Best Homeowners Insurance in Colorado

State Farm is the cheapest company in Colorado for most customers and has excellent satisfaction ratings. Its rates average to $312 a month, which is 19% less than the state average of $386 a month.

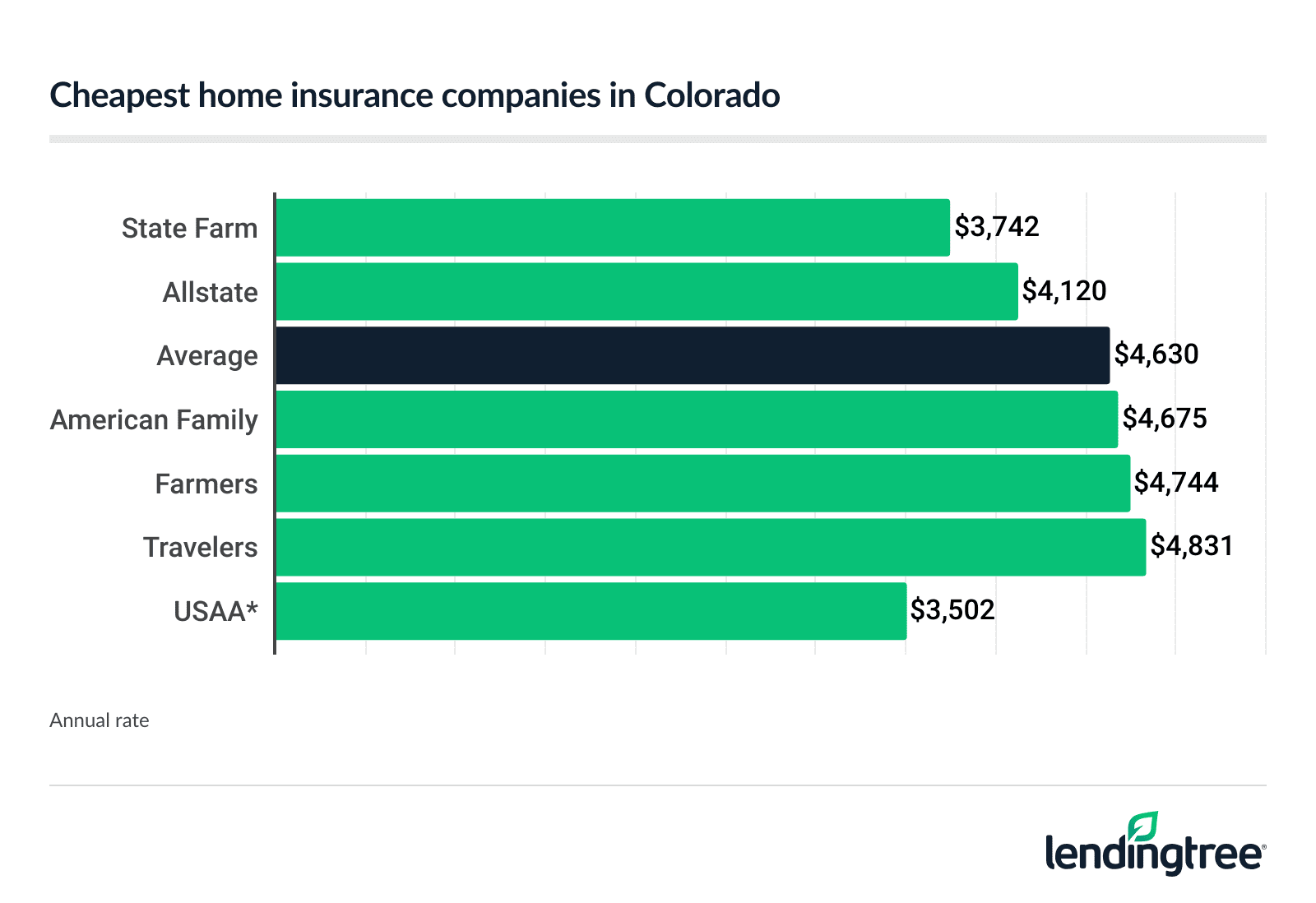

Cheapest insurance companies in Colorado

Cheapest homeowners insurance in Colorado: State Farm

State Farm has the cheapest homeowners insurance in Colorado for most customers. State Farm’s rates average to $3,742 a year ($312 a month) for a typical Colorado home.

That’s 19% less than the state average of $4,630 a year.

USAA actually has Colorado’s cheapest overall home insurance company, at an average of $3,502 a year ($292 a month). However, USAA is only available to military members and their families.

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| State Farm | $3,742 | |

| Allstate | $4,120 | |

| American Family | $4,675 | |

| Farmers | $4,744 | |

| Travelers | $4,831 | |

| Country Financial | $5,268 | |

| Nationwide | $6,627 | |

| USAA* | $3,502 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. *USAA is only available to the military community.

Best home insurance companies in Colorado

The best home insurance companies in Colorado combine low rates with high customer service ratings. State Farm, Allstate, American Family and USAA are the best home insurance companies in Colorado.

| Company | LendingTree score | J.D. Power customer satisfaction Customer satisfaction scores are from J.D. Power’s 2023 U.S. Home Insurance Study. | NAIC Complaint Index rating Complaint index ratings come from the National Association of Insurance Commissioners (NAIC). Lower scores are better; 1.0 is average. |

|---|---|---|---|

| Best overall: State Farm | 829 (Good) | 1.0 (Average) | |

| Best policy features: Allstate | 809 (Below average) | 0.9 (Average) | |

| Best discounts: American Family | 813 (Average) | 0.4 (Excellent) | |

| Best for military families: USAA | 861 (Excellent) | 0.4 (Excellent) |

Best overall: State Farm

Annual rate: $3,742

![]()

Pros

Cheapest average rate in Colorado for most homeowners

High satisfaction ratings

Agents widely available to provide personalized service

Generous discounts for bundling home and auto insurance

Cons

Complaint rating is just average

Affordable rates and quality customer service have helped State Farm remain the state’s largest home insurance company. State Farm ranks second only to USAA in Colorado for price and customer satisfaction.

Best policy features: Allstate

Annual rate: $4,120

![]()

Pros

Average rate 11% less than the state average

Offers optional coverage that protects against a potential rate increase after first claim

Bundling home and auto saves an average of 25%

Cons

Satisfaction score is lower than average

Although Allstate might not have the cheapest rates in Colorado, some of its policy features may save you money down the line. Allstate offers many discounts, including discounts for newly constructed homes and recent homebuyers.

Best discounts: American Family

Annual rate: $4,675

![]()

Pros

Received less complaints than what’s expected for a company of its size

Age discount lowers rates for homes less than 15 years old

Renovated home discount for replacing your plumbing, electrical or heating systems

Cons

Average rate before discounts is slightly higher than the state average

American Family’s home insurance rates are close to the state average, but you may qualify for a lower rate if your home is relatively new or if you upgrade your home’s major systems.

Best for military families: USAA

Annual rate: $3,502

![]()

Pros

Cheapest home insurance rates in Colorado

Replacement cost coverage is standard for your belongings

Discounts available on home security devices and services

Cons

Only available to current and former military members and their families

You may end up talking to a different call center representative each time you phone in for help

In addition to low rates and high satisfaction scores, USAA also offers several other benefits to its home insurance customers, such as military equipment and uniform coverage.

How much is home insurance in Colorado?

The average cost of home insurance in Colorado is $4,630 a year ($386 a month).

The actual price you pay depends on factors such as:

- The amount of coverage you need

- Your credit and insurance history

- Your neighborhood’s wildfire risks and exposure to severe weather

- Any discounts you may be eligible to receive

Since insurance companies weigh these factors differently, one may offer you a significantly lower rate than the others. This is why you should compare quotes from multiple companies when you shop for home insurance.

Home insurance rates by coverage amount

The average price of home insurance with $450,000 in dwelling coverage will usually cost 10% more than a home insured for $400,000.

| Dwelling limit | Average annual rate |

|---|---|

| $350,000 | $4,164 |

| $400,000 | $4,630 |

| $450,000 | $5,083 |

Your policy’s dwelling coverage pays to repair damage from covered perils such as fire or windstorm, up to the limit you choose.

For mortgages, lenders require you to insure your home at its replacement value or the cost of rebuilding it. This is usually lower than your home’s purchase price, or market value.

You can choose a lower dwelling limit when your mortgage balance gets low enough or if you own your home outright. However, if your dwelling limit is too low, you may not get enough insurance money to rebuild after a disaster.

Colorado homeowners insurance rates by city

Among Colorado’s cities, average homeowners insurance rates range from $2,079 a year in Orchard Mesa to $7,095 in Lamar.

The typical price of a home insurance policy in Denver is $5,307, which is 14% higher than the state average.

| City | Annual rate |

|---|---|

| Acres Green | $5,652 |

| Agate | $5,942 |

| Aguilar | $4,721 |

| Air Force Academy | $5,207 |

| Akron | $6,574 |

| Alamosa | $2,674 |

| Alamosa East | $2,634 |

| Allenspark | $4,182 |

| Alma | $3,289 |

| Almont | $2,400 |

| Amherst | $6,562 |

| Anton | $6,172 |

| Antonito | $2,588 |

| Applewood | $5,104 |

| Arapahoe | $6,562 |

| Arlington | $6,146 |

| Arriba | $6,012 |

| Arvada | $4,996 |

| Aspen | $2,297 |

| Atwood | $5,955 |

| Ault | $4,684 |

| Aurora | $5,424 |

| Austin | $2,241 |

| Avon | $2,391 |

| Avondale | $5,708 |

| Bailey | $3,541 |

| Basalt | $2,347 |

| Battlement Mesa | $2,303 |

| Bayfield | $2,296 |

| Bedrock | $2,464 |

| Bellvue | $3,880 |

| Bennett | $5,547 |

| Berkley | $4,988 |

| Berthoud | $4,067 |

| Bethune | $6,576 |

| Beulah | $5,450 |

| Black Forest | $5,825 |

| Black Hawk | $4,062 |

| Blanca | $2,924 |

| Blende | $6,081 |

| Blue River | $2,724 |

| Boncarbo | $4,416 |

| Bond | $2,486 |

| Boone | $5,542 |

| Boulder | $4,151 |

| Bow Mar | $4,976 |

| Branson | $5,292 |

| Breckenridge | $2,720 |

| Briggsdale | $5,770 |

| Brighton | $5,082 |

| Brookside | $3,486 |

| Broomfield | $4,564 |

| Brush | $6,433 |

| Buena Vista | $2,520 |

| Buffalo Creek | $4,441 |

| Burlington | $7,025 |

| Burns | $3,014 |

| Byers | $5,876 |

| Cahone | $2,235 |

| Calhan | $5,690 |

| Campo | $6,015 |

| Canon City | $3,485 |

| Capulin | $2,760 |

| Carbondale | $2,275 |

| Carr | $4,720 |

| Cascade | $5,275 |

| Castle Pines | $5,366 |

| Castle Pines North | $5,369 |

| Castle Rock | $5,350 |

| Cedaredge | $2,305 |

| Centennial | $5,408 |

| Center | $2,385 |

| Central City | $4,166 |

| Chama | $2,919 |

| Cherry Creek | $5,494 |

| Cherry Hills Village | $5,360 |

| Cheyenne Wells | $6,916 |

| Chromo | $2,428 |

| Cimarron | $2,445 |

| Cimarron Hills | $5,744 |

| Clark | $2,667 |

| Clifton | $2,110 |

| Climax | $2,661 |

| Coal Creek | $4,342 |

| Coaldale | $3,581 |

| Coalmont | $3,051 |

| Collbran | $2,297 |

| Colorado City | $5,181 |

| Colorado Springs | $5,538 |

| Columbine | $4,983 |

| Columbine Valley | $4,976 |

| Commerce City | $5,241 |

| Como | $3,416 |

| Conejos | $2,620 |

| Conifer | $4,779 |

| Cope | $6,115 |

| Copper Mountain | $2,736 |

| Cortez | $2,182 |

| Cory | $2,488 |

| Cotopaxi | $3,435 |

| Cowdrey | $3,282 |

| Craig | $2,195 |

| Crawford | $2,401 |

| Creede | $2,313 |

| Crested Butte | $2,291 |

| Crestone | $2,687 |

| Cripple Creek | $4,003 |

| Crook | $6,079 |

| Crowley | $6,510 |

| Dacono | $4,820 |

| Dakota Ridge | $5,200 |

| De Beque | $2,550 |

| Deer Trail | $5,887 |

| Del Norte | $2,436 |

| Delta | $2,225 |

| Denver | $5,307 |

| Derby | $5,239 |

| Dillon | $2,831 |

| Dinosaur | $2,563 |

| Divide | $3,975 |

| Dolores | $2,308 |

| Dove Creek | $2,241 |

| Dove Valley | $5,516 |

| Drake | $3,903 |

| Dumont | $3,550 |

| Dupont | $5,068 |

| Durango | $2,301 |

| Eads | $7,044 |

| Eagle | $2,394 |

| East Pleasant View | $5,108 |

| Eastlake | $4,837 |

| Eaton | $5,166 |

| Eckert | $2,217 |

| Eckley | $6,727 |

| Edgewater | $4,992 |

| Edwards | $2,357 |

| Egnar | $2,528 |

| El Jebel | $2,314 |

| El Moro | $5,040 |

| Elbert | $5,648 |

| Eldorado Springs | $4,325 |

| Elizabeth | $5,789 |

| Empire | $3,515 |

| Englewood | $5,357 |

| Erie | $4,601 |

| Estes Park | $3,455 |

| Evans | $4,894 |

| Evergreen | $4,556 |

| Fairmount | $4,966 |

| Fairplay | $3,137 |

| Federal Heights | $4,849 |

| Firestone | $4,509 |

| Flagler | $6,455 |

| Fleming | $6,374 |

| Florence | $3,714 |

| Florissant | $4,140 |

| Fort Carson | $5,381 |

| Fort Collins | $3,828 |

| Fort Garland | $3,013 |

| Fort Lupton | $5,031 |

| Fort Lyon | $6,523 |

| Fort Morgan | $6,399 |

| Fountain | $5,535 |

| Fowler | $5,663 |

| Foxfield | $5,503 |

| Franktown | $5,660 |

| Fraser | $2,868 |

| Frederick | $4,465 |

| Frisco | $2,726 |

| Fruita | $2,117 |

| Fruitvale | $2,081 |

| Galeton | $5,395 |

| Garden City | $4,910 |

| Gardner | $4,013 |

| Gateway | $2,383 |

| Genesee | $5,164 |

| Genoa | $5,927 |

| Georgetown | $3,473 |

| Gilcrest | $4,789 |

| Gill | $5,441 |

| Glade Park | $2,225 |

| Glen Haven | $3,930 |

| Glendale | $5,364 |

| Gleneagle | $5,292 |

| Glenwood Springs | $2,277 |

| Golden | $4,849 |

| Granada | $6,629 |

| Granby | $2,779 |

| Grand Junction | $2,100 |

| Grand Lake | $2,955 |

| Grand View Estates | $5,752 |

| Granite | $2,783 |

| Grant | $3,532 |

| Greeley | $4,882 |

| Green Mountain Falls | $5,198 |

| Greenwood Village | $5,427 |

| Grover | $5,625 |

| Guffey | $3,365 |

| Gunbarrel | $4,127 |

| Gunnison | $2,490 |

| Gypsum | $2,397 |

| Hamilton | $2,543 |

| Hartman | $6,053 |

| Hartsel | $3,248 |

| Hasty | $7,024 |

| Haswell | $6,646 |

| Haxtun | $6,500 |

| Hayden | $2,455 |

| Henderson | $5,219 |

| Hereford | $5,719 |

| Hesperus | $2,332 |

| Highlands Ranch | $5,344 |

| Hillrose | $6,022 |

| Hillside | $3,224 |

| Hoehne | $5,058 |

| Holly | $6,690 |

| Holly Hills | $5,279 |

| Holyoke | $6,952 |

| Homelake | $2,746 |

| Hooper | $2,752 |

| Hot Sulphur Springs | $2,935 |

| Hotchkiss | $2,320 |

| Howard | $3,370 |

| Hudson | $5,513 |

| Hugo | $6,407 |

| Hygiene | $4,428 |

| Idaho Springs | $3,451 |

| Idalia | $6,034 |

| Idledale | $5,155 |

| Ignacio | $2,281 |

| Iliff | $5,912 |

| Indian Hills | $4,692 |

| Inverness | $5,516 |

| Jamestown | $4,430 |

| Jaroso | $2,894 |

| Jefferson | $3,456 |

| Joes | $6,434 |

| Johnstown | $4,771 |

| Julesburg | $6,520 |

| Karval | $6,000 |

| Keenesburg | $5,886 |

| Ken Caryl | $5,004 |

| Kersey | $5,552 |

| Keystone | $2,829 |

| Kim | $5,075 |

| Kiowa | $5,654 |

| Kirk | $6,056 |

| Kit Carson | $6,464 |

| Kittredge | $4,641 |

| Kremmling | $2,639 |

| La Jara | $2,633 |

| La Junta | $6,588 |

| La Salle | $5,008 |

| La Veta | $3,936 |

| Lafayette | $4,404 |

| Lake City | $2,258 |

| Lake George | $3,576 |

| Lakewood | $5,078 |

| Lamar | $7,095 |

| Laporte | $4,094 |

| Larkspur | $5,440 |

| Las Animas | $6,696 |

| Lazear | $2,554 |

| Leadville | $2,483 |

| Leadville North | $2,482 |

| Lewis | $2,443 |

| Limon | $6,292 |

| Lincoln Park | $3,488 |

| Lindon | $6,173 |

| Littleton | $5,144 |

| Livermore | $3,965 |

| Lochbuie | $5,163 |

| Log Lane Village | $6,086 |

| Loma | $2,226 |

| Lone Tree | $5,652 |

| Longmont | $4,210 |

| Louisville | $4,358 |

| Louviers | $5,109 |

| Loveland | $3,890 |

| Lucerne | $5,273 |

| Lyons | $4,257 |

| Mack | $2,498 |

| Manassa | $2,737 |

| Mancos | $2,241 |

| Manitou Springs | $5,261 |

| Manzanola | $6,829 |

| Marvel | $2,421 |

| Masonville | $4,070 |

| Matheson | $6,100 |

| Maybell | $2,530 |

| Mc Clave | $6,615 |

| Mc Coy | $2,468 |

| Mead | $4,454 |

| Meeker | $2,355 |

| Meredith | $2,612 |

| Meridian | $5,669 |

| Merino | $6,282 |

| Mesa | $2,443 |

| Mesa Verde National Park | $2,359 |

| Milliken | $4,985 |

| Minturn | $2,541 |

| Model | $5,146 |

| Moffat | $2,804 |

| Molina | $2,452 |

| Monarch | $3,102 |

| Monte Vista | $2,479 |

| Montrose | $2,151 |

| Monument | $5,240 |

| Morrison | $5,120 |

| Mosca | $2,709 |

| Mount Crested Butte | $2,297 |

| Mountain View | $5,144 |

| Mountain Village | $2,183 |

| Nathrop | $2,565 |

| Naturita | $2,270 |

| Nederland | $4,234 |

| New Castle | $2,409 |

| New Raymer | $5,808 |

| Niwot | $4,347 |

| North Washington | $5,136 |

| Northglenn | $4,893 |

| Norwood | $2,223 |

| Nucla | $2,218 |

| Nunn | $4,905 |

| Oak Creek | $2,446 |

| Ohio City | $2,470 |

| Olathe | $2,173 |

| Olney Springs | $6,257 |

| Ophir | $2,392 |

| Orchard | $5,786 |

| Orchard Mesa | $2,079 |

| Ordway | $6,959 |

| Otis | $6,580 |

| Ouray | $2,241 |

| Ovid | $6,625 |

| Padroni | $5,929 |

| Pagosa Springs | $2,323 |

| Palisade | $2,174 |

| Palmer Lake | $5,376 |

| Paoli | $6,542 |

| Paonia | $2,312 |

| Parachute | $2,312 |

| Paradox | $2,390 |

| Paragon Estates | $4,135 |

| Parker | $5,614 |

| Parlin | $2,434 |

| Parshall | $2,812 |

| Peetz | $6,324 |

| Penrose | $3,834 |

| Perry Park | $5,447 |

| Peyton | $5,862 |

| Phippsburg | $2,544 |

| Pierce | $4,560 |

| Pine | $4,281 |

| Pine Brook Hill | $4,194 |

| Pinecliffe | $4,348 |

| Pitkin | $2,610 |

| Placerville | $2,593 |

| Platteville | $4,868 |

| Pleasant View | $2,357 |

| Poncha Springs | $2,732 |

| Ponderosa Park | $5,785 |

| Powderhorn | $2,310 |

| Pritchett | $6,018 |

| Pueblo | $5,919 |

| Pueblo West | $5,687 |

| Ramah | $5,400 |

| Rand | $3,321 |

| Rangely | $2,301 |

| Red Cliff | $2,637 |

| Red Feather Lakes | $3,836 |

| Redlands | $2,155 |

| Redvale | $2,296 |

| Ridgway | $2,314 |

| Rifle | $2,221 |

| Rockvale | $3,475 |

| Rocky Ford | $6,993 |

| Roggen | $5,590 |

| Rollinsville | $4,034 |

| Romeo | $2,687 |

| Roxborough Park | $5,327 |

| Rush | $5,720 |

| Rye | $5,182 |

| Saguache | $2,426 |

| Salida | $2,498 |

| Salt Creek | $6,082 |

| San Luis | $2,870 |

| Sanford | $2,722 |

| Sargents | $2,805 |

| Security-Widefield | $5,532 |

| Sedalia | $5,117 |

| Sedgwick | $6,208 |

| Seibert | $6,454 |

| Severance | $4,458 |

| Shaw Heights | $4,858 |

| Shawnee | $3,857 |

| Sheridan | $5,234 |

| Sheridan Lake | $6,504 |

| Sherrelwood | $5,096 |

| Silt | $2,259 |

| Silver Plume | $3,439 |

| Silverthorne | $2,684 |

| Silverton | $2,202 |

| Simla | $5,803 |

| Slater | $2,482 |

| Snowmass | $2,398 |

| Snowmass Village | $2,395 |

| Snyder | $6,427 |

| Somerset | $2,504 |

| South Fork | $2,354 |

| Springfield | $6,226 |

| Steamboat Springs | $2,402 |

| Sterling | $6,353 |

| Stonegate | $5,748 |

| Stoneham | $5,845 |

| Strasburg | $6,111 |

| Stratmoor | $5,536 |

| Stratton | $6,988 |

| Sugar City | $6,174 |

| Sugarloaf | $4,198 |

| Superior | $4,361 |

| Swink | $6,145 |

| Tabernash | $2,788 |

| Telluride | $2,179 |

| The Pinery | $5,761 |

| Thornton | $4,986 |

| Timnath | $3,901 |

| Todd Creek | $5,035 |

| Toponas | $2,572 |

| Towaoc | $2,162 |

| Trinchera | $5,151 |

| Trinidad | $4,953 |

| Twin Lakes | $3,858 |

| Two Buttes | $6,008 |

| Upper Bear Creek | $4,439 |

| Usaf Academy | $5,233 |

| Vail | $2,472 |

| Vernon | $6,419 |

| Victor | $4,100 |

| Vilas | $6,015 |

| Villa Grove | $2,630 |

| Vona | $5,918 |

| Walden | $2,834 |

| Walsenburg | $4,588 |

| Walsh | $6,398 |

| Ward | $4,320 |

| Watkins | $5,445 |

| Welby | $5,135 |

| Weldona | $6,264 |

| Wellington | $4,088 |

| West Pleasant View | $5,109 |

| Westcliffe | $3,369 |

| Westminster | $4,861 |

| Weston | $4,480 |

| Wetmore | $3,938 |

| Wheat Ridge | $5,034 |

| Whitewater | $2,292 |

| Wiggins | $6,287 |

| Wild Horse | $6,006 |

| Wiley | $6,979 |

| Windsor | $4,455 |

| Winter Park | $3,011 |

| Wolcott | $2,521 |

| Woodland Park | $4,088 |

| Woodmoor | $5,225 |

| Woodrow | $5,639 |

| Woody Creek | $2,643 |

| Wray | $6,418 |

| Yampa | $2,389 |

| Yellow Jacket | $2,234 |

| Yoder | $5,525 |

| Yuma | $7,087 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. *USAA is only available to the military community.

Flood insurance for Colorado homes

Since standard home insurance does not cover floods, you would have to purchase flood insurance separately to protect your home from this risk.

Most flood insurance is purchased through the National Flood Insurance Program (NFIP), which is managed by the Federal Emergency Management Agency (FEMA). Several private companies also offer flood insurance in Colorado as an alternative to an NFIP policy.

The average cost of flood insurance in Colorado is $810 a year, or $68 a month, for NFIP insurance.

Flood insurance is required for a mortgage if your home is in a high-risk flood zone. Flood insurance is also often worth considering if you don’t have a mortgage and/or your home is in a low- or moderate-risk area.

You can find your home’s flood zone, or the flood zone of a home you want to buy, in the Flood Map Service Center on FEMA’s website.

Other insurance protections for Colorado homeowners

Earthquakes, landslides and mudslides are among the other Colorado risks that homeowners insurance does not typically cover.

Some home insurance companies offer an endorsement that you can buy to add earthquake coverage to your home insurance. Earthquake insurance is also offered as a separate, standalone policy.

Landslides and mudslides are a little trickier to insure against. You usually have to purchase a “difference-in-conditions” (expanded) policy to protect against these risks.

Some difference-in-conditions policies protect against multiple risks, such as landslides, floods and earthquakes. Depending on the insurance company, these may be cheaper than getting separate policies for each of these dangers.

Frequently asked questions

Massive wildfires and hailstorms in recent years, along with soaring construction costs, have led to high homeowners insurance rates throughout Colorado. Home insurance companies have increased their rates to keep up with their payments to repair and rebuild damaged homes.

Homeowners insurance is not required by state law, but you usually need it for a mortgage. Lenders typically require you to insure your home at its replacement value. If you live in a high-risk flood zone, your lender will probably make you get flood insurance, too.

Shopping around for the cheapest rate and bundling multiple policies with the same company can help you save money on homeowners insurance. Make sure to ask about additional discounts when you shop.