What Is Foreclosure and How Does It Work?

Foreclosure is the legal process a lender uses to take ownership of your house if you default on a mortgage loan. It’s expensive to go through the foreclosure process and causes long-term damage to your credit score and financial profile.

Right now it’s relatively rare for homes to go into foreclosure. However, it’s important to understand the foreclosure process so that, if the worst happens, you know how to survive it — and that you can still go on to thrive.

Foreclosure definition: What is it?

When you take out a mortgage, you’re agreeing to use your house as collateral for the loan. If you fail to make timely payments, your lender can take back the house and sell it to recoup some of its money. Foreclosure rules set out exactly how a creditor can do this, but also provide some rights and protections for the homeowner.

At the end of the foreclosure process, your home is repossessed and you must move out.

How much are foreclosure fees?

The average homeowner stands to pay around $12,500 in foreclosure costs and fees, according to data from the Consumer Financial Protection Bureau (CFPB).

The foreclosure process and timeline

It takes around two years on average to complete the foreclosure process, according to data covering foreclosure filings during the third quarter of 2024 from ATTOM. However, non-judicial foreclosures can take only a few months.

Understanding the foreclosure process

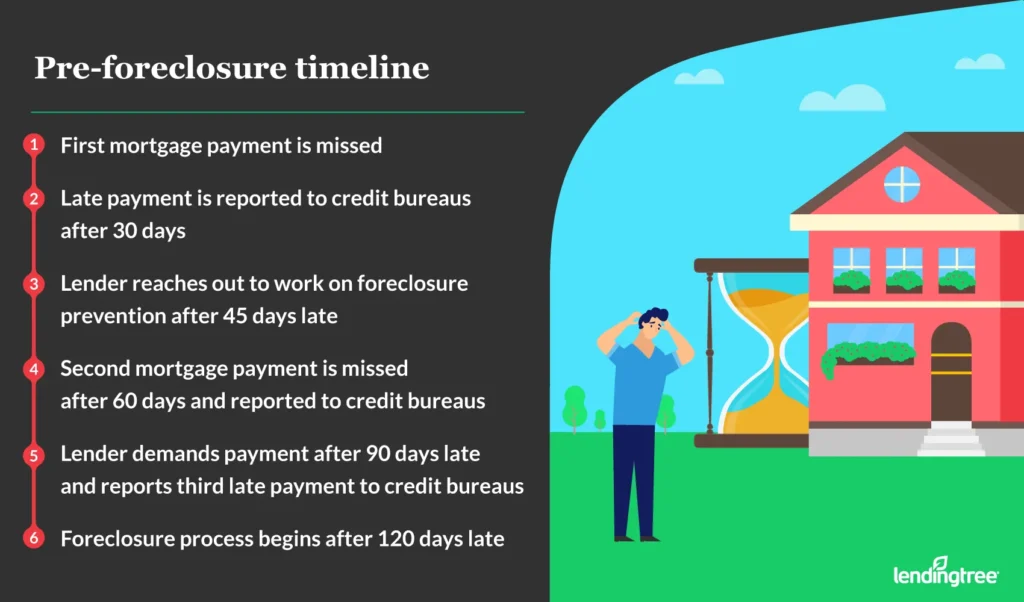

Typically, your lender can’t initiate foreclosure unless you’re at least 120 days behind on your mortgage payments — this is known as the pre-foreclosure period.

During those 120 days, your lender is also required to provide “loss mitigation” options — these are alternative plans for how you can catch up on your mortgage and/or resolve the situation with as little damage to your credit and finances as possible.

- Repayment plan

- Forbearance

- Loan modification

- Short sale

- Deed-in-lieu

For more detail about how these options work, jump to the “How to stop foreclosure” section below.

If you can’t work out an alternative repayment plan, though, your lender will continue to pursue foreclosure and repossess your house. Your state of residence will dictate which type of foreclosure process can be used: judicial or non-judicial.

The two types of foreclosure

Non-judicial foreclosure

Non-judicial foreclosure means that the creditor can take back your home without going to court, which is typically the quickest and cheapest option.

Judicial foreclosure

Judicial foreclosure, on the other hand, is slower because it requires a creditor to file a lawsuit and get a court order before it can take legal control of a house and sell it. Since you still own the house until it’s sold, you’re legally allowed to continue living in your home until the foreclosure process concludes.

The financial consequences of foreclosure and missed payments

1. Immediate credit damage due to missed payments. Missing mortgage payments (also known as being “delinquent”) will affect your credit score, and the higher your score was to begin with, the more you stand to lose.

For example, if you had a 740 score before missing your first mortgage payment, you might lose 11 points in the two years after that missed mortgage payment, according to risk management consulting firm Milliman. In comparison, someone with a starting score of 680 might lose only 2 points in the same scenario.

2. Delayed credit damage due to foreclosure. Once you enter foreclosure, your credit score will continue to drop. The same pattern holds that we saw above with missed payments: the higher your score was to begin with, the more precipitously your score will drop.

For example, if you had a 780 score before losing your home, you might lose as many as 160 points after a foreclosure, according to data from FICO.com. For comparison, someone with a 680 starting score likely stands to lose only 105 points.

3. Slow credit recovery after foreclosure. The data also show that it can take around three to seven years for your score to fully recover after a foreclosure, short sale or deed-in-lieu of foreclosure.

How soon can I get a mortgage after foreclosure?

The good news is that it’s possible to get another mortgage after a foreclosure, just not immediately. A foreclosure will remain on your credit report for seven years, but not all lenders make you wait that long.

Here are the most common waiting period requirements:

| Loan program | Waiting period | With extenuating circumstances |

|---|---|---|

| Conventional | 7 years | 3 years |

| FHA | 3 years | Less than 3 years |

| VA | 2 years | Less than 2 years |

| USDA | 3 years | Less than 3 years |

How to stop foreclosure

If you’re having financial difficulties, you can reach out to your mortgage lender at any time — you don’t have to wait until you’re behind on payments to get help. Lenders aren’t only required to offer you other options before foreclosing, but are generally motivated to help you avoid foreclosure by their own financial interests.

Here are a few options your mortgage lender may be able to offer you to ease your financial hardship:

- Repayment plan. A structured plan for how and when you’ll get back on track with any mortgage payments you’ve missed, as well as make future payments on time.

- Forbearance. The lender agrees to reduce or hit “pause” on your mortgage payments for a period of time so that you can catch up. During that time, you won’t be charged interest or late fees.

- Loan modification. The lender modifies the terms of your mortgage so that your monthly payments are more affordable. For instance, Fannie Mae and Freddie Mac offer the Flex Modification program, which can reduce your payments by 20%.

- Deed-in-lieu of foreclosure. Also known as a mortgage release, a deed-in-lieu allows you to transfer legal ownership of your home to your mortgage lender. In doing so, you lose the asset, and suffer a temporary credit score drop, but gain freedom from your obligation to repay what remains on the loan.

- Short sale. A short sale is when you sell your home for less than (“short” of) what you owe on your mortgage loan. The money goes to your mortgage lender, who in return agrees to release you from any further debt.

Moving forward from foreclosure

Although home foreclosures can be scary and discouraging, you should face the process head on. Reach out for help as soon as you begin to struggle to make your mortgage payments. That can mean working with your lender, speaking with a housing counselor or both.

Anyone can access free foreclosure-prevention counseling through the federal government’s housing counseling program.

Taking an active approach can help you stand a good chance of coming out the other side with less damage to your credit and finances than you might expect.

View mortgage loan offers from up to 5 lenders in minutes