Best Missouri Homeowners Insurance

Allstate is the best home insurance company for most Missouri homeowners. It has the cheapest average rate, at $2,356 a year, and offers many discounts for qualified homeowners.

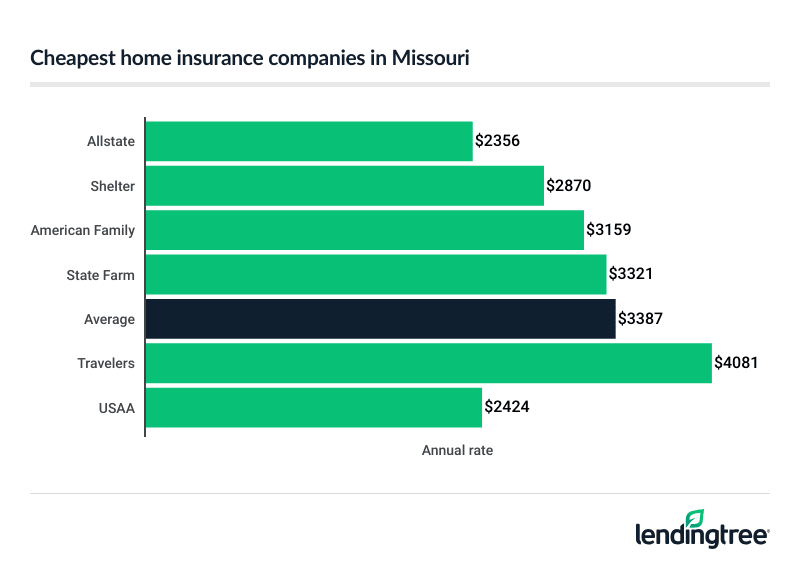

Best cheap home insurance companies in Missouri

Missouri’s cheapest home insurance companies

Allstate is the cheapest home insurance option in Missouri, offering an average rate of $2,356 a year.

USAA is the second-cheapest option in the state, at $2,424 a year. However, USAA only provides home insurance to active-duty and veteran military members, as well as their families.

American Family is the second-best option for most Missouri homeowners, at $3,159 a year.

To compare, the average home insurance rate in Missouri is $3,387 a year.

Cheapest home insurance companies in Missouri

| Company | Average annual rate | LendingTree score | |

|---|---|---|---|

| Allstate | $2,356 | |

| Shelter | $2,870 | |

| American Family | $3,159 | |

| State Farm | $3,321 | |

| Travelers | $4,081 | |

| Nationwide | $5,496 | |

| USAA* | $2,424 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. *USAA is only offered to military personnel and veterans along with their families

Best homeowners insurance companies in Missouri

Allstate is the best homeowners insurance company in Missouri for cheap rates. USAA has the best policy options for homeowners in the military, and Shelter has the best complaint rating.

Missouri home insurance company comparison

| Company | Average annual rate | Overall satisfaction (higher is better) | Complaint index (lower is better) |

|---|---|---|---|

| Cheapest rates: Allstate | $2,356 | 868 (below average) | 1.79 (below average) |

| Best for military: USAA* | $2,424 | 899 (above average) | 0.50 (above average) |

| Best complaint index: Shelter | $2,870 | NA | 0.31 (above average) |

| Average | $3,387 | 869 | 1.0 |

Sources: J.D. Power’s 2024 Property Claims Satisfaction Study and 2023 complaint data from the National Association of Insurance Commissioners (NAIC).

Cheapest average home insurance rates: Allstate

Annual rate: $2,356

![]()

Pros

Cheapest average rate in Missouri

Offers great optional policy features

Many discounts for qualified homeowners

Cons

High complaint rating

Allstate has the cheapest rates of the major home insurance companies we surveyed in Missouri, at an average of $2,356 a year. This is 30% cheaper than the average Missouri home insurance rate of $3,387 a year.

Allstate offers a Rateguard program, which lets you file one claim every five years without a rate increase.You can also take advantage of their Deductible Rewards program, which can lower your deductible if you don’t make a claim. However, you will need to upgrade to Allstate’s Enhanced Package to take part in RateGuard and Deductible Rewards programs.

Best for military members: USAA

Annual rate: $2,424

![]()

Pros

Second-cheapest home insurance rates in Missouri

Active-duty service members get coverage for military equipment and uniforms with no deductible

Personal property coverage at replacement cost

Cons

May not get the same agent every time you contact USAA

Only available to active-duty and veteran military and their families

USAA offers home insurance rates that are cheaper than the state average. It also has policy offerings tailored to active-duty and veteran military members. Both USAA’s claims satisfaction and complaint index rating are excellent.

Best complaint index rating: Shelter

Annual rate: $2,870

![]()

Pros

Excellent complaint rating

Below-average home insurance premium

Good discounts

Cons

No 24/7 customer service

No J.D. Power rating

Shelter has a National Association of Insurance Commissioners (NAIC) Complaint Index rating of 0.31, the best complaint rating of the homeowners insurance companies we surveyed in Missouri.

Cost of homeowners insurance in Missouri

The average cost of homeowners insurance in Missouri is $3,387 a year. This is 21% higher than the national average home insurance rate of $2,801.

There are a few different reasons for Missouri’s high home insurance rates. The state’s high flood risk combined with frequent tornadoes and earthquakes all increase the risk of homeowners filing claims. Companies raise rates to offset costs when a claim is filed.

Other factors that affect your final home insurance quote include:

- Age of your home

- ZIP code

- Construction materials used

- Your claim history

Home insurance companies consider these factors differently when calculating your quote. For example, one company may think your neighborhood is more of a risk than another company, and that could raise your rate.

To get the best combination of cost and coverage, compare home insurance quotes from several different companies online before buying a policy.

Missouri home insurance rates by city

Of the most populated cities in Missouri, O’Fallon has an affordable average home insurance rate at $2,894 a year. Joplin has one of the highest average rates at $3,978 a year.

Average cost of home insurance by city

| City |

Average annual rate

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

|

|---|---|

| Adrian | $3,915 |

| Advance | $3,212 |

| Affton | $2,861 |

| Agency | $3,786 |

| Airport Drive | $3,983 |

| Alba | $3,936 |

| Albany | $3,604 |

| Aldrich | $3,643 |

| Alexandria | $3,148 |

| Allendale | $3,565 |

| Alma | $3,371 |

| Altamont | $3,382 |

| Altenburg | $3,452 |

| Alton | $3,460 |

| Amazonia | $3,647 |

| Amity | $3,686 |

| Amoret | $3,828 |

| Amsterdam | $3,941 |

| Anabel | $3,198 |

| Anderson | $4,159 |

| Annada | $3,160 |

| Annapolis | $3,370 |

| Anniston | $3,294 |

| Appleton City | $3,651 |

| Arbela | $3,255 |

| Arbyrd | $3,422 |

| Arcadia | $3,346 |

| Archie | $3,896 |

| Arcola | $3,575 |

| Argyle | $3,113 |

| Armstrong | $3,269 |

| Arnold | $2,964 |

| Arrow Rock | $3,371 |

| Asbury | $3,921 |

| Ash Grove | $3,629 |

| Ashburn | $3,175 |

| Ashland | $3,202 |

| Atlanta | $3,211 |

| Augusta | $2,923 |

| Aurora | $3,694 |

| Auxvasse | $3,113 |

| Ava | $3,505 |

| Avilla | $3,625 |

| Bakersfield | $3,443 |

| Ballwin | $2,943 |

| Baring | $3,197 |

| Barnard | $3,535 |

| Barnett | $3,409 |

| Barnhart | $3,079 |

| Bates City | $3,424 |

| Battlefield | $3,566 |

| Beaufort | $3,100 |

| Bel-Nor | $3,176 |

| Bel-Ridge | $3,161 |

| Belgrade | $3,343 |

| Bell City | $3,249 |

| Bella Villa | $2,923 |

| Belle | $3,184 |

| Bellefontaine Neighbors | $3,095 |

| Bellerive | $3,190 |

| Belleview | $3,368 |

| Bellflower | $3,188 |

| Belton | $3,825 |

| Benton | $3,230 |

| Benton City | $3,105 |

| Berger | $3,075 |

| Berkeley | $3,145 |

| Bernie | $3,335 |

| Bertrand | $3,254 |

| Bethany | $3,347 |

| Bethel | $3,278 |

| Beulah | $3,216 |

| Beverly Hills | $3,216 |

| Bevier | $3,227 |

| Billings | $3,805 |

| Birch Tree | $3,423 |

| Bismarck | $3,296 |

| Bixby | $3,379 |

| Black | $3,376 |

| Black Jack | $2,957 |

| Blackburn | $3,403 |

| Blackwater | $3,291 |

| Blackwell | $3,226 |

| Blairstown | $3,466 |

| Bland | $3,088 |

| Blodgett | $3,246 |

| Bloomfield | $3,289 |

| Bloomsdale | $3,145 |

| Blue Eye | $3,721 |

| Blue Springs | $3,633 |

| Blythedale | $3,284 |

| Bogard | $3,462 |

| Bois D Arc | $3,566 |

| Bolckow | $3,592 |

| Bolivar | $3,630 |

| Bonne Terre | $3,206 |

| Bonnots Mill | $3,136 |

| Boonville | $3,267 |

| Boss | $3,376 |

| Bosworth | $3,452 |

| Bourbon | $3,231 |

| Bowling Green | $3,140 |

| Bradleyville | $3,505 |

| Bragg City | $3,549 |

| Brandsville | $3,387 |

| Branson | $3,731 |

| Branson West | $3,728 |

| Brashear | $3,171 |

| Braymer | $3,375 |

| Brazeau | $3,249 |

| Breckenridge | $3,383 |

| Breckenridge Hills | $3,090 |

| Brentwood | $2,958 |

| Briar | $3,334 |

| Bridgeton | $3,033 |

| Brighton | $3,569 |

| Brinktown | $3,206 |

| Brixey | $3,387 |

| Bronaugh | $3,986 |

| Brookfield | $3,327 |

| Brookline | $3,542 |

| Broseley | $3,311 |

| Browning | $3,338 |

| Brownwood | $3,443 |

| Brumley | $3,381 |

| Bruner | $3,633 |

| Brunswick | $3,295 |

| Bucklin | $3,341 |

| Buckner | $3,670 |

| Bucyrus | $3,457 |

| Buffalo | $3,699 |

| Bunceton | $3,290 |

| Bunker | $3,452 |

| Burfordville | $3,421 |

| Burlington Junction | $3,534 |

| Butler | $3,676 |

| Byrnes Mill | $3,067 |

| Cabool | $3,530 |

| Cadet | $3,273 |

| Cainsville | $3,284 |

| Cairo | $3,254 |

| Caledonia | $3,354 |

| Calhoun | $3,465 |

| California | $3,327 |

| Callao | $3,219 |

| Calverton Park | $3,141 |

| Camden | $3,609 |

| Camden Point | $3,735 |

| Camdenton | $3,434 |

| Cameron | $3,426 |

| Campbell | $3,361 |

| Canalou | $3,473 |

| Canton | $3,162 |

| Cape Fair | $3,824 |

| Cape Girardeau | $3,246 |

| Caplinger Mills | $3,399 |

| Cardwell | $3,407 |

| Carl Junction | $3,962 |

| Carrollton | $3,307 |

| Carterville | $3,956 |

| Carthage | $3,670 |

| Caruthersville | $3,454 |

| Carytown | $3,672 |

| Cascade | $3,302 |

| Cassville | $3,631 |

| Castle Point | $3,191 |

| Catawissa | $3,034 |

| Catron | $3,297 |

| Caulfield | $3,433 |

| Cedar Hill | $3,102 |

| Cedar Hill Lakes | $3,102 |

| Cedarcreek | $3,560 |

| Center | $3,187 |

| Centertown | $3,311 |

| Centerview | $3,440 |

| Centerville | $3,443 |

| Centralia | $3,144 |

| Chadwick | $3,703 |

| Chaffee | $3,282 |

| Chamois | $3,111 |

| Charlack | $3,090 |

| Charleston | $3,244 |

| Cherryville | $3,312 |

| Chesterfield | $2,941 |

| Chestnutridge | $3,668 |

| Chilhowee | $3,461 |

| Chillicothe | $3,253 |

| Chula | $3,369 |

| Clarence | $3,217 |

| Clark | $3,292 |

| Clarksburg | $3,336 |

| Clarksdale | $3,697 |

| Clarkson Valley | $2,939 |

| Clarksville | $3,181 |

| Clarkton | $3,391 |

| Claycomo | $3,726 |

| Clayton | $3,137 |

| Clearmont | $3,652 |

| Cleveland | $3,816 |

| Clever | $3,727 |

| Clifton Hill | $3,248 |

| Climax Springs | $3,440 |

| Clinton | $3,512 |

| Clubb | $3,294 |

| Clyde | $3,528 |

| Coatsville | $3,291 |

| Coffey | $3,190 |

| Cole Camp | $3,410 |

| Collins | $3,709 |

| Columbia | $3,154 |

| Commerce | $3,474 |

| Conception | $3,528 |

| Conception Junction | $3,614 |

| Concord | $2,895 |

| Concordia | $3,359 |

| Conway | $3,420 |

| Cook Sta | $3,273 |

| Cool Valley | $3,199 |

| Cooter | $3,375 |

| Corder | $3,383 |

| Cosby | $3,706 |

| Cottleville | $3,008 |

| Couch | $3,456 |

| Country Club | $3,660 |

| Country Club Hills | $3,212 |

| Cowgill | $3,374 |

| Craig | $3,690 |

| Crane | $3,749 |

| Creighton | $3,540 |

| Crestwood | $2,892 |

| Creve Coeur | $2,936 |

| Crocker | $3,416 |

| Cross Timbers | $3,641 |

| Crystal City | $3,194 |

| Crystal Lakes | $3,721 |

| Cuba | $3,214 |

| Curryville | $3,140 |

| Dadeville | $3,673 |

| Daisy | $3,452 |

| Dalton | $3,241 |

| Dardenne Prairie | $2,854 |

| Darlington | $3,505 |

| Davisville | $3,382 |

| Dawn | $3,269 |

| De Kalb | $3,786 |

| De Soto | $3,292 |

| De Witt | $3,314 |

| Dearborn | $3,826 |

| Deepwater | $3,616 |

| Deerfield | $3,881 |

| Deering | $3,309 |

| Defiance | $2,978 |

| Dellwood | $3,189 |

| Delta | $3,231 |

| Denver | $3,555 |

| Des Arc | $3,211 |

| Des Peres | $2,914 |

| Desloge | $3,188 |

| Devils Elbow | $3,244 |

| Dexter | $3,297 |

| Diamond | $3,830 |

| Dittmer | $3,248 |

| Dixon | $3,299 |

| Doe Run | $3,286 |

| Doniphan | $3,386 |

| Dora | $3,430 |

| Dover | $3,376 |

| Downing | $3,265 |

| Drexel | $3,898 |

| Drury | $3,414 |

| Dudley | $3,318 |

| Duenweg | $3,987 |

| Duke | $3,238 |

| Dunnegan | $3,787 |

| Duquesne | $3,954 |

| Durham | $3,232 |

| Dutchtown | $3,231 |

| Dutzow | $3,105 |

| Eagle Rock | $3,700 |

| Eagleville | $3,356 |

| Earth City | $3,073 |

| East Lynne | $3,818 |

| East Prairie | $3,271 |

| Easton | $3,697 |

| Edgar Springs | $3,276 |

| Edgerton | $3,765 |

| Edina | $3,194 |

| Edmundson | $3,127 |

| Edwards | $3,477 |

| El Dorado Springs | $3,719 |

| Eldon | $3,354 |

| Eldridge | $3,483 |

| Elk Creek | $3,462 |

| Elkland | $3,649 |

| Ellington | $3,445 |

| Ellisville | $2,942 |

| Ellsinore | $3,416 |

| Elmer | $3,210 |

| Elmo | $3,514 |

| Elsberry | $3,187 |

| Emden | $3,225 |

| Eminence | $3,420 |

| Emma | $3,406 |

| Eolia | $3,170 |

| Essex | $3,274 |

| Ethel | $3,210 |

| Eugene | $3,279 |

| Eunice | $3,368 |

| Eureka | $3,000 |

| Everton | $3,587 |

| Ewing | $3,224 |

| Excello | $3,211 |

| Excelsior Springs | $3,704 |

| Exeter | $3,732 |

| Fagus | $3,307 |

| Fair Grove | $3,578 |

| Fair Play | $3,706 |

| Fairdealing | $3,429 |

| Fairfax | $3,665 |

| Fairview | $3,678 |

| Falcon | $3,323 |

| Farber | $3,169 |

| Farley | $3,676 |

| Farmington | $3,215 |

| Farrar | $3,199 |

| Faucett | $3,816 |

| Fayette | $3,260 |

| Fenton | $2,926 |

| Ferguson | $3,161 |

| Ferrelview | $3,741 |

| Festus | $3,236 |

| Fillmore | $3,664 |

| Fisk | $3,348 |

| Flemington | $3,739 |

| Fletcher | $3,258 |

| Flinthill | $2,977 |

| Flordell Hills | $3,215 |

| Florence | $3,368 |

| Florissant | $2,960 |

| Foley | $3,177 |

| Fordland | $3,691 |

| Forest City | $3,584 |

| Foristell | $2,917 |

| Forsyth | $3,627 |

| Fort Leonard Wood | $3,314 |

| Fortuna | $3,288 |

| Foster | $3,828 |

| Frankford | $3,158 |

| Franklin | $3,241 |

| Fredericktown | $3,316 |

| Freeburg | $3,118 |

| Freeman | $3,847 |

| Freistatt | $3,580 |

| Fremont | $3,324 |

| Fremont Hills | $3,656 |

| French Village | $3,159 |

| Friedheim | $3,163 |

| Frohna | $3,184 |

| Frontenac | $2,922 |

| Fulton | $3,087 |

| Gainesville | $3,463 |

| Galena | $3,752 |

| Gallatin | $3,366 |

| Galt | $3,338 |

| Garden City | $3,636 |

| Garrison | $3,513 |

| Gatewood | $3,369 |

| Gentry | $3,538 |

| Gerald | $3,111 |

| Gibbs | $3,163 |

| Gibson | $3,255 |

| Gideon | $3,407 |

| Gilliam | $3,350 |

| Gilman City | $3,231 |

| Gipsy | $3,283 |

| Gladstone | $3,655 |

| Glasgow | $3,283 |

| Glasgow Village | $3,093 |

| Glen Echo Park | $3,202 |

| Glenallen | $3,222 |

| Glencoe | $2,973 |

| Glendale | $2,903 |

| Glenwood | $3,216 |

| Gobler | $3,384 |

| Golden | $3,800 |

| Golden City | $3,678 |

| Goodman | $4,159 |

| Gordonville | $3,191 |

| Gorin | $3,218 |

| Gower | $3,780 |

| Graff | $3,441 |

| Graham | $3,501 |

| Grain Valley | $3,652 |

| Granby | $3,876 |

| Grandin | $3,378 |

| Grandview | $3,894 |

| Granger | $3,210 |

| Grant City | $3,637 |

| Grantwood Village | $2,861 |

| Gravois Mills | $3,388 |

| Gray Summit | $2,997 |

| Grayridge | $3,227 |

| Green Castle | $3,278 |

| Green City | $3,309 |

| Green Park | $2,852 |

| Green Ridge | $3,406 |

| Greenfield | $3,680 |

| Greentop | $3,210 |

| Greenville | $3,355 |

| Greenwood | $3,762 |

| Grovespring | $3,503 |

| Grubville | $3,121 |

| Guilford | $3,503 |

| Hale | $3,313 |

| Half Way | $3,706 |

| Hallsville | $3,210 |

| Halltown | $3,587 |

| Hamilton | $3,350 |

| Hanley Hills | $3,110 |

| Hannibal | $3,124 |

| Hardenville | $3,419 |

| Hardin | $3,388 |

| Harris | $3,411 |

| Harrisburg | $3,237 |

| Harrisonville | $3,837 |

| Hartsburg | $3,132 |

| Hartshorn | $3,367 |

| Hartville | $3,504 |

| Harviell | $3,294 |

| Harwood | $3,718 |

| Hatfield | $3,526 |

| Hawk Point | $3,049 |

| Hayti | $3,470 |

| Hazelwood | $3,011 |

| Helena | $3,620 |

| Hematite | $3,231 |

| Henley | $3,233 |

| Henrietta | $3,657 |

| Herculaneum | $3,177 |

| Hermann | $3,047 |

| Hermitage | $3,731 |

| Higbee | $3,259 |

| Higginsville | $3,381 |

| High Hill | $3,201 |

| High Point | $3,181 |

| High Ridge | $3,000 |

| Highlandville | $3,682 |

| Hillsboro | $3,250 |

| Hillsdale | $3,217 |

| Holcomb | $3,545 |

| Holden | $3,467 |

| Holliday | $3,165 |

| Hollister | $3,637 |

| Holt | $3,739 |

| Holts Summit | $3,020 |

| Hopkins | $3,640 |

| Hornersville | $3,370 |

| House Springs | $3,086 |

| Houston | $3,459 |

| Houstonia | $3,351 |

| Huggins | $3,367 |

| Hughesville | $3,373 |

| Humansville | $3,775 |

| Hume | $3,828 |

| Humphreys | $3,352 |

| Hunnewell | $3,225 |

| Huntleigh | $2,914 |

| Huntsville | $3,264 |

| Hurdland | $3,159 |

| Iberia | $3,348 |

| Imperial | $3,052 |

| Independence | $3,685 |

| Innsbrook | $3,037 |

| Ionia | $3,340 |

| Iron Mountain Lake | $3,293 |

| Irondale | $3,303 |

| Ironton | $3,308 |

| Isabella | $3,469 |

| Jackson | $3,424 |

| Jacksonville | $3,255 |

| Jadwin | $3,352 |

| Jameson | $3,297 |

| Jamesport | $3,347 |

| Jamestown | $3,267 |

| Jasper | $3,701 |

| Jefferson City | $3,024 |

| Jennings | $3,204 |

| Jerico Springs | $3,722 |

| Jerome | $3,181 |

| Jonesburg | $3,187 |

| Joplin | $3,978 |

| Josephville | $2,933 |

| Kahoka | $3,204 |

| Kaiser | $3,377 |

| Kansas City | $3,832 |

| Kearney | $3,718 |

| Kennett | $3,534 |

| Kewanee | $3,284 |

| Keytesville | $3,292 |

| Kidder | $3,383 |

| Kimberling City | $3,745 |

| Kimmswick | $3,138 |

| King City | $3,590 |

| Kingdom City | $3,116 |

| Kingston | $3,366 |

| Kingsville | $3,713 |

| Kirbyville | $3,634 |

| Kirksville | $3,107 |

| Kirkwood | $2,912 |

| Kissee Mills | $3,681 |

| Knob Lick | $3,297 |

| Knob Noster | $3,395 |

| Knox City | $3,172 |

| Koeltztown | $3,113 |

| Koshkonong | $3,399 |

| La Belle | $3,177 |

| La Grange | $3,205 |

| La Monte | $3,398 |

| La Plata | $3,208 |

| La Russell | $3,629 |

| Labadie | $3,045 |

| LaBarque Creek | $3,000 |

| Laclede | $3,229 |

| Laddonia | $3,151 |

| Ladue | $2,965 |

| Lake Lotawana | $3,694 |

| Lake Ozark | $3,400 |

| Lake Spring | $3,351 |

| Lake St. Louis | $2,912 |

| Lake Tapawingo | $3,692 |

| Lake Waukomis | $3,637 |

| Lake Winnebago | $3,743 |

| Lakeshire | $2,856 |

| Lamar | $3,625 |

| Lampe | $3,737 |

| Lanagan | $4,154 |

| Lancaster | $3,268 |

| Laquey | $3,378 |

| Laredo | $3,379 |

| Latham | $3,252 |

| Lathrop | $3,738 |

| Laurie | $3,310 |

| Lawson | $3,729 |

| Lead Hill | $3,554 |

| Leadwood | $3,220 |

| Leasburg | $3,282 |

| Leawood | $4,037 |

| Lebanon | $3,372 |

| Lee's Summit | $3,707 |

| Leeton | $3,477 |

| Lemay | $2,891 |

| Lenox | $3,332 |

| Lentner | $3,227 |

| Leonard | $3,247 |

| Leopold | $3,226 |

| Leslie | $3,066 |

| Lesterville | $3,431 |

| Levasy | $3,725 |

| Lewistown | $3,145 |

| Lexington | $3,403 |

| Liberal | $3,970 |

| Liberty | $3,659 |

| Licking | $3,468 |

| Liguori | $3,097 |

| Lilbourn | $3,359 |

| Lincoln | $3,410 |

| Linn | $3,158 |

| Linn Creek | $3,448 |

| Linneus | $3,238 |

| Livonia | $3,299 |

| Loch Lloyd | $3,825 |

| Lock Springs | $3,298 |

| Lockwood | $3,686 |

| Lodi | $3,203 |

| Lohman | $3,138 |

| Lone Jack | $3,616 |

| Lonedell | $3,057 |

| Long Lane | $3,562 |

| Loose Creek | $3,137 |

| Louisburg | $3,728 |

| Louisiana | $3,158 |

| Lowndes | $3,343 |

| Lowry City | $3,750 |

| Lucerne | $3,366 |

| Ludlow | $3,228 |

| Luebbering | $3,074 |

| Luray | $3,188 |

| Lynchburg | $3,394 |

| Macks Creek | $3,533 |

| Macomb | $3,597 |

| Macon | $3,198 |

| Madison | $3,149 |

| Maitland | $3,684 |

| Malden | $3,362 |

| Malta Bend | $3,362 |

| Manchester | $2,939 |

| Mansfield | $3,570 |

| Mapaville | $3,216 |

| Maplewood | $3,013 |

| Marble Hill | $3,208 |

| Marceline | $3,362 |

| Marionville | $3,692 |

| Marlborough | $2,854 |

| Marquand | $3,306 |

| Marshall | $3,344 |

| Marshfield | $3,513 |

| Marston | $3,362 |

| Marthasville | $3,078 |

| Martinsburg | $3,165 |

| Martinsville | $3,526 |

| Maryland Heights | $2,943 |

| Maryville | $3,597 |

| Matthews | $3,322 |

| Maysville | $3,680 |

| Mayview | $3,431 |

| Maywood | $3,207 |

| Mc Bride | $3,199 |

| Mc Fall | $3,554 |

| Mc Gee | $3,285 |

| Mc Girk | $3,265 |

| Meadville | $3,286 |

| Mehlville | $2,948 |

| Memphis | $3,243 |

| Mendon | $3,265 |

| Mercer | $3,210 |

| Merriam Woods | $3,637 |

| Meta | $3,101 |

| Mexico | $3,102 |

| Miami | $3,342 |

| Middle Brook | $3,293 |

| Middletown | $3,193 |

| Milan | $3,381 |

| Milford | $3,765 |

| Mill Spring | $3,358 |

| Miller | $3,764 |

| Millersville | $3,162 |

| Milo | $3,539 |

| Mindenmines | $3,855 |

| Miner | $3,278 |

| Mineral Point | $3,276 |

| Missouri City | $3,601 |

| Moberly | $3,245 |

| Mokane | $3,141 |

| Moline Acres | $3,191 |

| Monett | $3,710 |

| Monroe City | $3,183 |

| Montgomery City | $3,061 |

| Monticello | $3,161 |

| Montier | $3,333 |

| Montreal | $3,383 |

| Montrose | $3,586 |

| Moody | $3,383 |

| Mooresville | $3,278 |

| Mora | $3,347 |

| Morehouse | $3,318 |

| Morrison | $3,049 |

| Morrisville | $3,636 |

| Morse Mill | $3,216 |

| Mosby | $3,658 |

| Moscow Mills | $2,993 |

| Mound City | $3,688 |

| Moundville | $3,999 |

| Mount Sterling | $3,088 |

| Mount Vernon | $3,751 |

| Mountain Grove | $3,567 |

| Mountain View | $3,362 |

| Murphy | $2,968 |

| Myrtle | $3,398 |

| Napoleon | $3,416 |

| Naylor | $3,411 |

| Neck City | $3,666 |

| Neelyville | $3,349 |

| Nelson | $3,329 |

| Neosho | $3,788 |

| Nevada | $3,926 |

| New Bloomfield | $3,103 |

| New Boston | $3,322 |

| New Cambria | $3,238 |

| New Florence | $3,025 |

| New Franklin | $3,219 |

| New Hampton | $3,525 |

| New Haven | $3,106 |

| New London | $3,142 |

| New Madrid | $3,354 |

| New Melle | $2,955 |

| Newark | $3,169 |

| Newburg | $3,199 |

| Newtown | $3,352 |

| Niangua | $3,529 |

| Nixa | $3,672 |

| Noble | $3,396 |

| Noel | $4,144 |

| Norborne | $3,317 |

| Normandy | $3,208 |

| North Kansas City | $3,698 |

| Northwoods | $3,233 |

| Norwood | $3,572 |

| Norwood Court | $3,207 |

| Novelty | $3,226 |

| Novinger | $3,284 |

| O Fallon | $2,894 |

| O'Fallon | $2,899 |

| Oak Grove | $3,594 |

| Oak Grove Village | $3,107 |

| Oak Ridge | $3,436 |

| Oakland | $2,895 |

| Oakville | $2,959 |

| Odessa | $3,412 |

| Old Appleton | $3,197 |

| Old Jamestown | $2,986 |

| Old Monroe | $3,022 |

| Oldfield | $3,471 |

| Olean | $3,270 |

| Olivette | $3,024 |

| Olney | $3,205 |

| Oran | $3,233 |

| Oregon | $3,685 |

| Oronogo | $4,006 |

| Orrick | $3,726 |

| Osage Beach | $3,419 |

| Osborn | $3,683 |

| Osceola | $3,709 |

| Otterville | $3,307 |

| Overland | $3,080 |

| Owensville | $3,115 |

| Oxly | $3,405 |

| Ozark | $3,677 |

| Pacific | $2,975 |

| Pagedale | $3,144 |

| Palmyra | $3,150 |

| Paris | $3,148 |

| Park Hills | $3,187 |

| Parkville | $3,676 |

| Parkway | $3,070 |

| Parma | $3,398 |

| Parnell | $3,551 |

| Pasadena Park | $3,208 |

| Patterson | $3,296 |

| Patton | $3,250 |

| Pattonsburg | $3,669 |

| Peace Valley | $3,396 |

| Peculiar | $3,734 |

| Perkins | $3,199 |

| Perry | $3,156 |

| Perryville | $3,206 |

| Pevely | $3,220 |

| Philadelphia | $3,203 |

| Phillipsburg | $3,590 |

| Pickering | $3,642 |

| Piedmont | $3,326 |

| Pierce City | $3,719 |

| Pilot Grove | $3,306 |

| Pilot Knob | $3,272 |

| Pine Lawn | $3,255 |

| Pineville | $4,149 |

| Pittsburg | $3,736 |

| Plato | $3,434 |

| Platte City | $3,745 |

| Plattsburg | $3,776 |

| Pleasant Hill | $3,724 |

| Pleasant Hope | $3,596 |

| Pleasant Valley | $3,647 |

| Plevna | $3,198 |

| Pocahontas | $3,274 |

| Point Lookout | $3,533 |

| Polk | $3,606 |

| Pollock | $3,302 |

| Polo | $3,424 |

| Pomona | $3,402 |

| Ponce De Leon | $3,640 |

| Pontiac | $3,396 |

| Poplar Bluff | $3,327 |

| Portage Des Sioux | $3,205 |

| Portageville | $3,364 |

| Portland | $3,003 |

| Potosi | $3,286 |

| Pottersville | $3,425 |

| Powell | $3,664 |

| Powersite | $3,673 |

| Powersville | $3,366 |

| Prairie Home | $3,265 |

| Preston | $3,745 |

| Princeton | $3,237 |

| Protem | $3,707 |

| Purcell | $3,711 |

| Purdin | $3,322 |

| Purdy | $3,713 |

| Puxico | $3,298 |

| Queen City | $3,223 |

| Quincy | $3,613 |

| Qulin | $3,377 |

| Racine | $3,704 |

| Ravenwood | $3,622 |

| Raymondville | $3,447 |

| Raymore | $3,658 |

| Raytown | $3,772 |

| Rayville | $3,501 |

| Rea | $3,673 |

| Redford | $3,394 |

| Redings Mill | $4,042 |

| Reeds | $3,755 |

| Reeds Spring | $3,723 |

| Renick | $3,298 |

| Republic | $3,600 |

| Revere | $3,148 |

| Reynolds | $3,394 |

| Rhineland | $3,081 |

| Rich Hill | $3,705 |

| Richards | $3,829 |

| Richland | $3,390 |

| Richmond | $3,655 |

| Richmond Heights | $3,141 |

| Richwoods | $3,241 |

| Ridgedale | $3,690 |

| Ridgeway | $3,338 |

| Risco | $3,303 |

| Riverside | $3,624 |

| Riverview | $3,100 |

| Rives | $3,316 |

| Roach | $3,427 |

| Robertsville | $3,057 |

| Roby | $3,357 |

| Rocheport | $3,206 |

| Rock Hill | $2,948 |

| Rock Port | $3,667 |

| Rockaway Beach | $3,636 |

| Rockbridge | $3,429 |

| Rockville | $3,592 |

| Rocky Comfort | $3,794 |

| Rocky Mount | $3,324 |

| Rogersville | $3,584 |

| Rolla | $3,183 |

| Rombauer | $3,322 |

| Rosebud | $3,102 |

| Rosendale | $3,701 |

| Rothville | $3,342 |

| Rueter | $3,588 |

| Rush Hill | $3,133 |

| Rushville | $3,777 |

| Russellville | $3,180 |

| Rutledge | $3,228 |

| Saginaw | $3,974 |

| Salem | $3,395 |

| Salisbury | $3,286 |

| Santa Fe | $3,159 |

| Sappington | $2,919 |

| Sarcoxie | $3,780 |

| Savannah | $3,683 |

| Schell City | $3,614 |

| Scott City | $3,285 |

| Sedalia | $3,372 |

| Sedgewickville | $3,202 |

| Seligman | $3,649 |

| Senath | $3,425 |

| Seneca | $4,076 |

| Seymour | $3,709 |

| Shelbina | $3,215 |

| Shelbyville | $3,311 |

| Sheldon | $3,648 |

| Shell Knob | $3,817 |

| Sheridan | $3,630 |

| Shrewsbury | $2,931 |

| Sibley | $3,685 |

| Sikeston | $3,268 |

| Silex | $3,178 |

| Silva | $3,241 |

| Silver Creek | $4,028 |

| Skidmore | $3,613 |

| Slater | $3,334 |

| Smithton | $3,419 |

| Smithville | $3,757 |

| Solo | $3,351 |

| South Greenfield | $3,679 |

| South West City | $4,131 |

| Spanish Lake | $3,074 |

| Sparta | $3,682 |

| Spickard | $3,397 |

| Spokane | $3,724 |

| Springfield | $3,522 |

| Squires | $3,401 |

| St. Albans | $3,054 |

| St. Ann | $3,086 |

| St. Charles | $2,958 |

| St. Clair | $3,071 |

| St. Elizabeth | $3,286 |

| St. George | $2,859 |

| St. James | $3,197 |

| St. John | $3,100 |

| St. Joseph | $3,712 |

| St. Louis | $3,189 |

| St. Martins | $3,046 |

| St. Mary | $3,240 |

| St. Patrick | $3,148 |

| St. Peters | $2,977 |

| St. Robert | $3,220 |

| St. Thomas | $3,058 |

| Stanberry | $3,612 |

| Stanton | $3,126 |

| Stark City | $3,889 |

| Ste. Genevieve | $3,206 |

| Steedman | $3,133 |

| Steele | $3,926 |

| Steelville | $3,308 |

| Stella | $4,055 |

| Stet | $3,270 |

| Stewartsville | $3,695 |

| Stockton | $3,716 |

| Stotts City | $3,782 |

| Stoutland | $3,397 |

| Stoutsville | $3,156 |

| Stover | $3,418 |

| Strafford | $3,589 |

| Strasburg | $3,722 |

| Sturdivant | $3,268 |

| Sturgeon | $3,215 |

| Success | $3,359 |

| Sugar Creek | $3,779 |

| Sullivan | $3,130 |

| Summersville | $3,412 |

| Sumner | $3,224 |

| Sunrise Beach | $3,391 |

| Sunset Hills | $2,897 |

| Sweet Springs | $3,380 |

| Sycamore Hills | $3,085 |

| Syracuse | $3,356 |

| Tallapoosa | $3,868 |

| Taneyville | $3,632 |

| Taos | $3,006 |

| Tarkio | $3,648 |

| Taylor | $3,170 |

| Tebbetts | $3,124 |

| Tecumseh | $3,449 |

| Terre du Lac | $3,212 |

| Thayer | $3,442 |

| Theodosia | $3,452 |

| Thompson | $3,135 |

| Thornfield | $3,491 |

| Tiff | $3,256 |

| Tiff City | $4,012 |

| Tina | $3,335 |

| Tipton | $3,278 |

| Town and Country | $2,945 |

| Treloar | $3,108 |

| Trenton | $3,242 |

| Trimble | $3,764 |

| Triplett | $3,272 |

| Troy | $3,013 |

| Truesdale | $3,102 |

| Truxton | $3,246 |

| Tunas | $3,693 |

| Turners | $3,564 |

| Turney | $3,644 |

| Tuscumbia | $3,379 |

| Udall | $3,382 |

| Ulman | $3,318 |

| Union | $3,040 |

| Union Star | $3,650 |

| Uniontown | $3,184 |

| Unionville | $3,359 |

| University City | $3,094 |

| Urbana | $3,748 |

| Urich | $3,568 |

| Utica | $3,228 |

| Valles Mines | $3,155 |

| Valley Park | $2,949 |

| Van Buren | $3,417 |

| Vandalia | $3,132 |

| Vanduser | $3,202 |

| Vanzant | $3,527 |

| Velda City | $3,217 |

| Velda Village Hills | $3,217 |

| Verona | $3,724 |

| Versailles | $3,437 |

| Viburnum | $3,300 |

| Vichy | $3,231 |

| Vienna | $3,232 |

| Villa Ridge | $3,009 |

| Village of Four Seasons | $3,404 |

| Vinita Park | $3,086 |

| Vulcan | $3,298 |

| Waldron | $3,600 |

| Walker | $3,691 |

| Walnut Grove | $3,680 |

| Walnut Shade | $3,632 |

| Wappapello | $3,356 |

| Wardell | $3,290 |

| Warrensburg | $3,380 |

| Warrenton | $3,063 |

| Warsaw | $3,443 |

| Warson Woods | $2,899 |

| Washburn | $3,760 |

| Washington | $3,010 |

| Wasola | $3,485 |

| Watson | $3,566 |

| Waverly | $3,386 |

| Wayland | $3,147 |

| Waynesville | $3,381 |

| Weatherby | $3,346 |

| Weatherby Lake | $3,664 |

| Weaubleau | $3,700 |

| Webb City | $3,971 |

| Webster Groves | $2,932 |

| Weldon Spring | $2,898 |

| Wellington | $3,418 |

| Wellston | $3,161 |

| Wellsville | $3,180 |

| Wentworth | $3,757 |

| Wentzville | $2,941 |

| Wesco | $3,296 |

| West Alton | $3,023 |

| West Plains | $3,431 |

| Westboro | $3,549 |

| Weston | $3,750 |

| Westphalia | $3,156 |

| Westwood | $2,914 |

| Wheatland | $3,729 |

| Wheaton | $3,701 |

| Wheeling | $3,369 |

| Whiteman AFB | $3,423 |

| Whiteoak | $3,263 |

| Whiteside | $3,302 |

| Whitewater | $3,185 |

| Wildwood | $2,956 |

| Willard | $3,574 |

| Williamsburg | $3,137 |

| Williamstown | $3,145 |

| Williamsville | $3,360 |

| Willow Springs | $3,397 |

| Winchester | $2,945 |

| Windsor | $3,423 |

| Windyville | $3,615 |

| Winfield | $3,028 |

| Winigan | $3,326 |

| Winona | $3,420 |

| Winston | $3,256 |

| Wolf Island | $3,248 |

| Woodson Terrace | $3,115 |

| Wooldridge | $3,265 |

| Worth | $3,553 |

| Worthington | $3,239 |

| Wright City | $3,033 |

| Wyaconda | $3,211 |

| Wyatt | $3,248 |

| Yukon | $3,340 |

| Zalma | $3,310 |

| Zanoni | $3,383 |

Methodology

The rates shown in this article are based on nonbinding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in Missouri.

The following coverages and deductible were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

*USAA is only available to active-duty and veteran military members and their families.