First Federal Bank Mortgage Review 2026

First Federal Bank specializes in low-rate VA loans, but it also offers other government-backed mortgages, making it a good option for borrowers who don’t have large down payments.

See how we reached our verdict below.

- Specializes in VA loans

- Multiple government-backed loan options

- Competitive interest rates

- Does not disclose rates or fees online

- Must submit personal data to get details

- No in-person branches outside main office

First Federal Bank mortgage overview

First Federal Bank Mortgage Lenders is an online-only Kansas-based mortgage lender with deep roots in community banking. It was formed in 2023 after the Florida-based mutual bank, First Federal, acquired the mortgage operations of South Dakota-based regional bank, BNC National.

Serving customers nationwide, First Federal specializes in low-rate loans for active and former military service members and their families, including no down payment U.S. Department of Veterans Affairs (VA) mortgages for qualified borrowers and VA interest rate reduction refinance loans (IRRRL). Although VA loans are its specialty, First Federal also offers conventional loans, as well as mortgages backed by the Federal Housing Administration (FHA) and the U.S. Department of Agriculture (USDA).

The company boasts strong customer reviews, with a rating of 4.75 out of 5 stars on Zillow.

- Areas of service: Nationwide

- Digital service: Online application

- Headquarters: 7007 College Blvd., Suite 600, Overland Park, KS 66211

- Website: FFBML.com

First Federal Bank mortgage rates and fees

Rates

First Federal Bank Mortgage Lenders doesn’t disclose its mortgage rates online. However, we analyzed data that was issued under the Home Mortgage Disclosure Act (HMDA), and found that its rates are among the lowest on the market. Across all loan types approved in 2024, First Federal Bank’s rates averaged 0.08 percentage points below the average prime offer rate (APOR). This difference is known as the rate spread. Calculated by the Consumer Financial Protection Bureau (CFPB), APOR is a useful indicator of the lowest rates lenders offer.

First Federal’s mortgage rates have also become more competitive over time. In 2023, the average First Federal mortgage rate across all loan types was 0.22 percentage points above APOR.

Fees

First Federal Bank Lenders doesn’t publish its fees on its website either. Instead, you’ll need to submit information and speak with a loan officer to receive details about its rates and fees.

Based on HMDA data, we found that the average origination fee across all First Federal home loan types was $2,861, which is more than $1,000 below the industry average. Total loan costs for a First Federal Bank mortgage are also competitive, coming in at $6,802 in 2024.

First Federal Bank Mortgage Lenders doesn’t advertise any discount programs on its website.

What types of mortgage loans does First Federal Bank offer?

First Federal Bank offers a variety of home loans including:

With First Federal Bank Mortgage Lenders, you can qualify for a conventional loan with fixed interest rates and choose a term of 15, 20 or 30 years. Or you can select an adjustable-rate mortgage that starts with a fixed interest rate for up to a maximum of 10 years. If you’re a first-time homebuyer, you may qualify for a conventional loan with a down payment as low as 3%, but most homebuyers will likely need to put down at least 5%.

First Federal Bank also offers conventional loan refinancing.

Conventional loan qualification requirements

- 620 minimum credit score

- 3% to 5% minimum down payment

For homebuyers who may not qualify for conventional loans because of their credit score or because they don’t have a large enough down payment, Federal Housing Administration (FHA) loans could be a solution. These government-backed loans have lower requirements for both credit scores and down payments than conventional loans.

In addition to FHA loans, First Federal Bank offers FHA 203(k) loans, which can be used to purchase and renovate a home.

FHA loan qualification requirements

- 580 minimum credit score

- 3.5% minimum down payment

VA loans are a specialty of First Federal Bank Mortgage Lenders. Available exclusively to military veterans and service members, these types of mortgages are backed by the U.S. Department of Veterans Affairs. VA loans are available without a down payment for qualified borrowers, and information from First Federal indicates that its VA mortgage rates are typically 0.50 to 1 percentage point lower than conventional rates.

VA loan qualification requirements

- 620 minimum credit score

- Typically, no down payment is required

With a First Federal Bank Mortgage Lenders USDA loan –– a mortgage backed by the U.S. Department of Agriculture (USDA) –– potential homebuyers can purchase a home in eligible rural or suburban areas without a down payment.

USDA loan qualification requirements

- No minimum required credit score

- Typically, no down payment is required

If your desired home has a higher price tag than the maximum for conventional mortgages, you can use a jumbo loan to complete the transaction. First Federal Bank Mortgage Lenders offers jumbo loans as large as $548,250 to $822,375 or more, depending on where you live.

Jumbo loan qualification requirements

- 680 minimum credit score

- Contact a mortgage specialist for minimum down payment requirements

First Federal Bank mortgage qualifications

| Credit score minimum | Conventional: 620FHA: 580VA: 620USDA: Not specified |

| DTI ratio

Debt-to-income (DTI) ratio compares your monthly gross income to your monthly debt payments.

| Conventional: 45% to 50%FHA: 50%VA: 41%USDA: 41% |

| Down payment minimum | Conventional: 3% to 5%FHA: 3.5%VA: 0%USDA: 0% |

Don’t know your credit score? Get your free score on LendingTree Spring today.

In 2024, First Federal Bank approved just over 87% of its home loan applications. To improve your odds of qualifying for a loan –– and securing competitive rates –– follow these tips:

- Pay down debt: Your debt-to-income (DTI) ratio, or how much of your monthly income goes toward debt payment, plays a big role in determining your eligibility for a mortgage. Over 49% of approved homebuyers for purchase loans with First Federal Bank had a DTI ratio below 40%. Don’t be discouraged, though, if your DTI ratio is higher. Among home purchase applicants with DTI ratios above 50% in 2024, 74% of them were still approved for a mortgage.

- Improve your credit: First Federal Bank doesn’t reject nearly as many applicants as some competitors do, but it’s still fairly selective. Boosting your credit by reducing your debt, making your payments on time and limiting new credit applications can help you get approved and earn the best interest rates and terms.

- Save: A larger down payment shows you have the discipline and financial ability to save, so amassing a larger down payment can enable you to qualify for a mortgage with competitive rates. With First Federal Bank, the average down payment for a home purchase was 16.2% in 2024.

How to apply for a First Federal Bank mortgage

1. Choose your loan type

On the First Federal Bank Mortgage Lenders website, navigate to “Apply Now.” You’ll then be given the option to learn more about rates, programs and preapproval or begin the mortgage application process. First Federal Bank has a variety of mortgage options, including conventional loans and government-backed mortgages. Based on your credit, desired property and down payment amount, you may find that some mortgage options are a better fit than others.

For example, people with less-than-perfect credit and less money available for a down payment may be good candidates for FHA loans, while those homebuyers with excellent credit and more money saved may be eligible for a jumbo loan.

2. Get prequalified

First Federal Bank doesn’t allow you to view your rates or loan options without undergoing a full credit check. To begin the process, you can submit a basic form with your personal details, and the company will connect you with a loan officer. Or you can contact a loan officer near you.

You can meet with the loan officer over the phone or on a video call or communicate via text or over email. When you’re ready, the loan officer can help you submit your application for a preapproval letter –– an essential element of the home-buying process.

3. Submit a loan application

First Federal Bank allows homebuyers to fill out and submit an application online. To lock in a mortgage rate, you’ll be asked to upload documents and other supporting information to complete the application process.

Find out more about how to apply for a home loan.

- Identification

- Tax documents

- Bank statement

- Pay stubs

- Debt and asset statements

- Gift letters (if you’re using gifted funds)

Is it safe to get prequalified with First Federal Bank?

First Federal Bank is a well-established and reputable lender with a highly experienced staff, so you can submit your information with confidence. However, First Federal Bank doesn’t have a prequalification option. The only way to view your rates is to submit your details and consent to a hard credit check, which can cause some temporary damage to your credit.

First Federal Bank’s customer service experience

You can contact First Federal Bank via phone or email, or you can schedule a video call with a loan officer. Its customer support team is available Monday through Friday, from 8:30 a.m. until 5 p.m. Central.

- Phone: 913-647-7000

- Email: [email protected]

Unlike some lenders, First Federal Bank doesn’t offer an online chat feature, nor does it have a mobile app, so you can’t monitor your application progress or submit information with your smartphone.

How does First Federal Bank compare to other lenders?

|  |  |

|

| LendingTree’s rating |

Expert review from LendingTree.

Back to our First Federal Bank summary |

Expert review from LendingTree.

Read our First Federal Bank vs. Chase comparison |

Expert review from LendingTree.

Read our First Federal Bank vs Alliant comparison |

| Minimum credit score | 580 to 680 | Not specified | Not specified |

| Minimum down payment | 0% to 5% | 0% to 3.5% | 0% to 5% |

| Rate spread

Rate spread is the difference between the average prime offer rate (APOR) — the lowest APR a bank is likely to offer any private customer — and the average annual percentage rate (APR) the lender offered to mortgage customers in 2024. The higher the number, the more expensive the loan.

| -0.08% | 0.11% | 0.35% |

| Loan products and programs |

|

|

|

| Better for: | Borrowers looking for a lower-rate USDA, FHA or VA loan. | Borrowers looking for a wider range of loan options, as well as current customers who may qualify for a rate discount. | Borrowers who want a variety of options for low-down-payment loans, don’t mind an all-digital experience and are open to joining a credit union. |

First Federal Bank vs. Chase

First Federal offers more government-backed loan options than Chase, including specialty loans like an FHA 203(k) rehab mortgage and a VA IRRRL. In addition to low-cost FHA and VA loans, qualifying First Federal Bank mortgage applicants can also take advantage of USDA loans to buy a rural or suburban property with a low down payment. First Federal’s mortgage rates are also more competitive than those offered by Chase.

However, borrowers who want a larger jumbo loan may find Chase to be a better fit; Chase allows homebuyers to take out loans as large as $9.5 million.

Read more in our full Chase mortgage review.

First Federal Bank vs. Alliant Credit Union

Unlike First Federal Bank, Alliant is a credit union, and it offers some financing options that First Federal doesn’t. For example, Alliant offers home equity lines of credit (HELOCs), which homeowners with equity can use to pay for home renovations, consolidate debt or finance other personal goals. On the downside, Alliant’s mortgage rates are also higher than those offered by First Federal Bank.

Read more in our full Alliant Credit Union mortgage review.

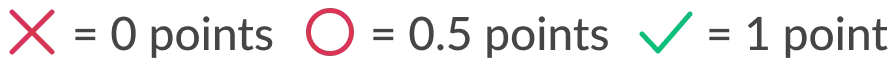

How LendingTree rated First Federal Bank

LendingTree’s mortgage lender rating is based on a five-point scoring system that factors in several features, including digital application processes, available loan products and the accessibility of product and lending information.

LendingTree’s editorial team calculates each rating based on a review of information available on the lender’s website. Lenders receive a half-point on the “offers standard mortgage products” criterion if they offer only two of the three standard loan programs (conventional, FHA and VA). In some cases, additional information was provided by a lender representative.

First Federal Bank’s scorecard:

❌ Publishes rates online

✅ Offers standard mortgage products

✅ Includes detailed product info online

✅ Shares resources about mortgage lending

✅ Provides an online application

Frequently asked questions

Compared to other remote lenders, First Federal Bank’s online presence is very basic. It offers educational articles about VA loans and other mortgages and an online application. But it only offers a few basic calculators that require you to share your email and doesn’t offer much else.

Yes, First Federal Bank Mortgage Lenders is a legitimate mortgage lender. It was established by the merger of two longstanding banks’ mortgage units and now issues mortgages nationwide.

You can view more info about First Federal Bank’s state licenses and registrations through the Nationwide Multistate Licensing System and Registry (NMLS) website.

First Federal Bank Mortgage doesn’t offer prequalification, so you must consent to a credit check to view your mortgage options. That can temporarily ding your credit score, typically by as much as 20 points, according to our study. But generally within about one year, your credit will improve as you make timely payments.

First Federal Bank Mortgage Lenders is a reputable lender with strong reviews and competitive rates and fees. On Zillow, several positive reviews called out First Federal Bank mortgage lenders by name, praising the lenders for their responsiveness and excellent customer service.

View mortgage loan offers from up to 5 lenders in minutes