Best Homeowners Insurance in Georgia

Progressive is the best home insurance company in Georgia for most homeowners. Progressive has the cheapest rates in the state, which averages to $2,061 a year. It also offers discounts that are easy to qualify for.

Best cheap home insurance companies in Georgia

Georgia’s cheapest home insurance companies

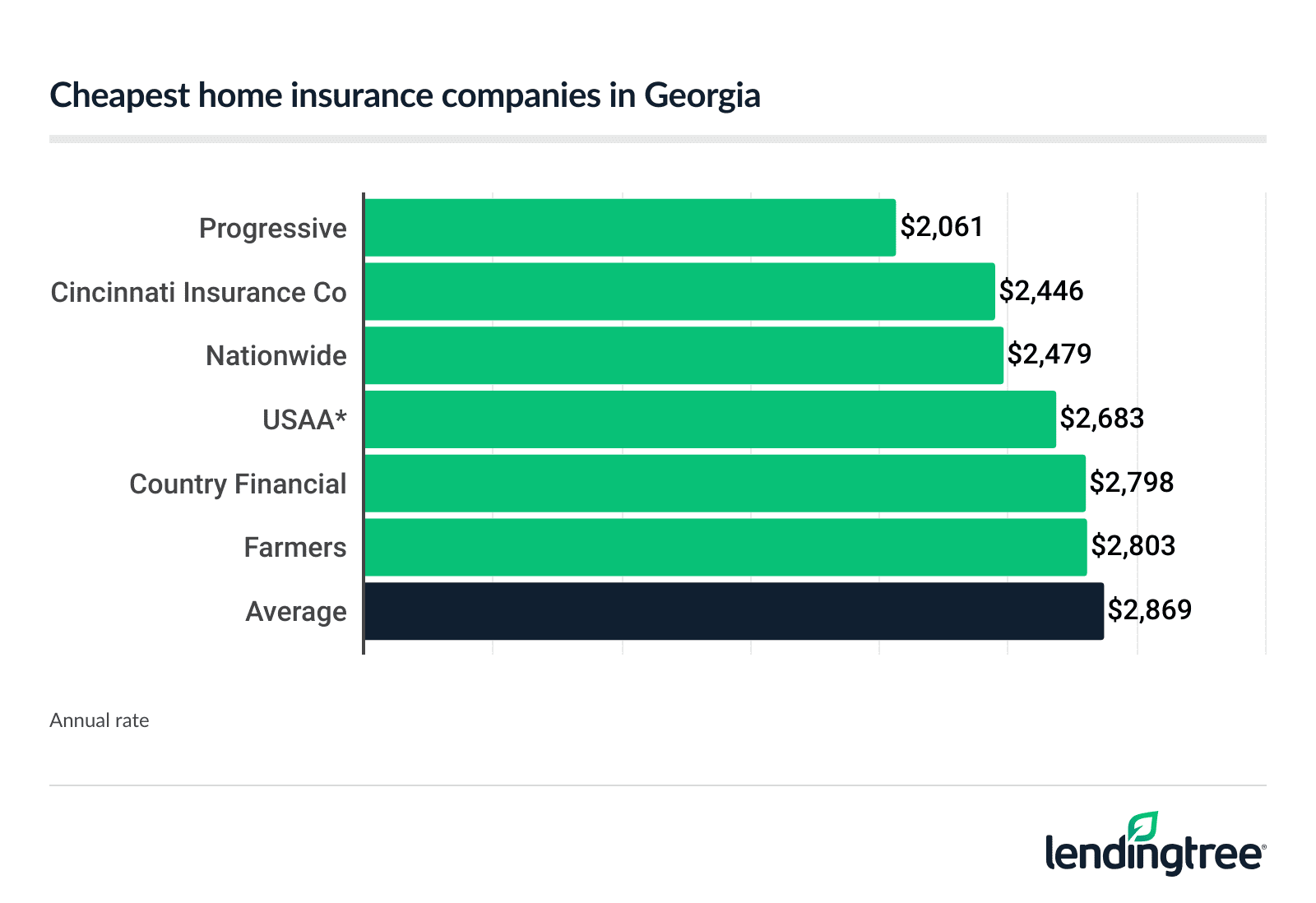

Progressive, the Cincinnati Insurance Company and Nationwide offer the cheapest home insurance rates in Georgia.

Progressive has the cheapest quotes overall, at an average rate of $2,061 a year. The Cincinnati Insurance Company is next at $2,446 a year.

Georgia home insurance rates by company

| Company | Average annual rate | LendingTree score | |

|---|---|---|---|

| Progressive | $2,061 | |

| Cincinnati Insurance Co | $2,446 | Not rated |

| Nationwide | $2,479 | |

| USAA* | $2,683 | |

| Country Financial | $2,798 | |

| Farmers | $2,803 | |

| Allstate | $3,100 | |

| Georgia Farm Bureau | $3,147 | |

| State Farm | $3,116 | |

| Chubb | $3,280 | Not rated |

| Travelers | $3,650 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. *USAA is only available to active-duty and veteran military members and their families.

Best homeowners insurance companies in Georgia

Progressive, Chubb and Country Financial are the best home insurance companies in Georgia, based on factors like cost, coverage, discounts and customer service.

| Company | Annual rate Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. | Customer satisfaction Source: J.D. Power 2024 U.S. Home Insurance Study. Higher is better; 640 is average. | Complaints Source: National Association of Insurance Commissioners (NAIC) 2024 Complaint Index. Lower is better; 1.0 is average. |

|---|---|---|---|

| Progressive | $2,061 | 634 | 1.73 |

| Cincinnati Insurance Co | $2,446 | - | 0.14 |

| USAA* | $2,683 | 737 | 0.37 |

| Country Financial | $2,798 | 635 | 0.37 |

| State Farm | $3,116 | 643 | 1.22 |

| Chubb | $3,280 | 688 | 0.08 |

Best overall home insurance in Georgia: Progressive

Annual rate: $2,061

Pros

Cheapest rates in Georgia

Several discounts to save even more

Website lets you get quotes, pay bills and file claims

Cons

Poor customer complaint rating

Customer satisfaction score is below average

Not many add-ons compared to competitors

Progressive is the best home insurance company in Georgia for most homeowners. It offers the most affordable quotes in the state and many discount options that can make it even cheaper.

In fact, Progressive’s average rate for home insurance is $800 a year cheaper than the state average. That’s a difference of 28%.

Best home insurance company for coverage in Georgia: Chubb

Annual rate: $3,280

![]()

Pros

Great coverage options, especially for high-value homes

Few customer complaints

Excellent customer satisfaction score

Cons

Rates are higher than the state average

You may not qualify for coverage if home isn’t worth enough

Chubb offers some great coverage if you upgrade to its Masterpiece policy. With it, you can get a cash settlement if your home is a total loss due to a covered peril A covered peril is an event — like fire, lightning or vandalism — that your home insurance may cover if it causes damage to your home or property. and you decide not to rebuild your home.

If items in your home are damaged, Chubb’s Masterpiece policy will replace them. This includes upgraded appliances, custom cabinets and flooring.

Chubb also receives many fewer customer complaints than are expected of a company its size, according to the NAIC The NAIC rates companies on confirmed complaints by size. A confirmed complaint is one that leads to a finding of fault. .

Best home insurance company for discounts in Georgia: Country Financial

Annual rate: $2,798

![]()

Pros

Many discount options

Several coverage add-ons to personalize policy

Rates are cheaper than the state average

Cons

Need to talk with an agent to get quotes

Country Financial offers a variety of unique home insurance discounts. You can qualify for a discount if you have new or upgraded electrical wiring. You can also save if your home doesn’t have a solid fuel-burning unit.

Country Financial offers common discounts, too, like ones for owning a new home, having more than one policy and being a loyal customer.

How much is homeowners insurance in Georgia?

The average cost of home insurance in Georgia is $2,869 a year for a typical home. However, insurance companies consider many factors when determining your home insurance quote. This includes:

- Crime rates and weather patterns in your area

- The age of your home

- Your insurance history

- Deductible amount

What you pay for home insurance can also vary a lot based on the amount of coverage you need.

In Georgia, you’ll pay 16% more for home insurance if your policy has $400,000 in dwelling coverage Dwelling coverage helps rebuild or repair the structure of your home than you would if it had $350,000 in dwelling coverage. A home insurance policy with $450,000 in dwelling coverage costs 11% more than one with $400,000 in this coverage.

| Dwelling coverage amount | Average annual rate |

|---|---|

| $350,000 | $2,553 |

| $400,000 | $2,869 |

| $450,000 | $3,194 |

Georgia home insurance rates by city

Athens residents pay the cheapest home insurance rates in the state, at around $2,406 per year. Sea Island has the state’s highest home insurance rates of $4,365 a year.

Home insurance rates near you

| City | Annual rate |

|---|---|

| Abbeville | $2,911 |

| Acworth | $2,598 |

| Adairsville | $2,753 |

| Adel | $2,938 |

| Adrian | $2,989 |

| Ailey | $2,940 |

| Alamo | $2,902 |

| Alapaha | $3,028 |

| Albany | $2,804 |

| Aldora | $2,673 |

| Allenhurst | $3,165 |

| Allentown | $2,875 |

| Alma | $2,987 |

| Alpharetta | $2,525 |

| Alston | $2,868 |

| Alto | $2,673 |

| Ambrose | $2,967 |

| Americus | $2,763 |

| Andersonville | $2,807 |

| Appling | $2,589 |

| Arabi | $2,927 |

| Aragon | $2,973 |

| Argyle | $2,752 |

| Arlington | $2,965 |

| Armuchee | $2,890 |

| Arnoldsville | $2,487 |

| Ashburn | $2,908 |

| Athens | $2,406 |

| Atlanta | $2,967 |

| Attapulgus | $2,858 |

| Auburn | $2,505 |

| Augusta | $2,990 |

| Austell | $2,752 |

| Avera | $3,017 |

| Avondale Estates | $2,572 |

| Axson | $3,008 |

| Baconton | $3,038 |

| Bainbridge | $2,926 |

| Baldwin | $2,576 |

| Ball Ground | $2,729 |

| Barnesville | $2,686 |

| Barney | $2,941 |

| Bartow | $2,983 |

| Barwick | $3,040 |

| Baxley | $2,927 |

| Bellville | $2,948 |

| Belvedere Park | $2,826 |

| Berkeley Lake | $2,515 |

| Berlin | $2,997 |

| Bethlehem | $2,439 |

| Bishop | $2,486 |

| Blackshear | $2,977 |

| Blairsville | $2,544 |

| Blakely | $2,932 |

| Bloomingdale | $3,440 |

| Blue Ridge | $2,675 |

| Bluffton | $2,894 |

| Blythe | $2,976 |

| Bogart | $2,421 |

| Bolingbroke | $3,985 |

| Bonaire | $2,723 |

| Bonanza | $2,780 |

| Boneville | $4,163 |

| Boston | $2,848 |

| Bostwick | $3,675 |

| Bowdon | $2,625 |

| Bowdon Junction | $3,932 |

| Bowersville | $2,602 |

| Bowman | $2,680 |

| Box Springs | $2,886 |

| Braselton | $2,442 |

| Bremen | $2,655 |

| Brinson | $2,919 |

| Bristol | $2,980 |

| Bronwood | $2,789 |

| Brookfield | $4,211 |

| Brooklet | $2,941 |

| Brooks | $2,660 |

| Broxton | $3,032 |

| Brunswick | $3,407 |

| Buchanan | $2,660 |

| Buckhead | $2,468 |

| Buena Vista | $2,873 |

| Buford | $2,486 |

| Butler | $2,971 |

| Byromville | $2,831 |

| Byron | $2,709 |

| Cadwell | $2,708 |

| Cairo | $2,809 |

| Calhoun | $3,105 |

| Calvary | $4,118 |

| Camak | $2,700 |

| Camilla | $3,067 |

| Candler-McAfee | $2,957 |

| Canon | $2,594 |

| Canton | $2,598 |

| Carlton | $2,534 |

| Carnesville | $2,542 |

| Carrollton | $2,755 |

| Cartersville | $2,668 |

| Cassville | $4,078 |

| Cataula | $2,939 |

| Cave Spring | $2,823 |

| Cecil | $3,028 |

| Cedar Springs | $4,138 |

| Cedartown | $2,895 |

| Centerville | $2,688 |

| Centralhatchee | $2,877 |

| Chamblee | $2,477 |

| Chatsworth | $2,598 |

| Chattahoochee Hills | $2,742 |

| Chattanooga Valley | $2,678 |

| Chauncey | $2,840 |

| Cherry Log | $2,735 |

| Chester | $2,937 |

| Chestnut Mountain | $4,018 |

| Chickamauga | $2,706 |

| Chula | $2,947 |

| Cisco | $2,614 |

| Clarkdale | $3,961 |

| Clarkesville | $2,644 |

| Clarkston | $2,849 |

| Claxton | $2,951 |

| Clayton | $2,545 |

| Clermont | $2,591 |

| Cleveland | $2,525 |

| Climax | $2,945 |

| Clinchfield | $4,087 |

| Clyo | $3,155 |

| Cobb | $2,841 |

| Cobbtown | $3,043 |

| Cochran | $2,862 |

| Cohutta | $2,647 |

| Colbert | $2,447 |

| Coleman | $2,871 |

| College Park | $2,967 |

| Collins | $3,099 |

| Colquitt | $2,952 |

| Columbus | $3,170 |

| Comer | $2,565 |

| Commerce | $2,509 |

| Concord | $2,801 |

| Conley | $2,941 |

| Conyers | $2,698 |

| Coolidge | $2,926 |

| Coosa | $4,197 |

| Cordele | $2,871 |

| Cornelia | $2,536 |

| Cotton | $4,283 |

| Country Club Estates | $3,115 |

| Covington | $2,553 |

| Crandall | $2,678 |

| Crawford | $2,463 |

| Crawfordville | $2,632 |

| Crescent | $4,253 |

| Culloden | $2,600 |

| Cumming | $2,526 |

| Cusseta | $2,881 |

| Cuthbert | $2,907 |

| Dacula | $2,445 |

| Dahlonega | $2,980 |

| Daisy | $2,967 |

| Dallas | $2,603 |

| Dalton | $2,652 |

| Damascus | $2,976 |

| Danielsville | $2,529 |

| Danville | $2,897 |

| Darien | $3,378 |

| Dasher | $2,709 |

| Davisboro | $2,867 |

| Dawson | $2,822 |

| Dawsonville | $2,634 |

| De Soto | $2,862 |

| Dearing | $2,847 |

| Decatur | $2,677 |

| Deenwood | $2,902 |

| Deepstep | $2,820 |

| Demorest | $2,563 |

| Denton | $2,884 |

| Dewy Rose | $2,688 |

| Dexter | $2,720 |

| Dillard | $2,505 |

| Dixie | $2,906 |

| Dock Junction | $3,522 |

| Doerun | $2,935 |

| Donalsonville | $2,960 |

| Doraville | $2,688 |

| Douglas | $3,014 |

| Douglasville | $2,745 |

| Dover | $4,235 |

| Druid Hills | $2,779 |

| Dry Branch | $2,769 |

| Du Pont | $2,950 |

| Dublin | $2,732 |

| Dudley | $2,713 |

| Duluth | $2,483 |

| Dunwoody | $2,558 |

| Dutch Island | $3,572 |

| East Dublin | $2,708 |

| East Ellijay | $2,796 |

| East Griffin | $2,703 |

| East Point | $2,917 |

| Eastanollee | $2,644 |

| Eastman | $2,973 |

| Eatonton | $2,519 |

| Eden | $3,021 |

| Edison | $2,981 |

| Elberton | $2,690 |

| Elko | $2,777 |

| Ellabell | $3,174 |

| Ellaville | $2,820 |

| Ellenton | $3,015 |

| Ellenwood | $2,923 |

| Ellerslie | $2,929 |

| Ellijay | $2,772 |

| Emerson | $2,676 |

| Enigma | $3,048 |

| Epworth | $2,713 |

| Esom Hill | $4,272 |

| Eton | $2,640 |

| Euharlee | $2,672 |

| Evans | $2,639 |

| Experiment | $2,698 |

| Fair Oaks | $2,724 |

| Fairburn | $2,711 |

| Fairmount | $2,944 |

| Fairview | $2,569 |

| Fargo | $2,921 |

| Farmington | $2,645 |

| Fayetteville | $2,681 |

| Felton | $4,067 |

| Fitzgerald | $3,011 |

| Fleming | $3,168 |

| Flemington | $3,296 |

| Flintstone | $2,754 |

| Flovilla | $2,508 |

| Flowery Branch | $2,492 |

| Folkston | $2,928 |

| Forest Park | $2,954 |

| Forsyth | $2,592 |

| Fort Gaines | $2,901 |

| Fort Moore | $3,095 |

| Fort Oglethorpe | $2,621 |

| Fort Stewart | $3,250 |

| Fort Valley | $2,780 |

| Fortson | $2,906 |

| Fowlstown | $4,161 |

| Franklin | $2,889 |

| Franklin Springs | $2,560 |

| Funston | $2,963 |

| Gainesville | $2,585 |

| Garden City | $3,443 |

| Garfield | $2,965 |

| Gay | $2,982 |

| Geneva | $2,806 |

| Georgetown | $3,634 |

| Gibson | $3,054 |

| Gillsville | $2,563 |

| Girard | $3,058 |

| Glenn | $4,210 |

| Glennville | $3,251 |

| Glenwood | $2,898 |

| Good Hope | $2,485 |

| Gordon | $2,774 |

| Gough | $4,197 |

| Gracewood | $4,286 |

| Grantville | $2,899 |

| Gray | $2,619 |

| Grayson | $2,489 |

| Graysville | $2,625 |

| Greensboro | $2,581 |

| Greenville | $2,966 |

| Gresham Park | $2,869 |

| Griffin | $2,714 |

| Grovetown | $2,663 |

| Gumlog | $2,592 |

| Guyton | $3,114 |

| Haddock | $2,594 |

| Hagan | $2,978 |

| Hahira | $2,669 |

| Hamilton | $2,913 |

| Hampton | $2,752 |

| Hannahs Mill | $2,831 |

| Hapeville | $3,035 |

| Haralson | $4,098 |

| Hardwick | $2,743 |

| Harlem | $2,684 |

| Harrison | $2,832 |

| Hartsfield | $2,931 |

| Hartwell | $2,579 |

| Hawkinsville | $2,853 |

| Hazlehurst | $2,990 |

| Helen | $2,538 |

| Helena | $2,926 |

| Hephzibah | $3,002 |

| Hiawassee | $2,585 |

| High Shoals | $3,972 |

| Hillsboro | $2,682 |

| Hinesville | $3,243 |

| Hiram | $2,636 |

| Hoboken | $2,983 |

| Hogansville | $3,011 |

| Holly Springs | $2,590 |

| Homer | $2,560 |

| Homerville | $2,973 |

| Hortense | $3,018 |

| Hoschton | $2,440 |

| Howard | $2,871 |

| Hull | $2,509 |

| Ideal | $2,836 |

| Ila | $3,901 |

| Indian Springs | $2,684 |

| Iron City | $2,978 |

| Irondale | $2,933 |

| Irwinton | $2,899 |

| Isle of Hope | $3,564 |

| Ivey | $2,796 |

| Jackson | $2,560 |

| Jacksonville | $2,965 |

| Jakin | $2,942 |

| Jasper | $2,781 |

| Jefferson | $2,482 |

| Jeffersonville | $2,760 |

| Jekyll Island | $3,994 |

| Jenkinsburg | $2,605 |

| Jersey | $4,023 |

| Jesup | $2,963 |

| Jewell | $2,802 |

| Johns Creek | $2,476 |

| Jonesboro | $2,915 |

| Juliette | $2,646 |

| Junction City | $2,845 |

| Kathleen | $2,849 |

| Kennesaw | $2,605 |

| Keysville | $3,022 |

| Kings Bay | $3,101 |

| Kings Bay Base | $3,458 |

| Kingsland | $3,178 |

| Kingston | $2,646 |

| Kite | $2,864 |

| Knoxville | $2,862 |

| LaFayette | $2,749 |

| Lagrange | $2,999 |

| Lake City | $2,899 |

| Lake Park | $2,729 |

| Lakeland | $2,981 |

| Lakemont | $2,498 |

| Lakeview | $2,593 |

| Lakeview Estates | $2,601 |

| Lavonia | $2,543 |

| Lawrenceville | $2,599 |

| Leary | $2,906 |

| Lebanon | $3,839 |

| Leesburg | $2,714 |

| Lenox | $3,019 |

| Leslie | $2,809 |

| Lexington | $2,488 |

| Lilburn | $2,579 |

| Lilly | $2,788 |

| Lincoln Park | $2,834 |

| Lincolnton | $2,669 |

| Lindale | $2,809 |

| Lithia Springs | $2,783 |

| Lithonia | $3,131 |

| Lizella | $2,857 |

| Locust Grove | $2,736 |

| Loganville | $2,528 |

| Lookout Mountain | $2,749 |

| Louisville | $2,991 |

| Louvale | $3,034 |

| Lovejoy | $2,774 |

| Ludowici | $2,815 |

| Lula | $2,583 |

| Lumber City | $2,939 |

| Lumpkin | $3,152 |

| Luthersville | $2,928 |

| Lyerly | $2,857 |

| Lyons | $2,985 |

| Mableton | $2,727 |

| Macon | $2,843 |

| Madison | $2,485 |

| Manassas | $2,882 |

| Manchester | $2,985 |

| Manor | $2,898 |

| Mansfield | $2,506 |

| Marble Hill | $2,745 |

| Marietta | $2,719 |

| Marshallville | $2,726 |

| Martin | $2,652 |

| Martinez | $2,630 |

| Matthews | $2,940 |

| Mauk | $2,952 |

| Maxeys | $2,521 |

| Maysville | $2,569 |

| Mc Intyre | $2,821 |

| McCaysville | $2,743 |

| Mcdonough | $2,756 |

| McRae | $2,899 |

| Meansville | $2,640 |

| Meigs | $2,917 |

| Meldrim | $2,981 |

| Menlo | $2,814 |

| Meridian | $3,218 |

| Mershon | $2,979 |

| Mesena | $4,070 |

| Metter | $2,912 |

| Midland | $3,013 |

| Midville | $3,132 |

| Midway | $3,338 |

| Milan | $2,995 |

| Milledgeville | $2,813 |

| Millen | $3,010 |

| Millwood | $2,979 |

| Milner | $2,717 |

| Milton | $2,493 |

| Mineral Bluff | $2,684 |

| Mitchell | $3,046 |

| Molena | $2,795 |

| Monroe | $2,522 |

| Montezuma | $2,800 |

| Montgomery | $3,557 |

| Monticello | $2,621 |

| Montrose | $2,727 |

| Moody AFB | $3,921 |

| Moreland | $2,770 |

| Morgan | $2,912 |

| Morganton | $2,733 |

| Morris | $2,851 |

| Morrow | $2,888 |

| Morven | $2,903 |

| Moultrie | $2,947 |

| Mount Airy | $2,616 |

| Mount Berry | $4,209 |

| Mount Vernon | $2,910 |

| Mount Zion | $2,633 |

| Mountain City | $2,555 |

| Mountain Park | $2,580 |

| Murrayville | $2,526 |

| Musella | $2,846 |

| Mystic | $3,944 |

| Nahunta | $3,023 |

| Nashville | $3,070 |

| Naylor | $2,744 |

| Nelson | $4,088 |

| Newborn | $2,510 |

| Newington | $2,947 |

| Newnan | $2,837 |

| Newton | $2,958 |

| Nicholls | $3,017 |

| Nicholson | $2,411 |

| Norcross | $2,645 |

| Norman Park | $2,942 |

| Norristown | $2,796 |

| North Atlanta | $2,612 |

| North Decatur | $2,535 |

| North Druid Hills | $2,618 |

| North Metro | $3,946 |

| Norwood | $2,697 |

| Nunez | $2,931 |

| Oakfield | $2,811 |

| Oakman | $4,125 |

| Oakwood | $2,499 |

| Ochlocknee | $2,865 |

| Ocilla | $2,900 |

| Oconee | $2,801 |

| Odum | $2,964 |

| Offerman | $4,221 |

| Oglethorpe | $2,797 |

| Oliver | $4,192 |

| Omaha | $3,099 |

| Omega | $2,981 |

| Orchard Hill | $4,083 |

| Oxford | $2,641 |

| Palmetto | $2,764 |

| Panthersville | $3,045 |

| Parrott | $2,742 |

| Patterson | $3,026 |

| Pavo | $2,880 |

| Peachtree City | $2,665 |

| Peachtree Corners | $2,473 |

| Pearson | $3,108 |

| Pelham | $3,041 |

| Pembroke | $3,186 |

| Pendergrass | $2,429 |

| Perkins | $3,062 |

| Perry | $2,784 |

| Phillipsburg | $2,930 |

| Pine Lake | $2,660 |

| Pine Mountain | $2,998 |

| Pine Mountain Valley | $2,920 |

| Pinehurst | $2,828 |

| Pineview | $2,873 |

| Pitts | $2,901 |

| Plains | $2,835 |

| Plainville | $2,988 |

| Pooler | $3,332 |

| Port Wentworth | $3,407 |

| Portal | $2,974 |

| Porterdale | $2,557 |

| Poulan | $2,812 |

| Powder Springs | $2,571 |

| Pulaski | $3,981 |

| Putney | $2,800 |

| Quitman | $2,915 |

| Rabun Gap | $2,574 |

| Ranger | $3,043 |

| Raoul | $2,611 |

| Ray City | $3,002 |

| Rayle | $2,660 |

| Rebecca | $2,854 |

| Red Oak | $4,040 |

| Redan | $3,051 |

| Reed Creek | $2,576 |

| Register | $2,978 |

| Reidsville | $3,075 |

| Remerton | $2,691 |

| Rentz | $2,704 |

| Resaca | $2,834 |

| Rex | $2,887 |

| Reynolds | $2,922 |

| Rhine | $2,949 |

| Riceboro | $3,261 |

| Richland | $3,132 |

| Richmond Hill | $3,299 |

| Rincon | $3,139 |

| Ringgold | $2,698 |

| Rising Fawn | $2,818 |

| Riverdale | $2,979 |

| Roberta | $2,849 |

| Robins AFB | $2,740 |

| Rochelle | $2,903 |

| Rock Spring | $2,692 |

| Rockledge | $2,755 |

| Rockmart | $2,960 |

| Rocky Face | $2,653 |

| Rocky Ford | $2,979 |

| Rome | $2,861 |

| Roopville | $2,716 |

| Rossville | $2,555 |

| Roswell | $2,489 |

| Royston | $2,574 |

| Rupert | $2,945 |

| Russell | $2,470 |

| Rutledge | $2,514 |

| Rydal | $2,719 |

| Sale City | $3,015 |

| Sandersville | $2,821 |

| Sandy Springs | $2,588 |

| Sapelo Island | $3,343 |

| Sardis | $3,042 |

| Sargent | $2,799 |

| Sasser | $4,125 |

| Satilla | $3,005 |

| Sautee Nacoochee | $2,560 |

| Savannah | $3,623 |

| Scotland | $2,955 |

| Scottdale | $2,695 |

| Screven | $2,941 |

| Sea Island | $4,365 |

| Senoia | $2,865 |

| Seville | $4,091 |

| Shady Dale | $2,536 |

| Shannon | $2,878 |

| Sharon | $2,574 |

| Sharpsburg | $2,816 |

| Shellman | $2,857 |

| Shiloh | $2,881 |

| Siloam | $2,537 |

| Silver Creek | $2,837 |

| Skidaway Island | $3,511 |

| Sky Valley | $2,536 |

| Smarr | $3,704 |

| Smithville | $2,724 |

| Smyrna | $2,701 |

| Snellville | $2,526 |

| Social Circle | $2,506 |

| Soperton | $2,860 |

| Sparks | $2,995 |

| Sparta | $2,718 |

| Springfield | $3,103 |

| St. George | $2,881 |

| St. Marys | $3,765 |

| St. Simons | $4,132 |

| St. Simons Island | $3,934 |

| Stapleton | $2,955 |

| Statenville | $2,864 |

| Statesboro | $3,065 |

| Statham | $2,507 |

| Stephens | $2,503 |

| Stillmore | $2,931 |

| Stockbridge | $2,733 |

| Stockton | $2,862 |

| Stone Mountain | $2,774 |

| Suches | $2,587 |

| Sugar Hill | $2,480 |

| Sugar Valley | $2,937 |

| Summerville | $2,803 |

| Sumner | $2,796 |

| Sunny Side | $4,034 |

| Sunnyside | $2,879 |

| Surrency | $2,921 |

| Suwanee | $2,472 |

| Swainsboro | $3,047 |

| Sycamore | $2,900 |

| Sylvania | $2,984 |

| Sylvester | $2,796 |

| Talahi Island | $4,233 |

| Talbotton | $2,849 |

| Talking Rock | $2,829 |

| Tallapoosa | $2,661 |

| Tallulah Falls | $3,746 |

| Talmo | $2,440 |

| Tarrytown | $2,923 |

| Tate | $2,942 |

| Taylorsville | $2,730 |

| Temple | $2,699 |

| Tennga | $3,906 |

| Tennille | $2,826 |

| The Rock | $2,678 |

| Thomaston | $2,833 |

| Thomasville | $2,879 |

| Thomson | $2,851 |

| Thunderbolt | $3,774 |

| Tifton | $2,959 |

| Tiger | $2,615 |

| Tignall | $2,688 |

| Toccoa | $2,644 |

| Toccoa Falls | $2,685 |

| Toomsboro | $2,880 |

| Townsend | $3,439 |

| Trenton | $2,786 |

| Trion | $2,796 |

| Tucker | $2,609 |

| Tunnel Hill | $2,677 |

| Turin | $4,156 |

| Turnerville | $3,858 |

| Twin City | $3,038 |

| Ty Ty | $2,900 |

| Tybee Island | $4,017 |

| Tyrone | $2,602 |

| Unadilla | $2,835 |

| Union City | $2,905 |

| Union Point | $2,436 |

| Unionville | $2,932 |

| Upatoi | $3,026 |

| Uvalda | $2,836 |

| Valdosta | $2,768 |

| Varnell | $4,053 |

| Vidalia | $2,869 |

| Vienna | $2,801 |

| Villa Rica | $2,638 |

| Vinings | $2,779 |

| Waco | $2,662 |

| Wadley | $2,979 |

| Waleska | $2,691 |

| Walnut Grove | $2,557 |

| Walthourville | $3,255 |

| Waresboro | $4,075 |

| Warm Springs | $3,058 |

| Warner Robins | $2,705 |

| Warrenton | $2,807 |

| Warthen | $2,835 |

| Warwick | $2,799 |

| Washington | $2,663 |

| Watkinsville | $2,410 |

| Waverly | $3,124 |

| Waverly Hall | $2,905 |

| Waycross | $2,893 |

| Waynesboro | $3,055 |

| Waynesville | $2,973 |

| Webster County | $2,932 |

| West Green | $2,990 |

| West Point | $3,005 |

| Weston | $2,925 |

| Whigham | $2,968 |

| White | $2,675 |

| White Oak | $3,108 |

| White Plains | $2,615 |

| Whitemarsh Island | $4,210 |

| Whitesburg | $2,702 |

| Wildwood | $2,801 |

| Wiley | $2,612 |

| Willacoochee | $3,103 |

| Williamson | $2,767 |

| Wilmington Island | $4,204 |

| Winder | $2,478 |

| Winston | $2,776 |

| Winterville | $2,409 |

| Woodbine | $3,226 |

| Woodbury | $3,021 |

| Woodland | $2,811 |

| Woodstock | $2,616 |

| Wray | $2,815 |

| Wrens | $3,055 |

| Wrightsville | $2,844 |

| Yatesville | $2,714 |

| Young Harris | $2,592 |

| Zebulon | $2,771 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. *USAA is only available to active-duty and veteran military members and their families.

Additional home insurance coverages needed in Georgia

Tornadoes, floods and hurricanes are common in Georgia. A standard home insurance policy may cover some of these events, but you’ll need separate coverage for others.

Flood insurance

Home insurance policies do not include flood coverage, but you can buy flood insurance separately. Flood insurance is offered through the National Flood Insurance Program (NFIP).

The NFIP partners with insurance companies to service flood insurance. You can also get private flood insurance from insurance companies.

The average cost of flood insurance in Georgia is $794 a year. This is 16% cheaper than the national average of $949 a year.

Tornado insurance

Standard home insurance policies usually cover wind damage. This means they cover most tornado damage, too.

You may have to pay a windstorm deductible before your insurer pays out a claim, though. In 19 states as well as Washington, D.C., homeowners must pay deductibles for wind damage. Also, in some states or regions that are prone to strong winds, home insurance may exclude wind coverage. In this case, you’ll need to buy windstorm insurance.

Hurricane insurance

If a hurricane damages your home, a standard home insurance policy may cover the damage caused by wind. It won’t cover damage from flooding, though. For that, you need a flood insurance policy.