Best Homeowners Insurance in Indiana

Erie’s cheap rates and high satisfaction score make it the best homeowners insurance company in Indiana. A policy costs an average of $1,453 a year — 45% less than the state average.

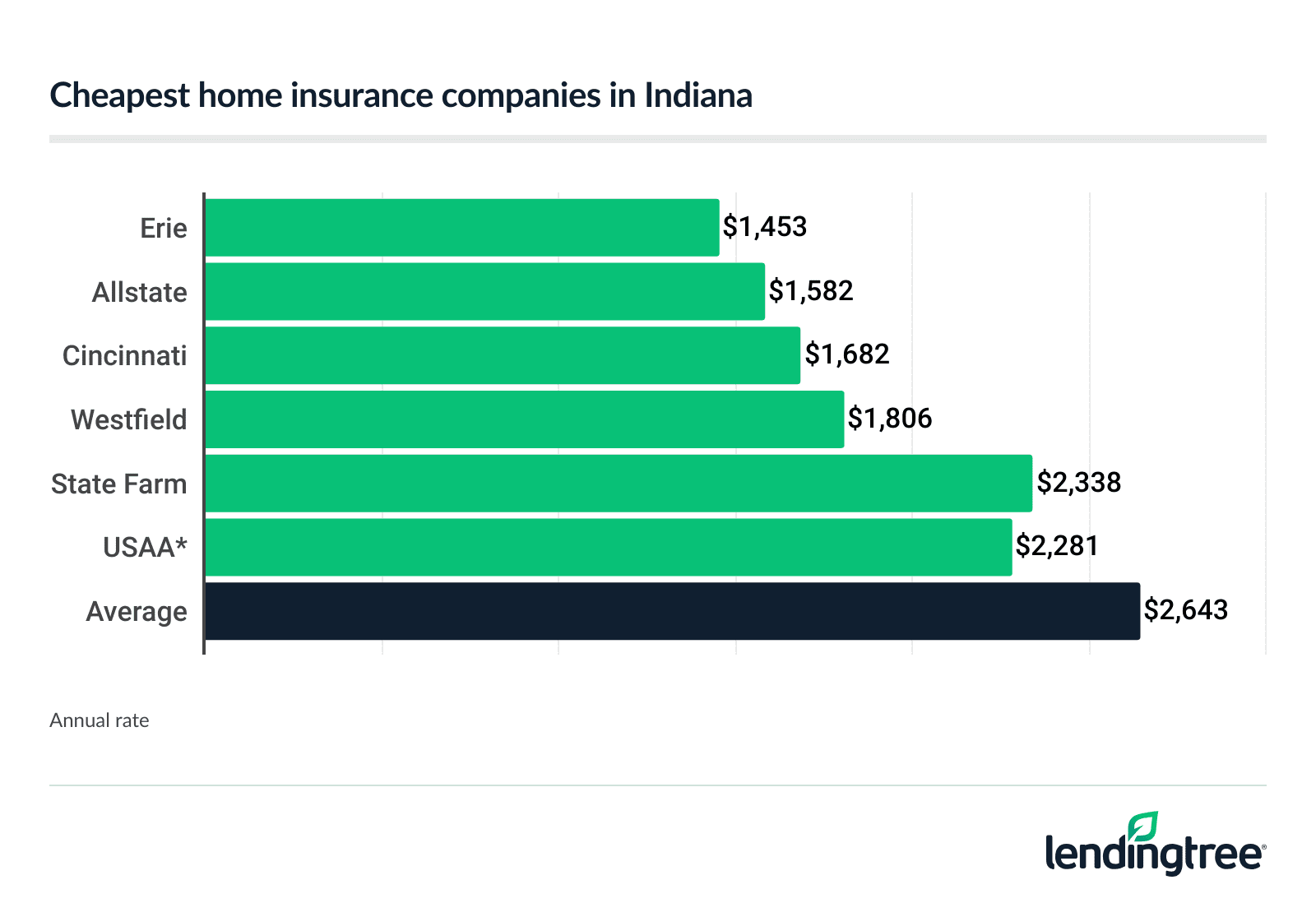

Cheapest home insurance in Indiana

Erie offers the cheapest home insurance quotes in Indiana, at $1,453 a year ($121 a month) on average, followed by Allstate and Cincinnati, respectively.

Since home insurance rates vary by customer, you should compare quotes from multiple companies to make sure you are getting the best price.

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Erie | $1,453 | |

| Allstate | $1,582 | |

| Cincinnati | $1,682 | Not rated |

| Westfield | $1,806 | Not rated |

| State Farm | $2,338 | |

| ASI Progressive | $2,880 | |

| Nationwide | $3,139 | |

| Indiana Farm Bureau | $3,343 | |

| Grange | $3,345 | Not rated |

| American Family | $3,580 | |

| Farmers | $4,290 | |

| USAA* | $2,281 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. *USAA is only available to active-duty and veteran military members and their families.

Best homeowners insurance in Indiana

Erie is the best overall homeowners insurance company in Indiana, while Allstate has the best policy features.

Westfield also stands out as the best small homeowners insurance company, while USAA is generally best for military families.

| Company | LendingTree score | Satisfaction score | Complaint rating |

|---|---|---|---|

| Best overall: Erie | 856 (Excellent) | 0.38 (Excellent) | |

| Best policy features: Allstate | 809 (Below Average) | 0.9 (Average) | |

| Best small company: Westfield | Not rated | Not available | 0.08 (Excellent) |

| Best for military families: USAA | 881 (Excellent) | 0.36 (Excellent) |

The satisfaction scores are from J.D. Power’s 2023 U.S. Home Insurance Study. The segment average for home insurers is 819.

The complaint ratings are based on confirmed complaints (those that lead to a finding of fault), as tracked by the National Association of Insurance Commissioners.

A 2.0 complaint rating indicates a company has twice as many confirmed complaints as expected for its size. A 0.5 score indicates half as many.

Best overall home insurance company in Indiana: Erie

Annual rate: $1,453

![]()

Pros

Rate is 45% less than the state average

Satisfaction score and complaint rating are excellent

Guaranteed replacement cost coverage at no extra charge

Extended water damage endorsement covers basement floods

Cons

Home insurance quotes are not available online

In addition to the lowest average home insurance rate in Indiana, Erie also has a higher satisfaction score than every company, except for USAA, which is only available to the military community.

Best policy features: Allstate

Annual rate: $1,582

![]()

Pros

Claim RateGuard feature protects you from a rate increase after your first claim

Deductible Rewards reduces your deductible if you avoid claims

Discounts available for bundling, buying a newer home or being a recent homebuyer

Cons

Satisfaction score is below the segment average

Complaint rating is just average

In addition to costing 40% less than the state average for home insurance, Allstate also offers policy features that may save you additional money down the line.

Indiana’s best small homeowners insurance company: Westfield

Annual rate: $1,806

![]()

Pros

Has the best complaint rating among Indiana home insurers

Rates are 32% less than the state average

An A rating for financial strength from A.M. Best

Extra coverage features when you bundle your home and auto policies

Cons

Limited policy information provided on the company’s website

Online quotes are not available

Although Westfield does not crack the top 10 in Indiana for size, it competes well with larger Indiana home insurers on price and ratings.

Best for military families: USAA

Annual rate: $2,281

![]()

Pros

Home insurance rates 14% less than the state average

Replacement cost coverage for your belongings is a standard feature

Discounts on home security products and services

Coverage for military equipment and uniforms

Cons

Can get a different representative each time you call

Only available to current and former service members and their families

USAA has the highest customer satisfaction score among Indiana home insurance companies. It also rewards customers with valuable perks.

How much is homeowners insurance in Indiana?

The average cost of homeowners insurance in Indiana is $2,643 a year, or $220 a month.

The actual price you pay depends on factors such as:

- The amount of coverage you need

- Where you lived

- Your credit and insurance history

- Any discounts you may be eligible to receive

You can often save money by shopping around because each home insurance company weighs these factors differently.

Home insurance rates by coverage amounts

An insurance policy that covers your home or dwelling for $400,000 costs an average of 11% more in Indiana than a $350,000 policy.

| Dwelling amount | Annual rate |

|---|---|

| $350,000 | $2,386 |

| $400,000 | $2,643 |

| $450,000 | $2,915 |

For a new mortgage, lenders typically require you to insure your home at its replacement value, or the estimated cost of rebuilding it.

You can insure your home for a lower amount if you have a low loan balance or if you own your home outright. But this puts you at risk of not getting enough insurance money to rebuild after a disaster.

Most insurance companies use a software program to estimate your home’s replacement value, based on its specifications. Make sure that the information the insurance company has about your home is accurate.

Indiana homeowners insurance rates by city

Shipshewana has the cheapest home insurance in Indiana. Homeowners in Shipshewana pay an average of $2,300 per year.

Home insurance costs an average of $3,126 a year in Gary, making it Indiana’s most expensive city to insure a home.

| City | Annual rate |

|---|---|

| Aberdeen | $2,533 |

| Advance | $2,654 |

| Akron | $2,531 |

| Alamo | $2,764 |

| Albany | $2,576 |

| Albion | $2,452 |

| Alexandria | $2,576 |

| Altona | $2,355 |

| Ambia | $2,705 |

| Amboy | $2,566 |

| Americus | $2,424 |

| Amo | $2,781 |

| Anderson | $2,598 |

| Andrews | $2,474 |

| Angola | $2,367 |

| Arcadia | $2,578 |

| Arcola | $2,396 |

| Argos | $2,514 |

| Arlington | $2,592 |

| Ashley | $2,376 |

| Athens | $2,566 |

| Atlanta | $2,567 |

| Attica | $2,654 |

| Atwood | $2,476 |

| Auburn | $2,331 |

| Aurora | $2,607 |

| Austin | $2,872 |

| Avilla | $2,385 |

| Avoca | $2,831 |

| Avon | $2,728 |

| Bainbridge | $2,732 |

| Bargersville | $2,785 |

| Bass Lake | $2,693 |

| Batesville | $2,551 |

| Bath | $2,451 |

| Battle Ground | $2,472 |

| Bedford | $2,809 |

| Beech Grove | $2,928 |

| Bellmore | $2,783 |

| Bennington | $2,710 |

| Bentonville | $2,507 |

| Berne | $2,369 |

| Bethlehem | $2,783 |

| Beverly Shores | $2,736 |

| Bicknell | $2,800 |

| Bippus | $2,435 |

| Birdseye | $2,705 |

| Blanford | $2,837 |

| Bloomfield | $2,820 |

| Bloomingdale | $2,742 |

| Bloomington | $2,543 |

| Bluffton | $2,390 |

| Boggstown | $2,683 |

| Boone Grove | $2,690 |

| Boonville | $2,849 |

| Borden | $2,849 |

| Boswell | $2,669 |

| Bourbon | $2,484 |

| Bowling Green | $3,056 |

| Bradford | $2,830 |

| Branchville | $2,728 |

| Brazil | $2,918 |

| Bremen | $2,446 |

| Bridgeton | $2,812 |

| Bright | $2,507 |

| Brimfield | $2,448 |

| Bringhurst | $2,663 |

| Bristol | $2,359 |

| Bristow | $2,751 |

| Brook | $2,655 |

| Brooklyn | $2,780 |

| Brookston | $2,577 |

| Brookville | $2,512 |

| Brownsburg | $2,696 |

| Brownstown | $2,735 |

| Brownsville | $2,556 |

| Bruceville | $2,849 |

| Bryant | $2,497 |

| Buckskin | $2,914 |

| Buffalo | $2,606 |

| Bunker Hill | $2,566 |

| Burket | $2,511 |

| Burlington | $2,693 |

| Burnettsville | $2,657 |

| Burns Harbor | $2,534 |

| Burrows | $2,610 |

| Butler | $2,381 |

| Butlerville | $2,724 |

| Cambridge City | $2,474 |

| Camby | $2,873 |

| Camden | $2,648 |

| Campbellsburg | $2,930 |

| Canaan | $2,755 |

| Cannelburg | $2,822 |

| Cannelton | $2,797 |

| Carbon | $2,917 |

| Carlisle | $2,874 |

| Carmel | $2,590 |

| Carthage | $2,554 |

| Cayuga | $2,757 |

| Cedar Grove | $2,539 |

| Cedar Lake | $2,483 |

| Celestine | $2,743 |

| Centerpoint | $2,954 |

| Centerville | $2,551 |

| Central | $2,773 |

| Chalmers | $2,590 |

| Chandler | $2,845 |

| Charlestown | $2,738 |

| Charlottesville | $2,616 |

| Chesterfield | $2,626 |

| Chesterton | $2,533 |

| Chrisney | $2,879 |

| Churubusco | $2,364 |

| Cicero | $2,587 |

| Clarks Hill | $2,523 |

| Clarksburg | $2,666 |

| Clarksville | $2,739 |

| Clay City | $2,942 |

| Claypool | $2,471 |

| Clayton | $2,753 |

| Clear Lake | $2,366 |

| Clermont | $2,932 |

| Clifford | $2,583 |

| Clinton | $2,821 |

| Coal City | $2,956 |

| Coalmont | $2,957 |

| Coatesville | $2,718 |

| Colfax | $2,616 |

| Columbia City | $2,384 |

| Columbus | $2,560 |

| Commiskey | $2,771 |

| Connersville | $2,520 |

| Converse | $2,597 |

| Cordry Sweetwater Lakes | $2,708 |

| Cortland | $2,765 |

| Corunna | $2,429 |

| Cory | $2,992 |

| Corydon | $2,737 |

| Country Club Heights | $2,590 |

| Country Squire Lakes | $2,772 |

| Covington | $2,703 |

| Craigville | $2,444 |

| Crandall | $2,757 |

| Crane | $2,870 |

| Crane Naval Depot | $2,859 |

| Crawfordsville | $2,657 |

| Cromwell | $2,447 |

| Cross Plains | $2,806 |

| Crothersville | $2,859 |

| Crown Point | $2,442 |

| Culver | $2,554 |

| Cumberland | $2,953 |

| Cutler | $2,700 |

| Cynthiana | $2,770 |

| Dale | $2,750 |

| Daleville | $2,634 |

| Dana | $2,844 |

| Danville | $2,701 |

| Darlington | $2,690 |

| Dayton | $2,461 |

| De Motte | $2,667 |

| Decatur | $2,363 |

| Decker | $2,803 |

| Deedsville | $2,585 |

| Delong | $2,569 |

| Delphi | $2,571 |

| Denver | $2,565 |

| Depauw | $2,785 |

| Deputy | $2,860 |

| Derby | $2,784 |

| Dillsboro | $2,613 |

| Donaldson | $2,492 |

| Dublin | $2,561 |

| Dubois | $2,723 |

| Dugger | $2,810 |

| Dunkirk | $2,524 |

| Dunlap | $2,323 |

| Dunreith | $2,614 |

| Dupont | $2,820 |

| Dyer | $2,352 |

| Earl Park | $2,694 |

| East Chicago | $2,842 |

| East Enterprise | $2,733 |

| Eaton | $2,552 |

| Eckerty | $2,917 |

| Economy | $2,554 |

| Edgewood | $2,584 |

| Edinburgh | $2,593 |

| Edwardsport | $2,835 |

| Elberfeld | $2,842 |

| Elizabeth | $2,785 |

| Elizabethtown | $2,614 |

| Elkhart | $2,348 |

| Ellettsville | $2,550 |

| Elnora | $2,820 |

| Elwood | $2,568 |

| Eminence | $2,786 |

| English | $2,868 |

| Etna Green | $2,490 |

| Evanston | $2,789 |

| Evansville | $2,698 |

| Fair Oaks | $2,780 |

| Fairland | $2,654 |

| Fairmount | $2,641 |

| Fairview Park | $2,831 |

| Falmouth | $2,596 |

| Farmersburg | $2,875 |

| Farmland | $2,576 |

| Fillmore | $2,798 |

| Finly | $2,654 |

| Fish Lake | $2,573 |

| Fishers | $2,609 |

| Flat Rock | $2,606 |

| Flora | $2,616 |

| Florence | $2,736 |

| Floyds Knobs | $2,783 |

| Fontanet | $2,893 |

| Fort Branch | $2,814 |

| Fort Wayne | $2,389 |

| Fortville | $2,595 |

| Fountain City | $2,473 |

| Fountaintown | $2,661 |

| Fowler | $2,619 |

| Fowlerton | $2,651 |

| Francesville | $2,669 |

| Francisco | $2,884 |

| Frankfort | $2,536 |

| Franklin | $2,748 |

| Frankton | $2,620 |

| Fredericksburg | $2,946 |

| Freedom | $2,896 |

| Freelandville | $2,817 |

| Freetown | $2,795 |

| Fremont | $2,358 |

| French Lick | $2,917 |

| Friendship | $2,772 |

| Fulda | $2,726 |

| Fulton | $2,513 |

| Galveston | $2,601 |

| Garrett | $2,346 |

| Gary | $3,126 |

| Gas City | $2,625 |

| Gaston | $2,604 |

| Geneva | $2,407 |

| Gentryville | $2,801 |

| Georgetown | $2,831 |

| Glenwood | $2,573 |

| Goldsmith | $2,581 |

| Goodland | $2,724 |

| Goshen | $2,301 |

| Gosport | $2,869 |

| Grabill | $2,381 |

| Grammer | $2,639 |

| Grandview | $2,825 |

| Granger | $2,301 |

| Grantsburg | $2,842 |

| Grass Creek | $2,540 |

| Graysville | $2,795 |

| Greencastle | $2,789 |

| Greendale | $2,525 |

| Greenfield | $2,657 |

| Greens Fork | $2,572 |

| Greensburg | $2,601 |

| Greentown | $2,564 |

| Greenwood | $2,780 |

| Griffin | $2,867 |

| Griffith | $2,587 |

| Grissom AFB | $2,524 |

| Grovertown | $2,668 |

| Guilford | $2,569 |

| Gwynneville | $2,738 |

| Hagerstown | $2,521 |

| Hamilton | $2,389 |

| Hamlet | $2,665 |

| Hammond | $2,706 |

| Hanna | $2,644 |

| Hanover | $2,812 |

| Hardinsburg | $2,931 |

| Harlan | $2,400 |

| Harrodsburg | $2,571 |

| Hartford City | $2,574 |

| Hartsville | $2,613 |

| Hatfield | $2,811 |

| Haubstadt | $2,889 |

| Hayden | $2,769 |

| Hazleton | $2,924 |

| Hebron | $2,605 |

| Helmsburg | $2,736 |

| Heltonville | $2,816 |

| Hemlock | $2,570 |

| Henryville | $2,818 |

| Heritage Lake | $2,689 |

| Hidden Valley | $2,504 |

| Highland | $2,556 |

| Hillsboro | $2,722 |

| Hillsdale | $2,816 |

| Hoagland | $2,500 |

| Hobart | $2,559 |

| Hobbs | $2,598 |

| Holland | $2,656 |

| Holton | $2,771 |

| Homecroft | $3,046 |

| Homer | $2,668 |

| Hope | $2,552 |

| Howe | $2,412 |

| Hudson | $2,398 |

| Hudson Lake | $2,560 |

| Huntertown | $2,356 |

| Huntingburg | $2,647 |

| Huntington | $2,396 |

| Huron | $2,764 |

| Hymera | $2,836 |

| Idaville | $2,652 |

| Indian Heights | $2,501 |

| Indianapolis | $3,010 |

| Ingalls | $2,599 |

| Inglefield | $2,705 |

| Ireland | $2,631 |

| Jamestown | $2,580 |

| Jasonville | $2,846 |

| Jasper | $2,663 |

| Jeffersonville | $2,747 |

| Jonesboro | $2,647 |

| Jonesville | $2,606 |

| Kempton | $2,554 |

| Kendallville | $2,350 |

| Kennard | $2,665 |

| Kentland | $2,707 |

| Kewanna | $2,562 |

| Keystone | $2,499 |

| Kimmell | $2,479 |

| Kingman | $2,768 |

| Kingsbury | $2,660 |

| Kingsford Heights | $2,585 |

| Knightstown | $2,592 |

| Knightsville | $2,912 |

| Knox | $2,687 |

| Kokomo | $2,501 |

| Koleen | $2,807 |

| Koontz Lake | $2,587 |

| Kouts | $2,605 |

| Kurtz | $2,707 |

| La Crosse | $2,689 |

| La Fontaine | $2,558 |

| La Paz | $2,508 |

| La Porte | $2,538 |

| Laconia | $2,776 |

| Ladoga | $2,754 |

| Lafayette | $2,389 |

| Lagrange | $2,368 |

| Lake Cicott | $2,575 |

| Lake Dalecarlia | $2,518 |

| Lake Santee | $2,614 |

| Lake Station | $2,670 |

| Lake Village | $2,724 |

| Lakes Of The Four Seasons | $2,510 |

| Laketon | $2,559 |

| Lakeville | $2,529 |

| Lamar | $2,816 |

| Landess | $2,632 |

| Lanesville | $2,805 |

| Laotto | $2,440 |

| Lapel | $2,631 |

| Larwill | $2,429 |

| Lawrence | $2,990 |

| Lawrenceburg | $2,516 |

| Leavenworth | $2,871 |

| Lebanon | $2,549 |

| Leesburg | $2,415 |

| Leiters Ford | $2,552 |

| Leo | $2,364 |

| Leo-Cedarville | $2,349 |

| Leopold | $2,762 |

| Leroy | $2,561 |

| Lewis | $2,974 |

| Lewisville | $2,632 |

| Liberty | $2,499 |

| Liberty Center | $2,506 |

| Liberty Mills | $2,547 |

| Ligonier | $2,381 |

| Lincoln City | $2,747 |

| Linden | $2,691 |

| Linn Grove | $2,429 |

| Linton | $2,833 |

| Lizton | $2,749 |

| Logansport | $2,513 |

| Long Beach | $2,578 |

| Loogootee | $2,811 |

| Losantville | $2,584 |

| Lowell | $2,518 |

| Lucerne | $2,605 |

| Lynn | $2,525 |

| Lynnville | $2,854 |

| Lyons | $2,815 |

| Mackey | $2,843 |

| Macy | $2,553 |

| Madison | $2,782 |

| Manilla | $2,619 |

| Marengo | $2,934 |

| Mariah Hill | $2,725 |

| Marion | $2,622 |

| Markle | $2,449 |

| Markleville | $2,621 |

| Marshall | $2,759 |

| Martinsville | $2,792 |

| Marysville | $2,852 |

| Matthews | $2,642 |

| Mauckport | $2,790 |

| Maxwell | $2,659 |

| Mays | $2,606 |

| McCordsville | $2,600 |

| Mecca | $2,768 |

| Medaryville | $2,665 |

| Medora | $2,836 |

| Mellott | $2,694 |

| Melody Hill | $2,614 |

| Memphis | $2,815 |

| Mentone | $2,479 |

| Meridian Hills | $2,859 |

| Merom | $2,879 |

| Merrillville | $2,546 |

| Metamora | $2,565 |

| Mexico | $2,504 |

| Miami | $2,660 |

| Michiana Shores | $2,555 |

| Michigan City | $2,578 |

| Michigantown | $2,631 |

| Middlebury | $2,331 |

| Middletown | $2,645 |

| Midland | $2,771 |

| Milan | $2,753 |

| Milford | $2,401 |

| Mill Creek | $2,591 |

| Millersburg | $2,411 |

| Millhousen | $2,714 |

| Milltown | $2,868 |

| Milroy | $2,622 |

| Milton | $2,556 |

| Mishawaka | $2,372 |

| Mitchell | $2,769 |

| Modoc | $2,591 |

| Mongo | $2,469 |

| Monon | $2,606 |

| Monroe | $2,440 |

| Monroe City | $2,890 |

| Monroeville | $2,471 |

| Monrovia | $2,761 |

| Monterey | $2,700 |

| Montezuma | $2,783 |

| Montgomery | $2,827 |

| Monticello | $2,551 |

| Montmorenci | $2,398 |

| Montpelier | $2,624 |

| Mooreland | $2,617 |

| Moores Hill | $2,601 |

| Mooresville | $2,767 |

| Morgantown | $2,734 |

| Morocco | $2,694 |

| Morris | $2,669 |

| Morristown | $2,629 |

| Mount Auburn | $2,483 |

| Mount Ayr | $2,635 |

| Mount St. Francis | $2,758 |

| Mount Summit | $2,641 |

| Mount Vernon | $2,830 |

| Mulberry | $2,594 |

| Muncie | $2,581 |

| Munster | $2,483 |

| Muscatatuck | $2,724 |

| Nabb | $2,838 |

| Napoleon | $2,688 |

| Nappanee | $2,381 |

| Nashville | $2,692 |

| Nebraska | $2,724 |

| Needham | $2,699 |

| New Albany | $2,781 |

| New Carlisle | $2,529 |

| New Castle | $2,578 |

| New Chicago | $2,647 |

| New Goshen | $2,920 |

| New Harmony | $2,859 |

| New Haven | $2,401 |

| New Lisbon | $2,619 |

| New Market | $2,706 |

| New Middletown | $2,762 |

| New Palestine | $2,649 |

| New Paris | $2,376 |

| New Point | $2,674 |

| New Richmond | $2,728 |

| New Ross | $2,779 |

| New Salisbury | $2,756 |

| New Trenton | $2,554 |

| New Washington | $2,811 |

| New Waverly | $2,567 |

| New Whiteland | $2,745 |

| Newberry | $2,873 |

| Newburgh | $2,796 |

| Newport | $2,736 |

| Newtown | $2,709 |

| Noblesville | $2,631 |

| Nora | $2,740 |

| Norman | $2,776 |

| North Judson | $2,673 |

| North Liberty | $2,532 |

| North Manchester | $2,476 |

| North Salem | $2,682 |

| North Terre Haute | $2,903 |

| North Vernon | $2,770 |

| North Webster | $2,446 |

| Norway | $2,570 |

| Notre Dame | $2,443 |

| Oakford | $2,529 |

| Oakland City | $2,873 |

| Oaktown | $2,821 |

| Oakville | $2,615 |

| Odon | $2,834 |

| Ogden Dunes | $2,616 |

| Oldenburg | $2,537 |

| Onward | $2,599 |

| Oolitic | $2,735 |

| Ora | $2,734 |

| Orestes | $2,686 |

| Orland | $2,423 |

| Orleans | $2,938 |

| Osceola | $2,381 |

| Osgood | $2,701 |

| Ossian | $2,443 |

| Otisco | $2,852 |

| Otterbein | $2,625 |

| Otwell | $2,842 |

| Owensburg | $2,815 |

| Owensville | $2,870 |

| Oxford | $2,613 |

| Palmyra | $2,793 |

| Paoli | $2,935 |

| Paragon | $2,798 |

| Paris Crossing | $2,792 |

| Parker City | $2,576 |

| Patoka | $2,854 |

| Patricksburg | $2,903 |

| Patriot | $2,783 |

| Paxton | $2,820 |

| Pekin | $2,922 |

| Pendleton | $2,589 |

| Pennville | $2,559 |

| Perrysville | $2,761 |

| Peru | $2,522 |

| Petersburg | $2,836 |

| Petroleum | $2,484 |

| Pierceton | $2,471 |

| Pierceville | $2,748 |

| Pimento | $2,981 |

| Pine Village | $2,703 |

| Pittsboro | $2,710 |

| Plainfield | $2,748 |

| Plainville | $2,868 |

| Pleasant Lake | $2,427 |

| Pleasant Mills | $2,409 |

| Plymouth | $2,489 |

| Point Isabel | $2,648 |

| Poland | $2,953 |

| Poneto | $2,499 |

| Portage | $2,605 |

| Porter | $2,533 |

| Portland | $2,496 |

| Poseyville | $2,819 |

| Princes Lakes | $2,701 |

| Princeton | $2,852 |

| Purdue University | $2,386 |

| Putnamville | $2,807 |

| Quincy | $2,911 |

| Ragsdale | $2,784 |

| Ramsey | $2,755 |

| Redkey | $2,576 |

| Reelsville | $2,810 |

| Remington | $2,673 |

| Rensselaer | $2,686 |

| Reynolds | $2,605 |

| Richland | $2,869 |

| Richmond | $2,479 |

| Ridgeville | $2,580 |

| Rising Sun | $2,711 |

| Roachdale | $2,753 |

| Roann | $2,558 |

| Roanoke | $2,397 |

| Rochester | $2,520 |

| Rockfield | $2,620 |

| Rockport | $2,862 |

| Rockville | $2,755 |

| Rocky Ripple | $3,019 |

| Rolling Prairie | $2,581 |

| Rome | $2,805 |

| Rome City | $2,404 |

| Romney | $2,505 |

| Rosedale | $2,829 |

| Roseland | $2,492 |

| Roselawn | $2,663 |

| Rossville | $2,576 |

| Royal Center | $2,596 |

| Rushville | $2,547 |

| Russellville | $2,753 |

| Russiaville | $2,604 |

| Salamonia | $2,513 |

| Salem | $2,879 |

| Salt Creek Commons | $2,540 |

| San Pierre | $2,680 |

| Sandborn | $2,856 |

| Santa Claus | $2,726 |

| Saratoga | $2,530 |

| Schererville | $2,438 |

| Schneider | $2,611 |

| Schnellville | $2,727 |

| Scipio | $2,733 |

| Scotland | $2,790 |

| Scottsburg | $2,837 |

| Sedalia | $2,605 |

| Seelyville | $2,849 |

| Sellersburg | $2,770 |

| Selma | $2,627 |

| Servia | $2,558 |

| Seymour | $2,711 |

| Shadeland | $2,386 |

| Sharpsville | $2,604 |

| Shelburn | $2,873 |

| Shelbyville | $2,566 |

| Shepardsville | $2,863 |

| Sheridan | $2,664 |

| Shipshewana | $2,300 |

| Shirley | $2,641 |

| Shoals | $2,821 |

| Shorewood Forest | $2,541 |

| Silver Lake | $2,509 |

| Simonton Lake | $2,334 |

| Smithville | $2,616 |

| Smithville-Sanders | $2,499 |

| Solsberry | $2,799 |

| Somerset | $2,546 |

| Somerville | $2,849 |

| South Bend | $2,531 |

| South Haven | $2,536 |

| South Milford | $2,410 |

| South Whitley | $2,357 |

| Southport | $3,053 |

| Speedway | $3,011 |

| Spencer | $2,886 |

| Spencerville | $2,402 |

| Spiceland | $2,605 |

| Springport | $2,635 |

| Springville | $2,782 |

| Spurgeon | $2,820 |

| St. Anthony | $2,694 |

| St. Bernice | $2,844 |

| St. Croix | $2,789 |

| St. Joe | $2,357 |

| St. John | $2,450 |

| St. Mary of the Woods | $2,905 |

| St. Meinrad | $2,748 |

| St. Paul | $2,683 |

| Stanford | $2,664 |

| Star City | $2,723 |

| State Line | $2,653 |

| Staunton | $2,937 |

| Stendal | $2,831 |

| Stilesville | $2,772 |

| Stinesville | $2,649 |

| Stockwell | $2,408 |

| Straughn | $2,665 |

| Stroh | $2,457 |

| Sullivan | $2,814 |

| Sulphur | $2,814 |

| Sulphur Springs | $2,688 |

| Sumava Resorts | $2,721 |

| Summitville | $2,606 |

| Sunman | $2,667 |

| Swayzee | $2,684 |

| Sweetser | $2,670 |

| Switz City | $2,894 |

| Syracuse | $2,383 |

| Talbot | $2,605 |

| Taswell | $2,886 |

| Taylorsville | $2,612 |

| Tefft | $2,721 |

| Tell City | $2,707 |

| Templeton | $2,612 |

| Tennyson | $2,833 |

| Terre Haute | $2,865 |

| Thayer | $2,711 |

| Thorntown | $2,572 |

| Tipton | $2,547 |

| Topeka | $2,415 |

| Town of Pines | $2,553 |

| Trafalgar | $2,714 |

| Trail Creek | $2,572 |

| Tri-Lakes | $2,368 |

| Troy | $2,767 |

| Tunnelton | $2,813 |

| Twelve Mile | $2,607 |

| Tyner | $2,559 |

| Underwood | $2,837 |

| Union City | $2,535 |

| Union Mills | $2,576 |

| Uniondale | $2,473 |

| Unionville | $2,583 |

| Universal | $2,795 |

| Upland | $2,584 |

| Urbana | $2,563 |

| Utica | $2,748 |

| Vallonia | $2,837 |

| Valparaiso | $2,513 |

| Van Buren | $2,626 |

| Veedersburg | $2,746 |

| Velpen | $2,848 |

| Versailles | $2,723 |

| Vevay | $2,769 |

| Vincennes | $2,799 |

| Wabash | $2,535 |

| Wadesville | $2,841 |

| Wakarusa | $2,394 |

| Waldron | $2,658 |

| Walkerton | $2,552 |

| Wallace | $2,675 |

| Walton | $2,575 |

| Wanatah | $2,629 |

| Warren | $2,494 |

| Warren Park | $3,044 |

| Warsaw | $2,428 |

| Washington | $2,819 |

| Waterloo | $2,348 |

| Waveland | $2,761 |

| Wawaka | $2,448 |

| Waynetown | $2,712 |

| Webster | $2,478 |

| West Baden Springs | $2,897 |

| West College Corner | $2,504 |

| West Harrison | $2,577 |

| West Lafayette | $2,389 |

| West Lebanon | $2,703 |

| West Middleton | $2,583 |

| West Newton | $3,088 |

| West Terre Haute | $2,910 |

| Westfield | $2,631 |

| Westphalia | $2,832 |

| Westpoint | $2,504 |

| Westport | $2,684 |

| Westville | $2,572 |

| Wheatfield | $2,678 |

| Wheatland | $2,847 |

| Wheeler | $2,664 |

| Whiteland | $2,745 |

| Whitestown | $2,585 |

| Whiting | $2,635 |

| Wilkinson | $2,606 |

| Williams | $2,849 |

| Williams Creek | $2,866 |

| Williamsburg | $2,505 |

| Williamsport | $2,651 |

| Winamac | $2,660 |

| Winchester | $2,533 |

| Windfall | $2,597 |

| Winfield | $2,464 |

| Wingate | $2,761 |

| Winona Lake | $2,378 |

| Winslow | $2,860 |

| Wolcott | $2,620 |

| Wolcottville | $2,382 |

| Wolflake | $2,459 |

| Woodburn | $2,402 |

| Worthington | $2,859 |

| Wyatt | $2,475 |

| Yeoman | $2,653 |

| Yoder | $2,428 |

| Yorktown | $2,581 |

| Young America | $2,630 |

| Zanesville | $2,462 |

| Zionsville | $2,560 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

How much is flood insurance in Indiana?

The average price of flood insurance in Indiana is $895 a year, or $75 a month, for policies from the National Flood Insurance Program (NFIP). The average national rate for flood insurance through the NFIP is $883 per year.

Standard home insurance does not cover flood damage.

If you have a mortgage in a high-risk flood zone, your lender will usually insist you get flood insurance. Flood insurance is often also worth considering if you own your home outright, or even in a low- or moderate-risk area.

Most flood insurance is purchased through the NFIP, which is managed by the Federal Emergency Management Agency (FEMA). However, several private companies also offer flood insurance in Indiana.

Methodology

The rates shown in this article are based on an analysis of non-binding quotes obtained from Quadrant Information Services for homes in every ZIP code in Indiana. Unless otherwise noted, standard home insurance policies include:

- Dwelling coverage: $400,000

- Other structures: $40,000

- Personal property: $200,000

- Loss of use: $80,000

- Personal liability: $100,000

- Guest medical payments: $5,000

- Deductible: $1,000

*USAA is only available to current and former members of the military and their families.

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third party customer service ratings, and app / website experience. We weighted these categories based on what customers value in an insurance company.

For 3rd party customer service ratings, we included NAIC’s Complaint Index scores and financial strength ratings from A.M. Best. NAIC Complaint Index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from A.M. Best reflect the ability to pay out claims.

Frequently asked questions

Standard home insurance costs an average of $2,643 a year in Indiana and covers most damage from tornadoes. Wind and hail are among the normal perils that home insurance covers.

However, home insurance does not cover flooding that may accompany a tornado.

Insurance companies typically require you to insure your home at 80% of its estimated replacement value to receive a full payment for covered repairs.

If you insure your home for less than this amount, your insurance company may reduce your claims payment.

Erie Insurance is the highest-rated home insurance company for claims satisfaction by J.D. Power. USAA, Amica and Nationwide have the next highest rankings, in that order.