Best Homeowners Insurance in Mississippi

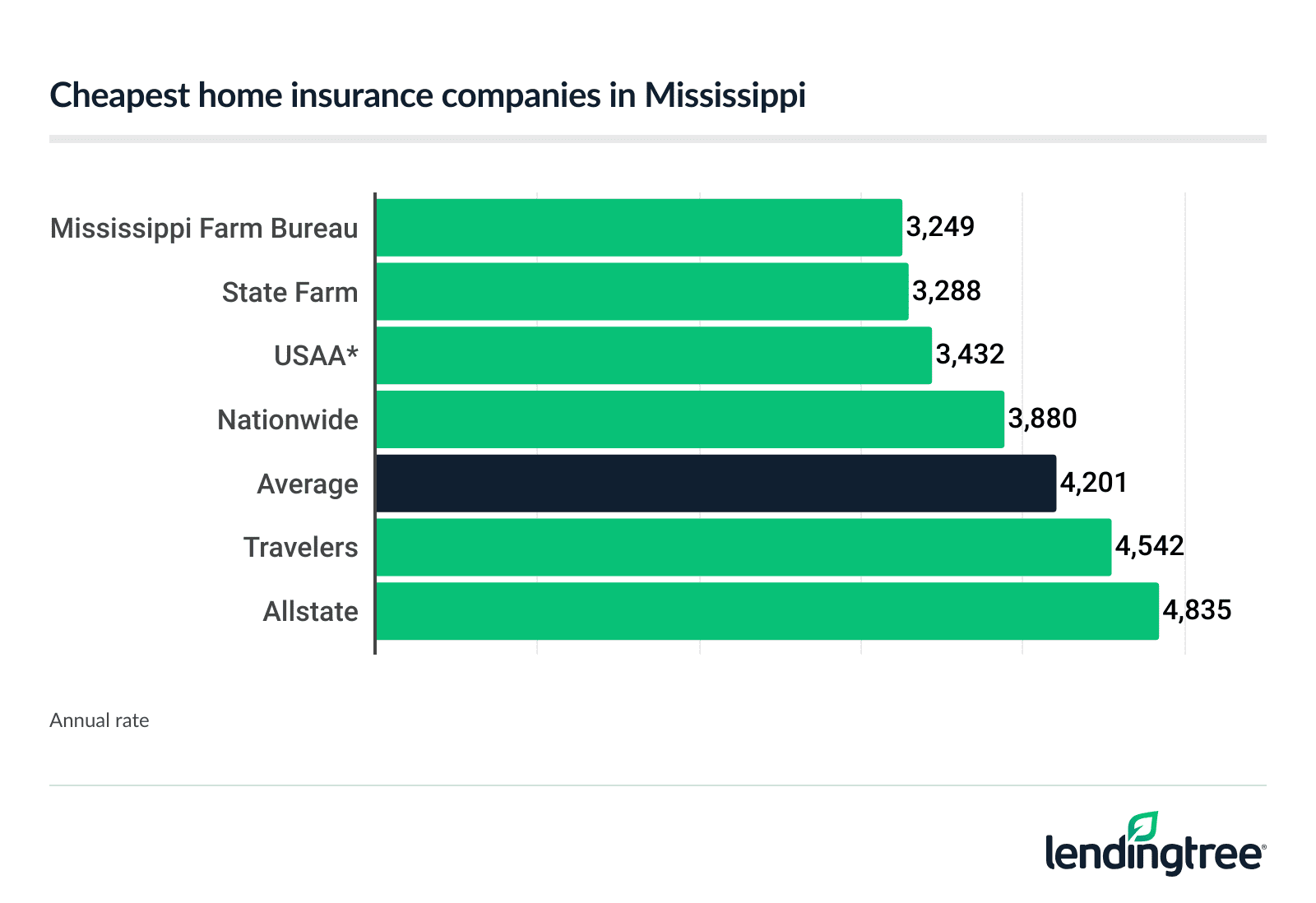

Mississippi Farm Bureau is the best company for cheap home insurance in Mississippi, at an average rate of $3,249 a year.

Nationwide, State Farm and USAA are also great options for homeowners in Mississippi.

Best cheap home insurance companies in Mississippi

Cheapest home insurance in Mississippi

Both companies offer more than just low home insurance rates, though. Mississippi Farm Bureau also has one of the state’s best complaint ratings, while State Farm has a great customer satisfaction score.

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Mississippi Farm Bureau | $3,249 | |

| State Farm | $3,288 | |

| USAA* | $3,432 | |

| Nationwide | $3,880 | |

| Travelers | $4,542 | |

| Allstate | $4,835 | |

| Farmers | $6,184 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. *USAA is only offered to military personnel and veterans along with their families

USAA and Nationwide also charge rates that are cheaper than the state average of $350 a month. However, only members of the military and their families can buy home insurance from USAA.

To find the best and lowest home insurance for your needs, compare home insurance quotes from several companies while you shop around.

Best home insurance companies in Mississippi

Nationwide is the state’s best home insurance company for add-on coverages, while Farmers offers the best discounts. USAA is the best company for military members and their families.

| Company | Best for | Average annual rate | Customer satisfaction** | Complaint index*** |

|---|---|---|---|---|

| Mississippi Farm Bureau | Cheap rates | $3,249 | Not rated | 0.52 |

| Nationwide | Coverage options | $3,880 | 812 | 0.96 |

| State Farm | Customer satisfaction | $3,288 | 829 | 1.05 |

| Farmers | Discounts | $6,184 | 800 | 0.85 |

| USAA* | Members of the military | $3,432 | 881 | 0.33 |

Best cheap home insurance rates: Mississippi Farm Bureau

Mississippi Farm Bureau is the best home insurance company for cheap rates in Mississippi, charging $3,249 a year, on average. This is 23% lower than the state average rate of $4,201 a year.

It also has one of the state’s best complaint ratings from the National Association of Insurance Commissioners (NAIC).

| Pros | Cons |

|---|---|

State’s lowest average home insurance rate Second-best NAIC complaint rating | Doesn’t offer as many add-on coverages or discounts as some other companies No customer satisfaction rating |

Best home insurance coverage options: Nationwide

Nationwide is the best homeowners insurance company in Mississippi for coverage options.

Some of the optional coverages you can add to a Nationwide home insurance policy include:

- Dwelling replacement cost

- Equipment breakdown

- Identity theft

- Service line

- Water backup

| Pros | Cons |

|---|---|

Offers more add-on coverages than most other companies Also offers many discounts Average rate is cheaper than the state average | Customer satisfaction rating is slightly worse than average |

Best for customer satisfaction: State Farm

State Farm has the best J.D. Power customer satisfaction score for most Mississippi homeowners.

| Pros | Cons |

|---|---|

Best customer satisfaction score for most Mississippians Low average home insurance rate | Doesn’t offer as many add-on coverages or discounts as other companies surveyed Complaint rating is slightly worse than average |

Best discounts: Farmers

Farmers’ average home insurance rate is the highest of the companies we surveyed in Mississippi, but it offers many discounts that could make it much cheaper for you.

You may earn a home insurance discount from Farmers if you:

- Own a home that’s less than 14 years old

- Have certain protective devices or safety features installed in your home

- Don’t file any claims for three consecutive years

- Bundle your home and auto insurance with Farmers

- Pay your bill on time

| Pros | Cons |

|---|---|

Best discount selection of companies we surveyed Complaint rating is better than average | High average home insurance rate Customer satisfaction rating is worse than average Offers fewer add-on coverages than other companies |

Best for military: USAA

USAA is the best home insurance company in Mississippi for members of the military and their families.

USAA’s average home insurance rate is among the cheapest in the state. It also boasts the state’s best complaint rating.

| Pros | Cons |

|---|---|

Best complaint rating in Mississippi Great customer satisfaction score Low average home insurance premium | Only available to members of the military and their families Doesn’t offer as many discounts or add-on coverages as other companies surveyed |

How much is home insurance in Mississippi?

This average rate is based on a policy with $400,000 of dwelling coverage. The state average home insurance rate is $306 a month for a policy with a $350,000 dwelling limit. That’s 13% less than for a policy with a $400,000 limit. Policies with a $450,000 limit are 13% more.

| Dwelling limit | Annual rate | Monthly rate |

|---|---|---|

| $350,000 | $3,677 | $306 |

| $400,000 | $4,201 | $350 |

| $450,000 | $4,744 | $395 |

The dwelling coverage portion of your home insurance policy pays to repair or rebuild the structure of your home if a fire, hail or other event damages or destroys it. These events are called perils in your policy.

Mississippi homeowners insurance rates by city

The most expensive home insurance rates are found in Gautier. The average rate of Gautier is $9,038 a year.

| City |

Average annual rate

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

|

|---|---|

| Abbeville | $3,082 |

| Aberdeen | $3,446 |

| Ackerman | $3,690 |

| Alcorn State University | $4,219 |

| Algoma | $4,529 |

| Alligator | $3,871 |

| Amory | $3,536 |

| Anguilla | $3,908 |

| Arcola | $3,742 |

| Arkabutla | $5,473 |

| Arnold Line | $4,732 |

| Artesia | $3,142 |

| Ashland | $3,944 |

| Avon | $3,841 |

| Bailey | $3,495 |

| Baldwyn | $3,560 |

| Banner | $3,922 |

| Bassfield | $4,270 |

| Batesville | $3,388 |

| Bay Springs | $4,077 |

| Bay St. Louis | $6,092 |

| Beaumont | $5,458 |

| Becker | $4,394 |

| Beechwood | $3,701 |

| Belden | $3,507 |

| Bellefontaine | $3,821 |

| Belmont | $3,991 |

| Belzoni | $3,782 |

| Benoit | $3,676 |

| Benton | $3,705 |

| Bentonia | $3,712 |

| Beulah | $3,755 |

| Big Creek | $4,016 |

| Biloxi | $6,346 |

| Blue Mountain | $4,066 |

| Blue Springs | $3,209 |

| Bogue Chitto | $4,275 |

| Bolton | $3,733 |

| Booneville | $4,013 |

| Boyle | $3,812 |

| Brandon | $3,362 |

| Braxton | $4,236 |

| Brookhaven | $4,352 |

| Brooklyn | $5,062 |

| Brooksville | $3,375 |

| Bruce | $3,930 |

| Buckatunna | $4,275 |

| Bude | $4,310 |

| Burnsville | $3,991 |

| Byhalia | $3,547 |

| Byram | $3,818 |

| Caledonia | $3,354 |

| Calhoun City | $3,974 |

| Camden | $3,628 |

| Canton | $3,612 |

| Carriere | $4,676 |

| Carrollton | $3,799 |

| Carson | $4,167 |

| Carthage | $3,786 |

| Cary | $3,808 |

| Cascilla | $3,711 |

| Cedarbluff | $3,539 |

| Centreville | $4,144 |

| Charleston | $3,717 |

| Chatawa | $3,879 |

| Chatham | $3,811 |

| Chunky | $3,740 |

| Clara | $5,035 |

| Clarksdale | $3,888 |

| Cleveland | $3,779 |

| Clinton | $3,852 |

| Cloverdale | $4,080 |

| Coahoma | $3,787 |

| Coffeeville | $3,731 |

| Coila | $3,792 |

| Coldwater | $3,302 |

| Collins | $4,188 |

| Collinsville | $3,525 |

| Columbia | $4,349 |

| Columbus | $3,311 |

| Columbus AFB | $3,159 |

| Como | $3,314 |

| Conehatta | $3,832 |

| Corinth | $3,859 |

| Courtland | $3,280 |

| Crawford | $3,283 |

| Crenshaw | $3,485 |

| Crosby | $4,054 |

| Crowder | $3,850 |

| Cruger | $3,606 |

| Crystal Springs | $4,292 |

| D Lo | $5,136 |

| D'Iberville | $6,193 |

| Daleville | $3,536 |

| Darling | $3,897 |

| De Kalb | $3,575 |

| Decatur | $3,731 |

| DeLisle | $6,039 |

| Delta City | $3,968 |

| Dennis | $4,040 |

| Derma | $3,968 |

| Diamondhead | $5,764 |

| Doddsville | $3,767 |

| Drew | $3,625 |

| Dublin | $3,828 |

| Duck Hill | $3,824 |

| Dumas | $4,039 |

| Duncan | $3,871 |

| Dundee | $3,785 |

| Durant | $3,676 |

| Eastabuchie | $4,366 |

| Ecru | $3,725 |

| Edwards | $3,805 |

| Elliott | $4,735 |

| Ellisville | $4,371 |

| Enid | $3,733 |

| Enterprise | $3,914 |

| Escatawpa | $6,016 |

| Ethel | $3,743 |

| Etta | $3,249 |

| Eupora | $3,769 |

| Falkner | $3,900 |

| Farmington | $3,873 |

| Farrell | $3,998 |

| Fayette | $4,101 |

| Fernwood | $3,829 |

| Flora | $3,680 |

| Florence | $3,503 |

| Flowood | $3,450 |

| Forest | $3,831 |

| Foxworth | $4,550 |

| French Camp | $3,688 |

| Friars Point | $3,783 |

| Fulton | $3,821 |

| Gallman | $6,017 |

| Gattman | $3,448 |

| Gautier | $9,038 |

| Georgetown | $4,291 |

| Glen | $3,941 |

| Glen Allan | $3,707 |

| Glendora | $3,843 |

| Gloster | $4,135 |

| Golden | $3,866 |

| Goodman | $3,702 |

| Gore Springs | $4,032 |

| Grace | $4,960 |

| Greenville | $3,760 |

| Greenwood | $3,882 |

| Greenwood Springs | $3,514 |

| Grenada | $3,796 |

| Gulf Hills | $6,491 |

| Gulf Park Estates | $6,492 |

| Gulfport | $6,378 |

| Gunnison | $3,816 |

| Guntown | $3,519 |

| Hamilton | $3,480 |

| Harperville | $4,594 |

| Harrisville | $4,144 |

| Hattiesburg | $4,605 |

| Hazlehurst | $4,273 |

| Heidelberg | $4,156 |

| Helena | $6,035 |

| Hermanville | $4,286 |

| Hernando | $3,043 |

| Hickory | $3,744 |

| Hickory Flat | $4,055 |

| Hide-A-Way Lake | $4,661 |

| Hillsboro | $3,818 |

| Holcomb | $3,765 |

| Hollandale | $3,712 |

| Holly Bluff | $3,560 |

| Holly Springs | $3,601 |

| Horn Lake | $2,991 |

| Houlka | $3,810 |

| Houston | $3,831 |

| Hurley | $7,161 |

| Independence | $5,473 |

| Indianola | $3,717 |

| Inverness | $3,677 |

| Isola | $3,796 |

| Itta Bena | $3,823 |

| Iuka | $3,886 |

| Jackson | $4,076 |

| Jayess | $4,250 |

| Jonestown | $3,758 |

| Kilmichael | $3,902 |

| Kiln | $5,817 |

| Kokomo | $4,363 |

| Kosciusko | $3,763 |

| Lake | $3,810 |

| Lake Cormorant | $2,980 |

| Lakeshore | $6,683 |

| Lamar | $3,552 |

| Lambert | $3,770 |

| Latimer | $5,726 |

| Lauderdale | $3,520 |

| Laurel | $4,169 |

| Lawrence | $3,822 |

| Leakesville | $5,493 |

| Leland | $3,714 |

| Lena | $3,839 |

| Lexington | $3,793 |

| Liberty | $4,084 |

| Little Rock | $3,596 |

| Long Beach | $6,266 |

| Lorman | $4,151 |

| Louin | $4,107 |

| Louise | $3,891 |

| Louisville | $3,619 |

| Lucedale | $5,160 |

| Ludlow | $3,838 |

| Lula | $3,840 |

| Lumberton | $4,563 |

| Lyman | $5,879 |

| Lynchburg | $3,000 |

| Lyon | $3,791 |

| Maben | $3,571 |

| Macon | $3,600 |

| Madden | $3,724 |

| Madison | $3,556 |

| Magee | $4,181 |

| Magnolia | $4,091 |

| Mantachie | $3,802 |

| Mantee | $3,566 |

| Marietta | $3,748 |

| Marion | $3,521 |

| Marks | $3,805 |

| Mathiston | $3,803 |

| Mayersville | $3,637 |

| Mayhew | $4,219 |

| Mc Adams | $4,808 |

| Mc Call Creek | $4,264 |

| Mc Carley | $3,799 |

| Mc Cool | $3,764 |

| Mc Henry | $4,866 |

| Mc Neill | $4,131 |

| McComb | $4,086 |

| McLain | $5,441 |

| Meadville | $4,264 |

| Mendenhall | $4,238 |

| Meridian | $3,606 |

| Merigold | $3,736 |

| Metcalfe | $3,839 |

| Michigan City | $3,949 |

| Midnight | $5,123 |

| Minter City | $3,921 |

| Mississippi State | $3,107 |

| Mississippi Valley State University | $3,865 |

| Mize | $4,086 |

| Monticello | $4,236 |

| Montpelier | $4,199 |

| Mooreville | $3,399 |

| Moorhead | $3,660 |

| Morgan City | $3,841 |

| Morgantown | $4,039 |

| Morton | $3,866 |

| Moselle | $4,345 |

| Moss | $4,883 |

| Moss Point | $6,763 |

| Mound Bayou | $3,671 |

| Mount Olive | $4,204 |

| Mount Pleasant | $3,514 |

| Myrtle | $3,284 |

| Natchez | $4,052 |

| Neely | $5,338 |

| Nellieburg | $3,481 |

| Nesbit | $3,032 |

| Nettleton | $3,712 |

| New Albany | $3,260 |

| New Augusta | $5,223 |

| New Houlka | $3,813 |

| New Site | $4,019 |

| Newhebron | $4,232 |

| Newton | $3,791 |

| Nicholson | $4,500 |

| North Carrollton | $3,799 |

| North Tunica | $3,713 |

| Noxapater | $3,710 |

| Oak Vale | $4,211 |

| Oakland | $3,732 |

| Ocean Springs | $6,483 |

| Okolona | $3,884 |

| Olive Branch | $3,071 |

| Osyka | $4,311 |

| Ovett | $4,409 |

| Oxford | $3,057 |

| Pace | $3,794 |

| Pachuta | $3,912 |

| Panther Burn | $3,968 |

| Parchman | $3,664 |

| Paris | $3,040 |

| Pascagoula | $6,660 |

| Pass Christian | $6,039 |

| Pattison | $4,312 |

| Paulding | $4,065 |

| Pearl | $3,573 |

| Pearl River | $3,761 |

| Pearlington | $7,253 |

| Pelahatchie | $3,351 |

| Perkinston | $4,824 |

| Petal | $4,475 |

| Pheba | $3,361 |

| Philadelphia | $3,759 |

| Philipp | $3,784 |

| Picayune | $4,576 |

| Pickens | $3,735 |

| Piney Woods | $3,489 |

| Pinola | $4,109 |

| Pittsboro | $3,950 |

| Plantersville | $3,540 |

| Pontotoc | $3,754 |

| Pope | $3,378 |

| Poplarville | $4,638 |

| Port Gibson | $4,232 |

| Porterville | $3,648 |

| Potts Camp | $3,536 |

| Prairie | $3,452 |

| Prentiss | $4,127 |

| Preston | $3,788 |

| Puckett | $3,529 |

| Pulaski | $3,926 |

| Purvis | $4,774 |

| Quitman | $3,893 |

| Raleigh | $4,129 |

| Randolph | $3,887 |

| Rawls Springs | $4,725 |

| Raymond | $3,768 |

| Red Banks | $3,531 |

| Redwater | $3,751 |

| Redwood | $3,733 |

| Rena Lara | $3,894 |

| Richland | $3,415 |

| Richton | $5,176 |

| Ridgeland | $3,635 |

| Rienzi | $3,917 |

| Ripley | $4,080 |

| Robinhood | $3,447 |

| Robinsonville | $3,699 |

| Rolling Fork | $3,808 |

| Rome | $3,721 |

| Rose Hill | $4,056 |

| Rosedale | $3,709 |

| Roxie | $4,178 |

| Ruleville | $3,722 |

| Ruth | $4,338 |

| Sallis | $3,726 |

| Saltillo | $3,523 |

| Sandersville | $4,196 |

| Sandhill | $3,352 |

| Sandy Hook | $4,314 |

| Sarah | $3,355 |

| Sardis | $3,416 |

| Satartia | $3,622 |

| Saucier | $5,558 |

| Schlater | $3,851 |

| Scobey | $3,784 |

| Scooba | $3,639 |

| Scott | $3,776 |

| Sebastopol | $3,780 |

| Seminary | $4,430 |

| Senatobia | $3,280 |

| Shannon | $3,368 |

| Sharon | $4,185 |

| Shaw | $3,683 |

| Shelby | $3,676 |

| Sherard | $3,894 |

| Sherman | $3,631 |

| Shubuta | $4,049 |

| Shuqualak | $3,608 |

| Sibley | $4,796 |

| Sidon | $3,849 |

| Silver City | $3,843 |

| Silver Creek | $4,236 |

| Slate Spring | $4,704 |

| Sledge | $3,888 |

| Smithdale | $4,072 |

| Smithville | $3,509 |

| Snow Lake Shores | $3,948 |

| Sontag | $4,236 |

| Soso | $4,112 |

| Southaven | $3,016 |

| St. Martin | $5,735 |

| Star | $4,344 |

| Starkville | $3,093 |

| State Line | $4,837 |

| Steens | $3,243 |

| Stewart | $3,867 |

| Stoneville | $4,684 |

| Stonewall | $4,065 |

| Stringer | $4,008 |

| Sturgis | $3,195 |

| Summit | $4,074 |

| Sumner | $3,826 |

| Sumrall | $4,803 |

| Sunflower | $3,703 |

| Swan Lake | $4,643 |

| Swiftown | $3,856 |

| Taylor | $3,035 |

| Taylorsville | $4,090 |

| Tchula | $3,721 |

| Terry | $3,774 |

| Thaxton | $3,700 |

| Thomastown | $4,506 |

| Tie Plant | $4,735 |

| Tillatoba | $3,793 |

| Tinsley | $3,627 |

| Tiplersville | $3,866 |

| Tippo | $3,769 |

| Tishomingo | $3,968 |

| Toccopola | $3,210 |

| Toomsuba | $3,410 |

| Tougaloo | $5,018 |

| Trebloc | $4,586 |

| Tremont | $3,847 |

| Tunica | $3,727 |

| Tupelo | $3,479 |

| Tutwiler | $3,744 |

| Tylertown | $4,349 |

| Union | $3,858 |

| Union Church | $4,357 |

| University | $3,076 |

| Utica | $3,770 |

| Vaiden | $3,792 |

| Valley Park | $3,745 |

| Van Vleet | $4,586 |

| Vance | $3,797 |

| Vancleave | $5,719 |

| Vardaman | $3,947 |

| Vaughan | $3,632 |

| Verona | $3,522 |

| Vicksburg | $3,734 |

| Victoria | $4,483 |

| Vossburg | $4,047 |

| Walls | $3,009 |

| Walnut | $3,876 |

| Walnut Grove | $3,811 |

| Walthall | $3,849 |

| Washington | $4,796 |

| Water Valley | $3,672 |

| Waterford | $3,510 |

| Waveland | $6,187 |

| Waynesboro | $4,292 |

| Wayside | $4,686 |

| Webb | $3,822 |

| Weir | $3,727 |

| Wesson | $4,296 |

| West | $3,755 |

| West Hattiesburg | $4,725 |

| West Point | $3,484 |

| Wheeler | $4,851 |

| Whitfield | $4,343 |

| Wiggins | $5,168 |

| Winona | $3,908 |

| Winstonville | $4,710 |

| Winterville | $4,693 |

| Woodland | $3,810 |

| Woodville | $4,092 |

| Yazoo City | $3,697 |

Jackson, Mississippi’s capital and largest city overall, has an average home insurance rate of $4,076 a year.

Additional home insurance coverages needed in Mississippi

Mississippi homeowners deal with a lot of severe weather every year, including hurricanes, tornadoes and thunderstorms.

Standard home insurance policy covers damage and destruction caused by most of these events or perils, but it won’t cover flood damage. You’ll need to buy separate flood insurance to help with that.

Flood insurance in Mississippi

You need flood insurance coverage to protect your home from flood damage in Mississippi.

State law doesn’t require homeowners to buy flood insurance, but your mortgage lender will likely require it if you live in a high-risk flood zone.

You can buy flood insurance through the National Flood Insurance Program (NFIP) or some private insurance companies.

Frequently asked questions

Mississippi Farm Bureau and State Farm offer Mississippi’s best home insurance rates, based on our survey of the state’s insurers. Mississippi Farm Bureau charges $3,249 a year, on average. State Farm’s average rate is just a few dollars more, $3,288 a year.

The average cost of homeowners insurance in Mississippi is $4,201 a year, or $350 a month. What you pay for home insurance depends on several factors, though, such as:

- Where you live in the state

- The age of your home

- The amount of coverage you buy

- The deductible you choose

- Your credit, insurance and claims history

One of the main reasons homeowners insurance is expensive in Mississippi is that the state experiences a lot of severe weather every year. Hurricanes and tornadoes, especially, cause a lot of expensive damage.