What Is a HELOC Loan?

A home equity line of credit (HELOC) is a secured loan tied to your home that allows you to access funds as needed over a set period.

You can make as many purchases as you’d like, as long as they don’t exceed your credit limit. But, unlike a credit card, you risk foreclosure if you stop making payments because HELOCs use your house as collateral.

In this guide, we’ll cover how HELOCs work, as well as their benefits and disadvantages, to help you decide if it’s the right option for you.

- You can use a HELOC to access cash for a wide variety of purposes, including home improvements or debt consolidation. Specific use restrictions may vary by lender.

- You may be able to make interest-only payments during the HELOC’s draw period, which typically lasts for 10 years.

- HELOC interest rates are variable and will likely change from payment to payment.

How does a HELOC work?

A HELOC allows you to tap some of your home equity to fund purchases you may not have the cash for upfront.

Your home equity is the difference between your home’s value and your remaining mortgage balance, and lenders generally allow you to borrow some of that money, minus your outstanding mortgage balance. Let’s say your home is worth $300,000 and you owe $150,000 on your mortgage. In this case, you can borrow up to $105,000.

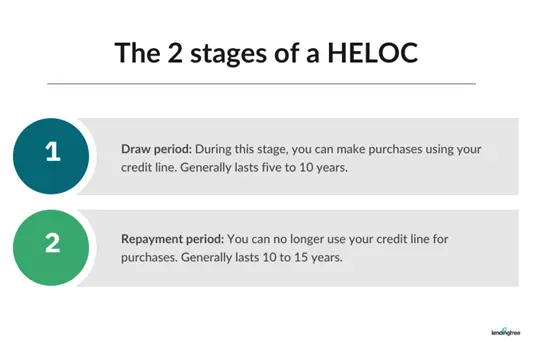

HELOCs have a draw period and a repayment period. The draw period typically lasts anywhere from five to 10 years, while repayment periods generally range from 10 to 20 years.

During the draw period, you may only need to make interest payments or a combination of both interest and principal, depending on your loan’s structure. Once you reach the repayment period, you can no longer draw from the credit line.

How to qualify for a HELOC

To qualify, you’ll typically need a credit score of 620 or higher, a manageable debt-to-income (DTI) ratio and sufficient home equity. Those are just the broad strokes — for more details, check out our full page on HELOC requirements in 2026.

How much money can you borrow with a HELOC?

Most lenders usually allow homeowners to borrow up to 85% of their home value with a HELOC.

Your loan-to-value (LTV) ratio is a large factor in how much money you can borrow with a home equity line of credit. The LTV borrowing limit that your lender sets based on your home’s appraised value is normally capped at 85%.

So, if your home is worth $300,000, then the combined total of your current mortgage and the new HELOC amount can’t exceed $255,000.

But it’s good to know that some lenders may set lower or higher home equity LTV ratio limits.

Use LendingTree’s HELOC calculator to estimate how much money you might qualify for.

How HELOC closing costs work

You’ll usually have to pay HELOC closing costs ranging from 2% to 5% of the credit line amount.

In addition, some lenders charge monthly maintenance fees, and you could face a prepayment penalty if you close your HELOC early.

If you’re not planning to remain in your home for the long haul, make sure you’ll be there long enough to break even on your HELOC. To estimate this, divide your upfront fees by your expected monthly benefit.

Here’s how to calculate your break even time for different HELOC use cases:

Debt consolidation example

Let’s say your HELOC closing costs are $3,000 and using the HELOC to consolidate your debts saves you $120 per month in interest. It would take about 25 months to break even.

Remodel example

Imagine you pay $4,000 in HELOC closing costs to do a remodel that increases your home’s value by $15,000. Your profit would immediately exceed the upfront fees — though you’ll still need to factor in interest paid over time to determine your true net gain.

Are HELOCs more expensive than other loans?

Home equity lines of credit can have lower costs than other types of loans, like personal loans or home equity loans, but this depends on multiple factors.

To determine whether a HELOC is actually cheaper in your situation, you should compare:

- The starting interest rate

- Whether the rate is variable, and if so how much it can adjust by

- Total closing costs (often 2% to 5%)

- Ongoing fees (annual or maintenance fees)

- Potential prepayment penalties

HELOC interest rates have been falling since the beginning of 2025. However, the exact rate you get on a HELOC will depend on your lender and overall personal financial situation.

And, even if a HELOC’s rate looks lower, closing costs and rate volatility can increase the true long-term cost. Always compare the total cost of borrowing — not just the advertised rate.

Pros and cons of a HELOC

Pros

- Money is easy to use. You can access money when you need it, in most cases simply by swiping a card.

- Reusable credit line. You can pay off the balance and reuse the credit line as many times as you’d like during the draw period, which usually lasts several years.

- Interest accrues based on use. You’ll only pay interest on the amount you use, not the total credit line amount.

- Competitive interest rates. You’ll likely pay a lower interest rate than a home equity loan, personal loan or credit card, and your lender may offer a low introductory rate for a brief period. Plus, your rate will have a cap and can only go so high, no matter what happens in the broader market.

- Low monthly payments. You may have the option to make low-interest-only payments during the draw period if your lender offers it.

- No mortgage insurance. You can avoid private mortgage insurance (PMI), even if you finance more than 80% of your home’s value.

Cons

- Your home is collateral. You could lose your home if you can’t keep up with your HELOC payments and the loan goes into default.

- Tough credit requirements. You may need a higher minimum credit score to qualify than you would for a standard purchase mortgage or refinance.

- Higher rates than first mortgages. HELOC rates are higher than cash-out refinance rates because they’re second mortgages.

- Changing interest rates. Unlike a home equity loan, HELOC rates are usually variable, which means your payments can change over time. If your rate rises, you could end up with a higher monthly payment.

- Potential balloon payment. You may have a very large balloon payment due after the interest-only draw period ends.

- Sudden repayment. If you sell your house soon after taking out a HELOC, you’ll likely have to pay back the credit line in full — in addition to your first mortgage

We bought an older home in our dream neighborhood, knowing it would need some work (new siding, a new roof, etc.) We explored several options, including a home improvement loan, but a HELOC made the most sense to us. We shopped around but ultimately decided to go with our primary bank, Truist, since they offered a great intro APR and covered our closing costs.

Is a HELOC right for you?

You can use LendingTree’s HELOC readiness checklist to help you decide if a home equity line of credit is a good option for your needs.

HELOC readiness checklist

| Would you have at least 15% to 20% equity remaining after taking out the HELOC? | Many lenders cap HELOC borrowing at a 80% to 85% combined loan-to-value (CLTV) ratio. |

| Is your credit in solid shape? | You’ll likely need at least a 620 score. |

| Can you afford payments at both the lowest and highest interest rates the loan could adjust to? | Imagine a homeowner with $120,000 in equity who takes out a $50,000 HELOC. The loan comes with a starting rate of 7.61%, and their monthly payments won’t be more than $406 — even if they utilize 100% of the credit line. However, the payments would jump to $572 to $757 per month if the HELOC rate were adjusted up by 5 to 10 percentage points. |

| Would you still be comfortable if your home value dropped 10%? | A HELOC reduces your equity cushion. If home prices drop, you could have less flexibility to refinance, sell or take out additional loans. Lenders may even freeze unused credit lines in declining markets. |

| Do you need ongoing access to funds rather than a lump sum? | If you plan to borrow a specific amount immediately and repay it on a fixed schedule, a home equity loan may offer more payment stability. A HELOC can function similarly if fully drawn, but because most HELOCs have variable rates and may have interest-only draw periods, the long-term cost and payment structure may be less predictable. |

| Do you understand the risks of defaulting on a HELOC? | When your home is at risk, it’s crucial to go in with a plan and your eyes wide open. |

Best uses for a HELOC loan

Home improvements

Use your home equity to make upgrades or renovations that could increase your home’s value.

Debt consolidation

If you have high-interest credit cards or personal loans, you can use a HELOC to consolidate that debt and save on monthly interest charges.

Medical expenses

A HELOC can help you repay costly medical debt without dipping into your savings or retirement accounts.

Smoothing variable income

If your income is commission-based or you’re self-employed, having ongoing access to HELOC funds can help smooth out your cash flow.

College expenses

You can use a HELOC to pay for college or other education expenses, and lenders may be more flexible with qualification requirements compared to other, unsecured loan options.

When to avoid a HELOC

- You can’t comfortably afford the payments.

- Your income is unstable and you don’t have a six- to 12-month emergency buffer.

- You struggle with overspending.

- You plan to use it to consolidate debt, but might run balances back up.

- You’re within five years of selling your home and may not recoup the HELOC’s closing costs.

- You’re already carrying high-interest revolving debt.

HELOC alternatives

- Home equity loan: A home equity loan allows you to borrow against your home equity in a lump sum. The loan amount depends on your home’s value and your remaining mortgage balance. Home equity loan rates are usually fixed, and loan repayment terms range from five to 30 years.

- Cash-out refinance: A cash-out refinance replaces your current mortgage with a larger loan, allowing you to “cash out” the difference between the two amounts. The maximum LTV ratio for most cash-out refinance programs is 80%.

- Personal loan: A personal loan is generally an unsecured loan that’s available through private lenders. Personal loan repayment terms are usually shorter than HELOCs, and the interest rates are usually higher.

- Credit card: Using a credit card can be a quick, convenient way to make purchases, but the interest rates are generally much higher than HELOCs.

- Reverse mortgage: If you’re age 62 or older, a reverse mortgage allows you to convert some of your home equity into an income stream and doesn’t require monthly payments. A reverse mortgage loan is typically repaid when the borrower moves out, sells the home or dies.

Learn more about how to choose between a HELOC, home equity loan and cash-out refinance.

Frequently asked questions

You may be able to write off your HELOC interest at tax time if you use the funds for home improvements that substantially improve your home.

It’s possible to get a HELOC on an investment property, but lenders typically impose stricter eligibility requirements, such as higher income and larger cash reserves.

Some of the drawbacks of HELOCs include the risk of foreclosure if you default on the payments, variable interest rates, closing costs and ongoing fees.

Compare Home Equity Offers

Recommended Articles