Best Homeowners Insurance in Oregon

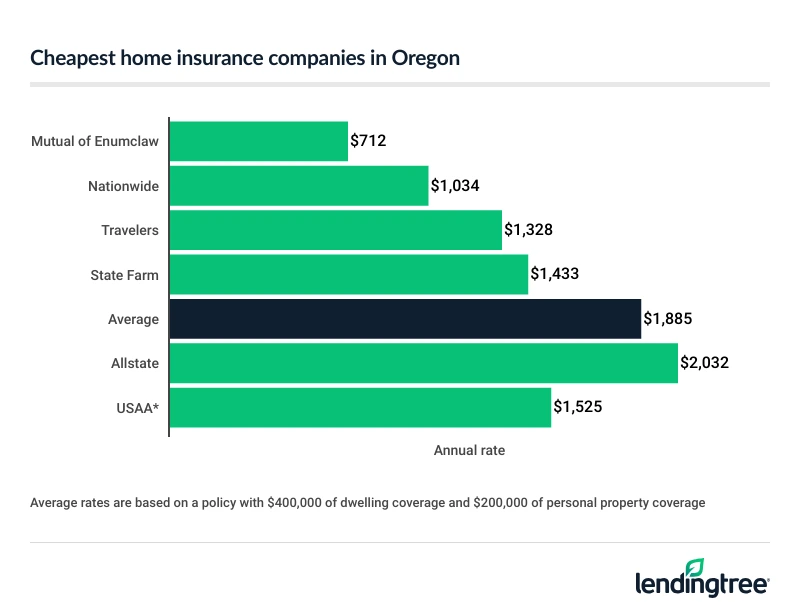

- Mutual of Enumclaw has Oregon’s cheapest home insurance, charging an average of $712 a year.

- Country Financial has the best customer service ratings, but a higher price.

- State Farm is the best overall home insurance company, based on rates and ratings.

Best cheap home insurance companies in Oregon

Cheapest homeowners insurance in Oregon: Mutual of Enumclaw

Mutual of Enumclaw has the cheapest homeowners insurance in Oregon, charging an average of $712 a year. This is 31% less than the next-cheapest rate, $1,034 a year from Nationwide.

Oregon homeowners insurance rates

| Company | Annual rate | LendingTree score | |

|---|---|---|---|

| Mutual of Enumclaw | $712 | Not rated |

| Nationwide | $1,034 | |

| Travelers | $1,328 | |

| State Farm | $1,433 | |

| Allstate | $2,032 | |

| Country Financial | $2,084 | |

| American Family | $2,153 | |

| Farmers | $2,800 | |

| USAA* | $1,525 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. *USAA is only available to the military community and their families.

Since each company’s rates vary by customer, it’s good to compare home insurance quotes from multiple companies.

Best homeowners insurance companies in Oregon

State Farm is the best home insurance company in Oregon overall, based on its rates and ratings. Mutual of Enumclaw, Country Financial and USAA stand out as the state’s other top home insurance companies for various reasons.

Best Oregon home insurance companies

| Company | Best for | Annual rate | Overall satisfaction** | Complaint rating*** |

|---|---|---|---|---|

| State Farm | Overall quality | $1,433 | 829 | 1.05 |

| Mutual of Enumclaw | Cheapest rate | $712 | Not rated | 0.18 |

| Country Financial | Customer Service | $2,084 | 819 | 0.10 |

| USAA* | Military families | $1,525 | 881 | 0.33 |

**Source: J.D. Power. Higher is better; 819 is average.***Source: National Association of Insurance Commissioners (NAIC). Lower is better; 1.0 is average.

Best overall home insurance company: State Farm

Its rates are 24% lower than the state average. It also has a higher overall satisfaction rating than most other companies.

State Farm’s wildfire protection program is valuable for homes in forested or brushy areas. If a wildfire threatens your home, State Farm sends a crew out to protect it with fire-retardant gel and other measures. The service is provided by Wildfire Defense Systems, which works with a few Oregon home insurers.

| Pros | Cons |

|---|---|

Rates are cheaper than state average Good discount for bundling home and auto policies High customer satisfaction rating Wildfire protection services available Website and app make it easy to shop and manage your policy | A few other companies have lower rates Complaint rating is just average |

Best cheap home insurance rates in Oregon: Mutual of Enumclaw

Although it’s a small company, Mutual of Enumclaw offers many benefits that larger companies provide. This includes wildfire protection from the same company that State Farm uses — Wildfire Defense Systems.

Mutual of Enumclaw is available through independent insurance agents. Independent agents can usually also get you quotes from multiple companies at once. But you still have to contact companies with exclusive agents, including State Farm and Allstate, separately.

| Pros | Cons |

|---|---|

Cheapest home insurance rates in Oregon Policies include wildfire protection Independent agents make it easy to comparison shop Discounts for bundling home and auto insurance Online and app-based policy management available | Limited policy information on website Online quoting only forwards your contact information to an agent |

Best customer service: Country Financial

In 2023, it had about one-tenth the average number of confirmed complaints for its size. A confirmed complaint is one that leads to a finding of fault.

When it comes to home insurance coverage, Country Financial offers flexible options. Its standard policies cover your home against a set of listed perils, or risks, such as fire, lightning and wind. Its premier policies cover a wider range of risks, but cost more.

Country Financial’s rates are higher than the state average, but it offers several discounts. These include:

- Multipolicy discount for bundling your home and auto insurance

- Welcome discount for up to three years after you buy your policy

- Loyalty discount each time you renew after three years

- Discount for basic security like a deadbolt lock and smoke detectors

- Discount for connected systems that detect break-ins, smoke and water leaks

- Discounts for replacing your roof and/or upgrading old electrical wiring

| Pros | Cons |

|---|---|

Best home insurance complaint rating in Oregon Flexible coverage options Easy-to-earn discounts Online and app-based policy management | Higher-than-average rates before discounts Overall satisfaction rating is just average Wildfire protection not available |

Best for military families: USAA

The company’s rates are 19% less than the state average. It also has a higher overall satisfaction rating than every other home insurance company in Oregon.

With USAA, replacement cost coverage for your belongings is a standard feature. This pays to replace stolen or damaged items with new ones. Unfortunately, USAA is only available to current and former members of the military and their families.

| Pros | Cons |

|---|---|

Rates are cheaper than state average Strong customer service ratings Online and app-based policy management Offers wildfire protection services | Only available to the military community You get a different rep each time you call for live assistance |

How much is homeowners insurance in Oregon

The average cost of home insurance in Oregon is $1,885 a year for a typical home, or $157 a month.

The actual price you pay depends on several factors. These include your location, your home’s construction features and your credit.

The amount of dwelling coverage you need also impacts your rate. For example, a $450,000 policy costs 25% more than a $350,000 policy. Your dwelling limit should match your home’s replacement value, or estimated rebuild cost.

Insurance rates by dwelling limit

| Dwelling limit | Annual rate | Monthly rate |

|---|---|---|

| $350,000 | $1,678 | $140 |

| $400,000 | $1,885 | $157 |

| $450,000 | $2,092 | $174 |

Oregon homeowners insurance rates by city

Among Oregon’s largest cities, homeowners insurance rates range from $1,577 a month in Corvallis to $1,991 a year in Grants Pass.

Portland homeowners pay an average of $1,703 a year, which is 10% less than the state average.

Insurance rates in Oregon cities

| City |

Average annual rate

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

|

|---|---|

| Albany | $1,681 |

| Aloha | $1,658 |

| Beaverton | $1,685 |

| Bend | $1,978 |

| Bethany | $1,670 |

| Corvallis | $1,577 |

| Eugene | $1,635 |

| Grants Pass | $1,991 |

| Gresham | $1,689 |

| Hillsboro | $1,666 |

| Keizer | $1,717 |

| Lake Oswego | $1,648 |

| McMinnville | $1,712 |

| Medford | $1,811 |

| Oregon City | $1,803 |

| Portland | $1,703 |

| Redmond | $1,894 |

| Salem | $1,746 |

| Springfield | $1,672 |

| Tigard | $1,645 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

Insurance for earthquakes and floods

How to get earthquake insurance in Oregon

Several Oregon home insurance companies offer earthquake insurance as an add-on. A few specialty insurance companies, including Palomar and GeoVera, offer standalone earthquake insurance.

Earthquake insurance can protect you from a major financial hit if an earthquake damages or destroys your home. It usually includes these coverages:

- Dwelling: This pays to repair or rebuild your home, including its foundation.

- Other structures: This usually includes retaining walls and pavement, which are particularly susceptible to earthquake damage.

- Personal property: This covers damage to your belongings, including personal property, furniture, clothing and other personal items.

- Loss of use: This covers temporary living expenses if an earthquake leaves your home unsafe to live in.

Earthquake insurance is typically offered with a high deductible. These can range from 2% to 25% of your coverage limits. If you insure your home for $300,000 with a 15% earthquake deductible, you’re responsible for $45,000 in repairs.

How much is flood insurance in Oregon?

The average cost of flood insurance in Oregon is $842 a year for National Flood Insurance Program (NFIP) policies. This works out to about $70 a month.

The actual price you pay depends on your home’s characteristics and your flood risk. NFIP flood insurance costs an average of $112 a month in Oregon areas with the greatest flood risks. Rates average $50 a month in less risky areas.

Most Oregon flood insurance is bought through the NFIP, which is managed by the Federal Emergency Management Agency (FEMA). However, a few companies offer private flood insurance.

If you need a mortgage for a home in a high-risk flood zone, your lender will make you get flood insurance as well as normal home insurance. Flood insurance is also often worth considering if you don’t have a mortgage or live in a low- or moderate-risk zone.

You can find your home’s flood risk, or the flood risk of a house you want to buy, on FEMA’s online Flood Map Service Center.

Methodology

The rates shown in this article are based on non-binding quotes collected from Quadrant Information Services. Your rates may vary. Average rates were compiled from rates in every Oregon ZIP code. The following coverages and deductible were used unless otherwise noted:

- $400,000 dwelling coverage

- $40,000 other structures

- $200,000 personal property

- $80,000 loss of use coverage

- $100,000 liability

- $5,000 medical payments

- $1,000 deductible

*USAA is only available to current and former members of the military and their families.