Best Homeowners Insurance in Delaware

Best cheap home insurance in Delaware

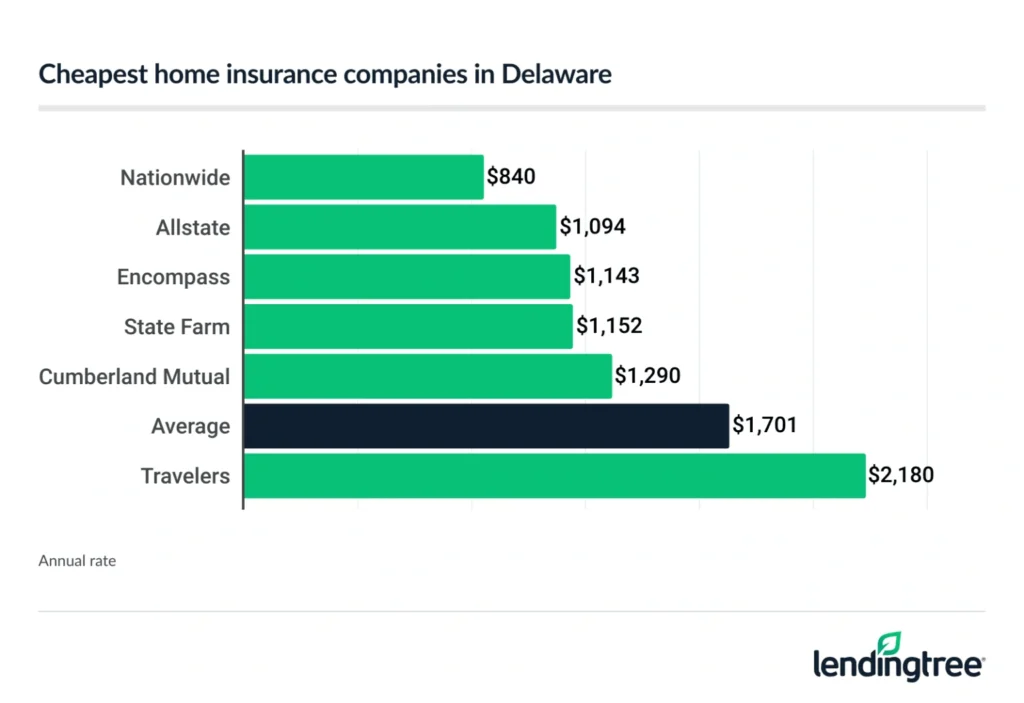

Cheapest home insurance in Delaware

Nationwide has Delaware’s cheapest home insurance, with rates of around $840 a year, or $70 a month. This is half the state average of $142 a month.

Allstate, Encompass and State Farm all offer home insurance rates that are cheaper than $100 a month.

Delaware’s cheapest home insurance quotes

| Company | Annual rate | Monthly rate | LendingTree score | |

|---|---|---|---|---|

| Nationwide | $840 | $70 | |

| Allstate | $1,094 | $91 | |

| Encompass | $1,143 | $95 | Not rated |

| State Farm | $1,152 | $96 | |

| Cumberland Mutual | $1,290 | $108 | Not rated |

| Travelers | $2,180 | $182 | |

| American Family | $4,204 | $350 | |

One of the keys to getting the best and cheapest coverage is to compare home insurance quotes from multiple companies before you buy or renew a policy.

Best homeowners insurance companies in Delaware

The best home insurance company in Delaware is Allstate because of its winning combination of affordable rates and many discount and coverage options.

Delaware’s best home insurance companies

| Company | Best for | Annual rate | Customer satisfaction* | Complaint index** |

|---|---|---|---|---|

| Allstate | Overall | $1,094 | 631 | 1.3 |

| Nationwide | Low rates | $840 | 641 | .96 |

| State Farm | Customer service | $1,152 | 643 | 1.05 |

**Source: National Association of Insurance Commissioners (NAIC). Lower is better; 1.0 is average.

Best overall: Allstate

Annual rate: $1,094

Allstate is the best home insurance company in Delaware because of its low rates and many discount and coverage options.

PROS

- Second-cheapest rates in state

- Many discounts that could make it even cheaper

- Several options to expand your coverage

- Helpful website lets you pay bills and file claims

CONS

- Customer service rating is worse than average

- Complaint rating is worse than average, too

Lowest rates: Nationwide

Annual rate: $2,020

Delaware homeowners may get the cheapest home insurance from Nationwide, which has an average rate of $70 a month. That’s 23% lower than second-place Allstate.

Nationwide also is Delaware’s best home insurance company for discounts, offering more ways to save than any other insurer we surveyed in the state.

PROS

- Lowest rates in Delaware

- Many add-on coverages and discounts

- Good customer satisfaction rating

CONS

- Complaint rating is average

Best customer service: State Farm

Annual rate: $1,152

State Farm has the best customer satisfaction rating from J.D. Power of the companies we surveyed in Delaware.

PROS

- Great customer satisfaction rating

- Rates are well below state average

- Website lets you get quotes, pay bills and file claims

CONS

- Fewer discounts and coverage options than some other companies

- Complaint rating is average

How much is home insurance in Delaware?

The average homeowner in Delaware pays $1,701 a year for home insurance. That equals $142 a month.

This average homeowners insurance rate is based on a policy with $400,000 of dwelling coverage. Delaware’s average home insurance rate for a policy with a $350,000 dwelling limit is $127 a month. The average rate for a policy with a $450,000 dwelling limit is $160 a month.

You’ll pay about 21% more for a home insurance policy with $450,000 in dwelling coverage than you will for a policy with $350,000 of coverage in Delaware.

Average home insurance rate by dwelling limit

| Dwelling limit | Annual rate | Monthly rate |

|---|---|---|

| $350,000 | $1,521 | $127 |

| $400,000 | $1,701 | $142 |

| $450,000 | $1,921 | $160 |

Delaware homeowners insurance rates by city

Pike Creek residents pay about $111 a month for homeowners insurance. That’s the cheapest average home insurance rate among Delaware’s cities and towns. Hockessin comes in second at $114 a month.

The Delaware city or town with the most expensive home insurance is Fenwick Island. Homeowners there pay $220 a month, on average. The neighboring towns of Bethany Beach and South Bethany are next at $219 a month.

Home insurance rates near you

| City | Annual rate

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

| Monthly rate

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

|

|---|---|---|

| Arden | $1,468 | $122 |

| Bear | $1,457 | $121 |

| Bellefonte | $1,590 | $133 |

| Bethany Beach | $2,626 | $219 |

| Bethel | $1,743 | $145 |

| Bridgeville | $2,013 | $168 |

| Brookside | $1,465 | $122 |

| Camden | $1,568 | $131 |

| Camden Wyoming | $1,984 | $165 |

| Cheswold | $1,972 | $164 |

| Claymont | $1,539 | $128 |

| Clayton | $1,534 | $128 |

| Dagsboro | $2,243 | $187 |

| Delaware City | $1,443 | $120 |

| Delmar | $1,691 | $141 |

| Dewey Beach | $2,333 | $194 |

| Dover | $1,598 | $133 |

| Dover Air Force Base | $1,867 | $156 |

| Dover Base Housing | $1,978 | $165 |

| Edgemoor | $1,570 | $131 |

| Ellendale | $1,819 | $152 |

| Elsmere | $1,466 | $122 |

| Felton | $2,016 | $168 |

| Fenwick Island | $2,636 | $220 |

| Frankford | $2,230 | $186 |

| Frederica | $1,981 | $165 |

| Georgetown | $1,974 | $164 |

| Glasgow | $1,451 | $121 |

| Greenville | $1,414 | $118 |

| Greenwood | $2,009 | $167 |

| Harbeson | $2,157 | $180 |

| Harrington | $1,686 | $141 |

| Hartly | $1,533 | $128 |

| Henlopen Acres | $2,335 | $195 |

| Highland Acres | $1,640 | $137 |

| Hockessin | $1,365 | $114 |

| Houston | $1,760 | $147 |

| Kent Acres | $1,634 | $136 |

| Kirkwood | $1,812 | $151 |

| Laurel | $1,693 | $141 |

| Lewes | $2,275 | $190 |

| Lincoln | $2,019 | $168 |

| Little Creek | $1,888 | $157 |

| Long Neck | $2,230 | $186 |

| Magnolia | $1,872 | $156 |

| Marydel | $1,550 | $129 |

| Middletown | $1,834 | $153 |

| Milford | $1,818 | $152 |

| Millsboro | $1,966 | $164 |

| Millville | $2,219 | $185 |

| Milton | $1,832 | $153 |

| Montchanin | $1,397 | $116 |

| Nassau | $2,127 | $177 |

| New Castle | $1,427 | $119 |

| Newark | $1,451 | $121 |

| Newport | $1,413 | $118 |

| North Star | $1,410 | $117 |

| Ocean View | $2,328 | $194 |

| Odessa | $1,441 | $120 |

| Pike Creek | $1,332 | $111 |

| Pike Creek Valley | $1,371 | $114 |

| Port Penn | $1,441 | $120 |

| Rehoboth Beach | $2,338 | $195 |

| Rising Sun-Lebanon | $1,872 | $156 |

| Riverview | $2,006 | $167 |

| Rockland | $1,434 | $120 |

| Rodney Village | $1,556 | $130 |

| Seaford | $1,817 | $151 |

| Selbyville | $2,096 | $175 |

| Smyrna | $1,506 | $125 |

| South Bethany | $2,629 | $219 |

| St. Georges | $1,433 | $119 |

| Townsend | $1,962 | $164 |

| Viola | $1,599 | $133 |

| Wilmington | $1,474 | $123 |

| Wilmington Manor | $1,409 | $117 |

| Winterthur | $1,532 | $128 |

| Woodside | $1,587 | $132 |

| Woodside East | $1,869 | $156 |

| Wyoming | $1,566 | $131 |

| Yorklyn | $1,446 | $121 |

Where you live is one factor that insurance companies look at when setting your home insurance rate. Some of the other factors they look at:

- Your home’s age

- Your credit, insurance and claims history

- How much coverage you buy

- Your deductible

Frequently asked questions

The average cost of homeowners insurance in Delaware is $142 a month, or $1,701 a year.

Nationwide has the cheapest home insurance in Delaware, with rates that average $70 a month, or $840 a year.

State law doesn’t require you to buy home insurance in Delaware. If you get a mortgage, though, your lender will probably make you buy it.

Methodology

The rates shown in this article are based on non-binding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in Delaware.

The following coverages and deductible were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

—

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.