Highland Home | $2,746 |

| Highland Lake | $3,180 |

| Highland Lakes | $2,400 |

| Hodges | $3,433 |

| Hokes Bluff | $3,015 |

| Hollins | $2,956 |

| Holly Pond | $3,159 |

| Hollytree | $3,282 |

| Hollywood | $3,161 |

| Holt | $2,634 |

| Holtville | $2,660 |

| Holy Trinity | $4,292 |

| Homewood | $2,712 |

| Honoraville | $2,870 |

| Hoover | $2,506 |

| Horton | $3,282 |

| Houston | $3,644 |

| Hueytown | $2,906 |

| Huguley | $2,935 |

| Huntsville | $2,746 |

| Huxford | $4,242 |

| Indian Springs Village | $2,402 |

| Irondale | $2,636 |

| Irvington | $7,920 |

| Ivalee | $3,132 |

| Jachin | $4,020 |

| Jack | $2,858 |

| Jackson | $2,981 |

| Jacksons Gap | $2,475 |

| Jacksonville | $2,990 |

| Jasper | $3,326 |

| Jefferson | $4,419 |

| Jemison | $2,742 |

| Jones | $3,037 |

| Joppa | $3,247 |

| Kansas | $3,590 |

| Kellerman | $4,240 |

| Kellyton | $2,760 |

| Kennedy | $3,305 |

| Kent | $4,231 |

| Kimberly | $2,808 |

| Kinsey | $2,740 |

| Kinston | $2,948 |

| Knoxville | $3,857 |

| La Fayette | $2,874 |

| Lanett | $2,908 |

| Langston | $3,142 |

| Lapine | $2,975 |

| Lawley | $2,932 |

| Leeds | $2,671 |

| Lenox | $3,178 |

| Leroy | $3,299 |

| Lester | $2,925 |

| Letohatchee | $4,241 |

| Level Plains | $2,863 |

| Lexington | $3,188 |

| Lillian | $4,458 |

| Lincoln | $2,998 |

| Linden | $2,974 |

| Lineville | $2,903 |

| Lipscomb | $2,993 |

| Little River | $3,559 |

| Littleville | $3,421 |

| Livingston | $4,022 |

| Loachapoka | $4,169 |

| Lockhart | $3,245 |

| Locust Fork | $3,239 |

| Lookout Mountain | $3,061 |

| Lower Peach Tree | $3,044 |

| Loxley | $3,513 |

| Luverne | $2,839 |

| Lynn | $3,740 |

| Madison | $2,731 |

| Magnolia | $2,987 |

| Magnolia Springs | $3,867 |

| Malcolm | $3,707 |

| Malvern | $2,800 |

| Marbury | $2,840 |

| Margaret | $2,911 |

| Marion | $4,394 |

| Marion Junction | $3,617 |

| Mathews | $2,762 |

| Maxwell Air Force Base | $2,742 |

| Maxwell Air Force Base Gunter Annex | $2,670 |

| Maylene | $2,393 |

| Mc Shan | $3,127 |

| Mc Williams | $4,361 |

| McCalla | $2,761 |

| McDonald Chapel | $3,114 |

| McKenzie | $2,819 |

| Meadowbrook | $2,388 |

| Megargel | $4,342 |

| Melvin | $3,068 |

| Mentone | $3,233 |

| Meridianville | $2,824 |

| Mexia | $4,342 |

| Midfield | $3,005 |

| Midland City | $2,781 |

| Millbrook | $2,653 |

| Millerville | $2,956 |

| Minor | $3,127 |

| Minter | $3,811 |

| Mobile | $5,101 |

| Monroeville | $4,307 |

| Montevallo | $2,502 |

| Montgomery | $2,615 |

| Montrose | $6,425 |

| Moody | $2,797 |

| Moores Mill | $2,862 |

| Mooresville | $2,832 |

| Morris | $2,889 |

| Morvin | $3,036 |

| Moulton | $3,298 |

| Moundville | $3,083 |

| Mount Olive | $2,728 |

| Mountain Brook | $2,515 |

| Mulga | $3,046 |

| Muscadine | $3,096 |

| Muscle Shoals | $2,995 |

| Myrtlewood | $3,121 |

| Nanafalia | $4,556 |

| Napier Field | $2,796 |

| Natural Bridge | $4,761 |

| Needham | $3,116 |

| New Brockton | $2,808 |

| New Castle | $2,816 |

| New Hope | $2,858 |

| New Site | $2,562 |

| Newton | $2,813 |

| Newville | $2,853 |

| Normal | $4,379 |

| Northport | $2,565 |

| Notasulga | $2,931 |

| Oak Hill | $4,476 |

| Odenville | $2,885 |

| Ohatchee | $3,181 |

| Oneonta | $3,108 |

| Opelika | $2,502 |

| Opp | $2,927 |

| Orange Beach | $3,906 |

| Our Town | $2,568 |

| Owens Cross Roads | $2,739 |

| Oxford | $2,848 |

| Ozark | $2,791 |

| Paint Rock | $3,122 |

| Palmerdale | $4,139 |

| Panola | $3,747 |

| Pansey | $2,948 |

| Parrish | $3,468 |

| Pelham | $2,360 |

| Pell City | $2,904 |

| Pennington | $3,180 |

| Perdido | $3,593 |

| Perdido Beach | $6,570 |

| Perdue Hill | $2,892 |

| Perote | $4,368 |

| Peterman | $2,949 |

| Peterson | $4,195 |

| Petrey | $4,353 |

| Phenix City | $2,590 |

| Phil Campbell | $3,488 |

| Piedmont | $3,284 |

| Pike Road | $2,684 |

| Pinckard | $2,774 |

| Pine Level | $2,726 |

| Pinson | $2,791 |

| Pisgah | $3,284 |

| Pittsview | $2,825 |

| Plantersville | $3,444 |

| Pleasant Grove | $2,782 |

| Point Clear | $7,885 |

| Powell | $3,269 |

| Prairie | $3,073 |

| Prattville | $2,613 |

| Priceville | $2,925 |

| Prichard | $4,869 |

| Princeton | $3,213 |

| Quinton | $3,331 |

| Rainbow City | $2,952 |

| Rainsville | $3,245 |

| Ralph | $2,772 |

| Randolph | $2,991 |

| Range | $3,179 |

| Red Bay | $3,248 |

| Red Level | $2,871 |

| Redland | $2,644 |

| Reeltown | $2,687 |

| Rehobeth | $2,802 |

| Remlap | $3,243 |

| River Falls | $2,839 |

| Riverside | $2,956 |

| Roanoke | $3,031 |

| Robertsdale | $5,949 |

| Rock Mills | $2,976 |

| Rockford | $2,931 |

| Rogersville | $3,268 |

| Russellville | $3,455 |

| Rutledge | $2,960 |

| Ryland | $4,423 |

| Safford | $3,938 |

| Saginaw | $4,060 |

| Saks | $2,975 |

| Salem | $2,707 |

| Samantha | $4,241 |

| Samson | $3,075 |

| Saraland | $4,549 |

| Sardis City | $3,226 |

| Satsuma | $4,490 |

| Sayre | $2,693 |

| Scottsboro | $3,173 |

| Seale | $2,875 |

| Selma | $3,331 |

| Selmont-West Selmont | $3,430 |

| Seminole | $6,590 |

| Shannon | $4,119 |

| Sheffield | $2,978 |

| Shelby | $2,532 |

| Shoal Creek | $2,406 |

| Shorter | $2,930 |

| Shorterville | $3,095 |

| Siluria | $4,030 |

| Silverhill | $6,854 |

| Sipsey | $3,212 |

| Skipperville | $3,018 |

| Slocomb | $2,950 |

| Smiths Station | $2,647 |

| Smoke Rise | $2,999 |

| Southside | $2,971 |

| Spanish Fort | $4,942 |

| Spring Garden | $4,690 |

| Spruce Pine | $3,545 |

| St. Elmo | $5,167 |

| St. Stephens | $3,400 |

| Stanton | $2,866 |

| Stapleton | $8,335 |

| Steele | $3,030 |

| Sterrett | $2,657 |

| Stevenson | $3,306 |

| Stewartville | $3,049 |

| Sulligent | $3,355 |

| Sumiton | $3,193 |

| Sunflower | $3,532 |

| Susan Moore | $3,353 |

| Sycamore | $3,026 |

| Sylacauga | $2,941 |

| Sylvania | $3,390 |

| Talladega | $2,983 |

| Tallassee | $2,731 |

| Tanner | $2,916 |

| Tarrant | $2,905 |

| Taylor | $2,714 |

| Theodore | $5,944 |

| Thomasville | $3,060 |

| Thorsby | $2,833 |

| Tibbie | $3,536 |

| Tidmore Bend | $3,008 |

| Tillmans Corner | $5,618 |

| Toney | $2,871 |

| Town Creek | $3,221 |

| Toxey | $3,071 |

| Trafford | $3,262 |

| Trenton | $3,145 |

| Trinity | $3,000 |

| Troy | $3,105 |

| Trussville | $2,622 |

| Tuscaloosa | $2,662 |

| Tuscumbia | $2,998 |

| Tuskegee | $2,979 |

| Tuskegee Institute | $2,961 |

| Tyler | $3,610 |

| Underwood-Petersville | $2,990 |

| Union Springs | $3,786 |

| Uniontown | $3,776 |

| Valhermoso Springs | $2,903 |

| Valley | $2,849 |

| Valley Grande | $3,407 |

| Valley Head | $3,380 |

| Vance | $2,950 |

| Vandiver | $2,723 |

| Vernon | $3,287 |

| Vestavia Hills | $2,544 |

| Vina | $3,370 |

| Vincent | $2,830 |

| Vinegar Bend | $3,574 |

| Wagarville | $3,530 |

| Walnut Grove | $3,320 |

| Ward | $4,018 |

| Warrior | $2,779 |

| Watson | $4,231 |

| Wattsville | $4,565 |

| Waverly | $2,708 |

| Weaver | $2,963 |

| Webb | $2,809 |

| Wellington | $3,054 |

| Weogufka | $3,094 |

| West End-Cobb Town | $3,019 |

| West Greene | $4,332 |

| Westover | $4,190 |

| Wetumpka | $2,660 |

| Whatley | $3,043 |

| White Plains | $2,985 |

| Wilmer | $6,228 |

| Wilton | $4,198 |

| Winfield | $3,520 |

| Wing | $3,094 |

| Woodstock | $2,968 |

| Woodville | $3,215 |

| York | $3,782 |

Additional home insurance coverages needed in Alabama

Tornadoes, hurricanes and floods can occur in Alabama. A standard home insurance policy will cover some natural disasters, but you need a separate policy for flood coverage.

Flood insurance

Home insurance policies will not cover damages from floods. However, you can buy flood insurance through the National Flood Insurance Program (NFIP) or from private flood insurance companies. The NFIP offers up to $250,000 in building coverage for your home and up to $100,000 in contents coverage for your personal belongings. The average cost of flood insurance in Alabama is $762 a year, however, your rate will vary by your exact location.

If you live in a high-risk flood zone and have a mortgage, your lender will most likely require you to buy flood insurance.

Wind damage

Standard homeowners insurance policies usually cover wind damage, which can help protect you against tornadoes and hurricanes.

If you want to be better protected against hurricane damage, we recommend buying both a home insurance policy and flood insurance. Standard home insurance policies don’t cover flood damage from a hurricane.

Methodology

The rates shown in this article are based on non-binding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in Alabama. The following coverages and deductible were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

Overall satisfaction ratings were obtained from J.D. Power’s 2023 U.S. Home Insurance Study. The agency’s scores are based on customer surveys that rate insurance companies on factors including price, policy offerings and claims.

Complaint ratings are based on NAIC Complaint Index data from 2023. A company with a 2.0 Complaint Index score has twice as many confirmed complaints as expected for its size. A company with a 0.5 rating has half as many.

*USAA only provides insurance to currently serving and retired military personnel, and their families.