Best Homeowners Insurance in Pennsylvania

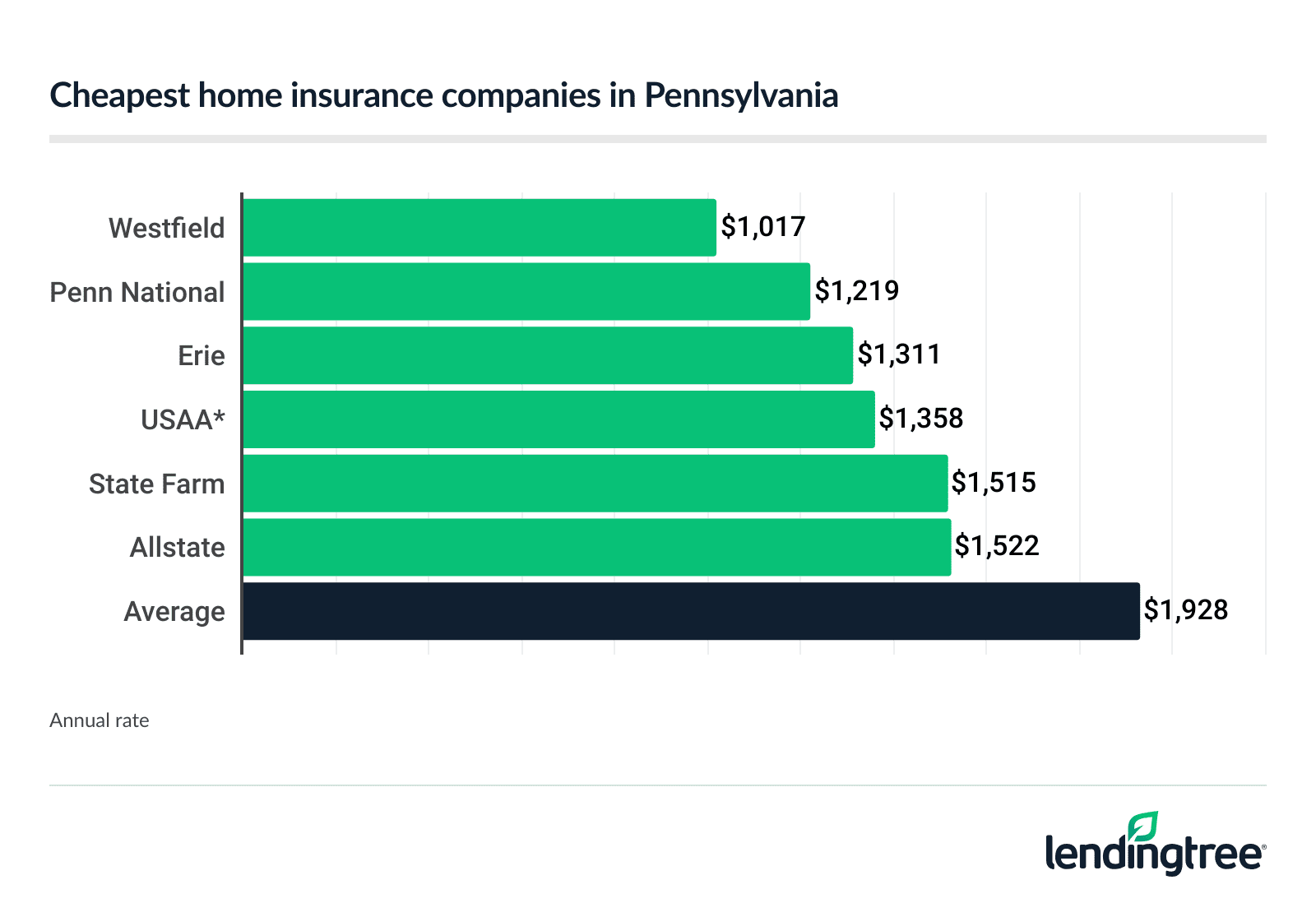

Westfield has the cheapest homeowners insurance in Pennsylvania. However, Erie stands out as the state’s best overall homeowners insurance company, based on its combination of rates, customer service scores and policy offerings.

Cheapest insurance companies in Pennsylvania

Cheapest homeowners insurance in Pennsylvania: Westfield

Westfield has the cheapest homeowners insurance quotes in Pennsylvania. Its rates average $1,017 a year, or $85 a month, for a typical home.

The next-cheapest quotes come from Penn National, at $1,219 a year, and Erie, at $1,311 a year.

| Company | Annual rate |

|---|---|

Westfield Westfield | $1,017 |

Penn National Penn National | $1,219 |

Erie Erie | $1,311 |

USAA* USAA* | $1,358 |

State Farm State Farm | $1,515 |

Allstate Allstate | $1,522 |

Nationwide Nationwide | $1,665 |

Travelers Travelers | $1,896 |

Farmers Farmers | $3,185 |

Chubb Chubb | $4,594 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage. *USAA is only available to active-duty and veteran military members and their families.

Since rates vary by customer, compare quotes from multiple companies when it’s time to buy or renew your home insurance to get your best rate.

Best homeowners insurance companies in Pennsylvania

Erie is the best overall homeowners insurance company in Pennsylvania, based on a combination of price, customer satisfaction and policy offerings.

Pennsylvania’s top home insurance companies

| Company | Annual rate | Satisfaction score | Complaint rating |

|---|---|---|---|

| Best overall: Erie | $1,311 | 855 (Excellent) | 0.72 (Good) |

| Best price: Westfield | $1,017 | Not rated | 0.08 (Excellent) |

| Best small company: Penn National | $1,219 | Not rated | 0.52 (Good) |

| Best large company: State Farm | $1,515 | 829 (Excellent) | 0.95 (Average) |

| Best for military families: USAA | $1,358 | 881 (Excellent) | 0.36 (Excellent) |

Satisfaction scores are from J.D. Power’s 2023 U.S. Home Insurance Study. Rankings are based on a 1,000-point scale, with a segment average of 819.

Complaint ratings reflect confirmed complaints recorded by the National Association of Insurance Commissioners in 2022. A 2.0 rating reflects twice as many complaints as expected for a company’s size. A 0.5 rating means half as many.

Best overall home insurance company in Pennsylvania: Erie

Erie is the not cheapest home insurance company in Pennsylvania, but it has a higher customer satisfaction rating than most of its competitors. Erie’s policy highlights include guaranteed replacement cost coverage for your home at no extra charge.

| Pros | Cons |

|---|---|

Rates are 32% lower than the state average Guaranteed replacement cost ensures enough money to rebuild your home Additional discounts for bundling your home and auto insurance | Instant quotes not available online |

Best home insurance price in Pennsylvania: Westfield

Westfield’s excellent complaint rating reflects its ability to meet customer expectations while keeping its rates low.

| Pros | Cons |

|---|---|

Cheapest home insurance rate in Pennsylvania Fewer complaints than what's expected for a company of its size Policy upgrades provided for bundling your home and auto insurance | Does not offer instant online quotes or a smartphone app Endorsements to customize your coverage are limited |

Best small home insurance company in Pennsylvania: Penn National

Penn National doesn’t crack the top 10 for market share in Pennsylvania. Nevertheless, it holds its own against its larger competitors with low prices and an excellent complaint rating. The company’s A rating from AM Best speaks to its financial stability.

| Pros | Cons |

|---|---|

Rates are 37% lower than the state average Dwelling coverage can be extended by up to 50% Various other endorsements and upgrades are also available | Instant quotes not available online |

Best large home insurance company in Pennsylvania: State Farm

State Farm only has slightly lower rates than Allstate and Nationwide. However, State Farm has a much higher satisfaction score than those companies.

| Pros | Cons |

|---|---|

Rates are 21% lower than the state average Generous discounts for bundling home and auto insurance Personalized service from a wide network of agents | State Farm agents don’t quote other companies’ rates Complaint rating is just average |

Best for Pennsylvania military families: USAA

Along with low rates, USAA offers quality customer service and policy perks that can make you feel like a VIP.

| Pros | Cons |

|---|---|

Rates are 30% lower than the state average Highest satisfaction score among all Pennsylvania home insurers Replacement cost coverage provided for your belongings at no extra charge Coverage for uniforms and military equipment included for active-duty service members | Only current and former members of the military and their families can get insurance from USAA You get a different agent each time you call for help |

How much is homeowners insurance in Pennsylvania?

The average cost of homeowners insurance in Pennsylvania is $1,928 a year, or $161 a month, for a typical home.

The price you pay depends on factors such as:

- The amounts of coverage you need

- Your credit and insurance history

- Your area’s crime rates and exposure to severe weather

- Any discounts you may be eligible to receive

Each insurance company weighs these factors differently. Getting home insurance quotes from a few different companies helps you find the cheapest rate.

Home insurance rates by coverage

Increasing the dwelling coverage of your home insurance policy by $50,000 usually only adds about $17 a month to your rate.

For example, a policy with $450,000 of coverage costs $199 more per year than one that insures your home for $400,000.

| Dwelling coverage | Annual rate |

|---|---|

| $350,000 | $1,730 |

| $400,000 | $1,928 |

| $450,000 | $2,127 |

Dwelling coverage pays to repair or rebuild your home. For a new mortgage, lenders typically require you to insure your home at its replacement value, which is the cost of rebuilding it.

You can choose a lower limit if you have a low loan balance or no mortgage at all. However, doing so puts you at risk of not getting enough insurance money to rebuild after a disaster.

Most insurance companies use a software program to estimate your home’s replacement value, based on its characteristics. Make sure the details the insurance company has about your home are accurate.

Pennsylvania homeowners insurance rates by city

In Philadelphia, home insurance rates average to $2,892 a year. In Pittsburgh, homeowners insurance costs an average of $1,862 a year, which is 3% less than the state average.

| City | Annual rate |

|---|---|

| Aaronsburg | $1,785 |

| Abbottstown | $1,631 |

| Abington | $2,145 |

| Ackermanville | $1,699 |

| Acme | $1,720 |

| Acosta | $1,768 |

| Adah | $1,913 |

| Adamsburg | $1,746 |

| Adamstown | $1,653 |

| Adamsville | $1,918 |

| Addison | $1,803 |

| Adrian | $1,812 |

| Airville | $1,658 |

| Akron | $1,600 |

| Alba | $1,731 |

| Albion | $1,883 |

| Albrightsville | $1,830 |

| Alburtis | $1,629 |

| Aldan | $2,275 |

| Aleppo | $1,922 |

| Alexandria | $1,800 |

| Aliquippa | $1,758 |

| Allenport | $1,822 |

| Allensville | $1,832 |

| Allentown | $1,708 |

| Allenwood | $1,785 |

| Allison | $1,888 |

| Allison Park | $1,663 |

| Allport | $1,810 |

| Alsace Manor | $1,669 |

| Altamont | $1,872 |

| Altoona | $1,746 |

| Alum Bank | $1,854 |

| Alverda | $1,817 |

| Alverton | $1,724 |

| Amberson | $1,922 |

| Ambler | $2,133 |

| Ambridge | $1,767 |

| Amity | $1,758 |

| Amity Gardens | $1,672 |

| Analomink | $2,089 |

| Ancient Oaks | $1,641 |

| Andreas | $1,820 |

| Anita | $1,828 |

| Annville | $1,622 |

| Antes Fort | $1,997 |

| Apollo | $1,684 |

| Aquashicola | $1,749 |

| Arcadia | $1,827 |

| Archbald | $1,822 |

| Ardara | $1,753 |

| Ardmore | $2,189 |

| Arendtsville | $1,634 |

| Aristes | $1,796 |

| Arlington Heights | $1,819 |

| Armagh | $1,787 |

| Armbrust | $2,002 |

| Arnold | $1,682 |

| Arnot | $1,740 |

| Arona | $1,766 |

| Artemas | $1,929 |

| Ashfield | $2,043 |

| Ashland | $1,860 |

| Ashley | $1,736 |

| Ashville | $1,723 |

| Aspers | $1,638 |

| Aspinwall | $1,750 |

| Aston | $2,202 |

| Atglen | $1,932 |

| Athens | $1,690 |

| Atlantic | $1,946 |

| Atlasburg | $1,765 |

| Auburn | $1,794 |

| Audubon | $2,112 |

| Aultman | $1,802 |

| Austin | $1,770 |

| Avalon | $1,772 |

| Avella | $1,738 |

| Avis | $1,741 |

| Avoca | $1,757 |

| Avon | $1,641 |

| Avondale | $1,944 |

| Avonmore | $1,747 |

| Baden | $1,754 |

| Baidland | $1,725 |

| Bainbridge | $1,607 |

| Bairdford | $1,713 |

| Bakerstown | $1,693 |

| Bala Cynwyd | $2,278 |

| Baldwin | $1,785 |

| Bally | $1,666 |

| Bangor | $1,701 |

| Barnesville | $1,856 |

| Barto | $1,720 |

| Bartonsville | $1,842 |

| Bath | $1,664 |

| Bausman | $1,900 |

| Beach Haven | $1,782 |

| Beach Lake | $1,851 |

| Beallsville | $1,782 |

| Bear Creek Village | $1,753 |

| Bear Lake | $1,848 |

| Bear Rocks | $1,812 |

| Beaver | $1,779 |

| Beaver Falls | $1,796 |

| Beaver Meadows | $1,776 |

| Beaver Springs | $1,863 |

| Beaverdale | $1,708 |

| Beavertown | $1,894 |

| Beccaria | $1,846 |

| Bechtelsville | $1,639 |

| Bedford | $1,843 |

| Beech Creek | $1,755 |

| Beech Mountain Lakes | $1,732 |

| Belfast | $1,669 |

| Bell Acres | $1,709 |

| Belle Vernon | $1,805 |

| Bellefonte | $1,700 |

| Belleville | $1,804 |

| Bellevue | $1,764 |

| Bellwood | $1,741 |

| Belmont | $1,715 |

| Belsano | $2,015 |

| Ben Avon | $1,774 |

| Ben Avon Heights | $1,770 |

| Bendersville | $1,616 |

| Benezett | $1,787 |

| Bensalem | $2,487 |

| Bentleyville | $1,722 |

| Benton | $1,759 |

| Berlin | $1,756 |

| Bernville | $1,719 |

| Berrysburg | $1,715 |

| Berwick | $1,775 |

| Berwyn | $1,854 |

| Bessemer | $1,952 |

| Bethany | $1,811 |

| Bethel | $1,676 |

| Bethel Park | $1,719 |

| Bethlehem | $1,708 |

| Beyer | $2,053 |

| Big Bass Lake | $1,810 |

| Big Beaver | $1,800 |

| Big Cove Tannery | $1,913 |

| Big Run | $1,818 |

| Biglerville | $1,635 |

| Birchrunville | $1,929 |

| Birchwood Lakes | $1,786 |

| Bird-in-Hand | $1,606 |

| Birdsboro | $1,666 |

| Black Lick | $1,765 |

| Blain | $1,807 |

| Blairs Mills | $1,857 |

| Blairsville | $1,741 |

| Blakely | $1,820 |

| Blakeslee | $1,862 |

| Blanchard | $1,746 |

| Blandburg | $1,753 |

| Blandon | $1,665 |

| Blawnox | $1,689 |

| Bloomfield | $1,829 |

| Blooming Glen | $2,148 |

| Blooming Valley | $1,889 |

| Bloomsburg | $1,776 |

| Blossburg | $1,737 |

| Blue Ball | $1,634 |

| Blue Bell | $2,109 |

| Blue Ridge Summit | $1,619 |

| Boalsburg | $1,715 |

| Bobtown | $1,835 |

| Boiling Springs | $1,611 |

| Bolivar | $1,727 |

| Bonneauville | $1,619 |

| Boothwyn | $2,179 |

| Boston | $1,757 |

| Boswell | $1,747 |

| Bovard | $2,003 |

| Bowers | $1,659 |

| Bowmanstown | $1,753 |

| Bowmansville | $1,606 |

| Boyers | $1,847 |

| Boyertown | $1,662 |

| Boynton | $1,778 |

| Brackenridge | $1,710 |

| Brackney | $1,778 |

| Braddock | $1,769 |

| Braddock Hills | $1,822 |

| Bradenville | $1,716 |

| Bradford | $1,796 |

| Bradford Woods | $1,702 |

| Branchdale | $1,836 |

| Branchton | $1,847 |

| Brandamore | $1,989 |

| Brandy Camp | $1,816 |

| Brave | $1,832 |

| Breezewood | $1,862 |

| Breinigsville | $1,661 |

| Brentwood | $1,773 |

| Bressler | $1,695 |

| Briar Creek | $1,769 |

| Brickerville | $1,608 |

| Bridgeport | $2,117 |

| Bridgeville | $1,746 |

| Bridgewater | $1,777 |

| Brier Hill | $2,130 |

| Brisbin | $1,834 |

| Bristol | $2,498 |

| Brittany Farms-The Highlands | $1,948 |

| Broad Top | $1,838 |

| Brockport | $1,803 |

| Brockton | $1,854 |

| Brockway | $1,803 |

| Brodheadsville | $1,825 |

| Brogue | $1,654 |

| Brookhaven | $2,205 |

| Brookville | $1,779 |

| Broomall | $2,121 |

| Brownfield | $2,116 |

| Brownstown | $1,666 |

| Brownsville | $1,866 |

| Browntown | $1,760 |

| Bruin | $1,784 |

| Bryn Athyn | $2,274 |

| Bryn Mawr | $2,060 |

| Buck Hill Falls | $1,814 |

| Buena Vista | $1,803 |

| Buffalo Mills | $1,880 |

| Bulger | $1,735 |

| Bunola | $1,753 |

| Burgettstown | $1,753 |

| Burnham | $1,822 |

| Burnt Cabins | $1,906 |

| Bushkill | $1,815 |

| Butler | $1,741 |

| Byrnedale | $1,817 |

| Cabot | $1,678 |

| Cadogan | $1,810 |

| Cairnbrook | $1,779 |

| California | $1,737 |

| Callensburg | $1,840 |

| Callery | $1,738 |

| Callimont | $1,806 |

| Caln | $1,965 |

| Calumet | $1,710 |

| Calvin | $1,867 |

| Cambra | $1,780 |

| Cambridge Springs | $1,853 |

| Cammal | $1,735 |

| Camp Hill | $1,676 |

| Campbelltown | $1,644 |

| Camptown | $2,025 |

| Canadensis | $1,829 |

| Canonsburg | $1,706 |

| Canton | $1,713 |

| Carbondale | $1,833 |

| Cardale | $1,874 |

| Carlisle | $1,639 |

| Carlton | $1,877 |

| Carmichaels | $1,846 |

| Carnegie | $1,767 |

| Carnot-Moon | $1,729 |

| Carroll Valley | $1,613 |

| Carrolltown | $1,766 |

| Carversville | $1,984 |

| Cashtown | $1,907 |

| Cassandra | $1,710 |

| Cassville | $1,866 |

| Castanea | $1,753 |

| Castle Shannon | $1,788 |

| Catasauqua | $1,670 |

| Catawissa | $1,769 |

| Cecil-Bishop | $1,709 |

| Cedar Run | $1,741 |

| Cedars | $2,045 |

| Cementon | $1,684 |

| Center Valley | $1,684 |

| Centerport | $1,640 |

| Centerville | $1,852 |

| Central City | $1,782 |

| Centre Hall | $1,722 |

| Cetronia | $1,703 |

| Chadds Ford | $2,032 |

| Chalfant | $1,823 |

| Chalfont | $1,949 |

| Chalk Hill | $2,108 |

| Chambersburg | $1,626 |

| Chambersville | $1,784 |

| Champion | $1,844 |

| Chandlers Valley | $2,114 |

| Chapman | $1,661 |

| Charleroi | $1,732 |

| Cheltenham | $2,374 |

| Cherry Tree | $1,821 |

| Cherryville | $1,703 |

| Chest Springs | $1,742 |

| Chester | $2,314 |

| Chester Heights | $2,152 |

| Chester Hill | $1,807 |

| Chester Springs | $1,863 |

| Chesterbrook | $1,882 |

| Chestnut Ridge | $1,882 |

| Cheswick | $1,710 |

| Chevy Chase Heights | $1,743 |

| Cheyney | $2,179 |

| Chicora | $1,780 |

| Chinchilla | $1,787 |

| Christiana | $1,635 |

| Churchill | $1,813 |

| Churchville | $2,238 |

| Clairton | $1,765 |

| Clarence | $1,757 |

| Clarendon | $1,812 |

| Claridge | $1,725 |

| Clarington | $1,860 |

| Clarion | $1,786 |

| Clark | $1,844 |

| Clarks Mills | $1,891 |

| Clarks Summit | $1,789 |

| Clarksburg | $1,766 |

| Clarksville | $1,782 |

| Clay | $1,607 |

| Claysburg | $1,777 |

| Claysville | $1,745 |

| Clearfield | $1,835 |

| Clearville | $1,850 |

| Cleona | $1,634 |

| Clifton Heights | $2,259 |

| Clinton | $1,786 |

| Clintonville | $1,881 |

| Clune | $2,029 |

| Clymer | $1,763 |

| Coal Center | $1,732 |

| Coal Township | $1,822 |

| Coaldale | $1,870 |

| Coalport | $1,840 |

| Coatesville | $1,887 |

| Coburn | $1,776 |

| Cochranton | $1,866 |

| Cochranville | $1,954 |

| Cocolamus | $1,845 |

| Cogan Station | $1,714 |

| Cokeburg | $1,750 |

| Collegeville | $2,027 |

| Collingdale | $2,361 |

| Collinsburg | $1,748 |

| Colmar | $2,022 |

| Colonial Park | $1,703 |

| Colony Park | $1,627 |

| Columbia | $1,602 |

| Columbia Cross Roads | $1,707 |

| Columbus | $1,829 |

| Colver | $1,777 |

| Colwyn | $2,394 |

| Commodore | $1,837 |

| Conashaugh Lakes | $1,773 |

| Concord | $1,682 |

| Concordville | $2,394 |

| Conestoga | $1,625 |

| Confluence | $1,834 |

| Conneaut Lake | $1,877 |

| Conneaut Lakeshore | $1,875 |

| Conneautville | $1,920 |

| Connellsville | $1,899 |

| Conshohocken | $2,113 |

| Conway | $1,763 |

| Conyngham | $1,813 |

| Cooksburg | $1,874 |

| Coolspring | $1,833 |

| Coopersburg | $1,706 |

| Cooperstown | $1,872 |

| Coplay | $1,693 |

| Coral | $1,813 |

| Coraopolis | $1,736 |

| Cornwall | $1,611 |

| Cornwells Heights | $2,491 |

| Corry | $1,865 |

| Corsica | $1,820 |

| Coudersport | $1,766 |

| Coulters | $1,777 |

| Coupon | $1,717 |

| Courtdale | $1,748 |

| Covington | $1,742 |

| Cowansville | $1,811 |

| Crabtree | $1,733 |

| Crafton | $1,786 |

| Craley | $1,875 |

| Cranberry | $1,832 |

| Cranberry Township | $1,724 |

| Cranesville | $1,876 |

| Creamery | $2,048 |

| Creekside | $1,810 |

| Creighton | $1,731 |

| Crescent | $1,751 |

| Cresco | $1,834 |

| Cresson | $1,720 |

| Cressona | $1,876 |

| Crosby | $1,840 |

| Cross Fork | $1,783 |

| Cross Roads | $1,623 |

| Crown | $2,082 |

| Croydon | $2,509 |

| Crucible | $1,866 |

| Crum Lynne | $2,255 |

| Crystal Spring | $1,863 |

| Cuddy | $1,751 |

| Cumbola | $1,827 |

| Curllsville | $2,085 |

| Curryville | $1,739 |

| Curtisville | $1,727 |

| Curwensville | $1,809 |

| Custer City | $1,851 |

| Cyclone | $1,826 |

| Dagus Mines | $2,044 |

| Daisytown | $1,763 |

| Dale | $1,720 |

| Dallas | $1,768 |

| Dallastown | $1,636 |

| Dalmatia | $1,838 |

| Dalton | $1,802 |

| Damascus | $1,840 |

| Danboro | $2,148 |

| Danielsville | $1,714 |

| Danville | $1,790 |

| Darby | $2,381 |

| Darlington | $1,800 |

| Darragh | $1,734 |

| Dauberville | $1,620 |

| Dauphin | $1,721 |

| Davidsville | $1,711 |

| Dawson | $1,883 |

| Dayton | $1,824 |

| De Lancey | $1,851 |

| De Young | $1,859 |

| Deemston | $1,781 |

| Defiance | $1,856 |

| Delano | $1,866 |

| Delaware Water Gap | $1,855 |

| Delmont | $1,695 |

| Delta | $1,658 |

| Denbo | $1,799 |

| Denver | $1,612 |

| Derrick City | $1,814 |

| Derry | $1,694 |

| DeSales University | $1,677 |

| Devault | $1,931 |

| Devon | $1,853 |

| Dewart | $1,790 |

| Dickerson Run | $1,896 |

| Dickson City | $1,822 |

| Dilliner | $1,812 |

| Dillsburg | $1,611 |

| Dilltown | $1,773 |

| Dingmans Ferry | $1,786 |

| Distant | $1,783 |

| Dixonville | $1,800 |

| Donegal | $1,750 |

| Donora | $1,748 |

| Dormont | $1,852 |

| Dorneyville | $1,701 |

| Dornsife | $1,823 |

| Douglassville | $1,680 |

| Dover | $1,613 |

| Downingtown | $1,958 |

| Doylesburg | $1,684 |

| Doylestown | $1,949 |

| Dravosburg | $1,776 |

| Dresher | $2,118 |

| Drexel Hill | $2,225 |

| Drifting | $1,808 |

| Drifton | $1,763 |

| Driftwood | $1,824 |

| Drumore | $1,633 |

| Drums | $1,736 |

| Dry Run | $1,673 |

| Dublin | $1,906 |

| DuBois | $1,824 |

| Duboistown | $1,687 |

| Dudley | $1,812 |

| Duke Center | $1,829 |

| Dunbar | $1,891 |

| Duncannon | $1,785 |

| Duncansville | $1,716 |

| Dunlevy | $1,779 |

| Dunlo | $1,709 |

| Dunmore | $1,806 |

| Dupont | $1,760 |

| Duquesne | $1,789 |

| Duryea | $1,769 |

| Dushore | $1,718 |

| Dysart | $1,738 |

| Eagles Mere | $1,735 |

| Eagleview | $1,955 |

| Eagleville | $2,134 |

| Earlington | $2,223 |

| Earlston | $1,845 |

| Earlville | $1,675 |

| East Bangor | $1,704 |

| East Berlin | $1,654 |

| East Berwick | $1,764 |

| East Brady | $1,794 |

| East Butler | $1,786 |

| East Conemaugh | $1,721 |

| East Earl | $1,643 |

| East Freedom | $1,729 |

| East Greenville | $1,914 |

| East Hickory | $1,891 |

| East Lansdowne | $2,381 |

| East McKeesport | $1,757 |

| East Millsboro | $1,883 |

| East Petersburg | $1,613 |

| East Pittsburgh | $1,802 |

| East Prospect | $1,608 |

| East Rochester | $1,793 |

| East Side | $1,772 |

| East Smethport | $1,847 |

| East Smithfield | $1,734 |

| East Springfield | $1,878 |

| East Stroudsburg | $1,817 |

| East Texas | $1,957 |

| East Uniontown | $1,905 |

| East Vandergrift | $1,727 |

| East Washington | $1,735 |

| East Waterford | $1,868 |

| East York | $1,643 |

| Eastlawn Gardens | $1,682 |

| Easton | $1,709 |

| Eau Claire | $1,814 |

| Ebensburg | $1,765 |

| Ebervale | $1,992 |

| Economy | $1,751 |

| Eddington | $2,489 |

| Eddystone | $2,256 |

| Edgemont | $2,424 |

| Edgewood | $1,784 |

| Edgeworth | $1,711 |

| Edinboro | $1,893 |

| Edinburg | $1,939 |

| Edwardsville | $1,746 |

| Effort | $1,862 |

| Egypt | $1,681 |

| Ehrenfeld | $1,720 |

| Eighty Four | $1,715 |

| Elco | $1,762 |

| Elderton | $1,837 |

| Eldred | $1,826 |

| Elgin | $2,108 |

| Elim | $1,714 |

| Elizabeth | $1,759 |

| Elizabethtown | $1,584 |

| Elizabethville | $1,705 |

| Elkins Park | $2,394 |

| Elkland | $1,711 |

| Elliottsburg | $1,827 |

| Ellport | $1,855 |

| Ellsworth | $1,779 |

| Ellwood City | $1,837 |

| Elm | $1,908 |

| Elmora | $2,034 |

| Elrama | $1,757 |

| Elton | $1,740 |

| Elverson | $1,961 |

| Elysburg | $1,836 |

| Emeigh | $2,034 |

| Emerald Lakes | $1,841 |

| Emigsville | $1,629 |

| Emlenton | $1,841 |

| Emmaus | $1,674 |

| Emporium | $1,794 |

| Emsworth | $1,770 |

| Endeavor | $1,869 |

| Enhaut | $1,695 |

| Enola | $1,671 |

| Enon Valley | $1,920 |

| Entriken | $1,801 |

| Ephrata | $1,603 |

| Equinunk | $1,859 |

| Erie | $1,861 |

| Ernest | $1,806 |

| Erwinna | $1,962 |

| Espy | $1,776 |

| Essington | $2,289 |

| Etna | $1,733 |

| Etters | $1,638 |

| Evans City | $1,721 |

| Everett | $1,846 |

| Everson | $1,830 |

| Exeter | $1,745 |

| Export | $1,720 |

| Exton | $1,879 |

| Factoryville | $1,756 |

| Fairbank | $2,120 |

| Fairchance | $1,919 |

| Fairdale | $1,839 |

| Fairfield | $1,619 |

| Fairhope | $1,827 |

| Fairless Hills | $2,443 |

| Fairmount City | $1,811 |

| Fairview | $1,845 |

| Fairview Village | $2,090 |

| Fairview-Ferndale | $1,816 |

| Fallentimber | $1,751 |

| Falls | $1,778 |

| Falls Creek | $1,817 |

| Fannettsburg | $1,681 |

| Farmersville | $1,612 |

| Farmington | $1,943 |

| Farrell | $1,906 |

| Fawn Grove | $1,639 |

| Faxon | $1,682 |

| Fayette City | $1,832 |

| Fayetteville | $1,619 |

| Feasterville | $2,465 |

| Feasterville Trevose | $2,311 |

| Felton | $1,613 |

| Fenelton | $1,779 |

| Ferndale | $1,713 |

| Fernville | $1,763 |

| Fernway | $1,717 |

| Finleyville | $1,704 |

| Fisher | $2,070 |

| Fishertown | $1,876 |

| Fleetville | $1,815 |

| Fleetwood | $1,648 |

| Fleming | $1,987 |

| Flemington | $1,748 |

| Flicksville | $1,977 |

| Flinton | $1,773 |

| Flourtown | $2,191 |

| Flying Hills | $1,659 |

| Fogelsville | $1,667 |

| Folcroft | $2,324 |

| Folsom | $2,202 |

| Fombell | $1,799 |

| Forbes Road | $1,729 |

| Force | $1,823 |

| Ford City | $1,744 |

| Ford Cliff | $1,773 |

| Forest City | $1,776 |

| Forest Grove | $2,157 |

| Forest Hills | $1,817 |

| Forestville | $1,804 |

| Forksville | $1,705 |

| Fort Hill | $1,811 |

| Fort Littleton | $1,892 |

| Fort Loudon | $1,661 |

| Fort Washington | $2,158 |

| Forty Fort | $1,747 |

| Fountain Hill | $1,692 |

| Fountainville | $1,926 |

| Fox Chapel | $1,713 |

| Fox Chase | $1,651 |

| Fox Run | $1,725 |

| Foxburg | $1,835 |

| Frackville | $1,867 |

| Franklin | $1,843 |

| Franklin Park | $1,705 |

| Franklintown | $1,864 |

| Frederick | $2,030 |

| Fredericksburg | $1,777 |

| Fredericktown | $1,781 |

| Fredonia | $1,869 |

| Freeburg | $1,871 |

| Freedom | $1,770 |

| Freeland | $1,735 |

| Freemansburg | $1,713 |

| Freeport | $1,705 |

| Frenchville | $1,825 |

| Friedens | $1,774 |

| Friedensburg | $1,806 |

| Friendsville | $1,785 |

| Fryburg | $1,830 |

| Fullerton | $1,700 |

| Furlong | $1,998 |

| Gaines | $1,743 |

| Galeton | $1,734 |

| Gallitzin | $1,700 |

| Gans | $2,121 |

| Gap | $1,627 |

| Garards Fort | $1,873 |

| Garden View | $1,692 |

| Gardners | $1,638 |

| Garland | $1,844 |

| Garnet Valley | $2,222 |

| Garrett | $1,785 |

| Gastonville | $1,696 |

| Geigertown | $1,643 |

| Geistown | $1,718 |

| Genesee | $1,782 |

| Georgetown | $1,730 |

| Germansville | $1,704 |

| Gettysburg | $1,625 |

| Gibbon Glade | $1,913 |

| Gibsonia | $1,691 |

| Gifford | $1,843 |

| Gilbert | $1,851 |

| Gilberton | $1,880 |

| Gilbertsville | $1,994 |

| Gillett | $1,683 |

| Gipsy | $1,844 |

| Girard | $1,851 |

| Girardville | $1,878 |

| Gladwyne | $2,100 |

| Glasgow | $2,004 |

| Glassport | $1,750 |

| Glen Campbell | $1,856 |

| Glen Hope | $1,857 |

| Glen Lyon | $1,754 |

| Glen Mills | $2,208 |

| Glen Osborne | $1,723 |

| Glen Richey | $1,859 |

| Glen Riddle Lima | $2,334 |

| Glen Rock | $1,610 |

| Glenburn | $1,788 |

| Glenfield | $1,713 |

| Glenmoore | $1,845 |

| Glenolden | $2,286 |

| Glenshaw | $1,700 |

| Glenside | $2,286 |

| Glenville | $1,647 |

| Gold Key Lake | $1,767 |

| Goodville | $1,646 |

| Gordon | $1,849 |

| Gordonville | $1,571 |

| Gouldsboro | $1,813 |

| Gradyville | $2,391 |

| Grampian | $1,823 |

| Grand Valley | $1,885 |

| Grantham | $1,656 |

| Grantley | $1,627 |

| Grantville | $1,697 |

| Granville | $1,830 |

| Granville Summit | $1,729 |

| Grapeville | $1,729 |

| Grassflat | $1,847 |

| Gratz | $1,671 |

| Gray | $1,765 |

| Graysville | $1,866 |

| Grazierville | $1,745 |

| Great Bend | $1,759 |

| Greeley | $1,804 |

| Green Hills | $1,747 |

| Green Lane | $1,979 |

| Green Tree | $1,814 |

| Greencastle | $1,584 |

| Greenfields | $1,679 |

| Greenock | $1,760 |

| Greens Landing | $1,694 |

| Greensboro | $1,846 |

| Greensburg | $1,704 |

| Greentown | $1,812 |

| Greenville | $1,861 |

| Greenwood | $1,747 |

| Grier City | $1,844 |

| Grill | $1,659 |

| Grindstone | $1,869 |

| Grove City | $1,784 |

| Grover | $1,979 |

| Guilford | $1,613 |

| Guys Mills | $1,885 |

| Gwynedd | $2,095 |

| Gwynedd Valley | $2,109 |

| Hadley | $1,898 |

| Halfway House | $2,010 |

| Halifax | $1,702 |

| Hallam | $1,630 |

| Hallstead | $1,776 |

| Hamburg | $1,662 |

| Hamilton | $1,791 |

| Hampton | $1,609 |

| Hannastown | $1,716 |

| Hanover | $1,608 |

| Harborcreek | $1,825 |

| Harford | $1,781 |

| Harleigh | $1,790 |

| Harleysville | $2,010 |

| Harmonsburg | $1,922 |

| Harmony | $1,786 |

| Harrisburg | $1,717 |

| Harrison City | $1,708 |

| Harrison Valley | $1,786 |

| Harrisonville | $1,892 |

| Harrisville | $1,835 |

| Hartleton | $1,848 |

| Hartstown | $1,923 |

| Harveys Lake | $1,739 |

| Harwick | $1,726 |

| Hasson Heights | $1,808 |

| Hastings | $1,758 |

| Hatboro | $2,154 |

| Hatfield | $1,961 |

| Haverford | $2,095 |

| Haverford College | $2,080 |

| Havertown | $2,141 |

| Hawk Run | $1,846 |

| Hawley | $1,820 |

| Hawthorn | $1,774 |

| Haysville | $1,713 |

| Hazel Hurst | $1,844 |

| Hazleton | $1,788 |

| Hebron | $1,636 |

| Hegins | $1,832 |

| Heidelberg | $1,763 |

| Heilwood | $1,837 |

| Hellertown | $1,698 |

| Hemlock Farms | $1,825 |

| Hendersonville | $1,978 |

| Henryville | $1,850 |

| Hereford | $1,661 |

| Herman | $2,084 |

| Herminie | $1,747 |

| Hermitage | $1,881 |

| Herndon | $1,838 |

| Herrick Center | $1,811 |

| Hershey | $1,657 |

| Hesston | $1,845 |

| Hibbs | $1,874 |

| Hickory | $1,749 |

| Hickory Hills | $1,784 |

| Hidden Valley | $2,005 |

| Highland Park | $1,802 |

| Highspire | $1,687 |

| Hilldale | $1,754 |

| Hiller | $1,861 |

| Hilliards | $1,841 |

| Hillsdale | $2,075 |

| Hillsgrove | $1,704 |

| Hillsville | $1,963 |

| Hilltown | $1,933 |

| Hokendauqua | $1,692 |

| Holbrook | $1,893 |

| Holicong | $2,176 |

| Hollidaysburg | $1,716 |

| Hollsopple | $1,724 |

| Holmes | $2,248 |

| Holtwood | $1,625 |

| Home | $1,807 |

| Homeacre-Lyndora | $1,738 |

| Homer City | $1,730 |

| Homestead | $1,752 |

| Hometown | $1,847 |

| Honesdale | $1,807 |

| Honey Brook | $1,954 |

| Honey Grove | $1,889 |

| Hookstown | $1,777 |

| Hooversville | $1,798 |

| Hop Bottom | $1,789 |

| Hopeland | $1,880 |

| Hopewell | $1,877 |

| Hopwood | $1,910 |

| Horsham | $2,118 |

| Hostetter | $2,006 |

| Houserville | $1,719 |

| Houston | $1,718 |

| Houtzdale | $1,821 |

| Howard | $1,737 |

| Hudson | $1,747 |

| Hughestown | $1,763 |

| Hughesville | $1,680 |

| Hulmeville | $2,332 |

| Hummels Wharf | $1,821 |

| Hummelstown | $1,649 |

| Hunker | $1,726 |

| Hunlock Creek | $1,735 |

| Huntingdon | $1,775 |

| Huntingdon Valley | $2,289 |

| Huntington Mills | $1,761 |

| Hustontown | $1,874 |

| Hutchinson | $1,753 |

| Hyde | $1,832 |

| Hyde Park | $1,695 |

| Hydetown | $2,013 |

| Hyndman | $1,878 |

| Ickesburg | $1,830 |

| Idaville | $1,885 |

| Imler | $1,823 |

| Immaculata | $1,940 |

| Imperial | $1,754 |

| Indian Head | $1,859 |

| Indian Lake | $1,784 |

| Indian Mountain Lake | $1,849 |

| Indiana | $1,782 |

| Indianola | $1,734 |

| Industry | $1,791 |

| Ingomar | $1,956 |

| Ingram | $1,777 |

| Inkerman | $1,761 |

| Intercourse | $1,866 |

| Irvine | $1,792 |

| Irvona | $1,857 |

| Irwin | $1,745 |

| Isabella | $1,870 |

| Jackson | $1,787 |

| Jackson Center | $1,846 |

| Jacksonville | $2,011 |

| Jacksonwald | $1,652 |

| Jacobs Creek | $1,755 |

| Jacobus | $1,633 |

| James City | $1,873 |

| James Creek | $1,811 |

| Jamestown | $1,871 |

| Jamison | $2,002 |

| Jeannette | $1,696 |

| Jefferson | $1,880 |

| Jefferson Hills | $1,746 |

| Jenkintown | $2,185 |

| Jenners | $1,794 |

| Jennerstown | $1,777 |

| Jermyn | $1,826 |

| Jerome | $1,711 |

| Jersey Mills | $1,724 |

| Jersey Shore | $1,719 |

| Jessup | $1,790 |

| Jim Thorpe | $1,804 |

| Joffre | $1,743 |

| Johnsonburg | $1,812 |

| Johnstown | $1,723 |

| Jones Mills | $1,759 |

| Jonestown | $1,679 |

| Josephine | $1,804 |

| Julian | $1,709 |

| Junedale | $1,766 |

| Kane | $1,874 |

| Kantner | $1,789 |

| Karns City | $1,765 |

| Karthaus | $1,825 |

| Keisterville | $2,094 |

| Kelayres | $1,785 |

| Kelton | $2,155 |

| Kemblesville | $2,159 |

| Kempton | $1,649 |

| Kenhorst | $1,664 |

| Kenilworth | $1,947 |

| Kenmar | $1,686 |

| Kennerdell | $1,834 |

| Kennett Square | $1,831 |

| Kent | $1,798 |

| Kersey | $1,817 |

| Kimberton | $1,973 |

| King of Prussia | $2,118 |

| Kingsley | $1,757 |

| Kingston | $1,742 |

| Kintnersville | $1,933 |

| Kinzers | $1,604 |

| Kirkwood | $1,617 |

| Kittanning | $1,764 |

| Kleinfeltersville | $1,930 |

| Klingerstown | $1,809 |

| Knox | $1,848 |

| Knox Dale | $1,793 |

| Knoxville | $1,732 |

| Koppel | $1,800 |

| Kossuth | $1,848 |

| Kreamer | $1,811 |

| Kresgeville | $1,882 |

| Kulpmont | $1,795 |

| Kulpsville | $2,038 |

| Kunkletown | $1,855 |

| Kutztown | $1,676 |

| Kutztown University | $1,671 |

| Kylertown | $1,849 |

| La Belle | $1,900 |

| La Jose | $1,835 |

| Laceyville | $1,743 |

| Lackawaxen | $1,827 |

| Lafayette Hill | $2,177 |

| Laflin | $1,748 |

| Lahaska | $2,200 |

| Lairdsville | $1,774 |

| Lake Ariel | $1,807 |

| Lake City | $1,875 |

| Lake Como | $1,828 |

| Lake Harmony | $1,844 |

| Lake Lynn | $1,907 |

| Lake Meade | $1,655 |

| Lake Winola | $1,746 |

| Lake Wynonah | $1,792 |

| Lakemont | $1,755 |

| Lakeville | $1,830 |

| Lakewood | $1,838 |

| Lamartine | $2,069 |

| Lampeter | $1,600 |

| Lancaster | $1,591 |

| Landenberg | $1,918 |

| Landisburg | $1,784 |

| Landisville | $1,586 |

| Lanesboro | $1,784 |

| Langeloth | $1,748 |

| Langhorne | $2,364 |

| Langhorne Manor | $2,206 |

| Lansdale | $2,041 |

| Lansdowne | $2,373 |

| Lanse | $1,826 |

| Lansford | $1,836 |

| Larimer | $1,759 |

| Larksville | $1,728 |

| Latrobe | $1,701 |

| Lattimer | $1,765 |

| Lattimer Mines | $1,779 |

| Laughlintown | $1,727 |

| Laurel Run | $1,748 |

| Laureldale | $1,662 |

| Laurelton | $1,891 |

| Laurys Station | $1,681 |

| Lavelle | $1,859 |

| Lawn | $1,634 |

| Lawnton | $1,680 |

| Lawrence | $1,698 |

| Lawrence Park | $1,828 |

| Lawrenceville | $1,709 |

| Lawson Heights | $1,702 |

| Lawton | $1,825 |

| Le Raysville | $1,760 |

| Lebanon | $1,651 |

| Lebanon South | $1,638 |

| Leck Kill | $1,813 |

| Leckrone | $1,853 |

| Lecontes Mills | $1,855 |

| Lederach | $2,022 |

| Leechburg | $1,717 |

| Leeper | $1,834 |

| Leesport | $1,662 |

| Leetsdale | $1,751 |

| Lehigh Valley | $1,948 |

| Lehighton | $1,779 |

| Leisenring | $1,866 |

| Leith-Hatfield | $1,914 |

| Lemasters | $1,939 |

| Lemont | $1,729 |

| Lemont Furnace | $1,897 |

| Lemoyne | $1,676 |

| Lenhartsville | $1,676 |

| Lenni | $2,365 |

| Lenoxville | $1,838 |

| Leola | $1,589 |

| Level Green | $1,695 |

| Levittown | $2,497 |

| Lewis Run | $1,826 |

| Lewisberry | $1,648 |

| Lewisburg | $1,787 |

| Lewistown | $1,805 |

| Lewisville | $2,154 |

| Liberty | $1,750 |

| Lickingville | $1,847 |

| Lightstreet | $1,767 |

| Ligonier | $1,712 |

| Lilly | $1,705 |

| Lima | $2,121 |

| Lime Ridge | $1,782 |

| Limekiln | $1,662 |

| Limeport | $1,961 |

| Lincoln | $1,776 |

| Lincoln Park | $1,633 |

| Lincoln University | $1,955 |

| Linden | $1,723 |

| Line Lexington | $1,922 |

| Linesville | $1,915 |

| Linglestown | $1,714 |

| Linntown | $1,789 |

| Linwood | $2,191 |

| Lionville | $1,872 |

| Listie | $1,999 |

| Lititz | $1,597 |

| Little Meadows | $1,778 |

| Littlestown | $1,594 |

| Liverpool | $1,790 |

| Llewellyn | $1,829 |

| Lock Haven | $1,750 |

| Locust Gap | $1,791 |

| Locustdale | $1,813 |

| Loganton | $1,775 |

| Loganville | $1,617 |

| Long Branch | $1,734 |

| Long Pond | $1,848 |

| Lopez | $1,717 |

| Lorain | $1,714 |

| Lorane | $1,649 |

| Loretto | $1,713 |

| Lost Creek | $1,800 |

| Lowber | $1,755 |

| Lower Allen | $1,667 |

| Lower Burrell | $1,677 |

| Loyalhanna | $1,706 |

| Loysburg | $1,900 |

| Loysville | $1,837 |

| Lucernemines | $1,784 |

| Lucinda | $1,817 |

| Ludlow | $1,839 |

| Lumberville | $1,986 |

| Lurgan | $1,657 |

| Luthersburg | $1,872 |

| Luxor | $1,708 |

| Luzerne | $1,734 |

| Lykens | $1,692 |

| Lyndell | $2,177 |

| Lyndora | $1,777 |

| Lynnwood-Pricedale | $1,753 |

| Lyon Station | $1,668 |

| Mackeyville | $1,751 |

| Macungie | $1,649 |

| Madera | $1,824 |

| Madisonburg | $1,787 |

| Mahaffey | $1,892 |

| Mahanoy City | $1,884 |

| Mahanoy Plane | $1,836 |

| Mainesburg | $1,723 |

| Mainland | $2,023 |

| Malvern | $1,866 |

| Mammoth | $2,006 |

| Manchester | $1,612 |

| Manheim | $1,576 |

| Manns Choice | $1,828 |

| Manor | $1,718 |

| Manorville | $1,788 |

| Mansfield | $1,677 |

| Maple Glen | $2,094 |

| Mapleton | $1,826 |

| Mapleton Depot | $1,833 |

| Mar Lin | $1,825 |

| Marble | $1,836 |

| Marchand | $1,808 |

| Marcus Hook | $2,191 |

| Marianna | $1,769 |

| Marianne | $1,817 |

| Marienville | $1,831 |

| Marietta | $1,612 |

| Marion | $1,621 |

| Marion Center | $1,821 |

| Marion Heights | $1,803 |

| Markleton | $1,779 |

| Markleysburg | $1,932 |

| Marlin | $1,848 |

| Mars | $1,725 |

| Marshalls Creek | $2,095 |

| Marshallton | $1,810 |

| Marsteller | $1,785 |

| Martin | $1,854 |

| Martindale | $1,881 |

| Martins Creek | $1,685 |

| Martinsburg | $1,712 |

| Mary D | $1,821 |

| Marysville | $1,811 |

| Masontown | $1,889 |

| Masthope | $1,813 |

| Matamoras | $1,767 |

| Mather | $1,863 |

| Mattawana | $2,025 |

| Mayfield | $1,831 |

| Mayport | $1,794 |

| Maytown | $1,596 |

| Mc Alisterville | $1,857 |

| Mc Clellandtown | $1,907 |

| Mc Elhattan | $1,774 |

| Mc Ewensville | $1,799 |

| Mc Grann | $1,804 |

| Mc Intyre | $1,838 |

| Mc Kean | $1,864 |

| Mc Knightstown | $1,569 |

| Mc Veytown | $1,808 |

| McAdoo | $1,829 |

| McClure | $1,811 |

| McConnellsburg | $1,840 |

| McConnellstown | $1,763 |

| McDonald | $1,697 |

| McGovern | $1,713 |

| McKees Rocks | $1,745 |

| McKeesport | $1,768 |

| McMurray | $1,697 |

| McSherrystown | $1,636 |

| Meadow Lands | $1,756 |

| Meadowood | $1,740 |

| Meadville | $1,859 |

| Mechanicsburg | $1,661 |

| Mechanicsville | $1,959 |

| Media | $2,132 |

| Mehoopany | $1,787 |

| Melcroft | $1,882 |

| Mendenhall | $2,073 |

| Mentcle | $1,827 |

| Mercer | $1,822 |

| Mercersburg | $1,641 |

| Meridian | $1,737 |

| Merion Station | $2,321 |

| Merrittstown | $2,122 |

| Mertztown | $1,627 |

| Meshoppen | $1,810 |

| Messiah College | $1,642 |

| Mexico | $2,040 |

| Meyersdale | $1,804 |

| Middleburg | $1,809 |

| Middlebury Center | $1,732 |

| Middleport | $1,864 |

| Middletown | $1,676 |

| Midland | $1,815 |

| Midway | $1,665 |

| Mifflin | $1,845 |

| Mifflinburg | $1,795 |

| Mifflintown | $1,801 |

| Mifflinville | $1,790 |

| Milan | $1,713 |

| Milanville | $1,857 |

| Mildred | $1,730 |

| Milesburg | $1,772 |

| Milford | $1,763 |

| Milford Square | $2,154 |

| Mill Creek | $1,814 |

| Mill Hall | $1,725 |

| Mill Run | $1,919 |

| Mill Village | $1,856 |

| Millbourne | $2,392 |

| Millersburg | $1,706 |

| Millerstown | $1,784 |

| Millersville | $1,568 |

| Millerton | $1,695 |

| Millheim | $1,773 |

| Millmont | $1,877 |

| Millrift | $1,769 |

| Mills | $1,783 |

| Millsboro | $1,797 |

| Millvale | $1,775 |

| Millville | $1,810 |

| Milnesville | $1,784 |

| Milroy | $1,783 |

| Milton | $1,801 |

| Mineral Point | $1,728 |

| Mineral Springs | $1,842 |

| Minersville | $1,888 |

| Mingoville | $1,802 |

| Minisink Hills | $1,826 |

| Mocanaqua | $1,743 |

| Modena | $1,950 |

| Mohnton | $1,656 |

| Mohrsville | $1,622 |

| Monaca | $1,783 |

| Monessen | $1,740 |

| Monocacy Station | $1,617 |

| Monongahela | $1,727 |

| Monroeton | $1,737 |

| Monroeville | $1,740 |

| Mont Alto | $1,624 |

| Mont Clare | $2,102 |

| Montandon | $1,832 |

| Montgomery | $1,729 |

| Montgomeryville | $2,039 |

| Montoursville | $1,681 |

| Montrose | $1,741 |

| Montrose Manor | $1,661 |

| Moosic | $1,804 |

| Morann | $1,790 |

| Morgan | $1,763 |

| Morgantown | $1,663 |

| Morris | $1,733 |

| Morris Run | $1,731 |

| Morrisdale | $1,842 |

| Morrisville | $2,083 |

| Morton | $2,138 |

| Moscow | $1,797 |

| Moshannon | $1,759 |

| Mount Aetna | $1,668 |

| Mount Bethel | $1,677 |

| Mount Braddock | $2,120 |

| Mount Carmel | $1,824 |

| Mount Cobb | $1,812 |

| Mount Gretna | $1,631 |

| Mount Holly Springs | $1,642 |

| Mount Jewett | $1,862 |

| Mount Joy | $1,573 |

| Mount Morris | $1,882 |

| Mount Oliver | $1,821 |

| Mount Penn | $1,668 |

| Mount Pleasant | $1,735 |

| Mount Pleasant Mills | $1,868 |

| Mount Pocono | $1,857 |

| Mount Union | $1,812 |

| Mount Wolf | $1,636 |

| Mountain Top | $1,763 |

| Mountainhome | $1,831 |

| Mountville | $1,599 |

| Muhlenberg Park | $1,650 |

| Muir | $1,811 |

| Muncy | $1,679 |

| Muncy Valley | $1,726 |

| Mundys Corner | $1,727 |

| Munhall | $1,747 |

| Munson | $1,836 |

| Murrysville | $1,706 |

| Muse | $1,707 |

| Myerstown | $1,653 |

| Nanticoke | $1,744 |

| Nanty-Glo | $1,742 |

| Narberth | $2,315 |

| Narvon | $1,626 |

| Natrona Heights | $1,713 |

| Nazareth | $1,685 |

| Needmore | $1,884 |

| Neelyton | $1,865 |

| Neffs | $1,946 |

| Nelson | $1,737 |

| Nemacolin | $1,888 |

| Nescopeck | $1,712 |

| Nesquehoning | $1,836 |

| New Albany | $1,712 |

| New Alexandria | $1,694 |

| New Baltimore | $1,757 |

| New Beaver | $1,858 |

| New Bedford | $1,944 |

| New Berlin | $1,856 |

| New Berlinville | $1,663 |

| New Bethlehem | $1,770 |

| New Bloomfield | $1,839 |

| New Brighton | $1,803 |

| New Britain | $1,953 |

| New Buffalo | $1,801 |

| New Castle | $1,911 |

| New Castle Northwest | $1,889 |

| New Columbia | $1,832 |

| New Cumberland | $1,639 |

| New Derry | $1,723 |

| New Eagle | $1,722 |

| New Enterprise | $1,808 |

| New Florence | $1,710 |

| New Freedom | $1,637 |

| New Freeport | $1,931 |

| New Galilee | $1,809 |

| New Geneva | $2,131 |

| New Germantown | $2,100 |

| New Holland | $1,607 |

| New Hope | $1,976 |

| New Kensington | $1,681 |

| New Kingstown | $1,679 |

| New Milford | $1,729 |

| New Millport | $1,849 |

| New Oxford | $1,600 |

| New Paris | $1,861 |

| New Park | $1,680 |

| New Philadelphia | $1,883 |

| New Providence | $1,644 |

| New Ringgold | $1,752 |

| New Salem | $1,815 |

| New Stanton | $1,719 |

| New Tripoli | $1,684 |

| New Wilmington | $1,912 |

| Newburg | $1,627 |

| Newell | $1,840 |

| Newfoundland | $1,834 |

| Newmanstown | $1,607 |

| Newport | $1,798 |

| Newry | $1,756 |

| Newton Hamilton | $1,809 |

| Newtown | $2,168 |

| Newtown Grant | $2,173 |

| Newtown Square | $2,049 |

| Newville | $1,666 |

| Nicholson | $1,773 |

| Nicktown | $1,762 |

| Nineveh | $1,907 |

| Nixon | $1,739 |

| Normalville | $1,902 |

| Norristown | $2,117 |

| North Apollo | $1,725 |

| North Belle Vernon | $1,749 |

| North Bend | $1,782 |

| North Braddock | $1,768 |

| North Catasauqua | $1,678 |

| North Charleroi | $1,737 |

| North East | $1,814 |

| North Springfield | $1,933 |

| North Versailles | $1,769 |

| North Wales | $2,039 |

| North Warren | $1,763 |

| North Washington | $2,081 |

| North York | $1,622 |

| Northampton | $1,679 |

| Northern Cambria | $1,791 |

| Northpoint | $1,812 |

| Northumberland | $1,818 |

| Northwest Harborcreek | $1,817 |

| Norvelt | $1,715 |

| Norwood | $2,276 |

| Nottingham | $1,798 |

| Noxen | $1,765 |

| Nu Mine | $1,820 |

| Nuangola | $1,766 |

| Numidia | $2,024 |

| Nuremberg | $1,766 |

| Oak Hills | $1,742 |

| Oak Ridge | $1,777 |

| Oakdale | $1,719 |

| Oakland | $1,817 |

| Oakland Mills | $1,847 |

| Oakmont | $1,710 |

| Oaks | $2,055 |

| Oakwood | $1,904 |

| Oberlin | $1,695 |

| Ohiopyle | $1,924 |

| Ohioville | $1,802 |

| Oil City | $1,800 |

| Oklahoma | $1,782 |

| Olanta | $1,841 |

| Old Forge | $1,806 |

| Old Orchard | $1,702 |

| Old Zionsville | $1,925 |

| Oley | $1,638 |

| Oliveburg | $1,820 |

| Oliver | $1,900 |

| Olyphant | $1,821 |

| Ono | $1,627 |

| Orangeville | $1,752 |

| Orbisonia | $1,853 |

| Orchard Hills | $1,688 |

| Orefield | $1,667 |

| Oreland | $2,166 |

| Orrstown | $1,627 |

| Orrtanna | $1,624 |

| Orson | $2,045 |

| Orviston | $1,781 |

| Orwigsburg | $1,798 |

| Osceola | $1,720 |

| Osceola Mills | $1,827 |

| Osterburg | $1,881 |

| Ottsville | $1,896 |

| Oval | $1,723 |

| Oxford | $1,932 |

| Paint | $1,725 |

| Palm | $2,030 |

| Palmdale | $1,662 |

| Palmer Heights | $1,704 |

| Palmerton | $1,768 |

| Palmyra | $1,643 |

| Paoli | $1,857 |

| Paradise | $1,577 |

| Paris | $1,757 |

| Park Forest Village | $1,709 |

| Parker | $1,828 |

| Parker Ford | $1,955 |

| Parkesburg | $1,989 |

| Parkhill | $1,748 |

| Parkside | $2,315 |

| Parkville | $1,606 |

| Parryville | $1,773 |

| Patton | $1,760 |

| Paupack | $1,808 |

| Paxinos | $1,846 |

| Paxtang | $1,685 |

| Paxtonia | $1,713 |

| Paxtonville | $1,856 |

| Peach Bottom | $1,639 |

| Peach Glen | $1,660 |

| Peckville | $1,818 |

| Pen Argyl | $1,690 |

| Penbrook | $1,713 |

| Penfield | $1,822 |

| Penn | $1,739 |

| Penn Estates | $1,815 |

| Penn Run | $1,800 |

| Penn State Erie (Behrend) | $1,815 |

| Penn Wynne | $2,283 |

| Penndel | $2,335 |

| Penns Creek | $1,831 |

| Penns Park | $2,161 |

| Pennsburg | $1,977 |

| Pennsbury Village | $1,797 |

| Pennside | $1,664 |

| Pennsylvania Furnace | $1,731 |

| Pennville | $1,603 |

| Penryn | $1,905 |

| Pequea | $1,628 |

| Perkasie | $1,899 |

| Perkiomenville | $1,968 |

| Perryopolis | $1,866 |

| Petersburg | $1,789 |

| Petrolia | $1,827 |

| Philadelphia | $2,892 |

| Philipsburg | $1,784 |

| Phoenixville | $2,001 |

| Picture Rocks | $1,717 |

| Pillow | $1,719 |

| Pine Forge | $1,643 |

| Pine Grove | $1,804 |

| Pine Grove Mills | $1,723 |

| Pine Ridge | $1,810 |

| Pineville | $2,157 |

| Pipersville | $1,922 |

| Pitcairn | $1,772 |

| Pitman | $1,829 |

| Pittsburgh | $1,862 |

| Pittsfield | $1,819 |

| Pittston | $1,758 |

| Plains | $1,751 |

| Platea | $1,855 |

| Pleasant Gap | $1,704 |

| Pleasant Hall | $1,626 |

| Pleasant Hill | $1,641 |

| Pleasant Hills | $1,790 |

| Pleasant Mount | $1,841 |

| Pleasant Unity | $1,732 |

| Pleasant View | $1,719 |

| Pleasantville | $1,842 |

| Plum | $1,734 |

| Plumsteadville | $1,922 |

| Plumville | $1,810 |

| Plymouth | $1,711 |

| Plymouth Meeting | $2,174 |

| Plymptonville | $1,847 |

| Pocono Lake | $1,830 |

| Pocono Lake Preserve | $2,077 |

| Pocono Manor | $1,853 |

| Pocono Pines | $1,845 |

| Pocono Ranch Lands | $1,807 |

| Pocono Springs | $1,800 |

| Pocono Summit | $1,831 |

| Pocono Woodland Lakes | $1,765 |

| Point Marion | $1,896 |

| Point Pleasant | $2,165 |

| Polk | $1,877 |

| Pomeroy | $1,967 |

| Port Allegany | $1,822 |

| Port Carbon | $1,860 |

| Port Clinton | $1,775 |

| Port Matilda | $1,720 |

| Port Royal | $1,834 |

| Port Trevorton | $1,862 |

| Port Vue | $1,751 |

| Portage | $1,697 |

| Porters Sideling | $1,610 |

| Portersville | $1,830 |

| Portland | $1,700 |

| Pottersdale | $1,837 |

| Potts Grove | $1,840 |

| Pottsgrove | $2,017 |

| Pottstown | $1,985 |

| Pottsville | $1,851 |

| Poyntelle | $2,093 |

| Presto | $1,705 |

| Preston Park | $1,845 |

| Pricedale | $1,742 |

| Pringle | $1,747 |

| Progress | $1,695 |

| Prompton | $1,796 |

| Prospect | $1,810 |

| Prospect Park | $2,248 |

| Prosperity | $1,757 |

| Pulaski | $1,923 |

| Punxsutawney | $1,813 |

| Pymatuning Central | $1,908 |

| Pymatuning South | $1,895 |

| Quakake | $1,815 |

| Quakertown | $1,921 |

| Quarryville | $1,603 |

| Quecreek | $2,043 |

| Queen | $1,811 |

| Queens Gate | $1,624 |

| Quentin | $1,632 |

| Railroad | $1,612 |

| Ralston | $1,759 |

| Ramblewood | $1,723 |

| Ramey | $1,811 |

| Rankin | $1,771 |

| Ransom | $1,774 |

| Raubsville | $1,713 |

| Ravine | $1,800 |

| Reading | $1,675 |

| Reamstown | $1,627 |

| Rebersburg | $1,798 |

| Rebuck | $1,832 |

| Rector | $1,735 |

| Red Hill | $2,023 |

| Red Lion | $1,631 |

| Reeders | $1,851 |

| Reedsville | $1,788 |

| Refton | $1,906 |

| Rehrersburg | $1,667 |

| Reiffton | $1,648 |

| Reinerton | $1,825 |

| Reinholds | $1,656 |

| Renfrew | $1,705 |

| Rennerdale | $1,723 |

| Renningers | $1,842 |

| Reno | $1,849 |

| Renovo | $1,787 |

| Republic | $1,911 |

| Revere | $2,173 |

| Revloc | $1,756 |

| Rew | $1,829 |

| Rexmont | $1,881 |

| Reynolds Heights | $1,862 |

| Reynoldsville | $1,831 |

| Rheems | $1,600 |

| Rices Landing | $1,866 |

| Riceville | $1,903 |

| Richboro | $2,204 |

| Richeyville | $1,722 |

| Richfield | $1,889 |

| Richland | $1,637 |

| Richlandtown | $1,922 |

| Riddlesburg | $1,857 |

| Ridgway | $1,810 |

| Ridley Park | $2,252 |

| Riegelsville | $1,918 |

| Rillton | $1,765 |

| Rimersburg | $1,796 |

| Ringgold | $1,827 |

| Ringtown | $1,811 |

| Riverside | $1,770 |

| Riverview Park | $1,651 |

| Rixford | $1,826 |

| Roaring Branch | $1,756 |

| Roaring Spring | $1,703 |

| Robertsdale | $1,812 |

| Robesonia | $1,659 |

| Robinson | $1,760 |

| Rochester | $1,804 |

| Rochester Mills | $1,833 |

| Rock Glen | $1,798 |

| Rockhill | $1,827 |

| Rockhill Furnace | $1,831 |

| Rockledge | $2,211 |

| Rockton | $1,833 |

| Rockwood | $1,799 |

| Rogersville | $1,877 |

| Rome | $1,698 |

| Ronco | $1,882 |

| Ronks | $1,627 |

| Roscoe | $1,786 |

| Rose Valley | $2,163 |

| Roseto | $1,705 |

| Rossiter | $1,812 |

| Rosslyn Farms | $1,773 |

| Rossville | $1,866 |

| Rothsville | $1,597 |

| Roulette | $1,792 |

| Rouseville | $1,817 |

| Rouzerville | $1,604 |

| Rowland | $1,808 |

| Roxbury | $1,901 |

| Royalton | $1,652 |

| Royersford | $2,028 |

| Ruffs Dale | $1,733 |

| Rural Ridge | $1,777 |

| Rural Valley | $1,835 |

| Rushland | $2,164 |

| Russell | $1,784 |

| Russellton | $1,730 |

| Rutherford | $1,680 |

| Rutledge | $2,143 |

| Sabinsville | $1,745 |

| Sacramento | $1,817 |

| Sadsburyville | $1,972 |

| Saegertown | $1,879 |

| Sagamore | $1,837 |

| Salfordville | $2,267 |

| Salina | $1,745 |

| Salisbury | $1,810 |

| Salix | $1,733 |

| Salladasburg | $1,721 |

| Salona | $1,782 |

| Saltillo | $1,844 |

| Saltsburg | $1,768 |

| Salunga | $1,589 |

| Sanatoga | $2,019 |

| Sand Hill | $1,663 |

| Sandy | $1,827 |

| Sandy Lake | $1,881 |

| Sandy Ridge | $1,817 |

| Sankertown | $1,720 |

| Sarver | $1,719 |

| Sassamansville | $2,001 |

| Saw Creek | $1,805 |

| Saxonburg | $1,725 |

| Saxton | $1,794 |

| Saylorsburg | $1,777 |

| Sayre | $1,689 |

| Scalp Level | $1,722 |

| Scenery Hill | $1,771 |

| Schaefferstown | $1,612 |

| Schellsburg | $1,842 |

| Schenley | $2,046 |

| Schlusser | $1,636 |

| Schnecksville | $1,681 |

| Schoeneck | $1,611 |

| Schuylkill Haven | $1,841 |

| Schwenksville | $2,002 |

| Sciota | $1,809 |

| Scotland | $1,621 |

| Scotrun | $1,841 |

| Scottdale | $1,745 |

| Scranton | $1,812 |

| Seanor | $1,749 |

| Selinsgrove | $1,811 |

| Sellersville | $1,906 |

| Seltzer | $1,792 |

| Seminole | $1,815 |

| Seneca | $1,821 |

| Seven Fields | $1,692 |

| Seven Valleys | $1,617 |

| Seward | $1,751 |

| Sewickley | $1,714 |

| Sewickley Heights | $1,714 |

| Sewickley Hills | $1,708 |

| Shade Gap | $1,844 |

| Shady Grove | $1,879 |

| Shamokin | $1,784 |

| Shamokin Dam | $1,858 |

| Shanksville | $1,789 |

| Shanor-Northvue | $1,730 |

| Sharon | $1,904 |

| Sharon Hill | $2,367 |

| Sharpsburg | $1,746 |

| Sharpsville | $1,887 |

| Shartlesville | $1,668 |

| Shavertown | $1,752 |

| Shawanese | $1,996 |

| Shawnee On Delaware | $1,841 |

| Shawville | $2,122 |

| Sheakleyville | $1,856 |

| Sheffield | $1,847 |

| Shelocta | $1,804 |

| Shenandoah | $1,869 |

| Sheppton | $1,811 |

| Shermans Dale | $1,789 |

| Shickshinny | $1,751 |

| Shillington | $1,655 |

| Shiloh | $1,625 |

| Shinglehouse | $1,804 |

| Shippensburg | $1,619 |

| Shippensburg University | $1,626 |

| Shippenville | $1,817 |

| Shippingport | $2,068 |

| Shiremanstown | $1,673 |

| Shirleysburg | $1,824 |

| Shoemakersville | $1,660 |

| Shohola | $1,803 |

| Shrewsbury | $1,618 |

| Shunk | $1,755 |

| Sidman | $1,713 |

| Sierra View | $1,866 |

| Sigel | $1,825 |

| Silkworth | $1,731 |

| Silverdale | $1,916 |

| Sinking Spring | $1,660 |

| Sinnamahoning | $1,817 |

| Sipesville | $2,026 |

| Six Mile Run | $1,867 |

| Skippack | $2,022 |

| Skyline View | $1,690 |

| Skytop | $1,816 |

| Slabtown | $1,787 |

| Slate Run | $2,011 |

| Slatedale | $1,668 |

| Slatington | $1,684 |

| Slickville | $1,722 |

| Sligo | $1,816 |

| Slippery Rock | $1,772 |

| Slippery Rock University | $1,759 |

| Slovan | $1,752 |

| Smethport | $1,819 |

| Smicksburg | $1,851 |

| Smithfield | $1,876 |

| Smithmill | $1,841 |

| Smithton | $1,753 |

| Smock | $1,911 |

| Smokerun | $1,847 |

| Smoketown | $1,638 |

| Snow Shoe | $1,746 |

| Snydersburg | $1,831 |

| Snydertown | $2,105 |

| Somerset | $1,773 |

| Soudersburg | $1,616 |

| Souderton | $1,971 |

| South Canaan | $1,835 |

| South Coatesville | $1,973 |

| South Connellsville | $1,909 |

| South Fork | $1,715 |

| South Gibson | $1,790 |

| South Greensburg | $1,704 |

| South Heights | $1,741 |

| South Montrose | $2,029 |

| South Mountain | $1,898 |

| South New Castle | $1,895 |

| South Park Township | $1,736 |

| South Philipsburg | $1,772 |

| South Pottstown | $1,946 |

| South Renovo | $1,774 |

| South Sterling | $1,836 |

| South Temple | $1,655 |

| South Uniontown | $1,910 |

| South Waverly | $1,693 |

| South Williamsport | $1,692 |

| Southampton | $2,263 |

| Southeastern | $2,106 |

| Southmont | $1,713 |

| Southview | $1,727 |

| Southwest | $1,724 |

| Southwest Greensburg | $1,699 |

| Spangler | $1,772 |

| Spartansburg | $1,901 |

| Speers | $1,740 |

| Spinnerstown | $1,913 |

| Spraggs | $1,888 |

| Sprankle Mills | $1,828 |

| Spring Church | $1,794 |

| Spring City | $1,953 |

| Spring Creek | $1,861 |

| Spring Glen | $1,801 |

| Spring Grove | $1,621 |

| Spring Hill | $1,702 |

| Spring House | $2,162 |

| Spring Mills | $1,724 |

| Spring Mount | $2,001 |

| Spring Ridge | $1,634 |

| Spring Run | $1,674 |

| Springboro | $1,909 |

| Springdale | $1,688 |

| Springfield | $2,147 |

| Springmont | $1,641 |

| Springs | $1,831 |

| Springtown | $1,863 |

| Springville | $1,786 |

| Sproul | $1,758 |

| Spruce Creek | $1,783 |

| Spry | $1,647 |

| St. Benedict | $1,798 |

| St. Boniface | $2,009 |

| St. Clair | $1,883 |

| St. Johns | $2,030 |

| St. Lawrence | $1,656 |

| St. Marys | $1,788 |

| St. Michael | $1,969 |

| St. Peters | $1,904 |

| St. Petersburg | $1,816 |

| St. Thomas | $1,645 |

| St. Vincent College | $1,701 |

| Stahlstown | $1,725 |

| Star Junction | $1,880 |

| Starford | $1,851 |

| Starlight | $1,835 |

| Starrucca | $1,837 |

| State College | $1,714 |

| State Line | $1,579 |

| Steelton | $1,695 |

| Sterling | $1,817 |

| Stevens | $1,629 |

| Stevensville | $1,758 |

| Stewartstown | $1,628 |

| Stiles | $1,694 |

| Stillwater | $1,803 |

| Stockdale | $1,793 |

| Stockertown | $1,683 |

| Stoneboro | $1,883 |

| Stonerstown | $1,809 |

| Stony Creek Mills | $1,673 |

| Stonybrook | $1,642 |

| Stormstown | $1,717 |

| Stouchsburg | $1,652 |

| Stowe | $2,005 |

| Stoystown | $1,770 |

| Strabane | $1,720 |

| Strasburg | $1,627 |

| Strattanville | $1,815 |

| Strausstown | $1,654 |

| Strongstown | $1,814 |

| Stroudsburg | $1,821 |

| Stump Creek | $1,849 |

| Sturgeon | $1,741 |

| Sugar Grove | $1,825 |

| Sugar Notch | $1,740 |

| Sugar Run | $1,735 |

| Sugarcreek | $1,849 |

| Sugarloaf | $1,747 |

| Summerdale | $1,652 |

| Summerhill | $1,727 |

| Summerville | $1,814 |

| Summit Hill | $1,815 |

| Summit Station | $1,811 |

| Sumneytown | $2,264 |

| Sun Valley | $1,863 |

| Sunbury | $1,802 |

| Suplee | $2,175 |

| Susquehanna | $1,736 |

| Susquehanna Depot | $1,740 |

| Susquehanna Trails | $1,644 |

| Sutersville | $1,779 |

| Swarthmore | $2,122 |

| Swartzville | $1,607 |

| Sweet Valley | $1,711 |

| Swengel | $2,093 |

| Swiftwater | $1,839 |

| Swissvale | $1,782 |

| Swoyersville | $1,742 |

| Sybertsville | $1,773 |

| Sycamore | $1,864 |

| Sykesville | $1,846 |

| Sylvania | $1,986 |

| Tafton | $1,782 |

| Talmage | $1,909 |

| Tamaqua | $1,852 |

| Tamiment | $1,804 |

| Tannersville | $1,855 |

| Tarentum | $1,731 |

| Tarrs | $1,756 |

| Tatamy | $1,703 |

| Taylor | $1,806 |

| Taylorstown | $2,023 |

| Telford | $1,871 |

| Temple | $1,656 |

| Templeton | $1,823 |

| Terre Hill | $1,636 |

| The Hideout | $1,805 |

| Thomasville | $1,597 |

| Thompson | $1,780 |

| Thompsontown | $1,847 |

| Thompsonville | $1,690 |

| Thornburg | $1,793 |

| Thorndale | $1,952 |

| Thornton | $2,167 |

| Three Springs | $1,844 |

| Throop | $1,799 |

| Tidioute | $1,821 |

| Timblin | $1,820 |

| Tioga | $1,715 |

| Tiona | $1,853 |

| Tionesta | $1,868 |

| Tipton | $1,738 |

| Tire Hill | $1,978 |

| Titusville | $1,854 |

| Tobyhanna | $1,826 |

| Todd | $1,875 |

| Toftrees | $1,710 |

| Topton | $1,645 |

| Torrance | $1,824 |

| Toughkenamon | $1,946 |

| Towamensing Trails | $1,840 |

| Towanda | $1,683 |

| Tower City | $1,833 |

| Townville | $1,900 |

| Trafford | $1,699 |

| Trainer | $2,205 |

| Transfer | $1,854 |

| Trappe | $2,017 |

| Treasure Lake | $1,830 |

| Treichlers | $1,677 |

| Tremont | $1,814 |

| Tresckow | $1,771 |

| Trevorton | $1,865 |

| Trevose | $2,465 |

| Trexlertown | $1,647 |

| Trooper | $2,128 |

| Trout Run | $1,697 |

| Troutville | $1,878 |

| Troxelville | $1,874 |

| Troy | $1,684 |

| Trucksville | $1,748 |

| Trumbauersville | $1,903 |

| Tullytown | $2,514 |

| Tunkhannock | $1,797 |

| Turbotville | $1,893 |

| Turkey City | $2,071 |

| Turtle Creek | $1,771 |

| Turtlepoint | $1,816 |

| Tuscarora | $1,822 |

| Twin Rocks | $1,986 |

| Tyler Hill | $1,866 |

| Tyler Run | $1,624 |

| Tylersburg | $1,878 |

| Tylersport | $2,243 |

| Tyrone | $1,746 |

| Uledi | $1,883 |

| Ulster | $1,683 |

| Ulysses | $1,762 |

| Union City | $1,859 |

| Union Dale | $1,753 |

| Uniontown | $1,914 |

| Unionville | $2,062 |

| United | $1,747 |

| Unity House | $2,061 |

| Unityville | $1,750 |

| University of Pittsburgh Johnstown | $1,713 |

| University Park | $1,705 |

| Upland | $2,228 |

| Upper Black Eddy | $1,927 |

| Upper Darby | $2,353 |

| Upper St. Clair | $1,748 |

| Upperstrasburg | $1,629 |

| Ursina | $1,840 |

| Utica | $1,885 |

| Uwchland | $1,934 |

| Valencia | $1,700 |

| Valier | $1,819 |

| Valley Forge | $1,969 |

| Valley Green | $1,640 |

| Valley View | $1,727 |

| Van Voorhis | $1,998 |

| Vanderbilt | $1,882 |

| Vandergrift | $1,714 |

| Venango | $1,879 |

| Venetia | $1,709 |

| Venus | $1,849 |

| Verona | $1,711 |

| Versailles | $1,767 |

| Vestaburg | $1,746 |

| Vicksburg | $2,091 |

| Villa Maria | $1,925 |

| Village Green-Green Ridge | $2,191 |

| Village Shires | $2,270 |

| Villanova | $2,081 |

| Vinco | $1,729 |

| Vintondale | $1,749 |

| Virginville | $1,682 |

| Volant | $1,880 |

| Vowinckel | $1,853 |

| Wagner | $1,816 |

| Wagontown | $2,170 |

| Wall | $1,787 |

| Wallaceton | $1,864 |

| Wallingford | $2,179 |

| Walnut Bottom | $1,682 |

| Walnutport | $1,701 |

| Walston | $1,839 |

| Waltersburg | $1,895 |

| Wampum | $1,854 |

| Wapwallopen | $1,764 |

| Warfordsburg | $1,842 |

| Warminster | $2,131 |

| Warminster Heights | $2,105 |

| Warren | $1,751 |

| Warren Center | $1,736 |

| Warrendale | $1,729 |

| Warrington | $1,979 |

| Warrior Run | $1,736 |

| Warriors Mark | $1,745 |

| Washington | $1,739 |

| Washington Boro | $1,591 |

| Washington Crossing | $2,024 |

| Washingtonville | $1,838 |

| Waterfall | $1,907 |

| Waterford | $1,845 |

| Waterville | $1,721 |

| Watsontown | $1,790 |

| Wattsburg | $1,874 |

| Waverly | $1,782 |

| Waymart | $1,768 |

| Wayne | $1,977 |

| Waynesboro | $1,610 |

| Waynesburg | $1,851 |

| Weatherly | $1,775 |

| Webster | $1,735 |

| Weedville | $1,804 |

| Weigelstown | $1,611 |

| Weikert | $1,836 |

| Weissport East | $1,778 |

| Wellersburg | $1,853 |

| Wells Tannery | $1,912 |

| Wellsboro | $1,710 |

| Wellsville | $1,614 |

| Wendel | $2,014 |

| Wernersville | $1,678 |

| Wescosville | $1,676 |

| Wesleyville | $1,820 |

| West Alexander | $1,782 |

| West Brownsville | $1,808 |

| West Chester | $1,942 |

| West Conshohocken | $2,098 |

| West Decatur | $1,833 |

| West Easton | $1,708 |

| West Elizabeth | $1,766 |

| West Fairview | $1,673 |

| West Falls | $1,778 |

| West Finley | $1,823 |

| West Grove | $1,929 |

| West Hazleton | $1,782 |

| West Hickory | $1,854 |

| West Hills | $1,760 |

| West Homestead | $1,752 |

| West Kittanning | $1,758 |

| West Lawn | $1,638 |

| West Leechburg | $1,707 |

| West Leisenring | $1,859 |

| West Mayfield | $1,804 |

| West Middlesex | $1,891 |

| West Middletown | $1,794 |

| West Mifflin | $1,790 |

| West Milton | $1,853 |

| West Newton | $1,751 |

| West Pittsburg | $1,896 |

| West Pittston | $1,744 |

| West Point | $2,069 |

| West Reading | $1,647 |

| West Salisbury | $1,822 |

| West Springfield | $1,899 |

| West Sunbury | $1,797 |

| West View | $1,749 |

| West Willow | $1,868 |

| West Wyoming | $1,746 |

| West Wyomissing | $1,642 |

| West York | $1,620 |

| Westfield | $1,702 |

| Westland | $1,765 |

| Westmont | $1,711 |

| Westmoreland City | $1,753 |

| Weston | $1,773 |

| Westover | $1,865 |

| Westport | $1,791 |

| Westwood | $1,976 |

| Wexford | $1,689 |

| Wheatland | $1,894 |

| Whitaker | $1,762 |

| White | $1,902 |

| White Deer | $1,815 |

| White Haven | $1,784 |

| White Mills | $1,825 |

| White Oak | $1,778 |

| Whitehall | $1,780 |

| Whitfield | $1,645 |

| Whitney | $1,734 |

| Wickerham Manor-Fisher | $1,722 |

| Wickhaven | $1,899 |

| Wiconsico | $1,685 |

| Widnoon | $1,851 |

| Wilburton | $1,835 |

| Wilcox | $1,839 |

| Wildwood | $1,954 |

| Wilkes-Barre | $1,759 |

| Wilkinsburg | $1,819 |

| Williamsburg | $1,742 |

| Williamsport | $1,687 |

| Williamstown | $1,744 |

| Willow Grove | $2,099 |

| Willow Hill | $1,704 |

| Willow Street | $1,591 |

| Wilmerding | $1,805 |

| Wilmore | $1,963 |

| Wilson | $1,710 |

| Winburne | $1,834 |

| Wind Gap | $1,697 |

| Wind Ridge | $1,926 |

| Windber | $1,717 |

| Windsor | $1,632 |

| Winfield | $1,850 |

| Winterstown | $1,640 |

| Witmer | $1,608 |

| Wolfdale | $1,742 |

| Womelsdorf | $1,650 |

| Woodbourne | $2,403 |

| Woodbury | $1,838 |

| Woodland | $1,849 |

| Woodland Heights | $1,799 |

| Woodlyn | $2,209 |

| Woodside | $2,189 |

| Woodward | $1,770 |

| Woolrich | $2,027 |

| Wormleysburg | $1,674 |

| Worthington | $1,792 |

| Worthville | $1,831 |

| Woxall | $2,273 |

| Woxhall | $2,003 |

| Wrightsville | $1,608 |

| Wyalusing | $1,724 |

| Wyano | $1,754 |

| Wycombe | $2,005 |

| Wyncote | $2,331 |

| Wyndmoor | $2,301 |

| Wynnewood | $2,235 |

| Wyoming | $1,746 |

| Wyomissing | $1,632 |

| Wysox | $1,715 |

| Yardley | $2,182 |

| Yatesboro | $1,835 |

| Yatesville | $1,761 |

| Yeadon | $2,409 |

| Yeagertown | $1,811 |

| Yoe | $1,633 |

| York | $1,635 |

| York Haven | $1,609 |

| York New Salem | $1,867 |

| York Springs | $1,651 |

| Yorklyn | $1,641 |

| Youngstown | $1,710 |

| Youngsville | $1,813 |

| Youngwood | $1,696 |

| Yukon | $1,756 |

| Zelienople | $1,787 |

| Zieglerville | $2,021 |

| Zion | $1,709 |

| Zion Grove | $1,774 |

| Zionhill | $2,201 |

| Zionsville | $1,657 |

| Zullinger | $1,926 |

Average rates are based on a policy with $400,000 of dwelling coverage and $200,000 of personal property coverage.

Flood insurance in Pennsylvania

Homeowners insurance does not cover floods, but you can buy flood insurance to protect against this risk.

The average cost of flood insurance in Pennsylvania is $1,250 a year, or $104 a month, for policies from the National Flood Insurance Program (NFIP).

Most flood insurance is bought through the NFIP, which is managed by the Federal Emergency Management Agency (FEMA). Several private companies also offer it.

Lenders typically require flood insurance for a mortgage in a high-risk flood zone. However, flood insurance is often worth considering even if you own your home outright and/or if it’s in a low- or moderate-risk area.

You can find a home’s flood zone online in the Flood Map Service Center on FEMA’s website.

Other insurance protections for Pennsylvania homes

Earthquakes, mine subsidence and sinkholes are among the other Pennsylvania risks that standard homeowners insurance does not cover. Here’s how to protect against them:

- Several home insurance companies offer earthquake insurance as an add-on to an existing home insurance policy.

- You can get mine subsidence insurance from the Pennsylvania Department of Environmental Protection. The department’s website also has a map that shows if your home is above a known mine.

- Sinkholes are a potential risk in areas of Pennsylvania with karst landscapes. Some companies offer sinkhole insurance as an add-on, and it’s also available as stand-alone insurance.

Frequently asked questions

Homeowners insurance is not required by law in Pennsylvania, but lenders typically require it for a mortgage. If your home is in a high-risk flood zone, your lender will make you get flood insurance, too.

Bundling your home insurance with your auto policy and shopping around for the cheapest price are among the best ways to save money on homeowners insurance. Make sure your quotes include all discounts that may be available to you.

Homeowners insurance covers most common causes of damage or loss in Pennsylvania. These include fire, hailstorms, tornadoes, falling objects, burst pipes, vandalism and theft.

Homeowners insurance does not cover floods, earthquakes, mine subsidence, sinkholes or other earth movements. However, separate insurance is available for these excluded risks.