Best Homeowners Insurance in Iowa

Farmers Insurance has the cheapest home insurance rate in Iowa with an average of $207 a month. It also offers a great selection of discounts.

Best cheap home insurance companies in Iowa

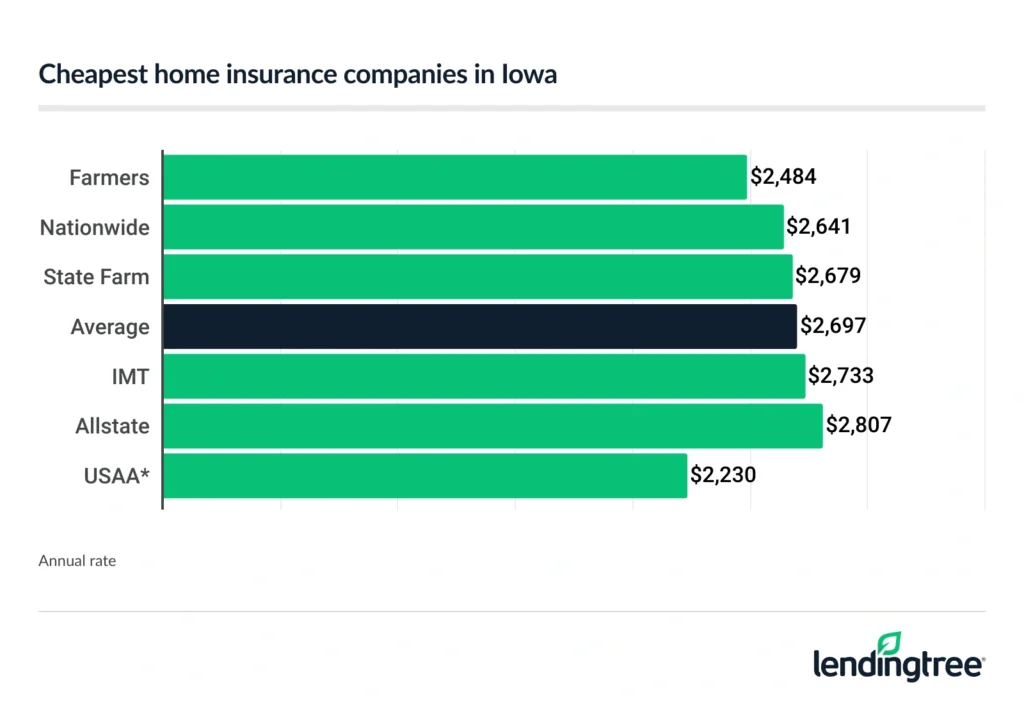

Cheapest home insurance in Iowa

Farmers has the cheapest home insurance for most Iowans, based on our research, charging rates that average $2,484 a year.

Nationwide’s average rate is only $13 a month more. If you qualify for some of its many discounts, it might be the cheapest for you.

USAA’s average rate of $2,230 a year is cheaper than that of both companies, but only members of the military and their families can buy home insurance from USAA.

| Company | Annual rate | Monthly rate | LendingTree score | |

|---|---|---|---|---|

| Farmers | $2,484 | $207 | |

| Nationwide | $2,641 | $220 | |

| State Farm | $2,679 | $223 | |

| IMT | $2,733 | $228 | Not rated |

| Allstate | $2,807 | $234 | |

| American Family | $2,955 | $246 | |

| Travelers | $3,127 | $261 | |

| Farm Bureau | $3,480 | $290 | |

| USAA* | $2,230 | $186 |

To get the cheapest homeowners insurance in Iowa for your needs, compare home insurance quotes from several companies as you shop around for coverage.

Best homeowners insurance companies in Iowa

Farmers is the best home insurance company in Iowa if you want a low rate and you don’t have military ties. It also offers the widest selection of home insurance discounts of the companies we surveyed.

Other home insurance companies may be the best for you, though, depending on what you find important. American Family offers tons of coverage options, for example. State Farm is known for customer satisfaction.

| Company | Best for | Average annual rate | Customer satisfaction** | Complaint index*** |

|---|---|---|---|---|

| Farmers | Cheap rates, discounts | $2,484 | 800 | 0.63 |

| American Family | Coverage options | $2,955 | 813 | 0.49 |

| State Farm | Customer satisfaction | $2,679 | 829 | 1.05 |

| IMT | Complaint rating | $2,733 | NA | 0.35 |

| USAA* | Military | $2,230 | 881 | 0.33 |

**Higher is better, ***Lower is better

Best for cheap rates and discounts: Farmers

Most Iowa homeowners will get the cheapest rates from Farmers, which charges $2,484 a year, on average.

Farmers also has the best home insurance discounts in Iowa. You may get a discount from Farmers for:

- Bundling home and auto insurance

- Owning a home that’s less than 14 years old

- Installing certain protective devices or safety features

- Not filing any claims for three consecutive years

- Paying your bill on time

PROS

- Lowest average home insurance rate for most Iowans

- Best selection of discounts among companies surveyed

- Complaint rating is better than average

CONS

- Customer satisfaction rating could be better

- Doesn’t offer as many coverage options as some other companies

Best home insurance coverage options: American Family

American Family offers the best coverage options of the home insurance companies we surveyed in Iowa.

Some of the optional coverages you can add to an American Family home insurance policy:

- Equipment breakdown

- Hidden water damage

- Matching undamaged siding

- Sewer and septic backup as well as sump overflow

- Identity protection

- Credit monitoring

PROS

- Offers more coverage options than any company we surveyed

- Good selection of discounts

- Complaint rating is better than average

CONS

- Average rate is higher than the state average

- Customer satisfaction rating is slightly worse than average

Best for customer satisfaction: State Farm

State Farm has the best J.D. Power customer satisfaction score for most homeowners in Iowa.

PROS

- Best customer satisfaction score for most Iowans

- Home insurance rate is just below the state average

CONS

- Doesn’t offer as many add-on coverages or discounts as some other companies

- Complaint rating is a slightly worse than average

Best complaint rating: IMT

IMT has the best complaint rating from the National Association of Insurance Commissioners (NAIC) for most Iowa homeowners.

PROS

- Best complaint rating for most homeowners in Iowa

- Good selection of discounts to help lower your rate

CONS

- Average rate could be better

- Doesn’t offer as many add-on coverages as some other companies

Best for military: USAA

USAA is the best home insurance company in Iowa for members of the military and their families.

USAA has Iowa’s cheapest home insurance rates for those who qualify. It also has the state’s best customer satisfaction and complaint ratings.

PROS

- Best home insurance rates in Iowa overall

- Best customer satisfaction score and complaint rating

CONS

- Only available to members of the military and their families

- Doesn’t offer as many discounts or add-on coverages as some other companies

What is the average home insurance cost in Iowa?

The average cost of home insurance in Iowa is $2,697 a year, based on our data.

This average rate is based on a policy with $400,000 of dwelling coverage. Policies with a higher dwelling coverage limit are more expensive, while those with less are cheaper.

| Dwelling limit | Annual rate | Monthly rate |

|---|---|---|

| $350,000 | $2,439 | $203 |

| $400,000 | $2,697 | $225 |

| $450,000 | $2,958 | $247 |

Your home insurance policy’s dwelling coverage pays to repair or rebuild the structure of your home if a fire, hail or other event damages or destroys it.

The amount of coverage you choose for your policy is just one of the factors that impacts your home insurance quote. Some other home insurance rate factors:

- Age of your home

- How much coverage you buy

- Your deductible

- Your credit, insurance and claims history

- Where you live in the state

Iowa homeowners insurance rates by city

Bettendorf has the cheapest home insurance in Iowa. Homeowners in Bettendorf pay an average of $2,365 per year.

Home insurance costs an average of $3,404 a year in Crescent, making it Iowa’s most expensive city to insure a home.

| City | Average annual rate

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

|

|---|---|

| Ackley | $2,651 |

| Ackworth | $2,763 |

| Adair | $2,876 |

| Adel | $2,721 |

| Afton | $2,925 |

| Agency | $2,593 |

| Ainsworth | $2,584 |

| Akron | $2,812 |

| Albert City | $2,783 |

| Albia | $2,677 |

| Albion | $2,721 |

| Alburnett | $2,488 |

| Alexander | $2,817 |

| Algona | $2,665 |

| Alleman | $2,569 |

| Allerton | $2,687 |

| Allison | $2,646 |

| Alta | $2,721 |

| Alta Vista | $2,628 |

| Alton | $2,787 |

| Altoona | $2,558 |

| Alvord | $2,772 |

| Amana | $2,677 |

| Ames | $2,563 |

| Anamosa | $2,458 |

| Andover | $2,563 |

| Andrew | $2,583 |

| Anita | $3,206 |

| Ankeny | $2,506 |

| Anthon | $2,974 |

| Aplington | $2,671 |

| Archer | $2,757 |

| Aredale | $2,646 |

| Argyle | $2,681 |

| Arion | $2,942 |

| Arispe | $2,880 |

| Arlington | $2,613 |

| Armstrong | $2,763 |

| Arnolds Park | $2,894 |

| Arthur | $2,853 |

| Asbury | $2,417 |

| Ashton | $2,837 |

| Aspinwall | $2,907 |

| Atalissa | $2,533 |

| Atkins | $2,561 |

| Atlantic | $3,121 |

| Auburn | $2,875 |

| Audubon | $2,977 |

| Aurelia | $2,671 |

| Aurora | $2,651 |

| Austinville | $2,712 |

| Avoca | $3,262 |

| Ayrshire | $2,781 |

| Badger | $2,816 |

| Bagley | $2,939 |

| Baldwin | $2,570 |

| Bancroft | $2,720 |

| Barnes City | $2,729 |

| Barnum | $2,916 |

| Batavia | $2,572 |

| Battle Creek | $2,922 |

| Baxter | $2,695 |

| Bayard | $2,951 |

| Beacon | $2,776 |

| Beaman | $2,743 |

| Bedford | $3,027 |

| Belle Plaine | $2,577 |

| Bellevue | $2,450 |

| Belmond | $2,747 |

| Bennett | $2,469 |

| Benton | $2,868 |

| Bernard | $2,460 |

| Berwick | $2,573 |

| Bettendorf | $2,365 |

| Bevington | $2,745 |

| Birmingham | $2,560 |

| Blairsburg | $2,718 |

| Blairstown | $2,586 |

| Blakesburg | $2,599 |

| Blanchard | $2,988 |

| Blencoe | $2,936 |

| Blockton | $3,030 |

| Bloomfield | $2,607 |

| Bode | $2,815 |

| Bondurant | $2,574 |

| Boone | $2,737 |

| Booneville | $2,756 |

| Bouton | $2,746 |

| Boxholm | $2,781 |

| Boyden | $2,781 |

| Braddyville | $3,113 |

| Bradgate | $2,825 |

| Brandon | $2,615 |

| Brayton | $2,982 |

| Breda | $2,936 |

| Bridgewater | $3,304 |

| Brighton | $2,486 |

| Bristow | $2,648 |

| Britt | $2,694 |

| Bronson | $2,968 |

| Brooklyn | $2,819 |

| Brunsville | $2,779 |

| Bryant | $2,457 |

| Buckingham | $2,695 |

| Buffalo Center | $2,718 |

| Burlington | $2,548 |

| Burnside | $2,984 |

| Bussey | $2,707 |

| Calamus | $2,431 |

| Callender | $2,960 |

| Calumet | $2,757 |

| Camanche | $2,423 |

| Cambridge | $2,683 |

| Cantril | $2,471 |

| Carbon | $3,051 |

| Carlisle | $2,739 |

| Carpenter | $2,652 |

| Carroll | $2,827 |

| Carson | $3,341 |

| Carter Lake | $3,375 |

| Cascade | $2,487 |

| Casey | $3,066 |

| Castalia | $2,526 |

| Castana | $2,860 |

| Cedar | $2,784 |

| Cedar Falls | $2,508 |

| Cedar Rapids | $2,519 |

| Center Junction | $2,493 |

| Center Point | $2,552 |

| Centerville | $2,549 |

| Central City | $2,487 |

| Chapin | $2,753 |

| Chariton | $2,761 |

| Charles City | $2,649 |

| Charlotte | $2,463 |

| Charter Oak | $3,008 |

| Chatsworth | $2,693 |

| Chelsea | $2,635 |

| Cherokee | $2,746 |

| Chester | $2,699 |

| Chillicothe | $2,580 |

| Churdan | $2,780 |

| Cincinnati | $2,671 |

| Clare | $2,846 |

| Clarence | $2,474 |

| Clarinda | $3,083 |

| Clarion | $2,682 |

| Clarksville | $2,638 |

| Clear Lake | $2,618 |

| Clearfield | $3,049 |

| Cleghorn | $2,735 |

| Clemons | $2,790 |

| Clermont | $2,519 |

| Climbing Hill | $2,893 |

| Clinton | $2,387 |

| Clio | $2,735 |

| Clive | $2,645 |

| Clutier | $2,770 |

| Coggon | $2,499 |

| Coin | $3,016 |

| Colesburg | $2,637 |

| Colfax | $2,803 |

| College Springs | $3,037 |

| Collins | $2,639 |

| Colo | $2,714 |

| Columbia | $2,635 |

| Columbus City | $2,663 |

| Columbus Junction | $2,636 |

| Colwell | $2,661 |

| Conesville | $2,656 |

| Conrad | $2,742 |

| Conroy | $2,692 |

| Coon Rapids | $3,003 |

| Cooper | $2,714 |

| Coralville | $2,454 |

| Corning | $2,985 |

| Correctionville | $2,853 |

| Corwith | $2,639 |

| Corydon | $2,744 |

| Coulter | $2,820 |

| Council Bluffs | $3,401 |

| Crawfordsville | $2,599 |

| Crescent | $3,404 |

| Cresco | $2,515 |

| Creston | $2,847 |

| Cromwell | $2,893 |

| Crystal Lake | $2,590 |

| Cumberland | $3,315 |

| Cumming | $2,694 |

| Curlew | $2,776 |

| Cushing | $2,839 |

| Cylinder | $2,776 |

| Dakota City | $2,762 |

| Dallas Center | $2,742 |

| Dana | $2,639 |

| Danbury | $2,952 |

| Davenport | $2,378 |

| Davis City | $2,736 |

| Dawson | $2,728 |

| Dayton | $2,875 |

| De Soto | $2,773 |

| De Witt | $2,394 |

| Decatur | $2,694 |

| Decorah | $2,516 |

| Dedham | $2,980 |

| Defiance | $3,254 |

| Delaware | $2,671 |

| Delmar | $2,591 |

| Deloit | $2,893 |

| Delta | $2,593 |

| Denison | $2,881 |

| Denmark | $2,575 |

| Denver | $2,587 |

| Derby | $2,705 |

| Des Moines | $2,666 |

| Dewar | $2,658 |

| Dexter | $2,759 |

| Diagonal | $2,975 |

| Dickens | $2,785 |

| Dike | $2,691 |

| Dixon | $2,405 |

| Dolliver | $2,765 |

| Donahue | $2,421 |

| Donnellson | $2,634 |

| Dorchester | $2,510 |

| Douds | $2,586 |

| Dougherty | $2,658 |

| Dow City | $3,025 |

| Dows | $2,746 |

| Drakesville | $2,579 |

| Dubuque | $2,405 |

| Dumont | $2,628 |

| Duncombe | $2,939 |

| Dundee | $2,659 |

| Dunkerton | $2,601 |

| Dunlap | $3,074 |

| Durango | $2,488 |

| Durant | $2,458 |

| Dyersville | $2,569 |

| Dysart | $2,692 |

| Eagle Grove | $2,703 |

| Earlham | $2,758 |

| Earling | $3,039 |

| Earlville | $2,654 |

| Early | $2,944 |

| East Peru | $2,778 |

| Eddyville | $2,666 |

| Edgewood | $2,684 |

| Elberon | $2,747 |

| Eldon | $2,585 |

| Eldora | $2,780 |

| Eldridge | $2,431 |

| Elgin | $2,532 |

| Elk Horn | $3,025 |

| Elk Run Heights | $2,559 |

| Elkader | $2,578 |

| Elkport | $2,667 |

| Elliott | $3,006 |

| Ellston | $2,869 |

| Ellsworth | $2,827 |

| Elma | $2,630 |

| Ely | $2,504 |

| Emerson | $3,054 |

| Emmetsburg | $2,814 |

| Epworth | $2,488 |

| Essex | $3,053 |

| Estherville | $2,816 |

| Evansdale | $2,541 |

| Everly | $2,813 |

| Exira | $3,053 |

| Exline | $2,694 |

| Fairfax | $2,507 |

| Fairfield | $2,514 |

| Farley | $2,499 |

| Farnhamville | $2,962 |

| Farragut | $3,121 |

| Fayette | $2,628 |

| Ferguson | $2,801 |

| Fertile | $2,676 |

| Floris | $2,500 |

| Floyd | $2,671 |

| Fonda | $2,909 |

| Fontanelle | $2,878 |

| Forest City | $2,690 |

| Fort Atkinson | $2,550 |

| Fort Dodge | $2,891 |

| Fort Madison | $2,532 |

| Fostoria | $2,725 |

| Fredericksburg | $2,598 |

| Fremont | $2,715 |

| Fruitland | $2,684 |

| Galt | $2,765 |

| Galva | $2,792 |

| Garber | $2,628 |

| Garden City | $2,837 |

| Garden Grove | $2,774 |

| Garnavillo | $2,511 |

| Garner | $2,724 |

| Garrison | $2,694 |

| Garwin | $2,704 |

| George | $2,828 |

| Gibson | $2,678 |

| Gifford | $2,748 |

| Gilbert | $2,633 |

| Gilbertville | $2,590 |

| Gilman | $2,706 |

| Gilmore City | $2,801 |

| Gladbrook | $2,718 |

| Glenwood | $2,952 |

| Glidden | $2,858 |

| Goldfield | $2,721 |

| Goodell | $2,748 |

| Goose Lake | $2,444 |

| Gowrie | $2,909 |

| Graettinger | $2,777 |

| Grafton | $2,750 |

| Grand Junction | $2,747 |

| Grand Mound | $2,445 |

| Granger | $2,645 |

| Granville | $2,769 |

| Gravity | $3,069 |

| Gray | $2,895 |

| Greeley | $2,696 |

| Greene | $2,684 |

| Greenfield | $2,818 |

| Greenville | $2,783 |

| Grimes | $2,656 |

| Grinnell | $2,786 |

| Griswold | $3,276 |

| Grundy Center | $2,679 |

| Guernsey | $2,675 |

| Guthrie Center | $2,985 |

| Guttenberg | $2,628 |

| Halbur | $2,854 |

| Hamburg | $3,109 |

| Hamilton | $2,718 |

| Hamlin | $3,016 |

| Hampton | $2,676 |

| Hancock | $3,292 |

| Hanlontown | $2,655 |

| Harcourt | $2,898 |

| Hardy | $2,758 |

| Harlan | $3,209 |

| Harper | $2,617 |

| Harpers Ferry | $2,478 |

| Harris | $2,884 |

| Hartford | $2,809 |

| Hartley | $2,860 |

| Hartwick | $2,647 |

| Harvey | $2,672 |

| Hastings | $3,049 |

| Havelock | $2,802 |

| Haverhill | $2,769 |

| Hawarden | $2,767 |

| Hawkeye | $2,604 |

| Hayesville | $2,529 |

| Hazleton | $2,647 |

| Hedrick | $2,560 |

| Henderson | $3,086 |

| Hiawatha | $2,486 |

| Highlandville | $2,624 |

| Hills | $2,695 |

| Hillsboro | $2,481 |

| Hinton | $2,818 |

| Holland | $2,677 |

| Holstein | $2,884 |

| Holy Cross | $2,473 |

| Homestead | $2,684 |

| Honey Creek | $3,388 |

| Hopkinton | $2,612 |

| Hornick | $2,908 |

| Hospers | $2,829 |

| Houghton | $2,642 |

| Hubbard | $2,748 |

| Hudson | $2,575 |

| Hull | $2,808 |

| Humboldt | $2,758 |

| Humeston | $2,721 |

| Huxley | $2,673 |

| Ida Grove | $2,885 |

| Imogene | $3,011 |

| Independence | $2,611 |

| Indianola | $2,764 |

| Inwood | $2,774 |

| Ionia | $2,675 |

| Iowa City | $2,476 |

| Iowa Falls | $2,683 |

| Ira | $2,772 |

| Ireton | $2,728 |

| Irwin | $3,219 |

| Jamaica | $2,872 |

| Janesville | $2,583 |

| Jefferson | $2,734 |

| Jesup | $2,565 |

| Jewell | $2,819 |

| Johnston | $2,629 |

| Joice | $2,644 |

| Jolley | $2,958 |

| Kalona | $2,456 |

| Kamrar | $2,745 |

| Kanawha | $2,739 |

| Kellerton | $2,830 |

| Kelley | $2,615 |

| Kensett | $2,707 |

| Keokuk | $2,559 |

| Keosauqua | $2,545 |

| Keota | $2,578 |

| Kesley | $2,639 |

| Keswick | $2,559 |

| Keystone | $2,613 |

| Killduff | $2,751 |

| Kimballton | $2,974 |

| Kingsley | $2,809 |

| Kinross | $2,548 |

| Kirkman | $3,161 |

| Kirkville | $2,725 |

| Kiron | $2,854 |

| Klemme | $2,722 |

| Knierim | $2,934 |

| Knoxville | $2,665 |

| La Motte | $2,400 |

| La Porte City | $2,581 |

| Lacona | $2,731 |

| Ladora | $2,633 |

| Lake City | $2,858 |

| Lake Mills | $2,639 |

| Lake Park | $2,907 |

| Lake View | $2,877 |

| Lakota | $2,770 |

| Lamoni | $2,792 |

| Lamont | $2,615 |

| Lanesboro | $3,108 |

| Langworthy | $2,542 |

| Lansing | $2,448 |

| Larchwood | $2,795 |

| Larrabee | $2,687 |

| Latimer | $2,788 |

| Laurel | $2,713 |

| Laurens | $2,841 |

| Lawler | $2,635 |

| Lawton | $2,925 |

| Le Claire | $2,384 |

| Le Grand | $2,749 |

| Le Mars | $2,764 |

| Ledyard | $2,791 |

| Lehigh | $2,955 |

| Leighton | $2,670 |

| Leland | $2,715 |

| Lenox | $3,022 |

| Leon | $2,750 |

| Letts | $2,593 |

| Lewis | $3,339 |

| Liberty Center | $2,825 |

| Libertyville | $2,530 |

| Lidderdale | $3,110 |

| Lime Springs | $2,570 |

| Linden | $2,708 |

| Lineville | $2,655 |

| Linn Grove | $2,783 |

| Lisbon | $2,478 |

| Little Cedar | $2,643 |

| Little Rock | $2,736 |

| Little Sioux | $2,982 |

| Livermore | $2,820 |

| Logan | $3,076 |

| Lohrville | $2,849 |

| Lone Rock | $2,721 |

| Lone Tree | $2,566 |

| Long Grove | $2,384 |

| Lorimor | $2,898 |

| Lost Nation | $2,458 |

| Lovilia | $2,724 |

| Low Moor | $2,584 |

| Lowden | $2,469 |

| Lu Verne | $2,723 |

| Luana | $2,475 |

| Lucas | $2,761 |

| Luther | $2,710 |

| Luxemburg | $2,636 |

| Luzerne | $2,610 |

| Lynnville | $2,758 |

| Lytton | $2,941 |

| Macksburg | $2,792 |

| Madrid | $2,719 |

| Magnolia | $3,017 |

| Malcom | $2,812 |

| Mallard | $2,778 |

| Malvern | $3,054 |

| Manchester | $2,556 |

| Manilla | $3,183 |

| Manly | $2,715 |

| Manning | $3,168 |

| Manson | $2,934 |

| Mapleton | $2,998 |

| Maquoketa | $2,582 |

| Marathon | $2,826 |

| Marble Rock | $2,733 |

| Marcus | $2,708 |

| Marengo | $2,585 |

| Marion | $2,501 |

| Marne | $3,194 |

| Marquette | $2,538 |

| Marshalltown | $2,678 |

| Martelle | $2,491 |

| Martensdale | $2,779 |

| Martinsburg | $2,613 |

| Mason City | $2,673 |

| Masonville | $2,584 |

| Massena | $3,365 |

| Matlock | $2,757 |

| Maurice | $2,788 |

| Maxwell | $2,689 |

| Maynard | $2,632 |

| Mc Callsburg | $2,648 |

| Mc Causland | $2,578 |

| Mc Clelland | $3,360 |

| Mc Gregor | $2,520 |

| Mc Intire | $2,640 |

| Mechanicsville | $2,457 |

| Mediapolis | $2,639 |

| Melbourne | $2,704 |

| Melcher-Dallas | $2,699 |

| Melrose | $2,719 |

| Melvin | $2,906 |

| Menlo | $3,028 |

| Meriden | $2,687 |

| Merrill | $2,801 |

| Meservey | $2,772 |

| Middle | $2,607 |

| Middle Amana | $2,607 |

| Middletown | $2,603 |

| Miles | $2,474 |

| Milford | $2,783 |

| Millersburg | $2,679 |

| Millerton | $2,740 |

| Milo | $2,801 |

| Milton | $2,562 |

| Minburn | $2,725 |

| Minden | $3,298 |

| Mineola | $3,069 |

| Mingo | $2,791 |

| Missouri Valley | $3,097 |

| Mitchellville | $2,616 |

| Modale | $3,051 |

| Mondamin | $3,127 |

| Monmouth | $2,477 |

| Monona | $2,470 |

| Monroe | $2,768 |

| Montezuma | $2,721 |

| Monticello | $2,484 |

| Montour | $2,730 |

| Montpelier | $2,677 |

| Montrose | $2,668 |

| Moorhead | $3,009 |

| Moorland | $2,931 |

| Moravia | $2,603 |

| Morley | $2,481 |

| Morning Sun | $2,630 |

| Morrison | $2,669 |

| Moscow | $2,569 |

| Moulton | $2,531 |

| Mount Auburn | $2,673 |

| Mount Ayr | $2,884 |

| Mount Pleasant | $2,486 |

| Mount Sterling | $2,534 |

| Mount Union | $2,471 |

| Mount Vernon | $2,487 |

| Moville | $2,957 |

| Murray | $2,932 |

| Muscatine | $2,462 |

| Mystic | $2,584 |

| Nashua | $2,672 |

| Nemaha | $2,878 |

| Nevada | $2,572 |

| New Albin | $2,487 |

| New Hampton | $2,584 |

| New Hartford | $2,709 |

| New Liberty | $2,464 |

| New London | $2,479 |

| New Market | $3,088 |

| New Providence | $2,810 |

| New Sharon | $2,761 |

| New Vienna | $2,595 |

| New Virginia | $2,812 |

| Newell | $2,896 |

| Newhall | $2,582 |

| Newton | $2,706 |

| Nichols | $2,634 |

| Nodaway | $3,020 |

| Nora Springs | $2,697 |

| North Buena Vista | $2,652 |

| North English | $2,587 |

| North Liberty | $2,578 |

| North Washington | $2,614 |

| Northboro | $3,058 |

| Northwood | $2,666 |

| Norwalk | $2,782 |

| Norway | $2,588 |

| Oakland | $3,362 |

| Oakville | $2,635 |

| Odebolt | $2,904 |

| Oelwein | $2,552 |

| Ogden | $2,694 |

| Okoboji | $2,885 |

| Olds | $2,559 |

| Olin | $2,477 |

| Ollie | $2,561 |

| Onawa | $2,949 |

| Onslow | $2,525 |

| Oran | $2,670 |

| Orange City | $2,781 |

| Orchard | $2,637 |

| Orient | $2,906 |

| Osage | $2,544 |

| Osceola | $2,917 |

| Oskaloosa | $2,684 |

| Ossian | $2,529 |

| Otley | $2,731 |

| Oto | $2,943 |

| Ottosen | $2,805 |

| Ottumwa | $2,552 |

| Oxford | $2,587 |

| Oxford Junction | $2,530 |

| Oyens | $2,803 |

| Pacific Junction | $3,010 |

| Packwood | $2,523 |

| Palmer | $2,891 |

| Palo | $2,543 |

| Panama | $3,013 |

| Panora | $2,961 |

| Park View | $2,450 |

| Parkersburg | $2,728 |

| Parnell | $2,665 |

| Patterson | $2,823 |

| Paullina | $2,736 |

| Pella | $2,618 |

| Peosta | $2,523 |

| Percival | $3,028 |

| Perry | $2,761 |

| Persia | $3,053 |

| Peru | $2,778 |

| Pierson | $2,816 |

| Pilot Grove | $2,679 |

| Pilot Mound | $2,812 |

| Pisgah | $3,022 |

| Plainfield | $2,681 |

| Plano | $2,585 |

| Pleasant Hill | $2,640 |

| Pleasant Valley | $2,512 |

| Pleasantville | $2,733 |

| Plover | $2,903 |

| Plymouth | $2,674 |

| Pocahontas | $2,818 |

| Polk City | $2,552 |

| Pomeroy | $2,906 |

| Popejoy | $2,761 |

| Portsmouth | $3,140 |

| Postville | $2,504 |

| Prairie City | $2,759 |

| Prairieburg | $2,524 |

| Prescott | $2,970 |

| Preston | $2,450 |

| Primghar | $2,736 |

| Princeton | $2,378 |

| Prole | $2,733 |

| Promise City | $2,761 |

| Protivin | $2,588 |

| Pulaski | $2,599 |

| Quasqueton | $2,625 |

| Quimby | $2,731 |

| Radcliffe | $2,727 |

| Rake | $2,772 |

| Ralston | $3,121 |

| Randalia | $2,660 |

| Randall | $2,757 |

| Randolph | $3,138 |

| Raymond | $2,588 |

| Readlyn | $2,584 |

| Reasnor | $2,741 |

| Red Oak | $3,070 |

| Redding | $2,898 |

| Redfield | $2,714 |

| Reinbeck | $2,618 |

| Rembrandt | $2,789 |

| Remsen | $2,776 |

| Renwick | $2,769 |

| Rhodes | $2,714 |

| Riceville | $2,650 |

| Ricketts | $2,903 |

| Ridgeway | $2,560 |

| Ringsted | $2,731 |

| Rippey | $2,727 |

| Riverside | $2,512 |

| Riverton | $3,058 |

| Robins | $2,491 |

| Rock Falls | $2,635 |

| Rock Rapids | $2,758 |

| Rock Valley | $2,766 |

| Rockford | $2,611 |

| Rockwell | $2,722 |

| Rockwell City | $2,946 |

| Rodney | $2,914 |

| Roland | $2,677 |

| Rolfe | $2,861 |

| Rose Hill | $2,766 |

| Rowan | $2,740 |

| Rowley | $2,621 |

| Royal | $2,749 |

| Rudd | $2,750 |

| Runnells | $2,650 |

| Russell | $2,758 |

| Ruthven | $2,807 |

| Rutland | $2,767 |

| Ryan | $2,564 |

| Sabula | $2,457 |

| Sac City | $2,904 |

| Salem | $2,502 |

| Salix | $2,978 |

| Sanborn | $2,824 |

| Saylorville | $2,606 |

| Scarville | $2,684 |

| Schaller | $2,912 |

| Schleswig | $2,916 |

| Searsboro | $2,747 |

| Selma | $2,505 |

| Sergeant Bluff | $2,983 |

| Seymour | $2,700 |

| Shambaugh | $3,028 |

| Shannon City | $2,991 |

| Sharpsburg | $2,981 |

| Sheffield | $2,687 |

| Sheldahl | $2,628 |

| Sheldon | $2,803 |

| Shell Rock | $2,592 |

| Shellsburg | $2,584 |

| Shenandoah | $2,952 |

| Sherrill | $2,472 |

| Sibley | $2,889 |

| Sidney | $3,105 |

| Sigourney | $2,547 |

| Silver City | $2,967 |

| Sioux Center | $2,808 |

| Sioux City | $2,995 |

| Sioux Rapids | $2,806 |

| Slater | $2,648 |

| Smithland | $2,951 |

| Soldier | $2,903 |

| Solon | $2,515 |

| Somers | $2,927 |

| South Amana | $2,666 |

| South English | $2,548 |

| Spencer | $2,690 |

| Sperry | $2,590 |

| Spillville | $2,665 |

| Spirit Lake | $2,869 |

| Spragueville | $2,429 |

| Springbrook | $2,562 |

| Springville | $2,524 |

| St. Ansgar | $2,597 |

| St. Anthony | $2,769 |

| St. Charles | $2,741 |

| St. Donatus | $2,565 |

| St. Lucas | $2,722 |

| St. Marys | $2,697 |

| St. Olaf | $2,505 |

| St. Paul | $2,614 |

| Stanhope | $2,692 |

| Stanley | $2,610 |

| Stanton | $3,082 |

| Stanwood | $2,443 |

| Steamboat Rock | $2,774 |

| Stockport | $2,555 |

| Stockton | $2,450 |

| Storm Lake | $2,834 |

| Story City | $2,664 |

| Stout | $2,689 |

| Stratford | $2,677 |

| Strawberry Point | $2,603 |

| Stuart | $2,975 |

| Sully | $2,755 |

| Sumner | $2,605 |

| Superior | $2,883 |

| Sutherland | $2,765 |

| Swaledale | $2,753 |

| Swan | $2,704 |

| Swea City | $2,721 |

| Swedesburg | $2,571 |

| Swisher | $2,572 |

| Tabor | $3,111 |

| Tama | $2,724 |

| Teeds Grove | $2,471 |

| Templeton | $2,818 |

| Terril | $2,892 |

| Thayer | $2,881 |

| Thompson | $2,734 |

| Thor | $2,791 |

| Thornburg | $2,606 |

| Thornton | $2,750 |

| Thurman | $3,097 |

| Tiffin | $2,536 |

| Tingley | $2,899 |

| Tipton | $2,455 |

| Titonka | $2,775 |

| Toddville | $2,489 |

| Toeterville | $2,675 |

| Toledo | $2,725 |

| Tracy | $2,639 |

| Traer | $2,750 |

| Treynor | $3,322 |

| Tripoli | $2,611 |

| Troy Mills | $2,656 |

| Truesdale | $2,826 |

| Truro | $2,782 |

| Udell | $2,579 |

| Underwood | $3,352 |

| Unionville | $2,543 |

| University Heights | $2,477 |

| University Park | $2,801 |

| Urbana | $2,611 |

| Urbandale | $2,552 |

| Ute | $2,989 |

| Vail | $2,906 |

| Van Horne | $2,646 |

| Van Meter | $2,770 |

| Van Wert | $2,765 |

| Varina | $2,845 |

| Ventura | $2,657 |

| Victor | $2,625 |

| Villisca | $2,987 |

| Vincent | $2,888 |

| Vining | $2,739 |

| Vinton | $2,653 |

| Volga | $2,622 |

| Wadena | $2,637 |

| Walcott | $2,402 |

| Walford | $2,593 |

| Walker | $2,551 |

| Wall Lake | $2,908 |

| Wallingford | $2,916 |

| Walnut | $3,268 |

| Wapello | $2,596 |

| Washington | $2,579 |

| Washta | $2,772 |

| Waterloo | $2,583 |

| Waterville | $2,491 |

| Watkins | $2,608 |

| Waucoma | $2,556 |

| Waukee | $2,646 |

| Waukon | $2,466 |

| Waverly | $2,570 |

| Wayland | $2,531 |

| Webb | $2,853 |

| Webster | $2,550 |

| Webster City | $2,732 |

| Weldon | $2,730 |

| Wellman | $2,513 |

| Wellsburg | $2,667 |

| Welton | $2,584 |

| West Bend | $2,761 |

| West Branch | $2,486 |

| West Burlington | $2,572 |

| West Chester | $2,596 |

| West Des Moines | $2,594 |

| West Liberty | $2,481 |

| West Point | $2,623 |

| West Union | $2,506 |

| Westfield | $2,917 |

| Westgate | $2,596 |

| Westside | $2,862 |

| Wever | $2,613 |

| What Cheer | $2,680 |

| Wheatland | $2,417 |

| Whiting | $2,990 |

| Whittemore | $2,756 |

| Whitten | $2,747 |

| Williams | $2,699 |

| Williamsburg | $2,594 |

| Williamson | $2,731 |

| Wilton | $2,526 |

| Windsor Heights | $2,597 |

| Winfield | $2,513 |

| Winterset | $2,786 |

| Winthrop | $2,604 |

| Wiota | $3,194 |

| Woden | $2,714 |

| Woodbine | $3,140 |

| Woodburn | $2,804 |

| Woodward | $2,677 |

| Woolstock | $2,745 |

| Worthington | $2,560 |

| Yale | $2,971 |

| Yarmouth | $2,480 |

| Yorktown | $3,113 |

| Zearing | $2,712 |

| Zwingle | $2,523 |

In Iowa’s two largest cities, Des Moines and Cedar Rapids, the average homeowners insurance rates are $222 and $210 a month, respectively.

Frequently asked questions

Farmers Insurance has the best home insurance in Iowa for those who want the cheapest rate. American Family, State Farm, IMT and USAA are the state’s best companies in other areas. (See more above.)

Farmers Insurance is the best source of cheap homeowners insurance in Iowa, with rates that average $2,484 a year, or $207 a month.

If you or a family member have military ties, USAA may be even cheaper for you. Its rates average $2,230 a year, or $186 a month.

Home insurance in Iowa costs an average of $2,697 a year, or $225 a month.

What you pay depends on several factors, including the age of your home, where you live, how much coverage you choose and more.

Methodology

The rates shown in this article are based on non-binding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in Iowa. The following coverages and deductible were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

Overall satisfaction ratings were obtained from J.D. Power’s 2023 U.S. Home Insurance Study. The agency’s scores are based on customer surveys that rate insurance companies on factors including price, policy offerings and claims.

Complaint ratings are based on NAIC Complaint Index data from 2023. A company with a 2.0 Complaint Index score has twice as many confirmed complaints as expected for its size. A company with a 0.5 rating has half as many.

*USAA is only available to current and former members of the military as well as certain family members.