Best Homeowners Insurance in Minnesota

North Star Mutual has Minnesota’s best home insurance rates at $167 a month.

Top Minnesota home insurance companies

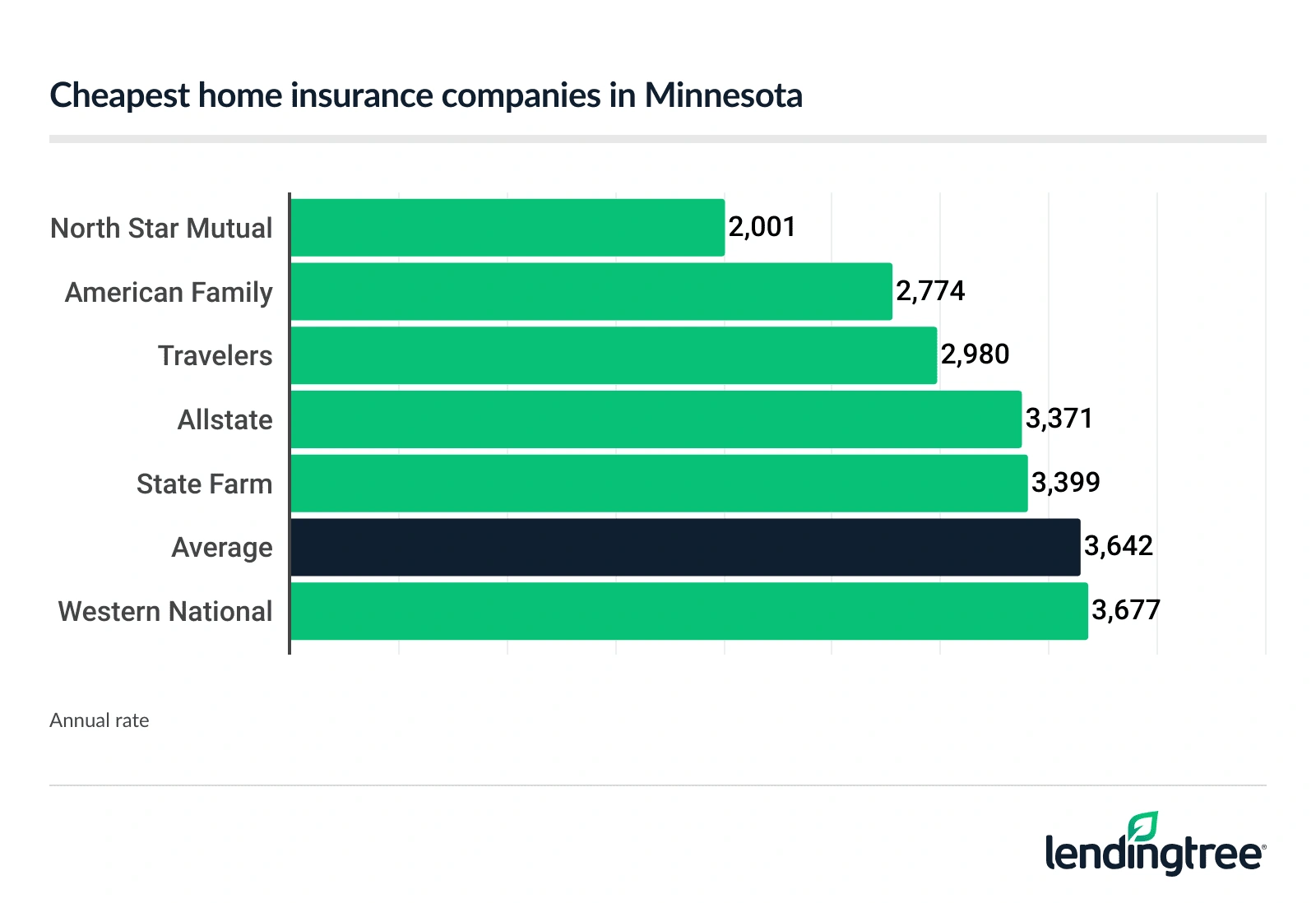

Cheapest homeowners insurance in Minnesota: North Star Mutual

With an average rate of $2,001 a year for $400,000 in dwelling coverage, North Star Mutual has Minnesota’s cheapest homeowners insurance. This works out to $167 a month and is 28% less than the next-cheapest rate of $231 a month from American Family.

MN homeowners insurance rates

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| North Star Mutual | $2,001 |  |

| American Family | $2,774 |  |

| Travelers | $2,980 |  |

| Allstate | $3,371 |  |

| State Farm | $3,399 |  |

| Western National | Western National | $3,677 |  |

| Farmers | $4,149 |  |

| Country Financial | $4,433 |  |

| AAA | $5,998 |  |

Best homeowners insurance companies in Minnesota

North Star Mutual’s price and coverage options help make it Minnesota’s best homeowners insurance company.

American Family has the best customer service ratings. These include satisfaction scores

State Farm stands out as the state’s best large home insurance company. It has a satisfaction score that’s better than average, plus a convenient website and smartphone app.

Best MN insurance companies at a glance

| Company | Annual rate | Customer satisfaction

Source: J.D. Power 2024 U.S. Home Insurance Study. Higher is better; 640 is average.

| Complaint rating

Source: National Association of Insurance Commissioners (NAIC). Lower is better; 1.0 is average.

| LendingTree score |

|---|---|---|---|---|

| Best overall: North Star Mutual | $2,001 | Not rated | 0.8 (Good) |  |

| Best customer service: American Family | $2,774 | 638 (Average) | 0.49 (Excellent) |  |

| Best large company: State Farm | $3,399 | 643 (Above average) | 1.05 (Average) |  |

Best overall home insurance company: North Star Mutual

North Star Mutual’s good complaint rating shows that it gets fewer complaints than average. However, it doesn’t offer online quotes or claims.

- Cheapest average home insurance rate in Minnesota

- Upgrades can boost your protection

- Discounts for new homes and mature homeowners

- Offers watercraft and RV liability.

- No online quotes and claims

Best customer service: American Family

American Family also has coverages for home-based businesses and short-term rentals. These add-ons can protect you from risks that standard home insurance usually doesn’t cover.

- Excellent complaint rating

- Useful add-ons for extra protection

- Coverage available for short-term rentals

- Average satisfaction rating from J.D. Power

Best large company: State Farm

State Farm offers online quotes and claims on its user-friendly website. Its highly-rated smartphone app offers even more convenience.

- Customer satisfaction rating beats the industry average

- Rates are cheaper than state average

- Convenient website and smartphone app

- Complaint rating is just average

How much is homeowners insurance in Minnesota?

Homeowners insurance costs an average of $3,642 a year in Minnesota, or $304 a month.

Your actual rate depends on factors like:

- Your home’s size and construction features

- The amount of coverage you need

- Your location and credit

- The discounts you qualify to receive

Each insurance company weighs these factors differently and offers different discounts. This is why it’s good to compare home insurance quotes from a few different companies when you buy or renew your policy.

Home insurance rates by coverage amounts

Your policy’s dwelling limit has a large impact on your insurance rate. For example, a policy with a $450,000 dwelling limit costs 27% more than one with a $350,000 limit. The difference works out to $858 a year, or $72 a month.

If you have a mortgage, your dwelling limit has to match your home’s replacement value limit. A home’s replacement value is the estimated cost of rebuilding it from the ground up. This is usually lower than its market value. You can choose a lower amount if you have a low loan balance or no mortgage. However, reducing your coverage may also leave you short on insurance funds if you need to rebuild after a major disaster.

Insurance rates by dwelling limit

| Dwelling limit | Annual rate |

|---|---|

| $350,000 | $3,217 |

| $400,000 | $3,642 |

| $450,000 | $4,075 |

Minnesota home insurance rates by city

Rochester has the cheapest homeowners insurance among Minnesota’s largest cities. Its rates average $3,301 a year. Homeowners in St. Cloud have the next-cheapest rate at $3,506 a year.

Minneapolis has the state’s highest home insurance rates at $4,039 a year, or $337 a month. This is 11% higher than the state average. St. Paul homeowners have the next-highest rate at $326 a year.

Homeowners insurance rates near you

| City | Annual rate

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

| Difference from state average |

|---|---|---|

| Ada | $3,578 | -2% |

| Adams | $3,514 | -4% |

| Adolph | $3,496 | -4% |

| Adrian | $3,646 | 0% |

| Afton | $3,963 | 9% |

| Ah Gwah Ching | $3,575 | -2% |

| Aitkin | $3,573 | -2% |

| Akeley | $3,513 | -4% |

| Albany | $3,358 | -8% |

| Albert Lea | $3,829 | 5% |

| Alberta | $3,745 | 3% |

| Albertville | $3,746 | 3% |

| Alborn | $3,586 | -2% |

| Alden | $3,849 | 6% |

| Aldrich | $3,566 | -2% |

| Alexandria | $3,612 | -1% |

| Almelund | $3,883 | 7% |

| Alpha | $3,691 | 1% |

| Altura | $3,507 | -4% |

| Alvarado | $3,688 | 1% |

| Amboy | $3,567 | -2% |

| Andover | $3,874 | 6% |

| Angle Inlet | $3,602 | -1% |

| Angora | $3,567 | -2% |

| Annandale | $3,674 | 1% |

| Anoka | $3,832 | 5% |

| Apple Valley | $3,707 | 2% |

| Appleton | $3,635 | 0% |

| Arco | $3,749 | 3% |

| Arden Hills | $3,893 | 7% |

| Argyle | $3,631 | 0% |

| Arlington | $3,824 | 5% |

| Arnold | $3,490 | -4% |

| Ashby | $3,628 | 0% |

| Askov | $3,483 | -4% |

| Atwater | $3,645 | 0% |

| Audubon | $3,656 | 0% |

| Aurora | $3,540 | -3% |

| Austin | $3,553 | -2% |

| Avoca | $3,763 | 3% |

| Avon | $3,356 | -8% |

| Babbitt | $3,399 | -7% |

| Backus | $3,590 | -1% |

| Badger | $3,631 | 0% |

| Bagley | $3,631 | 0% |

| Balaton | $3,693 | 1% |

| Barnesville | $3,552 | -2% |

| Barnum | $3,557 | -2% |

| Barrett | $3,610 | -1% |

| Barry | $3,732 | 2% |

| Battle Lake | $3,449 | -5% |

| Baudette | $3,575 | -2% |

| Baxter | $3,409 | -6% |

| Bayport | $3,845 | 6% |

| Beardsley | $3,644 | 0% |

| Beaver Creek | $3,607 | -1% |

| Becker | $3,885 | 7% |

| Bejou | $3,509 | -4% |

| Belgrade | $3,413 | -6% |

| Belle Plaine | $3,675 | 1% |

| Bellingham | $3,537 | -3% |

| Beltrami | $3,675 | 1% |

| Belview | $3,659 | 0% |

| Bemidji | $3,484 | -4% |

| Bena | $3,563 | -2% |

| Benedict | $3,561 | -2% |

| Benson | $3,535 | -3% |

| Bertha | $3,510 | -4% |

| Bethel | $3,903 | 7% |

| Big Falls | $3,653 | 0% |

| Big Lake | $3,783 | 4% |

| Bigelow | $3,711 | 2% |

| Bigfork | $3,613 | -1% |

| Bingham Lake | $3,733 | 2% |

| Birchdale | $3,637 | 0% |

| Birchwood Village | $3,966 | 9% |

| Bird Island | $3,751 | 3% |

| Biwabik | $3,479 | -4% |

| Blackduck | $3,543 | -3% |

| Blaine | $3,820 | 5% |

| Blomkest | $3,662 | 1% |

| Blooming Prairie | $3,784 | 4% |

| Bloomington | $3,794 | 4% |

| Blue Earth | $3,544 | -3% |

| Bluffton | $3,549 | -3% |

| Bock | $3,841 | 5% |

| Borup | $3,680 | 1% |

| Bovey | $3,545 | -3% |

| Bowlus | $3,466 | -5% |

| Bowstring | $3,577 | -2% |

| Boyd | $3,564 | -2% |

| Braham | $3,728 | 2% |

| Brainerd | $3,430 | -6% |

| Brandon | $3,539 | -3% |

| Breckenridge | $3,518 | -3% |

| Breezy Point | $3,438 | -6% |

| Brewster | $3,645 | 0% |

| Bricelyn | $3,555 | -2% |

| Brimson | $3,565 | -2% |

| Britt | $3,573 | -2% |

| Brook Park | $3,767 | 3% |

| Brooklyn Center | $3,776 | 4% |

| Brooklyn Park | $3,805 | 4% |

| Brooks | $3,691 | 1% |

| Brookston | $3,594 | -1% |

| Brooten | $3,417 | -6% |

| Browerville | $3,470 | -5% |

| Browns Valley | $3,701 | 2% |

| Brownsdale | $3,477 | -5% |

| Brownsville | $3,457 | -5% |

| Brownton | $3,536 | -3% |

| Bruno | $3,494 | -4% |

| Buffalo | $3,755 | 3% |

| Buffalo Lake | $3,828 | 5% |

| Buhl | $3,553 | -2% |

| Burnsville | $3,766 | 3% |

| Burtrum | $3,523 | -3% |

| Butterfield | $3,582 | -2% |

| Byron | $3,372 | -7% |

| Caledonia | $3,465 | -5% |

| Callaway | $3,630 | 0% |

| Calumet | $3,611 | -1% |

| Cambridge | $3,630 | 0% |

| Campbell | $3,618 | -1% |

| Canby | $3,687 | 1% |

| Cannon Falls | $3,634 | 0% |

| Canton | $3,451 | -5% |

| Canyon | $3,508 | -4% |

| Carlos | $3,539 | -3% |

| Carlton | $3,488 | -4% |

| Carver | $3,729 | 2% |

| Cass Lake | $3,510 | -4% |

| Cedar | $3,864 | 6% |

| Center City | $3,795 | 4% |

| Centerville | $3,900 | 7% |

| Ceylon | $3,498 | -4% |

| Champlin | $3,760 | 3% |

| Chandler | $3,773 | 4% |

| Chanhassen | $3,705 | 2% |

| Chaska | $3,705 | 2% |

| Chatfield | $3,379 | -7% |

| Chisago City | $3,829 | 5% |

| Chisholm | $3,587 | -2% |

| Chokio | $3,630 | 0% |

| Circle Pines | $3,793 | 4% |

| Clara City | $3,701 | 2% |

| Claremont | $3,449 | -5% |

| Clarissa | $3,452 | -5% |

| Clarkfield | $3,751 | 3% |

| Clarks Grove | $3,704 | 2% |

| Clear Lake | $3,848 | 6% |

| Clearbrook | $3,631 | 0% |

| Clearwater | $3,598 | -1% |

| Clements | $3,647 | 0% |

| Cleveland | $3,319 | -9% |

| Climax | $3,676 | 1% |

| Clinton | $3,634 | 0% |

| Clitherall | $3,499 | -4% |

| Clontarf | $3,673 | 1% |

| Cloquet | $3,663 | 1% |

| Cohasset | $3,548 | -3% |

| Cokato | $3,747 | 3% |

| Cold Spring | $3,386 | -7% |

| Coleraine | $3,547 | -3% |

| Cologne | $3,831 | 5% |

| Columbia Heights | $3,862 | 6% |

| Columbus | $3,905 | 7% |

| Comfrey | $3,658 | 0% |

| Comstock | $3,556 | -2% |

| Conger | $3,744 | 3% |

| Cook | $3,554 | -2% |

| Coon Rapids | $3,827 | 5% |

| Corcoran | $3,739 | 3% |

| Correll | $3,754 | 3% |

| Cosmos | $3,656 | 0% |

| Cottage Grove | $3,890 | 7% |

| Cotton | $3,565 | -2% |

| Cottonwood | $3,663 | 1% |

| Courtland | $3,641 | 0% |

| Crane Lake | $3,589 | -1% |

| Cromwell | $3,688 | 1% |

| Crookston | $3,618 | -1% |

| Crosby | $3,421 | -6% |

| Crosslake | $3,461 | -5% |

| Crystal | $3,818 | 5% |

| Crystal Bay | $3,821 | 5% |

| Currie | $3,734 | 3% |

| Cushing | $3,521 | -3% |

| Cyrus | $3,655 | 0% |

| Dakota | $3,458 | -5% |

| Dalbo | $3,700 | 2% |

| Dalton | $3,374 | -7% |

| Danube | $3,695 | 1% |

| Danvers | $3,577 | -2% |

| Darfur | $3,562 | -2% |

| Darwin | $3,656 | 0% |

| Dassel | $3,760 | 3% |

| Dawson | $3,595 | -1% |

| Dayton | $3,777 | 4% |

| Deephaven | $3,706 | 2% |

| Deer Creek | $3,572 | -2% |

| Deer River | $3,568 | -2% |

| Deerwood | $3,450 | -5% |

| Delano | $3,900 | 7% |

| Delavan | $3,608 | -1% |

| Dellwood | $3,899 | 7% |

| Dennison | $3,665 | 1% |

| Dent | $3,571 | -2% |

| Detroit Lakes | $3,572 | -2% |

| Dexter | $3,577 | -2% |

| Dilworth | $3,501 | -4% |

| Dodge Center | $3,488 | -4% |

| Donaldson | $3,664 | 1% |

| Donnelly | $3,519 | -3% |

| Dover | $3,470 | -5% |

| Dovray | $3,753 | 3% |

| Duluth | $3,524 | -3% |

| Dumont | $3,722 | 2% |

| Dundas | $3,675 | 1% |

| Dunnell | $3,524 | -3% |

| Eagan | $3,854 | 6% |

| Eagle Bend | $3,440 | -6% |

| Eagle Lake | $3,556 | -2% |

| East Bethel | $3,822 | 5% |

| East Grand Forks | $3,637 | 0% |

| East Gull Lake | $3,477 | -5% |

| Easton | $3,570 | -2% |

| Echo | $3,804 | 4% |

| Eden Prairie | $3,706 | 2% |

| Eden Valley | $3,534 | -3% |

| Edgerton | $3,601 | -1% |

| Edina | $3,698 | 2% |

| Effie | $3,578 | -2% |

| Eitzen | $3,437 | -6% |

| Elbow Lake | $3,615 | -1% |

| Elgin | $3,436 | -6% |

| Elizabeth | $3,537 | -3% |

| Elk River | $3,867 | 6% |

| Elko New Market | $3,816 | 5% |

| Elkton | $3,550 | -3% |

| Ellendale | $3,680 | 1% |

| Ellsworth | $3,712 | 2% |

| Elmore | $3,543 | -3% |

| Elrosa | $3,400 | -7% |

| Ely | $3,526 | -3% |

| Elysian | $3,621 | -1% |

| Embarrass | $3,523 | -3% |

| Emily | $3,473 | -5% |

| Emmons | $3,858 | 6% |

| Erhard | $3,517 | -3% |

| Erskine | $3,697 | 2% |

| Esko | $3,576 | -2% |

| Essig | $3,600 | -1% |

| Euclid | $3,742 | 3% |

| Evansville | $3,574 | -2% |

| Eveleth | $3,558 | -2% |

| Excelsior | $3,951 | 8% |

| Eyota | $3,366 | -8% |

| Fairfax | $3,706 | 2% |

| Fairmont | $3,490 | -4% |

| Falcon Heights | $3,784 | 4% |

| Faribault | $3,630 | 0% |

| Farmington | $3,704 | 2% |

| Farwell | $3,557 | -2% |

| Federal Dam | $3,546 | -3% |

| Felton | $3,635 | 0% |

| Fergus Falls | $3,423 | -6% |

| Fertile | $3,691 | 1% |

| Fifty Lakes | $3,465 | -5% |

| Finland | $3,443 | -5% |

| Finlayson | $3,748 | 3% |

| Fisher | $3,690 | 1% |

| Flensburg | $3,551 | -3% |

| Flom | $3,653 | 0% |

| Floodwood | $3,575 | -2% |

| Foley | $3,594 | -1% |

| Forbes | $3,553 | -2% |

| Forest Lake | $3,937 | 8% |

| Foreston | $3,781 | 4% |

| Fort Ripley | $3,492 | -4% |

| Fosston | $3,638 | 0% |

| Fountain | $3,426 | -6% |

| Foxhome | $3,600 | -1% |

| Franklin | $3,639 | 0% |

| Frazee | $3,611 | -1% |

| Freeborn | $3,751 | 3% |

| Freeport | $3,374 | -7% |

| Fridley | $3,812 | 5% |

| Frontenac | $3,681 | 1% |

| Frost | $3,552 | -2% |

| Fulda | $3,645 | 0% |

| Garden City | $3,676 | 1% |

| Garfield | $3,529 | -3% |

| Garrison | $3,465 | -5% |

| Garvin | $3,671 | 1% |

| Gary | $3,634 | 0% |

| Gatzke | $3,664 | 1% |

| Gaylord | $3,678 | 1% |

| Genola | $3,590 | -1% |

| Georgetown | $3,578 | -2% |

| Ghent | $3,600 | -1% |

| Gibbon | $3,637 | 0% |

| Gilbert | $3,493 | -4% |

| Gilman | $3,698 | 2% |

| Glencoe | $3,675 | 1% |

| Glenville | $3,827 | 5% |

| Glenwood | $3,522 | -3% |

| Glyndon | $3,597 | -1% |

| Golden Valley | $3,802 | 4% |

| Gonvick | $3,667 | 1% |

| Good Thunder | $3,567 | -2% |

| Goodhue | $3,729 | 2% |

| Goodland | $3,612 | -1% |

| Goodridge | $3,530 | -3% |

| Goodview | $3,442 | -5% |

| Graceville | $3,633 | 0% |

| Granada | $3,495 | -4% |

| Grand Marais | $3,495 | -4% |

| Grand Meadow | $3,476 | -5% |

| Grand Portage | $3,515 | -3% |

| Grand Rapids | $3,558 | -2% |

| Grandy | $3,722 | 2% |

| Granite Falls | $3,723 | 2% |

| Grant | $3,954 | 9% |

| Grasston | $3,636 | 0% |

| Green Isle | $3,846 | 6% |

| Greenbush | $3,631 | 0% |

| Greenfield | $3,697 | 1% |

| Greenwald | $3,461 | -5% |

| Greenwood | $3,799 | 4% |

| Grey Eagle | $3,456 | -5% |

| Grove City | $3,754 | 3% |

| Grygla | $3,713 | 2% |

| Gully | $3,713 | 2% |

| Hackensack | $3,619 | -1% |

| Hallock | $3,626 | 0% |

| Halma | $3,644 | 0% |

| Halstad | $3,594 | -1% |

| Ham Lake | $3,900 | 7% |

| Hamburg | $3,853 | 6% |

| Hamel | $3,829 | 5% |

| Hampton | $3,826 | 5% |

| Hancock | $3,722 | 2% |

| Hanley Falls | $3,717 | 2% |

| Hanover | $3,687 | 1% |

| Hanska | $3,603 | -1% |

| Hardwick | $3,613 | -1% |

| Harmony | $3,433 | -6% |

| Harris | $3,717 | 2% |

| Hartland | $3,715 | 2% |

| Hastings | $3,790 | 4% |

| Hawley | $3,544 | -3% |

| Hayfield | $3,406 | -6% |

| Hayward | $3,823 | 5% |

| Hector | $3,692 | 1% |

| Henderson | $3,685 | 1% |

| Hendricks | $3,703 | 2% |

| Hendrum | $3,620 | -1% |

| Henning | $3,491 | -4% |

| Henriette | $3,702 | 2% |

| Herman | $3,610 | -1% |

| Hermantown | $3,599 | -1% |

| Heron Lake | $3,592 | -1% |

| Hewitt | $3,495 | -4% |

| Hibbing | $3,569 | -2% |

| Hill City | $3,566 | -2% |

| Hillman | $3,416 | -6% |

| Hills | $3,561 | -2% |

| Hilltop | $3,842 | 6% |

| Hinckley | $3,620 | -1% |

| Hines | $3,577 | -2% |

| Hitterdal | $3,642 | 0% |

| Hoffman | $3,623 | -1% |

| Hokah | $3,478 | -5% |

| Holdingford | $3,377 | -7% |

| Holland | $3,661 | 1% |

| Hollandale | $3,700 | 2% |

| Holloway | $3,683 | 1% |

| Holmes City | $3,649 | 0% |

| Holyoke | $3,624 | -1% |

| Hopkins | $3,725 | 2% |

| Houston | $3,446 | -5% |

| Hovland | $3,561 | -2% |

| Howard Lake | $3,730 | 2% |

| Hoyt Lakes | $3,498 | -4% |

| Hugo | $3,903 | 7% |

| Humboldt | $3,644 | 0% |

| Huntley | $3,696 | 1% |

| Hutchinson | $3,649 | 0% |

| Ihlen | $3,658 | 0% |

| Independence | $3,891 | 7% |

| International Falls | $3,589 | -1% |

| Inver Grove Heights | $3,845 | 6% |

| Iona | $3,754 | 3% |

| Iron | $3,418 | -6% |

| Ironton | $3,454 | -5% |

| Isabella | $3,444 | -5% |

| Isanti | $3,654 | 0% |

| Isle | $3,719 | 2% |

| Ivanhoe | $3,634 | 0% |

| Jackson | $3,597 | -1% |

| Jacobson | $3,511 | -4% |

| Janesville | $3,624 | -1% |

| Jasper | $3,603 | -1% |

| Jeffers | $3,725 | 2% |

| Jenkins | $3,561 | -2% |

| Jordan | $3,771 | 4% |

| Kabetogama | $3,645 | 0% |

| Kanaranzi | $3,697 | 2% |

| Kandiyohi | $3,669 | 1% |

| Karlstad | $3,631 | 0% |

| Kasota | $3,620 | -1% |

| Kasson | $3,432 | -6% |

| Keewatin | $3,595 | -1% |

| Kelliher | $3,490 | -4% |

| Kellogg | $3,564 | -2% |

| Kennedy | $3,644 | 0% |

| Kenneth | $3,613 | -1% |

| Kensington | $3,564 | -2% |

| Kent | $3,616 | -1% |

| Kenyon | $3,687 | 1% |

| Kerkhoven | $3,483 | -4% |

| Kerrick | $3,679 | 1% |

| Kettle River | $3,646 | 0% |

| Kiester | $3,837 | 5% |

| Kilkenny | $3,637 | 0% |

| Kimball | $3,449 | -5% |

| Kinney | $3,571 | -2% |

| Knife River | $3,368 | -8% |

| La Crescent | $3,519 | -3% |

| La Salle | $3,641 | 0% |

| Lafayette | $3,679 | 1% |

| Lake Benton | $3,663 | 1% |

| Lake Bronson | $3,661 | 1% |

| Lake City | $3,535 | -3% |

| Lake Crystal | $3,555 | -2% |

| Lake Elmo | $3,983 | 9% |

| Lake George | $3,594 | -1% |

| Lake Hubert | $3,570 | -2% |

| Lake Lillian | $3,551 | -3% |

| Lake Park | $3,665 | 1% |

| Lake Shore | $3,485 | -4% |

| Lake St. Croix Beach | $4,004 | 10% |

| Lake Wilson | $3,768 | 3% |

| Lakefield | $3,473 | -5% |

| Lakeland | $4,010 | 10% |

| Lakeville | $3,750 | 3% |

| Lamberton | $3,615 | -1% |

| Lancaster | $3,644 | 0% |

| Lanesboro | $3,433 | -6% |

| Laporte | $3,534 | -3% |

| Lastrup | $3,590 | -1% |

| Lauderdale | $3,798 | 4% |

| Le Center | $3,566 | -2% |

| Le Roy | $3,474 | -5% |

| Le Sueur | $3,555 | -2% |

| Lengby | $3,651 | 0% |

| Leonard | $3,617 | -1% |

| Leota | $3,712 | 2% |

| Lester Prairie | $3,734 | 3% |

| Lewiston | $3,573 | -2% |

| Lewisville | $3,594 | -1% |

| Lexington | $3,861 | 6% |

| Lilydale | $3,795 | 4% |

| Lindstrom | $3,851 | 6% |

| Lino Lakes | $3,829 | 5% |

| Lismore | $3,678 | 1% |

| Litchfield | $3,698 | 2% |

| Little Canada | $3,876 | 6% |

| Little Falls | $3,414 | -6% |

| Little Rock | $3,571 | -2% |

| Littlefork | $3,649 | 0% |

| Loman | $3,666 | 1% |

| Long Lake | $3,938 | 8% |

| Long Prairie | $3,653 | 0% |

| Longville | $3,676 | 1% |

| Lonsdale | $3,644 | 0% |

| Loretto | $3,767 | 3% |

| Lowry | $3,521 | -3% |

| Lucan | $3,724 | 2% |

| Lutsen | $3,516 | -3% |

| Luverne | $3,516 | -3% |

| Lyle | $3,498 | -4% |

| Lynd | $3,652 | 0% |

| Mabel | $3,539 | -3% |

| Madelia | $3,507 | -4% |

| Madison | $3,587 | -2% |

| Madison Lake | $3,470 | -5% |

| Magnolia | $3,609 | -1% |

| Mahnomen | $3,596 | -1% |

| Mahtomedi | $3,938 | 8% |

| Mahtowa | $3,553 | -2% |

| Makinen | $3,498 | -4% |

| Mankato | $3,598 | -1% |

| Mantorville | $3,360 | -8% |

| Maple Grove | $3,841 | 5% |

| Maple Lake | $3,714 | 2% |

| Maple Plain | $3,904 | 7% |

| Mapleton | $3,543 | -3% |

| Maplewood | $3,861 | 6% |

| Marble | $3,464 | -5% |

| Marcell | $3,627 | 0% |

| Margie | $3,653 | 0% |

| Marietta | $3,659 | 0% |

| Marine on St. Croix | $3,985 | 9% |

| Marshall | $3,553 | -2% |

| Martin Lake | $3,859 | 6% |

| Max | $3,617 | -1% |

| Mayer | $3,829 | 5% |

| Maynard | $3,663 | 1% |

| Mazeppa | $3,527 | -3% |

| Mc Grath | $3,628 | 0% |

| McGregor | $3,644 | 0% |

| McIntosh | $3,704 | 2% |

| Meadowlands | $3,631 | 0% |

| Medford | $3,592 | -1% |

| Medicine Lake | $3,831 | 5% |

| Medina | $3,694 | 1% |

| Melrose | $3,372 | -7% |

| Melrude | $3,550 | -3% |

| Menahga | $3,549 | -3% |

| Mendota | $3,747 | 3% |

| Mendota Heights | $3,864 | 6% |

| Mentor | $3,500 | -4% |

| Merrifield | $3,408 | -6% |

| Middle River | $3,703 | 2% |

| Milaca | $3,899 | 7% |

| Milan | $3,604 | -1% |

| Millville | $3,582 | -2% |

| Milroy | $3,576 | -2% |

| Miltona | $3,539 | -3% |

| Minneapolis | $4,039 | 11% |

| Minneota | $3,660 | 1% |

| Minnesota City | $3,641 | 0% |

| Minnesota Lake | $3,559 | -2% |

| Minnetonka | $3,772 | 4% |

| Minnetonka Beach | $3,797 | 4% |

| Minnetrista | $3,918 | 8% |

| Mizpah | $3,671 | 1% |

| Montevideo | $3,610 | -1% |

| Montgomery | $3,526 | -3% |

| Monticello | $3,669 | 1% |

| Montrose | $3,832 | 5% |

| Moorhead | $3,474 | -5% |

| Moose Lake | $3,522 | -3% |

| Mora | $3,788 | 4% |

| Morgan | $3,600 | -1% |

| Morris | $3,611 | -1% |

| Morristown | $3,625 | 0% |

| Morton | $3,660 | 1% |

| Motley | $3,444 | -5% |

| Mound | $3,834 | 5% |

| Mounds View | $3,822 | 5% |

| Mountain Iron | $3,514 | -4% |

| Mountain Lake | $3,636 | 0% |

| Murdock | $3,596 | -1% |

| Nashua | $3,618 | -1% |

| Nashwauk | $3,560 | -2% |

| Navarre | $3,770 | 4% |

| Naytahwaush | $3,670 | 1% |

| Nelson | $3,531 | -3% |

| Nerstrand | $3,653 | 0% |

| Nett Lake | $3,544 | -3% |

| Nevis | $3,505 | -4% |

| New Brighton | $3,887 | 7% |

| New Germany | $3,984 | 9% |

| New Hope | $3,878 | 6% |

| New London | $3,579 | -2% |

| New Munich | $3,495 | -4% |

| New Prague | $3,741 | 3% |

| New Richland | $3,597 | -1% |

| New Ulm | $3,589 | -1% |

| New York Mills | $3,496 | -4% |

| Newfolden | $3,445 | -5% |

| Newport | $3,951 | 8% |

| Nicollet | $3,753 | 3% |

| Nielsville | $3,658 | 0% |

| Nimrod | $3,651 | 0% |

| Nisswa | $3,417 | -6% |

| Norcross | $3,707 | 2% |

| North Branch | $3,684 | 1% |

| North Mankato | $3,700 | 2% |

| North Oaks | $3,888 | 7% |

| North St. Paul | $3,941 | 8% |

| Northfield | $3,634 | 0% |

| Northome | $3,575 | -2% |

| Northrop | $3,494 | -4% |

| Norwood | $3,847 | 6% |

| Norwood Young America | $3,778 | 4% |

| Nowthen | $3,864 | 6% |

| Noyes | $3,631 | 0% |

| Oak Grove | $3,892 | 7% |

| Oak Island | $3,471 | -5% |

| Oak Park | $3,701 | 2% |

| Oak Park Heights | $3,916 | 8% |

| Oakdale | $3,957 | 9% |

| Oakport | $3,521 | -3% |

| Odessa | $3,734 | 3% |

| Odin | $3,674 | 1% |

| Ogema | $3,623 | -1% |

| Ogilvie | $3,812 | 5% |

| Okabena | $3,494 | -4% |

| Oklee | $3,658 | 0% |

| Olivia | $3,629 | 0% |

| Onamia | $3,823 | 5% |

| Ormsby | $3,602 | -1% |

| Orono | $3,750 | 3% |

| Oronoco | $3,330 | -9% |

| Orr | $3,473 | -5% |

| Ortonville | $3,607 | -1% |

| Osage | $3,650 | 0% |

| Osakis | $3,472 | -5% |

| Oslo | $3,621 | -1% |

| Osseo | $3,804 | 4% |

| Ostrander | $3,470 | -5% |

| Otsego | $3,717 | 2% |

| Ottertail | $3,495 | -4% |

| Outing | $3,577 | -2% |

| Owatonna | $3,645 | 0% |

| Palisade | $3,589 | -1% |

| Park Rapids | $3,535 | -3% |

| Parkers Prairie | $3,511 | -4% |

| Paynesville | $3,381 | -7% |

| Pease | $3,661 | 1% |

| Pelican Rapids | $3,535 | -3% |

| Pemberton | $3,461 | -5% |

| Pengilly | $3,540 | -3% |

| Pennington | $3,580 | -2% |

| Pennock | $3,582 | -2% |

| Pequot Lakes | $3,446 | -5% |

| Perham | $3,470 | -5% |

| Perley | $3,657 | 0% |

| Peterson | $3,485 | -4% |

| Pierz | $3,492 | -4% |

| Pillager | $3,543 | -3% |

| Pine City | $3,719 | 2% |

| Pine Island | $3,463 | -5% |

| Pine River | $3,556 | -2% |

| Pipestone | $3,598 | -1% |

| Plainview | $3,546 | -3% |

| Plato | $3,763 | 3% |

| Plummer | $3,703 | 2% |

| Plymouth | $3,796 | 4% |

| Ponemah | $3,606 | -1% |

| Ponsford | $3,638 | 0% |

| Porter | $3,744 | 3% |

| Preston | $3,433 | -6% |

| Princeton | $3,845 | 6% |

| Prinsburg | $3,649 | 0% |

| Prior Lake | $3,718 | 2% |

| Proctor | $3,558 | -2% |

| Puposky | $3,564 | -2% |

| Racine | $3,445 | -5% |

| Ramsey | $3,881 | 7% |

| Randall | $3,477 | -5% |

| Randolph | $3,779 | 4% |

| Ranier | $3,571 | -2% |

| Raymond | $3,545 | -3% |

| Reading | $3,732 | 2% |

| Reads Landing | $3,534 | -3% |

| Red Lake Falls | $3,580 | -2% |

| Red Wing | $3,696 | 1% |

| Redby | $3,588 | -1% |

| Redlake | $3,463 | -5% |

| Redwood Falls | $3,580 | -2% |

| Remer | $3,585 | -2% |

| Renville | $3,686 | 1% |

| Revere | $3,700 | 2% |

| Rice | $3,549 | -3% |

| Richfield | $3,773 | 4% |

| Richmond | $3,376 | -7% |

| Richville | $3,534 | -3% |

| Richwood | $3,675 | 1% |

| Robbinsdale | $3,859 | 6% |

| Rochert | $3,621 | -1% |

| Rochester | $3,301 | -9% |

| Rock Creek | $3,703 | 2% |

| Rockford | $3,716 | 2% |

| Rockville | $3,380 | -7% |

| Rogers | $3,802 | 4% |

| Rollingstone | $3,462 | -5% |

| Roosevelt | $3,651 | 0% |

| Roscoe | $3,463 | -5% |

| Rose Creek | $3,508 | -4% |

| Roseau | $3,618 | -1% |

| Rosemount | $3,796 | 4% |

| Roseville | $3,848 | 6% |

| Rothsay | $3,543 | -3% |

| Round Lake | $3,610 | -1% |

| Royalton | $3,419 | -6% |

| Rush City | $3,968 | 9% |

| Rushford | $3,433 | -6% |

| Rushford Village | $3,433 | -6% |

| Rushmore | $3,600 | -1% |

| Russell | $3,671 | 1% |

| Ruthton | $3,628 | 0% |

| Sabin | $3,562 | -2% |

| Sacred Heart | $3,715 | 2% |

| Saginaw | $3,444 | -5% |

| Salol | $3,684 | 1% |

| Sanborn | $3,632 | 0% |

| Sandstone | $3,674 | 1% |

| Santiago | $3,935 | 8% |

| Sargeant | $3,526 | -3% |

| Sartell | $3,447 | -5% |

| Sauk Centre | $3,392 | -7% |

| Sauk Rapids | $3,526 | -3% |

| Savage | $3,653 | 0% |

| Sawyer | $3,725 | 2% |

| Scandia | $3,948 | 8% |

| Scanlon | $3,638 | 0% |

| Schroeder | $3,510 | -4% |

| Seaforth | $3,724 | 2% |

| Searles | $3,674 | 1% |

| Sebeka | $3,574 | -2% |

| Shafer | $3,814 | 5% |

| Shakopee | $3,720 | 2% |

| Shelly | $3,619 | -1% |

| Sherburn | $3,494 | -4% |

| Shevlin | $3,678 | 1% |

| Shoreview | $3,895 | 7% |

| Shorewood | $3,832 | 5% |

| Side Lake | $3,519 | -3% |

| Silver Bay | $3,380 | -7% |

| Silver Creek | $3,866 | 6% |

| Silver Lake | $3,614 | -1% |

| Slayton | $3,659 | 0% |

| Sleepy Eye | $3,545 | -3% |

| Solway | $3,582 | -2% |

| Soudan | $3,500 | -4% |

| South Haven | $3,654 | 0% |

| South International Falls | $3,629 | 0% |

| South St. Paul | $3,844 | 6% |

| Spicer | $3,709 | 2% |

| Spring Grove | $3,464 | -5% |

| Spring Lake | $3,564 | -2% |

| Spring Lake Park | $3,844 | 6% |

| Spring Park | $3,926 | 8% |

| Spring Valley | $3,432 | -6% |

| Springfield | $3,592 | -1% |

| Squaw Lake | $3,601 | -1% |

| St. Anthony | $3,804 | 4% |

| St. Augusta | $3,386 | -7% |

| St. Bonifacius | $3,915 | 7% |

| St. Charles | $3,502 | -4% |

| St. Clair | $3,537 | -3% |

| St. Cloud | $3,506 | -4% |

| St. Francis | $3,798 | 4% |

| St. Hilaire | $3,522 | -3% |

| St. James | $3,528 | -3% |

| St. Joseph | $3,325 | -9% |

| St. Louis Park | $3,774 | 4% |

| St. Marys Point | $4,004 | 10% |

| St. Michael | $3,740 | 3% |

| St. Paul | $3,911 | 7% |

| St. Paul Park | $3,967 | 9% |

| St. Peter | $3,606 | -1% |

| St. Rosa | $3,481 | -4% |

| St. Stephen | $3,314 | -9% |

| St. Vincent | $3,638 | 0% |

| Stacy | $3,786 | 4% |

| Stanchfield | $3,712 | 2% |

| Staples | $3,534 | -3% |

| Starbuck | $3,500 | -4% |

| Steen | $3,629 | 0% |

| Stephen | $3,408 | -6% |

| Stewart | $3,663 | 1% |

| Stewartville | $3,334 | -8% |

| Stillwater | $3,836 | 5% |

| Stockton | $3,574 | -2% |

| Storden | $3,740 | 3% |

| Strandquist | $3,549 | -3% |

| Strathcona | $3,651 | 0% |

| Sturgeon Lake | $3,750 | 3% |

| Sunburg | $3,601 | -1% |

| Sunfish Lake | $3,905 | 7% |

| Swan River | $3,596 | -1% |

| Swanville | $3,469 | -5% |

| Swatara | $3,513 | -4% |

| Swift | $3,633 | 0% |

| Taconite | $3,609 | -1% |

| Talmoon | $3,504 | -4% |

| Tamarack | $3,686 | 1% |

| Taopi | $3,637 | 0% |

| Taunton | $3,610 | -1% |

| Taylors Falls | $3,846 | 6% |

| Tenstrike | $3,567 | -2% |

| The Lakes | $3,672 | 1% |

| Thief River Falls | $3,461 | -5% |

| Tintah | $3,725 | 2% |

| Tofte | $3,513 | -4% |

| Tonka Bay | $3,722 | 2% |

| Tower | $3,518 | -3% |

| Tracy | $3,590 | -1% |

| Trail | $3,689 | 1% |

| Trimont | $3,371 | -7% |

| Truman | $3,476 | -5% |

| Twig | $3,518 | -3% |

| Twin Lakes | $3,949 | 8% |

| Twin Valley | $3,596 | -1% |

| Two Harbors | $3,415 | -6% |

| Tyler | $3,761 | 3% |

| Ulen | $3,611 | -1% |

| Underwood | $3,541 | -3% |

| Upsala | $3,467 | -5% |

| Utica | $3,463 | -5% |

| Vadnais Heights | $3,955 | 9% |

| Vergas | $3,566 | -2% |

| Verndale | $3,580 | -2% |

| Vernon Center | $3,543 | -3% |

| Vesta | $3,724 | 2% |

| Victoria | $3,684 | 1% |

| Viking | $3,461 | -5% |

| Villard | $3,601 | -1% |

| Vining | $3,481 | -4% |

| Virginia | $3,549 | -3% |

| Wabasha | $3,512 | -4% |

| Wabasso | $3,729 | 2% |

| Waconia | $3,715 | 2% |

| Wadena | $3,451 | -5% |

| Wahkon | $3,677 | 1% |

| Waite Park | $3,338 | -8% |

| Waldorf | $3,576 | -2% |

| Walker | $3,504 | -4% |

| Walnut Grove | $3,630 | 0% |

| Waltham | $3,528 | -3% |

| Wanamingo | $3,632 | 0% |

| Wanda | $3,744 | 3% |

| Wannaska | $3,651 | 0% |

| Warba | $3,567 | -2% |

| Warren | $3,597 | -1% |

| Warroad | $3,619 | -1% |

| Warsaw | $3,760 | 3% |

| Waseca | $3,656 | 0% |

| Waskish | $3,635 | 0% |

| Watertown | $3,805 | 4% |

| Waterville | $3,613 | -1% |

| Watkins | $3,561 | -2% |

| Watson | $3,708 | 2% |

| Waubun | $3,666 | 1% |

| Waverly | $3,754 | 3% |

| Wayzata | $3,834 | 5% |

| Webster | $3,759 | 3% |

| Welch | $3,799 | 4% |

| Welcome | $3,485 | -4% |

| Wells | $3,817 | 5% |

| Wendell | $3,702 | 2% |

| West Concord | $3,275 | -10% |

| West St. Paul | $3,871 | 6% |

| West Union | $3,525 | -3% |

| Westbrook | $3,568 | -2% |

| Wheaton | $3,637 | 0% |

| White Bear Lake | $3,824 | 5% |

| Willernie | $3,742 | 3% |

| Williams | $3,634 | 0% |

| Willmar | $3,560 | -2% |

| Willow River | $3,700 | 2% |

| Wilmont | $3,697 | 2% |

| Windom | $3,702 | 2% |

| Winger | $3,491 | -4% |

| Winnebago | $3,570 | -2% |

| Winona | $3,377 | -7% |

| Winsted | $3,779 | 4% |

| Winthrop | $3,724 | 2% |

| Winton | $3,491 | -4% |

| Wirt | $3,617 | -1% |

| Wolverton | $3,613 | -1% |

| Wood Lake | $3,810 | 5% |

| Woodbury | $3,845 | 6% |

| Woodland | $3,770 | 4% |

| Woodstock | $3,675 | 1% |

| Worthington | $3,577 | -2% |

| Wrenshall | $3,590 | -1% |

| Wright | $3,700 | 2% |

| Wykoff | $3,416 | -6% |

| Wyoming | $3,794 | 4% |

| Young America | $3,779 | 4% |

| Zimmerman | $3,873 | 6% |

| Zumbro Falls | $3,537 | -3% |

| Zumbrota | $3,623 | -1% |

Flood insurance in Minnesota

The average cost of flood insurance in Minnesota is $1,020 a year, or $85 a month.

Standard homeowners insurance does not cover flood damage. However, you can get flood insurance to protect your home from this risk. Your lender will make you get it for a mortgage in a high-risk flood zone. It’s otherwise optional, though often worth considering.

The Federal Emergency Management Agency (FEMA) has mapped the flood risks in most Minnesota communities. You can find a home’s flood zone online in the FEMA Flood Map Service Center. Any zone label that begins with the letter A or V is high risk.

Most flood insurance is issued through the National Flood Insurance Program (NFIP), which is managed by FEMA. However, a few private companies also offer it.

The actual price you pay for flood insurance depends on factors like your home’s flood risks and design features:

- Rates average $149 a month in areas with the greatest chances of flooding.

- Flood insurance only costs an average of $64 a month in low-risk areas.

- You can often get a discount if you elevate your home or essential appliances.

You can get an NFIP flood insurance quote from any FEMA-authorized insurance agent. Start with your current agent, or the agents you contact for home insurance quotes. If they can’t help, you can find one in FEMA’s online provider directory.

Methodology

The rates shown in this article are based on non-binding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from quotes for a typical home in every Minnesota ZIP code. The following coverages and deductible were used, unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

—

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

Third-party customer service ratings include Complaint Index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC’s scores are used to determine how satisfied customers are with their claims. AM Best’s ratings reflect a company’s ability to pay out claims.