Best Homeowners Insurance in Arkansas

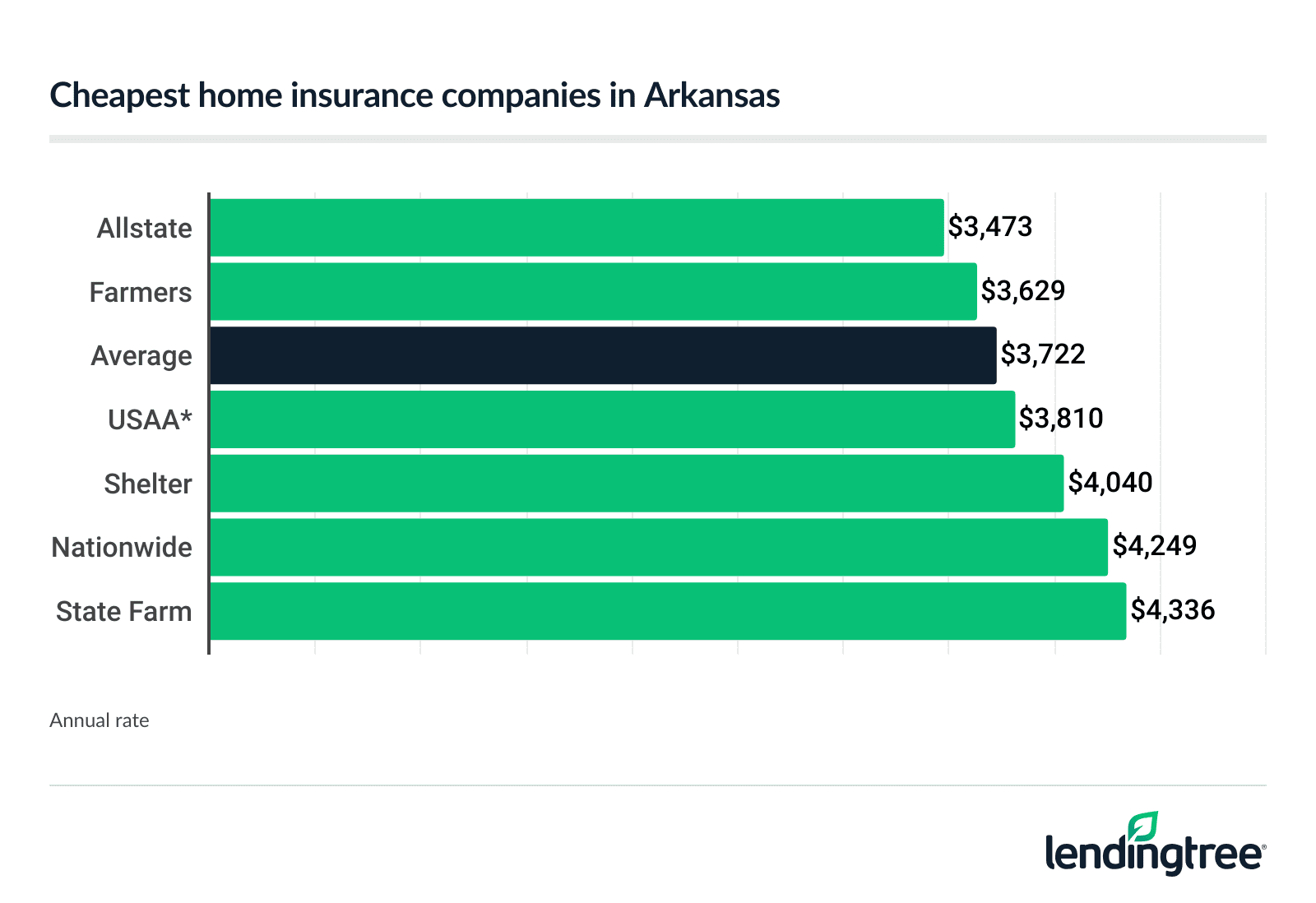

Allstate has the best average rate for Arkansas homeowners insurance, at $289 a month. It also has the best selection of discounts.

Best cheap home insurance companies in Arkansas

Arkansas’ cheapest home insurance companies

Farmers is the second-cheapest choice, at $3,629 a year.

Cheapest quotes in Arkansas

| Company | Average annual rate | LendingTree score | |

|---|---|---|---|

| Allstate | $3,473 | |

| Farmers | $3,629 | |

| USAA* | $3,810 | |

| Shelter | $4,040 | Not rated |

| Nationwide | $4,249 | |

| State Farm | $4,336 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. *USAA is only available to active-duty and veteran military members and their families.

Best homeowners insurance companies in Arkansas

Allstate has the cheapest home insurance rates and best discount options.

Meanwhile, Shelter has the best NAIC Complaint Index rating and USAA has the best benefits for military personnel.

Best Arkansas home insurance companies

| Company | Average annual rate | Customer satisfaction Customer satisfaction scores are from J.D. Power’s 2023 U.S. Home Insurance Study. | Complaint index Complaint index ratings come from the National Association of Insurance Commissioners (NAIC). Lower scores are better; 1.0 is average. |

|---|---|---|---|

| Allstate | $3,473 | 868 | 1.79 |

| Shelter | $4,040 | Not rated | 0.31 |

| USAA | $3,810 | 899 | Not rated |

| Average | $3,722 in Arkansas | 869 | 1.0 |

Cheapest rates and best discounts: Allstate

Annual rate: $3,473

![]()

Pros

Wide range of discounts

Low annual rate in Arkansas

No banned breed dog list

Cons

More complaints than average

Doesn’t offer extended replacement cost coverage

Allstate has Arkansas’ cheapest home insurance rate of $3,473 a year, on average. It also offers many discounts to lower your premium even more.

If you bundle your home and auto insurance with Allstate, you could save up to 25% on your premiums. It also gives discounts for:

- Buying a newly constructed home

- Early policy signing

- Automatic payment sign-up

- Installing fire alarms or other safety systems

- Loyalty

Best complaint index rating: Shelter

Annual rate: $4,040

Pros

Excellent complaint rating

Good discounts

Cons

No 24/7 customer service

Premium higher than Arkansas average rate

Shelter has a National Association of Insurance Commissioners (NAIC) Complaint Index rating of 0.31. This is the best complaint rating of the homeowners insurance companies we surveyed in Arkansas. The NAIC Complaint Index rates insurance companies based on claim-based complaints they receive, compared to similar-sized companies.

Best for military members: USAA

Annual rate: $3,810

![]()

Pros

Top-tier claims satisfaction

Active-duty service members get coverage for military equipment and uniforms with no deductible

Personal property coverage at replacement cost

Cons

Only available to active-duty and veteran military and their families

Few discounts compared to competitors

No dedicated agents

USAA has homeowners insurance policy offerings tailored to active-duty and veteran military members. Both USAA’s claims satisfaction and complaint index ratings are excellent.

Cost of homeowners insurance in Arkansas

Insurers calculate your home insurance quote by weighing different risk factors, including your:

- ZIP code

- Home’s age and construction materials

- Coverage limits and deductible

- Insurance claim history

Standard home insurance policies tend to be similar from company to company. However, as you can see, premiums vary. This is due to homeowners insurance companies weighing risk factors differently.

Arkansas home insurance rates by coverage amounts

The dwelling coverage limit you choose impacts the price of your homeowners insurance policy. The higher the limit, the higher your premium.

Average annual rate by dwelling coverage

| Dwelling coverage limit | Average annual rate |

|---|---|

| $350,000 | $3,357 |

| $400,000 | $3,722 |

| $450,000 | $4,126 |

If you want to save money on your home insurance costs, consider raising your deductible. The higher your deductible, the lower your annual premium.

Arkansas home insurance rates by city

Average home insurance rate by city

| City |

Average annual rate

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

|

|---|---|

| Adona | $3,685 |

| Alexander | $3,695 |

| Alicia | $3,440 |

| Alix | $3,777 |

| Alleene | $4,022 |

| Alma | $3,996 |

| Almyra | $3,658 |

| Alpena | $3,607 |

| Alpine | $3,846 |

| Altheimer | $3,791 |

| Altus | $3,854 |

| Amagon | $3,999 |

| Amity | $3,870 |

| Antoine | $3,845 |

| Arkadelphia | $3,894 |

| Arkansas City | $3,767 |

| Armorel | $3,577 |

| Ash Flat | $3,638 |

| Ashdown | $4,066 |

| Atkins | $3,544 |

| Aubrey | $3,748 |

| Augusta | $3,774 |

| Austin | $3,716 |

| Avoca | $3,473 |

| Bald Knob | $3,941 |

| Banks | $3,949 |

| Barling | $3,871 |

| Barton | $3,737 |

| Bass | $3,556 |

| Bassett | $3,576 |

| Batesville | $3,526 |

| Bauxite | $3,756 |

| Bay | $3,600 |

| Bearden | $3,851 |

| Bee Branch | $3,416 |

| Beebe | $3,726 |

| Beech Grove | $3,577 |

| Beedeville | $3,901 |

| Beirne | $3,844 |

| Bella Vista | $3,470 |

| Belleville | $3,654 |

| Ben Lomond | $4,069 |

| Benton | $3,780 |

| Bentonville | $3,603 |

| Bergman | $3,632 |

| Berryville | $3,605 |

| Bethel Heights | $3,442 |

| Bexar | $3,554 |

| Big Flat | $3,502 |

| Bigelow | $3,479 |

| Biggers | $3,404 |

| Bismarck | $3,827 |

| Black Oak | $3,627 |

| Black Rock | $3,562 |

| Blevins | $4,164 |

| Bluff City | $4,060 |

| Bluffton | $3,650 |

| Blytheville | $3,823 |

| Board Camp | $3,776 |

| Boles | $3,711 |

| Bonnerdale | $3,790 |

| Bono | $3,594 |

| Booneville | $3,785 |

| Bradford | $3,873 |

| Bradley | $4,028 |

| Branch | $3,724 |

| Brickeys | $3,925 |

| Briggsville | $3,636 |

| Brinkley | $4,003 |

| Brockwell | $4,177 |

| Brookland | $3,609 |

| Bruno | $3,552 |

| Bryant | $3,736 |

| Buckner | $3,949 |

| Bull Shoals | $3,381 |

| Burdette | $3,628 |

| Cabot | $3,655 |

| Caddo Gap | $3,935 |

| Caldwell | $4,037 |

| Cale | $4,006 |

| Calico Rock | $3,939 |

| Calion | $3,935 |

| Camden | $3,883 |

| Cammack Village | $3,339 |

| Camp | $3,568 |

| Canehill | $3,546 |

| Caraway | $3,594 |

| Carlisle | $3,687 |

| Carthage | $3,964 |

| Casa | $3,736 |

| Cash | $3,619 |

| Casscoe | $3,702 |

| Caulksville | $3,753 |

| Cave City | $3,613 |

| Cave Springs | $3,527 |

| Cecil | $3,675 |

| Cedarville | $3,977 |

| Center Ridge | $3,576 |

| Centerton | $3,590 |

| Charleston | $3,684 |

| Charlotte | $3,511 |

| Cherokee Village | $3,606 |

| Cherry Valley | $3,985 |

| Chester | $3,655 |

| Chidester | $4,050 |

| Clarendon | $4,017 |

| Clarkedale | $3,672 |

| Clarkridge | $3,459 |

| Clarksville | $3,772 |

| Cleveland | $3,475 |

| Clinton | $3,481 |

| Coal Hill | $3,773 |

| College Station | $3,586 |

| Colt | $4,016 |

| Columbus | $4,203 |

| Combs | $3,384 |

| Compton | $3,740 |

| Concord | $3,386 |

| Conway | $3,470 |

| Cord | $3,473 |

| Corning | $3,588 |

| Cotter | $3,406 |

| Cotton Plant | $3,903 |

| Cove | $4,019 |

| Coy | $3,636 |

| Crawfordsville | $3,624 |

| Crocketts Bluff | $3,640 |

| Crossett | $4,078 |

| Crumrod | $3,758 |

| Curtis | $4,017 |

| Cushman | $3,550 |

| Damascus | $3,524 |

| Danville | $3,797 |

| Dardanelle | $3,644 |

| Datto | $3,539 |

| De Queen | $4,069 |

| De Valls Bluff | $3,831 |

| De Witt | $3,693 |

| Decatur | $3,669 |

| Deer | $3,813 |

| Delaplaine | $3,551 |

| Delaware | $3,692 |

| Delight | $3,902 |

| Dell | $3,657 |

| Dennard | $3,575 |

| Dermott | $4,004 |

| Des Arc | $3,792 |

| Desha | $3,517 |

| DeWitt | $3,678 |

| Diamond City | $3,614 |

| Diaz | $4,027 |

| Dierks | $4,229 |

| Doddridge | $3,996 |

| Dolph | $3,804 |

| Donaldson | $3,845 |

| Dover | $3,598 |

| Drasco | $3,361 |

| Driver | $3,618 |

| Dumas | $3,798 |

| Dyess | $3,712 |

| Earle | $3,588 |

| East Camden | $3,908 |

| East End | $3,642 |

| Edgemont | $3,398 |

| Edmondson | $3,549 |

| El Dorado | $3,848 |

| El Paso | $3,704 |

| Elaine | $3,813 |

| Elizabeth | $3,505 |

| Elkins | $3,463 |

| Elm Springs | $3,582 |

| Emerson | $3,770 |

| Emmet | $4,154 |

| England | $3,657 |

| Enola | $3,575 |

| Ethel | $3,674 |

| Etowah | $3,727 |

| Eudora | $4,119 |

| Eureka Springs | $3,589 |

| Evansville | $3,484 |

| Evening Shade | $3,692 |

| Everton | $3,667 |

| Fairfield Bay | $3,529 |

| Farmington | $3,524 |

| Fayetteville | $3,548 |

| Fifty Six | $4,027 |

| Fisher | $4,043 |

| Flippin | $3,383 |

| Floral | $3,421 |

| Fordyce | $3,891 |

| Foreman | $4,036 |

| Forrest City | $3,950 |

| Fort Smith | $3,839 |

| Fouke | $3,959 |

| Fountain Hill | $4,071 |

| Fox | $3,664 |

| Franklin | $4,292 |

| Fredonia (Biscoe) | $3,793 |

| Frenchmans Bayou | $3,668 |

| Friendship | $3,749 |

| Fulton | $4,168 |

| Gamaliel | $3,466 |

| Garfield | $3,503 |

| Garland City | $3,963 |

| Garner | $3,801 |

| Gassville | $3,421 |

| Gateway | $3,532 |

| Genoa | $3,925 |

| Gentry | $3,737 |

| Gepp | $3,556 |

| Gibson | $3,477 |

| Gilbert | $3,630 |

| Gillett | $3,686 |

| Gillham | $4,073 |

| Gilmore | $3,646 |

| Glencoe | $3,539 |

| Glenwood | $3,896 |

| Goodwin | $3,967 |

| Goshen | $3,662 |

| Gosnell | $3,836 |

| Gould | $3,694 |

| Grady | $3,745 |

| Grannis | $3,970 |

| Grapevine | $3,745 |

| Gravelly | $3,751 |

| Gravette | $3,587 |

| Green Forest | $3,945 |

| Greenbrier | $3,560 |

| Greenland | $3,521 |

| Greenway | $3,512 |

| Greenwood | $3,612 |

| Greers Ferry | $3,435 |

| Gregory | $3,831 |

| Griffithville | $3,853 |

| Grubbs | $3,952 |

| Guion | $4,376 |

| Gurdon | $3,889 |

| Guy | $3,580 |

| Hackett | $3,644 |

| Hagarville | $3,572 |

| Hamburg | $4,079 |

| Hampton | $3,970 |

| Hardy | $3,585 |

| Harrell | $3,946 |

| Harriet | $3,642 |

| Harrisburg | $3,921 |

| Harrison | $3,604 |

| Hartford | $3,664 |

| Hartman | $3,781 |

| Harvey | $3,792 |

| Haskell | $3,668 |

| Hasty | $3,715 |

| Hatfield | $4,111 |

| Hattieville | $3,604 |

| Havana | $3,802 |

| Haynes | $3,829 |

| Hazen | $3,801 |

| Heber Springs | $3,401 |

| Hector | $3,594 |

| Helena-West Helena | $3,817 |

| Henderson | $3,492 |

| Hensley | $3,727 |

| Hermitage | $3,970 |

| Heth | $3,857 |

| Hickory Plains | $3,704 |

| Hickory Ridge | $3,928 |

| Higden | $3,444 |

| Higginson | $3,818 |

| Highfill | $3,632 |

| Highland | $3,589 |

| Hindsville | $3,439 |

| Hiwasse | $3,524 |

| Holiday Island | $3,590 |

| Holly Grove | $4,000 |

| Hope | $4,188 |

| Horatio | $4,051 |

| Horseshoe Bend | $3,829 |

| Hot Springs | $3,613 |

| Hot Springs National Park | $3,626 |

| Hot Springs Village | $3,515 |

| Houston | $3,543 |

| Hoxie | $3,538 |

| Hughes | $3,677 |

| Humnoke | $3,687 |

| Humphrey | $3,670 |

| Hunter | $3,863 |

| Huntington | $3,712 |

| Huntsville | $3,514 |

| Huttig | $3,995 |

| Ida | $3,334 |

| Imboden | $3,500 |

| Ivan | $3,836 |

| Jacksonport | $3,989 |

| Jacksonville | $3,628 |

| Jasper | $3,732 |

| Jefferson | $3,845 |

| Jersey | $3,929 |

| Jerusalem | $3,580 |

| Jessieville | $3,633 |

| Johnson | $3,592 |

| Joiner | $3,681 |

| Jones Mill | $3,810 |

| Jonesboro | $3,593 |

| Judsonia | $3,815 |

| Junction City | $3,898 |

| Keiser | $3,709 |

| Kensett | $3,764 |

| Keo | $3,651 |

| Kibler | $3,986 |

| Kingsland | $3,917 |

| Kingston | $3,449 |

| Kirby | $3,943 |

| Knobel | $3,554 |

| Knoxville | $3,665 |

| La Grange | $3,855 |

| Lafe | $3,530 |

| Lake City | $3,594 |

| Lake Hamilton | $3,577 |

| Lake Village | $4,101 |

| Lakeview | $3,409 |

| Lamar | $3,670 |

| Lambrook | $3,831 |

| Landmark | $3,638 |

| Langley | $3,953 |

| Lavaca | $3,966 |

| Lawson | $3,845 |

| Leachville | $3,780 |

| Lead Hill | $3,591 |

| Leola | $3,740 |

| Lepanto | $3,982 |

| Leslie | $3,725 |

| Letona | $3,755 |

| Lewisville | $4,023 |

| Lexa | $3,846 |

| Lincoln | $3,545 |

| Little Flock | $3,451 |

| Little Rock | $3,650 |

| Little Rock Air Force Base | $3,774 |

| Lockesburg | $4,092 |

| Locust Grove | $3,478 |

| London | $3,616 |

| Lonoke | $3,699 |

| Lonsdale | $3,635 |

| Louann | $3,840 |

| Lowell | $3,439 |

| Luxora | $3,720 |

| Lynn | $3,581 |

| Mabelvale | $3,759 |

| Madison | $3,952 |

| Magazine | $3,778 |

| Magnolia | $3,753 |

| Malvern | $3,910 |

| Mammoth Spring | $3,554 |

| Manila | $3,797 |

| Mansfield | $3,796 |

| Marble Falls | $3,753 |

| Marcella | $3,594 |

| Marianna | $3,942 |

| Marion | $3,547 |

| Marked Tree | $3,973 |

| Marmaduke | $3,596 |

| Marshall | $3,672 |

| Marvell | $3,876 |

| Maumelle | $3,519 |

| Mayflower | $3,476 |

| Maynard | $3,406 |

| Maysville | $3,536 |

| Mc Caskill | $4,129 |

| Mc Crory | $3,879 |

| Mc Dougal | $3,550 |

| Mc Gehee | $3,891 |

| Mc Neil | $3,954 |

| Mc Rae | $3,721 |

| McAlmont | $3,651 |

| McCrory | $3,867 |

| McGehee | $3,894 |

| Melbourne | $3,892 |

| Mellwood | $3,821 |

| Mena | $3,963 |

| Menifee | $3,510 |

| Midland | $3,755 |

| Midway | $3,422 |

| Mineral Springs | $4,193 |

| Minturn | $3,555 |

| Monette | $3,646 |

| Monticello | $3,988 |

| Montrose | $4,079 |

| Moro | $3,882 |

| Morrilton | $3,668 |

| Morrow | $3,509 |

| Moscow | $4,042 |

| Mount Holly | $3,856 |

| Mount Ida | $3,909 |

| Mount Judea | $3,556 |

| Mount Pleasant | $4,039 |

| Mount Vernon | $3,514 |

| Mountain Home | $3,399 |

| Mountain Pine | $3,568 |

| Mountain View | $3,856 |

| Mountainburg | $3,755 |

| Mulberry | $3,743 |

| Murfreesboro | $3,969 |

| Nashville | $4,220 |

| Natural Dam | $3,677 |

| New Blaine | $3,627 |

| New Edinburg | $3,881 |

| Newark | $3,510 |

| Newhope | $4,089 |

| Newport | $4,026 |

| Norfork | $3,529 |

| Norman | $3,885 |

| Norphlet | $3,832 |

| North Crossett | $4,099 |

| North Little Rock | $3,596 |

| O Kean | $3,354 |

| Oak Grove | $3,597 |

| Oak Grove Heights | $3,602 |

| Oakland | $3,370 |

| Oark | $3,739 |

| Oden | $3,957 |

| Ogden | $4,033 |

| Oil Trough | $3,492 |

| Okolona | $3,868 |

| Ola | $3,799 |

| Omaha | $3,561 |

| Oneida | $3,804 |

| Onia | $3,727 |

| Osceola | $3,702 |

| Oxford | $3,963 |

| Ozan | $4,206 |

| Ozark | $3,818 |

| Ozone | $3,706 |

| Palestine | $3,984 |

| Pangburn | $3,759 |

| Paragould | $3,578 |

| Paris | $3,822 |

| Parkdale | $4,101 |

| Parkin | $3,906 |

| Parks | $3,809 |

| Paron | $3,627 |

| Parthenon | $3,702 |

| Patterson | $3,807 |

| Pea Ridge | $3,484 |

| Peach Orchard | $3,524 |

| Pearcy | $3,686 |

| Peel | $3,501 |

| Pelsor | $3,607 |

| Pencil Bluff | $3,832 |

| Perry | $3,637 |

| Perryville | $3,516 |

| Pettigrew | $3,450 |

| Pickens | $3,907 |

| Piggott | $3,520 |

| Pindall | $3,592 |

| Pine Bluff | $3,827 |

| Pineville | $3,885 |

| Piney | $3,595 |

| Plainview | $3,690 |

| Pleasant Grove | $3,739 |

| Pleasant Plains | $3,505 |

| Plumerville | $3,624 |

| Pocahontas | $3,422 |

| Pollard | $3,512 |

| Ponca | $3,749 |

| Poplar Grove | $3,811 |

| Portia | $3,509 |

| Portland | $4,102 |

| Pottsville | $3,559 |

| Poughkeepsie | $3,578 |

| Powhatan | $3,495 |

| Poyen | $3,719 |

| Prairie Creek | $3,493 |

| Prairie Grove | $3,516 |

| Prattsville | $3,719 |

| Prescott | $4,034 |

| Prim | $3,355 |

| Proctor | $3,597 |

| Pyatt | $3,568 |

| Quitman | $3,370 |

| Ratcliff | $3,713 |

| Ravenden | $3,552 |

| Ravenden Springs | $3,437 |

| Rector | $3,638 |

| Redfield | $3,802 |

| Reydell | $3,767 |

| Reyno | $3,487 |

| Rison | $3,672 |

| Rivervale | $3,895 |

| Rockwell | $3,573 |

| Roe | $4,002 |

| Rogers | $3,469 |

| Rohwer | $3,763 |

| Roland | $3,613 |

| Romance | $3,695 |

| Rose Bud | $3,786 |

| Rosie | $3,474 |

| Rosston | $4,029 |

| Rover | $3,701 |

| Royal | $3,640 |

| Rudy | $4,019 |

| Russell | $3,824 |

| Russellville | $3,564 |

| Saffell | $3,555 |

| Sage | $4,325 |

| Salem | $3,712 |

| Saratoga | $4,139 |

| Scotland | $3,459 |

| Scott | $3,760 |

| Scranton | $3,742 |

| Searcy | $3,794 |

| Sedgwick | $3,498 |

| Shannon Hills | $3,752 |

| Sheridan | $3,737 |

| Sherrill | $3,731 |

| Sherwood | $3,542 |

| Shirley | $3,431 |

| Sidney | $4,361 |

| Siloam Springs | $3,719 |

| Sims | $3,889 |

| Smackover | $3,846 |

| Smithville | $3,559 |

| Snow Lake | $3,607 |

| Solgohachia | $3,562 |

| Sparkman | $3,856 |

| Springdale | $3,492 |

| Springfield | $3,647 |

| St. Charles | $3,556 |

| St. Francis | $3,510 |

| St. Joe | $3,596 |

| St. Paul | $3,531 |

| Stamps | $4,044 |

| Star City | $3,731 |

| State University | $3,576 |

| Stephens | $4,001 |

| Story | $3,835 |

| Strawberry | $3,580 |

| Strong | $3,928 |

| Sturkie | $3,633 |

| Stuttgart | $3,638 |

| Subiaco | $3,815 |

| Success | $3,524 |

| Sulphur Rock | $3,507 |

| Sulphur Springs | $3,591 |

| Summers | $3,548 |

| Summit | $3,419 |

| Sweet Home | $3,588 |

| Swifton | $3,987 |

| Taylor | $3,916 |

| Texarkana | $3,968 |

| Thida | $3,446 |

| Thornton | $4,021 |

| Tichnor | $3,573 |

| Tillar | $3,889 |

| Tilly | $3,484 |

| Timbo | $3,761 |

| Tollette | $4,185 |

| Tontitown | $3,607 |

| Traskwood | $3,666 |

| Trumann | $3,942 |

| Tucker | $3,824 |

| Tuckerman | $4,046 |

| Tumbling Shoals | $3,327 |

| Tupelo | $3,897 |

| Turner | $3,751 |

| Turrell | $3,615 |

| Twin Groves | $3,632 |

| Tyronza | $3,957 |

| Ulm | $3,659 |

| Umpire | $4,001 |

| Uniontown | $4,011 |

| Valley Springs | $3,520 |

| Van Buren | $3,982 |

| Vandervoort | $3,973 |

| Vanndale | $3,895 |

| Vendor | $3,679 |

| Vilonia | $3,537 |

| Viola | $3,685 |

| Violet Hill | $3,937 |

| Wabash | $3,847 |

| Wabbaseka | $3,752 |

| Walcott | $3,560 |

| Waldenburg | $4,087 |

| Waldo | $3,990 |

| Waldron | $3,791 |

| Walnut Ridge | $3,509 |

| Ward | $3,545 |

| Warm Springs | $3,373 |

| Warren | $3,897 |

| Washington | $4,192 |

| Watson | $3,917 |

| Weiner | $4,065 |

| Wesley | $3,416 |

| West Crossett | $4,081 |

| West Fork | $3,483 |

| West Helena | $3,846 |

| West Memphis | $3,579 |

| West Point | $3,723 |

| West Ridge | $3,668 |

| Western Grove | $3,574 |

| Wheatley | $3,885 |

| Whelen Springs | $4,040 |

| White Hall | $3,813 |

| Wickes | $4,003 |

| Wideman | $3,860 |

| Widener | $3,878 |

| Wilburn | $3,354 |

| Williford | $3,573 |

| Willisville | $4,014 |

| Wilmar | $3,986 |

| Wilmot | $4,110 |

| Wilson | $3,770 |

| Wilton | $4,031 |

| Winchester | $3,821 |

| Winslow | $3,400 |

| Winthrop | $4,028 |

| Wiseman | $3,834 |

| Witter | $3,567 |

| Witts Springs | $3,581 |

| Woodson | $3,546 |

| Wooster | $3,476 |

| Wright | $3,749 |

| Wrightsville | $3,555 |

| Wynne | $3,980 |

| Yellville | $3,543 |

| Yorktown | $3,678 |

Methodology

The rates shown in this article are based on non-binding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in Arkansas.

The following coverages and deductible were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third party customer service ratings, and app / website experience. We weighted these categories based on what customers value in an insurance company.

For 3rd party customer service ratings, we included NAIC’s Complaint Index scores and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

*USAA is only available to active-duty and veteran military members and their families.

Overall customer satisfaction ratings are from the J.D. Power 2023 U.S. Home Insurance Study.

Complaint ratings are based on NAIC data from 2023.