15-Year Mortgages Could Save Borrowers Hundreds of Thousands of Dollars Over Lifetime of Loans, but Those Savings Come at a Cost

Though mortgage rates have fluctuated up and down over the past few months, they’re considerably higher than at the start of the year.

Higher rates mean new borrowers will likely need to pay more mortgage interest charges. This is unavoidable for most new borrowers, but interest payments won’t be the same for all mortgage types. Mortgages with shorter term lengths — like 15-year, fixed-rate mortgages — usually require significantly lower interest payouts.

To show how much less interest borrowers with 15-year fixed mortgages tend to pay compared to borrowers with 30-year fixed mortgages, LendingTree analyzed about 381,000 loans offered to users of our online shopping platform from July through August 2022.

Even though 15-year mortgages are more expensive monthly, getting one instead of a 30-year fixed mortgage could save borrowers an average of nearly $215,000 in interest over their loan’s lifetime. That said, borrowers with 15-year mortgages would need to shell out an average of $572 more monthly to take advantage of these long-term savings.o are homeowners are more likely to spend an excessive amount of their monthly incomes — 30% or more — on housing costs.

Key findings

- 15-year mortgages could save borrowers hundreds of thousands of dollars over the lifetime of their loans. Through lower rates and shorter repayment periods, borrowers who choose 15-year, fixed-rate mortgages could save an average of $214,899 in interest over the lifetime of their loans compared to borrowers who choose 30-year mortgages.

- Mortgage rates are usually significantly lower for 15-year fixed mortgages. Across the nation’s 50 states, the average APR offered to borrowers with a 15-year fixed mortgage is 5.14% — 92 basis points lower than the average APR of 6.06% offered to 30-year fixed borrowers.

- Despite overall savings, 15-year mortgage borrowers will spend considerably more on their monthly payments than 30-year mortgage borrowers. On average, payments for 15-year fixed mortgages cost $572 more monthly than for 30-year fixed mortgages.

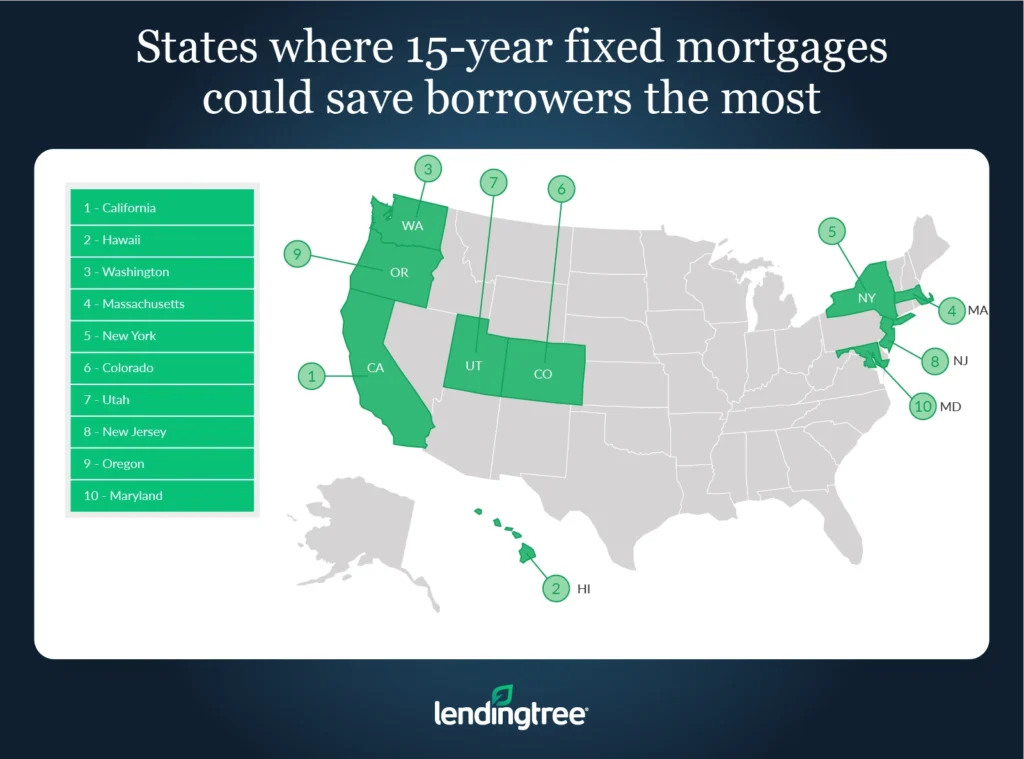

- California, Hawaii and Washington borrowers could save the most over the lifetime of their loans by choosing 15-year mortgages over 30-year ones. Across these states, the total lifetime cost of a 30-year mortgage averages $306,687 more than the total cost of a 15-year mortgage. That said, borrowers in these states who choose a 15-year mortgage over a 30-year one would spend, on average, $833 more a month.

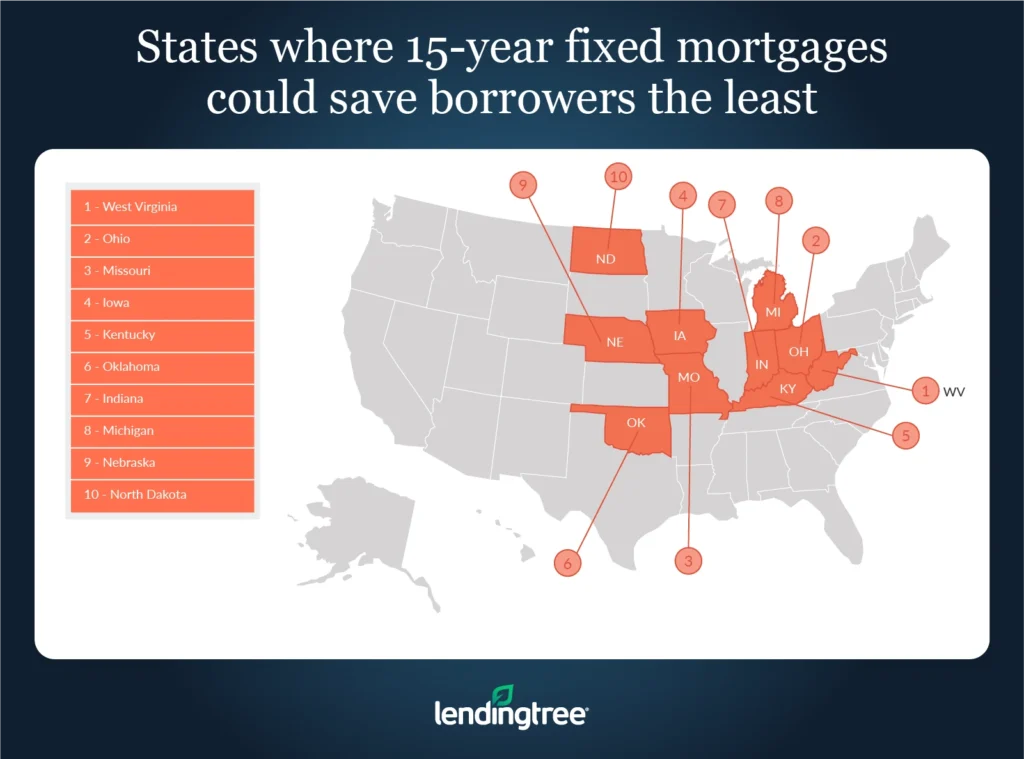

- West Virginia, Ohio and Missouri borrowers could save the least over the lifetime of their loans by choosing 15-year mortgages over 30-year ones. Despite appearing at the bottom of the list, borrowers in these states could save an average of $171,632 over the lifetime of 15-year mortgages compared to 30-year mortgages.

States where 15-year fixed mortgages could save borrowers the most

1. California

- Average offered loan amount: $457,965

- Average offered APR, 15-year fixed: 4.92%

- Average offered APR, 30-year fixed: 5.89%

- Average extra monthly costs for a 15-year fixed mortgage: $890

- Average lifetime interest savings for a 15-year fixed mortgage: $328,064

2. Hawaii

- Average offered loan amount: $413,913

- Average offered APR, 15-year fixed: 5.02%

- Average offered APR, 30-year fixed: 5.95%

- Average extra monthly costs for a 15-year fixed mortgage: $810

- Average lifetime interest savings for a 15-year fixed mortgage: $298,674

3. Washington

- Average offered loan amount: $410,083

- Average offered APR, 15-year fixed: 4.94%

- Average offered APR, 30-year fixed: 5.89%

- Average extra monthly costs for a 15-year fixed mortgage: $800

- Average lifetime interest savings for a 15-year fixed mortgage: $293,324

States where 15-year year fixed mortgages could save borrowers the least

1. West Virginia

- Average offered loan amount: $218,480

- Average offered APR, 15-year fixed: 5.38%

- Average offered APR, 30-year fixed: 6.32%

- Average extra monthly costs for a 15-year fixed mortgage: $417

- Average lifetime interest savings for a 15-year fixed mortgage: $168,946

2. Ohio

- Average offered loan amount: $233,908

- Average offered APR, 15-year fixed: 5.15%

- Average offered APR, 30-year fixed: 6.03%

- Average extra monthly costs for a 15-year fixed mortgage: $462

- Average lifetime interest savings for a 15-year fixed mortgage: $170,113

3. Missouri

- Average offered loan amount: $238,835

- Average offered APR, 15-year fixed: 5.28%

- Average offered APR, 30-year fixed: 6.12%

- Average extra monthly costs for a 15-year fixed mortgage: $473

- Average lifetime interest savings for a 15-year fixed mortgage: $175,838

Are 15-year mortgages worth the extra monthly costs?

Based on the study’s findings, 15-year, fixed-rate mortgages have pros and cons. On the one hand, lower interest rates and shorter repayment periods mean 15-year mortgages are considerably cheaper than their 30-year counterparts in the long run. On the other hand, 15-year mortgages come with much higher monthly payments.

Considering that 15-year mortgages account for less than 10% of originated mortgages, it’s likely that the extra monthly costs associated with them are too high of a barrier for many borrowers to overcome.

That said, 15-year mortgages can be well worth the extra monthly cost for those who can afford them. Not only can borrowers with a 15-year mortgage potentially save hundreds of thousands of dollars over the loan’s lifetime, but they can also see additional benefits like building home equity faster.

Though higher short-term costs may keep many borrowers from taking on 15-year mortgages, they remain a potentially good option for borrowers who can afford to spend extra on their monthly payments.

Tips for paying less interest on your mortgage

While paying interest will be necessary for most homebuyers, there are various ways for a person to reduce how much of it they’ll need to pay.

Here are three tips — outside of getting a loan with a shorter repayment period — that can help borrowers pay less interest on their mortgages:

- Make a larger down payment. The more money you put toward a down payment, the smaller the value of your loan will be. Because the amount of interest you pay is largely based on the size of your loan, putting more money toward a down payment can help you spend less in interest over the lifetime of your loan.

- Put extra toward your monthly payments. Putting extra cash toward a monthly mortgage payment can be a great option for those who want to pay off their loan faster but can’t necessarily afford to be locked into a loan with a shorter term. That said, while most lenders will let you put extra toward your mortgage each month, some may charge a fee if you repay your loan early. You’ll want to double-check the terms and conditions of your loan before you start making larger payments than you’re required.

- Shop around for a mortgage lender. Different lenders can offer different rates to the same borrowers. This means that one lender could offer you a higher rate than another, even if everything about your financial profile remains the same. By shopping around for a lender before you buy, you can potentially get a lower rate on your loan and spend less in interest over your loan’s lifetime.

Methodology

Data in this study is derived from about 381,000 loan offers given to users of the LendingTree online loan marketplace for 15-year or 30-year, fixed-rate mortgages between July 1, 2022, and Aug. 31, 2022.

View mortgage loan offers from up to 5 lenders in minutes