Better Mortgage Review 2026

Better Mortgage is a fully online mortgage lender that focuses on speed and automation. It leverages artificial intelligence (AI) to unlock lower rates and speed up the mortgage approval process. As such, Better Mortgage is best for tech-savvy borrowers with straightforward financial profiles

See how we reached our verdict below.

- Fast preapproval and fully online application process

- Competitive rates and fees

- Transparency

- No physical branches for in-person help

- Unreliable communication per customer reviews

- Not well-suited to complex financial situations

Better Mortgage mortgage overview

Better Mortgage is an online lender that leverages technology to improve the online lending process. It uses a proprietary AI-powered loan engine called Tinman to underwrite loans, and an AI loan assistant called Betsy to help you through the application process. These are paired with human loan consultants who can step in for more personal or complex needs.

- Areas of service: All 50 states and District of Columbia

- Digital service: Specializes in digital mortgages with 100% online application process

- Headquarters: 3 World Trade Center, 175 Greenwich Street, 57th Floor, New York, NY 10007

- Website: Better.com

Better Mortgage rates and fees

Rates

Better Mortgage’s focus on transparency includes making all rates available on its website. You can enter your ZIP code to instantly see rates in your area.

Better Mortgage’s rates are fairly competitive compared to industry peers, and are about 0.19 percentage points above the average prime offer rate (APOR) in 2024. The APOR represents the average APR a bank would offer to highly qualified borrowers.

Better Mortgage saw a 0.23 increase in rate spread from 2023 to 2024.

Fees

The average total cost of a Better Mortgage loan was $6,411 in 2024. This puts it roughly in the middle in terms of costs relative to industry peers. Total loan costs ranged from $2,367 to $12,406 in 2024.

Better Mortgage’s digital loan process helps keep fees low. According to the lender, it doesn’t charge origination fees, application fees or loan officer commissions. Keep in mind, however, that even if a lender advertises not charging a given fee, it may simply be folding that cost into other parts of the loan.

You can see an estimate of the third-party fees for loans in your area by entering your ZIP code into the rate comparison tool on the company website.

You may be able to get a $2,000 discount on closing costs by using a real estate agent referred to you by Better Mortgage. This is known as the Better Real Estate Discount, and it is not available in all states. You can learn more about it by calling 415-523-8837.

The lender also occasionally provides partner promotions, such as a $500 discount on closing costs for Chime customers. To qualify, you’re requested to access Better.com through Chime.

Like many lenders, Better Mortgage also lets borrowers buy discount points to lower their mortgage interest rate. This isn’t a true discount, but a way of repaying your interest in exchange for a lower rate throughout the life of your loan.

What types of mortgage loans does Better Mortgage offer?

Better Mortgage offers a variety of home loans, including:

Better Mortgage offers fixed- and adjustable-rate conventional loans for home purchases, as well as rate-and-term and cash-out refinances.

Conventional loan qualification requirements

- 620 minimum credit score

- 3% minimum down payment

- Debt-to-income (DTI) of 50% or less

You can get loans backed by the Federal Housing Administration (FHA) through Better Mortgage. FHA loans tend to be easier to qualify for and are available for both purchase and refinance loans.

FHA loan qualification requirements

- 580 minimum credit score

- 3.5% minimum down payment (10% for credit scores between 500 and 579)

- DTI of 57% or below

- Upfront and monthly mortgage insurance is required

Better Mortgage offers mortgages guaranteed by the U.S. Department of Veterans Affairs, known as VA loans to U.S. veterans, service members and their eligible spouses. These loans are easier to qualify for than conventional loans and may provide better terms.

VA loan qualification requirements

- No minimum credit score for most borrowers, but a score of 620 or above is recommended

- Typically no down payment required

- DTI of 41% or less is recommended

- No PMI

- Certificate of Eligibility (COE) demonstrating you meet the service requirement

Better Mortgage offers jumbo loans for borrowers seeking a loan above their area’s conforming limits. Better Mortgage jumbo loans are available for single-unit primary residences, single- and multi-unit second homes with up to four units and investment properties. You can borrow up to $3 million through a jumbo loan with Better Mortgage.

Jumbo loan qualification requirements

- 700 minimum credit score

- 10% minimum down payment

- DTI of 43% or below

Better Mortgage offers home equity loans and home equity lines of credit (HELOCs). These let you borrow against the equity in a home or property you already own. With a home equity loan, you receive a single lump sum of cash, whereas a HELOC provides a revolving line of credit like a credit card. Home equity loans are available for 15-, 20- or 30-year fixed interest terms. A HELOC credit line has an adjustable interest rate and can last for three to 10 years. You must borrow at least $50,000.

Home equity loan qualification requirements

- 680 minimum credit score

- Borrow up to 90% of your home’s value or $500,000, whichever is less

Better Mortgage mortgage qualifications

| Credit score minimum | 580 to 700 |

| DTI ratio

Debt-to-income (DTI) ratio compares your monthly gross income to your monthly debt payments.

| Conventional: 50% FHA: 57% VA: 41% Jumbo: 43% |

| Down payment minimum | Conventional: 3% FHA: 3.5% VA: 0% Jumbo: 10% |

Don’t know your credit score? Get your free score on LendingTree Spring today.

The best way to boost your loan approval odds is to ensure you meet a lender’s minimum requirements. Nationwide data shows that Better Mortgage approved customers who, on average, have a loan-to-value (LTV) ratio of 76.3%. The majority had a DTI ratio under 40%, but just barely. Almost 46% were able to get approval with a DTI ratio above 40%, but only about 30% of applicants got approved with a DTI above 43%.

Better Mortgage rejected just over 27% of conforming home loans in 2024. This is about average for the industry, with most lenders falling in the low teens to low 30% rejection range. Some are as low as under 10%. On the highest end are lenders who reject upward of 80% of applicants.

How to apply for a Better Mortgage mortgage

1. Choose your loan type

To apply for a mortgage through Better Mortgage, start by navigating to the lender’s website and clicking the “Start my pre-approval” button.

2. Get prequalified

Prequalification lets you get an estimate of the rates you may qualify for after providing some personal information. It doesn’t require a hard pull on your credit, but it also isn’t a guarantee that you will get the rates shown. Preapproval provides the exact rate you qualify for, but requires a more thorough credit assessment. Neither provides a guarantee of the rate you will receive.

3. Submit a loan application

You can get your preapproval letter in as little as 3 minutes after submitting your application. The final loan application, where you can lock in your rate, takes as little as one hour, according to Better Mortgage.

Find out more about how to apply for a home loan.

- Identification

- Tax documents

- Bank statement

- Pay stubs

- Debt and asset statements

- Gift letters (if you’re using gifted funds)

Is it safe to get prequalified with Better Mortgage?

Yes, it’s generally safe to get prequalified with Better Mortgage because they use a soft credit pull that has no impact on your credit profile. This initial, nonbinding step quickly provides an estimate of your borrowing power based on the information you provide. While quick and easy, a prequalification is not a loan commitment; you’ll need a formal preapproval, which involves a hard credit pull, when you’re ready to make an offer on a home.

Better Mortgage’s customer service experience

Better Mortgage’s customer service model is built around its fully digital platform and speed, aiming to provide a high-efficiency mortgage experience. This can be a benefit if you’re looking for quick responses, but contacting a human loan officer for more complex help can be a bit harder. You also can’t access in-person help since Better Mortgage is fully online.

You can contact Better Mortgage via email, phone or online chat. Representatives are available from 8 a.m. to 9 p.m. Monday through Friday and 9 a.m. to 9 p.m. on the weekends.

- Email: [email protected]

- Phone: 415-523-8837

How does Better Mortgage compare to other lenders?

|  |  |

|

| LendingTree’s rating |

Expert review from LendingTree.

|

Expert review from LendingTree.

|

Expert review from LendingTree.

|

| Minimum credit score | 580 to 700 | Not disclosed | 600 |

| Minimum down payment | 0% to 10% | 0% to 5% | 0% to 10% |

| Rate spread

Rate spread is the difference between the average prime offer rate (APOR) — the lowest APR a bank is likely to offer any private customer — and the average annual percentage rate (APR) the lender offered to mortgage customers in 2023. The higher the number, the more expensive the loan.

| 0.19% | 0.35% | 0.74% |

| Loan products and programs |

|

|

|

| Better for: | Better Mortgage is best for tech-savvy borrowers with straightforward financial profiles. | Alliant Credit Union is best for digital-friendly borrowers looking for a low down payment. | SoFi is best for borrowers looking for fixed-rate conventional or jumbo loans and a quick closing time. |

Better Mortgage vs. Alliant Credit Union

Better Mortgage and Alliant Credit Union appeal to different segments of the digital-friendly borrower market based on their structure and product focus. Better Mortgage is geared toward the tech-savvy borrower with a straightforward financial profile who values speed and cost-saving transparency. The ideal borrower is also comfortable leveraging AI to get fast pre-approvals and eliminate many standard lender fees. In contrast, Alliant Credit Union is a member-owned, not-for-profit financial institution. This often makes it the better choice for the digital-friendly borrower looking for flexible, low down payment options. Alliant offers unique programs like a 0% down payment mortgage for first-time buyers that also waives private mortgage insurance (PMI), making them an excellent choice for those with less saved but who still qualify for membership.

Read more in our full Alliant Credit Union mortgage review.

Better Mortgage vs. SoFi Bank

Better Mortgage is well-suited for the tech-savvy borrower with a straightforward financial profile, as its fully digitized platform minimizes friction and delivers a highly efficient, fast online application experience with generally lower fees. Conversely, SoFi caters best to those seeking a full suite of established loan products, especially fixed-rate conventional or jumbo loans, and prioritizes a rapid transaction. The online bank offers highly competitive rates and backs its process with a substantial on-time close guarantee to ensure a swift closing timeline.

Read more in our full SoFi mortgage review.

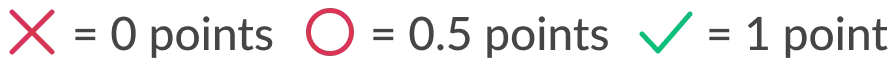

How LendingTree rated Better Mortgage Mortgage

LendingTree’s mortgage lender rating is based on a five-point scoring system that factors in several features, including digital application processes, available loan products and the accessibility of product and lending information.

LendingTree’s editorial team calculates each rating based on a review of information available on the lender’s website. Lenders receive a half-point on the “offers standard mortgage products” criterion if they offer only two of the three standard loan programs (conventional, FHA and VA). In some cases, additional information was provided by a lender representative.

Better Mortgage’s scorecard:

⭕ Publishes rates online

✅ Offers standard mortgage products

✅ Includes detailed product info online

✅ Shares resources about mortgage lending

✅ Provides an online application

Frequently asked questions

Better Mortgage provides a fully digital, paperless platform that allows users to complete the entire mortgage process online, from rate shopping to closing. A core feature is the ability to instantly generate a preapproval letter without a hard credit pull, giving borrowers fast purchasing power. Their system uses technology to streamline processes, including automated asset and income verification, along with a personalized dashboard for real-time loan tracking and communication with dedicated loan officers.

Yes, Better Mortgage is a legitimate mortgage lender. It is licensed in all 50 states. You can view more info about Better Mortgage’s state licenses and registrations through the Nationwide Multistate Licensing System and Registry (NMLS) website.

Taking out a home loan through any lender will affect your credit score, but the impact is typically no more than 20 points, according to a LendingTree study. On average, borrowers’ credit scores returned to preapplication level within 340 days.

Better Mortgage has a TrustPilot rating of 4 out of 5 stars from 1,857 reviews. This is considered “great,” and suggests most customers are pleased with the business’s services. The company is also BBB accredited with an A- rating. This is despite having a 2.48-star rating from 61 customer reviews and 61 complaints filed against Better.com in the past three years.

Customers frequently praise the company’s streamlined process and competitive rates. Complaints generally centered on poor, inconsistent communication and customer service. Many critical reviews mention delays, especially in cases involving complicated financial situations.

View mortgage loan offers from up to 5 lenders in minutes