Best Homeowners Insurance in Louisiana

State Farm is the best cheap home insurance for most homeowners in Louisiana, with an average rate of $1,274 a year.

Best cheap home insurance companies in Louisiana

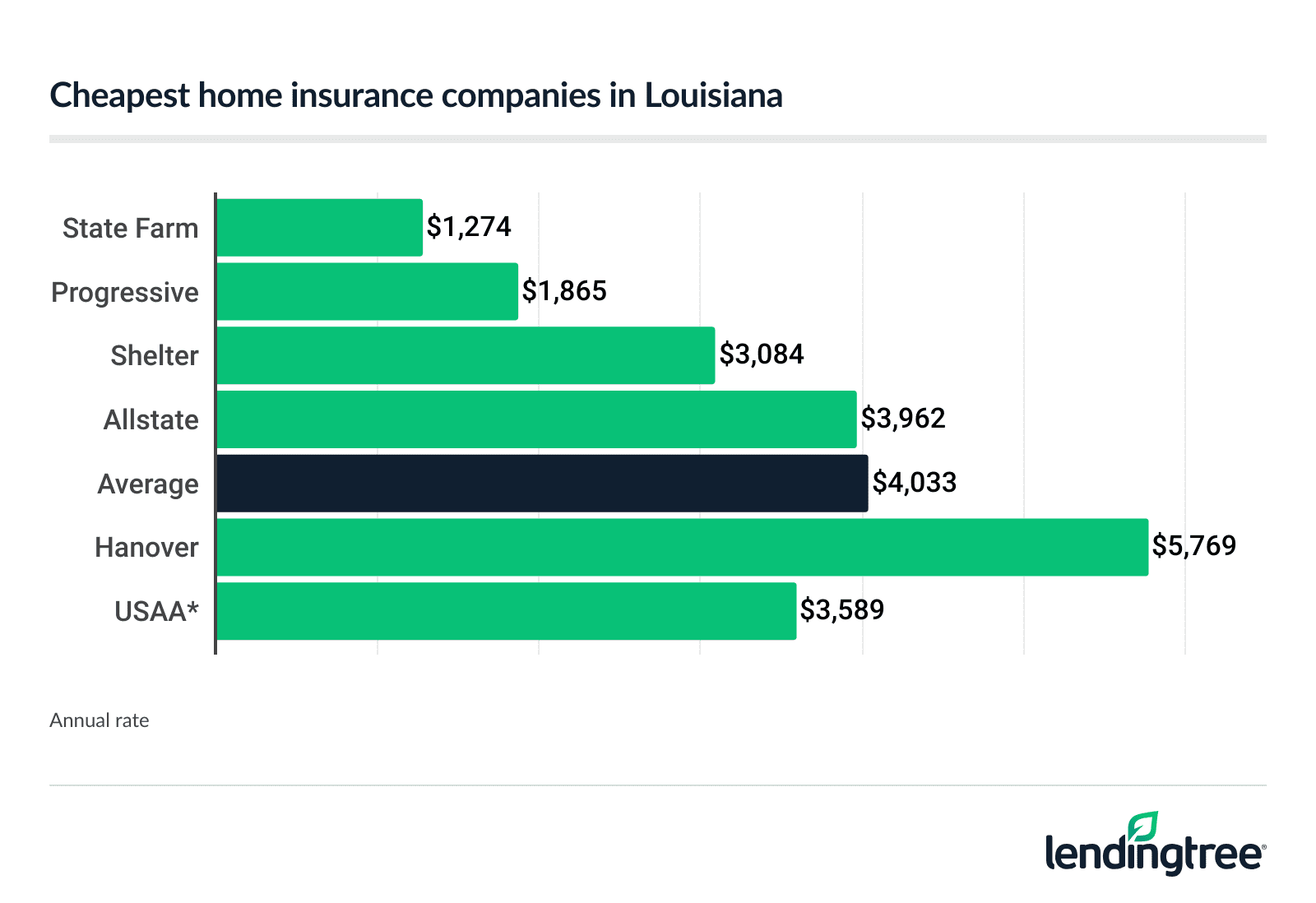

Louisiana’s cheapest home insurance companies

State Farm has the cheapest home insurance for most homeowners in Louisiana, with an average annual rate of $1,274. Progressive is the second-cheapest option at $1,865 a month.

For comparison, the average rate for home insurance in Louisiana is $4,033 a year.

Cheapest home insurance companies in Louisiana

| Company | Average annual rate | LendingTree score | |

|---|---|---|---|

| State Farm | $1,274 | |

| Progressive | $1,865 | |

| Shelter | $3,084 | Not rated |

| Allstate | $3,962 | |

| Hanover | $5,769 | Not rated |

| Farmers | $8,708 | |

| USAA* | $3,589 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

Best homeowners insurance companies in Louisiana

State Farm, Allstate, Hanover and USAA are the best home insurance companies in Louisiana.

| Company | Annual rate | Overall satisfaction (higher is better) | Complaint index (lower is better) |

|---|---|---|---|

| Best overall: State Farm | $1,274 | 873 (above average) | 1.69 (poor) |

| Best discounts: Allstate | $3,962 | 868 (average) | 3.08 (poor) |

| Best complaint rating: Hanover | $5,772 | NA | 0.57 (good) |

| Best for military: USAA* | $3,589 | 899 (above average) | 2.26 (poor) |

Sources: J.D. Power’s 2024 Property Claims Satisfaction Study and 2022 complaint data from the National Association of Insurance Commissioners (NAIC).

Best overall: State Farm

Annual rate: $1,274

![]()

Pros

Cheapest average rate for most homeowners

High property claims satisfaction rating

Cons

Poor complaint index rating

Low number of home insurance discounts

State Farm is the cheapest home insurance company in Louisiana, charging an average rate of $1,274 a year. It also has a great overall satisfaction rating with property claims, according to J.D. Power’s 2024 Property Claims Satisfaction Study.

A potential downside to State Farm is its below-average NAIC Complaint Index rating; however, that may be expected from a company of its size.

Allstate: Best discounts

Annual rate: $3,962

![]()

Pros

Great discounts

Below-average rates in Louisiana

Good overall claim satisfaction

No banned dog list

Cons

Below-average complaint index rating

No extended replacement cost coverage

Allstate’s average annual rate in Louisiana of $3,962 a year is just under the state average, but you may be able to make it cheaper with one or more of the company’s many discounts. These include:

- Multi-policy discount: Bundling a car or life insurance policy with your home insurance through Allstate can save you up to 20% on your insurance costs.

- Claim-free discount: If you sign on with Allstate with no recent claims on your record, you could save up to 20%.

Best complaint rating: Hanover

Annual rate: $5,769

![]()

Pros

Great discounts

Good overall complaint index rating

Cons

High average premiums

Hanover has the best NAIC Complaint Index rating of the home insurance companies we looked at in Louisiana. It currently stands at 0.57, with the average complaint index being 1.0.

Best for military families: USAA

Annual rate: $3,589

![]()

Pros

Coverage for military equipment and uniforms

Personal property coverage is at replacement cost

Excellent overall satisfaction

Cons

Can get a different agent every time you call

Only available to current and veteran military and their families

Below-average complaint index rating

USAA has policy offerings aimed at active-duty and veteran military members. This includes personal property coverage due to wartime damage, which home insurance doesn’t usually cover.

Louisiana home insurance rates by coverage amounts

The dwelling coverage limit you choose for your home insurance affects your premium. For example, there’s a $1,054 difference between a $350,000 and a $450,000 home insurance policy in Louisiana.

Home insurance cost by dwelling coverage limit

| Dwelling limit | Average annual rate |

|---|---|

| $350,000 | $3,510 |

| $400,000 | $4,033 |

| $450,000 | $4,564 |

When choosing your dwelling coverage limit, make it equal to the replacement value cost of your house in the event of a total loss. Replacement cost reflects the house by itself, not the ground it’s built on.

Cost of home insurance in Louisiana

The average cost of home insurance in Louisiana is $4,033 a year. This is 44% higher than the national average of $2,801.

A major reason for Louisiana’s high home insurance costs is that a lot of floods impact the state’s homeowners each year.

Several other factors determine what you pay for a home insurance policy, too, including:

- The age of the house

- Construction materials

- ZIP code

- Your claim history

- The coverage limits and deductible you choose

- Discounts you qualify for

Home insurance companies tend to have similar policy offerings, so why the difference in policy costs? This is because home insurance companies weigh risk factors differently. For example, one insurer may see the age of your home as more of a risk than another company, resulting in a higher quote.

To get the coverage you want at the cheapest price, compare home insurance quotes from several companies.

Louisiana home insurance rates by city

Of Louisiana’s cities, Eastwood has the cheapest average rate for home insurance, at $2,783 a year. Grand Isle has the highest rate, which averages $7,735.

Average rate by city

| City | Average annual rate |

|---|---|

| Abbeville | $4,713 |

| Abita Springs | $3,854 |

| Acme | $3,037 |

| Addis | $3,933 |

| Aimwell | $3,004 |

| Akers | $4,435 |

| Albany | $4,384 |

| Alexandria | $2,893 |

| Ama | $4,933 |

| Amelia | $4,941 |

| Amite City | $4,432 |

| Anacoco | $3,219 |

| Angie | $4,207 |

| Angola | $3,688 |

| Arabi | $5,658 |

| Arcadia | $3,000 |

| Archibald | $3,029 |

| Arnaudville | $3,968 |

| Ashland | $3,230 |

| Athens | $2,874 |

| Atlanta | $3,253 |

| Avery Island | $4,789 |

| Avondale | $5,292 |

| Baker | $3,876 |

| Baldwin | $4,962 |

| Ball | $2,892 |

| Banks Springs | $3,020 |

| Barataria | $5,980 |

| Barksdale AFB | $2,818 |

| Basile | $3,807 |

| Baskin | $3,075 |

| Bastrop | $2,966 |

| Batchelor | $3,797 |

| Baton Rouge | $3,844 |

| Bawcomville | $2,956 |

| Bayou Blue | $5,285 |

| Bayou Cane | $5,372 |

| Bayou Country Club | $5,015 |

| Bayou Gauche | $4,928 |

| Bayou Goula | $4,428 |

| Bayou L'Ourse | $4,939 |

| Bayou Vista | $4,942 |

| Belcher | $2,864 |

| Bell City | $4,710 |

| Belle Chasse | $6,014 |

| Belle Rose | $4,542 |

| Belmont | $3,245 |

| Bentley | $3,137 |

| Benton | $2,795 |

| Bernice | $2,958 |

| Berwick | $5,248 |

| Bethany | $2,787 |

| Bienville | $2,996 |

| Blanchard | $2,835 |

| Bogalusa | $4,248 |

| Bonita | $2,984 |

| Boothville | $7,022 |

| Bordelonville | $3,695 |

| Bossier City | $2,784 |

| Bourg | $5,505 |

| Boutte | $4,912 |

| Boyce | $2,902 |

| Braithwaite | $6,097 |

| Branch | $3,952 |

| Breaux Bridge | $4,031 |

| Bridge City | $5,294 |

| Brittany | $4,077 |

| Broussard | $3,940 |

| Brownfields | $3,916 |

| Brownsville | $2,951 |

| Brusly | $3,950 |

| Bunkie | $3,671 |

| Buras | $7,011 |

| Burnside | $4,210 |

| Bush | $3,894 |

| Cade | $4,079 |

| Calhoun | $2,965 |

| Calvin | $3,258 |

| Cameron | $5,604 |

| Campti | $3,254 |

| Cankton | $3,914 |

| Carencro | $3,912 |

| Carlyss | $4,518 |

| Carville | $4,343 |

| Castor | $2,951 |

| Catahoula | $4,087 |

| Cecilia | $4,037 |

| Center Point | $3,702 |

| Centerville | $5,039 |

| Central | $3,828 |

| Chackbay | $5,025 |

| Chalmette | $5,678 |

| Charenton | $4,778 |

| Chase | $3,022 |

| Chataignier | $3,748 |

| Chatham | $3,017 |

| Chauvin | $6,344 |

| Cheneyville | $2,944 |

| Choudrant | $2,912 |

| Church Point | $4,030 |

| Claiborne | $2,961 |

| Clarence | $3,231 |

| Clarks | $3,057 |

| Clayton | $2,990 |

| Clinton | $3,790 |

| Cloutierville | $3,260 |

| Colfax | $3,139 |

| Collinston | $2,937 |

| Columbia | $3,021 |

| Convent | $4,336 |

| Converse | $3,274 |

| Cotton Valley | $3,008 |

| Cottonport | $3,727 |

| Coushatta | $3,284 |

| Covington | $3,988 |

| Creole | $6,907 |

| Crowley | $4,083 |

| Crowville | $3,046 |

| Cullen | $3,005 |

| Cut Off | $6,347 |

| Darrow | $4,297 |

| Delcambre | $4,762 |

| Delhi | $3,062 |

| Delta | $2,967 |

| Denham Springs | $4,027 |

| Dequincy | $4,388 |

| Deridder | $3,931 |

| Des Allemands | $4,927 |

| Destrehan | $4,934 |

| Deville | $2,920 |

| Dodson | $3,248 |

| Donaldsonville | $4,309 |

| Donner | $5,433 |

| Downsville | $2,953 |

| Doyline | $2,983 |

| Dry Creek | $4,075 |

| Dry Prong | $3,091 |

| Dubach | $2,906 |

| Dubberly | $2,980 |

| Dulac | $7,319 |

| Duplessis | $4,201 |

| Dupont | $3,703 |

| Duson | $4,012 |

| Eastwood | $2,783 |

| Echo | $2,907 |

| Eden Isle | $4,323 |

| Edgard | $4,676 |

| Effie | $3,697 |

| Egan | $3,958 |

| Elizabeth | $4,414 |

| Elm Grove | $2,812 |

| Elmer | $2,888 |

| Elmwood | $5,686 |

| Elton | $3,900 |

| Empire | $7,018 |

| Enterprise | $2,996 |

| Epps | $3,064 |

| Erath | $4,717 |

| Eros | $2,917 |

| Erwinville | $3,935 |

| Estelle | $5,228 |

| Estherwood | $4,088 |

| Ethel | $3,795 |

| Eunice | $3,807 |

| Evangeline | $3,945 |

| Evans | $3,212 |

| Evergreen | $3,705 |

| Fairbanks | $2,929 |

| Farmerville | $2,896 |

| Fenton | $3,909 |

| Ferriday | $3,035 |

| Fisher | $3,237 |

| Flatwoods | $2,878 |

| Flora | $3,223 |

| Florien | $3,281 |

| Fluker | $4,355 |

| Folsom | $3,784 |

| Fordoche | $3,905 |

| Forest | $3,009 |

| Forest Hill | $2,915 |

| Fort Jesup | $3,259 |

| Fort Necessity | $3,051 |

| Fort Polk | $3,235 |

| Fort Polk North | $3,236 |

| Fort Polk South | $3,230 |

| Franklin | $4,963 |

| Franklinton | $4,207 |

| French Settlement | $4,423 |

| Frierson | $3,238 |

| Galliano | $6,532 |

| Garden City | $4,985 |

| Gardere | $3,806 |

| Gardner | $2,888 |

| Garyville | $4,469 |

| Geismar | $4,169 |

| Georgetown | $3,129 |

| Gheens | $5,027 |

| Gibsland | $2,988 |

| Gibson | $5,485 |

| Gilbert | $3,093 |

| Gilliam | $2,885 |

| Glenmora | $2,928 |

| Gloster | $3,216 |

| Glynn | $3,809 |

| Golden Meadow | $7,335 |

| Goldonna | $3,251 |

| Gonzales | $4,185 |

| Gorum | $3,227 |

| Grambling | $2,894 |

| Gramercy | $4,324 |

| Grand Cane | $3,250 |

| Grand Chenier | $5,344 |

| Grand Coteau | $3,922 |

| Grand Isle | $7,735 |

| Grand Point | $4,542 |

| Grant | $4,415 |

| Gray | $5,402 |

| Grayson | $3,105 |

| Greensburg | $4,378 |

| Greenwell Springs | $3,839 |

| Greenwood | $2,811 |

| Gretna | $5,320 |

| Grosse Tete | $4,039 |

| Gueydan | $4,761 |

| Hackberry | $6,059 |

| Hahnville | $4,927 |

| Hall Summit | $3,245 |

| Hamburg | $3,696 |

| Hammond | $4,386 |

| Harahan | $5,561 |

| Harrisonburg | $3,034 |

| Harvey | $5,318 |

| Haughton | $2,785 |

| Hayes | $4,689 |

| Haynesville | $2,878 |

| Heflin | $2,984 |

| Hessmer | $3,714 |

| Hester | $4,541 |

| Hineston | $2,908 |

| Hodge | $3,010 |

| Holden | $4,388 |

| Homer | $2,865 |

| Hornbeck | $3,236 |

| Hosston | $2,821 |

| Houma | $5,379 |

| Husser | $4,383 |

| Ida | $2,853 |

| Independence | $4,396 |

| Innis | $3,787 |

| Inniswold | $3,791 |

| Iota | $3,938 |

| Iowa | $4,474 |

| Jackson | $3,796 |

| Jamestown | $2,987 |

| Jarreau | $3,843 |

| Jeanerette | $4,789 |

| Jefferson | $5,802 |

| Jena | $3,104 |

| Jennings | $4,024 |

| Jigger | $3,038 |

| Jones | $2,934 |

| Jonesboro | $3,006 |

| Jonesville | $3,038 |

| Joyce | $3,186 |

| Kaplan | $4,722 |

| Keatchie | $3,257 |

| Keithville | $2,797 |

| Kelly | $3,051 |

| Kenner | $6,352 |

| Kentwood | $4,400 |

| Kilbourne | $3,017 |

| Killian | $4,508 |

| Kinder | $4,461 |

| Kraemer | $5,024 |

| Krotz Springs | $3,865 |

| Kurthwood | $3,184 |

| La Place | $5,187 |

| Labadieville | $4,609 |

| Lacassine | $4,590 |

| Lacombe | $4,608 |

| Lafayette | $3,976 |

| Lafitte | $6,666 |

| Lafourche Crossing | $5,012 |

| Lake Arthur | $4,599 |

| Lake Charles | $4,497 |

| Lake Providence | $3,052 |

| Lakeland | $3,922 |

| Lakeshore | $2,960 |

| Lakeview | $2,833 |

| Laplace | $5,174 |

| Larose | $5,556 |

| Lawtell | $3,783 |

| Lebeau | $3,750 |

| Leblanc | $4,406 |

| Lecompte | $2,930 |

| Leesville | $3,216 |

| Lena | $2,919 |

| Leonville | $3,787 |

| Lettsworth | $3,674 |

| Libuse | $2,886 |

| Lillie | $2,969 |

| Lisbon | $2,892 |

| Livingston | $4,374 |

| Livonia | $3,918 |

| Lockport | $5,249 |

| Lockport Heights | $5,246 |

| Logansport | $3,258 |

| Longleaf | $2,900 |

| Longstreet | $3,223 |

| Longville | $4,113 |

| Loranger | $4,401 |

| Loreauville | $4,521 |

| Lottie | $3,900 |

| Luling | $4,931 |

| Lutcher | $4,342 |

| Lydia | $4,770 |

| Madisonville | $4,372 |

| Mamou | $3,767 |

| Mandeville | $4,400 |

| Mangham | $3,073 |

| Mansfield | $3,264 |

| Mansura | $3,723 |

| Many | $3,277 |

| Maringouin | $3,962 |

| Marion | $2,900 |

| Marksville | $3,702 |

| Marrero | $5,232 |

| Marthaville | $3,260 |

| Martin | $3,290 |

| Mathews | $5,066 |

| Maurepas | $4,445 |

| Maurice | $4,098 |

| Melrose | $3,238 |

| Melville | $3,861 |

| Mer Rouge | $2,991 |

| Meraux | $5,910 |

| Mermentau | $4,093 |

| Merrydale | $3,905 |

| Merryville | $4,100 |

| Metairie | $6,199 |

| Midway | $3,103 |

| Milton | $3,966 |

| Minden | $2,968 |

| Minorca | $3,042 |

| Mittie | $4,367 |

| Monroe | $2,956 |

| Montegut | $6,350 |

| Monterey | $3,078 |

| Montgomery | $3,133 |

| Monticello | $3,875 |

| Montz | $5,180 |

| Mooringsport | $2,831 |

| Mora | $3,001 |

| Moreauville | $3,721 |

| Morgan City | $4,978 |

| Morganza | $3,826 |

| Morrow | $3,764 |

| Morse | $4,354 |

| Moss Bluff | $4,294 |

| Mount Airy | $4,492 |

| Mount Hermon | $4,157 |

| Napoleonville | $4,390 |

| Natalbany | $4,384 |

| Natchez | $3,238 |

| Natchitoches | $3,261 |

| Negreet | $3,242 |

| New Iberia | $4,764 |

| New Llano | $3,231 |

| New Orleans | $5,962 |

| New Roads | $3,718 |

| New Sarpy | $4,935 |

| Newellton | $3,021 |

| Noble | $3,271 |

| Norco | $4,935 |

| North Hodge | $3,070 |

| North Vacherie | $4,360 |

| Norwood | $3,746 |

| Oak Grove | $3,054 |

| Oak Hills Place | $3,803 |

| Oak Ridge | $3,024 |

| Oakdale | $4,236 |

| Oberlin | $4,430 |

| Oil City | $2,878 |

| Old Jefferson | $3,809 |

| Olla | $3,100 |

| Opelousas | $3,779 |

| Oscar | $3,785 |

| Ossun | $3,980 |

| Otis | $2,889 |

| Paincourtville | $4,395 |

| Palmetto | $3,750 |

| Paradis | $4,722 |

| Patterson | $5,254 |

| Paulina | $4,542 |

| Pearl River | $4,220 |

| Pelican | $3,126 |

| Perry | $4,741 |

| Pierre Part | $4,584 |

| Pilottown | $6,189 |

| Pine Grove | $4,372 |

| Pine Prairie | $3,748 |

| Pineville | $2,959 |

| Pioneer | $3,060 |

| Pitkin | $3,254 |

| Plain Dealing | $2,848 |

| Plaquemine | $4,134 |

| Plattenville | $4,547 |

| Plaucheville | $3,720 |

| Pleasant Hill | $3,270 |

| Point Place | $3,259 |

| Pointe A La Hache | $6,375 |

| Pollock | $3,141 |

| Ponchatoula | $4,434 |

| Port Allen | $3,928 |

| Port Barre | $3,754 |

| Port Sulphur | $7,022 |

| Powhatan | $3,231 |

| Poydras | $5,862 |

| Prairieville | $3,954 |

| Presquille | $5,498 |

| Pride | $3,831 |

| Prien | $4,255 |

| Princeton | $2,798 |

| Provencal | $3,262 |

| Quitman | $3,030 |

| Raceland | $5,053 |

| Ragley | $4,143 |

| Rayne | $3,979 |

| Rayville | $3,065 |

| Red Chute | $2,783 |

| Reddell | $3,759 |

| Reeves | $4,424 |

| Reserve | $4,663 |

| Rhinehart | $3,028 |

| Richmond | $2,988 |

| Richwood | $2,976 |

| Ringgold | $2,983 |

| River Ridge | $5,564 |

| Roanoke | $4,047 |

| Robeline | $3,252 |

| Robert | $4,391 |

| Rodessa | $2,892 |

| Rosedale | $4,025 |

| Roseland | $4,380 |

| Rosepine | $3,203 |

| Rougon | $3,927 |

| Ruby | $2,947 |

| Ruston | $2,867 |

| Saline | $2,927 |

| Sarepta | $2,999 |

| Schriever | $5,394 |

| Scott | $3,984 |

| Shenandoah | $3,806 |

| Shongaloo | $3,001 |

| Shreveport | $2,911 |

| Sibley | $2,985 |

| Sicily Island | $3,034 |

| Sieper | $2,886 |

| Sikes | $3,256 |

| Simmesport | $3,719 |

| Simpson | $3,208 |

| Simsboro | $2,895 |

| Singer | $4,103 |

| Slagle | $3,184 |

| Slaughter | $3,834 |

| Slidell | $4,460 |

| Sondheimer | $3,032 |

| Sorrel | $4,808 |

| Sorrento | $4,196 |

| South Vacherie | $4,353 |

| Spearsville | $2,892 |

| Spokane | $3,036 |

| Springfield | $4,507 |

| Springhill | $3,006 |

| St. Amant | $4,108 |

| St. Benedict | $3,937 |

| St. Bernard | $5,856 |

| St. Francisville | $3,670 |

| St. Gabriel | $4,122 |

| St. James | $4,527 |

| St. Joseph | $3,023 |

| St. Landry | $3,733 |

| St. Martinville | $4,081 |

| St. Maurice | $3,123 |

| St. Rose | $4,908 |

| Stanley | $3,256 |

| Starks | $4,361 |

| Start | $3,025 |

| Sterlington | $2,992 |

| Stonewall | $3,236 |

| Sugartown | $4,064 |

| Sulphur | $4,556 |

| Summerfield | $2,851 |

| Sun | $3,772 |

| Sunset | $3,913 |

| Sunshine | $4,135 |

| Supreme | $4,387 |

| Swartz | $2,959 |

| Talisheek | $3,892 |

| Tallulah | $2,995 |

| Tangipahoa | $4,321 |

| Taylor | $2,967 |

| Terrytown | $5,326 |

| Theriot | $6,209 |

| Thibodaux | $5,026 |

| Tickfaw | $4,387 |

| Timberlane | $5,322 |

| Tioga | $2,945 |

| Transylvania | $3,069 |

| Triumph | $7,004 |

| Trout | $3,105 |

| Tullos | $3,063 |

| Tunica | $3,653 |

| Turkey Creek | $3,748 |

| Uncle Sam | $4,371 |

| Union | $4,343 |

| Urania | $3,105 |

| Vacherie | $4,351 |

| Varnado | $4,182 |

| Venice | $7,020 |

| Ventress | $3,828 |

| Vidalia | $3,027 |

| Village St. George | $3,800 |

| Ville Platte | $3,756 |

| Vinton | $4,739 |

| Violet | $5,953 |

| Vivian | $2,885 |

| Waggaman | $5,296 |

| Wakefield | $3,653 |

| Walker | $4,315 |

| Washington | $3,755 |

| Waterproof | $3,023 |

| Watson | $4,283 |

| Welcome | $4,515 |

| Welsh | $4,077 |

| West Monroe | $2,962 |

| Westlake | $4,559 |

| Westminster | $3,794 |

| Westwego | $5,293 |

| Weyanoke | $3,653 |

| White Castle | $4,424 |

| Wildsville | $2,948 |

| Wilson | $3,814 |

| Winnfield | $3,255 |

| Winnsboro | $3,081 |

| Wisner | $3,093 |

| Woodmere | $5,321 |

| Woodworth | $2,921 |

| Youngsville | $4,032 |

| Zachary | $3,797 |

| Zwolle | $3,271 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

Flood insurance in Louisiana

Flood insurance isn’t legally required in Louisiana. However, if you financed your home and live in a Federal Emergency Management Agency or FEMA-designated high-risk flood zone, your lender will likely require you to carry it as part of your mortgage agreement.

Flood damage isn’t covered by any home insurance policy. You can buy it separately, though. The average cost of flood insurance in Louisiana is $814 a year. You can get a policy through insurance companies affiliated with the National Flood Insurance Program (NFIP), or some private insurers in Louisiana.

Methodology

The rates shown in this article are based on non-binding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in Louisiana. The following coverages and deductible were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

*USAA is only available to active-duty and veteran military members and their families.