Best Homeowners Insurance in New Hampshire

Best cheap home insurance in New Hampshire

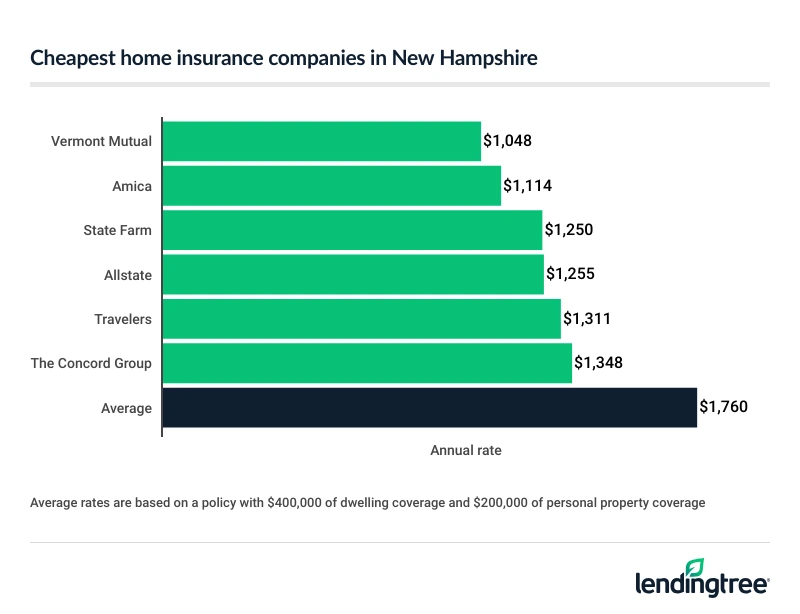

Cheapest home insurance in New Hampshire

Amica is a close second, with rates of around $93 a month. Allstate and State Farm are a bit more expensive, but both companies offer several discounts that could make it cheaper for you.

New Hampshire’s cheapest home insurance companies

| Company | Annual rate | Monthly rate | LendingTree score | |

|---|---|---|---|---|

| Vermont Mutual | $1,048 | $87 | |

| Amica | $1,114 | $93 | |

| State Farm | $1,250 | $104 | |

| Allstate | $1,255 | $105 | |

| Travelers | $1,311 | $109 | |

| The Concord Group | $1,348 | $112 | |

| USAA* | $4,996 | $416 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. *USAA is only available to the military community.

With many of New Hampshire’s top home insurance companies offering similar rates, make sure you compare home insurance quotes from multiple companies before you buy or renew a policy.

Best homeowners insurance companies in New Hampshire

| Company | Best for | Annual rate | Customer satisfaction** | Complaint index*** |

|---|---|---|---|---|

| Vermont Mutual | Low rates | $1,048 | Not rated | 0.08 |

| Allstate | Coverages | $1,255 | 631 | 1.3 |

| The Concord Group | Discounts | $1,348 | Not rated | 0.25 |

| Amica | Customer service | $1,114 | 679 | 0.33 |

**Source: J.D. Power 2024 U.S. Home Insurance Study. Higher is better; 640 is average.

***Source: National Association of Insurance Commissioners (NAIC). Lower is better; 1.0 is average.

Best for low rates: Vermont Mutual

Annual rate: $1,048

![]()

Pros

Lowest rates in the state, on average

Best complaint rating of companies surveyed

Cons

Fewer discounts and coverage options than most other companies

No customer satisfaction rating

Can’t get quotes from company website

For the cheapest homeowners insurance in New Hampshire, get a quote from Vermont Mutual. Vermont Mutual’s average home insurance quote of $87 a month is the lowest in the state.

Best coverage options: Allstate

Annual rate: $1,255

![]()

Pros

Many optional coverages

Several discounts that can save you money

Average rate is well below state average

Cons

Customer satisfaction rating is worse than average

Complaint rating also worse than average

Allstate is the best homeowners insurance company in New Hampshire for coverage options. It offers more add-on coverages than any other company we surveyed in the state.

Allstate offers add-on coverages for:

- Water backup

- Sports equipment

- Green improvement reimbursement

- Identity theft restoration

Best discounts: The Concord Group

Annual rate: $1,348

![]()

Pros

Many discount and coverage options

Complaint rating is much better than average

Can get quotes, pay bills and file claims on website

Cons

Average rate is higher than most other companies

No customer satisfaction rating

The Concord Group has the best home insurance discounts among the companies we surveyed in New Hampshire.

You may get a discount from The Concord Group if you:

- Bundle home and auto insurance with the company

- Have certain protective devices in your home

- Own a home that was built less than 15 years ago

- Sign up for electronic document delivery

Best customer satisfaction: Amica

Annual rate: $1,114

![]()

Pros

Second-cheapest average rates in state

Excellent customer satisfaction rating

Complaint rating is much better than average

Cons

Not as many add-on coverages as some other companies

Fewer discounts than some competitors, too

New Hampshire homeowners who care about customer satisfaction and service should consider Amica for home insurance. Amica has by far the highest J.D. Power customer satisfaction rating of the companies we surveyed. Its score is also the third-highest in the U.S. overall.

How much is home insurance in New Hampshire?

What you pay for home insurance in New Hampshire is based on many factors, including where you live in the state, how old your home is and how much coverage you buy.

The dwelling limit you choose for your policy also plays a role. We found that homeowners with $450,000 of dwelling coverage pay around 18% more for home insurance than those who get $350,000 of coverage, for example.

Average home insurance rate by dwelling limit

| Dwelling limit | Annual rate | Monthly rate |

|---|---|---|

| $350,000 | 1,589 | $132 |

| $400,000 | 1,760 | $147 |

| $450,000 | 1,922 | $160 |

New Hampshire homeowners insurance rates by city

With rates that average $1,968 a year, or $164 a month, Hampton is the city with the most expensive home insurance in New Hampshire.

Homeowners in New Hampshire’s most expensive city for home insurance pay about 18% more than those in the state’s cheapest city.

Average home insurance rates in New Hampshire’s biggest cities:

- Manchester, $148 a month

- Nashua, $138 a month

- Concord, $150 a month

Home insurance rates near you

| City | Annual rate Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. | Monthly rate Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. |

|---|---|---|

| Alton Bay | $1,848 | $154 |

| Antrim | $1,745 | $145 |

| Ashland | $1,873 | $156 |

| Ashuelot | $1,671 | $139 |

| Barnstead | $1,798 | $150 |

| Belmont | $1,836 | $153 |

| Berlin | $1,706 | $142 |

| Bretton Woods | $1,712 | $143 |

| Bristol | $1,814 | $151 |

| Center Barnstead | $1,790 | $149 |

| Center Conway | $1,693 | $141 |

| Center Ossipee | $1,684 | $140 |

| Center Sandwich | $1,824 | $152 |

| Center Strafford | $1,695 | $141 |

| Center Tuftonboro | $1,816 | $151 |

| Charlestown | $1,776 | $148 |

| Chesterfield | $1,677 | $140 |

| Chocorua | $1,818 | $152 |

| Claremont | $1,737 | $145 |

| Colebrook | $1,710 | $143 |

| Concord | $1,800 | $150 |

| Contoocook | $1,793 | $149 |

| Conway | $1,766 | $147 |

| Cornish Flat | $1,736 | $145 |

| Derry | $1,724 | $144 |

| Dover | $1,732 | $144 |

| Drewsville | $1,755 | $146 |

| Durham | $1,731 | $144 |

| East Andover | $1,839 | $153 |

| East Candia | $1,665 | $139 |

| East Derry | $1,672 | $139 |

| East Hampstead | $1,721 | $143 |

| East Hebron | $1,800 | $150 |

| East Merrimack | $1,697 | $141 |

| East Wakefield | $1,733 | $144 |

| Eaton Center | $1,757 | $146 |

| Elkins | $1,805 | $150 |

| Enfield | $1,769 | $147 |

| Enfield Center | $1,763 | $147 |

| Epping | $1,761 | $147 |

| Etna | $1,745 | $145 |

| Exeter | $1,743 | $145 |

| Farmington | $1,813 | $151 |

| Franklin | $1,875 | $156 |

| Georges Mills | $1,741 | $145 |

| Gilmanton Iron Works | $1,801 | $150 |

| Glen | $1,759 | $147 |

| Glencliff | $1,760 | $147 |

| Goffstown | $1,822 | $152 |

| Greenville | $1,703 | $142 |

| Groveton | $1,705 | $142 |

| Guild | $1,729 | $144 |

| Hampton | $1,968 | $164 |

| Hampton Beach | $1,939 | $162 |

| Hanover | $1,728 | $144 |

| Haverhill | $1,686 | $141 |

| Hebron | $1,800 | $150 |

| Henniker | $1,781 | $148 |

| Hillsborough | $1,762 | $147 |

| Hooksett | $1,779 | $148 |

| Hudson | $1,612 | $134 |

| Intervale | $1,742 | $145 |

| Jaffrey | $1,674 | $140 |

| Kearsarge | $1,761 | $147 |

| Keene | $1,685 | $140 |

| Laconia | $1,829 | $152 |

| Lancaster | $1,705 | $142 |

| Lebanon | $1,749 | $146 |

| Lincoln | $1,829 | $152 |

| Lisbon | $1,755 | $146 |

| Littleton | $1,750 | $146 |

| Lochmere | $1,824 | $152 |

| Londonderry | $1,674 | $139 |

| Lyme Center | $1,705 | $142 |

| Manchester | $1,779 | $148 |

| Melvin Village | $1,807 | $151 |

| Meredith | $1,853 | $154 |

| Meriden | $1,734 | $145 |

| Milford | $1,708 | $142 |

| Milton Mills | $1,761 | $147 |

| Mirror Lake | $1,829 | $152 |

| Monroe | $1,730 | $144 |

| Mount Washington | $1,676 | $140 |

| Munsonville | $1,720 | $143 |

| Nashua | $1,661 | $138 |

| Nelson | $1,720 | $143 |

| Newmarket | $1,757 | $146 |

| Newport | $1,709 | $142 |

| Newton Junction | $1,666 | $139 |

| North Conway | $1,657 | $138 |

| North Haverhill | $1,702 | $142 |

| North Salem | $1,758 | $146 |

| North Sandwich | $1,849 | $154 |

| North Stratford | $1,690 | $141 |

| North Sutton | $1,858 | $155 |

| North Walpole | $1,775 | $148 |

| North Woodstock | $1,814 | $151 |

| Peterborough | $1,687 | $141 |

| Piermont | $1,737 | $145 |

| Pike | $1,686 | $140 |

| Pinardville | $1,812 | $151 |

| Plymouth | $1,809 | $151 |

| Portsmouth | $1,787 | $149 |

| Randolph | $1,725 | $144 |

| Raymond | $1,796 | $150 |

| Rochester | $1,793 | $149 |

| Rye Beach | $1,941 | $162 |

| Sanbornville | $1,749 | $146 |

| Seabrook Beach | $1,943 | $162 |

| Silver Lake | $1,761 | $147 |

| Somersworth | $1,792 | $149 |

| South Acworth | $1,702 | $142 |

| South Hooksett | $1,766 | $147 |

| South Newbury | $1,840 | $153 |

| South Sutton | $1,844 | $154 |

| South Tamworth | $1,814 | $151 |

| Spofford | $1,678 | $140 |

| Stinson Lake | $1,846 | $154 |

| Sugar Hill | $1,784 | $149 |

| Suncook | $1,759 | $147 |

| Tilton Northfield | $1,884 | $157 |

| Troy | $1,657 | $138 |

| Twin Mountain | $1,736 | $145 |

| Union | $1,761 | $147 |

| Waterville Valley | $1,823 | $152 |

| West Chesterfield | $1,676 | $140 |

| West Lebanon | $1,698 | $142 |

| West Nottingham | $1,759 | $147 |

| West Ossipee | $1,739 | $145 |

| West Peterborough | $1,682 | $140 |

| West Stewartstown | $1,701 | $142 |

| West Swanzey | $1,703 | $142 |

| Winchester | $1,646 | $137 |

| Winnisquam | $1,740 | $145 |

| Wolfeboro | $1,826 | $152 |

| Wolfeboro Falls | $1,827 | $152 |

| Wonalancet | $1,823 | $152 |

| Woodsville | $1,715 | $143 |

Frequently asked questions

New Hampshire state law doesn’t require you to buy home insurance. If you get a mortgage, though, your lender will probably make you buy it.

The average cost of homeowners insurance in New Hampshire is $147 a month, or $1,760 a year.

Vermont Mutual has the cheapest home insurance in New Hampshire at $87 a month, or $1,048 a year.