Best Homeowners Insurance in Idaho

Best Idaho home insurance companies

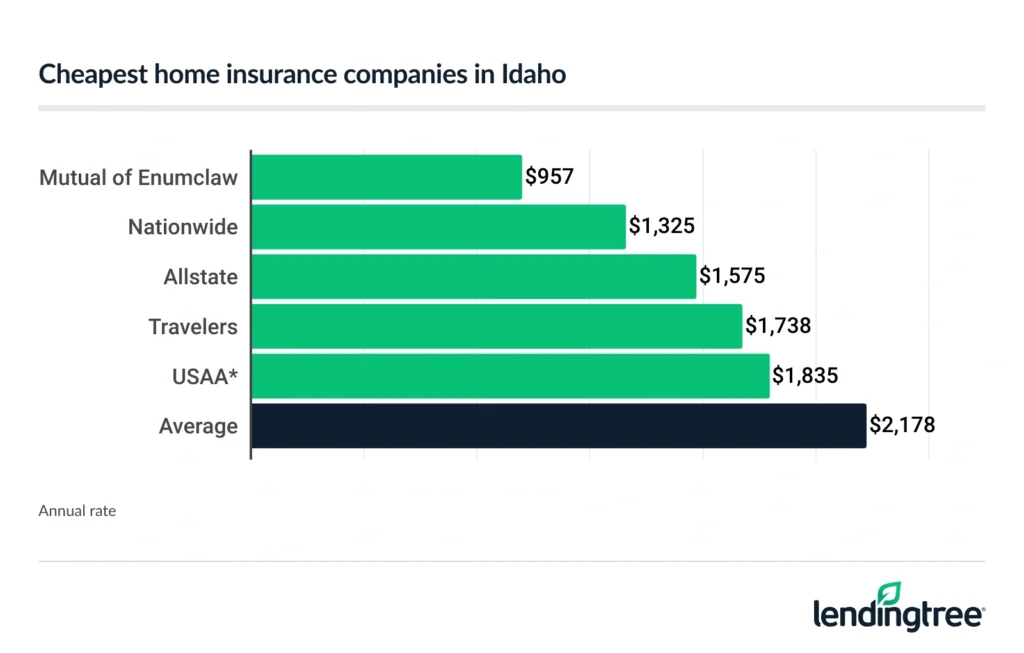

Cheapest home insurance companies in Idaho

Mutual of Enumclaw has the cheapest home insurance rate for Idaho residents at $957 a year, on average. This is 56% cheaper than the state average of $2,178 a year.

Nationwide is the second-cheapest company at $1,325 a year, which is 39% cheaper than Idaho’s average.

Idaho’s cheapest home insurance quotes

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Mutual of Enumclaw | $957 | Not rated |

| Nationwide | $1,325 | |

| Allstate | $1,575 | |

| Travelers | $1,738 | |

| USAA* | $1,835 | |

| American Family | $2,499 | |

| Farmers | $2,512 | |

| State Farm | $2,669 | |

| Farm Bureau | $4,494 |

Best homeowners insurance companies in Idaho

Mutual of Enumclaw, Allstate and Travelers are the best homeowners insurance companies in Idaho, based on our research.

Mutual of Enumclaw offers the cheapest home insurance rates in Idaho. Allstate has the best discount options, and Travelers is the best for green homes.

Idaho’s best home insurance companies

| Company | Best for | Annual rate | Overall satisfaction** | Complaint index*** |

|---|---|---|---|---|

| Mutual of Enumclaw | Low rates | $957 | Not rated | 0.89 |

| Allstate | Discounts | $1,575 | 631 | 1.3 |

| Travelers | Green homes | $1,738 | 609 | 0.85 |

***Source: NAIC Complaint Index data from 2023. Lower scores are better; 1.0 is average.

Best for: Cheap rates – Mutual of Enumclaw

- Cheapest average rate in Idaho

- Good complaint rating

- Easy-to-use app

- No online quotes

- Few discounts

Best for: Discounts – Allstate

Discounts include:

- Bundling your home and auto policies

- Becoming and staying an Allstate policyholder

- Signing up for autopay

- Installing windstorm mitigation

- Many discounts

- Below-average home insurance rates

- Savings when you don’t file a claim

- Customer satisfaction and complaint ratings are below-average

Best for: Eco-friendly homes – Travelers

- Cheap average rate

- Green home discount

- Low overall customer satisfaction

- May have a banned dog list in your area

Cost of home insurance in Idaho

A standard home insurance policy in Idaho costs $2,178 a year, on average. This is 22% cheaper than the national average rate of $2,801.

When calculating your home insurance quote, insurers use many factors besides where you live. These include the:

- Age of your home

- Quality of construction materials

- Chosen coverage limits and deductible

Different insurance companies weigh these factors differently. For example, one insurer may see the age of your house as a higher risk than another company, and it may charge you more because of it. This is why it’s important to compare quotes from many companies before you buy or renew a policy.

Idaho home insurance rates by coverage amounts

The dwelling coverage limit you choose for your home insurance policy impacts your final rate. The higher the limit, the higher your rate.

For example, Idaho homeowners pay around $246 more per year for a home insurance policy with a $450,000 dwelling coverage limit than one with a $400,000 limit.

If you own a newer-build home, raising your deductible could be a good way to cut home insurance costs. The higher you set your deductible, the lower your annual premium.

Average annual rate by dwelling coverage

| Dwelling coverage limit | Annual rate |

|---|---|

| $350,000 | $1,947 |

| $400,000 | $2,178 |

| $450,000 | $2,424 |

Idaho home insurance rates by city

Boise has the cheapest homeowners rate of Idaho’s cities at an average of $2,251 a year. Ferdinand is the most expensive city in Idaho for home insurance at $2,628 a year.

Home insurance rates near you

| City | Annual rate

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

|

|---|---|

| Aberdeen | $2,509 |

| Ahsahka | $2,496 |

| Albion | $2,411 |

| Almo | $2,341 |

| American Falls | $2,441 |

| Ammon | $2,506 |

| Arbon | $2,444 |

| Arbon Valley | $2,426 |

| Arco | $2,442 |

| Arimo | $2,491 |

| Ashton | $2,445 |

| Athol | $2,403 |

| Atomic City | $2,453 |

| Avery | $2,454 |

| Bancroft | $2,455 |

| Banks | $2,485 |

| Basalt | $2,459 |

| Bayview | $2,410 |

| Bellevue | $2,397 |

| Bern | $2,358 |

| Blackfoot | $2,402 |

| Blanchard | $2,501 |

| Bliss | $2,452 |

| Bloomington | $2,345 |

| Boise | $2,251 |

| Bonners Ferry | $2,369 |

| Bovill | $2,499 |

| Bruneau | $2,505 |

| Buhl | $2,506 |

| Burley | $2,399 |

| Calder | $2,431 |

| Caldwell | $2,426 |

| Cambridge | $2,428 |

| Carey | $2,481 |

| Careywood | $2,486 |

| Carmen | $2,487 |

| Cascade | $2,516 |

| Castleford | $2,538 |

| Cataldo | $2,464 |

| Challis | $2,403 |

| Chester | $2,342 |

| Chubbuck | $2,411 |

| Clark Fork | $2,546 |

| Clarkia | $2,505 |

| Clayton | $2,395 |

| Clifton | $2,476 |

| Cobalt | $2,521 |

| Cocolalla | $2,523 |

| Coeur d’Alene | $2,465 |

| Colburn | $2,514 |

| Conda | $2,540 |

| Coolin | $2,487 |

| Corral | $2,449 |

| Cottonwood | $2,469 |

| Council | $2,606 |

| Craigmont | $2,542 |

| Culdesac | $2,456 |

| Dalton Gardens | $2,389 |

| Dayton | $2,444 |

| Deary | $2,470 |

| Declo | $2,390 |

| Desmet | $2,392 |

| Dietrich | $2,453 |

| Dingle | $2,505 |

| Donnelly | $2,520 |

| Dover | $2,524 |

| Downey | $2,530 |

| Driggs | $2,411 |

| Dubois | $2,371 |

| Eagle | $2,384 |

| Eastport | $2,391 |

| Eden | $2,405 |

| Elk City | $2,454 |

| Elk River | $2,508 |

| Ellis | $2,359 |

| Emmett | $2,307 |

| Fairfield | $2,351 |

| Felt | $2,317 |

| Fenn | $2,511 |

| Ferdinand | $2,628 |

| Fernwood | $2,449 |

| Filer | $2,419 |

| Firth | $2,464 |

| Fish Haven | $2,416 |

| Fort Hall | $2,428 |

| Franklin | $2,556 |

| Fruitland | $2,562 |

| Garden City | $2,375 |

| Garden Valley | $2,419 |

| Genesee | $2,466 |

| Geneva | $2,327 |

| Georgetown | $2,348 |

| Gibbonsville | $2,396 |

| Glenns Ferry | $2,442 |

| Gooding | $2,401 |

| Grace | $2,388 |

| Grand Total | $2,474 |

| Grand View | $2,457 |

| Grangeville | $2,514 |

| Greencreek | $2,534 |

| Greenleaf | $2,492 |

| Groveland | $2,453 |

| Hagerman | $2,435 |

| Hailey | $2,384 |

| Hamer | $2,352 |

| Hammett | $2,408 |

| Hansen | $2,453 |

| Harrison | $2,416 |

| Harvard | $2,354 |

| Hayden | $2,359 |

| Hazelton | $2,363 |

| Heyburn | $2,332 |

| Hill City | $2,307 |

| Holbrook | $2,389 |

| Homedale | $2,434 |

| Hope | $2,464 |

| Horseshoe Bend | $2,547 |

| Howe | $2,440 |

| Idaho City | $2,428 |

| Idaho Falls | $2,478 |

| Indian Valley | $2,489 |

| Inkom | $2,548 |

| Iona | $2,496 |

| Irwin | $2,402 |

| Island Park | $2,385 |

| Jerome | $2,386 |

| Juliaetta | $2,368 |

| Kamiah | $2,493 |

| Kellogg | $2,517 |

| Kendrick | $2,449 |

| Ketchum | $2,424 |

| Kimberly | $2,417 |

| King Hill | $2,430 |

| Kingston | $2,417 |

| Kooskia | $2,543 |

| Kootenai | $2,606 |

| Kuna | $2,435 |

| Laclede | $2,404 |

| Lake Fork | $2,601 |

| Lapwai | $2,572 |

| Lava Hot Springs | $2,483 |

| Leadore | $2,545 |

| Lemhi | $2,528 |

| Lenore | $2,511 |

| Letha | $2,539 |

| Lewiston | $2,443 |

| Lewisville | $2,368 |

| Lincoln | $2,398 |

| Lowman | $2,442 |

| Lucile | $2,544 |

| Mackay | $2,491 |

| Macks Inn | $2,358 |

| Malad City | $2,444 |

| Malta | $2,468 |

| Marsing | $2,389 |

| May | $2,500 |

| McCall | $2,522 |

| McCammon | $2,578 |

| Medimont | $2,443 |

| Melba | $2,422 |

| Menan | $2,412 |

| Meridian | $2,282 |

| Mesa | $2,368 |

| Middleton | $2,464 |

| Midvale | $2,425 |

| Monteview | $2,434 |

| Montpelier | $2,377 |

| Moore | $2,384 |

| Moreland | $2,437 |

| Moscow | $2,399 |

| Mountain Home | $2,361 |

| Mountain Home AFB | $2,397 |

| Moyie Springs | $2,468 |

| Mullan | $2,486 |

| Murphy | $2,459 |

| Murray | $2,440 |

| Murtaugh | $2,440 |

| Nampa | $2,390 |

| Naples | $2,428 |

| New Meadows | $2,587 |

| New Plymouth | $2,586 |

| Newdale | $2,447 |

| Nezperce | $2,421 |

| Nordman | $2,516 |

| North Fork | $2,476 |

| Oakley | $2,406 |

| Ola | $2,384 |

| Oldtown | $2,450 |

| Orofino | $2,520 |

| Osburn | $2,472 |

| Parker | $2,472 |

| Parma | $2,536 |

| Paul | $2,489 |

| Payette | $2,463 |

| Peck | $2,452 |

| Picabo | $2,387 |

| Pierce | $2,494 |

| Pinehurst | $2,507 |

| Pingree | $2,448 |

| Placerville | $2,464 |

| Plummer | $2,418 |

| Pocatello | $2,460 |

| Pollock | $2,564 |

| Ponderay | $2,581 |

| Porthill | $2,522 |

| Post Falls | $2,410 |

| Potlatch | $2,319 |

| Preston | $2,430 |

| Priest River | $2,573 |

| Princeton | $2,445 |

| Rathdrum | $2,345 |

| Reubens | $2,422 |

| Rexburg | $2,424 |

| Richfield | $2,459 |

| Rigby | $2,444 |

| Riggins | $2,492 |

| Ririe | $2,502 |

| Riverside | $2,425 |

| Roberts | $2,429 |

| Robie Creek | $2,459 |

| Rockland | $2,484 |

| Rogerson | $2,443 |

| Rupert | $2,423 |

| Sagle | $2,472 |

| Salmon | $2,475 |

| Sandpoint | $2,471 |

| Santa | $2,518 |

| Shelley | $2,498 |

| Shoshone | $2,480 |

| Shoup | $2,456 |

| Silverton | $2,433 |

| Smelterville | $2,412 |

| Soda Springs | $2,434 |

| Spencer | $2,402 |

| Spirit Lake | $2,397 |

| Springfield | $2,438 |

| St. Anthony | $2,389 |

| St. Charles | $2,377 |

| St. Maries | $2,408 |

| Stanley | $2,413 |

| Star | $2,339 |

| Stites | $2,454 |

| Sugar City | $2,494 |

| Sun Valley | $2,370 |

| Swan Valley | $2,397 |

| Swanlake | $2,470 |

| Sweet | $2,470 |

| Sweetwater | $2,428 |

| Tendoy | $2,443 |

| Tensed | $2,434 |

| Terreton | $2,450 |

| Teton | $2,426 |

| Tetonia | $2,327 |

| Thatcher | $2,401 |

| Troy | $2,425 |

| Twin Falls | $2,360 |

| Victor | $2,350 |

| Viola | $2,297 |

| Wallace | $2,363 |

| Warren | $2,540 |

| Wayan | $2,498 |

| Weippe | $2,435 |

| Weiser | $2,499 |

| Wendell | $2,443 |

| Weston | $2,485 |

| White Bird | $2,549 |

| Wilder | $2,497 |

| Winchester | $2,484 |

| Worley | $2,467 |

| Yellow Pine | $2,475 |

Methodology

The rates shown in this article are based on nonbinding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in Idaho.

The following coverages and deductible were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

—

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to active-duty and veteran military members and their families.