Best Homeowners Insurance in Kentucky

Cincinnati Insurance Company is the best homeowners insurance company in Kentucky. It charges the state’s cheapest average rate of $169 a month, and also offers the best selection of home insurance discounts.

State Farm is Kentucky’s best home insurance company for customer satisfaction, while Allstate has the best coverage options.

Best cheap home insurance companies in Kentucky

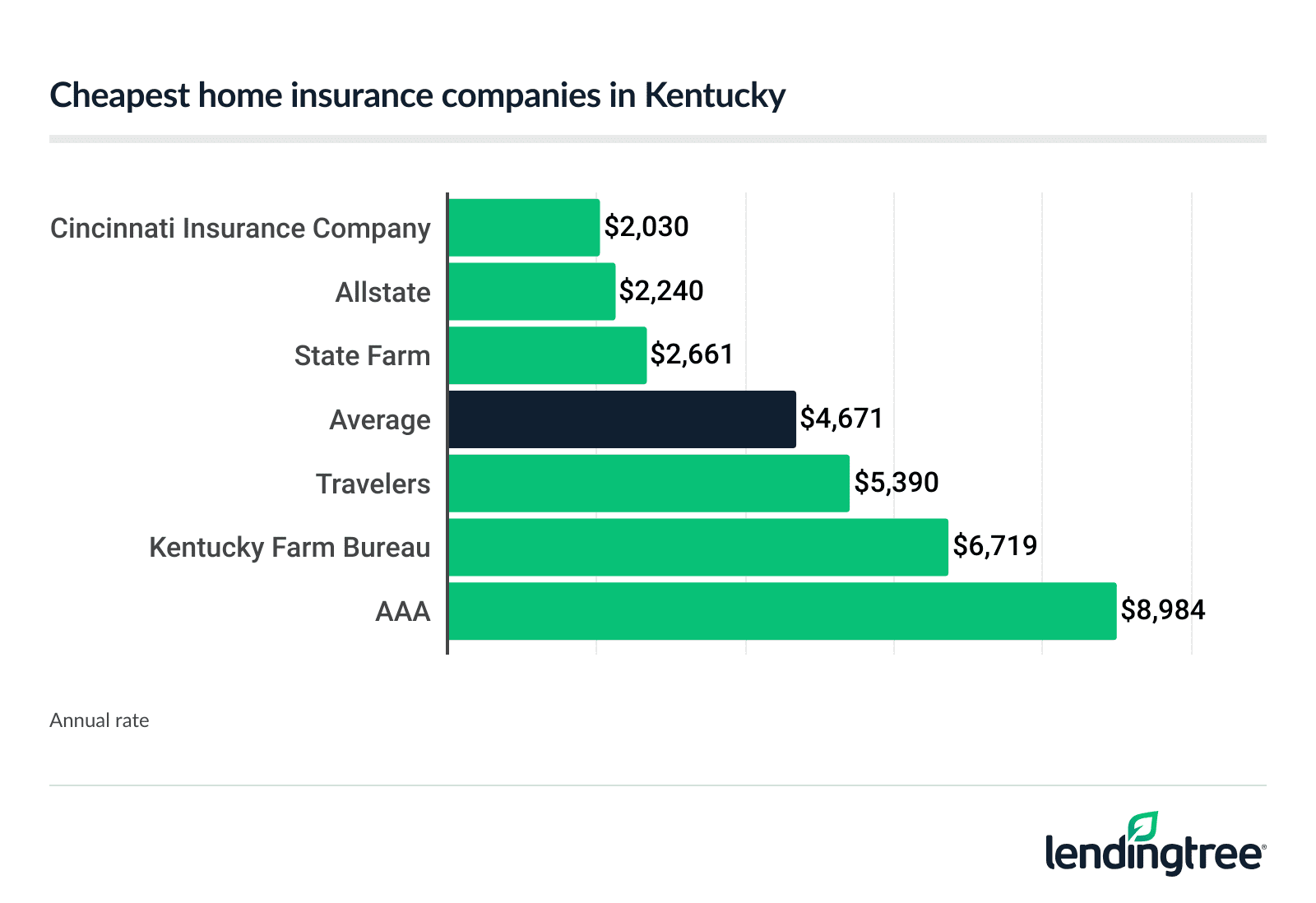

Cheapest homeowners insurance in Kentucky

Cincinnati Insurance Company and Allstate are the cheapest home insurance companies in Kentucky. Cincinnati Insurance Company charges $169 a month, or $2,030 a year, on average, while Allstate’s average rate is $187 a month, or $2,240 a year.

Both companies’ average rates are well below the state average home insurance rate of $389 a month, or $4,671 a year.

| Company | Annual rate | Monthly rate | LendingTree score |

|---|---|---|---|

Cincinnati Insurance Company Cincinnati Insurance Company | $2,030 | $169 | Not rated |

Allstate Allstate | $2,240 | $187 | |

State Farm State Farm | $2,661 | $222 | |

Travelers Travelers | $5,390 | $449 | |

Kentucky Farm Bureau Kentucky Farm Bureau | $6,719 | $560 | |

AAA AAA | $8,984 | $749 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

To find the cheapest home insurance rate for your situation, compare home insurance quotes from several companies while you shop around for coverage.

Best homeowners insurance companies in Kentucky

Cincinnati Insurance Company, State Farm and Allstate are the best home insurance companies in Kentucky due to their low rates, coverages, discounts and reputations for customer service.

| Company | Best for | Average annual rate | Customer satisfaction* | Complaint index** |

|---|---|---|---|---|

| Cincinnati Insurance Company | Cheap rates, discounts | $2,030 | Not rated | 0.22 |

| State Farm | Customer satisfaction | $2,661 | 829 | 1.05 |

| Allstate | Coverage options | $2,240 | 809 | 1.3 |

*Higher is better; 819 is average

**Lower is better; 1.0 is average

Best overall: Cincinnati Insurance Company

Cincinnati Insurance Company is Kentucky’s best homeowners insurance company due to its low rates, wide range of discounts and good complaint rating.

| Pros | Cons |

|---|---|

Lowest average home insurance premiums in Kentucky Offers the most home insurance discounts of the companies we surveyed Second-best complaint rating of surveyed companies | Most optional coverages limited to owners of high-value homes |

Best for cheap rates: Cincinnati Insurance Company

If you want cheap home insurance above all else, Cincinnati Insurance Company is the best company for you. Cincinnati Insurance Company has the cheapest home insurance in Kentucky, with rates that average $2,030 a year, or $169 a month.

Cincinnati’s average home insurance rate is 10% lower than that of second-place Allstate. It’s also 79% lower than the state average rate.

Best for customer satisfaction: State Farm

State Farm earned the highest score (829) from J.D. Power’s 2023 U.S. Home Insurance Study among the Kentucky home insurance companies we surveyed.

This study’s scores are based on customer surveys that rate insurance companies on factors like price, policy offerings and claims. The highest possible score is 1,000, while the segment average is 819.

| Pros | Cons |

|---|---|

Highest customer satisfaction rating of surveyed companies Average premium is affordable and well below the state average | Doesn’t offer many discounts or optional coverages Complaint rating is average |

Best coverage options: Allstate

Allstate is the best home insurance company for coverage options in Kentucky. Some of the optional coverages you can add to a home insurance policy bought through Allstate include:

- Green improvement reimbursement

- Electronic data recovery

- Identity theft restoration

- Sports equipment

- Musical instruments

- Water backup

| Pros | Cons |

|---|---|

Offers more optional coverages than any other company we surveyed in Kentucky Also offers many discounts Second-cheapest average home insurance rate in the state | Customer satisfaction rating is below average Complaint rating is the worst of the companies surveyed |

Best discounts: Cincinnati Insurance Company

Cincinnati Insurance Company offers more home insurance discounts than any of the other companies we surveyed in Kentucky. You can get common discounts from Cincinnati, like ones for bundling home and auto coverage or for buying a newer home, but you may also save money for:

- Automatic water shutoff systems

- Permanently installed backup generators

- Living in a secured community

- Having a year-round, live-in caretaker

Homeowners insurance average cost in Kentucky

The average cost of home insurance in Kentucky is $4,671 a year, or $389 a month.

You’ll usually pay more than this average amount if your home has a dwelling coverage limit that’s higher than $400,000. And you’ll usually pay less if your dwelling limit is lower.

| Dwelling limit | Annual rate | Monthly rate |

|---|---|---|

| $350,000 | $4,080 | $340 |

| $400,000 | $4,671 | $389 |

| $450,000 | $5,337 | $445 |

Your home insurance policy’s dwelling coverage helps pay to repair or rebuild the structure of your home if a covered peril damages or destroys it. Covered perils include events like fires, hail or even vandalism.

Your dwelling limit isn’t the only factor that determines what you pay for home insurance in Kentucky and elsewhere. Other home insurance rate factors include:

- Where you live in the state

- The age of your home

- The amount of coverage you buy

- Your deductible

- Your credit, insurance and claims history

Kentucky home insurance rates by city

Fort Thomas and Dayton pay the lowest home insurance rates among Kentucky’s cities, with them averaging $2,983 and $3,014 a year respectively.

Homeowners in Pittsburg pay the highest rates, at an average of $6,851 a year.

| City |

Average annual rate

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

|

|---|---|

| Aberdeen | $4,873 |

| Adairville | $4,780 |

| Adams | $5,806 |

| Adolphus | $4,527 |

| Ages Brookside | $5,500 |

| Albany | $4,958 |

| Alexandria | $3,048 |

| Allen | $5,889 |

| Allensville | $4,958 |

| Almo | $4,505 |

| Alpha | $5,224 |

| Alvaton | $4,519 |

| Anchorage | $3,934 |

| Annville | $6,573 |

| Argillite | $3,993 |

| Arjay | $6,069 |

| Arlington | $4,867 |

| Artemus | $6,364 |

| Ary | $6,481 |

| Ashcamp | $5,930 |

| Asher | $4,960 |

| Ashland | $4,112 |

| Auburn | $4,982 |

| Audubon Park | $3,762 |

| Augusta | $4,012 |

| Austin | $4,610 |

| Auxier | $5,867 |

| Avawam | $6,169 |

| Bagdad | $3,507 |

| Bandana | $4,429 |

| Banner | $5,644 |

| Barbourville | $6,147 |

| Bardstown | $3,970 |

| Bardwell | $4,922 |

| Barlow | $4,707 |

| Baskett | $4,153 |

| Battletown | $3,846 |

| Baxter | $5,621 |

| Bays | $5,230 |

| Bear Branch | $5,812 |

| Beattyville | $5,721 |

| Beaumont | $4,982 |

| Beauty | $5,033 |

| Beaver | $5,754 |

| Beaver Dam | $4,135 |

| Bedford | $4,135 |

| Bee Spring | $5,842 |

| Beech Creek | $4,570 |

| Beech Grove | $4,088 |

| Beechmont | $4,597 |

| Beechwood Village | $4,047 |

| Belcher | $5,904 |

| Belfry | $5,818 |

| Bellefonte | $3,887 |

| Bellemeade | $3,807 |

| Bellevue | $3,046 |

| Bellewood | $3,845 |

| Belton | $4,629 |

| Benham | $5,502 |

| Benton | $4,818 |

| Berea | $4,112 |

| Berry | $3,802 |

| Bethelridge | $4,696 |

| Bethlehem | $4,149 |

| Betsy Layne | $5,748 |

| Beverly | $6,232 |

| Bevinsville | $5,749 |

| Big Clifty | $5,407 |

| Big Creek | $6,351 |

| Big Laurel | $5,712 |

| Bighill | $3,697 |

| Bimble | $6,199 |

| Blackey | $5,722 |

| Blaine | $5,748 |

| Bledsoe | $5,588 |

| Bloomfield | $4,011 |

| Blue Ridge Manor | $3,876 |

| Blue River | $5,807 |

| Boaz | $4,542 |

| Bonnieville | $4,749 |

| Bonnyman | $5,908 |

| Booneville | $5,884 |

| Boons Camp | $5,442 |

| Boston | $4,002 |

| Bowling Green | $4,339 |

| Bradfordsville | $4,435 |

| Brandenburg | $3,846 |

| Breckinridge Center | $4,470 |

| Breeding | $4,523 |

| Bremen | $4,581 |

| Briarwood | $3,848 |

| Brodhead | $5,980 |

| Bronston | $5,220 |

| Brooks | $4,118 |

| Brooksville | $4,063 |

| Browder | $4,731 |

| Brownsboro Farm | $3,943 |

| Brownsville | $5,379 |

| Bryants Store | $6,367 |

| Buckhorn | $6,036 |

| Buckner | $3,698 |

| Buffalo | $4,653 |

| Bulan | $5,809 |

| Burdine | $5,107 |

| Burgin | $3,898 |

| Burkesville | $5,005 |

| Burlington | $3,071 |

| Burna | $4,253 |

| Burnside | $5,139 |

| Busy | $5,921 |

| Butler | $3,528 |

| Bypro | $5,113 |

| Cadiz | $4,111 |

| Calhoun | $4,096 |

| California | $3,051 |

| Calvert City | $4,850 |

| Calvin | $6,200 |

| Camargo | $3,769 |

| Cambridge | $3,853 |

| Campbellsburg | $4,031 |

| Campbellsville | $3,956 |

| Campton | $5,727 |

| Canada | $5,791 |

| Caneyville | $5,451 |

| Canmer | $4,677 |

| Cannel City | $5,077 |

| Cannon | $6,007 |

| Carlisle | $4,322 |

| Carrie | $5,902 |

| Carrollton | $4,332 |

| Catlettsburg | $4,271 |

| Cave City | $4,557 |

| Cawood | $5,623 |

| Cecilia | $4,010 |

| Center | $5,094 |

| Centertown | $4,489 |

| Central City | $4,267 |

| Cerulean | $4,127 |

| Chaplin | $4,027 |

| Chappell | $4,987 |

| Chavies | $6,345 |

| Clarkson | $5,162 |

| Claryville | $3,048 |

| Clay | $4,816 |

| Clay City | $4,643 |

| Clayhole | $6,456 |

| Clearfield | $4,454 |

| Cleaton | $4,410 |

| Clermont | $4,325 |

| Clifty | $4,182 |

| Clinton | $4,782 |

| Closplint | $5,796 |

| Cloverport | $4,584 |

| Coalgood | $5,827 |

| Cold Spring | $3,017 |

| Coldiron | $5,898 |

| Coldstream | $3,964 |

| Columbia | $4,213 |

| Columbus | $4,780 |

| Combs | $6,112 |

| Corbin | $6,155 |

| Corinth | $3,885 |

| Cornettsville | $5,903 |

| Corydon | $4,082 |

| Covington | $3,176 |

| Coxs Creek | $3,947 |

| Crab Orchard | $4,606 |

| Cranks | $5,839 |

| Crayne | $4,788 |

| Crestview | $3,021 |

| Crestview Hills | $3,186 |

| Crestwood | $3,714 |

| Crittenden | $3,865 |

| Crockett | $5,084 |

| Crofton | $4,373 |

| Cromona | $4,953 |

| Cromwell | $4,768 |

| Cub Run | $5,091 |

| Cumberland | $5,529 |

| Cunningham | $4,681 |

| Curdsville | $4,398 |

| Custer | $4,807 |

| Cynthiana | $3,599 |

| Dana | $5,688 |

| Danville | $4,022 |

| David | $5,734 |

| Dawson Springs | $4,279 |

| Dayhoit | $5,821 |

| Dayton | $3,014 |

| De Mossville | $3,524 |

| Deane | $6,045 |

| Debord | $6,437 |

| Delphia | $6,229 |

| Dema | $5,968 |

| Denniston | $5,818 |

| Denton | $4,429 |

| Dexter | $4,457 |

| Dixon | $5,168 |

| Doe Valley | $3,840 |

| Douglass Hills | $3,911 |

| Dover | $3,756 |

| Drake | $4,420 |

| Drakesboro | $4,528 |

| Drift | $4,871 |

| Druid Hills | $3,845 |

| Dry Ridge | $4,014 |

| Dubre | $4,869 |

| Dunbar | $4,820 |

| Dundee | $4,793 |

| Dunmor | $4,900 |

| Dunnville | $4,657 |

| Dwale | $4,968 |

| Dwarf | $5,159 |

| Dycusburg | $4,678 |

| Earlington | $4,421 |

| East Bernstadt | $6,690 |

| East Point | $5,587 |

| Eastern | $5,871 |

| Eastview | $4,098 |

| Eastwood | $3,895 |

| Eddyville | $4,172 |

| Edgewood | $3,216 |

| Edmonton | $4,761 |

| Eighty Eight | $4,903 |

| Ekron | $3,872 |

| Elizabethtown | $3,858 |

| Elizaville | $4,041 |

| Elk Creek | $3,943 |

| Elk Horn | $4,105 |

| Elkfork | $5,270 |

| Elkhorn City | $5,899 |

| Elkton | $4,087 |

| Elliottville | $5,260 |

| Elsmere | $3,242 |

| Emerson | $3,969 |

| Eminence | $4,015 |

| Emlyn | $6,084 |

| Emmalena | $5,986 |

| Eolia | $5,744 |

| Erlanger | $3,210 |

| Ermine | $5,665 |

| Essie | $4,993 |

| Etoile | $4,525 |

| Eubank | $4,865 |

| Evarts | $5,603 |

| Ewing | $3,921 |

| Ezel | $6,024 |

| Fairdale | $3,796 |

| Fairfield | $3,828 |

| Fairview | $4,289 |

| Falcon | $5,219 |

| Fall Rock | $6,018 |

| Falls Of Rough | $5,327 |

| Falmouth | $3,604 |

| Fancy Farm | $4,673 |

| Farley | $4,288 |

| Farmers | $5,260 |

| Farmington | $4,646 |

| Fedscreek | $6,160 |

| Ferguson | $5,385 |

| Fincastle | $3,890 |

| Finchville | $3,521 |

| Fisherville | $3,986 |

| Fisty | $5,986 |

| Flat Lick | $6,046 |

| Flatgap | $5,454 |

| Flatwoods | $3,931 |

| Flemingsburg | $3,889 |

| Florence | $3,168 |

| Fords Branch | $5,925 |

| Fordsville | $4,508 |

| Forest Hills | $5,792 |

| Fort Campbell North | $4,415 |

| Fort Knox | $3,889 |

| Fort Mitchell | $3,171 |

| Fort Thomas | $2,983 |

| Fort Wright | $3,172 |

| Foster | $4,012 |

| Fountain Run | $4,819 |

| Fourmile | $5,175 |

| Fox Chase | $4,303 |

| Frakes | $6,148 |

| Francisville | $3,088 |

| Frankfort | $3,365 |

| Franklin | $4,256 |

| Fredonia | $4,295 |

| Freeburn | $5,849 |

| Frenchburg | $5,778 |

| Fulton | $5,082 |

| Gamaliel | $4,869 |

| Garfield | $5,032 |

| Garner | $5,854 |

| Garrard | $5,118 |

| Garrett | $5,725 |

| Garrison | $4,106 |

| Gays Creek | $6,303 |

| Georgetown | $3,141 |

| Germantown | $4,033 |

| Ghent | $4,481 |

| Gilbertsville | $4,880 |

| Girdler | $5,825 |

| Glasgow | $4,379 |

| Glencoe | $4,116 |

| Glendale | $4,229 |

| Glens Fork | $4,384 |

| Glenview | $3,835 |

| Goose Creek | $3,950 |

| Goose Rock | $6,094 |

| Gordon | $5,672 |

| Goshen | $3,811 |

| Gracey | $4,656 |

| Gradyville | $4,881 |

| Graham | $4,501 |

| Grand Rivers | $4,501 |

| Gravel Switch | $4,563 |

| Gray | $6,185 |

| Gray Hawk | $5,127 |

| Graymoor-Devondale | $3,992 |

| Grays Knob | $5,893 |

| Grayson | $4,048 |

| Green Road | $5,950 |

| Greensburg | $4,578 |

| Greenup | $4,012 |

| Greenville | $4,261 |

| Grethel | $5,711 |

| Gulston | $4,811 |

| Gunlock | $6,139 |

| Guston | $3,887 |

| Guthrie | $4,671 |

| Hagerhill | $5,583 |

| Hallie | $5,719 |

| Hampton | $4,269 |

| Hanson | $4,647 |

| Happy | $5,897 |

| Hardin | $4,826 |

| Hardinsburg | $4,571 |

| Hardy | $5,862 |

| Hardyville | $4,702 |

| Harlan | $5,626 |

| Harned | $4,578 |

| Harold | $5,786 |

| Harrods Creek | $3,926 |

| Harrodsburg | $3,956 |

| Hartford | $4,207 |

| Hawesville | $4,739 |

| Hazard | $5,818 |

| Hazel | $4,386 |

| Hazel Green | $5,684 |

| Hebron | $3,087 |

| Hebron Estates | $4,242 |

| Heidrick | $6,042 |

| Hellier | $5,153 |

| Helton | $4,970 |

| Henderson | $3,817 |

| Hendron | $4,297 |

| Heritage Creek | $3,884 |

| Herndon | $4,425 |

| Hestand | $5,060 |

| Hi Hat | $5,737 |

| Hickman | $5,103 |

| Hickory | $4,555 |

| Highland Heights | $3,019 |

| Hillsboro | $3,991 |

| Hillview | $4,068 |

| Hima | $5,887 |

| Hindman | $5,850 |

| Hinkle | $5,839 |

| Hitchins | $4,354 |

| Hodgenville | $4,393 |

| Holland | $4,875 |

| Holmes Mill | $5,495 |

| Hope | $3,927 |

| Hopkinsville | $4,376 |

| Horse Branch | $4,483 |

| Horse Cave | $4,794 |

| Hoskinston | $4,999 |

| Houston Acres | $4,053 |

| Huddy | $5,988 |

| Hudson | $4,600 |

| Hueysville | $5,726 |

| Hulen | $5,972 |

| Hurstbourne | $3,805 |

| Hurstbourne Acres | $3,859 |

| Hustonville | $4,606 |

| Hyden | $5,794 |

| Independence | $3,232 |

| Inez | $5,831 |

| Ingram | $5,958 |

| Irvine | $6,123 |

| Irvington | $4,581 |

| Island | $4,406 |

| Isom | $6,020 |

| Isonville | $4,920 |

| Ivel | $5,663 |

| Jackhorn | $5,767 |

| Jackson | $5,768 |

| Jamestown | $4,367 |

| Jeff | $5,044 |

| Jeffersontown | $3,946 |

| Jeffersonville | $3,816 |

| Jenkins | $5,809 |

| Jeremiah | $5,829 |

| Jetson | $5,055 |

| Jonancy | $5,253 |

| Jonesville | $4,165 |

| Junction City | $4,005 |

| Keaton | $5,795 |

| Keavy | $6,549 |

| Kenton | $3,593 |

| Kenvir | $5,903 |

| Kettle Island | $6,144 |

| Kevil | $4,445 |

| Kimper | $5,857 |

| Kings Mountain | $4,706 |

| Kirksey | $4,365 |

| Kite | $5,733 |

| Knifley | $4,455 |

| Knob Lick | $4,728 |

| Krypton | $6,225 |

| Kuttawa | $4,131 |

| La Center | $4,470 |

| La Fayette | $4,385 |

| La Grange | $3,729 |

| Lackey | $5,981 |

| Lakeside Park | $3,185 |

| Lancaster | $4,159 |

| Langdon Place | $3,920 |

| Langley | $5,775 |

| Latonia | $3,248 |

| Lawrenceburg | $3,732 |

| Lebanon | $4,418 |

| Lebanon Junction | $4,375 |

| Leburn | $5,813 |

| Ledbetter | $4,468 |

| Leitchfield | $5,141 |

| Lejunior | $4,745 |

| Letcher | $5,667 |

| Lewisburg | $4,764 |

| Lewisport | $4,318 |

| Lexington | $3,141 |

| Liberty | $4,766 |

| Lick Creek | $6,173 |

| Lily | $6,849 |

| Linefork | $5,998 |

| Littcarr | $5,794 |

| Livermore | $4,279 |

| Livingston | $6,058 |

| Lockport | $4,323 |

| London | $6,817 |

| Lone | $5,888 |

| Lookout | $5,963 |

| Loretto | $4,428 |

| Lost Creek | $5,750 |

| Louisa | $5,851 |

| Louisville | $3,947 |

| Lovelaceville | $4,374 |

| Lovely | $5,810 |

| Lowes | $4,434 |

| Lowmansville | $6,075 |

| Loyall | $4,697 |

| Lucas | $4,682 |

| Ludlow | $3,188 |

| Lynch | $5,555 |

| Lyndon | $3,830 |

| Lynnview | $3,967 |

| Lynnville | $4,501 |

| Maceo | $3,984 |

| Mackville | $4,045 |

| Madisonville | $4,305 |

| Magnolia | $4,603 |

| Majestic | $5,011 |

| Mallie | $6,086 |

| Malone | $5,271 |

| Mammoth Cave National Park | $5,689 |

| Manchester | $5,953 |

| Manitou | $4,707 |

| Maple Mount | $3,920 |

| Marion | $4,627 |

| Marrowbone | $4,707 |

| Marshes Siding | $4,834 |

| Martha | $6,176 |

| Martin | $5,777 |

| Mary Alice | $5,410 |

| Mason | $4,074 |

| Masonic Home | $3,990 |

| Masonville | $3,950 |

| Massac | $4,329 |

| Mayfield | $4,736 |

| Mayking | $5,726 |

| Mayslick | $3,823 |

| Maysville | $3,649 |

| Mazie | $5,550 |

| Mc Andrews | $5,777 |

| Mc Carr | $5,848 |

| Mc Daniels | $4,815 |

| Mc Dowell | $5,740 |

| Mc Henry | $4,695 |

| Mc Kee | $6,327 |

| Mc Kinney | $4,476 |

| Mc Quady | $4,748 |

| McRoberts | $5,765 |

| Meadow Vale | $3,848 |

| Meally | $5,772 |

| Means | $4,904 |

| Melber | $4,553 |

| Melbourne | $3,066 |

| Melvin | $6,041 |

| Middleburg | $4,775 |

| Middlesborough | $6,063 |

| Middletown | $3,917 |

| Midway | $3,330 |

| Milburn | $4,787 |

| Milford | $4,110 |

| Millersburg | $3,235 |

| Millstone | $5,724 |

| Millwood | $5,494 |

| Milton | $4,157 |

| Minerva | $3,631 |

| Minnie | $5,016 |

| Miracle | $4,872 |

| Mistletoe | $6,102 |

| Mitchellsburg | $4,006 |

| Mize | $5,086 |

| Monticello | $4,980 |

| Moorefield | $4,577 |

| Moorland | $3,827 |

| Morehead | $4,432 |

| Morganfield | $4,470 |

| Morgantown | $5,037 |

| Morning View | $3,249 |

| Mortons Gap | $4,434 |

| Mount Eden | $4,031 |

| Mount Hermon | $5,021 |

| Mount Olivet | $3,698 |

| Mount Sherman | $4,811 |

| Mount Sterling | $3,758 |

| Mount Vernon | $5,938 |

| Mount Washington | $4,156 |

| Mousie | $5,750 |

| Mouthcard | $5,832 |

| Mozelle | $5,855 |

| Muldraugh | $3,867 |

| Munfordville | $4,761 |

| Murray | $4,334 |

| Muses Mills | $4,024 |

| Myra | $5,425 |

| Nancy | $4,797 |

| Nazareth | $3,746 |

| Nebo | $4,439 |

| Neon | $5,834 |

| Nerinx | $4,301 |

| New Castle | $4,072 |

| New Concord | $4,429 |

| New Haven | $4,013 |

| New Hope | $4,027 |

| New Liberty | $4,218 |

| Newport | $3,113 |

| Nicholasville | $3,553 |

| Norbourne Estates | $3,844 |

| North Corbin | $6,332 |

| North Middletown | $3,242 |

| Northfield | $3,804 |

| Nortonville | $4,491 |

| Oak Grove | $4,424 |

| Oakbrook | $3,199 |

| Oakland | $4,593 |

| Oil Springs | $5,701 |

| Olaton | $4,794 |

| Old Brownsboro Place | $3,843 |

| Olive Hill | $4,128 |

| Olmstead | $4,946 |

| Olympia | $4,076 |

| Oneida | $6,085 |

| Orchard Grass Hills | $3,697 |

| Orlando | $6,845 |

| Owensboro | $3,665 |

| Owenton | $4,010 |

| Owingsville | $3,961 |

| Paducah | $4,314 |

| Paint Lick | $4,036 |

| Paintsville | $5,657 |

| Paris | $3,227 |

| Park City | $4,950 |

| Park Hills | $3,164 |

| Parkers Lake | $5,087 |

| Parksville | $4,035 |

| Parkway Village | $4,007 |

| Partridge | $5,670 |

| Pathfork | $5,542 |

| Payneville | $3,895 |

| Pembroke | $4,410 |

| Pendleton | $4,098 |

| Perry Park | $4,276 |

| Perryville | $4,072 |

| Petersburg | $3,190 |

| Pewee Valley | $3,702 |

| Phelps | $5,786 |

| Philpot | $4,007 |

| Phyllis | $5,857 |

| Pikeville | $5,820 |

| Pilgrim | $5,847 |

| Pine Knot | $5,117 |

| Pine Ridge | $6,199 |

| Pine Top | $5,793 |

| Pineville | $6,125 |

| Pinsonfork | $5,822 |

| Pioneer Village | $4,290 |

| Pippa Passes | $5,725 |

| Pittsburg | $6,851 |

| Plano | $4,322 |

| Pleasureville | $4,092 |

| Plummers Landing | $3,951 |

| Poole | $4,983 |

| Port Royal | $4,404 |

| Powderly | $4,602 |

| Premium | $5,675 |

| Preston | $4,115 |

| Prestonsburg | $5,751 |

| Princeton | $4,215 |

| Printer | $5,687 |

| Prospect | $3,871 |

| Providence | $4,776 |

| Putney | $5,826 |

| Quincy | $4,076 |

| Raccoon | $5,983 |

| Raceland | $3,982 |

| Radcliff | $3,854 |

| Ransom | $5,793 |

| Raven | $5,837 |

| Ravenna | $6,070 |

| Raywick | $4,576 |

| Redfox | $5,795 |

| Reed | $4,073 |

| Regina | $6,086 |

| Reidland | $4,290 |

| Renfro Valley | $6,659 |

| Revelo | $5,146 |

| Reynolds Station | $4,806 |

| Rhodelia | $4,083 |

| Ricetown | $6,030 |

| Richlawn | $4,042 |

| Richmond | $3,646 |

| Rineyville | $3,893 |

| River | $5,770 |

| Riverwood | $3,845 |

| Roark | $5,914 |

| Robards | $4,069 |

| Robinson Creek | $6,086 |

| Rochester | $4,948 |

| Rockfield | $4,440 |

| Rockholds | $6,023 |

| Rockhouse | $6,212 |

| Rockport | $4,465 |

| Rocky Hill | $5,908 |

| Rogers | $5,804 |

| Rolling Fields | $3,850 |

| Rolling Hills | $3,852 |

| Rosine | $4,590 |

| Roundhill | $5,564 |

| Rousseau | $6,009 |

| Rowdy | $6,402 |

| Roxana | $5,089 |

| Royalton | $6,111 |

| Rumsey | $4,723 |

| Rush | $4,137 |

| Russell | $3,982 |

| Russell Springs | $4,502 |

| Russellville | $4,629 |

| Ryland Heights | $3,258 |

| Sacramento | $4,398 |

| Sadieville | $3,273 |

| Salem | $4,329 |

| Salt Lick | $4,015 |

| Salvisa | $4,010 |

| Salyersville | $5,838 |

| Sanders | $4,432 |

| Sandgap | $6,464 |

| Sandy Hook | $4,060 |

| Sassafras | $5,821 |

| Saul | $6,411 |

| Scalf | $5,953 |

| Science Hill | $4,909 |

| Scottsville | $4,906 |

| Scuddy | $5,960 |

| Sebree | $5,164 |

| Seco | $5,670 |

| Sedalia | $4,800 |

| Seneca Gardens | $3,857 |

| Sextons Creek | $5,993 |

| Sharon Grove | $4,415 |

| Sharpsburg | $3,853 |

| Shelbiana | $5,903 |

| Shelby Gap | $6,027 |

| Shelbyville | $3,541 |

| Shepherdsville | $4,264 |

| Shively | $3,729 |

| Sidney | $6,072 |

| Siler | $5,991 |

| Silver Grove | $3,119 |

| Simpsonville | $3,549 |

| Sitka | $5,528 |

| Sizerock | $4,897 |

| Slade | $5,572 |

| Slaughters | $4,676 |

| Slemp | $5,899 |

| Smilax | $5,674 |

| Smith Mills | $4,014 |

| Smithfield | $4,018 |

| Smithland | $4,533 |

| Smiths Grove | $4,969 |

| Soldier | $4,138 |

| Somerset | $4,870 |

| Sonora | $4,141 |

| South Carrollton | $4,349 |

| South Portsmouth | $4,047 |

| South Shore | $4,053 |

| South Wallins | $5,632 |

| South Williamson | $5,744 |

| Southgate | $3,031 |

| Sparta | $4,146 |

| Spottsville | $4,037 |

| Springfield | $3,993 |

| St. Catharine | $4,127 |

| St. Charles | $4,547 |

| St. Francis | $4,553 |

| St. Helens | $5,975 |

| St. Mary | $4,490 |

| St. Matthews | $3,836 |

| Staffordsville | $5,651 |

| Stambaugh | $5,726 |

| Stamping Ground | $3,228 |

| Stanford | $4,547 |

| Stanton | $5,586 |

| Stanville | $4,857 |

| Stearns | $5,085 |

| Steele | $5,742 |

| Stephensport | $5,113 |

| Stinnett | $5,864 |

| Stone | $5,789 |

| Stoney Fork | $5,968 |

| Stopover | $5,779 |

| Strathmoor Village | $3,854 |

| Strunk | $5,107 |

| Sturgis | $4,447 |

| Sullivan | $4,444 |

| Sulphur | $4,423 |

| Summer Shade | $4,938 |

| Summersville | $4,798 |

| Sweeden | $5,943 |

| Symsonia | $4,517 |

| Tateville | $5,056 |

| Taylor Mill | $3,255 |

| Taylorsville | $4,006 |

| Teaberry | $5,726 |

| Ten Broeck | $3,895 |

| Thelma | $5,543 |

| Thornton | $5,973 |

| Thousandsticks | $5,742 |

| Tiline | $4,850 |

| Tollesboro | $3,977 |

| Tomahawk | $5,842 |

| Tompkinsville | $4,611 |

| Topmost | $5,710 |

| Totz | $5,824 |

| Tram | $4,873 |

| Trenton | $4,232 |

| Trosper | $6,166 |

| Turners Station | $4,059 |

| Tutor Key | $5,466 |

| Tyner | $6,155 |

| Ulysses | $4,937 |

| Union | $3,148 |

| Union Star | $5,087 |

| Uniontown | $4,405 |

| Upton | $4,359 |

| Utica | $3,972 |

| Van Lear | $5,630 |

| Vanceburg | $3,908 |

| Vancleve | $5,761 |

| Varney | $5,883 |

| Verona | $3,473 |

| Versailles | $3,284 |

| Vest | $5,971 |

| Vicco | $5,911 |

| Villa Hills | $3,191 |

| Vincent | $6,087 |

| Vine Grove | $3,882 |

| Viper | $5,823 |

| Virgie | $6,113 |

| Waco | $3,908 |

| Waddy | $3,536 |

| Walker | $5,875 |

| Wallingford | $3,969 |

| Wallins Creek | $5,634 |

| Walton | $3,169 |

| Waneta | $5,314 |

| Warbranch | $4,951 |

| Warfield | $5,813 |

| Warsaw | $4,065 |

| Washington | $3,801 |

| Water Valley | $4,678 |

| Watterson Park | $3,825 |

| Waverly | $4,296 |

| Wayland | $5,689 |

| Waynesburg | $4,759 |

| Webbville | $5,007 |

| Webster | $4,690 |

| Weeksbury | $4,954 |

| Wellington | $5,728 |

| Wendover | $5,760 |

| West Buechel | $4,133 |

| West Liberty | $5,191 |

| West Louisville | $3,908 |

| West Paducah | $4,434 |

| West Point | $3,872 |

| West Somerset | $5,034 |

| West Van Lear | $4,953 |

| Westport | $3,698 |

| Westview | $4,823 |

| Westwood | $4,111 |

| Wheatcroft | $4,887 |

| Wheelwright | $4,953 |

| Whick | $5,933 |

| White Mills | $4,075 |

| White Plains | $4,402 |

| Whitesburg | $5,737 |

| Whitesville | $3,984 |

| Whitley City | $5,082 |

| Wickliffe | $4,609 |

| Wilder | $3,026 |

| Wildie | $6,029 |

| Williamsburg | $6,075 |

| Williamsport | $5,812 |

| Williamstown | $4,034 |

| Willisburg | $3,980 |

| Wilmore | $3,691 |

| Winchester | $3,758 |

| Windsor | $4,830 |

| Windy Hills | $3,847 |

| Wingo | $4,755 |

| Wittensville | $5,810 |

| Woodbine | $6,141 |

| Woodburn | $4,441 |

| Woodbury | $5,008 |

| Woodland Hills | $3,942 |

| Wooton | $5,683 |

| Worthington | $3,976 |

| Worthville | $4,307 |

| Wurtland | $3,987 |

| Yeaddiss | $5,610 |

| Yerkes | $5,400 |

| Yosemite | $4,959 |

| Zoe | $6,255 |

The average home insurance rate in Louisville is $3,947 a year, or $329 a month.

Additional home insurance coverages in Kentucky

Kentucky homeowners face severe weather throughout the year, including tornadoes, severe thunderstorms and hail. Although standard home insurance covers damage caused by most of these perils, it doesn’t cover flood damage. For that, you need separate flood insurance.

Flood insurance in Kentucky

To protect your home from flooding, you need to buy separate flood insurance coverage.

Kentucky state law doesn’t require homeowners to buy flood insurance, but your mortgage lender might require it if you live in a high-risk flood zone.

You can buy flood insurance through the National Flood Insurance Program (NFIP) or some private insurance companies.

Frequently asked questions

Kentucky homeowners insurance laws do not require you to buy home insurance. Most lenders require home insurance if you take out a mortgage with them, though. Lenders also often require flood insurance if your home is in a high-risk flood zone.

Kentucky home insurance costs $4,671 a year, on average, or $389 a month. The exact price you pay depends on a number of factors, including how much coverage you need, the deductible you choose and the age of your home.

Cincinnati Insurance Company has the cheapest homeowners insurance in Kentucky, with an average rate of $2,030 a year, or $169 a month.