Best Homeowners Insurance in New Jersey

If you’re looking for homeowners insurance in N.J., you’ll probably find the best combination of cost, coverage and customer satisfaction at NJM (New Jersey Manufacturers). However, Allstate is actually cheaper, at an annual average rate of $1,028.

Best cheap home insurance companies in New Jersey

Savings Tips

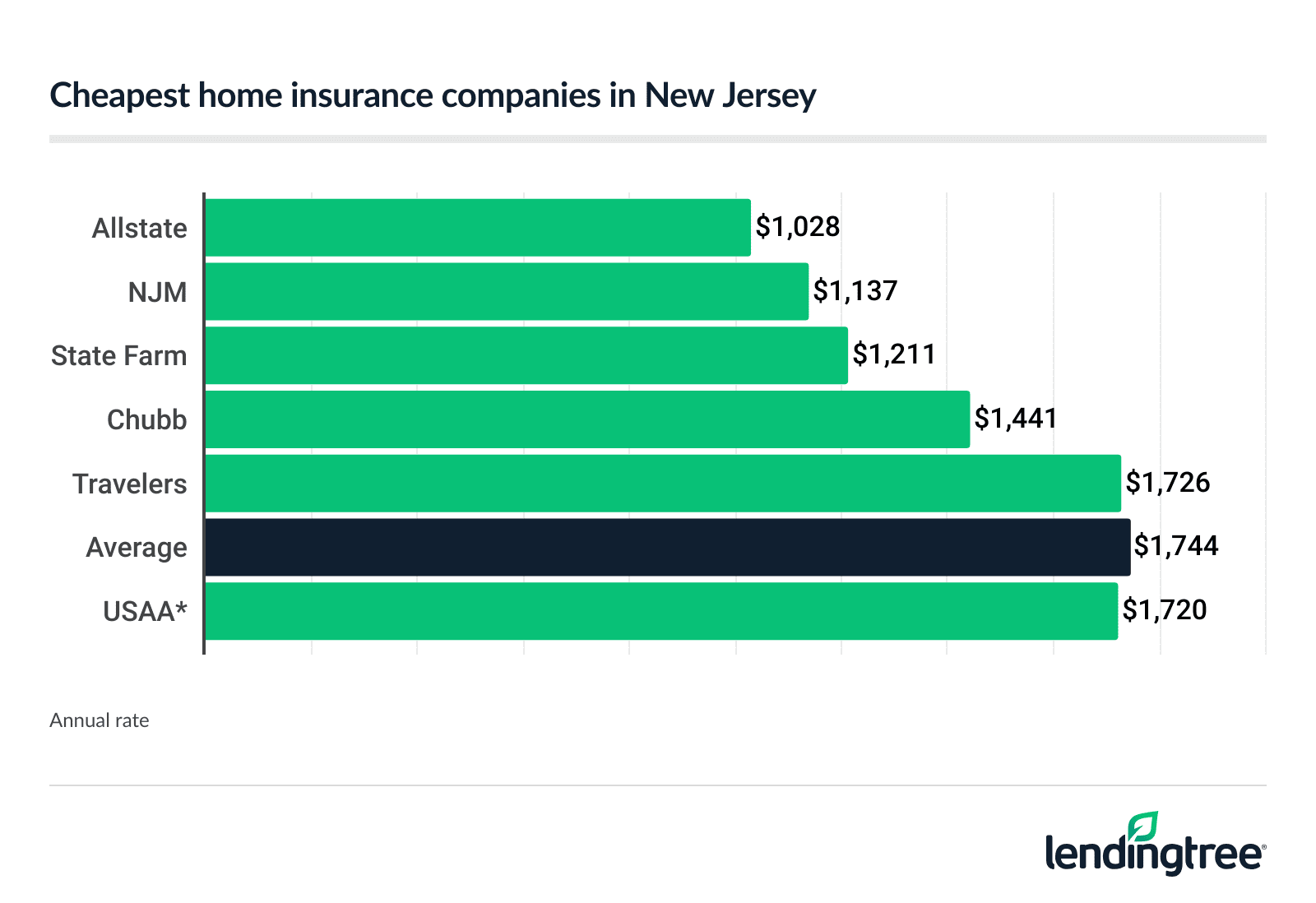

On average, homeowners can pay under $1,300 a year with Allstate, NJM, and State Farm.

Insurance companies can offer great savings if you bundle your home and auto insurance policies or take advantage of their other discounts.

You can potentially save around $700 a year by comparing quotes from multiple insurers.

New Jersey’s cheapest home insurance companies

If price is your top concern, know that Allstate is New Jersey’s cheapest home insurance company, averaging $1,028 a year. NJM is the second-cheapest, at $1,137 a year on average.

By comparison, New Jersey’s average home insurance rate is $1,744 a year

Cheapest quotes in New Jersey

| Company | Average annual rate | LendingTree score | |

|---|---|---|---|

| Allstate | $1,028 | |

| NJM | $1,137 | Not rated |

| State Farm | $1,211 | |

| Chubb | $1,441 | |

| Travelers | $1,726 | |

| Progressive | $2,414 | |

| Farmers | $3,276 | |

| USAA* | $1,720 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. *USAA is only available to active-duty and veteran military members and their families.

Best homeowners insurance companies in New Jersey

NJM has the best overall combination of home insurance cost, customer satisfaction and coverage in New Jersey.

Allstate, meanwhile, has the cheapest rate, at an average of $1,028 a year.

State Farm has the best discounts for home insurance in New Jersey, while Chubb is best for luxury homes, and USAA is best for military members and their families.

Best New Jersey home insurance companies

| Company | Average annual rate | Overall satisfaction (higher is better) J.D. Power’s 2024 Property Claims Satisfaction Study | Complaint index (lower is better) 2023 complaint data from the National Association of Insurance Commissioners (NAIC) |

|---|---|---|---|

| Best overall: NJM | $1,137 | NA | 0.04 (above average) |

| Cheapest rate: Allstate | $1,028 | 868 (below average) | 1.81 (above average) |

| Best for luxury homes: Chubb | $1,441 | 876 (above average) | 0.09 (above average) |

| Best for military: USAA | $1,720 | 899 (above average) | 0.50 (above average) |

| N.J. state average | $1,744 | 869 | 1.0 |

Best overall: NJM

NJM has an average home insurance rate in New Jersey of $1,137 a year. This is the second-cheapest rate in New Jersey after Allstate.

NJM also received fewer complaints than expected for a company of its size and has the best complaint rating of the companies we looked at in New Jersey.

| Pros | Cons |

|---|---|

Home insurance rate below state average Good complaint index rating Good add-on selection | Limited online resources Coverage may not be available in all parts of New Jersey |

Cheapest rate: Allstate

Allstate has an average homeowners insurance rate of $1,028. This is 41% cheaper than the New Jersey average rate of $1,744 a year.

Allstate also offers generous discounts for bundling your home and auto insurance.

| Pros | Cons |

|---|---|

Good discounts Identity theft coverage Water backup coverage No banned dog list | Below-average customer satisfaction rating Below-average complaint index rating No extended replacement cost coverage |

Best for luxury homes: Chubb

Chubb specializes in providing coverage of luxury homes. It offers benefits such as extended replacement cost coverage beyond your policy limit, offering cash payout instead of paying for repairs and the ability to use your own contractor.

| Pros | Cons |

|---|---|

Extended replacement cost coverage Good customer satisfaction and complaint index ratings You can use your own contractor on claims | Comparatively low number of discounts Eligibility for coverage may be based on home value |

Best for active military: USAA

USAA offers home insurance tailor-made for Armed Forces members. For example, you won’t have to pay a deductible for losses of personally owned military items and uniforms.

USAA’s standard home insurance policy also covers the full replacement cost of your belongings and some of your home’s building materials.

USAA is known for great customer service, too.

| Pros | Cons |

|---|---|

Excellent customer satisfaction rating Easy online quote process Personal property coverage at replacement cost | Eligibility restricted to active-duty and retired military, as well as tamilies No dedicated agents |

New Jersey home insurance rates by coverage amounts

The higher your dwelling coverage limit, the higher your premium usually is.

For instance, there’s a $378 a year difference in cost between New Jersey’s average rate for a policy with $350,000 dwelling coverage ($1,533 a year) versus a $450,000 dwelling coverage policy ($1,911 a year).

Roughly speaking, the additional $100,000 coverage adds an extra $32 a month to your premium.

Average annual rate by dwelling coverage

| Dwelling coverage limit | Average annual rate |

|---|---|

| $350,000 | $1,533 |

| $400,000 | $1,744 |

| $450,000 | $1,911 |

Cost of homeowners insurance in New Jersey

The average cost of home insurance in New Jersey is $1,744 a year, which is 38% lower than the national average home insurance rate of $2,801.

There are other factors insurers will look at when calculating your home insurance quote, such as:

- Your ZIP code

- Age of the house

- Quality of construction materials used

- Your insurance history

- Your chosen coverage limits and deductible

Standard home insurance policies can be pretty similar from company to company. So why the difference in cost? This is in part because homeowners insurance companies place different risk values on different factors.

For example, one company may think your neighborhood is at a higher risk for extreme weather damage than another company would, and it may raise your rates based on that.

With this in mind, it’s in your best interest to compare multiple home insurance quotes side-by-side in order to get the best combination of cost and coverage for your specific needs.

New Jersey home insurance rates by city

Newark residents pay $1,814 a year for home insurance, which is 4% higher than the state average. Residents in Belle Mead pay the least for home insurance on average at $1,339, while residents of Atlantic City pay the most at $2,857 a year.

Home insurance rates by city

| City | Average annual rate |

|---|---|

| Absecon | $2,298 |

| Adelphia | $2,054 |

| Allendale | $1,399 |

| Allenhurst | $2,483 |

| Allentown | $1,504 |

| Allenwood | $1,815 |

| Alpha | $1,514 |

| Alpine | $1,442 |

| Andover | $1,579 |

| Annandale | $1,458 |

| Asbury | $1,500 |

| Asbury Park | $2,320 |

| Ashland | $1,797 |

| Atco | $1,794 |

| Atlantic City | $2,857 |

| Atlantic Highlands | $2,229 |

| Audubon | $1,742 |

| Audubon Park | $1,741 |

| Augusta | $1,670 |

| Avalon | $2,590 |

| Avenel | $1,552 |

| Avon-by-the-Sea | $2,435 |

| Baptistown | $1,817 |

| Barclay | $1,768 |

| Barnegat | $2,368 |

| Barnegat Light | $2,746 |

| Barrington | $1,732 |

| Basking Ridge | $1,392 |

| Bay Head | $2,435 |

| Bayonne | $1,776 |

| Bayville | $2,159 |

| Beach Haven | $2,751 |

| Beach Haven West | $2,188 |

| Beachwood | $1,845 |

| Beattystown | $1,487 |

| Beckett | $1,846 |

| Bedminster | $1,455 |

| Belford | $2,067 |

| Belle Mead | $1,339 |

| Belleville | $1,615 |

| Bellmawr | $1,753 |

| Belmar | $2,321 |

| Belvidere | $1,545 |

| Bergenfield | $1,453 |

| Berkeley Heights | $1,361 |

| Berlin | $1,807 |

| Bernardsville | $1,428 |

| Beverly | $1,904 |

| Birmingham | $1,918 |

| Blackwells Mills | $1,480 |

| Blackwood | $1,854 |

| Blairstown | $1,573 |

| Blawenburg | $1,755 |

| Bloomfield | $1,491 |

| Bloomingdale | $1,420 |

| Bloomsbury | $1,530 |

| Bogota | $1,465 |

| Boonton | $1,445 |

| Bordentown | $1,782 |

| Bound Brook | $1,467 |

| Bradley Beach | $2,419 |

| Bradley Gardens | $1,418 |

| Branchville | $1,658 |

| Brass Castle | $1,500 |

| Brick | $2,127 |

| Bridgeport | $1,935 |

| Bridgeton | $1,830 |

| Bridgewater | $1,416 |

| Brielle | $2,330 |

| Brigantine | $2,775 |

| Broadway | $1,926 |

| Brookdale | $1,486 |

| Brooklawn | $1,777 |

| Brookside | $1,840 |

| Browns Mills | $1,856 |

| Brownville | $1,537 |

| Budd Lake | $1,488 |

| Buena | $1,923 |

| Burlington | $1,761 |

| Butler | $1,488 |

| Buttzville | $1,879 |

| Caldwell | $1,465 |

| Califon | $1,442 |

| Camden | $1,816 |

| Cape May | $2,457 |

| Cape May Court House | $2,297 |

| Cape May Point | $2,509 |

| Carlstadt | $1,493 |

| Carneys Point | $1,730 |

| Carteret | $1,743 |

| Cedar Brook | $2,169 |

| Cedar Glen Lakes | $1,628 |

| Cedar Glen West | $1,633 |

| Cedar Grove | $1,478 |

| Cedar Knolls | $1,470 |

| Cedarville | $1,892 |

| Changewater | $1,870 |

| Chatham | $1,413 |

| Chatsworth | $2,004 |

| Cherry Hill | $1,747 |

| Cherry Hill Mall | $1,746 |

| Chesilhurst | $1,833 |

| Chester | $1,440 |

| Chesterfield | $1,795 |

| Clark | $1,445 |

| Clarksboro | $1,760 |

| Clayton | $1,782 |

| Clearbrook Park | $1,420 |

| Clementon | $1,827 |

| Cliffside Park | $1,468 |

| Cliffwood | $1,973 |

| Cliffwood Beach | $2,088 |

| Clifton | $1,445 |

| Clinton | $1,470 |

| Closter | $1,407 |

| Collingswood | $1,772 |

| Cologne | $2,260 |

| Colonia | $1,503 |

| Colts Neck | $1,694 |

| Columbia | $1,567 |

| Columbus | $1,693 |

| Concordia | $1,420 |

| Convent Station | $1,829 |

| Cookstown | $1,713 |

| Country Lake Estates | $1,858 |

| Cranbury | $1,420 |

| Crandon Lakes | $1,681 |

| Cranford | $1,395 |

| Cream Ridge | $1,603 |

| Cresskill | $1,414 |

| Crestwood Village | $1,638 |

| Dayton | $1,450 |

| Deal | $2,484 |

| Deepwater | $1,789 |

| Deerfield Street | $1,830 |

| Delaware Park | $1,512 |

| Delmont | $1,869 |

| Demarest | $1,385 |

| Dennisville | $2,539 |

| Denville | $1,405 |

| Dividing Creek | $2,148 |

| Dorchester | $1,980 |

| Dorothy | $1,983 |

| Dover | $1,432 |

| Dover Beaches North | $2,644 |

| Dover Beaches South | $2,702 |

| Dumont | $1,467 |

| Dunellen | $1,522 |

| East Brunswick | $1,492 |

| East Franklin | $1,478 |

| East Freehold | $1,601 |

| East Hanover | $1,454 |

| East Newark | $1,571 |

| East Orange | $1,743 |

| East Rutherford | $1,443 |

| Eatontown | $1,769 |

| Echelon | $1,866 |

| Edgewater | $1,471 |

| Edison | $1,506 |

| Egg Harbor City | $1,916 |

| Egg Harbor Township | $2,040 |

| Elizabeth | $1,666 |

| Elizabethport | $1,746 |

| Ellisburg | $1,719 |

| Elmer | $1,693 |

| Elmwood Park | $1,449 |

| Elwood | $1,973 |

| Emerson | $1,402 |

| Englewood | $1,439 |

| Englewood Cliffs | $1,416 |

| Englishtown | $1,617 |

| Erma | $2,403 |

| Essex Fells | $1,499 |

| Estell Manor | $2,000 |

| Ewan | $2,076 |

| Fair Haven | $1,996 |

| Fair Lawn | $1,414 |

| Fairfield | $1,478 |

| Fairton | $1,909 |

| Fairview | $1,659 |

| Fanwood | $1,424 |

| Far Hills | $1,448 |

| Farmingdale | $1,614 |

| Fieldsboro | $1,788 |

| Finderne | $1,421 |

| Flagtown | $1,496 |

| Flanders | $1,492 |

| Flemington | $1,425 |

| Florence | $1,858 |

| Florham Park | $1,410 |

| Folsom | $1,927 |

| Fords | $1,521 |

| Forked River | $2,379 |

| Fort Dix | $1,771 |

| Fort Lee | $1,401 |

| Fort Monmouth | $1,724 |

| Fortescue | $1,888 |

| Franklin | $1,648 |

| Franklin Center | $1,472 |

| Franklin Lakes | $1,360 |

| Franklin Park | $1,420 |

| Franklinville | $1,823 |

| Freehold | $1,601 |

| Frenchtown | $1,469 |

| Garfield | $1,438 |

| Garwood | $1,440 |

| Gibbsboro | $1,789 |

| Gibbstown | $1,785 |

| Gillette | $1,450 |

| Gladstone | $1,499 |

| Glassboro | $1,777 |

| Glasser | $1,942 |

| Glen Gardner | $1,496 |

| Glen Ridge | $1,482 |

| Glen Rock | $1,381 |

| Glendora | $1,788 |

| Glenwood | $1,662 |

| Gloucester City | $1,779 |

| Golden Triangle | $1,722 |

| Goshen | $2,514 |

| Great Meadows | $1,535 |

| Green Creek | $2,507 |

| Green Knoll | $1,421 |

| Green Village | $1,453 |

| Greendell | $1,986 |

| Greentree | $1,807 |

| Greenwich | $1,666 |

| Grenloch | $1,791 |

| Groveville | $1,611 |

| Guttenberg | $1,564 |

| Hackensack | $1,474 |

| Hackettstown | $1,484 |

| Haddon Heights | $1,720 |

| Haddonfield | $1,694 |

| Hainesport | $1,737 |

| Haledon | $1,455 |

| Hamburg | $1,649 |

| Hamilton Square | $1,605 |

| Hammonton | $1,945 |

| Hampton | $1,489 |

| Hancocks Bridge | $1,791 |

| Harrington Park | $1,397 |

| Harrison | $1,574 |

| Harrisonville | $1,789 |

| Harvey Cedars | $2,731 |

| Hasbrouck Heights | $1,477 |

| Haskell | $1,445 |

| Haworth | $1,417 |

| Hawthorne | $1,484 |

| Hazlet | $2,049 |

| Heathcote | $1,418 |

| Heislerville | $1,859 |

| Helmetta | $1,499 |

| Hewitt | $1,658 |

| Hi-Nella | $1,750 |

| Hibernia | $1,470 |

| High Bridge | $1,440 |

| Highland Lakes | $1,711 |

| Highland Park | $1,537 |

| Highlands | $2,534 |

| Hightstown | $1,424 |

| Hillsborough | $1,474 |

| Hillsdale | $1,402 |

| Hillside | $1,536 |

| Ho-Ho-Kus | $1,372 |

| Hoboken | $1,594 |

| Holiday City South | $2,037 |

| Holiday City-Berkeley | $2,033 |

| Holiday Heights | $2,031 |

| Holmdel | $1,831 |

| Hopatcong | $1,572 |

| Hopewell | $1,415 |

| Howell | $1,647 |

| Imlaystown | $1,568 |

| Interlaken | $2,295 |

| Ironia | $1,867 |

| Irvington | $1,783 |

| Iselin | $1,532 |

| Island Heights | $2,324 |

| Jackson | $1,670 |

| Jamesburg | $1,396 |

| Jersey City | $1,958 |

| Jobstown | $1,738 |

| Johnsonburg | $1,560 |

| Joint Base Mdl | $1,778 |

| Juliustown | $1,715 |

| Keansburg | $2,137 |

| Kearny | $1,597 |

| Keasbey | $1,753 |

| Kendall Park | $1,435 |

| Kenilworth | $1,386 |

| Kenvil | $1,457 |

| Keyport | $2,101 |

| Kingston | $1,448 |

| Kingston Estates | $1,767 |

| Kinnelon | $1,488 |

| Lafayette | $1,718 |

| Lake Como | $2,415 |

| Lake Hiawatha | $1,484 |

| Lake Hopatcong | $1,524 |

| Lake Mohawk | $1,603 |

| Lakehurst | $1,648 |

| Lakewood | $1,771 |

| Lambertville | $1,489 |

| Landing | $1,540 |

| Landisville | $1,793 |

| Lanoka Harbor | $2,368 |

| Laurel Lake | $1,856 |

| Laurel Springs | $1,839 |

| Laurence Harbor | $1,716 |

| Lavallette | $2,638 |

| Lawnside | $1,797 |

| Lawrence Township | $1,463 |

| Lawrenceville | $1,463 |

| Layton | $1,725 |

| Lebanon | $1,513 |

| Ledgewood | $1,472 |

| Leeds Point | $2,349 |

| Leesburg | $1,983 |

| Leisure Knoll | $1,638 |

| Leisure Village | $1,798 |

| Leisure Village East | $1,810 |

| Leisure Village West | $1,639 |

| Leisuretowne | $1,757 |

| Leonardo | $2,118 |

| Leonia | $1,427 |

| Liberty Corner | $1,829 |

| Lincoln Park | $1,488 |

| Lincroft | $1,739 |

| Linden | $1,625 |

| Lindenwold | $1,835 |

| Linwood | $2,257 |

| Little Falls | $1,425 |

| Little Ferry | $1,442 |

| Little Silver | $1,873 |

| Little York | $1,805 |

| Livingston | $1,475 |

| Lodi | $1,455 |

| Long Branch | $2,435 |

| Long Valley | $1,430 |

| Longport | $2,732 |

| Lumberton | $1,740 |

| Lyndhurst | $1,486 |

| Lyons | $1,429 |

| Madison | $1,406 |

| Madison Park | $1,776 |

| Magnolia | $1,813 |

| Mahwah | $1,414 |

| Malaga | $1,843 |

| Manahawkin | $2,188 |

| Manasquan | $2,370 |

| Manchester Township | $1,628 |

| Mantoloking | $2,556 |

| Mantua | $1,746 |

| Manville | $1,464 |

| Maple Shade | $1,852 |

| Maplewood | $1,575 |

| Margate City | $2,783 |

| Marlboro | $1,596 |

| Marlton | $1,743 |

| Marmora | $2,383 |

| Martinsville | $1,431 |

| Matawan | $1,631 |

| Mauricetown | $1,902 |

| Mays Landing | $2,011 |

| Maywood | $1,436 |

| Mc Afee | $1,727 |

| McGuire AFB | $1,772 |

| Medford | $1,773 |

| Medford Lakes | $1,773 |

| Mendham | $1,403 |

| Mercerville | $1,623 |

| Merchantville | $1,792 |

| Metuchen | $1,500 |

| Mickleton | $1,770 |

| Middlebush | $1,480 |

| Middlesex | $1,513 |

| Middletown | $2,067 |

| Middleville | $1,918 |

| Midland Park | $1,351 |

| Milford | $1,477 |

| Millburn | $1,520 |

| Millington | $1,518 |

| Millstone | $1,478 |

| Millstone Township | $1,608 |

| Milltown | $1,494 |

| Millville | $1,864 |

| Milmay | $1,906 |

| Mine Hill | $1,452 |

| Minotola | $1,852 |

| Mizpah | $2,280 |

| Monmouth Beach | $2,402 |

| Monmouth Junction | $1,450 |

| Monroe Township | $1,400 |

| Monroeville | $1,761 |

| Montague | $1,662 |

| Montclair | $1,521 |

| Montvale | $1,385 |

| Montville | $1,484 |

| Moonachie | $1,470 |

| Moorestown | $1,754 |

| Moorestown-Lenola | $1,747 |

| Morganville | $1,603 |

| Morris Plains | $1,412 |

| Morristown | $1,437 |

| Mount Arlington | $1,505 |

| Mount Ephraim | $1,745 |

| Mount Freedom | $1,431 |

| Mount Holly | $1,715 |

| Mount Laurel | $1,751 |

| Mount Royal | $1,848 |

| Mount Tabor | $1,420 |

| Mountain Lake | $1,556 |

| Mountain Lakes | $1,429 |

| Mountainside | $1,443 |

| Mullica Hill | $1,706 |

| Mystic Island | $2,448 |

| National Park | $1,776 |

| Navesink | $2,151 |

| Neptune | $2,138 |

| Neptune City | $2,122 |

| Neshanic Station | $1,446 |

| Netcong | $1,503 |

| New Brunswick | $1,475 |

| New Egypt | $1,663 |

| New Gretna | $1,929 |

| New Lisbon | $1,909 |

| New Milford | $1,426 |

| New Providence | $1,373 |

| New Vernon | $1,462 |

| Newark | $1,814 |

| Newfield | $1,825 |

| Newfoundland | $1,542 |

| Newport | $1,906 |

| Newton | $1,673 |

| Newtonville | $1,983 |

| Norma | $2,094 |

| Normandy Beach | $2,618 |

| North Arlington | $1,459 |

| North Beach Haven | $2,724 |

| North Bergen | $1,573 |

| North Brunswick | $1,466 |

| North Caldwell | $1,466 |

| North Cape May | $2,429 |

| North Haledon | $1,451 |

| North Middletown | $2,068 |

| North Plainfield | $1,539 |

| North Wildwood | $2,624 |

| Northfield | $2,242 |

| Northvale | $1,414 |

| Norwood | $1,413 |

| Nutley | $1,509 |

| Oak Ridge | $1,524 |

| Oak Valley | $1,756 |

| Oakhurst | $2,322 |

| Oakland | $1,362 |

| Oaklyn | $1,787 |

| Ocean Acres | $2,237 |

| Ocean City | $2,560 |

| Ocean Gate | $2,454 |

| Ocean Grove | $2,343 |

| Ocean View | $2,407 |

| Oceanport | $2,240 |

| Oceanville | $2,252 |

| Ogdensburg | $1,640 |

| Old Bridge | $1,529 |

| Old Tappan | $1,440 |

| Oldwick | $1,439 |

| Olivet | $1,695 |

| Oradell | $1,388 |

| Orange | $1,695 |

| Oxford | $1,510 |

| Palisades Park | $1,393 |

| Palmyra | $1,752 |

| Panther Valley | $1,487 |

| Paramus | $1,448 |

| Park Ridge | $1,385 |

| Parlin | $1,565 |

| Parsippany | $1,497 |

| Passaic | $1,648 |

| Paterson | $1,690 |

| Paulsboro | $1,765 |

| Peapack | $1,523 |

| Pedricktown | $1,731 |

| Pemberton | $1,863 |

| Pemberton Heights | $1,855 |

| Pennington | $1,421 |

| Penns Grove | $1,721 |

| Pennsauken | $1,906 |

| Pennsville | $1,694 |

| Pequannock | $1,452 |

| Perth Amboy | $1,771 |

| Phillipsburg | $1,514 |

| Picatinny Arsenal | $1,479 |

| Pine Beach | $1,960 |

| Pine Brook | $1,513 |

| Pine Hill | $1,838 |

| Pine Lake Park | $2,024 |

| Pine Ridge at Crestwood | $1,628 |

| Piscataway | $1,521 |

| Pitman | $1,749 |

| Pittstown | $1,476 |

| Plainfield | $1,525 |

| Plainsboro | $1,407 |

| Plainsboro Center | $1,406 |

| Pleasantville | $2,318 |

| Pluckemin | $1,892 |

| Point Pleasant | $2,426 |

| Point Pleasant Beach | $2,435 |

| Pomona | $2,329 |

| Pompton Lakes | $1,419 |

| Pompton Plains | $1,486 |

| Port Elizabeth | $1,734 |

| Port Monmouth | $2,101 |

| Port Murray | $1,513 |

| Port Norris | $1,901 |

| Port Reading | $1,683 |

| Port Republic | $2,151 |

| Pottersville | $1,450 |

| Presidential Lakes Estates | $1,858 |

| Princeton | $1,381 |

| Princeton Junction | $1,392 |

| Princeton Meadows | $1,405 |

| Prospect Park | $1,456 |

| Quakertown | $1,885 |

| Rahway | $1,448 |

| Ramblewood | $1,753 |

| Ramsey | $1,350 |

| Ramtown | $1,647 |

| Rancocas | $1,847 |

| Randolph | $1,388 |

| Raritan | $1,416 |

| Red Bank | $1,762 |

| Richland | $1,982 |

| Richwood | $1,707 |

| Ridgefield | $1,412 |

| Ridgefield Park | $1,422 |

| Ridgewood | $1,394 |

| Ringoes | $1,463 |

| Ringwood | $1,464 |

| Rio Grande | $2,402 |

| River Edge | $1,420 |

| Riverdale | $1,482 |

| Riverside | $1,747 |

| Riverton | $1,757 |

| Robbinsville | $1,623 |

| Robertsville | $1,601 |

| Rochelle Park | $1,450 |

| Rockaway | $1,434 |

| Rockleigh | $1,410 |

| Rocky Hill | $1,393 |

| Roebling | $1,838 |

| Roosevelt | $1,537 |

| Roseland | $1,483 |

| Roselle | $1,412 |

| Roselle Park | $1,436 |

| Rosemont | $1,522 |

| Rosenhayn | $1,827 |

| Rossmoor | $1,399 |

| Rumson | $2,288 |

| Runnemede | $1,777 |

| Rutherford | $1,472 |

| Saddle Brook | $1,439 |

| Saddle River | $1,389 |

| Salem | $1,743 |

| Sayreville | $1,596 |

| Schooleys Mountain | $1,815 |

| Scotch Plains | $1,450 |

| Sea Bright | $2,243 |

| Sea Girt | $2,419 |

| Sea Isle City | $2,523 |

| Seabrook Farms | $1,831 |

| Seaside Heights | $2,702 |

| Seaside Park | $2,804 |

| Secaucus | $1,572 |

| Sergeantsville | $1,894 |

| Sewaren | $1,673 |

| Sewell | $1,811 |

| Shark River Hills | $2,098 |

| Shiloh | $1,850 |

| Ship Bottom | $2,717 |

| Short Hills | $1,495 |

| Shrewsbury | $1,783 |

| Sicklerville | $1,820 |

| Silver Lake | $1,615 |

| Silver Ridge | $2,038 |

| Singac | $1,425 |

| Six Mile Run | $1,480 |

| Skillman | $1,374 |

| Smithville | $2,376 |

| Society Hill | $1,521 |

| Somerdale | $1,743 |

| Somers Point | $2,181 |

| Somerset | $1,475 |

| Somerville | $1,478 |

| South Amboy | $1,751 |

| South Bound Brook | $1,451 |

| South Dennis | $2,269 |

| South Hackensack | $1,446 |

| South Orange | $1,559 |

| South Plainfield | $1,462 |

| South River | $1,527 |

| South Seaville | $2,460 |

| South Toms River | $2,047 |

| Sparta | $1,610 |

| Spotswood | $1,532 |

| Spring Lake | $2,416 |

| Spring Lake Heights | $2,354 |

| Springdale | $1,812 |

| Springfield | $1,469 |

| Stanhope | $1,577 |

| Stanton | $1,844 |

| Stewartsville | $1,491 |

| Stirling | $1,459 |

| Stockholm | $1,679 |

| Stockton | $1,466 |

| Stone Harbor | $2,626 |

| Stratford | $1,787 |

| Strathmere | $2,536 |

| Strathmore | $1,617 |

| Succasunna | $1,453 |

| Summit | $1,365 |

| Surf City | $2,717 |

| Sussex | $1,651 |

| Swartswood | $1,893 |

| Swedesboro | $1,843 |

| Teaneck | $1,459 |

| Ten Mile Run | $1,380 |

| Tenafly | $1,393 |

| Tennent | $2,125 |

| Teterboro | $1,508 |

| Thorofare | $1,774 |

| Three Bridges | $1,467 |

| Tinton Falls | $2,055 |

| Titusville | $1,485 |

| Toms River | $2,433 |

| Totowa | $1,459 |

| Towaco | $1,469 |

| Township Of Washington | $1,436 |

| Tranquility | $1,916 |

| Trenton | $1,827 |

| Tuckahoe | $2,495 |

| Tuckerton | $2,469 |

| Turnersville | $1,830 |

| Twin Rivers | $1,432 |

| Union | $1,493 |

| Union Beach | $2,124 |

| Union City | $1,729 |

| Upper Montclair | $1,482 |

| Upper Pohatcong | $1,513 |

| Upper Saddle River | $1,389 |

| Vauxhall | $1,398 |

| Ventnor City | $2,812 |

| Vernon | $1,679 |

| Vernon Center | $1,693 |

| Vernon Valley | $1,655 |

| Verona | $1,475 |

| Victory Gardens | $1,431 |

| Victory Lakes | $1,803 |

| Vienna | $1,912 |

| Villas | $2,293 |

| Vincentown | $1,777 |

| Vineland | $1,820 |

| Vista Center | $1,674 |

| Voorhees | $1,673 |

| Waldwick | $1,399 |

| Wallington | $1,457 |

| Wallpack Center | $1,690 |

| Wanamassa | $2,436 |

| Wanaque | $1,423 |

| Waretown | $2,422 |

| Warren | $1,404 |

| Washington | $1,506 |

| Watchung | $1,499 |

| Waterford Works | $1,844 |

| Wayne | $1,431 |

| Weehawken | $1,666 |

| Wenonah | $1,755 |

| West Belmar | $2,261 |

| West Berlin | $1,842 |

| West Cape May | $2,465 |

| West Creek | $2,149 |

| West Freehold | $1,601 |

| West Long Branch | $2,437 |

| West Milford | $1,550 |

| West New York | $1,561 |

| West Orange | $1,552 |

| West Wildwood | $2,624 |

| Westfield | $1,354 |

| Westville | $1,770 |

| Westwood | $1,439 |

| Wharton | $1,477 |

| Whippany | $1,470 |

| White Horse | $1,783 |

| White Meadow Lake | $1,435 |

| Whitehouse | $1,860 |

| Whitehouse Station | $1,442 |

| Whitesboro | $2,335 |

| Whittingham | $1,415 |

| Wickatunk | $2,028 |

| Wildwood | $2,622 |

| Wildwood Crest | $2,626 |

| Williamstown | $1,824 |

| Willingboro | $1,991 |

| Windsor | $1,449 |

| Winslow | $1,855 |

| Wood Ridge | $1,489 |

| Wood-Ridge | $1,493 |

| Woodbine | $2,365 |

| Woodbridge | $1,485 |

| Woodbury | $1,760 |

| Woodbury Heights | $1,724 |

| Woodcliff Lake | $1,394 |

| Woodland Park | $1,425 |

| Woodlynne | $1,786 |

| Woodstown | $1,714 |

| Wrightstown | $1,764 |

| Wyckoff | $1,372 |

| Yardville | $1,612 |

| Yorketown | $1,617 |

| Zarephath | $1,884 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

Additional home insurance coverages in New Jersey

Flood insurance in New Jersey

New Jersey law doesn’t require you to buy flood insurance, but mortgage lenders usually require it if you live in a high risk flood zone.

You can buy flood insurance through the National Flood Insurance Program (NFIP) or from private flood insurance companies. The average cost of flood insurance in New Jersey is $985 a year. However, your rate may vary a lot based on the flood zone where you live.

Methodology

The rates shown in this article are based on non-binding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in New Jersey.

The following coverages and deductible were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

*USAA is only available to active-duty and veteran military members and their families.