Best Homeowners Insurance in Maine

Best cheap home insurance companies in Maine

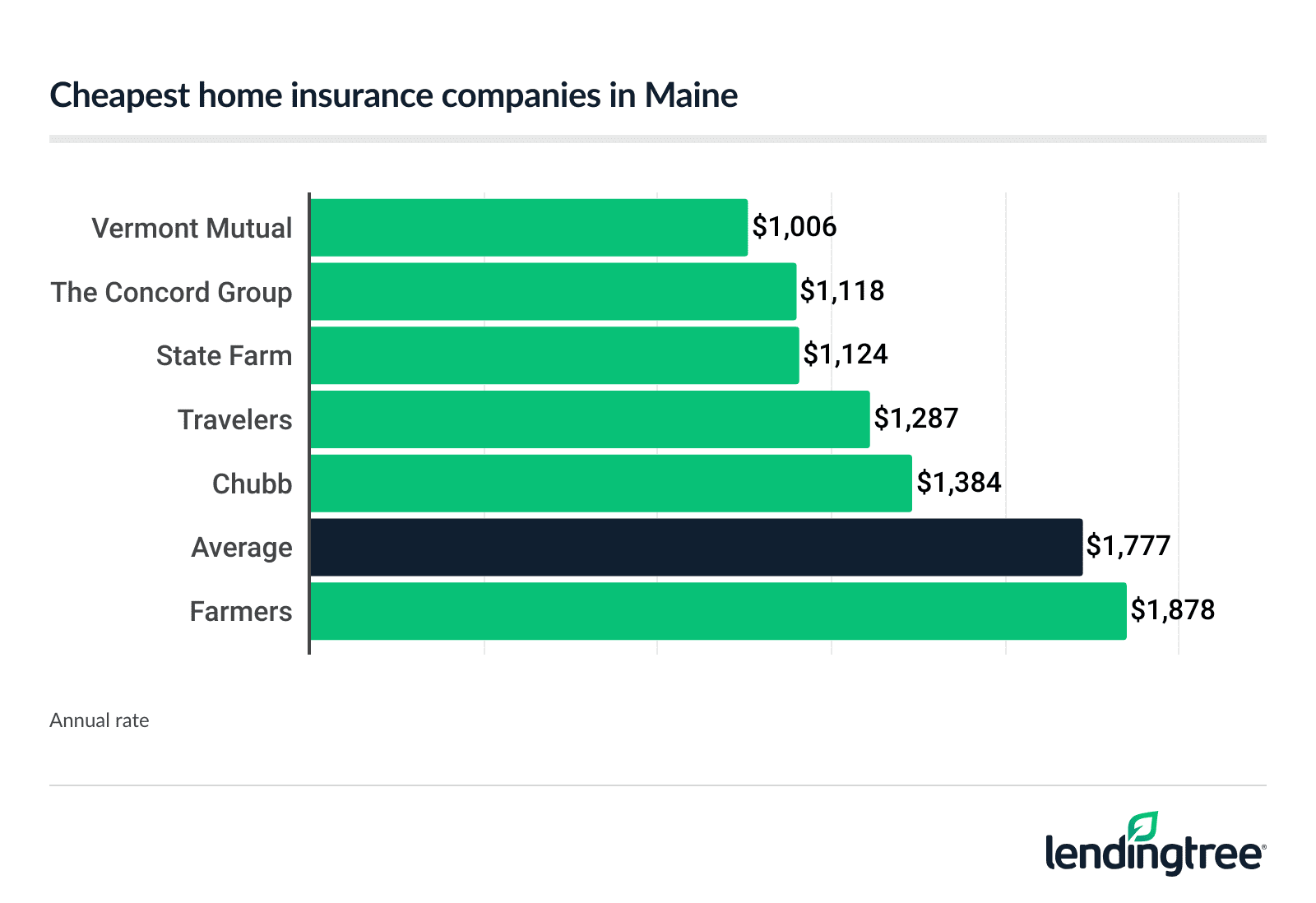

Cheapest home insurance companies in Maine

The Concord Group and State Farm are nearly as affordable as Vermont Mutual at around $93 a month each, so you should compare home insurance quotes from all three companies to get your best rate.

Although it’s not quite as cheap as Vermont Mutual, The Concord Group offers several discounts that could make it the cheapest for you.

Maine’s cheapest home insurance companies

| Company | Annual rate | Monthly rate | LendingTree score | |

|---|---|---|---|---|

| Vermont Mutual | $1,006 | $84 | |

| The Concord Group | $1,118 | $93 | |

| State Farm | $1,124 | $94 | |

| Travelers | $1,287 | $107 | |

| Chubb | $1,384 | $115 | |

| Farmers | $1,878 | $157 | |

| Allstate | $2,440 | $203 | |

| The Hanover | $2,821 | $235 | |

| Quincy Mutual | $2,933 | $244 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

Best homeowners insurance companies in Maine

It also has more coverage options — like coverage for equipment breakdown, service line damage or water backup — than many companies as well as a good complaint rating.

If you want the absolute lowest rate, though, make sure you also get a quote from Vermont Mutual. Do the same with Farmers if you want the most discounts or Allstate if add-on coverages are important to you.

| Company | Best for | Annual rate | Customer satisfaction* | Complaint index** |

|---|---|---|---|---|

| The Concord Group | Overall | $1,118 | Not rated | 0.25 |

| Vermont Mutual | Low rates | $1,006 | Not rated | 0.08 |

| Allstate | Coverage options | $2,440 | 631 | 1.3 |

| Chubb | Customer satisfaction | $1,384 | 688 | 0.11 |

| Farmers | Discounts | $1,878 | 609 | 0.85 |

*J.D. Power 2024 U.S. Home Insurance Study. Higher is better; 640 is average.

**Source: National Association of Insurance Commissioners (NAIC). Lower is better; 1.0 is average.

Best home insurance company overall: The Concord Group

Annual rate: $1,118

![]()

Pros

Second-cheapest average rate in the state

More discounts than most other companies

Many add-on coverage options

Low complaint rating points to happy customers

Cons

Can’t get online quotes from The Concord Group

No J.D. Power rating for customer satisfaction

The Concord Group is Maine’s best homeowners insurance company, with affordable rates ($93 a month) and a great complaint rating from the National Association of Insurance Commissioners (NAIC). It also offers many discount and coverage options to Maine homeowners.

Best for cheap rates: Vermont Mutual

Annual rate: $1,006

![]()

Pros

Maine’s lowest average home insurance rate

Great NAIC complaint rating

Cons

Not many add-on coverages or discounts

No online quotes

Website lacks helpful information

At $84 a month, or $1,006 a year, Vermont Mutual is Maine’s cheapest home insurance company. It also has the best complaint rating of the companies we surveyed in the state.

Best home insurance coverage options: Allstate

Annual rate: $2,440

Pros

More add-on coverages than any other company we surveyed

Also offers many discounts

Website lets you get online quotes, pay bills and file claims

Cons

Average rate is 37% higher than the state average

Customer satisfaction and complaint ratings are worse than average

Allstate is the best homeowners insurance company in Maine for coverage options. Some of the optional coverages you can add to an Allstate home insurance policy:

- Business property

- Green improvement reimbursement

- Identity theft restoration

- Sports equipment

- Water backup

Best for customer satisfaction: Chubb

Annual rate: $1,384

Pros

Best customer satisfaction score in the state (and U.S.)

Great complaint rating, too

Average home insurance rate is 22% less than the state average

Cons

Fewer add-on coverages and discounts than most other companies

No quotes through company website

If you value customer service and satisfaction, make sure you get a quote from Chubb before you buy or renew a home insurance policy. Chubb has the best J.D. Power customer satisfaction score of all home insurance companies — nationwide, not just in Maine.

Best discounts: Farmers

Annual rate: $1,878

Pros

Most discounts of surveyed companies

Complaint rating is better than average

Cons

Rates are 6% higher than state average

Customer satisfaction rating is worse than average

Fewer add-on coverages than most other companies

Farmers’ average home insurance rate is higher than the state average, but it offers many discounts that could make it a lot cheaper.

You may earn a home insurance discount from Farmers if you:

- Bundle home and auto insurance policies with Farmers

- Pay for your policy in full

- Pay your bill on time

- Don’t file any claims for three consecutive years

Annual rate: $2,440

![]()

Pros

More add-on coverages than any other company we surveyed

Also offers many discounts

Website lets you get online quotes, pay bills and file claims

Cons

Average rate is 37% higher than the state average

Customer satisfaction and complaint ratings are worse than average

Allstate is the best homeowners insurance company in Maine for coverage options. Some of the optional coverages you can add to an Allstate home insurance policy:

- Business property

- Green improvement reimbursement

- Identity theft restoration

- Sports equipment

- Water backup

Annual rate: $1,384

![]()

Pros

Best customer satisfaction score in the state (and U.S.)

Great complaint rating, too

Average home insurance rate is 22% less than the state average

Cons

Fewer add-on coverages and discounts than most other companies

No quotes through company website

If you value customer service and satisfaction, make sure you get a quote from Chubb before you buy or renew a home insurance policy. Chubb has the best J.D. Power customer satisfaction score of all home insurance companies — nationwide, not just in Maine.

Annual rate: $1,878

![]()

Pros

Most discounts of surveyed companies

Complaint rating is better than average

Cons

Rates are 6% higher than state average

Customer satisfaction rating is worse than average

Fewer add-on coverages than most other companies

Farmers’ average home insurance rate is higher than the state average, but it offers many discounts that could make it a lot cheaper.

You may earn a home insurance discount from Farmers if you:

- Bundle home and auto insurance policies with Farmers

- Pay for your policy in full

- Pay your bill on time

- Don’t file any claims for three consecutive years

How much is home insurance in Maine?

This average rate is based on a policy with $400,000 of dwelling coverage Dwelling coverage pays to repair or rebuild your home’s structure after destruction from fire, hail or other dangers (called “perils” in your policy). . The average home insurance rate in Maine for a policy with a $350,000 dwelling limit is $131 a month. That’s 11% less than for a policy with a $400,000 limit. Policies with a $450,000 limit are 11% more.

Average home insurance rate by dwelling limit

| Dwelling limit | Annual rate | Monthly rate |

|---|---|---|

| $350,000 | $1,578 | $131 |

| $400,000 | $1,777 | $148 |

| $450,000 | $1,980 | $165 |

Maine homeowners insurance rates by city

The most expensive home insurance rates among Maine’s cities and towns are found in Canaan and North Waterford. Homeowners in each of these cities pay about $179 a month for insurance.

Home insurance rates near you

| City | Annual rate Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. | Monthly rate Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. |

|---|---|---|

| Abbot | $2,030 | $169 |

| Acton | $1,835 | $153 |

| Addison | $2,000 | $167 |

| Albion | $1,908 | $159 |

| Alfred | $1,844 | $154 |

| Alna | $1,808 | $151 |

| Andover | $1,971 | $164 |

| Anson | $2,034 | $170 |

| Ashland | $1,811 | $151 |

| Athens | $2,036 | $170 |

| Auburn | $1,737 | $145 |

| Augusta | $1,783 | $149 |

| Aurora | $1,734 | $144 |

| Bailey Island | $2,059 | $172 |

| Bangor | $1,821 | $152 |

| Bar Harbor | $1,770 | $147 |

| Bar Mills | $1,862 | $155 |

| Bass Harbor | $1,789 | $149 |

| Bath | $1,859 | $155 |

| Beals | $2,006 | $167 |

| Belfast | $1,868 | $156 |

| Belgrade | $1,933 | $161 |

| Belgrade Lakes | $1,840 | $153 |

| Benedicta | $1,839 | $153 |

| Bernard | $1,788 | $149 |

| Berwick | $1,920 | $160 |

| Bethel | $2,045 | $170 |

| Biddeford | $1,845 | $154 |

| Biddeford Pool | $1,870 | $156 |

| Bingham | $1,997 | $166 |

| Birch Harbor | $1,789 | $149 |

| Blaine | $1,805 | $150 |

| Blue Hill | $1,715 | $143 |

| Boothbay | $1,849 | $154 |

| Boothbay Harbor | $1,839 | $153 |

| Bowdoin | $1,930 | $161 |

| Bowdoinham | $1,861 | $155 |

| Bradford | $1,891 | $158 |

| Bradley | $1,792 | $149 |

| Bremen | $1,868 | $156 |

| Brewer | $1,777 | $148 |

| Bridgewater | $1,853 | $154 |

| Bridgton | $1,919 | $160 |

| Bristol | $1,838 | $153 |

| Brooklin | $1,779 | $148 |

| Brooks | $1,882 | $157 |

| Brooksville | $1,788 | $149 |

| Brookton | $2,007 | $167 |

| Brownfield | $1,991 | $166 |

| Brownville | $2,017 | $168 |

| Brownville Junction | $2,090 | $174 |

| Brunswick | $1,975 | $165 |

| Brunswick Station | $1,976 | $165 |

| Bryant Pond | $2,030 | $169 |

| Buckfield | $2,043 | $170 |

| Bucksport | $1,888 | $157 |

| Burlington | $1,685 | $140 |

| Burnham | $1,888 | $157 |

| Bustins Island | $1,990 | $166 |

| Buxton | $1,914 | $159 |

| Calais | $1,980 | $165 |

| Cambridge | $2,107 | $176 |

| Camden | $1,803 | $150 |

| Canaan | $2,152 | $179 |

| Canton | $2,021 | $168 |

| Cape Elizabeth | $1,834 | $153 |

| Cape Neddick | $1,907 | $159 |

| Cape Porpoise | $1,946 | $162 |

| Caratunk | $2,034 | $170 |

| Caribou | $1,788 | $149 |

| Carmel | $1,815 | $151 |

| Casco | $1,897 | $158 |

| Castine | $1,776 | $148 |

| Center Lovell | $1,873 | $156 |

| Chamberlain | $1,909 | $159 |

| Charleston | $1,722 | $143 |

| Chebeague Island | $1,999 | $167 |

| Cherryfield | $1,901 | $158 |

| China Village | $2,036 | $170 |

| Chisholm | $2,049 | $171 |

| Clayton Lake | $1,829 | $152 |

| Cliff Island | $2,079 | $173 |

| Clinton | $1,944 | $162 |

| Columbia Falls | $1,906 | $159 |

| Coopers Mills | $1,751 | $146 |

| Corea | $1,833 | $153 |

| Corinna | $1,873 | $156 |

| Corinth | $1,918 | $160 |

| Cornish | $1,940 | $162 |

| Cousins Island | $2,010 | $167 |

| Cranberry Isles | $1,823 | $152 |

| Crouseville | $1,929 | $161 |

| Cumberland Center | $1,989 | $166 |

| Cumberland Foreside | $1,983 | $165 |

| Cushing | $1,846 | $154 |

| Cutler | $1,927 | $161 |

| Damariscotta | $1,865 | $155 |

| Danforth | $1,974 | $165 |

| Danville | $1,865 | $155 |

| Deer Isle | $1,858 | $155 |

| Denmark | $2,023 | $169 |

| Dennysville | $1,914 | $160 |

| Detroit | $2,132 | $178 |

| Dexter | $1,900 | $158 |

| Dixfield | $2,017 | $168 |

| Dixmont | $1,865 | $155 |

| Dover-Foxcroft | $1,943 | $162 |

| Dresden | $1,836 | $153 |

| Dryden | $1,956 | $163 |

| Durham | $1,794 | $149 |

| Eagle Lake | $1,825 | $152 |

| East Andover | $1,966 | $164 |

| East Baldwin | $1,910 | $159 |

| East Blue Hill | $1,771 | $148 |

| East Boothbay | $1,939 | $162 |

| East Dixfield | $2,107 | $176 |

| East Livermore | $1,840 | $153 |

| East Machias | $1,751 | $146 |

| East Millinocket | $1,781 | $148 |

| East Newport | $1,923 | $160 |

| East Orland | $1,778 | $148 |

| East Parsonsfield | $2,012 | $168 |

| East Poland | $1,866 | $156 |

| East Vassalboro | $1,955 | $163 |

| East Waterboro | $1,855 | $155 |

| East Wilton | $2,108 | $176 |

| East Winthrop | $1,878 | $156 |

| Easton | $1,849 | $154 |

| Eastport | $1,825 | $152 |

| Eddington | $1,809 | $151 |

| Edgecomb | $1,906 | $159 |

| Eliot | $1,887 | $157 |

| Ellsworth | $1,733 | $144 |

| Estcourt Station | $1,788 | $149 |

| Etna | $1,919 | $160 |

| Eustis | $1,972 | $164 |

| Exeter | $1,926 | $160 |

| Fairfield | $2,056 | $171 |

| Falmouth | $1,831 | $153 |

| Falmouth Foreside | $1,827 | $152 |

| Farmingdale | $1,744 | $145 |

| Farmington | $2,061 | $172 |

| Farmington Falls | $2,135 | $178 |

| Fort Fairfield | $1,829 | $152 |

| Fort Kent | $1,801 | $150 |

| Fort Kent Mills | $1,949 | $162 |

| Frankfort | $1,858 | $155 |

| Franklin | $1,754 | $146 |

| Freedom | $1,884 | $157 |

| Freeport | $2,000 | $167 |

| Frenchboro | $1,798 | $150 |

| Frenchville | $1,778 | $148 |

| Friendship | $1,848 | $154 |

| Fryeburg | $1,993 | $166 |

| Gardiner | $1,759 | $147 |

| Garland | $1,796 | $150 |

| Georgetown | $1,930 | $161 |

| Gorham | $1,742 | $145 |

| Gouldsboro | $1,786 | $149 |

| Grand Isle | $1,786 | $149 |

| Grand Lake Stream | $1,865 | $155 |

| Gray | $1,869 | $156 |

| Greenbush | $1,736 | $145 |

| Greene | $1,890 | $158 |

| Greenville | $1,924 | $160 |

| Greenville Junction | $2,038 | $170 |

| Greenwood | $1,963 | $164 |

| Guilford | $1,949 | $162 |

| Hallowell | $1,743 | $145 |

| Hampden | $1,867 | $156 |

| Hancock | $1,824 | $152 |

| Hanover | $1,990 | $166 |

| Harborside | $1,789 | $149 |

| Harmony | $1,984 | $165 |

| Harpswell | $1,964 | $164 |

| Harrington | $1,803 | $150 |

| Harrison | $1,923 | $160 |

| Hartland | $2,038 | $170 |

| Hebron | $1,999 | $167 |

| Hinckley | $2,118 | $177 |

| Hiram | $2,066 | $172 |

| Holden | $1,930 | $161 |

| Hollis Center | $1,871 | $156 |

| Hope | $1,815 | $151 |

| Houlton | $1,787 | $149 |

| Howland | $1,803 | $150 |

| Hudson | $1,897 | $158 |

| Hulls Cove | $1,853 | $154 |

| Island Falls | $1,793 | $149 |

| Isle Au Haut | $1,768 | $147 |

| Isle of Springs | $1,888 | $157 |

| Islesboro | $1,812 | $151 |

| Islesford | $1,774 | $148 |

| Jackman | $1,972 | $164 |

| Jay | $2,048 | $171 |

| Jefferson | $1,814 | $151 |

| Jonesboro | $1,906 | $159 |

| Jonesport | $1,904 | $159 |

| Kenduskeag | $1,875 | $156 |

| Kennebunk | $1,878 | $156 |

| Kennebunkport | $1,898 | $158 |

| Kents Hill | $1,827 | $152 |

| Kingfield | $2,031 | $169 |

| Kingman | $1,817 | $151 |

| Kittery | $1,896 | $158 |

| Kittery Point | $1,938 | $162 |

| Lagrange | $1,792 | $149 |

| Lake Arrowhead | $1,925 | $160 |

| Lambert Lake | $2,013 | $168 |

| Lebanon | $1,920 | $160 |

| Lee | $1,795 | $150 |

| Leeds | $1,854 | $155 |

| Levant | $1,875 | $156 |

| Lewiston | $1,774 | $148 |

| Liberty | $1,786 | $149 |

| Limerick | $1,947 | $162 |

| Limestone | $1,828 | $152 |

| Limington | $1,912 | $159 |

| Lincoln | $1,802 | $150 |

| Lincolnville | $1,962 | $164 |

| Lincolnville Center | $1,940 | $162 |

| Lisbon | $1,811 | $151 |

| Lisbon Falls | $1,802 | $150 |

| Litchfield | $1,817 | $151 |

| Little Deer Isle | $1,815 | $151 |

| Little Falls | $1,746 | $146 |

| Livermore | $1,870 | $156 |

| Livermore Falls | $1,893 | $158 |

| Long Island | $2,004 | $167 |

| Lovell | $2,019 | $168 |

| Lubec | $1,795 | $150 |

| Machias | $1,786 | $149 |

| Machiasport | $1,829 | $152 |

| Madawaska | $1,766 | $147 |

| Madison | $2,019 | $168 |

| Manchester | $1,833 | $153 |

| Mapleton | $1,810 | $151 |

| Mars Hill | $1,824 | $152 |

| Matinicus | $1,776 | $148 |

| Mattawamkeag | $1,822 | $152 |

| Mechanic Falls | $1,834 | $153 |

| Meddybemps | $1,725 | $144 |

| Medway | $1,876 | $156 |

| Mexico | $1,974 | $164 |

| Milbridge | $1,879 | $157 |

| Milford | $1,788 | $149 |

| Millinocket | $1,813 | $151 |

| Milo | $1,929 | $161 |

| Minot | $1,794 | $150 |

| Monhegan | $1,804 | $150 |

| Monmouth | $1,900 | $158 |

| Monroe | $1,859 | $155 |

| Monson | $1,911 | $159 |

| Monticello | $1,836 | $153 |

| Moody | $1,995 | $166 |

| Morrill | $1,842 | $154 |

| Mount Desert | $1,814 | $151 |

| Mount Vernon | $1,894 | $158 |

| Naples | $1,900 | $158 |

| New Gloucester | $1,910 | $159 |

| New Harbor | $1,919 | $160 |

| New Limerick | $1,804 | $150 |

| New Portland | $2,079 | $173 |

| New Sharon | $2,078 | $173 |

| New Sweden | $1,819 | $152 |

| New Vineyard | $2,063 | $172 |

| Newcastle | $1,807 | $151 |

| Newport | $1,854 | $155 |

| Newry | $1,910 | $159 |

| Nobleboro | $1,867 | $156 |

| Norridgewock | $2,050 | $171 |

| North Anson | $2,064 | $172 |

| North Berwick | $1,842 | $154 |

| North Bridgton | $1,907 | $159 |

| North Haven | $1,754 | $146 |

| North Jay | $2,104 | $175 |

| North Monmouth | $1,814 | $151 |

| North Turner | $1,843 | $154 |

| North Vassalboro | $1,935 | $161 |

| North Waterboro | $1,911 | $159 |

| North Waterford | $2,153 | $179 |

| North Windham | $1,843 | $154 |

| North Yarmouth | $1,919 | $160 |

| Northeast Harbor | $1,802 | $150 |

| Norway | $1,951 | $163 |

| Oakfield | $1,791 | $149 |

| Oakland | $1,888 | $157 |

| Ocean Park | $2,014 | $168 |

| Ogunquit | $1,887 | $157 |

| Old Orchard Beach | $2,012 | $168 |

| Old Town | $1,821 | $152 |

| Oquossoc | $1,983 | $165 |

| Orient | $1,862 | $155 |

| Orland | $1,806 | $150 |

| Orono | $1,818 | $152 |

| Orrington | $1,848 | $154 |

| Orrs Island | $2,097 | $175 |

| Owls Head | $1,813 | $151 |

| Oxbow | $1,785 | $149 |

| Oxford | $1,953 | $163 |

| Palermo | $1,815 | $151 |

| Palmyra | $2,008 | $167 |

| Parsonsfield | $1,972 | $164 |

| Passadumkeag | $1,740 | $145 |

| Patten | $1,864 | $155 |

| Peaks Island | $2,054 | $171 |

| Pemaquid | $1,893 | $158 |

| Pembroke | $2,039 | $170 |

| Penobscot | $1,827 | $152 |

| Perham | $1,784 | $149 |

| Perry | $2,048 | $171 |

| Peru | $2,026 | $169 |

| Phillips | $1,992 | $166 |

| Phippsburg | $1,932 | $161 |

| Pittsfield | $2,064 | $172 |

| Plymouth | $1,824 | $152 |

| Poland | $1,819 | $152 |

| Port Clyde | $1,860 | $155 |

| Portage | $1,779 | $148 |

| Porter | $2,067 | $172 |

| Portland | $1,817 | $151 |

| Pownal | $1,886 | $157 |

| Presque Isle | $1,759 | $147 |

| Princeton | $2,069 | $172 |

| Prospect Harbor | $1,800 | $150 |

| Randolph | $1,772 | $148 |

| Rangeley | $2,027 | $169 |

| Raymond | $1,850 | $154 |

| Readfield | $1,896 | $158 |

| Richmond | $1,805 | $150 |

| Robbinston | $2,002 | $167 |

| Rockland | $1,815 | $151 |

| Rockport | $1,860 | $155 |

| Rockwood | $2,054 | $171 |

| Round Pond | $1,943 | $162 |

| Roxbury | $2,026 | $169 |

| Rumford | $1,934 | $161 |

| Sabattus | $1,901 | $158 |

| Saco | $1,953 | $163 |

| Salsbury Cove | $1,776 | $148 |

| Sandy Point | $1,956 | $163 |

| Sanford | $1,839 | $153 |

| Sangerville | $1,917 | $160 |

| Sargentville | $1,746 | $146 |

| Scarborough | $1,898 | $158 |

| Seal Cove | $1,821 | $152 |

| Seal Harbor | $1,793 | $149 |

| Searsmont | $1,767 | $147 |

| Searsport | $1,868 | $156 |

| Sebago | $1,948 | $162 |

| Sebasco Estates | $1,920 | $160 |

| Sebec | $1,911 | $159 |

| Sedgwick | $1,756 | $146 |

| Shapleigh | $1,789 | $149 |

| Shawmut | $2,018 | $168 |

| Sheridan | $1,840 | $153 |

| Sherman | $1,819 | $152 |

| Shirley Mills | $1,987 | $166 |

| Sinclair | $1,837 | $153 |

| Skowhegan | $2,030 | $169 |

| Smithfield | $1,995 | $166 |

| Smyrna Mills | $1,844 | $154 |

| Solon | $2,041 | $170 |

| Sorrento | $1,771 | $148 |

| South Berwick | $1,854 | $154 |

| South Bristol | $1,873 | $156 |

| South Casco | $1,999 | $167 |

| South China | $1,967 | $164 |

| South Eliot | $1,885 | $157 |

| South Freeport | $1,982 | $165 |

| South Gardiner | $2,034 | $170 |

| South Paris | $1,952 | $163 |

| South Portland | $1,762 | $147 |

| South Sanford | $1,844 | $154 |

| South Thomaston | $1,875 | $156 |

| South Windham | $1,939 | $162 |

| Southport | $1,996 | $166 |

| Southwest Harbor | $1,798 | $150 |

| Springfield | $1,879 | $157 |

| Springvale | $1,861 | $155 |

| Spruce Head | $1,913 | $159 |

| Squirrel Island | $1,868 | $156 |

| St. Agatha | $1,804 | $150 |

| St. Albans | $2,018 | $168 |

| St. David | $1,771 | $148 |

| St. Francis | $1,778 | $148 |

| Stacyville | $1,868 | $156 |

| Standish | $1,729 | $144 |

| Steep Falls | $1,860 | $155 |

| Stetson | $1,957 | $163 |

| Steuben | $2,038 | $170 |

| Stillwater | $1,993 | $166 |

| Stockholm | $1,794 | $150 |

| Stockton Springs | $1,878 | $156 |

| Stoneham | $1,983 | $165 |

| Stonington | $1,852 | $154 |

| Stratton | $1,898 | $158 |

| Strong | $1,996 | $166 |

| Sullivan | $1,815 | $151 |

| Sumner | $2,010 | $167 |

| Sunset | $1,774 | $148 |

| Surry | $1,817 | $151 |

| Swans Island | $1,798 | $150 |

| Temple | $2,014 | $168 |

| Tenants Harbor | $1,880 | $157 |

| Thomaston | $1,833 | $153 |

| Thorndike | $1,890 | $157 |

| Topsfield | $2,015 | $168 |

| Topsham | $1,928 | $161 |

| Trevett | $1,864 | $155 |

| Troy | $1,896 | $158 |

| Turner | $1,872 | $156 |

| Union | $1,773 | $148 |

| Unity | $1,909 | $159 |

| Van Buren | $1,788 | $149 |

| Vanceboro | $1,982 | $165 |

| Vassalboro | $1,900 | $158 |

| Vienna | $1,940 | $162 |

| Vinalhaven | $1,823 | $152 |

| Waite | $1,987 | $166 |

| Waldoboro | $1,781 | $148 |

| Wallagrass | $1,869 | $156 |

| Walpole | $1,956 | $163 |

| Warren | $1,796 | $150 |

| Washburn | $1,780 | $148 |

| Washington | $1,784 | $149 |

| Waterboro | $1,840 | $153 |

| Waterford | $2,035 | $170 |

| Waterville | $1,763 | $147 |

| Wayne | $1,859 | $155 |

| Weld | $2,009 | $167 |

| Wells | $1,913 | $159 |

| Wesley | $2,042 | $170 |

| West Baldwin | $1,990 | $166 |

| West Bethel | $2,098 | $175 |

| West Boothbay Harbor | $2,047 | $171 |

| West Enfield | $1,815 | $151 |

| West Farmington | $2,053 | $171 |

| West Forks | $2,048 | $171 |

| West Kennebunk | $1,897 | $158 |

| West Minot | $1,941 | $162 |

| West Newfield | $1,858 | $155 |

| West Paris | $2,015 | $168 |

| West Poland | $1,945 | $162 |

| West Rockport | $1,926 | $160 |

| Westbrook | $1,727 | $144 |

| Westfield | $1,776 | $148 |

| Whitefield | $1,829 | $152 |

| Whiting | $2,014 | $168 |

| Wilton | $2,032 | $169 |

| Windham | $1,838 | $153 |

| Windsor | $1,870 | $156 |

| Winn | $1,765 | $147 |

| Winslow | $1,785 | $149 |

| Winter Harbor | $1,781 | $148 |

| Winterport | $1,885 | $157 |

| Winthrop | $1,878 | $157 |

| Wiscasset | $1,740 | $145 |

| Woodland Washington County | $2,031 | $169 |

| Woolwich | $1,856 | $155 |

| Wytopitlock | $1,839 | $153 |

| Yarmouth | $1,949 | $162 |

| York | $1,880 | $157 |

| York Beach | $1,985 | $165 |

| York Harbor | $1,877 | $156 |

Frequently asked questions

Vermont Mutual, The Concord Group and State Farm have the cheapest home insurance in Maine. All three companies offer average rates that are well below the state average of $148 a month. Vermont Mutual has the cheapest rates overall at around $84 a month.

The average cost of homeowners insurance in Maine is $148 a month, or $1,777 a year.

What you pay for home insurance depends on several factors, such as:

- Where you live in the state

- Your home’s age

- How much coverage you buy

- Your deductible

- Your credit, insurance and claims history