Best Homeowners Insurance in Kansas

Top Kansas home insurance companies

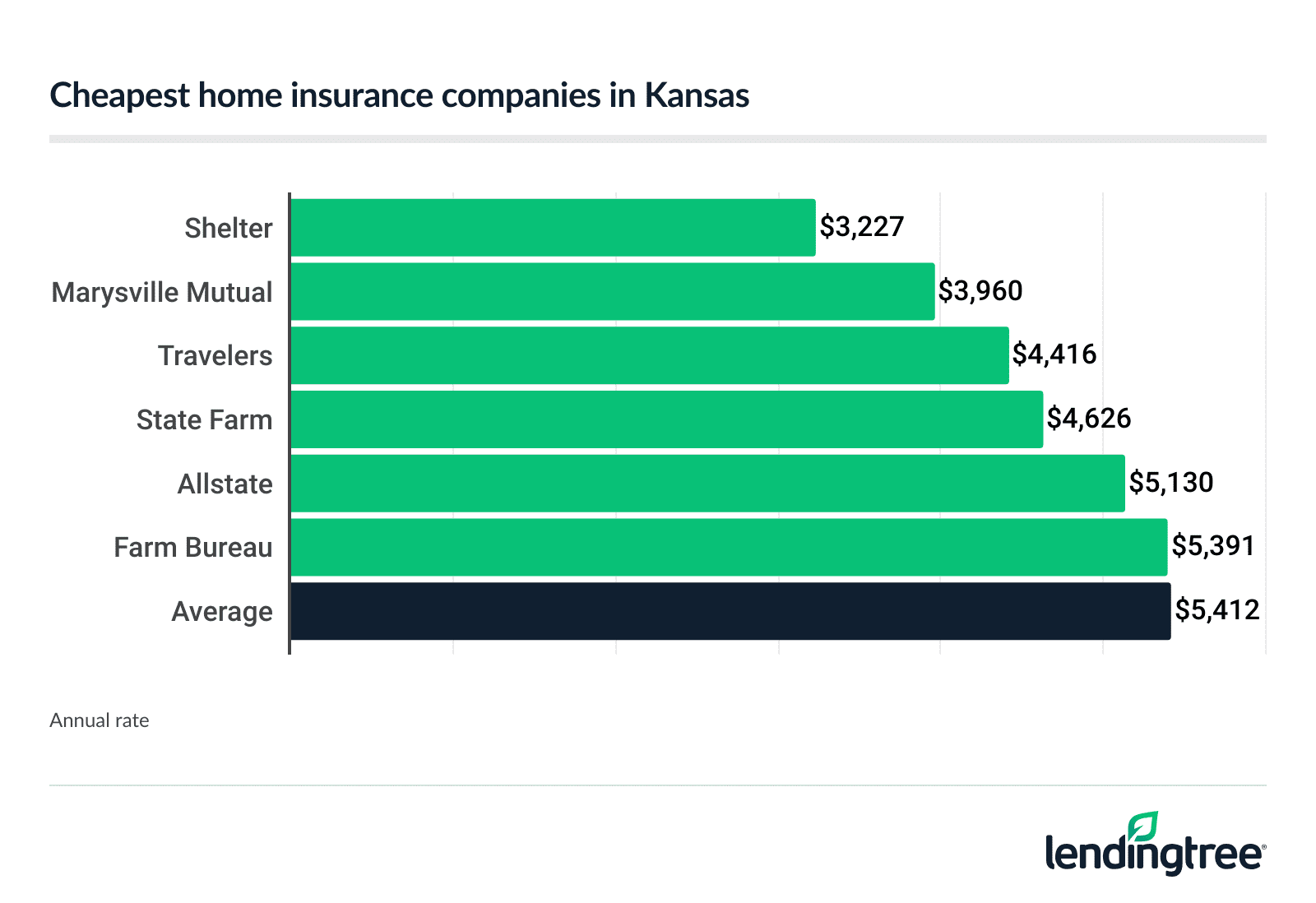

Cheapest homeowners insurance in Kansas: Shelter

Home insurance rates by company

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Shelter | $3,227 | |

| Marysville Mutual | Marysville Mutual | $3,960 | |

| Travelers | $4,416 | |

| State Farm | $4,626 | |

| Allstate | $5,130 | |

| Farm Bureau | $5,391 | |

| American Family | $7,210 | |

| Nationwide | $9,335 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

Best Kansas home insurance companies

| Company | Best for | Annual rate | Customer satisfaction* | Complaint rating** |

|---|---|---|---|---|

| Shelter | Overall | $3,227 | Not rated | 0.3 |

| State Farm | Shopping experience | $4,626 | 643 | 1.05 |

| Allstate | Coverage features | $5,130 | 631 | 1.3 |

*Source: J.D. Power 2024 U.S. Home Insurance Study. Higher is better; 640 is average.

**Source: National Association of Insurance Commissioners. Lower is better; 1.0 is average

Best home insurance company overall: Shelter

Annual rate: $3,227

![]()

Pros

Cheapest average rates in Kansas

Excellent complaint rating

Add-ons for some home businesses and farming

Cons

Instant quotes not available online

Along with low rates, Shelter has an excellent complaint rating NAIC’s Complaint Index compares companies on confirmed complaints by size. A complaint is confirmed if it leads to a finding of fault on the insurance company. from the National Association of Insurance Commissioners (NAIC). Its 0.3 score means it has about one-third as many complaints as average.

Shelter offers valuable add-ons as well as all the standard home insurance protections The standard protections cover your home and belongings for hazards like fire, wind, hail and theft, plus liability and medical claims against you. , too. These include protections from sewer and drain backups and coverage for some home business and farming activities.

Best shopping experience: State Farm

Annual rate: $4,626

![]()

Pros

Rates are 15% less than the state average

Good customer satisfaction score

User-friendly website for instant quotes

Personalized service from local agents

Cons

A few other companies have lower rates

State Farm complements personalized services from its agents with a convenient online shopping platform. Its website can give you a home insurance quote in minutes. It also connects you to an agent for more help.

The company’s rates are cheaper than average, and it has good customer service scores. This includes a customer satisfaction rating J.D. Power’s ratings are based on customer surveys grading insurance companies on factors like price, coverage options and dispute resolution. from J.D. Power that’s better than average.

Best policy features: Allstate

Annual rate: $5,130

![]()

Pros

Rates are cheaper than average

Policy features can save you money in the future

Widespread agent network for personalized service

Cons

Customer service scores are worse than average

Rates are only 5% less than state average

Allstate offers policy features that can save you money down the line. For example, its Deductible Rewards program lowers your deductible Your deductible is the amount you pay out of your own pocket for an insurance claim. at no extra cost when you avoid claims. Its Claim RateGuard feature protects you from a rate increase if you do have a claim.

Like other large companies, Allstate offers instant quotes online. This makes it easy to compare Allstate’s rates to the quotes you get from other companies.

How much is homeowners insurance in Kansas?

The actual price you pay depends on factors like:

- Your home’s age and construction features

- The home’s location

- Your insurance history and credit

- Any discounts you may receive

Each company weighs these factors differently. This makes it good to compare home insurance quotes from a few different companies when you buy or renew your policy.

Home insurance rates by coverage amount

Your policy’s dwelling limit Your dwelling limit is the most your insurance company pays to repair your rebuild your home after a covered disaster. has a big impact on your homeowners insurance rate. For example, a policy with a $450,000 dwelling limit costs 25% more than a $350,000 policy.

Home insurance costs by dwelling limit

| Dwelling limit | Annual rate |

|---|---|

| $350,000 | $4,825 |

| $400,000 | $5,412 |

| $450,000 | $6,029 |

If you have a mortgage, your lender will make you insure your home at its replacement value Replacement value is the estimated cost of rebuilding your home. This is usually lower than your home’s market value, or purchase price, which includes the value of your land. . You can choose a lower dwelling limit if you have a low loan balance or no mortgage at all. However, doing so can leave you short on insurance funds to rebuild, if a major disaster strikes.

Kansas home insurance rates by city

Home insurance costs an average of $4,669 a year in Kansas City, or $389 a month. This is 14% less than the state average. Topeka homeowners pay an average of $414 a month, or 8% less than the average.

Home insurance rates near you

| City | Annual rate Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. | Difference from state average |

|---|---|---|

| Abbyville | $6,088 | 12% |

| Abilene | $5,046 | -7% |

| Admire | $4,946 | -9% |

| Agenda | $4,846 | -10% |

| Agra | $5,902 | 9% |

| Albert | $6,620 | 22% |

| Alden | $5,590 | 3% |

| Alexander | $6,511 | 20% |

| Allen | $4,902 | -9% |

| Alma | $4,945 | -9% |

| Almena | $5,966 | 10% |

| Alta Vista | $4,995 | -8% |

| Altamont | $5,016 | -7% |

| Alton | $6,075 | 12% |

| Altoona | $5,256 | -3% |

| Americus | $4,942 | -9% |

| Andale | $6,317 | 17% |

| Andover | $6,161 | 14% |

| Anthony | $5,974 | 10% |

| Arcadia | $4,880 | -10% |

| Argonia | $6,172 | 14% |

| Arkansas City | $5,934 | 10% |

| Arlington | $6,054 | 12% |

| Arma | $4,898 | -9% |

| Arnold | $6,243 | 15% |

| Ashland | $6,186 | 14% |

| Assaria | $5,387 | 0% |

| Atchison | $4,577 | -15% |

| Athol | $6,041 | 12% |

| Atlanta | $6,173 | 14% |

| Attica | $6,074 | 12% |

| Atwood | $5,529 | 2% |

| Auburn | $4,868 | -10% |

| Augusta | $6,131 | 13% |

| Aurora | $4,962 | -8% |

| Axtell | $4,707 | -13% |

| Baileyville | $4,735 | -13% |

| Baldwin City | $4,384 | -19% |

| Barnard | $5,292 | -2% |

| Barnes | $5,064 | -6% |

| Bartlett | $5,000 | -8% |

| Basehor | $4,578 | -15% |

| Baxter Springs | $5,130 | -5% |

| Bazine | $6,314 | 17% |

| Beattie | $4,884 | -10% |

| Beaumont | $6,160 | 14% |

| Beeler | $6,721 | 24% |

| Bel Aire | $6,302 | 16% |

| Belle Plaine | $6,119 | 13% |

| Belleville | $4,889 | -10% |

| Beloit | $5,051 | -7% |

| Belpre | $6,483 | 20% |

| Belvue | $4,787 | -12% |

| Bendena | $4,584 | -15% |

| Benedict | $5,285 | -2% |

| Bennington | $5,447 | 1% |

| Bentley | $6,332 | 17% |

| Benton | $6,153 | 14% |

| Bern | $4,618 | -15% |

| Berryton | $4,885 | -10% |

| Beverly | $5,235 | -3% |

| Bird City | $5,577 | 3% |

| Bison | $6,318 | 17% |

| Blue Mound | $4,811 | -11% |

| Blue Rapids | $5,025 | -7% |

| Bluff City | $5,894 | 9% |

| Bogue | $6,390 | 18% |

| Bonner Springs | $4,633 | -14% |

| Bremen | $4,839 | -11% |

| Brewster | $5,847 | 8% |

| Bronson | $5,048 | -7% |

| Brookville | $5,299 | -2% |

| Brownell | $6,605 | 22% |

| Bucklin | $6,191 | 14% |

| Bucyrus | $4,686 | -13% |

| Buffalo | $5,256 | -3% |

| Buhler | $6,063 | 12% |

| Bunker Hill | $6,618 | 22% |

| Burden | $6,016 | 11% |

| Burdett | $6,249 | 15% |

| Burdick | $4,987 | -8% |

| Burlingame | $4,931 | -9% |

| Burlington | $5,102 | -6% |

| Burns | $5,591 | 3% |

| Burr Oak | $5,028 | -7% |

| Burrton | $5,936 | 10% |

| Bushton | $5,379 | -1% |

| Byers | $6,420 | 19% |

| Caldwell | $6,012 | 11% |

| Cambridge | $6,054 | 12% |

| Caney | $5,412 | 0% |

| Canton | $5,537 | 2% |

| Carbondale | $4,911 | -9% |

| Cassoday | $6,044 | 12% |

| Catharine | $6,529 | 21% |

| Cawker City | $4,951 | -9% |

| Cedar | $6,061 | 12% |

| Cedar Point | $4,974 | -8% |

| Cedar Vale | $5,495 | 2% |

| Centerville | $4,882 | -10% |

| Centralia | $4,665 | -14% |

| Chanute | $4,947 | -9% |

| Chapman | $4,997 | -8% |

| Chase | $5,608 | 4% |

| Chautauqua | $5,501 | 2% |

| Cheney | $6,259 | 16% |

| Cherokee | $4,886 | -10% |

| Cherryvale | $5,312 | -2% |

| Chetopa | $4,991 | -8% |

| Chicopee | $4,887 | -10% |

| Cimarron | $6,194 | 14% |

| Circleville | $4,814 | -11% |

| Claflin | $6,428 | 19% |

| Clay Center | $5,016 | -7% |

| Clayton | $6,238 | 15% |

| Clearview City | $4,406 | -19% |

| Clearwater | $6,458 | 19% |

| Clifton | $5,054 | -7% |

| Clyde | $5,012 | -7% |

| Coats | $6,521 | 20% |

| Coffeyville | $5,191 | -4% |

| Colby | $5,630 | 4% |

| Coldwater | $6,268 | 16% |

| Collyer | $6,324 | 17% |

| Colony | $4,913 | -9% |

| Columbus | $4,985 | -8% |

| Colwich | $6,283 | 16% |

| Concordia | $5,044 | -7% |

| Conway Springs | $6,144 | 14% |

| Coolidge | $5,872 | 8% |

| Copeland | $6,175 | 14% |

| Corning | $4,769 | -12% |

| Cottonwood Falls | $4,982 | -8% |

| Council Grove | $4,978 | -8% |

| Courtland | $4,867 | -10% |

| Crestline | $4,935 | -9% |

| Cuba | $4,937 | -9% |

| Cummings | $4,720 | -13% |

| Cunningham | $6,020 | 11% |

| Damar | $6,308 | 17% |

| Danville | $6,263 | 16% |

| De Soto | $4,561 | -16% |

| Dearing | $5,048 | -7% |

| Deerfield | $6,152 | 14% |

| Delia | $4,844 | -10% |

| Delphos | $5,411 | 0% |

| Denison | $4,852 | -10% |

| Dennis | $5,059 | -7% |

| Denton | $4,597 | -15% |

| Derby | $6,192 | 14% |

| Dexter | $6,003 | 11% |

| Dighton | $5,977 | 10% |

| Dodge City | $6,173 | 14% |

| Dorrance | $6,315 | 17% |

| Douglass | $6,154 | 14% |

| Downs | $6,155 | 14% |

| Dresden | $6,053 | 12% |

| Durham | $5,153 | -5% |

| Dwight | $4,958 | -8% |

| Eastborough | $6,365 | 18% |

| Easton | $4,686 | -13% |

| Edgerton | $4,445 | -18% |

| Edna | $5,040 | -7% |

| Edson | $6,029 | 11% |

| Edwardsville | $4,677 | -14% |

| Effingham | $4,690 | -13% |

| El Dorado | $6,001 | 11% |

| Elbing | $6,084 | 12% |

| Elk City | $5,466 | 1% |

| Elk Falls | $5,585 | 3% |

| Elkhart | $5,785 | 7% |

| Ellinwood | $6,423 | 19% |

| Ellis | $6,314 | 17% |

| Ellsworth | $5,620 | 4% |

| Elmdale | $4,881 | -10% |

| Elsmore | $4,967 | -8% |

| Elwood | $4,597 | -15% |

| Emmett | $4,868 | -10% |

| Emporia | $5,015 | -7% |

| Englewood | $6,135 | 13% |

| Ensign | $6,361 | 18% |

| Enterprise | $4,943 | -9% |

| Erie | $5,017 | -7% |

| Esbon | $4,970 | -8% |

| Eskridge | $4,894 | -10% |

| Eudora | $4,449 | -18% |

| Eureka | $5,469 | 1% |

| Everest | $4,575 | -15% |

| Fairview | $4,558 | -16% |

| Fairway | $4,422 | -18% |

| Fall River | $5,443 | 1% |

| Falun | $5,440 | 1% |

| Farlington | $4,892 | -10% |

| Florence | $5,274 | -3% |

| Fontana | $4,800 | -11% |

| Ford | $6,302 | 16% |

| Formoso | $5,002 | -8% |

| Fort Dodge | $6,385 | 18% |

| Fort Leavenworth | $4,569 | -16% |

| Fort Riley | $4,904 | -9% |

| Fort Scott | $4,993 | -8% |

| Fostoria | $5,289 | -2% |

| Fowler | $6,028 | 11% |

| Frankfort | $5,018 | -7% |

| Franklin | $4,811 | -11% |

| Fredonia | $5,327 | -2% |

| Freeport | $6,214 | 15% |

| Frontenac | $4,877 | -10% |

| Fulton | $4,970 | -8% |

| Galena | $4,913 | -9% |

| Galesburg | $4,960 | -8% |

| Galva | $5,588 | 3% |

| Garden City | $6,062 | 12% |

| Garden Plain | $6,331 | 17% |

| Gardner | $4,429 | -18% |

| Garfield | $6,442 | 19% |

| Garland | $4,926 | -9% |

| Garnett | $4,905 | -9% |

| Gas | $5,058 | -7% |

| Gaylord | $6,063 | 12% |

| Gem | $5,784 | 7% |

| Geneseo | $5,653 | 4% |

| Geuda Springs | $6,037 | 12% |

| Girard | $4,921 | -9% |

| Glade | $6,009 | 11% |

| Glasco | $5,092 | -6% |

| Glen Elder | $5,042 | -7% |

| Goddard | $6,385 | 18% |

| Goessel | $5,118 | -5% |

| Goff | $4,843 | -11% |

| Goodland | $5,650 | 4% |

| Gorham | $6,391 | 18% |

| Gove | $6,030 | 11% |

| Grainfield | $6,037 | 12% |

| Grandview Plaza | $4,822 | -11% |

| Grantville | $4,674 | -14% |

| Great Bend | $6,396 | 18% |

| Greeley | $4,945 | -9% |

| Green | $4,918 | -9% |

| Greenleaf | $5,046 | -7% |

| Greensburg | $6,229 | 15% |

| Greenwich | $6,280 | 16% |

| Grenola | $5,590 | 3% |

| Gridley | $5,086 | -6% |

| Grinnell | $5,715 | 6% |

| Gypsum | $5,214 | -4% |

| Haddam | $4,980 | -8% |

| Halstead | $5,933 | 10% |

| Hamilton | $5,354 | -1% |

| Hanover | $4,969 | -8% |

| Hanston | $6,292 | 16% |

| Hardtner | $6,488 | 20% |

| Harper | $6,103 | 13% |

| Hartford | $4,979 | -8% |

| Harveyville | $4,891 | -10% |

| Havana | $5,403 | 0% |

| Haven | $6,108 | 13% |

| Havensville | $4,912 | -9% |

| Haviland | $6,337 | 17% |

| Hays | $6,311 | 17% |

| Haysville | $6,300 | 16% |

| Hazelton | $6,233 | 15% |

| Healy | $5,948 | 10% |

| Hepler | $4,980 | -8% |

| Herington | $4,994 | -8% |

| Herndon | $5,895 | 9% |

| Hesston | $5,835 | 8% |

| Hiawatha | $4,569 | -16% |

| Highland | $4,573 | -15% |

| Hill City | $6,234 | 15% |

| Hillsboro | $5,128 | -5% |

| Hillsdale | $5,255 | -3% |

| Hoisington | $6,456 | 19% |

| Holcomb | $5,957 | 10% |

| Hollenberg | $4,850 | -10% |

| Holton | $4,803 | -11% |

| Holyrood | $5,471 | 1% |

| Home | $5,055 | -7% |

| Hope | $5,006 | -8% |

| Horton | $4,646 | -14% |

| Howard | $5,587 | 3% |

| Hoxie | $5,896 | 9% |

| Hoyt | $4,829 | -11% |

| Hudson | $6,580 | 22% |

| Hugoton | $5,866 | 8% |

| Humboldt | $5,018 | -7% |

| Hunter | $5,089 | -6% |

| Hutchinson | $6,040 | 12% |

| Independence | $5,350 | -1% |

| Ingalls | $6,169 | 14% |

| Inman | $5,656 | 5% |

| Iola | $5,050 | -7% |

| Isabel | $6,384 | 18% |

| Iuka | $6,479 | 20% |

| Jamestown | $5,138 | -5% |

| Jennings | $6,086 | 12% |

| Jetmore | $6,182 | 14% |

| Jewell | $5,055 | -7% |

| Johnson City | $5,785 | 7% |

| Junction City | $4,820 | -11% |

| Kanopolis | $5,612 | 4% |

| Kanorado | $5,776 | 7% |

| Kansas City | $4,669 | -14% |

| Kechi | $6,233 | 15% |

| Kendall | $5,943 | 10% |

| Kensington | $5,980 | 10% |

| Kincaid | $4,899 | -9% |

| Kingman | $6,080 | 12% |

| Kinsley | $6,022 | 11% |

| Kiowa | $6,315 | 17% |

| Kirwin | $5,949 | 10% |

| Kismet | $6,052 | 12% |

| La Crosse | $6,313 | 17% |

| La Harpe | $4,974 | -8% |

| Lacygne | $4,818 | -11% |

| Lake City | $6,347 | 17% |

| Lake Quivira | $4,516 | -17% |

| Lakin | $5,889 | 9% |

| Lamont | $5,857 | 8% |

| Lancaster | $4,621 | -15% |

| Lane | $4,824 | -11% |

| Lansing | $4,462 | -18% |

| Larned | $6,200 | 15% |

| Latham | $6,063 | 12% |

| Lawrence | $4,414 | -18% |

| Le Roy | $5,036 | -7% |

| Leavenworth | $4,578 | -15% |

| Leawood | $4,457 | -18% |

| Lebanon | $6,216 | 15% |

| Lebo | $5,108 | -6% |

| Lecompton | $4,427 | -18% |

| Lehigh | $5,196 | -4% |

| Lenexa | $4,457 | -18% |

| Lenora | $6,132 | 13% |

| Leon | $5,979 | 10% |

| Leonardville | $4,978 | -8% |

| Leoti | $5,770 | 7% |

| Levant | $5,688 | 5% |

| Lewis | $6,065 | 12% |

| Liberal | $5,999 | 11% |

| Liberty | $5,294 | -2% |

| Liebenthal | $6,474 | 20% |

| Lincoln | $5,360 | -1% |

| Lincoln Center | $5,360 | -1% |

| Lincolnville | $5,261 | -3% |

| Lindsborg | $5,531 | 2% |

| Linn | $5,027 | -7% |

| Linwood | $4,529 | -16% |

| Little River | $5,542 | 2% |

| Logan | $5,922 | 9% |

| Long Island | $5,939 | 10% |

| Longford | $4,880 | -10% |

| Longton | $5,536 | 2% |

| Lorraine | $5,552 | 3% |

| Lost Springs | $5,091 | -6% |

| Louisburg | $4,692 | -13% |

| Lucas | $6,587 | 22% |

| Ludell | $5,863 | 8% |

| Luray | $6,048 | 12% |

| Lyndon | $4,901 | -9% |

| Lyons | $5,590 | 3% |

| Macksville | $6,347 | 17% |

| Madison | $5,379 | -1% |

| Mahaska | $4,959 | -8% |

| Maize | $6,239 | 15% |

| Manhattan | $4,956 | -8% |

| Mankato | $5,028 | -7% |

| Manter | $6,001 | 11% |

| Maple City | $5,770 | 7% |

| Maple Hill | $4,921 | -9% |

| Mapleton | $5,055 | -7% |

| Marienthal | $6,010 | 11% |

| Marion | $5,259 | -3% |

| Marquette | $5,677 | 5% |

| Marysville | $4,984 | -8% |

| Matfield Green | $5,035 | -7% |

| Mayetta | $4,816 | -11% |

| Mayfield | $6,138 | 13% |

| Mc Cracken | $6,457 | 19% |

| Mc Cune | $4,959 | -8% |

| Mc Donald | $5,639 | 4% |

| Mc Farland | $4,882 | -10% |

| Mc Louth | $4,571 | -16% |

| McConnell AFB | $6,270 | 16% |

| McPherson | $5,631 | 4% |

| Meade | $5,993 | 11% |

| Medicine Lodge | $6,340 | 17% |

| Melvern | $4,961 | -8% |

| Meriden | $4,659 | -14% |

| Merriam | $4,528 | -16% |

| Milan | $6,218 | 15% |

| Milford | $4,898 | -10% |

| Milton | $6,231 | 15% |

| Miltonvale | $5,090 | -6% |

| Minneapolis | $5,454 | 1% |

| Minneola | $6,173 | 14% |

| Mission | $4,486 | -17% |

| Mission Hills | $4,426 | -18% |

| Moline | $5,612 | 4% |

| Montezuma | $6,010 | 11% |

| Monument | $5,774 | 7% |

| Moran | $5,049 | -7% |

| Morganville | $4,892 | -10% |

| Morland | $6,325 | 17% |

| Morrill | $4,558 | -16% |

| Morrowville | $4,865 | -10% |

| Moscow | $6,110 | 13% |

| Mound City | $4,809 | -11% |

| Mound Valley | $5,211 | -4% |

| Moundridge | $5,601 | 3% |

| Mount Hope | $6,190 | 14% |

| Mulberry | $4,866 | -10% |

| Mullinville | $6,328 | 17% |

| Mulvane | $6,122 | 13% |

| Munden | $4,952 | -9% |

| Murdock | $6,009 | 11% |

| Muscotah | $4,688 | -13% |

| Narka | $4,763 | -12% |

| Nashville | $6,003 | 11% |

| Natoma | $6,093 | 13% |

| Neal | $5,538 | 2% |

| Nekoma | $6,535 | 21% |

| Neodesha | $5,423 | 0% |

| Neosho Falls | $5,023 | -7% |

| Neosho Rapids | $4,845 | -10% |

| Ness City | $6,330 | 17% |

| Netawaka | $4,675 | -14% |

| New Cambria | $5,207 | -4% |

| New Century | $4,523 | -16% |

| Newton | $5,823 | 8% |

| Nickerson | $6,085 | 12% |

| Niotaze | $5,591 | 3% |

| Norcatur | $5,950 | 10% |

| North Newton | $5,847 | 8% |

| Norton | $5,990 | 11% |

| Nortonville | $4,565 | -16% |

| Norway | $4,825 | -11% |

| Norwich | $6,050 | 12% |

| Oaklawn-Sunview | $6,337 | 17% |

| Oakley | $5,767 | 7% |

| Oberlin | $5,968 | 10% |

| Offerle | $6,231 | 15% |

| Ogallah | $6,310 | 17% |

| Ogden | $4,948 | -9% |

| Oketo | $4,871 | -10% |

| Olathe | $4,460 | -18% |

| Olmitz | $6,456 | 19% |

| Olpe | $4,965 | -8% |

| Olsburg | $4,954 | -8% |

| Onaga | $4,921 | -9% |

| Oneida | $4,640 | -14% |

| Opolis | $4,799 | -11% |

| Osage City | $4,966 | -8% |

| Osawatomie | $4,828 | -11% |

| Osborne | $6,174 | 14% |

| Oskaloosa | $4,579 | -15% |

| Oswego | $4,956 | -8% |

| Otis | $6,456 | 19% |

| Ottawa | $4,816 | -11% |

| Overbrook | $4,677 | -14% |

| Overland Park | $4,480 | -17% |

| Oxford | $6,040 | 12% |

| Ozawkie | $4,629 | -14% |

| Palco | $6,309 | 17% |

| Palmer | $4,918 | -9% |

| Paola | $4,718 | -13% |

| Paradise | $6,281 | 16% |

| Park | $6,068 | 12% |

| Park City | $6,264 | 16% |

| Parker | $4,867 | -10% |

| Parkerfield | $5,935 | 10% |

| Parsons | $5,054 | -7% |

| Partridge | $6,025 | 11% |

| Pawnee Rock | $6,440 | 19% |

| Paxico | $4,893 | -10% |

| Peabody | $5,136 | -5% |

| Peck | $6,176 | 14% |

| Penokee | $6,188 | 14% |

| Perry | $4,565 | -16% |

| Peru | $5,571 | 3% |

| Pfeifer | $6,558 | 21% |

| Phillipsburg | $5,875 | 9% |

| Piedmont | $5,637 | 4% |

| Pierceville | $6,664 | 23% |

| Piqua | $5,119 | -5% |

| Pittsburg | $4,848 | -10% |

| Plains | $6,019 | 11% |

| Plainville | $5,977 | 10% |

| Pleasanton | $4,833 | -11% |

| Plevna | $6,085 | 12% |

| Pomona | $4,813 | -11% |

| Portis | $6,217 | 15% |

| Potwin | $6,016 | 11% |

| Powhattan | $4,557 | -16% |

| Prairie View | $6,009 | 11% |

| Prairie Village | $4,413 | -18% |

| Pratt | $6,309 | 17% |

| Prescott | $4,843 | -11% |

| Pretty Prairie | $6,080 | 12% |

| Princeton | $4,864 | -10% |

| Protection | $6,172 | 14% |

| Quenemo | $4,902 | -9% |

| Quinter | $5,974 | 10% |

| Ramona | $5,046 | -7% |

| Randall | $4,930 | -9% |

| Randolph | $4,917 | -9% |

| Ransom | $6,471 | 20% |

| Rantoul | $4,771 | -12% |

| Raymond | $5,468 | 1% |

| Reading | $4,886 | -10% |

| Redfield | $5,014 | -7% |

| Republic | $4,827 | -11% |

| Rexford | $5,600 | 3% |

| Richfield | $6,011 | 11% |

| Richmond | $4,856 | -10% |

| Riley | $4,939 | -9% |

| Riverton | $4,894 | -10% |

| Robinson | $4,569 | -16% |

| Rock | $6,101 | 13% |

| Roeland Park | $4,444 | -18% |

| Rolla | $5,823 | 8% |

| Rosalia | $6,206 | 15% |

| Rose Hill | $6,238 | 15% |

| Rossville | $4,898 | -9% |

| Roxbury | $5,488 | 1% |

| Rozel | $6,201 | 15% |

| Rush Center | $6,336 | 17% |

| Russell | $6,420 | 19% |

| Sabetha | $4,599 | -15% |

| Salina | $5,237 | -3% |

| Satanta | $6,015 | 11% |

| Savonburg | $5,078 | -6% |

| Sawyer | $6,484 | 20% |

| Scammon | $4,984 | -8% |

| Scandia | $4,935 | -9% |

| Schoenchen | $6,563 | 21% |

| Scott City | $5,914 | 9% |

| Scranton | $4,899 | -9% |

| Sedan | $5,506 | 2% |

| Sedgwick | $5,935 | 10% |

| Selden | $5,942 | 10% |

| Seneca | $4,653 | -14% |

| Severy | $5,556 | 3% |

| Sharon | $6,422 | 19% |

| Sharon Springs | $5,557 | 3% |

| Shawnee | $4,468 | -17% |

| Silver Lake | $4,895 | -10% |

| Simpson | $5,104 | -6% |

| Smith Center | $6,028 | 11% |

| Soldier | $4,912 | -9% |

| Solomon | $5,077 | -6% |

| South Haven | $6,003 | 11% |

| South Hutchinson | $6,058 | 12% |

| Spearville | $6,167 | 14% |

| Spivey | $6,154 | 14% |

| Spring Hill | $4,661 | -14% |

| St. Francis | $5,628 | 4% |

| St. George | $4,900 | -9% |

| St. John | $6,355 | 17% |

| St. Marys | $4,815 | -11% |

| St. Paul | $5,038 | -7% |

| Stafford | $6,331 | 17% |

| Stark | $5,080 | -6% |

| Sterling | $5,568 | 3% |

| Stilwell | $4,544 | -16% |

| Stockton | $5,957 | 10% |

| Strong City | $4,990 | -8% |

| Sublette | $6,042 | 12% |

| Summerfield | $4,749 | -12% |

| Sun City | $6,546 | 21% |

| Sylvan Grove | $5,479 | 1% |

| Sylvia | $6,072 | 12% |

| Syracuse | $5,664 | 5% |

| Talmage | $4,998 | -8% |

| Tampa | $5,095 | -6% |

| Tecumseh | $4,985 | -8% |

| Tescott | $5,416 | 0% |

| Thayer | $4,991 | -8% |

| Tipton | $4,981 | -8% |

| Tonganoxie | $4,672 | -14% |

| Topeka | $4,972 | -8% |

| Toronto | $5,261 | -3% |

| Towanda | $6,125 | 13% |

| Treece | $5,041 | -7% |

| Tribune | $5,621 | 4% |

| Troy | $4,556 | -16% |

| Turon | $6,025 | 11% |

| Tyro | $5,430 | 0% |

| Udall | $6,045 | 12% |

| Ulysses | $5,910 | 9% |

| Uniontown | $4,971 | -8% |

| Utica | $6,418 | 19% |

| Valley Center | $6,213 | 15% |

| Valley Falls | $4,529 | -16% |

| Vassar | $4,877 | -10% |

| Vermillion | $4,742 | -12% |

| Victoria | $6,254 | 16% |

| Viola | $6,371 | 18% |

| Virgil | $5,479 | 1% |

| Wakarusa | $4,903 | -9% |

| Wakeeney | $6,268 | 16% |

| Wakefield | $5,017 | -7% |

| Waldo | $6,322 | 17% |

| Waldron | $6,016 | 11% |

| Walker | $6,476 | 20% |

| Wallace | $5,881 | 9% |

| Walnut | $4,990 | -8% |

| Walton | $5,820 | 8% |

| Wamego | $4,915 | -9% |

| Washington | $5,029 | -7% |

| Waterville | $5,017 | -7% |

| Wathena | $4,568 | -16% |

| Waverly | $4,974 | -8% |

| Webber | $4,991 | -8% |

| Weir | $4,915 | -9% |

| Welda | $4,865 | -10% |

| Wellington | $6,083 | 12% |

| Wellsville | $4,740 | -12% |

| Weskan | $5,919 | 9% |

| West Mineral | $4,961 | -8% |

| Westmoreland | $4,931 | -9% |

| Westphalia | $4,822 | -11% |

| Westwood | $4,440 | -18% |

| Westwood Hills | $4,439 | -18% |

| Wetmore | $4,607 | -15% |

| White City | $4,955 | -8% |

| White Cloud | $4,557 | -16% |

| Whitewater | $6,019 | 11% |

| Whiting | $4,656 | -14% |

| Wichita | $6,352 | 17% |

| Williamsburg | $4,877 | -10% |

| Wilmore | $6,348 | 17% |

| Wilsey | $4,880 | -10% |

| Wilson | $5,484 | 1% |

| Winchester | $4,595 | -15% |

| Windom | $5,598 | 3% |

| Winfield | $5,979 | 10% |

| Winona | $5,600 | 3% |

| Woodbine | $4,948 | -9% |

| Woodston | $6,038 | 12% |

| Wright | $6,426 | 19% |

| Yates Center | $5,208 | -4% |

| Zenda | $6,134 | 13% |

Does Kansas homeowners insurance cover tornadoes?

- Wind and hail deductibles are often offered as a percentage of your policy’s dwelling limit. If you choose a $300,000 dwelling limit with a 5% deductible, for example, you must pay the first $15,000 in wind damage repairs.

- The deductible for other perils is usually offered in a flat dollar amount, often between about $500 and $2,500.

- Wind deductibles tend to be higher than the deductible for other perils.

- Choosing higher deductibles lowers your rate. They also require you to spend more of your own money to rebuild after a disaster.

Flood insurance protection for Kansas homes

If you have a mortgage and live in a high-risk flood zone, your lender will make you get flood insurance. But the coverage is optional if you don’t have a mortgage or live in a low- or moderate-risk area. You can find a home’s flood risk on the Federal Emergency Management Agency (FEMA) website.

Most flood insurance is bought through the FEMA-managed National Flood Insurance Program (NFIP). The average NFIP flood insurance cost in Kansas is $971 a year, or about $81 a month.

A few private companies also offer flood insurance. Some private flood insurance companies offer more coverage than NFIP. Unless you are buying flood insurance to close a loan, you have to wait 30 days for the coverage to kick in. Private flood insurance often has shorter waiting periods.

Most local home insurance agents can help you get flood insurance quotes. Start with your current agent, or speak with companies you contacted for home insurance quotes.