Best Homeowners Insurance in Connecticut

Allstate has the best average rate for homeowners insurance in Connecticut at $145 a month. Amica has the best claims satisfaction history.

Best cheap home insurance companies in Connecticut

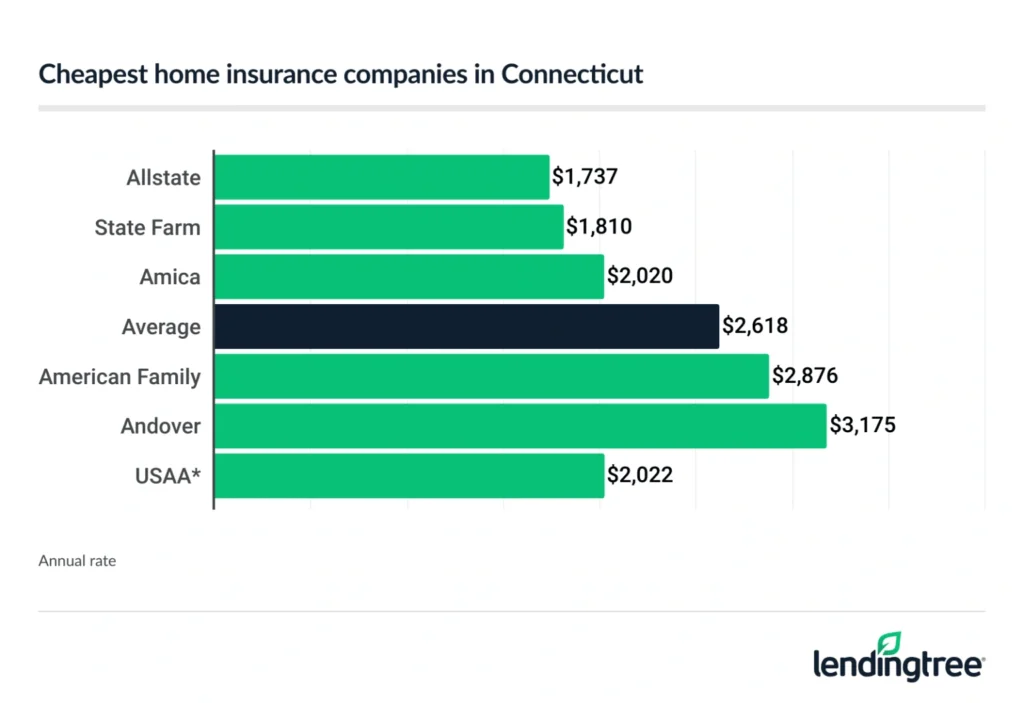

Connecticut’s cheapest home insurance companies

Connecticut homeowners find the cheapest home insurance with Allstate, at an average rate of $1,737 a year. This is 33% cheaper than the statewide average of $2,618 a year.

State Farm is the second-cheapest choice, at $1,810 a year.

Cheapest quotes in Connecticut

| Company | Average annual rate | LendingTree score | |

|---|---|---|---|

| Allstate | $1,737 | |

| State Farm | $1,810 | |

| Amica | $2,020 | |

| American Family | $2,876 | |

| Andover | $3,175 | Not rated |

| Travelers | $3,530 | |

| Chubb | $3,774 | |

| USAA* | $2,022 | |

Best homeowners insurance companies in Connecticut

Allstate, Amica, Chubb and USAA are the best home insurance companies in Connecticut, based on our research.

Allstate has the cheapest average homeowners rates in Connecticut and an excellent range of discounts.

Amica has the highest J.D. Power overall property claims satisfaction rating. Chubb has the lowest complaint rating, and USAA is the best for currently serving and veteran military, as well as their families.

| Company | Average annual rate | J.D. Power customer satisfaction

Customer satisfaction scores are from J.D. Power’s 2023 U.S. Home Insurance Study.

| NAIC Complaint Index rating

Complaint index ratings come from the National Association of Insurance Commissioners (NAIC). Lower scores are better; 1.0 is average.

|

|---|---|---|---|

| Allstate | $1,737 | 868 | 1.79 |

| Amica | $2,020 | 906 | 1.90 |

| Chubb | $3,774 | NA | 0.26 |

| USAA* | $2,022 | 899 | 0.49 |

| Average | $2,618 | 869 | 1.0 |

Best for cheap rates: Allstate

Annual rate: $1,737

Allstate has the cheapest rates of the major home insurance companies we looked at in Connecticut, an average rate of $1,737 a year. This is 33% cheaper than the average Connecticut home insurance rate of $2,618 a year.

Home insurance companies offer discounts to their policyholders to stay competitive. When you compare home insurance quotes, be sure to ask if you might qualify for any discounts.

Allstate also offers some great optional features. Allstate offers an Enhanced Package optional program, which includes a few benefits. It can lower your deductible by $100 each year you don’t file a claim, up to $500. Their Enhanced Package program also lets you file one claim every five years without a rate increase.

PROS

- Cheapest average rate

- Great optional features

- Many discounts for qualified homeowners

CONS

- Overall satisfaction slightly below national average

- High complaint rating

Best claims satisfaction: Amica

Annual rate: $2,020

Amica has a J.D. Power property claims satisfaction of 906, the highest rating of home insurance providers J.D. Power surveyed. J.D. Power rates companies by examining their interactions, policy offerings, cost, claims and more.

PROS

- Top-tier property claims satisfaction

- A+ financial strength rating from A.M. Best

- Low average home insurance rate in Connecticut

CONS

- Only uses independent agents

- Few discounts compared to competitors

Best for coverage options: Chubb

Annual rate: $3,774

Chubb has a National Association of Insurance Commissioners (NAIC) Complaint Index rating of 0.26. This is the best complaint rating of the home insurance companies we surveyed in Connecticut.

PROS

- Good complaint rating

- A++ rating from A.M. Best

CONS

- Little website info regarding policy pricing and discounts

- No mobile app access

- High average rate in Connecticut

Best for military members: USAAA

Annual rate: $2,022

USAA has homeowners insurance policy offerings specifically for active-duty and retired military members and their families. Its J.D. Power claims satisfaction rating is second only to Amica.

PROS

- Excellent property claims satisfaction

- Active-duty service members get coverage for military equipment and uniforms with no deductible

- Personal property coverage at replacement cost

CONS

- Only available to active-duty and veteran military and their families

- No dedicated agents

- Few discounts compared to competitors

Cost of homeowners insurance in Connecticut

The average cost of home insurance in Connecticut is $2,618 a year, which is slightly below the national average home insurance rate of $2,801 a year.

Insurers calculate your home insurance quote by weighing different risk factors, including your:

- ZIP code

- Home’s age

- Construction materials used

- Coverage limits and deductible

- Insurance claim history

Standard homeowners insurance policies tend to be similar from company to company. However, as you can see, premiums vary. This is due to homeowners insurance companies weighing risk factors differently. This is why comparing quotes is crucial to getting the best combo of cost and coverage for your needs.

Connecticut home insurance rates by coverage amounts

The dwelling limit you choose for your homeowners insurance policy affects your premium. The higher the coverage limit you choose, the higher your premium.

For example, in Connecticut you pay an average of $558 more a year for a home insurance policy with a $450,000 dwelling coverage limit than one with a $350,000 limit.

Average annual rate by dwelling coverage

| Dwelling coverage limit | Average annual rate |

|---|---|

| $350,000 | $2,342 |

| $400,000 | $2,618 |

| $450,000 | $2,900 |

A good way to counteract this cost difference is to choose a lower deductible. The higher your deductible, the lower your premium.

Connecticut home insurance rates by city

Of Connecticut’s cities, New Milford has the cheapest average home insurance rate of $1,970 a year. West Mystic has the most expensive average rate of $4,262.

Average home insurance rate by city

| City | Average annual rate

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

|

|---|---|

| Abington | $3,441 |

| Amston | $2,041 |

| Andover | $2,084 |

| Ansonia | $2,544 |

| Ashford | $2,091 |

| Avon | $2,078 |

| Ballouville | $3,452 |

| Baltic | $2,435 |

| Bantam | $2,045 |

| Barkhamsted | $2,008 |

| Beacon Falls | $2,547 |

| Berlin | $2,177 |

| Bethany | $2,579 |

| Bethel | $2,112 |

| Bethlehem | $2,031 |

| Bethlehem Village | $2,029 |

| Bloomfield | $2,214 |

| Blue Hills | $2,201 |

| Bolton | $2,051 |

| Botsford | $3,677 |

| Bozrah | $2,569 |

| Branford | $3,024 |

| Branford Center | $3,024 |

| Bridgeport | $2,697 |

| Bridgewater | $2,042 |

| Bristol | $2,097 |

| Broad Brook | $2,129 |

| Brookfield | $2,121 |

| Brooklyn | $2,034 |

| Burlington | $2,107 |

| Byram | $2,345 |

| Canaan | $2,031 |

| Canterbury | $2,063 |

| Canton | $2,092 |

| Canton Center | $2,052 |

| Canton Valley | $2,092 |

| Centerbrook | $2,721 |

| Central Village | $3,503 |

| Chaplin | $2,048 |

| Cheshire | $2,532 |

| Cheshire Village | $2,525 |

| Chester | $2,729 |

| Chester Center | $2,723 |

| Clinton | $3,122 |

| Cobalt | $4,062 |

| Colchester | $2,437 |

| Colebrook | $2,030 |

| Collinsville | $2,092 |

| Columbia | $2,061 |

| Conning Towers Nautilus Park | $3,805 |

| Cornwall Bridge | $2,070 |

| Cos Cob | $2,316 |

| Coventry | $2,058 |

| Coventry Lake | $2,064 |

| Cromwell | $2,380 |

| Crystal Lake | $1,991 |

| Danbury | $2,109 |

| Danielson | $2,078 |

| Darien | $2,368 |

| Dayville | $2,077 |

| Deep River | $2,705 |

| Deep River Center | $2,699 |

| Derby | $2,541 |

| Durham | $2,482 |

| East Berlin | $2,119 |

| East Brooklyn | $2,034 |

| East Canaan | $2,023 |

| East Glastonbury | $3,618 |

| East Granby | $2,117 |

| East Haddam | $2,556 |

| East Hampton | $2,458 |

| East Hartford | $2,156 |

| East Hartland | $2,119 |

| East Haven | $2,881 |

| East Killingly | $2,018 |

| East Lyme | $3,237 |

| East Windsor | $2,117 |

| East Windsor Hill | $3,622 |

| East Woodstock | $3,458 |

| Eastford | $2,099 |

| Easton | $2,172 |

| Ellington | $2,005 |

| Enfield | $2,100 |

| Essex Village | $2,717 |

| Fabyan | $3,476 |

| Fairfield | $2,863 |

| Falls Village | $2,069 |

| Farmington | $2,758 |

| Gales Ferry | $2,810 |

| Gaylordsville | $1,976 |

| Georgetown | $3,749 |

| Gilman | $2,613 |

| Glastonbury | $2,112 |

| Glastonbury Center | $2,118 |

| Glenville | $2,268 |

| Goshen | $2,055 |

| Granby | $2,119 |

| Greens Farms | $3,719 |

| Greenwich | $2,316 |

| Grosvenor Dale | $3,476 |

| Groton | $3,832 |

| Groton Long Point | $3,875 |

| Guilford | $2,908 |

| Guilford Center | $2,944 |

| Haddam | $2,475 |

| Hadlyme | $4,048 |

| Hamden | $2,579 |

| Hampton | $2,051 |

| Hanover | $4,035 |

| Hartford | $2,815 |

| Harwinton | $1,996 |

| Hawleyville | $3,683 |

| Hazardville | $2,099 |

| Hebron | $2,023 |

| Heritage Village | $2,449 |

| Higganum | $2,497 |

| Ivoryton | $2,791 |

| Jewett City | $2,505 |

| Kensington | $2,177 |

| Kent | $2,042 |

| Killingworth | $2,691 |

| Lake Pocotopaug | $2,454 |

| Lakeside | $2,068 |

| Lakeville | $2,049 |

| Lebanon | $2,496 |

| Ledyard | $2,811 |

| Litchfield | $2,050 |

| Long Hill | $3,832 |

| Madison | $2,978 |

| Madison Center | $3,019 |

| Manchester | $2,151 |

| Mansfield Center | $2,035 |

| Mansfield Depot | $3,490 |

| Marion | $3,621 |

| Marlborough | $2,137 |

| Mashantucket | $4,024 |

| Meriden | $2,532 |

| Middle Haddam | $3,900 |

| Middlebury | $2,524 |

| Middlefield | $2,454 |

| Middletown | $2,443 |

| Milford | $2,925 |

| Milldale | $3,597 |

| Monroe | $2,180 |

| Montville | $2,652 |

| Moodus | $2,570 |

| Moosup | $2,044 |

| Morris | $2,052 |

| Mystic | $3,161 |

| Naugatuck | $2,486 |

| New Britain | $2,205 |

| New Canaan | $2,125 |

| New Fairfield | $2,117 |

| New Hartford | $2,020 |

| New Hartford Center | $2,016 |

| New Haven | $3,209 |

| New London | $3,310 |

| New Milford | $1,970 |

| New Preston | $2,056 |

| New Preston Marble Dale | $2,067 |

| Newington | $2,115 |

| Newtown | $2,199 |

| Niantic | $4,240 |

| Noank | $3,844 |

| Norfolk | $2,059 |

| North Branford | $2,769 |

| North Canton | $2,098 |

| North Franklin | $2,521 |

| North Granby | $2,093 |

| North Grosvenor Dale | $2,000 |

| North Haven | $2,563 |

| North Stonington | $2,664 |

| North Westchester | $4,211 |

| North Windham | $2,047 |

| Northfield | $2,057 |

| Northford | $2,595 |

| Northwest Harwinton | $1,989 |

| Norwalk | $2,660 |

| Norwich | $2,519 |

| Oakdale | $2,562 |

| Oakville | $2,014 |

| Old Greenwich | $2,323 |

| Old Lyme | $3,033 |

| Old Mystic | $3,090 |

| Old Saybrook | $3,318 |

| Old Saybrook Center | $3,337 |

| Oneco | $2,010 |

| Orange | $2,892 |

| Oxford | $2,498 |

| Oxoboxo River | $2,575 |

| Pawcatuck | $3,214 |

| Pemberwick | $2,265 |

| Pequabuck | $3,542 |

| Pine Meadow | $3,493 |

| Plainfield | $2,051 |

| Plainfield Village | $2,051 |

| Plainville | $2,076 |

| Plantsville | $2,158 |

| Plymouth | $2,035 |

| Pomfret Center | $2,007 |

| Poquonock | $3,590 |

| Poquonock Bridge | $3,835 |

| Portland | $2,456 |

| Preston | $2,590 |

| Prospect | $2,552 |

| Putnam | $2,008 |

| Quaker Hill | $3,079 |

| Quinebaug | $1,983 |

| Redding | $2,121 |

| Redding Center | $3,568 |

| Redding Ridge | $3,568 |

| Ridgefield | $2,045 |

| Riverside | $2,330 |

| Riverton | $2,023 |

| Rockfall | $2,442 |

| Rockville | $2,028 |

| Rocky Hill | $2,123 |

| Rogers | $3,450 |

| Roxbury | $2,022 |

| Salem | $2,606 |

| Salisbury | $2,039 |

| Salmon Brook | $2,111 |

| Sandy Hook | $2,195 |

| Saybrook Manor | $3,337 |

| Scotland | $2,055 |

| Seymour | $2,542 |

| Sharon | $2,043 |

| Shelton | $2,200 |

| Sherman | $2,151 |

| Sherwood Manor | $2,100 |

| Simsbury | $2,076 |

| Simsbury Center | $2,077 |

| Somers | $1,987 |

| Somersville | $3,483 |

| South Britain | $3,938 |

| South Coventry | $2,064 |

| South Glastonbury | $2,122 |

| South Kent | $2,023 |

| South Lyme | $2,994 |

| South Willington | $3,508 |

| South Windham | $2,057 |

| South Windsor | $2,168 |

| South Woodstock | $2,080 |

| Southbury | $2,463 |

| Southington | $2,130 |

| Southport | $2,537 |

| Southwood Acres | $2,100 |

| Stafford Springs | $2,017 |

| Staffordville | $3,482 |

| Stamford | $2,403 |

| Sterling | $2,086 |

| Stevenson | $3,660 |

| Stonington | $3,620 |

| Storrs | $2,759 |

| Storrs Mansfield | $2,759 |

| Stratford | $2,830 |

| Suffield | $2,109 |

| Taconic | $3,535 |

| Taftville | $2,519 |

| Tariffville | $2,077 |

| Terramuggus | $2,137 |

| Terryville | $2,068 |

| Thomaston | $2,034 |

| Thompson | $2,003 |

| Thompsonville | $2,100 |

| Tolland | $2,007 |

| Torrington | $1,971 |

| Trumbull | $2,211 |

| Uncasville | $2,587 |

| Unionville | $2,033 |

| Vernon Rockville | $2,030 |

| Versailles | $3,953 |

| Voluntown | $2,572 |

| Wallingford | $2,542 |

| Wallingford Center | $2,542 |

| Washington | $2,069 |

| Washington Depot | $2,054 |

| Waterbury | $2,874 |

| Waterford | $4,174 |

| Watertown | $2,013 |

| Wauregan | $2,085 |

| Weatogue | $2,090 |

| West Cornwall | $2,075 |

| West Granby | $2,103 |

| West Hartford | $2,117 |

| West Hartland | $2,122 |

| West Haven | $2,847 |

| West Mystic | $4,262 |

| West Simsbury | $2,075 |

| West Suffield | $2,096 |

| Westbrook | $3,259 |

| Westbrook Center | $3,288 |

| Weston | $2,058 |

| Westport | $2,491 |

| Wethersfield | $2,143 |

| Willimantic | $1,998 |

| Willington | $2,030 |

| Wilton | $2,024 |

| Wilton Center | $2,024 |

| Winchester Center | $3,499 |

| Windham | $2,041 |

| Windsor | $2,163 |

| Windsor Locks | $2,112 |

| Winsted | $2,036 |

| Wolcott | $2,526 |

| Woodbridge | $2,555 |

| Woodbury | $2,037 |

| Woodbury Center | $2,037 |

| Woodmont | $3,093 |

| Woodstock | $2,064 |

| Woodstock Valley | $2,059 |

| Yantic | $4,157 |

Methodology

The rates shown in this article are based on nonbinding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in Connecticut.

The following coverages and deductible were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third party customer service ratings, and app / website experience. We weighted these categories based on what customers value in an insurance company.

For 3rd party customer service ratings, we included NAIC’s Complaint Index scores and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

*USAA is only available to active-duty and veteran military members and their families.